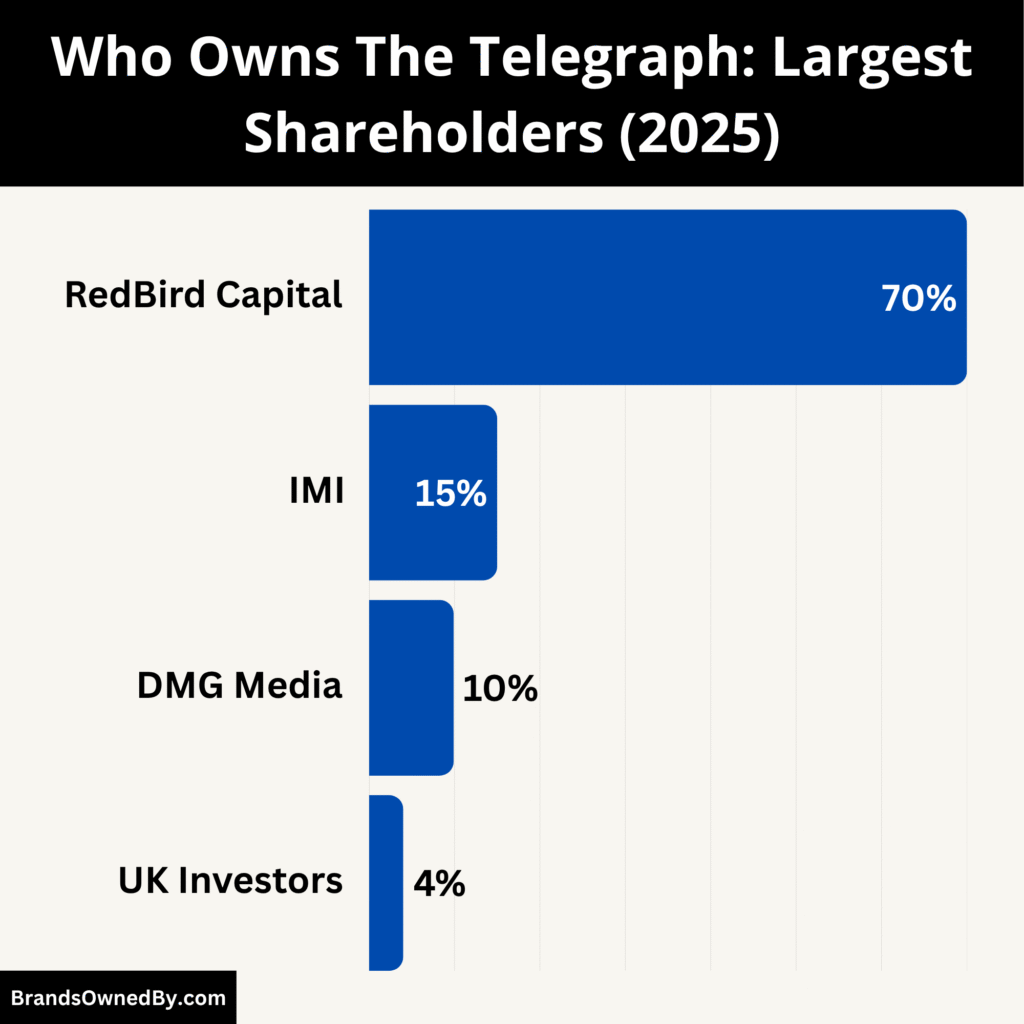

- RedBird Capital Partners holds the majority ownership stake of approximately 70% in The Telegraph, following its £500 million acquisition in 2025. It has full strategic and operational control, overseeing the company’s long-term growth and digital transformation.

- International Media Investments (IMI), an Abu Dhabi–based investment group backed by Sheikh Mansour bin Zayed Al Nahyan, owns a minority stake capped at 15%, in accordance with UK media ownership regulations limiting foreign state-linked holdings.

- UK-based minority investors, including potential participation from DMG Media and other strategic partners, collectively hold around 15%, providing British representation and maintaining national editorial oversight.

- This ownership structure — 70% RedBird, up to 15% IMI, and 15% UK investors — ensures The Telegraph remains financially strong, globally competitive, and editorially independent under its new leadership in 2025.

Telegraph Media Group (TMG) is one of the United Kingdom’s most established and influential media companies, best known for publishing The Daily Telegraph and The Sunday Telegraph.

Over the decades, it has evolved from a traditional newspaper publisher into a modern, subscription-first media organization focused on delivering quality journalism, insightful commentary, and premium digital content. The Telegraph’s digital transformation has positioned it as a leader in online news subscriptions and multimedia storytelling, balancing its heritage with innovation in the modern media landscape.

Telegraph Media Group Limited (Company No. 00451593) was formally incorporated in 1948, though its origins trace back to the mid-19th century. Its registered office is located at 111 Buckingham Palace Road, London SW1W 0DT. The company operates under the Standard Industrial Classification (SIC) code 58130, which covers the publishing of newspapers and related digital media.

