Everton FC is one of England’s oldest clubs, and many fans ask who owns Everton FC as the team moves through a major transition period. The club has faced ownership challenges, stalled takeovers, and shifting investment structures. Understanding the current situation helps explain Everton’s financial direction and long-term stability.

Key Takeaways

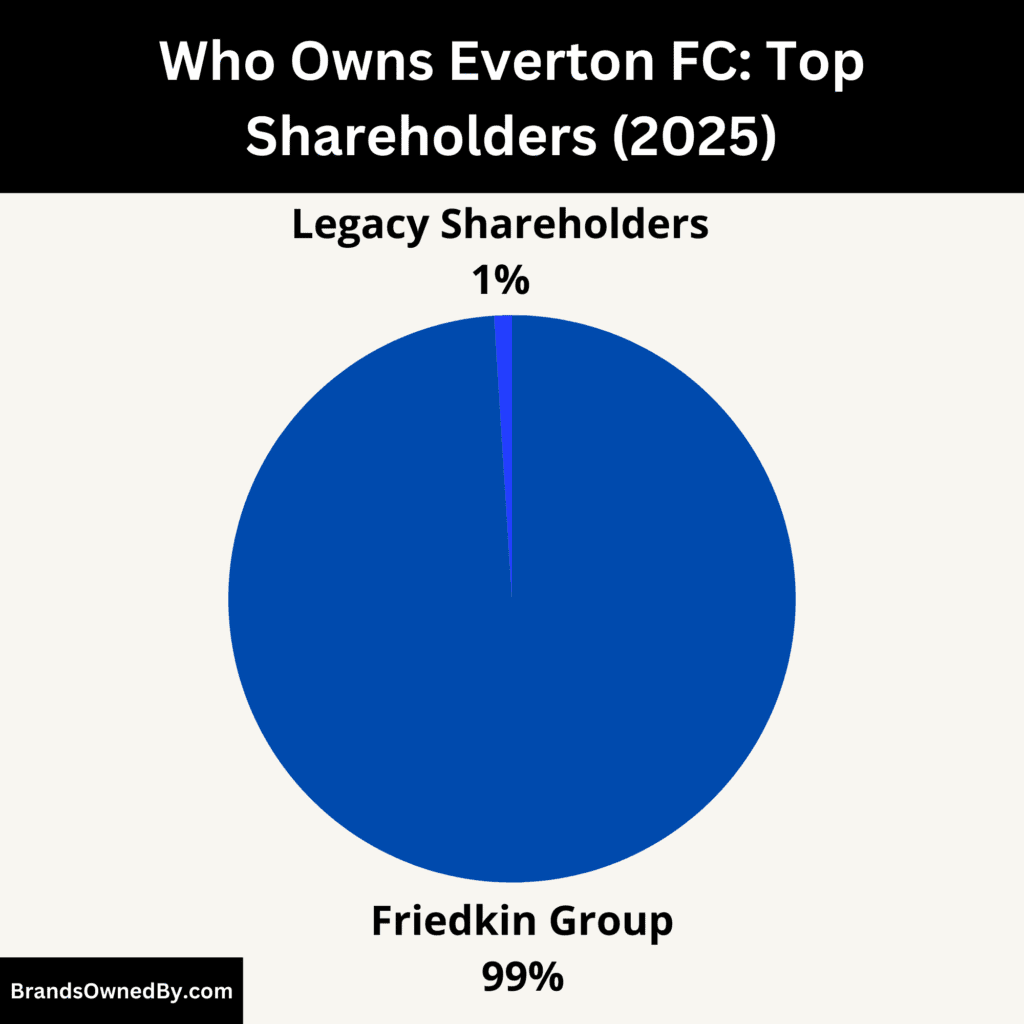

- Everton FC is owned by The Friedkin Group, which controls approximately 98.8% of the club through Roundhouse Capital Holdings as of 2025.

