The question of who owns Ipswich Town FC does not have a simple one-name answer. The club is owned through Gamechanger 20 Ltd, a group-ownership structure that combines institutional investment with private partners. This model replaced the traditional single-owner approach and introduced a professional governance system built around long-term funding and operational control. Ipswich is now run as a business organization rather than a personal project, with ownership focused on sustainability and growth instead of short-term results.

Key Takeaways

- Ipswich Town FC is owned through Gamechanger 20 Ltd, which controls 100% of the club under a group-ownership model rather than by a single individual.

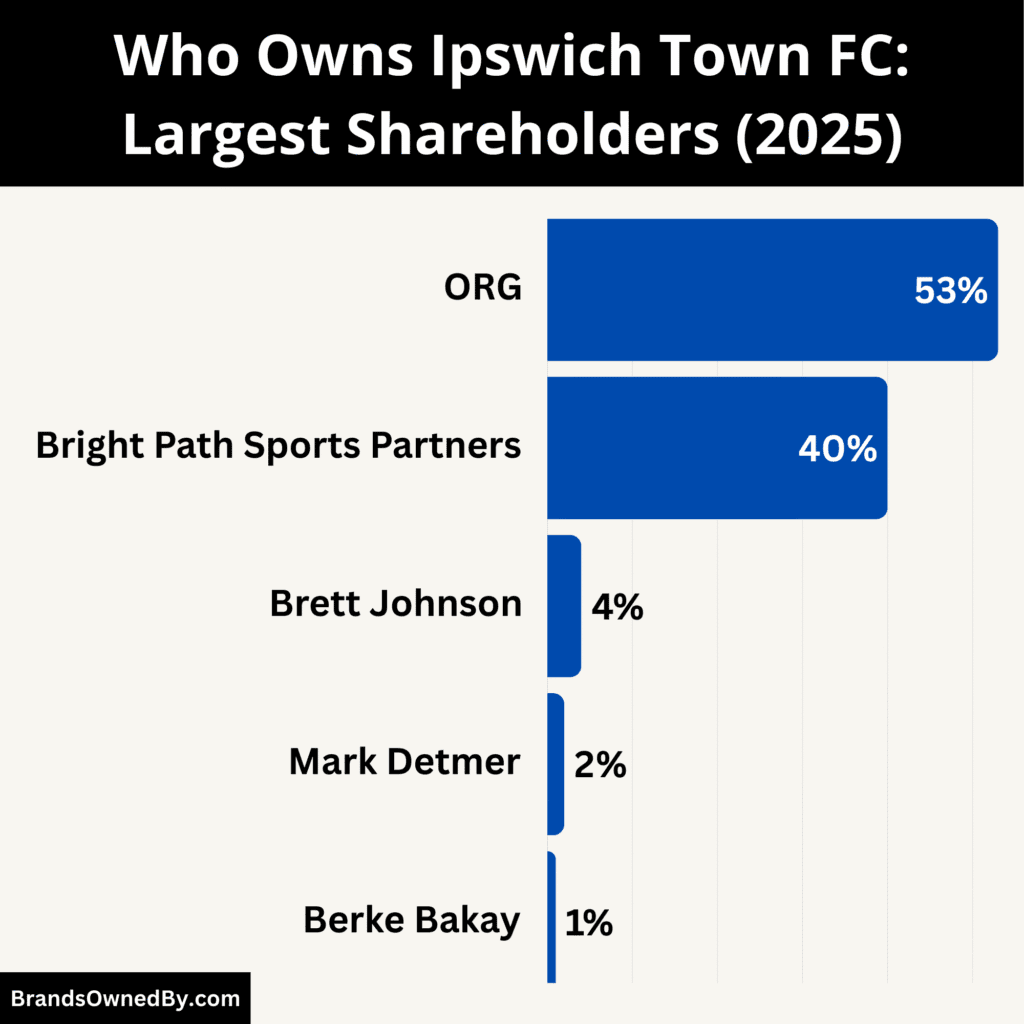

- ORG is the majority shareholder with approximately 53%, giving it decisive voting power and final control over governance and financial strategy.

- Bright Path Sports Partners holds about 40%, making it the largest minority investor with significant influence over investment planning and growth strategy, but without controlling authority.

- Brett Johnson, Mark Detmer, and Berke Bakay together hold about 7% and operate as founding partners with leadership roles rather than financial control.

Ipswich Town FC Overview

Ipswich Town FC is one of English football’s most historic provincial clubs. It is located in Ipswich, Suffolk, England. The team has played its home matches at Portman Road since 1884, making it one of the longest continuously used football stadiums in the country.

Ipswich is famous for achieving success without being supported by major industrial or metropolitan financial power. Instead, the club built its reputation through discipline, structure, and strong leadership. The club is widely admired for winning England’s top division in its first season after promotion and later becoming a European champion without ever having large spending power compared to rivals.