TMG manages several core platforms — including its main print newspapers, the digital hub telegraph.co.uk, a popular mobile application, and a growing portfolio of specialist magazines. Through these, it delivers breaking news, political analysis, lifestyle features, and cultural commentary to a global audience.

The Telegraph Founders

The Telegraph was originally founded in June 1855 by Colonel Arthur B. Sleigh, who launched it as The Daily Telegraph and Courier. However, Sleigh soon sold the struggling paper to Joseph Moses Levy, a printer and publisher who, alongside his son Edward Levy-Lawson, transformed it into The Daily Telegraph.

Under the Levy family’s stewardship, the newspaper grew rapidly in circulation and reputation, becoming one of Britain’s most respected dailies. Their editorial leadership and commitment to accessible yet high-quality journalism laid the foundation for the Telegraph’s long-standing success.

Telegraph Major Milestones

- 1855 – The Daily Telegraph and Courier publishes its first issue in London, marking the newspaper’s official launch.

- 1858 – The paper shortens its name to The Daily Telegraph and begins positioning itself as a leading voice for liberal, accessible journalism.

- 1908 – The Telegraph achieves record circulation and becomes one of Britain’s largest-selling newspapers of the early 20th century.

- 1961 – Launch of The Sunday Telegraph, expanding the brand’s reach into weekend journalism and lifestyle features.

- 1986 – The Telegraph moves its operations from Fleet Street to Canary Wharf, symbolizing modernization within British media.

- 1994 – Launch of the Electronic Telegraph, making the company one of the first major British newspapers to establish an online presence.

- 2004 – The Barclay brothers (Sir David and Sir Frederick Barclay) acquire Telegraph Media Group through Press Holdings, beginning two decades of family ownership.

- 2006 – The company officially rebrands as Telegraph Media Group, reflecting its expansion into multimedia platforms.

- 2016 – The Telegraph’s digital transformation accelerates, with a new focus on subscription models and digital journalism.

- 2020–2021 – TMG surpasses 700,000 paid subscribers, becoming one of the UK’s leading digital subscription publishers.

- 2023 – Acquisition of the Chelsea Magazine Company, adding premium lifestyle and specialist magazines to the group’s portfolio.

- 2024 – Telegraph.co.uk celebrates its 30th anniversary, marking three decades of online publishing and audience growth.

- 2025 – Ownership of Telegraph Media Group changes hands from the Barclay family to RedBird Capital Partners, a U.S.-based investment firm. The deal, valued at around £500 million, signifies a major new chapter, with RedBird assuming full control and introducing new leadership to drive global expansion and digital innovation.

Who Owns Telegraph: Top Shareholders

Telegraph Media Group’s ownership has undergone one of the most significant transformations in modern British media. After years under family control, the company entered a new era in 2025 under professional investment-led ownership.

A consortium headed by RedBird Capital Partners now leads the company, supported by International Media Investments (IMI) and a few strategic UK minority investors. This change reflects a wider trend across global media — where legacy institutions are shifting from family ownership to diversified corporate investment for sustainability and digital expansion.

Below are the major shareholders of The Telegraph as of November 2025:

| Shareholder / Investor | Type / Origin | Estimated Ownership & Role | Influence and Control | Key Contributions / Strategic Importance |

|---|---|---|---|---|

| RedBird Capital Partners | Private investment firm (United States) | Majority ownership (estimated above two-thirds of total shares). Acquired full control of Telegraph Media Group in 2025 through a £500 million deal. | Holds decisive voting control, appoints board members, and directs executive leadership. Responsible for setting overall corporate and editorial strategy. | Brings global investment expertise, media management experience, and strong financial resources to accelerate TMG’s digital growth, subscription model, and global expansion. |

| International Media Investments (IMI) | Investment vehicle based in Abu Dhabi, backed by Sheikh Mansour bin Zayed Al Nahyan | Minority ownership, capped under UK rules at an estimated 10–15%. No controlling rights. | Advisory and partnership role with limited voting rights. May have one board observer seat or non-executive representation. | Provides international reach, financial backing, and regional media experience. Enhances TMG’s global footprint while operating within UK regulatory limits. |

| UK Minority Investors (Various) | UK-based investors, likely institutional or strategic | Combined ownership estimated under 10%, typically in small single-digit stakes (1–5% each). | Limited direct control but potential influence through advisory roles or non-executive board positions. | Help maintain domestic representation and regulatory balance. Contribute local industry knowledge, stability, and UK editorial oversight. |

| DMG Media (Potential Investor) | British media group (publisher of The Daily Mail) | Reported interest in acquiring a sub-10% minority stake (around 9.9%). Still under negotiation as of 2025. | Non-controlling role with possible board representation or observer status if participation finalizes. | Offers strategic media alignment, UK market expertise, and operational synergies within the British publishing sector. |

| Other Strategic / Institutional Investors | Small-scale UK investors, family offices, or institutional funds | Collectively hold minor stakes estimated at 3–5% combined. | No significant control. May participate via shareholder committees or advisory panels. | Support TMG’s governance diversity, provide capital stability, and add reputational value for compliance with UK media ownership standards. |

RedBird Capital Partners

RedBird Capital Partners, a U.S.-based private investment firm, now holds the controlling ownership of Telegraph Media Group. Following a £500 million acquisition deal completed in 2025, RedBird assumed full operational and strategic control of the company. The firm is recognized for its global portfolio spanning sports, media, and technology, including stakes in AC Milan, Fenway Sports Group, and various U.S. media ventures.