- Dan Friedkin is the ultimate controller of the club, directing strategy and investment through his leadership of The Friedkin Group, although he does not hold shares personally.

- Minority investors such as Christopher Sarofim, Jason Kidd, and a small group of U.S. partners hold indirect stakes in Roundhouse, not in Everton FC itself.

- Legacy and fan shareholders hold less than 1%, giving The Friedkin Group full operational, financial, and strategic control of Everton FC.

Everton FC Profile

Everton FC is one of the most historic football institutions in England. It has shaped the landscape of the sport for nearly a century and a half. The club is defined by tradition, community loyalty, and long-standing Premier League involvement.

Everton FC is based in Liverpool and is widely known as “The People’s Club,” a title embraced by fans for decades. The team has spent more seasons in the top division than any other English football club, which underscores its legacy of resilience. Everton is recognized for its strong academy system, passionate supporters, and consistent contribution to English football culture.

The club has a deep-rooted rivalry with Liverpool FC, known as the Merseyside Derby. This derby is one of the most historic and emotionally charged fixtures in world football. Everton also stands out for its charity work through Everton in the Community, one of the most impactful club-led social programs in the UK.

On the sporting side, Everton has produced elite players, maintained strong traditions, and consistently attracted a global fanbase. The new stadium project has further strengthened Everton’s long-term ambitions.

Founders and Early Formation

Everton FC traces its origins to 1878, when St. Domingo Methodist New Connexion Chapel in Liverpool founded a football team to provide recreational activities for young church members. This team was named St. Domingo FC. As interest in the team grew beyond the church community, the founders recognized the need for a broader identity.

In November 1879, the club officially adopted the name Everton FC. The name was inspired by the Everton district of Liverpool, reflecting the community it represented. Early matches were played at Stanley Park before the club moved into its first proper ground.

Leadership in the early decades came from influential local figures who supported the club’s transition into professional football. These founders blended community values with ambition, helping Everton become one of the earliest clubs to adopt organized structures, competitive play, and formal membership systems.

Major Milestones

- 1878: St. Domingo FC is founded by members of the local Methodist chapel.

- 1879: The club is renamed Everton FC to represent the broader community.

- 1884: Everton briefly uses Anfield as its home ground before disputes lead to relocation.

- 1888: Everton becomes a founding member of the Football League.

- 1891: Everton wins its first Football League title.

- 1892: Everton moves to Goodison Park after leaving Anfield.

- 1906: The club wins the FA Cup for the first time.

- 1914–1915: Everton wins another league title before football is suspended due to World War I.

- 1928: Dixie Dean sets the English record by scoring 60 league goals in a single season.

- 1933: Everton wins the FA Cup and becomes the first club to play in numbered shirts.

- 1939: Everton secures another league title before World War II halts competitions.

- 1962: Everton establishes its Youth Academy, laying the foundation for future stars.

- 1963: Everton wins the league title under Harry Catterick.

- 1970: The club secures another league championship.

- 1984: Everton wins the FA Cup, sparking a dominant period in the 1980s.

- 1985: Everton wins the First Division title and the European Cup Winners’ Cup.

- 1987: Everton wins another league title under Howard Kendall.

- 1991: Goodison Park becomes an all-seater stadium following safety reforms.

- 1995: Everton wins the FA Cup, its most recent major trophy.

- 2000: Bill Kenwright becomes the major shareholder and club chairman.

- 2007: Everton regularly qualifies for European competitions under David Moyes.

- 2016: Farhad Moshiri acquires his initial stake and becomes majority owner.

- 2019: The Bramley-Moore Dock Stadium project receives government and council approval.

- 2021: Construction officially begins on the new stadium.

- 2023: Everton faces significant financial challenges and regulatory investigations.

- 2024: Point deductions impact league performance and increase scrutiny over spending.

- 2025: Everton prepares for the transition from Goodison Park to Bramley-Moore Dock Stadium, marking the largest infrastructural milestone in club history.