Ipswich has experienced promotions, relegations, financial pressure, and revival cycles throughout its existence. In recent years, under American ownership, the club has moved into a more analytics-focused operating model. Player recruitment and squad development now rely heavily on performance metrics and global scouting networks.

Founders & Formation

Ipswich Town FC was founded in 1878 under the name Ipswich Association FC. The founders were a group of local sportsmen and community leaders in Ipswich who wanted to organize football as a formal sport in the area. Unlike modern franchises, the club was not established by wealth or external investors. It grew organically from school teams, soldiers, and amateur football societies.

In its early years, the club was run entirely by volunteers and local officials. Players were unpaid and matches were arranged by local committees. The club adopted the name Ipswich Town in 1888 and officially joined competitive leagues in East Anglia.

The club remained amateur for more than 50 years. In 1936, it formally turned professional. This decision changed its financial structure, governance model, and recruitment base. Two years later, Ipswich was elected into the Football League, entering national competition for the first time.

The shift from amateur club to professional institution marked the beginning of Ipswich’s transformation from a local side into a national football organization.

Major Milestones

- 1878 – Ipswich Association FC is founded, marking the official birth of the club as a local amateur side.

- 1884 – Portman Road becomes the club’s permanent home ground, beginning one of football’s longest stadium associations.

- 1888 – The club officially adopts the name Ipswich Town FC after restructuring and merging with local teams.

- 1908 – Ipswich becomes a founder member of the Southern Amateur League, increasing competitive exposure.

- 1936 – Ipswich Town turns professional after nearly 60 years as an amateur club.

- 1938 – Ipswich is elected into the Football League, entering the national football system.

- 1954 – Promotion to the Second Division establishes Ipswich as a rising professional force.

- 1961 – Ipswich wins the Second Division title and enters the top flight for the first time.

- 1962 – Ipswich wins the English First Division title in its debut season at the top level under Alf Ramsey.

- 1963 – Alf Ramsey leaves Ipswich to manage England and later wins the World Cup in 1966.

- 1972 – Bobby Robson is appointed manager, beginning another legendary era.

- 1973 – Ipswich wins its first European trophy with the Texaco Cup.

- 1975 – Ipswich reaches the FA Cup semi-final, cementing domestic strength.

- 1978 – Ipswich wins the FA Cup, defeating Arsenal at Wembley.

- 1981 – Ipswich wins the UEFA Cup, becoming European champions after beating AZ Alkmaar.

- 1981 – Ipswich finishes second in the league during the same season as their European triumph.

- 1982 – Ipswich finishes second in the First Division again, completing back-to-back runner-up finishes.

- 1984 – Bobby Robson leaves to manage England after over a decade of success.

- 1992 – Ipswich wins promotion to the inaugural Premier League era through the old First Division title.

- 1995 – Ipswich is relegated from the Premier League, beginning a long recovery phase.

- 2000 – Ipswich wins promotion to the Premier League through the play-offs after more than a decade outside the top tier.

- 2001 – Ipswich qualifies for European competition again via league performance.

- 2002 – Relegation ends a strong Premier League era following financial overreach.

- 2009 – Ipswich suffers relegation to League One, the third tier of English football.

- 2015 – Ipswich reaches the Championship play-offs but narrowly misses promotion.

- 2021 – Gamechanger 20 Ltd acquires the club, marking a shift to American ownership.

- 2022 – Ipswich launches a modernized recruitment and data-driven football structure.

- 2024 – Ipswich secures promotion to the Premier League after finishing near the top of the Championship.

- 2025 – Ipswich enters a new era as a financially stable, professionally run Premier League club with long-term ownership backing.

Who Owns Ipswich Town FC: Major Shareholders

As of 2025, Ipswich Town FC is owned by a consortium under Gamechanger 20 Ltd. This company holds the majority of the club’s shares and provides the structure by which different investors and groups exercise control and funding. The ownership is layered: one major institutional investor holds the controlling share, while private equity firms and individual investors hold substantial minority stakes. This diversified model aims to combine financial stability, investment capital, long-term vision, and experienced football management.

Major recent changes (especially in 2024) reshaped the balance of power among investors — shifting some control from the original backers toward a new private equity firm. The result is a hybrid mix of institutional backing, private investment, and operational management.

Here are the main owners and investors currently involved, and how they influence and control the club.

ORG (53%)

ORG (acting on behalf of a large U.S. pension fund) remains the principal institutional investor in Ipswich Town FC through Gamechanger 20 Ltd. As of the most recent corporate filings, ORG retains the largest single shareholding of the club.

Because ORG holds the majority stake, it maintains effective control over major governance decisions, including overarching financial policies, board composition, and long-term strategic decisions. Their backing gives the club financial stability and a buffer against volatility, especially during transitions such as promotions, relegations, or major investments in infrastructure or squad.