Within the Telegraph’s structure, RedBird is the dominant decision-maker, responsible for appointing top executives, including board members and senior leadership. It is expected to implement a performance-driven management style and to accelerate digital subscription growth, video journalism, and event-based business models.

While exact figures are not publicly disclosed, reports suggest RedBird controls the majority of TMG’s shares, exceeding two-thirds ownership. This position gives it ultimate decision-making power, including control over capital allocation, corporate strategy, and long-term brand direction.

International Media Investments (IMI)

International Media Investments (IMI), based in Abu Dhabi and backed by Sheikh Mansour bin Zayed Al Nahyan, plays a minority but influential role in the Telegraph’s new ownership framework. IMI was initially a major funding partner in the joint venture that helped finance the acquisition of TMG. However, due to the UK government’s restrictions on foreign state ownership of national news outlets, IMI’s stake is limited to a minority share estimated to be around 15%.

Although IMI does not exercise management control, its involvement introduces significant strategic advantages, including potential for international expansion and access to broader media partnerships. IMI’s experience with regional media assets, such as The National newspaper in the UAE, complements RedBird’s investment expertise by adding global reach and cultural insight. Its role in TMG is largely advisory, with likely participation through a single board seat or observer status, allowing for influence without direct operational control.

UK Minority Investors and Strategic Partners

Alongside RedBird and IMI, Telegraph Media Group’s ownership also includes smaller UK-based minority investors. These stakeholders, primarily strategic investors or media groups, are included to ensure a balance of domestic influence and regulatory comfort. Among the names discussed publicly is DMG Media, the publisher of The Daily Mail, which has reportedly explored a potential minority position of under 10%.

These UK investors play a key role in reinforcing British representation within the company’s ownership structure. Their participation adds local insight, political balance, and alignment with national media standards. In corporate governance terms, they are likely to hold small voting stakes with possible representation through non-executive board seats.

Collectively, their influence ensures that the Telegraph remains anchored in the UK market, both editorially and operationally, despite international investment leadership.

The Telegraph Acquisition

The Telegraph Media Group, publisher of the UK newspapers The Daily Telegraph and The Sunday Telegraph, had been on the market after its previous controlling owners encountered financial difficulties. The sale process began in earnest around 2023, when the holding company controlled by Sir Frederick Barclay and Sir David Barclay (collectively the “Barclay brothers”) announced it would put the business up for sale. From this starting point, the acquisition process developed into a major transaction.

Agreement Terms

In May 2025, the U.S. investment firm RedBird Capital Partners announced an in-principle agreement to acquire the Telegraph Media Group in a transaction valuing the business at £500 million (approximately $674 million).

The agreement marked RedBird’s intent to become the sole controlling owner of the business. Under the terms of the deal, the Abu Dhabi-based investor International Media Investments (IMI) would participate as a minority investor, with its stake capped at up to 15% in compliance with UK ownership rules for media.

RedBird’s stated strategy under this acquisition included:

- investment in digital operations and subscription growth;

- use of data analytics and AI tools to enhance reader engagement and monetisation;

- international expansion of the brand, particularly into the U.S. market;

- leveraging the senior management team at TMG to execute the growth plan.

Regulatory and Political Challenges

The acquisition did not proceed in a straight line. Several regulatory, competition and public-interest issues emerged:

- In late 2023, the UK government issued a Public Interest Intervention Notice relating to an earlier attempt by RedBird/IMI to acquire the group, because of concerns over foreign state influence in the national press.

- U.K. legislation concerning foreign state ownership of British newspapers had to be amended. Initially, some proposals aimed to ban foreign state ownership altogether; by mid-2025, it was settled that foreign state-linked investors could hold up to 15% of a national newspaper publisher. This legislative change cleared a major hurdle for the deal.

- Media freedom and plurality groups raised concerns about potential influence from foreign state actors as part of the transaction. Their submissions emphasised the need for safeguards on editorial independence.

- The acquisition still remains subject to regulatory approval, including competition law, public interest review and media plurality oversight, so the deal is only in principle pending formal sign-off.

Stakeholder Roles and Ownership Structure

Under the acquisition, the roles of the principal stakeholders are defined as follows:

- RedBird Capital Partners will become the majority and controlling shareholder, with full strategic and operational control of TMG. It holds the decisive governance rights including board nominations, executive appointments and business strategy execution.

- International Media Investments (IMI) will take a minority stake, capped at up to 15%, which gives it financial exposure and strategic alignment but not controlling authority.

- Additional UK-based minority investors (such as strategic media groups) were reported to be invited to invest under the deal structure. These minority participants support domestic representation, regulatory acceptance and local market insight.

