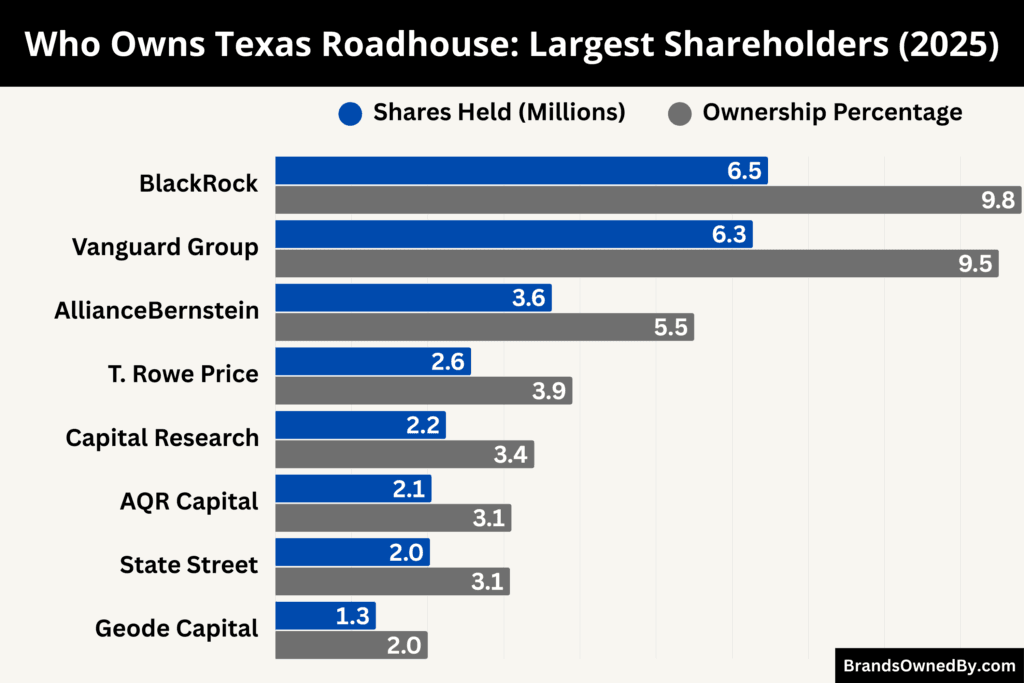

- Texas Roadhouse is a publicly traded company. The ownership is widely distributed, but institutional investors collectively control about 94% of the company’s outstanding shares.

- BlackRock is the largest shareholder, holding approximately 9.8% of Texas Roadhouse shares, giving it significant influence in shareholder voting and corporate governance matters.

- Vanguard Group is the second-largest shareholder with about 9.5% ownership, primarily through index and retirement funds, making it a key long-term, passive but powerful stakeholder.

- Other major institutional shareholders include AllianceBernstein (around 5.5%), T. Rowe Price Group (about 3.9%), Capital Research and Management Company (roughly 3.4%), and State Street Corporation (about 3.1%), together reinforcing strong institutional control over the company.

Texas Roadhouse is a leading American casual dining restaurant chain. The brand is best known for its hand-cut steaks, ribs, made-from-scratch sides, fresh-baked bread, and a lively dining atmosphere rooted in Texan and Southwestern culture. Its mission focuses on delivering hearty meals and friendly service in a fun, welcoming environment.

It has expanded from a single steakhouse into a global restaurant operator with hundreds of locations across the United States and internationally. Texas Roadhouse also supports its workforce through employee-centric programs and community initiatives.

Texas Roadhouse Founder

The restaurant concept was created by W. Kent Taylor, commonly referred to as Kent Taylor. He was a Louisville, Kentucky native with a background in restaurant management. Taylor envisioned a steakhouse that combined high-quality food with an energetic service culture.

After numerous rejections from potential investors, he secured backing from local physicians and opened the first Texas Roadhouse in Clarksville, Indiana, in February 1993. His original sketch of the concept was famously drawn on a cocktail napkin, symbolizing his entrepreneurial drive.

Kent Taylor led the company as its chief executive and chairman for many years. Under his leadership, the company cultivated a strong operational culture that emphasized fresh ingredients, value pricing, and customer engagement. Taylor remained deeply involved in the business until his death in March 2021.