With institutional backing, Ipswich Town benefits from a steady capital base. This ensures the club can sustain operations even during lean seasons. It also protects against reckless spending, encouraging more disciplined, long-term planning. The majority-shareholder model gives continuity, important for building consistency in football strategy and organizational structure.

Bright Path Sports Partners (40%)

In March 2024, Bright Path Sports Partners invested significantly into Ipswich Town FC through Gamechanger 20 Ltd. Their injection of capital — reportedly in the realm of £105 million — bought roughly a 40% stake in the club for the private equity firm.

This made Bright Path one of the largest external stakeholders, giving them substantial influence over financial injections, infrastructure funding, and medium-term growth plans.

Bright Path’s involvement signals a shift toward a more business-savvy, growth-oriented approach. Their mandate appears to include funding infrastructure — such as training ground improvements — and supporting club operations for sustainable growth rather than short-term gain.

Their presence brings fresh capital, operational discipline, and potentially new commercial strategies — with an outlook on global branding, modernization, and long-run returns.

Representatives of Bright Path joined the board of Gamechanger 20 Ltd upon investment, giving them a voice in strategic club decisions.

Three Lions Group (7%)

This small group of private investors — often referred to as the “Three Lions group” — includes individuals like Brett Johnson (4%), Berke Bakay (1%), and Mark Detmer (2%). They were among the core investors when Gamechanger 20 Ltd first acquired the club.

Their stake is more modest compared with ORG or Bright Path, but they play an influential role because of their direct involvement and vision for the club.

Brett Johnson – 4%

Brett Johnson holds roughly 4% ownership and is the most visible individual linked with Ipswich Town FC.

Despite owning a smaller percentage, Johnson wields influence that exceeds his shareholding because of his leadership role inside the ownership structure. He is the public face of the ownership project and one of the main strategic figures behind club direction.

Johnson focuses on:

- Long-term vision

- Recruitment modelling

- Data-based decision structures

- Business transformation philosophy.

He does not control votes through equity. However, he holds positional influence through leadership trust, board access, and ownership credibility.

Mark Detmer – 2%

Mark Detmer owns an estimated 2% stake and was one of the early financial backers of the club’s takeover.

His focus lies in:

- Financial oversight

- Long-term cash planning

- Internal governance.

Detmer plays a stabilizing role. He is not a public-facing owner, but his involvement is key to protecting Ipswich from financial mismanagement.

Berke Bakay – 1%

Berke Bakay owns roughly 1% and works primarily in commercial growth and operations strategy.

His responsibilities include:

- Commercial expansion

- Sponsorship direction

- Branding growth

- Business partnerships.

Bakay influences revenue strategy rather than football decisions.

Minority Shareholders

Beyond the major stakeholders, there remain smaller investors and minority partners. Their collective stake is relatively small, but they collectively act as a support mechanism — contributing additional funding, financial flexibility, and stability.

These minority shareholders do not have direct day-to-day influence over football operations or major strategic decisions. Their role is more passive — helping supply capital when needed, backing long-term financial health, and giving breathing room for larger investors to implement plans.

Their presence helps diversify financial risk. Rather than the club relying on a single wealthy owner, this diversified model allows multiple investors to back the club, reducing the danger of collapse if one party loses interest. It provides a broad base of support in challenging times (e.g., relegation, financial dips).

Current Leadership Structure & Governance

Since the 2024 investment by Bright Path, the governance structure of Ipswich Town FC has become more formalized and professional. The board of Gamechanger 20 Ltd includes representatives from ORG, Bright Path, and the Three Lions group, providing a blend of institutional oversight, private investment perspective, and football-centric leadership.

The day-to-day club operations remain managed by the club’s executive team — CEO, CFO, directors — while strategic, long-term financial and investment decisions are steered by the board. This separation helps maintain professionalism in football operations while preserving investor control over finances and long-term direction.

The ownership structure means that major capital investments (e.g., training facilities, youth development, stadium upkeep) are backed by stable funds with institutional commitment. At the same time, private equity and individual investors bring flexibility, innovation, and football-oriented passion.