Strategic Significance

This acquisition has several important implications:

- It signals one of the largest investments in UK print media in a decade, especially for a legacy newspaper group transitioning into digital-first operations.

- The deal reflects the ongoing transformation in the media industry: legacy print brands must shift towards subscription models, digital engagement, new product lines (events, verticals) and international expansion.

- For TMG, the injection of capital and global investment expertise aims to strengthen its competitive position in a crowded news market, enhance its technological capabilities (such as AI/data analytics) and broaden its reach beyond the UK.

- From a media-policy perspective, the deal underscores the increasing interplay between investment capital, regulatory frameworks (especially around foreign ownership) and concerns about media independence and influence.

Current Status and Next Steps

As of now, the acquisition is in the in-principle stage. RedBird has formally submitted the required documentation to the relevant UK authorities for approval. The deal will only close once regulatory sign-offs are secured. Meanwhile, TMG’s management is preparing to implement the growth strategy outlined by RedBird: scaling subscriptions, enhancing digital product suites, expanding internationally and investing in new content verticals. The process remains closely watched by regulators, media freedom groups and industry observers.

Who is the CEO of The Telegraph?

Anna Jones is the Chief Executive Officer of Telegraph Media Group (TMG), appointed in January 2024 following the departure of former CEO Nick Hugh. Her leadership comes at a crucial turning point for the Telegraph, coinciding with a major ownership transition and the company’s ongoing evolution from traditional print to digital-first publishing.

As CEO, Anna Jones oversees all business operations, including editorial strategy, digital transformation, subscription growth, commercial performance, and global expansion. She is also responsible for guiding the company through its post-acquisition restructuring and ensuring that the Telegraph remains both financially sustainable and editorially independent under new ownership.

Background and Career

Anna Jones is a veteran media executive with more than two decades of experience in publishing, digital media, and business leadership. Before joining TMG, she served as Chief Executive Officer of Hearst UK from 2014 to 2017, where she managed over 20 media brands, including Elle, Harper’s Bazaar, and Cosmopolitan. Under her tenure, Hearst UK underwent a successful digital transformation, doubling its online audience and diversifying its revenue streams through events and branded content.

Following her success at Hearst, Jones co-founded AllBright, a global network supporting women in business and entrepreneurship. She has also held senior roles at Hachette UK, Emap, and several digital ventures. Her background blends traditional media management with a modern entrepreneurial mindset, making her a strong fit for leading the Telegraph into its next growth phase.

Leadership Style and Strategic Vision

Anna Jones is known for her collaborative yet results-driven leadership style, balancing commercial ambition with editorial integrity. Since taking charge, she has reinforced a “subscription-first” strategy, emphasizing premium journalism, data-led storytelling, and technological investment. Her leadership has also focused on expanding TMG’s digital audience, launching new verticals in lifestyle and finance, and developing international readership through digital platforms.

She is a strong advocate for diversity, inclusion, and workplace culture, drawing from her experience at AllBright. Within the Telegraph, she has implemented initiatives to modernize newsroom practices, encourage innovation, and enhance internal collaboration between editorial, product, and technology teams.

Under her leadership, the company’s priorities include:

- Expanding digital subscriptions and premium content offerings

- Modernizing the Telegraph’s digital infrastructure and user experience

- Strengthening the brand’s global presence and digital advertising business

- Sustaining profitability amid industry-wide print decline

- Maintaining independence and editorial trust under new ownership.

Salary, Compensation, and Net Worth

As of 2025, Anna Jones’s compensation reflects her position as one of the leading media executives in the UK. While exact figures are not publicly disclosed, industry estimates place her base salary between £600,000 and £800,000 per year, with total compensation (including bonuses and incentives) potentially reaching £1 million to £1.5 million annually, depending on performance outcomes.

Her compensation package is understood to include performance-linked bonuses tied to subscriber growth, revenue diversification, and profitability metrics, as well as long-term incentive plans likely tied to the company’s equity performance following the RedBird Capital acquisition.

In terms of personal wealth, Anna Jones’s estimated net worth is believed to be in the multi-million-pound range, largely from her past executive roles, entrepreneurial ventures like AllBright, and investments in media-related projects.

Challenges and Future Outlook

As CEO, Jones faces the challenge of balancing rapid modernization with the preservation of the Telegraph’s 170-year heritage. She must maintain editorial independence while navigating expectations from new majority owner RedBird Capital Partners and minority stakeholders such as International Media Investments (IMI).

Her strategic vision aims to secure the Telegraph’s long-term sustainability by:

- Growing its subscription base beyond one million readers

- Diversifying into live events, premium podcasts, and digital video

- Expanding the Telegraph brand internationally

- Integrating AI and data analytics to personalize reader experiences.

Under her leadership, the Telegraph Media Group is expected to become one of Europe’s most digitally advanced legacy news organizations — combining its historic reputation with a modern, technology-driven business model.

In 2025, Anna Jones stands as a transformative figure in British media, symbolizing both the Telegraph’s evolution and the broader shift of journalism toward digital innovation, diversity, and global reach.