Who Owns Everton FC: Top Shareholders

Everton FC is now owned by The Friedkin Group, which took control of the club in late 2024 and solidified its position throughout 2025. This marked the end of the Farhad Moshiri era and the beginning of a new ownership model backed by stronger financial resources, expanded global sports experience, and a multi-club investment structure. The new ownership has brought increased capital injections, debt restructuring, and new board leadership.

Here’s an overview of the club’s ownership and shareholders as of November 2025:

- The Friedkin Group (Roundhouse Capital Holdings) – approx. 98.8% (full operational and strategic control)

- Historic legacy shareholders – under 1%, no operational influence.

The Friedkin Group (98.8%)

The Friedkin Group, through Roundhouse Capital Holdings Limited, owns roughly 98.8% of Everton FC. This stake gives the group near-total control over club operations, board appointments, strategic decisions, and long-term planning. The acquisition was completed with a combination of share purchase and the restructuring of inherited club debt, which had previously weighed heavily on Everton’s finances.

The group also injected additional funding across 2025 to stabilize cash flow, support squad planning, and keep the stadium development on track. Their takeover immediately strengthened Everton’s financial position, especially after years of regulatory issues and overspending concerns.

The Friedkin Group appoints the Everton board, including the club’s executive leadership. All major decisions — including transfer budgets, sponsorship agreements, back-room appointments, and stadium financing — require approval from Friedkin’s executive committee. The group has also aligned Everton with its emerging multi-club football model, allowing the club to access shared scouting, analytics, and operational resources.

TFG’s sports portfolio experience gives Everton a more structured and globally connected governance model than at any point in its modern history.

Dan Friedkin – Executive Chairman & Primary Decision Maker

As the head of The Friedkin Group, Dan Friedkin serves as the Executive Chairman of Everton FC. His leadership role is direct and influential. He personally oversees the club’s long-term planning, financial oversight, and executive appointments. His approval is required for high-value transfers, infrastructure spending, commercial partnerships, and any decision impacting the club’s core strategy.

Under his direction, Everton has adopted a long-term financial sustainability model, with emphasis on:

- completing the Bramley-Moore Dock Stadium as a central revenue engine,

- rationalizing the wage bill,

- strengthening academy output, and

- rebuilding the club’s global brand after several turbulent years.

Dan Friedkin’s involvement has reshaped Everton’s planning horizons from short-term survival to multi-year growth.

Christopher Sarofim – Minority Investor

In 2025, American investor Christopher Sarofim joined the ownership group by acquiring a minority stake in Roundhouse Capital Holdings. Although his exact percentage is not publicly disclosed, it is confirmed to be below the 10% threshold. His investment enhances the club’s financial base and brings seasoned wealth management expertise to the group.

Sarofim does not control sporting or operational decisions, but he plays a role in ownership-level discussions around financing, asset management, long-term risk planning, and broader investment strategy. His presence reflects The Friedkin Group’s approach of assembling a sophisticated, diversified investor group around Everton.

Jason Kidd & Other U.S. Investors

Former NBA star Jason Kidd and several U.S. business figures also hold minority positions within the Roundhouse ownership group. Their stakes are small, non-controlling, and contribute primarily to commercial backing, brand visibility, and long-term investment support rather than governance.

These minority investors do not influence recruitment, stadium strategy, or club policy. Their value lies in growing Everton’s presence in the U.S. market, supporting commercial relationships, and contributing capital to the ownership pool. This reflects a pattern of American sports investors diversifying across football, basketball, and baseball assets.

Legacy and Fan Shareholders

After the 2024–2025 restructuring, historic minority shareholders and fan-held shares account for less than 1% of total ownership. These shares remain for legacy and structural reasons, but no longer influence operations.

They maintain symbolic value and preserve Everton’s identity as a community club, but all strategic power resides with The Friedkin Group and its appointed leadership.