Ipswich Town FC Ownership History

Ipswich Town FC has passed through several ownership models since its founding. The club started as a community institution and later transitioned into a corporate organization. Over time, it moved from local leadership to individual ownership and eventually into investor control. Each phase reshaped how the club functioned financially and operationally.

| Period | Owner / Ownership Group | Ownership Type | Level of Control | Key Characteristics |

|---|---|---|---|---|

| 1878–1936 | Community committees | Volunteer / non-corporate | Collective (no single owner) | Club run by local members with no shareholders; funded by ticket sales and donations |

| 1936–1980s | Local shareholders and board | Corporate with dispersed ownership | Board-controlled | Club became a company; shares held locally; decisions made by board rather than individuals |

| 1990s–2010s | Various UK holding structures | Corporate ownership | Fragmented | Ownership passed between holding entities; financial pressure increased due to Premier League costs |

| 2016–2021 | Marcus Evans | Individual private owner | Full control | Financial stability restored; football investment slowed; promotion ambitions weakened |

| 2021–2024 | Gamechanger 20 Ltd | Investor-led group | Centralized | Introduction of governance structure, analytics departments, and modern recruitment |

| 2024–present | Institutional investors + private equity | Institutional ownership | Majority voting control | Ownership diversified; long-term capital introduced; club operated as a structured enterprise |

Community Ownership and Volunteer Control (1878–1936)

Ipswich Town FC was established as a community project in 1878. It did not have an owner. Everyone who worked for the club did so as a volunteer. There was no concept of profit, assets, or commercial growth. The club existed solely to provide organized football for the town.

Administration was handled by small committees made up of teachers, tradesmen, and community leaders. These committees controlled everything, from fixture arrangements to player selection and ground maintenance. Funding came from ticket receipts, donations, and social events. The club lived from week to week.

Footballers were unpaid and worked full-time jobs outside of the sport. Training was primitive. Medical care was minimal. Matches were as much social gatherings as competitive events.

This structure could only survive while football remained local. Once clubs in other regions began paying players and building facilities, amateur teams like Ipswich faced extinction. Professional football exposed the limitations of community ownership. Ipswich was forced to modernize or vanish.

Professional Era with Local Shareholding (1936–1980s)

When Ipswich turned professional in 1936, ownership changed form but not philosophy. The club became a registered company. Directors were appointed. Shares were issued. But ownership stayed local.

Local business leaders and supporters bought shares. No individual or group gained dominance. Control remained with a board largely made up of Suffolk figures. The club was still a civic institution, but now governed inside a legal and financial framework.

This era produced Ipswich’s greatest achievements. Under Alf Ramsey and Bobby Robson, Ipswich won major trophies without financial dominance. The board focused on stability, scouting intelligence, and coaching authority rather than aggressive spending.

The ownership model emphasized patience. The club invested in staff and structure rather than chasing stars. The result was one of the most respected football institutions in Europe despite a limited budget.

However, by the late 1980s, this governance model became unsustainable. Football finances exploded elsewhere. Ipswich could no longer compete financially through structure alone.

Financial Strain and Governance Drift (1990s–2010s)

The formation of the Premier League fundamentally changed football economics. Broadcasting contracts injected vast sums into elite clubs. Player salaries skyrocketed. Transfer fees became speculative investments.

Ipswich lacked capital resilience. Every promotion felt enormous. Every relegation caused severe financial harm.

Ownership passed between holding companies and internal entities. Governance became distant. Boardrooms lacked strategic clarity. Financial planning became reactive.

Investment in youth development and infrastructure declined. Recruitment shifted toward short-term fixes rather than squad planning.

The club became fragile. Every season felt critical. Stability disappeared.

Ipswich was no longer managing success.

It was managing decline.

Marcus Evans Ownership (2016–2021)

Marcus Evans acquired Ipswich Town FC during one of the most unstable financial periods in the club’s modern history. When he took control, Ipswich was facing regulatory pressure, losses, and declining competitiveness. His first impact was financial stabilization. Debts were managed more carefully, day-to-day operations were brought under control, and the club avoided further financial decline.

From a business standpoint, Evans restored order. Ipswich no longer faced the threat of administration. Wages were paid sustainably. Operational spending was controlled. The club returned to financial calm after years of uncertainty.

However, financial stability did not translate into football ambition.

Under Evans, investment in recruitment shrank. Budgets tightened. The squad relied heavily on free transfers and short-term contracts. The academy received less emphasis. Facilities aged without serious upgrades. Scouting networks remained outdated. Data analytics was not adopted.

Ipswich became defensive in mentality. The objective shifted from growth to containment. Instead of competing for promotion, the club attempted to preserve league position with minimal risk. Ambitious planning disappeared.

Supporters were not angry about losses. They were frustrated by stagnation. The club felt passive. Matches lacked belief. Promotions were no longer targeted. Relegation was merely endured.

By 2021, Ipswich had lost its competitive identity. The club was stable, but directionless. The model prioritized survival over ambition, and that ultimately failed to meet the scale of the club’s history and expectations.

The sale became unavoidable.

Gamechanger 20 Ltd Takeover (2021)

The takeover of Ipswich Town FC by Gamechanger 20 Ltd in 2021 marked the end of individual ownership and the beginning of institutional governance. This change represented a complete reset of the club’s operating philosophy.