The Telegraph Annual Revenue and Net Worth

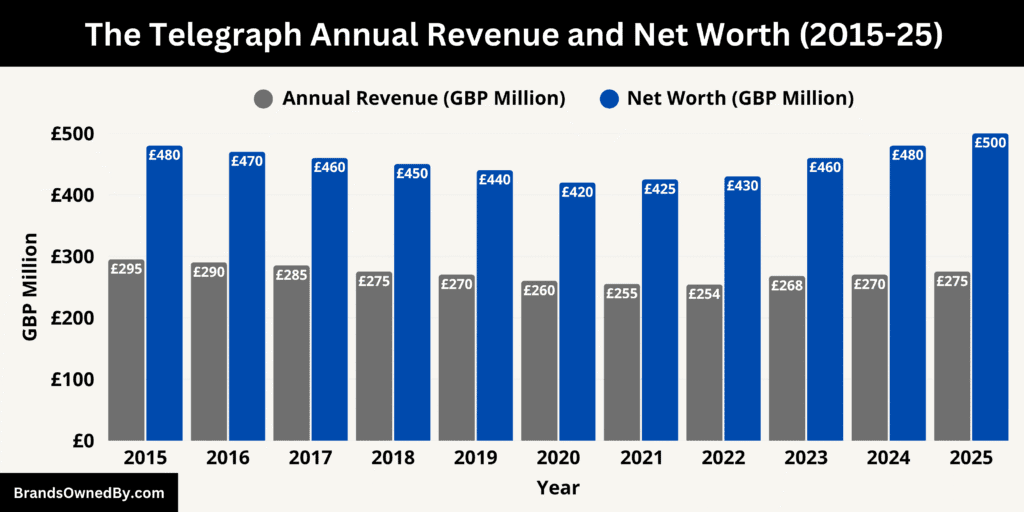

As of November 2025, Telegraph Media Group (TMG) continues to strengthen its financial position under new ownership and leadership. The company reported an estimated annual revenue of around £275 million for the most recent fiscal year, reflecting modest year-on-year growth driven by digital subscriptions, advertising, and branded content.

Despite economic headwinds and a shifting media landscape, TMG remains one of the most profitable traditional news publishers in the UK. The group’s estimated net worth is approximately £500 million, largely based on its acquisition valuation by RedBird Capital Partners in 2025. This valuation underscores the Telegraph’s strong brand equity, high subscription value, and resilient readership base in both print and digital segments.

Revenue Growth and Performance in 2025

Telegraph Media Group’s 2025 revenue performance demonstrates steady progress in adapting to a digital-first economy. The company’s total revenue of about £275 million represents an increase from £268 million in 2023, marking a return to growth following a challenging transition period. The improvement is attributed primarily to the expansion of paid digital subscriptions, which now contribute over half of total revenues.

TMG’s digital subscription base surpassed 800,000 active subscribers in 2025, reflecting growing demand for premium, paywalled journalism. The company’s introduction of new content verticals — including business intelligence, lifestyle, and finance-focused sections — has helped attract younger readers and professionals. Advertising revenue also showed resilience, supported by premium sponsorship deals, targeted data-driven campaigns, and programmatic growth through the Telegraph’s proprietary digital platforms.

Print operations, while declining as part of the global industry trend, continue to generate substantial revenue through loyal readership and high-end print advertising, particularly in the Saturday Telegraph and Sunday Telegraph editions. The group’s events division, which includes live conferences and branded experiences, also contributed to revenue diversification, generating steady growth year over year.

Profitability and Financial Stability

Despite earlier financial turbulence related to ownership restructuring under the Barclay family, TMG has stabilized its profitability. Under the new leadership of CEO Anna Jones and the backing of RedBird Capital, the company implemented tighter cost controls, technology investments, and an operational efficiency program focused on sustainable profitability.

Operating profit before exceptional items is estimated to have improved significantly in 2025 compared to the previous year’s performance, where accounting provisions had temporarily distorted results. The combination of higher subscription revenues, lower print distribution costs, and strategic investments in automation has restored the group’s profit margins.

Furthermore, the company’s subscription-first model provides predictable recurring revenue, improving cash flow and reducing reliance on volatile advertising income. This shift toward a membership-driven business model has been one of the most important financial transformations in TMG’s modern history.

Net Worth and Valuation in 2025

The estimated net worth of Telegraph Media Group in 2025 stands at around £500 million, consistent with its acquisition valuation by RedBird Capital Partners. This figure reflects the group’s total equity value, including its publishing assets, intellectual property, digital infrastructure, and brand goodwill.

This valuation positions TMG among the most valuable privately held media groups in the United Kingdom. Analysts attribute this high valuation to several factors: the Telegraph’s global reputation, its rapid digital growth trajectory, and its loyal subscriber base. Additionally, the value of the Telegraph brand — built over 170 years — remains one of its greatest intangible assets, contributing substantially to the company’s overall worth.