After his passing, executive leadership transitioned to the next generation of leaders while preserving the principles he established.

Major Milestones

- 1993: Texas Roadhouse opened its first restaurant in Clarksville, Indiana. Founder Kent Taylor introduced a steakhouse concept focused on hand-cut steaks, fresh ingredients, and a high-energy dining atmosphere.

- 1995: The brand expanded beyond Indiana, proving the concept could succeed in multiple Midwestern markets. Early expansion helped refine operational systems and training models.

- 1997: Texas Roadhouse began building a strong internal culture centered on local store management autonomy. This approach later became a defining feature of the company’s operating model.

- 1999: The company crossed several dozen locations nationwide. Texas Roadhouse established itself as a recognizable casual dining brand across the Midwest and Southern United States.

- 2002: The company opened its 100th restaurant, marking a major national footprint milestone and validating the scalability of its steakhouse concept.

- 2004: Texas Roadhouse became a publicly traded company on NASDAQ under the ticker TXRH. This transition accelerated expansion and increased brand visibility.

- 2006: The brand expanded into nearly all major US regions. Standardized training programs and supply chain systems were strengthened to support rapid growth.

- 2008: Despite economic pressures during the global financial crisis, Texas Roadhouse continued opening new locations, reinforcing its reputation for operational resilience.

- 2011: Texas Roadhouse entered international markets with its first location in Dubai. This marked the beginning of global expansion outside North America.

- 2013: The company celebrated its 20th anniversary. At this point, Texas Roadhouse had grown into one of the most recognizable casual dining chains in the US.

- 2015: The brand surpassed 450 locations globally. Leadership emphasized maintaining food quality and in-store experience while scaling.

- 2017: Texas Roadhouse introduced technology-driven kitchen and inventory systems to improve consistency and speed without altering its traditional dining experience.

- 2020: During the COVID-19 pandemic, the company adapted operations while maintaining a strong employee-focused culture. Founder Kent Taylor publicly supported employees during this period.

- 2021: Founder Kent Taylor passed away. Leadership transitioned internally, preserving the company’s culture, values, and long-term vision.

- 2022: Texas Roadhouse continued steady unit expansion and strengthened its position as a leader in the casual dining steakhouse category.

- 2023: The company expanded its international presence and refined its leadership structure, reinforcing decentralized restaurant management.

- 2024: Texas Roadhouse was widely recognized within the restaurant industry for operational consistency, employee retention, and customer loyalty.

- 2025: Texas Roadhouse stands as one of the most dominant casual dining brands in the United States, with a strong domestic footprint and a growing international presence. Its original operating philosophy remains central to its success.

Who Owns Texas Roadhouse: Major Shareholders

Texas Roadhouse is a publicly traded company listed on the NASDAQ under the ticker TXRH. Its ownership structure reflects a mix of institutional, insider, and public shareholders.

Most of the shares are held by large investment firms and mutual funds, while a smaller portion is owned by individuals, including company insiders. This ownership model influences strategic decisions, corporate governance, and long-term growth plans. The founder’s estate and key institutional holders together shape the direction of the company.

Below is a list of the major shareholders of Texas Roadhouse as of December 2025:

BlackRock

BlackRock is the largest shareholder of Texas Roadhouse. As of 2025, BlackRock holds 6.4 million shares, representing approximately 9.8% of total outstanding shares.

This stake is spread across BlackRock’s institutional funds, index products, and advisory portfolios. BlackRock does not participate in daily restaurant operations. However, its voting power gives it meaningful influence over corporate governance matters. These include board composition, shareholder proposals, and executive pay structures.

BlackRock’s long-term investment approach signals confidence in Texas Roadhouse’s operational consistency and brand durability. Its presence also increases governance discipline due to BlackRock’s emphasis on risk management and shareholder accountability.

Vanguard Group

Vanguard is the second-largest shareholder of Texas Roadhouse. The firm holds 6.2 million shares, equal to roughly 9.5% ownership.

Vanguard’s stake is primarily held through index funds and retirement-focused investment vehicles. This means Vanguard is a long-term, low-turnover shareholder. Its influence comes almost entirely from proxy voting rather than active engagement with management.