Unlike previous owners, the new group approached Ipswich as a long-term sports business rather than a cost-controlled asset. Their early focus was not transfer spending but systemic reform. Financial structures were reorganized. Governance became professional. Reporting systems were modernized.

Recruitment changed immediately. Analytics and performance data replaced subjective scouting. Player evaluation models were built. Global search networks expanded. Medical and performance departments were strengthened with modern methodologies.

The ownership also restructured football leadership. Clear lines of authority were introduced. Departments were separated and professionalized. Decision-making became process-driven instead of personality-driven.

Infrastructure became a priority. Training standards were upgraded. Performance support services were scaled.

Most importantly, the psychological direction of the club changed. Ipswich stopped operating in crisis mode. Long-term planning replaced survival instincts. Recruitment aligned with development. The academy regained focus.

The club reentered a professional operating standard for the first time in decades.

Institutional Capital and Investor Structure (2024)

In 2024, Ipswich Town’s ownership entered a new phase with the introduction of institutional investment and private capital into the structure. This was not just a cash injection. It was a structural reform.

Prior to this shift, funding depended heavily on personal investment from owners. This model created vulnerability to changes in personal circumstances. The institutional model removed that risk.

Capital became structured. Multi-year planning replaced season-by-season uncertainty. Infrastructure budgets were fixed. Recruitment spending stabilized. Emergency funding disappeared.

The club also moved beyond the traditional owner model. Governance expanded into committees, approvals, and operational checks. Board governance replaced individual authority.

Commercial strategy evolved. Sponsorship became long-term. Brand building became measurable. Operations moved toward enterprise scale rather than football survival.

Perhaps most importantly, institutional ownership introduced insulation. Ipswich no longer faced financial collapse after poor results. Budgeting could endure promotion failure. Risk became distributed across investment partners.

By the end of 2024, Ipswich Town FC was no longer a club run by dependency.

It was a club run by a structure.

Ipswich Town FC Owner’s Net Worth

Brett Johnson is widely known as the most visible individual associated with Ipswich Town FC’s ownership. However, the club is not funded or controlled by his personal wealth. Ipswich is owned through Gamechanger 20 Ltd, with financial backing coming primarily from institutional and group-level investors rather than one individual.

As of November 2025, Brett Johnson’s estimated personal net worth is $5 million. This places him in the category of private business owners rather than elite football power brokers. Ipswich Town FC is therefore not built around a wealthy benefactor model. The club operates using collective capital and a centralized investment strategy rather than funding from Johnson’s personal assets.

Core Investment Platform: Benevolent Capital

The central platform for Brett Johnson’s wealth is Benevolent Capital, a family office and private equity vehicle he co-founded in 2005 with his brother Grant Johnson. Benevolent Capital invests across professional sports, real estate, private equity, and venture capital.

Through Benevolent Capital, Johnson holds and manages stakes in:

- Professional soccer clubs, including Ipswich Town FC, Phoenix Rising FC, and Rhode Island FC.

- Real estate projects, often linked to stadium or sports-led developments.

- Growth-stage companies in the consumer and sustainability sectors.

Benevolent Capital is not a giant Wall Street fund. It functions as a focused family office. Johnson’s wealth here is built on long-hold positions rather than quick exits or high-risk speculation.

Sports and Club Ownership Stakes

A visible part of Brett Johnson’s wealth sits in his sports-related holdings. These are strategic, long-term assets rather than cash-generating machines in the short term.

Through Benevolent Capital and related structures, Johnson has ownership or investment roles in:

- Ipswich Town FC – Shareholder and director through Gamechanger 20 Ltd, part of the Three Lions group within the ownership consortium.

- Phoenix Rising FC (USL Championship) – Founding investor and co-owner of the Arizona-based club, originally through Phoenix Rising FC LLC and related entities.

- Rhode Island FC (USL Championship) – Co-founder and chairman of the new Rhode Island club and its stadium project at Tidewater Landing.

- Former role at FC Helsingør (Denmark) – Past director and investor in the Danish club, where he helped apply a data and project-based football model before stepping back.

These sports holdings are more about long-term asset growth and strategic positioning in football than immediate profit. They help explain Johnson’s role as a “football projects” operator rather than a pure financial investor.

Sports-Anchored Real Estate And Fortuitous Partners

Beyond direct club stakes, a second pillar of Johnson’s wealth is sports-anchored real estate.

He is the founder and CEO of Fortuitous Partners, an investment firm focused on real estate developments built around sports stadiums and clubs.

Key projects and entities linked to this side of his portfolio include:

- Tidewater Landing in Pawtucket, Rhode Island – A large mixed-use project built around the new Centreville Bank Stadium, home to Rhode Island FC. The project includes housing, commercial spaces, and entertainment facilities designed to grow in value alongside the club and stadium activity.