Everton FC Ownership History

Everton FC’s ownership journey spans almost 150 years and reflects the evolution of English football itself. The club began as a small community project and slowly transitioned into a modern, global sports asset.

| Ownership Era / Owner | Years Active | Ownership Type | Key Figures | Description & Impact |

|---|---|---|---|---|

| Community & Church Leadership | 1878–1920s | Community-run, committee-based | St. Domingo Methodist Church leaders, early Everton committee members | Club founded as St. Domingo FC and renamed Everton FC in 1879. Managed through volunteer-based committees. Decisions made collectively by community representatives. Oversaw the move to Goodison Park in 1892 and early Football League participation. |

| Local Business Families & Merseyside Board | 1920s–1990s | Local shareholders and business board | John Moores, Moores family, long-standing local directors | Control shifted to wealthy Merseyside business families. John Moores became a dominant influence and funded successful periods including multiple league titles. Ownership was stable and conservative, focused on tradition and long-term governance. |

| Bill Kenwright (True Blue Holdings) | 1999–2016 | Majority shareholder, local private investor | Bill Kenwright | Acquired major stake in 1999 and became chairman by 2004. Ran the club with limited financial resources but strong emotional leadership. Maintained Premier League stability and oversaw the David Moyes era. Faced rising pressure as finances tightened and stadium ambitions grew. |

| Farhad Moshiri | 2016–2024 | Private majority shareholder (approx. 94%) | Farhad Moshiri | Massive spending began across transfers, wages, and managers. Backed the Bramley-Moore Dock Stadium project. Era marked by heavy losses, unstable sporting decisions, regulatory breaches, and failed takeover attempts. Club faced debt, point deductions, and growing financial strain. |

| The Friedkin Group (Roundhouse Capital Holdings) | 2024–Present | Controlling shareholder (~98.8%) | Roundhouse Capital Holdings; oversight by The Friedkin Group | Acquired nearly all club shares in late 2024. Immediately restructured debt, injected capital, and replaced the board. Integrated Everton into a multi-club model. Focused on sustainability, commercial growth, and the stadium transition. Remains the controlling owner in 2025. |

| Minority Investors within Roundhouse (Not direct Everton owners) | 2025–Present | Indirect minority investors in the ownership vehicle | Christopher Sarofim, Jason Kidd, U.S. investment partners | Hold minority stakes inside Roundhouse, not in Everton itself. Provide capital and strategic support. No direct operational or football influence. Everton remains 98.8% owned by Roundhouse. |

Early Foundations and Community Control (1878–1920s)

Everton began in 1878 when members of St. Domingo Methodist Church formed a football team for local youth. Control of the club initially rested with church leaders and volunteers who organized matches in Stanley Park.

When the club became Everton FC in 1879, governance expanded to include local community representatives. Decision-making was based on a committee model common in early English football. Members paid small fees to support equipment, travel, and field rentals.

The club joined the Football League in 1888 and began attracting larger crowds, which pushed the leadership toward more structured financial management. Stadium decisions, including the move to Goodison Park in 1892, were made by community-directed club committees that operated on collective vote.

Growth of Local Business Ownership (1920s–1990s)

By the 1920s, Everton’s governance had shifted from community volunteers to local businessmen and Merseyside families who purchased shares and joined the board. These shareholders formed a powerful group that controlled club finances and set long-term policy.

Local entrepreneur John Moores, founder of the Littlewoods Pools betting empire, became a major influence starting in the 1960s. His wealth stabilized Everton, funded infrastructure improvements, and supported player recruitment during successful periods. Moores’ involvement helped Everton secure league titles in 1963, 1970, and later in 1987.

The board-led ownership model meant decisions were conservative but steady. Shareholding rarely changed hands rapidly, keeping control within a tight group of Merseyside business families who prized tradition over aggressive investment.

The Kenwright Era (1999–2016)

Bill Kenwright, a lifelong Evertonian and well-known theater producer, purchased a major stake in 1999 through his investment vehicle, True Blue Holdings.