Because Vanguard typically votes in favor of board recommendations unless governance issues arise, its ownership provides stability. At the same time, its scale ensures that management remains accountable to shareholder interests.

AllianceBernstein

AllianceBernstein owns 3.6 million shares, accounting for approximately 5.5% of Texas Roadhouse.

Unlike index-focused investors, AllianceBernstein actively manages its equity positions. This gives it a more analytical role in evaluating operational efficiency, leadership performance, and long-term strategy.

While AllianceBernstein does not control board decisions independently, its stake is large enough to influence outcomes when voting aligns with other major institutions. Its ownership reflects confidence in Texas Roadhouse’s operating model and management discipline.

T. Rowe Price Group

T. Rowe Price holds 2.5 million shares, representing approximately 3.9% of total shares outstanding.

The firm is known for long-term growth investing and fundamental analysis. Its ownership suggests belief in Texas Roadhouse’s ability to maintain customer demand and operational execution over time.

T. Rowe Price participates actively in governance voting and executive compensation evaluations. While it does not exert operational control, its voting alignment can materially impact shareholder resolutions.

Capital Research and Management Company

Capital Research and Management Company holds 2.2 million shares, equal to approximately 3.4% ownership.

This firm manages investments for Capital Group funds and is known for patient, research-driven investing. Its stake indicates confidence in Texas Roadhouse’s long-term brand strength rather than short-term performance fluctuations.

Capital Research typically engages selectively on governance issues. Its ownership adds depth to the institutional base without introducing activist pressure.

AQR Capital Management

AQR Capital Management owns 2.04 million shares, representing roughly 3.1% of Texas Roadhouse.

AQR uses quantitative and factor-based investment strategies. Its stake is part of broader diversified portfolios rather than a concentrated conviction play.

Although AQR does not actively influence management decisions, its holdings contribute to the overall institutional voting bloc that shapes governance outcomes.

State Street Corporation

State Street holds 2.03 million shares, equal to approximately 3.08% ownership.

Most of State Street’s shares are held through ETFs and index funds. Like Vanguard, State Street’s role is passive but influential due to scale.

State Street emphasizes corporate governance standards and routinely votes on board independence, risk oversight, and executive compensation matters.

Geode Capital Management

Geode Capital Management owns 1.3 million shares, representing approximately 2.0% of total outstanding shares.

Geode often manages index-related and systematic portfolios. Its ownership strengthens the institutional shareholder base and contributes to long-term shareholding stability.

Other Shareholders

Beyond the top holders, several mid-sized institutions collectively control millions of additional shares. These include Steadfast Capital Management, Neuberger Berman, and Invesco. Individually, these firms own between 1% and 2% each, but together they represent a meaningful voting bloc.

In total, institutional investors control approximately 94% of all Texas Roadhouse shares. This makes Texas Roadhouse one of the most institutionally owned companies in the casual dining sector.

Company insiders, including executives and board members, collectively own less than 1% of total outstanding shares. Insider holdings primarily come from equity-based compensation rather than founder control.

While small in percentage terms, insider ownership aligns leadership incentives with shareholder value creation. However, insiders do not have the voting power to override institutional investors.

Retail investors and smaller funds hold the remaining portion of shares not controlled by institutions or insiders. These shareholders contribute to liquidity and daily trading activity but have minimal influence over governance due to fragmented ownership.

Who is the CEO of Texas Roadhouse?

Jerry Morgan (Gerald L. Morgan) is the current Chief Executive Officer of Texas Roadhouse. He has led the company since March 19, 2021, when he was appointed CEO following the passing of founder Kent Taylor. Morgan has spent nearly three decades with Texas Roadhouse and has extensive experience in restaurant operations and leadership.

Morgan’s leadership style is described as collaborative and coach-like, emphasizing communication, culture, and strong execution across all levels of the business. He often refers to himself as a “head coach” focused on ensuring that each operational layer of the company performs at a high level.

Professional Background and Career Path

Morgan began his career with Texas Roadhouse in 1997 as a Managing Partner at the company’s first Texas location, demonstrating early leadership capability. Over the years, he has held a variety of roles, including:

- Managing Partner and Market Partner, growing and overseeing individual restaurant markets.