- Octagon Partners – A development firm associated with Johnson’s group, specializing in value-add real estate projects, often tied to redevelopment zones or underused sites.

These projects generate long-term asset value and potential future upside. They are capital-intensive and slow to mature, which is why his net worth is concentrated in private project equity rather than liquid cash.

Other Notable Portfolio Companies

Through Benevolent Capital and related vehicles, Brett Johnson also holds minority stakes in several well-known growth companies. These investments diversify his wealth outside of football and real estate.

Publicly highlighted portfolio companies include:

- TerraCycle – A company focused on recycling hard-to-recycle waste streams and circular-economy solutions. Johnson has served as a director and investor.

- Athletic Brewing Company – A fast-growing non-alcoholic craft beer brand.

- Ōura (Oura Ring) – A health technology company best known for its smart ring focused on sleep and readiness tracking.

- Seekr Technologies – An AI-powered search and evaluation technology company.

These stakes are minority positions, so they do not make him a billionaire. But they contribute to his overall $5 million net worth and reflect a strategy of backing scalable, mission-driven brands that can grow over time.

Previous Corporate Roles And Earned Capital

Before building his own investment platforms, Johnson held senior roles in several established companies. These positions helped him earn capital, build experience, and accumulate the base income that later moved into Benevolent Capital and his sports projects.

Notable roles have included:

- Senior roles and eventually president at Targus Group International, a global mobile computing accessories company.

- President and co-CEO of Forward Industries, a NASDAQ-listed accessories and electronics company.

- President at Greenwood & Hall, an education management and technology services firm.

- Board member at Blyth Inc., a multi-channel direct selling company.

These roles did not make him ultra-rich on their own. But they provided salary, bonuses, stock incentives, and network access that later fed into his private equity and sports investments.

What This Net Worth Means For Ipswich Town FC

Given an estimated personal net worth of around $5 million, Brett Johnson cannot and does not function as a “cheque book” owner at Ipswich Town FC. The club’s ownership and funding are designed so that:

- Institutional investors and private equity provide the heavy capital.

- Gamechanger 20 Ltd and its board structure set the budget and strategy.

- Johnson contributes leadership, football project experience, and network connections.

He is important as a strategist and project builder, not as a single financial backer. Ipswich Town FC’s sustainability does not depend on his personal wealth. It depends on the broader ownership structure and the institutional capital sitting behind Gamechanger 20 Ltd.

In simple terms, his $5 million net worth is enough for him to be a serious investor and operator. It is not enough to run Ipswich Town FC out of his own pocket. And the current model wisely does not expect him to.

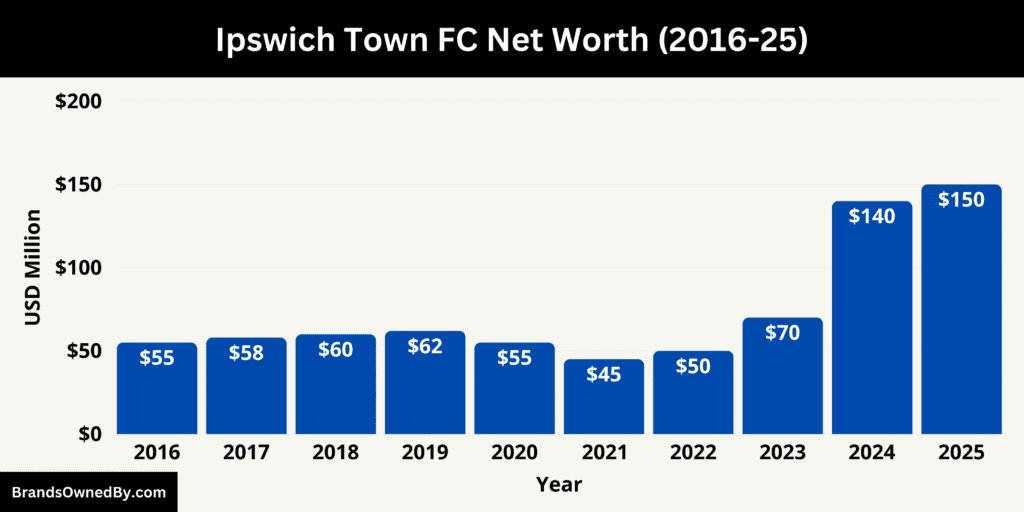

Ipswich Town FC Net Worth

Ipswich Town FC’s net worth is estimated at $150 million as of November 2025. This valuation reflects the club’s reinstatement as a Premier League member, the restructuring of its ownership, its modernized commercial operations, and the current market value of its playing squad and infrastructure. The figure represents enterprise value, not profit or cash reserves. It measures what the club would realistically be priced at if ownership were transferred today.

This valuation marks Ipswich’s highest recorded financial position in its history. A few years earlier, the club was valued as a lower-division side with limited commercial power. Promotion transformed that status immediately.