By 2004, Kenwright became chairman and the club’s largest shareholder. His era brought stability, emotional leadership, and strong ties with supporters, but limited financial resources. Everton often operated on modest transfer budgets and relied on player sales to balance finances.

Under David Moyes, the club achieved competitive consistency despite constraints, qualifying for European competitions, reaching a Champions League qualifier in 2005, and making an FA Cup final in 2009. Kenwright’s ownership also saw increasing pressure from fans who felt the club needed stronger investment to keep up with the modern Premier League.

By the mid-2010s, rising stadium costs, commercial demands, and competitive pressure forced Kenwright to seek new investors.

The Farhad Moshiri Era (2016–2024)

Farhad Moshiri purchased 49.9% of Everton in 2016 and soon increased his stake to around 94%. His ownership marked a dramatic shift to high-spending ambition. Everton invested heavily in new players, multiple management changes, and infrastructure upgrades.

Moshiri approved record signings, increased wage bills, and supported the development of the Bramley-Moore Dock Stadium project, committing hundreds of millions of dollars to the build. However, poor sporting decisions, rapid managerial turnover, and escalating losses caused financial instability. The club faced Premier League Profit and Sustainability Rule penalties, leading to point deductions in consecutive seasons.

By 2023–2024, Moshiri attempted to sell the club to 777 Partners, but the deal collapsed due to funding problems and regulatory failures. With rising debt, incomplete financing for the new stadium, and fan pressure, Moshiri sought a more credible buyer, opening the door for The Friedkin Group.

The Friedkin Group Era (2024–Present)

In late 2024, The Friedkin Group acquired approximately 98.8% of Everton FC through Roundhouse Capital Holdings. This takeover ended Moshiri’s turbulent eight-year tenure.

The Friedkin Group immediately restructured club debt, injected fresh capital, and overhauled the board. Leadership transitioned to a modern corporate model centered on financial discipline, commercial expansion, and long-term strategy. Everton was integrated into the group’s wider football portfolio, gaining access to shared scouting networks, data operations, and multi-club efficiencies.

During 2025, Roundhouse added new minority partners—including Christopher Sarofim and several U.S. investors—strengthening the ownership vehicle’s financial base. Everton itself, however, remained almost entirely owned by Roundhouse.

This era is defined by a push toward stability, repairing financial damage from previous years, and preparing the club for a transformative move into the Bramley-Moore Dock Stadium.

Everton FC Owner’s Net Worth

Everton FC’s current owner, Dan Friedkin, is one of the wealthiest figures in global sports ownership. His personal net worth, estimated at $9.3 billion as of November 2025, plays a significant role in the club’s new era of financial stability and long-term planning.

Dan Friedkin’s $9.3 billion net worth comes from decades of expansion across multiple industries. His fortune has grown steadily due to consistent profitability in automotive distribution, diversification into luxury travel and hospitality, high-value real estate, and ownership positions in global sports and entertainment.

The private nature of his group means valuations are based on business performance, industry benchmarks, and large-scale asset holdings. His wealth places him among the richest owners in the Premier League, giving Everton a stronger financial foundation compared to previous eras.

Core Source: Automotive Distribution

The largest source of Friedkin’s wealth is Gulf States Toyota (GST), a company founded by his father and now fully controlled through The Friedkin Group. GST is one of the world’s most profitable private automotive distribution businesses and serves as the exclusive distributor of Toyota vehicles across Texas, Oklahoma, Arkansas, Mississippi, and Louisiana.

GST handles the import, marketing, logistics, and wholesale distribution of Toyota vehicles for a massive region. Its annual revenues run into multiple billions, making it the financial engine of Friedkin’s empire. The predictable cash flow and long-term dealership relationships provide a stable wealth base that supports his investments in sports and entertainment.