RedBird Capital’s acquisition further reinforced this valuation by injecting new investment capital, restructuring debt obligations inherited from the previous ownership, and setting clear profitability targets. The transaction also strengthened TMG’s balance sheet, paving the way for sustainable growth and expansion into international markets.

Historical Revenue and Net Worth (2015-25)

Between 2015 and 2025, Telegraph Media Group (TMG) experienced a decade of transformation from a print-dependent publisher to a digitally driven media organization.

In the mid-2010s, annual revenues hovered around £290–£295 million, supported primarily by strong print sales and advertising. However, as the media landscape shifted, the company faced gradual declines in print income between 2016 and 2019, with revenue dropping to about £270 million. During this period, TMG began investing heavily in digital infrastructure and subscription models to offset falling ad revenue.

By 2020, the pandemic accelerated the transition to digital, leading to a surge in online readership and subscriptions, even as total revenue briefly fell to £260 million. From 2021 onward, the company regained stability as digital subscriptions surpassed 700,000, marking a turning point in its financial trajectory.

From 2022 to 2025, TMG entered a recovery and growth phase, supported by stronger digital revenues, operational efficiency, and renewed investor confidence. Revenue grew steadily to £275 million in 2025, while the company’s net worth rose from £420 million in 2020 to around £500 million following RedBird Capital’s acquisition.

This decade-long evolution highlights TMG’s resilience — transforming from a traditional print business into one of the UK’s most valuable and financially stable digital media organizations, ready for continued growth under its new ownership and leadership structure.

Financial Outlook and Future Growth

Looking ahead, TMG’s financial outlook for 2026 and beyond is optimistic. Under Anna Jones’s leadership, the company aims to cross the £300 million annual revenue mark within the next two years. The focus will remain on scaling its digital business, expanding paid products, and leveraging technology such as AI for content personalization and customer retention.

The group also plans to extend its brand globally through partnerships, international editions, and digital membership programs. With strong backing from RedBird Capital Partners, the Telegraph is expected to maintain its position as a financially stable and strategically agile media powerhouse.

Brands Owned by The Telegraph

As of 2025, Telegraph operates a diverse portfolio of news, lifestyle, and digital media brands. Below are the main companies, brands, and divisions directly owned and operated by The Telegraph:

| Brand / Entity | Category | Established / Acquired | Primary Focus / Description | Key Operations & Role |

|---|---|---|---|---|

| The Daily Telegraph | National Newspaper | Founded 1855 | Flagship publication of The Telegraph group, known for its political, economic, and international reporting. | Publishes daily in print and online; cornerstone of the subscription model; drives readership and editorial reputation. |

| The Sunday Telegraph | Sunday Newspaper | Founded 1961 | Weekend edition focused on long-form journalism, culture, lifestyle, and opinion. | Complements the daily paper; strong weekend circulation; contributes to digital and print subscriber growth. |

| Telegraph.co.uk | Digital News Platform | Launched 1994 | Central online hub for all Telegraph content, including news, sports, business, and lifestyle. | Hosts premium paywalled content; serves 800,000+ digital subscribers; integrates newsletters, podcasts, and multimedia. |

| Telegraph App | Mobile Application | Introduced 2018 | The official mobile platform for news updates and subscriber access. | Delivers personalized content and real-time news; enhances user engagement through push notifications and mobile exclusives. |

| Telegraph Travel | Lifestyle / Travel Vertical | Established 1997 | Travel journalism and destination expertise, including reviews and guides. | Produces travel content, organizes travel fairs, and partners with travel agencies for branded offerings. |

| Telegraph Lifestyle | Lifestyle Brand | Expanded 2010s | Covers health, fashion, food, and wellbeing content for modern audiences. | Develops lifestyle content, hosts online campaigns, and engages audiences through newsletters and video features. |

| Telegraph Sport | Sports Media Vertical | Established 1880s (as sports coverage) | Comprehensive sports journalism covering major global and UK sports. | Provides live coverage, analysis, and commentary; key contributor to digital subscriptions and reader engagement. |

| Telegraph Business | Business & Finance Vertical | Established mid-20th century | Focused on financial news, markets, and corporate analysis. | Produces business news, investor reports, and executive newsletters for professionals and entrepreneurs. |

| Telegraph Money | Financial & Consumer Advice | Established 1990s | Specializes in personal finance, investment, and pension coverage. | Offers money management guides, interactive tools, and consumer-focused features for subscribers. |

| Telegraph Women | Lifestyle & Opinion Vertical | Established 2018 | Platform highlighting women’s issues, leadership, health, and equality. | Features columns, interviews, and culture pieces targeting professional and female readership. |

| Telegraph Premium | Subscription Service | Launched 2016 | Premium tier for exclusive and ad-free journalism. | Provides members-only articles, opinion pieces, newsletters, and early access to investigative content. |

| Chelsea Magazine Company (CMC) | Magazine Publisher (Subsidiary) | Acquired 2023 | Publishes luxury and niche lifestyle magazines. | Owns The English Home, The English Garden, Artists & Illustrators, and Classic Boat; operates as a standalone subsidiary. |