What Drives Ipswich Town’s $150 Million Valuation

Ipswich’s valuation in 2025 is built on four measurable pillars: league income, squad value, operating revenue, and ownership security.

The strongest influence is Premier League broadcasting revenue. Television distributions dwarf all other income streams. Ipswich moved from lower-league earnings into one of the richest sports ecosystems in the world. This alone accounts for more than half of the valuation increase since promotion.

The second driver is the squad market value. Ipswich’s current playing squad represents a financial asset in the tens of millions through resale value, contract length, and market demand. Young players on long contracts increase balance-sheet value. Wages also rose significantly following promotion, indicating the club’s financial scale has structurally changed.

The third driver is commercial revenue. Sponsorship income, shirt deals, hospitality, and merchandise revenue all accelerated upon Premier League entry. Ipswich now competes in the same sponsorship market as globally televised clubs. That shifts contract size, exposure value, and negotiation leverage.

The final factor is ownership security. Ipswich is no longer owned by a single private individual. Institutional funding and corporate structure reduce collapse risk, which directly increases investor confidence and valuation.

Broadcasting Income Impact

Premier League participation has permanently altered Ipswich’s finances.

Broadcast distributions in the league are multi-year structured income streams. Ipswich’s annual television revenue now exceeds the club’s total revenue across multiple past seasons combined. This transforms wage budget, recruitment capacity, and scouting operation scale.

Broadcasting revenue also improves commercial leverage. Sponsors pay more to appear on teams that are televised globally. Ipswich now has international commercial relevance for the first time since the 1980s.

Squad Valuation

Ipswich’s squad value sits far above its pre-promotion level.

The club now holds multi-year contracts on players whose market value has grown through top-flight exposure. Player value rises when:

- They play at the Premier League level

- They feature internationally

- They remain under long-term contracts

- They avoid injury

- They gain resale demand.

Ipswich has prioritized structured recruitment rather than short-term signings. That approach increases asset stability and resale value.

Every transfer window, the squad is re-evaluated upward by market conditions and contract protection.

Wage Structure and Cost Base

Ipswich now operates on a Premier League wage structure.

The club’s payroll expanded significantly after promotion. Higher salaries reflect a larger operating scale. Wage growth also signals stability. Clubs without a long-term financial footing cannot operate at Premier League payroll levels sustainably.

Ipswich’s ownership has matched spending with income. That is required to maintain valuation without triggering debt risk.

Commercial Revenue

Ipswich’s commercial income in 2025 is no longer secondary to football operations.

The club generates revenue from:

- Kit sponsorship

- Shirt partnerships

- Hospitality

- Digital rights

- Merchandising

- Commercial partnerships.

With Premier League exposure, commercial revenue has risen sharply. Ipswich can now monetise its brand outside England in ways impossible in the Championship or League One.

Ipswich’s valuation includes ownership of Portman Road and training facilities.

Unlike clubs that lease stadiums, Ipswich owns its major infrastructure assets. Ownership increases valuation because physical assets appear on balance sheets and improve solvency.

Training facilities now include modern performance and medical departments. These additions reduce injury loss and improve player output, indirectly raising asset value through squad performance.

Valuation Compared to League Peers

At $150 million, Ipswich Town FC now ranks as a mid-table Premier League valuation club.

It is not priced among global brands like Manchester United or Liverpool. But it is well above historical provincial levels. Ipswich now occupies the tier occupied by sustainable Premier League operators rather than crisis-driven clubs.

The club is priced on projected stability rather than survival.

Ipswich Town FC CEO

Ipswich Town FC is run at the executive level by Mark Ashton, who serves as Chief Executive Officer. His role is to operate the club as a commercial enterprise, not a football team. He oversees finances, contracts, infrastructure investment, staffing, legal compliance, and commercial revenue. Unlike the head coach, he does not run training sessions or select players. Instead, he controls how the club functions financially and structurally.

As of 2025, Ashton remains the club’s senior executive, operating directly under the ownership group and board of directors. All major spending, long-term planning, and operational decisions flow through the CEO’s office before being implemented across departments.

Professional Background

Mark Ashton built his career within English football administration rather than coaching or player management.

Before joining Ipswich Town FC, he served as Chief Executive Officer at:

- Bristol City

- Bristol Rovers.

He also worked at The Football Association in leadership and communications roles, handling national-level stakeholders, governance policy, and major event operations.

His professional identity is that of a football operator, not a businessman from outside sport. He understands the regulatory structure of English football, including league compliance, financial reporting, licensing procedures, and club administration at the senior level.

His previous roles focused on restructuring failing operations rather than running already-successful clubs. At Bristol clubs, he dealt with rebuilding organizations financially and operationally, dealing with staffing imbalance, revenue weakness, and governance gaps.