Luxury Hospitality and Travel Businesses

Friedkin also owns Auberge Resorts Collection, a globally recognized group of luxury hotels, resorts, and residential properties. The collection includes high-value assets in the United States, Mexico, Greece, and Europe, focusing on ultra-luxury travel experiences.

Additionally, his ownership of Friedkin Aviation, including a private aviation fleet, contributes both to his business operations and his personal asset base. These hospitality and aviation holdings significantly increase his overall valuation and give his group international reach.

High-End Real Estate and Property Investments

Real estate is another major part of Friedkin’s net worth. His portfolio includes commercial properties, luxury residences, resort developments, and strategic land holdings across the United States and Europe. Many of these assets are long-term investments that appreciate consistently, strengthening the overall valuation of The Friedkin Group.

Film, Media, and Entertainment Operations

Friedkin is also active in film production through Imperative Entertainment, a company involved in major motion pictures, documentaries, and television productions. Imperative’s projects, including Oscar-nominated films, contribute to the group’s brand value and diversify income streams. While entertainment is not his largest revenue source, it expands his global profile and aligns with sports-related media opportunities.

Sports Ownership and Strategic Investments

Dan Friedkin owns multiple sports assets. In addition to Everton FC, he also controls AS Roma in Italy’s Serie A, operating both clubs within a multi-club investment structure. This enhances his overall valuation through growing sports asset values, shared talent pathways, and global visibility. These properties do not form the foundation of his wealth, but they significantly elevate his investment footprint and strategic influence in global football.

What $9.3 Billion Means for Everton FC

Friedkin’s wealth gives Everton access to a level of stability and long-term planning that was missing in recent years. His financial strength supports the completion of Bramley-Moore Dock Stadium, covers operational gaps during transition periods, and ensures compliance with Premier League financial rules.

It also helps Everton avoid excessive borrowing, reducing risk and improving sustainability. His wealth allows the club to think strategically rather than reactively, focusing on long-term competitiveness, academy investment, and global commercial growth.

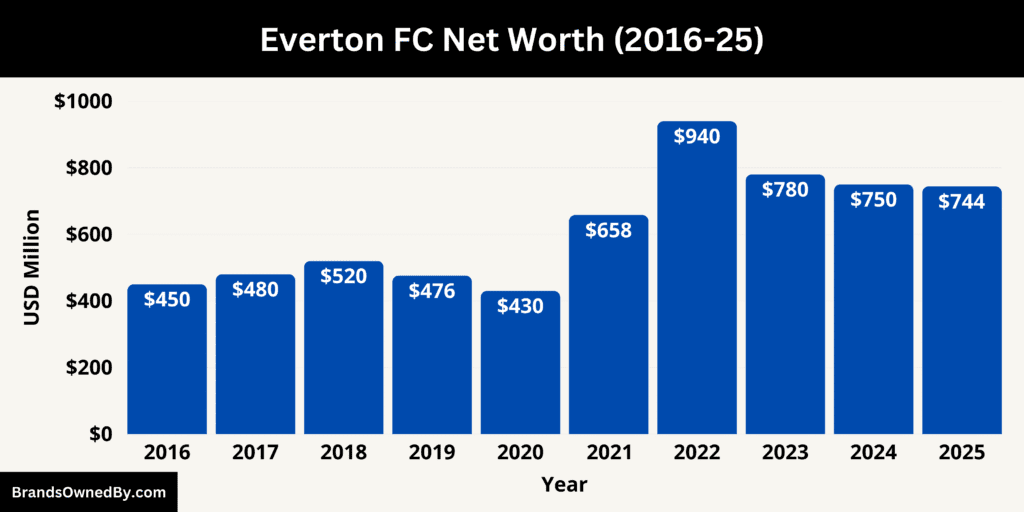

Everton FC Net Worth

Everton FC’s estimated net worth as of November 2025 is $744 million.

This figure captures the club’s total enterprise value — including assets, brand value, and future revenue potential — less liabilities and reflecting recent financial performance.