- Regional Market Partner, with oversight of multiple states and restaurant clusters.

- President of Texas Roadhouse, before his elevation to CEO.

His nearly 40 years of restaurant industry experience also includes time with other major foodservice operators prior to joining Texas Roadhouse.

Leadership Style and Decision-Making Structure

As CEO, Morgan is known for a hands-on and collaborative leadership style. He often describes his role as similar to a head coach rather than a top-down executive. Decision-making authority is distributed across regional and store-level leadership, with corporate leadership focused on strategy, standards, and long-term planning.

Morgan works closely with the board of directors on major strategic decisions. These include new market expansion, international growth, supply chain strategy, and leadership development. Daily operations are largely handled by experienced restaurant operators, preserving local accountability.

This decentralized model has been a defining feature of Texas Roadhouse for decades and continues under Morgan’s leadership.

CEO Salary and Net Worth

Jerry Morgan’s compensation reflects a mix of fixed salary, performance-based incentives, and equity awards. As of December 2025, his base salary is approximately $1.40 million annually.

His total annual compensation is approximately $6.19 million, expressed in millions as follows:

- Base salary: $1.40 million

- Performance and incentive compensation: $2.27 million

- Stock and equity awards: $2.60 million.

This structure is designed to align Morgan’s financial incentives with long-term company performance rather than short-term results. A significant portion of his pay is tied to operational execution, growth targets, and shareholder value creation.

In addition to cash compensation, Morgan holds company stock through equity grants and vested awards. While his ownership stake represents less than 1% of total outstanding shares, it provides meaningful alignment between executive leadership and shareholder interests.

Equity-based compensation ensures that Morgan’s personal financial outcomes are directly linked to the company’s long-term success. This structure is consistent with Texas Roadhouse’s broader executive compensation philosophy.

As of 2025, Jerry Morgan’s estimated net worth is between $13 million and $23 million, expressed entirely in millions. This net worth is primarily derived from:

- Accumulated salary and incentive compensation over many years

- Equity awards and vested company stock

- Long-term participation in executive compensation plans.

His net worth reflects a career spent largely within one organization, steadily building value through operational leadership rather than external ventures.

Past CEOs and Leadership Continuity

Before Jerry Morgan, the role of CEO was held by founder Kent Taylor. Taylor led Texas Roadhouse from its founding in 1993 until his death in 2021. He established the company’s core values, decentralized operating structure, and employee-first culture.

Morgan’s elevation to CEO ensured continuity rather than disruption. Many of the systems, incentives, and leadership principles created under Taylor remain in place today, with Morgan focused on refinement rather than reinvention.

This leadership continuity has been a key factor in Texas Roadhouse’s stability and long-term performance as a public company.

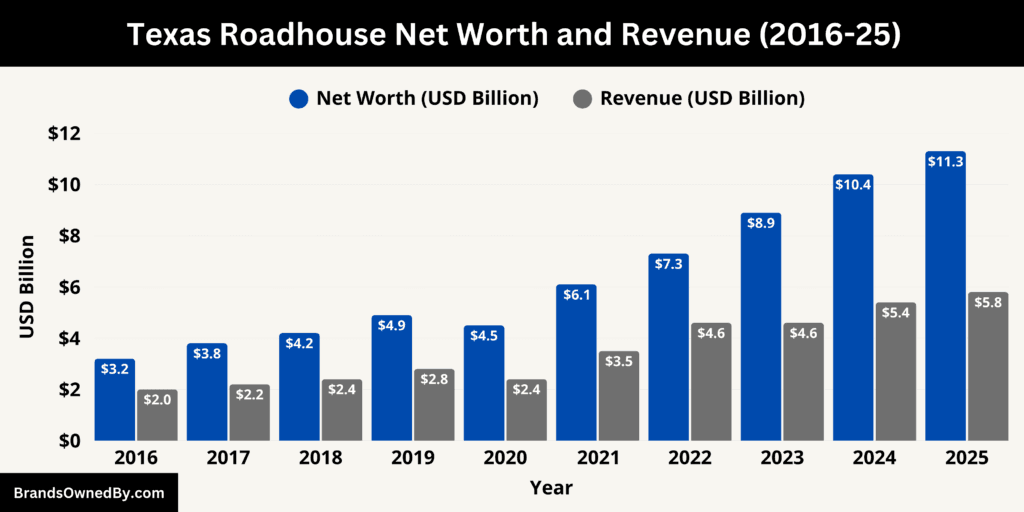

Texas Roadhouse Annual Revenue and Net Worth

In the most recent 12-month period ending in late 2025, Texas Roadhouse generated approximately $5.83 billion in total revenue, reflecting robust growth compared to prior years. The market valuation, often described as its net worth or market capitalization, sits around $11.3 billion as of December 2025, indicating how the market values the business based on its share price and outstanding shares.