Appointment at Ipswich Town FC

Mark Ashton was appointed during a period where Ipswich Town FC was operationally outdated.

When he arrived, the club had:

- Outdated commercial operations

- A limited sponsorship base

- Weak internal structure

- Fragmented leadership

- Unclear authority lines

- Minimal commercial strategy.

His hiring was part of the reset following ownership changes. The new ownership did not want symbolic leadership. They wanted an operational executive to rebuild the business.

Ashton’s appointment signaled that Ipswich’s rebuild would start in offices rather than on the pitch.

Authority and Responsibility

The CEO controls every non-football function of the club. His office determines:

- Annual operating budgets

- Player wage ceilings

- Departmental budgets

- Infrastructure investment

- Commercial targets

- Staffing structure

- Legal and regulatory compliance

- Risk management

- Crisis planning

- Audit and reporting standards.

He also authorizes major contracts such as sponsorship agreements, supplier agreements, stadium contractors, and long-term commercial partners.

He is responsible for financial sustainability and legal integrity. No department operates independently of the CEO’s authority.

Role in Financial Management

The CEO is the gatekeeper of spending.

Mark Ashton is responsible for:

- Approving transfer budgets

- Setting wage frameworks

- Managing operating losses

- Enforcing spending limits

- Overseeing cash flow

- Planning future expenditure

- Structuring departmental accountability.

During his leadership, Ipswich moved away from short-term financial survival and into structured annual budgeting. Financial reporting became centralized rather than fragmented.

Rather than reacting to losses, Ipswich began forecasting costs and revenues across multiple seasons.

This change is one of the most important parts of the club’s recovery.

Commercial and Revenue Strategy

Ashton overhauled Ipswich Town’s commercial model.

When he arrived, sponsorship and revenue were locally concentrated. After restructuring, Ipswich began operating with a layered commercial structure that included:

- Corporate sponsorship programs

- Hospitality packages

- Merchandising strategy

- Digital engagement planning

- Media rights monetization

- Matchday experience design.

Revenue streams were diversified to reduce dependency on ticket income alone.

Long-term partnerships replaced short-term deals. Branding standards were modernized. Commercial negotiation shifted from reactive sales to structured growth targets.

Infrastructure Oversight

Facility management is part of the CEO’s responsibility.

Mark Ashton oversees:

- Training ground upgrades

- Medical facility planning

- Performance facilities investment

- Stadium redevelopment planning

- Office systems modernization.

Infrastructure spending is evaluated as a business investment, not a cosmetic upgrade.

Facilities are tied directly to performance, revenue generation, and player retention.

Ashton does not authorize spending without long-term return metrics.

Relationship With Ownership

Ownership sets ambition.

Ashton executes it.

The CEO is responsible for translating ownership strategy into operational reality. He prepares financial forecasts, risk assessments, and investment plans for the board.

If ownership wants to expand infrastructure or raise budgets, the CEO confirms feasibility.

If spending becomes unsafe, the CEO has the authority to restrict it.

That makes him more powerful than most public-facing figures.

Ashton does not make football decisions.

He works alongside:

- Head coach

- Director of football

- Recruitment department

- Sports science staff

- Academy leadership.

His job is not to build a squad. It is to build the system that sustains the squad.

He ensures recruitment operates within budgets.

He ensures contracts remain compliant.

He ensures coaches have resources.

He does not choose tactics.

Final Thoughts

Knowing who owns Ipswich Town FC explains how the club has moved away from financial instability and into a structured ownership era. A controlling institutional shareholder holds the majority stake, supported by a major private investment partner and a small group of founding investors. Control is exercised through a board rather than a single individual, which has stabilized decision-making and protected the club from ownership chaos. Ipswich Town FC now operates under a modern ownership framework designed for long-term planning, financial discipline, and professional management.

FAQs

Who is the owner of Ipswich FC?

Ipswich Town FC is owned by Gamechanger 20 Ltd under a group-ownership model. The largest shareholder is ORG, which holds majority control, along with Bright Path Sports Partners and a small group of founding investors. The club is not owned by one individual.

Who are Ipswich Town FC’s new owners?

Ipswich Town FC’s new owners operate through Gamechanger 20 Ltd. The current ownership structure includes ORG as the majority shareholder, Bright Path Sports Partners as the largest minority investor, and individual investors such as Brett Johnson, Mark Detmer, and Berke Bakay. All decisions are made through a board-led governance model.

Does Ed Sheeran own Ipswich Town?

No. Ed Sheeran does not own Ipswich Town FC. He is a commercial partner and a well-known supporter, but he holds no ownership stake in the club.

What is the nickname of Ipswich Town FC?

Ipswich Town FC is commonly called “The Tractor Boys,” a nickname that reflects the club’s long-standing connection to the rural Suffolk region.