Despite several years of losses, the club’s value is supported by infrastructure investment, a global brand, and Premier League status.

Asset Value and Club Infrastructure

One of Everton’s principal asset drivers is the Bramley-Moore Dock Stadium under development, with cost estimates in excess of £750 million (roughly $950 million) per some construction updates.

While the stadium hasn’t yet generated full matchday revenue, the anticipated uplift in capacity (over 52,000 seats) and premium hospitality spaces underpin future earnings.

The club also lists in its 2023/24 Annual Report turnover of £186.9 million (approx $236 million) for the year.

Everton’s property assets, training facilities, and broadcast infrastructure contribute further tangible asset value, though many are leveraged through debt or long-term financing arrangements.

Brand Strength and Global Position

Everton’s global brand is reflected in its valuation. According to Forbes, it was valued at $744 million in May 2023 and retains similar value in 2025 with minor adjustments.

The club has over 30 million global supporters, a legacy spanning back to 1878, and consistent exposure through the Premier League’s worldwide broadcast footprint. Commercial side-revenues are rising: for instance, international broadcast share for 2023/24 included £56.6 million in recognition of global TV revenue.

These brand and broadcast advantages help justify Everton’s valuation despite sporting and financial challenges.

Revenue Streams and Financial Performance

In terms of recent performance, Everton’s 2023/24 Annual Report shows turnover of £186.9 million (about $236 million) — up from £172.2 million the previous year.

However, the club recorded a net loss of £53.2 million (about $67 million) in the same period, improving from a prior loss of £89.1 million.

The 2024 Annual Report shows gate receipts were £19.1 million, and international TV revenue rose by £7.8 million year-on-year. The combination of higher revenue and declining losses is positive, but the ongoing losses still weigh on overall valuation and risk profile.

Liabilities, Debt, and Financial Restructuring

Everton has significant liabilities that impact its net worth. The club secured a stadium financing deal of £350 million (roughly $450 million) in early 2025 to refinance its stadium debt.

This large debt burden, combined with prior years of losses, reduces equity value and limits free cash flow. The net worth estimate of $744 million assumes asset value and brand strength sufficiently offset debt and losses to generate positive enterprise value.

Long-Term Valuation Outlook

Going forward, Everton’s value is expected to increase if the new stadium opens and revenue grows as projected. A move to higher matchday income, improved commercial deals, and global media growth could raise valuations into the low billions. However, this is contingent on sporting performance improving, regulatory compliance holding up, and cost control.

At the current $744 million value, the club trades at roughly 3-4× its annual turnover and remains below the average Premier League club value (estimated at $1.51 billion.

Everton FC CEO

As of November 2025, Angus Kinnear serves as the Chief Executive Officer of Everton FC. His appointment reflects The Friedkin Group’s focus on disciplined financial management, commercial growth, and modernizing Everton’s operational structure as the club prepares to move into the Bramley-Moore Dock Stadium.

Background and Career Experience

Angus Kinnear brings extensive executive experience in the Premier League and elite football management. Before joining Everton, he served as the CEO of Leeds United, where he played a key role in their promotion to the Premier League in 2020 and oversaw major commercial growth. Prior to Leeds, Kinnear held high-level roles at:

- Arsenal FC, where he served as Managing Director of Marketing.

- West Ham United, where he also served as Managing Director.

Across these senior positions, he worked on expanding global fan engagement, securing major sponsorships, overseeing stadium operations, and modernizing revenue structures. This background made him a strategic fit for Everton during a transformational stage.

Responsibilities and Leadership Role

As CEO of Everton FC, Angus Kinnear is responsible for executing the strategic and commercial vision set by The Friedkin Group, the club’s controlling ownership. His key responsibilities include:

- Overseeing commercial operations, sponsorships, and revenue growth

- Strengthening financial governance and ensuring regulatory compliance

- Directing the club’s business departments, including marketing, operations, partnerships, and media

- Managing the move to Bramley-Moore Dock Stadium, including naming rights, hospitality design, and event operations

- Leading long-term commercial planning to grow Everton’s global footprint

- Serving as the main operational link between the board and the club’s executive departments.