Revenue Performance in 2025

Texas Roadhouse generated $5.83 billion in revenue over the most recent twelve-month period ending in 2025. This represents a clear continuation of the company’s multi-year revenue expansion. In the prior year, revenue stood at approximately $5.37 billion, meaning Texas Roadhouse added nearly $460 million in additional annual sales within a single year.

The 2025 revenue figure is supported by both organic and structural growth. Same-restaurant sales increased across the majority of company-owned locations, driven by higher customer traffic and increased average guest spend. At the same time, new restaurant openings contributed incremental revenue, with dozens of additional locations entering operation during the year.

Food and beverage sales continue to account for the overwhelming majority of revenue. Dine-in traffic remains the primary contributor, with off-premise and takeout sales serving as a supplemental but stable revenue stream rather than a core growth driver.

Revenue Mix and Scale

Texas Roadhouse operates hundreds of restaurants, with the majority being company-owned rather than franchised. This ownership structure means revenue is recorded directly on the company’s income statement instead of being limited to franchise fees or royalties. As a result, Texas Roadhouse reports higher absolute revenue figures compared to heavily franchised competitors with similar store counts.

On a per-restaurant basis, Texas Roadhouse consistently ranks among the highest-performing casual dining brands in terms of average unit volume. This operational efficiency plays a direct role in sustaining revenue growth without relying solely on aggressive expansion.

Net Worth in 2025

Texas Roadhouse’s net worth, measured through market capitalization, is approximately $11.3 billion as of December 2025. This valuation is based on the company’s publicly traded share price multiplied by its roughly 66 million outstanding shares.

The company’s market value reflects investor confidence in its long-term earnings power, operational consistency, and brand loyalty. Compared with earlier periods, Texas Roadhouse’s valuation has expanded alongside revenue growth, indicating that investors are pricing in sustained demand rather than short-term performance spikes.

Market capitalization fluctuates daily, but the 2025 valuation places Texas Roadhouse firmly within the upper tier of publicly traded restaurant companies in North America.

Relationship Between Revenue and Net Worth

The relationship between Texas Roadhouse’s revenue and net worth highlights its financial positioning. With nearly $6 billion in annual revenue and an $11.3 billion market valuation, the company trades at a valuation that reflects steady growth expectations rather than speculative expansion.

This balance suggests that investors view Texas Roadhouse as a mature but still expanding business with predictable cash generation. The company’s ability to convert high restaurant traffic into consistent revenue has been a key factor supporting its valuation level in 2025.

Brands Owned by Texas Roadhouse

Here’s a list of the major brands owned and operated by Texas Roadhouse as of December 2025:

Texas Roadhouse

Texas Roadhouse restaurants are the company’s core and flagship business. This brand accounts for the overwhelming majority of locations, employees, and revenue.

The restaurants specialize in hand-cut steaks, ribs, made-from-scratch sides, and a high-energy dining atmosphere. Most locations are company-owned, with a smaller portion operated through international franchise partnerships. Operational control, menu development, pricing, training, and supply chain management are handled centrally by Texas Roadhouse.

The brand’s decentralized management model allows local operators significant autonomy while maintaining strict food quality and service standards. This structure has been a major driver of consistency and scalability.

Bubba’s 33

Bubba’s 33 is a casual dining sports bar concept wholly owned and operated by Texas Roadhouse. The brand focuses on burgers, pizza, wings, and beer in a sports-centric environment.

Unlike Texas Roadhouse, Bubba’s 33 emphasizes televisions, bar seating, and a younger demographic. The concept was internally developed rather than acquired, allowing Texas Roadhouse to apply its operational expertise while targeting a different customer segment.