| The English Home | Lifestyle Magazine | Part of CMC | Focused on British interior design, architecture, and home décor. | Offers editorial content and luxury advertising targeted at affluent homeowners. |

| The English Garden | Gardening Magazine | Part of CMC | Dedicated to horticulture, garden design, and seasonal planting. | Publishes expert guides and features; hosts events and partnerships in garden design. |

| Artists & Illustrators | Art Magazine | Part of CMC | One of the UK’s top magazines for artists and art enthusiasts. | Covers techniques, exhibitions, and profiles; strong circulation among creative professionals. |

| Classic Boat | Maritime Magazine | Part of CMC | Focused on yachting heritage and classic boat craftsmanship. | Publishes features on restoration, sailing culture, and maritime history. |

| Telegraph Studios | Branded Content Division | Established 2015 | Commercial storytelling and multimedia production arm. | Develops branded campaigns, native advertising, and creative marketing partnerships. |

| Telegraph Audio | Podcast & Audio Division | Established 2020 | Produces podcasts and audio journalism. | Covers politics, business, culture, and sport; expands reach among podcast listeners. |

| Telegraph Events | Events & Experiences Division | Established 2010s | Organizes conferences, live events, and reader experiences. | Generates alternative revenue; hosts travel shows, leadership summits, and lifestyle expos. |

| Telegraph Data & Insights | Analytics & Research Division | Established 2021 | Focuses on audience behavior and digital strategy. | Uses data to drive personalization, marketing, and advertiser insights. |

The Daily Telegraph

The Daily Telegraph is the flagship publication and the foundation of The Telegraph’s media empire. Founded in 1855, it is known for its political coverage, investigative journalism, and analysis of national and global affairs. The daily newspaper remains one of the UK’s most respected and widely circulated titles.

While print continues to serve a loyal readership, The Daily Telegraph now reaches a larger audience online through its digital subscription platform. It produces exclusive subscriber-only articles, editorials, and features that form the cornerstone of the Telegraph’s premium journalism model.

The Sunday Telegraph

Launched in 1961, The Sunday Telegraph provides long-form analysis, lifestyle features, and in-depth commentary. It complements the weekday editions by offering weekend reporting on culture, travel, finance, and politics. The publication remains a staple in British households and continues to generate strong print and digital readership.

The Sunday edition shares editorial teams and digital infrastructure with The Daily Telegraph, ensuring consistency in tone and quality across all publishing formats.

Telegraph.co.uk

Telegraph.co.uk serves as the main digital hub for all Telegraph content. It combines breaking news, long-form journalism, and multimedia storytelling across categories such as news, business, politics, sport, lifestyle, and culture.

As of 2025, the website has surpassed 800,000 paid subscribers, making it one of the most successful digital news platforms in the UK. Its advanced personalization algorithms, mobile optimization, and AI-driven news recommendations have turned it into a leader in digital subscription publishing.

Telegraph App

The Telegraph App is a comprehensive mobile platform offering real-time news, alerts, live updates, and personalized reading experiences. It integrates all Telegraph publications and features sections for premium subscribers.

In 2025, the app continues to be a major driver of subscription growth and audience engagement, especially among mobile-first users. It also provides access to live events, newsletters, and curated news feeds tailored to readers’ interests.

Telegraph Travel

Telegraph Travel is one of the UK’s most popular travel media brands. It offers expert travel writing, hotel and destination reviews, and curated holiday recommendations. The platform also partners with travel companies to offer bespoke holiday packages and experiences.

Known for its editorial independence and award-winning journalism, Telegraph Travel maintains high reader trust while generating revenue through partnerships and sponsored content.

Telegraph Lifestyle

Telegraph Lifestyle covers a wide range of consumer interests, including health, fashion, food, fitness, relationships, and family. The brand’s digital section has become a key traffic driver for the main Telegraph website, appealing to younger and more diverse audiences.

It also produces digital newsletters, podcasts, and events focused on wellbeing and lifestyle trends, creating new engagement opportunities and revenue streams.

Telegraph Sport

Telegraph Sport is a major arm of the Telegraph’s publishing portfolio. It offers comprehensive coverage of football, cricket, rugby, tennis, golf, and Formula 1, among others.

The brand is known for exclusive interviews, opinion pieces, and match analysis written by prominent sports journalists and former athletes. In 2025, it continues to be one of the highest-performing verticals in terms of reader engagement and online subscriptions.

Telegraph Business

Telegraph Business provides in-depth coverage of financial markets, corporate developments, and economic policy. Its readership consists of professionals, investors, and business leaders seeking analytical reporting and insights.

The business desk produces newsletters, market reports, and data-backed opinion pieces, reinforcing the Telegraph’s reputation as a trusted source for financial news in the UK and internationally.

Telegraph Money

Telegraph Money focuses on personal finance, investment, pensions, property, and consumer advice. It serves as a practical guide for readers managing their savings, mortgages, and retirement plans.

In addition to print and online coverage, Telegraph Money hosts webinars and publishes regular financial guides for subscribers, making it one of the Telegraph’s most valuable service-oriented sections.

Telegraph Women

Telegraph Women is a lifestyle and opinion platform that highlights women’s voices, leadership, health, and cultural topics. It reflects The Telegraph’s commitment to inclusive journalism and aims to engage professional and female readership segments through thought-provoking commentary and expert columns.

Telegraph Premium

Telegraph Premium is the Telegraph’s subscriber-only service offering exclusive articles, opinion columns, and investigative reporting. This paywalled content is the backbone of the Telegraph’s digital business strategy, encouraging loyalty and long-term engagement from paying readers.

Subscribers gain access to enhanced features, premium newsletters, and ad-free browsing, aligning with the company’s “subscription-first” growth model.

Chelsea Magazine Company

Acquired in 2023, Chelsea Magazine Company (CMC) operates as a wholly owned subsidiary of The Telegraph. CMC specializes in high-quality lifestyle and specialist magazines catering to niche audiences.

The company publishes several well-known titles, including:

- The English Home — covering interior design, architecture, and traditional British homes.

- The English Garden — focused on horticulture and garden design.

- Artists & Illustrators — one of the UK’s leading art magazines for professionals and enthusiasts.

- Classic Boat — celebrating maritime heritage and craftsmanship.

Telegraph Studios

Telegraph Studios is the commercial and branded content division of The Telegraph. It develops creative advertising, multimedia storytelling, and sponsored campaigns for major brands.

The division produces content across video, print, and digital platforms, blending editorial quality with marketing innovation. It has become a key part of the Telegraph’s revenue diversification strategy, bridging journalism and brand partnership opportunities.

Telegraph Audio

Telegraph Audio is responsible for the company’s growing podcast and audio journalism portfolio. It produces a range of programs across news, business, politics, lifestyle, and sport.

In 2025, its most popular podcasts attract large audiences in the UK and abroad, enhancing the Telegraph’s cross-platform media presence and appeal among younger listeners.

Telegraph Events

Telegraph Events manages live and digital experiences under The Telegraph brand. These include reader-focused gatherings, business summits, travel expos, and lifestyle festivals.

The division generates significant non-subscription revenue and strengthens audience engagement by connecting readers directly with journalists, thought leaders, and partner organizations.

Telegraph Data & Insights

Telegraph Data & Insights is the analytics and research arm of the company, responsible for studying reader behavior, optimizing content strategy, and supporting advertisers with audience intelligence.

It plays a crucial role in The Telegraph’s digital transformation, helping drive personalization, retention, and marketing effectiveness.

Final Words

Understanding who owns The Telegraph in 2025 reveals a defining chapter in the evolution of one of Britain’s most prestigious media institutions. The paper has moved from generations of family stewardship to a modern, investment-led structure that ensures both financial strength and editorial independence.

With RedBird Capital Partners holding a controlling 70% stake, International Media Investments (IMI) owning up to 15%, and UK-based minority investors making up the remainder, The Telegraph’s ownership today reflects a balance of global capital and national oversight.

This new structure provides the resources and strategic direction needed for continued digital growth, global reach, and long-term sustainability. Backed by experienced investors yet firmly rooted in British journalism, The Telegraph stands stronger than ever — blending its historic legacy with a forward-looking vision for the future of news.

FAQs

Who owns the Telegraph Media Group?

As of 2025, Telegraph Media Group is majority-owned by RedBird Capital Partners, a U.S.-based investment firm that acquired around 70% of the company in a £500 million deal. International Media Investments (IMI), an Abu Dhabi–based investor backed by Sheikh Mansour bin Zayed Al Nahyan, holds a minority stake of up to 15%, while the remaining shares are owned by UK-based investors, including potential participation from DMG Media and other institutional partners.

Who owns the Telegraph newspaper UK?

The Telegraph newspaper in the UK, which includes The Daily Telegraph and The Sunday Telegraph, is owned by Telegraph Media Group Limited. The company is controlled by RedBird Capital Partners, making the U.S. investment firm the ultimate owner of the Telegraph titles. The acquisition was finalized in 2025, ending two decades of ownership by the Barclay family.

Who owns the Telegraph newspaper?

The Telegraph newspaper is owned by RedBird Capital Partners, with minority stakes held by International Media Investments (IMI) and several UK investors. This ownership model combines international financial backing with domestic oversight to maintain the newspaper’s editorial independence and British identity.

Who runs the Telegraph news?

Anna Jones serves as the Chief Executive Officer (CEO) of Telegraph Media Group. She oversees the company’s operations, strategic growth, and editorial direction, working closely with the board and ownership group. Under her leadership, The Telegraph has focused on digital transformation, subscription growth, and maintaining its reputation for credible, high-quality journalism.

Is The Telegraph a Murdoch paper?

No, The Telegraph is not a Murdoch paper. It is not owned or affiliated with Rupert Murdoch or his company, News Corp. Murdoch’s media empire includes outlets such as The Times, The Sunday Times, and The Sun, but The Telegraph operates independently under the ownership of RedBird Capital Partners and its investor consortium.