Bubba’s 33 has expanded steadily but remains smaller than the flagship brand. Texas Roadhouse continues to open new Bubba’s 33 locations selectively, using company ownership rather than aggressive franchising.

Jaggers

Jaggers is a fast-casual restaurant concept owned and operated by Texas Roadhouse. The brand focuses on burgers, chicken sandwiches, fries, and milkshakes with a simplified menu and a faster service model.

Jaggers was created to explore a different segment of the restaurant market while leveraging Texas Roadhouse’s supply chain and operational discipline. Locations are company-owned and strategically placed to test scalability and long-term viability.

As of 2025, Jaggers remains a smaller experimental brand. Texas Roadhouse continues to refine the concept rather than rapidly expanding it.

Restaurant Support and Operating Entities

In addition to consumer-facing brands, Texas Roadhouse operates internal entities that support restaurant operations. These include centralized meat-cutting facilities, training programs, and supply chain infrastructure designed to ensure consistency across all brands.

These entities are not branded independently but play a critical role in maintaining food quality, cost control, and operational efficiency. By keeping these functions in-house, Texas Roadhouse reduces reliance on third parties and preserves tight operational oversight.

Final Thoughts

Who owns Texas Roadhouse is best answered by understanding its public ownership model. The company is controlled by a broad base of shareholders, with institutional investors and the founder’s estate playing the most influential roles. This balance has allowed Texas Roadhouse to scale while preserving its original culture and operating discipline. Its ownership structure supports long-term growth rather than short-term financial engineering.

FAQs

Why is Texas Roadhouse called Texas Roadhouse?

Texas Roadhouse was named to reflect a Texas-style steakhouse experience, even though the company was not founded in Texas. The name was chosen to evoke bold flavors, hand-cut steaks, and a rustic roadhouse atmosphere associated with Texas culture.

Who owns Texas Roadhouse?

Texas Roadhouse is a publicly traded company owned by shareholders. There is no single owner. Ownership is dominated by large institutional investors, along with smaller holdings from insiders and retail investors.

Who is the parent company of Texas Roadhouse?

Texas Roadhouse does not have a parent company. It operates independently as a standalone public corporation listed on NASDAQ under the ticker TXRH.

Does Willie Nelson still own Texas Roadhouse?

No, Willie Nelson does not own Texas Roadhouse. He was never the owner of the company. His association with the brand comes from music licensing and early promotional connections, not ownership.

Who owns the most stock in Texas Roadhouse?

The largest shareholder of Texas Roadhouse is BlackRock, which owns approximately 9.8% of the company. Vanguard Group follows closely with about 9.5% ownership.

Is Texas Roadhouse owned by Darden?

No, Texas Roadhouse is not owned by Darden Restaurants. Darden operates separate brands such as Olive Garden and LongHorn Steakhouse. Texas Roadhouse is an independent company.

Who founded Texas Roadhouse?

Texas Roadhouse was founded by Kent Taylor in 1993. He created the concept to deliver affordable steaks in a high-energy, customer-focused environment.

What are Texas Roadhouse’s sister restaurants?

Texas Roadhouse’s sister restaurants are brands owned and operated by the same company. These include Bubba’s 33 and Jaggers, which target different dining segments.

What chain does Texas Roadhouse own?

Texas Roadhouse owns and operates Texas Roadhouse restaurants, Bubba’s 33, and Jaggers. All three concepts are developed internally rather than acquired through mergers.

What are Texas Roadhouse’s subsidiaries?

Texas Roadhouse subsidiaries include its company-owned restaurant operations, brand-specific operating entities, and internal support units such as training and supply chain operations. These entities exist to support restaurant management rather than operate as separate consumer brands.

Who started Texas Roadhouse?

Texas Roadhouse was started by Kent Taylor, who opened the first restaurant in Clarksville, Indiana, in 1993 after securing local investor backing.

Is the Texas Roadhouse franchise owned?

Texas Roadhouse operates a mixed model. Most US locations are company-owned, while some international locations are operated through franchise agreements. The company maintains strong operational control over both models.

Is Texas Roadhouse only in the USA?

No, Texas Roadhouse is not limited to the United States. While most locations are in the US, the company also operates internationally through franchised restaurants in multiple countries.