Kinnear’s leadership style is commercially driven, data-focused, and aligned with sustainable growth rather than short-term financial risks.

Commercial and Revenue Strategy

One of Kinnear’s strongest areas is commercial expansion. At Leeds United, he secured multi-year global partnerships with major brands and oversaw significant revenue growth. Everton’s new ownership expects him to replicate similar strategies by:

- Increasing commercial revenue through new sponsorship and hospitality deals

- Expanding Everton’s international fan engagement

- Rebuilding the club’s brand after several years of financial instability

- Booster events and non-matchday revenue at the new stadium

- Enhancing digital and retail operations.

This commercial strategy is central to strengthening Everton’s long-term financial profile.

Role in the Bramley-Moore Dock Stadium Transition

The stadium transition is the biggest operational project in Everton’s modern history. Angus Kinnear plays a leading role in:

- Structuring commercial partnerships tied to the stadium

- Overseeing naming rights negotiations

- Designing fan experience models and hospitality revenue pathways

- Ensuring smooth operational planning for the first matchday season

- Aligning stadium operations with Premier League and safety regulations.

His experience in stadium-related roles at West Ham and Leeds is directly relevant to this major transition.

Relationship with The Friedkin Group and Board Structure

As CEO, Kinnear works closely with The Friedkin Group’s senior executives and the Everton board appointed through Roundhouse Capital Holdings. He is the central operational decision-maker and ensures the club’s day-to-day business aligns with ownership’s long-term objectives.

His role includes preparing board reports, managing financial compliance updates, and collaborating with the sporting leadership team to ensure the football side operates within sustainable financial boundaries.

Since taking over, Kinnear has focused on rebuilding Everton’s commercial credibility, strengthening financial discipline, and improving transparency across operations. His leadership aims to move Everton away from the financial crises and regulatory breaches seen in previous years. He is expected to play a crucial role in positioning the club for long-term stability, revenue expansion, and competitive rebuilding.

Under his direction, Everton is shifting toward a more professional, structured, and commercially modern model — one that aligns with the standards of elite European football organizations.

Final Thoughts

Everton FC is entering a new era defined by financial stability, stronger governance, and long-term strategic planning under its new ownership structure. With The Friedkin Group now controlling the club, and with who owns Everton FC firmly established through a modern, centralized model, the franchise is better positioned to rebuild both on and off the pitch.

The combination of a transformational new stadium, improved commercial leadership, and a strengthened executive team sets the foundation for long-term growth. If the club continues to align its footballing decisions with this renewed financial discipline, Everton has a genuine opportunity to restore competitiveness and reshape its future trajectory.

FAQs

Who is the new owner of Everton FC?

The new owner of Everton FC is The Friedkin Group, which took control of the club in late 2024 through Roundhouse Capital Holdings.

Who are Everton FC new owners?

Everton’s new owners are The Friedkin Group, led by chairman Dan Friedkin, along with a small group of minority investors who hold indirect stakes through the ownership vehicle Roundhouse Capital Holdings.

What is the net worth of Everton?

As of November 2025, Everton FC’s estimated net worth is $744 million.

Who owns Friedkin Group?

The Friedkin Group is owned and controlled by American billionaire Dan Friedkin, who serves as the company’s chairman and CEO.

Who are the investors in Everton?

The primary investor is The Friedkin Group with approximately 98.8% ownership. Minority investors include Christopher Sarofim, Jason Kidd, and several U.S.-based partners who hold indirect stakes through Roundhouse Capital Holdings.

Which was founded first, Liverpool or Everton?

Everton was founded first in 1878, while Liverpool was founded later in 1892 after a split within Everton’s board.

How much did Farhad Moshiri sell Everton for?

The exact sale price was not publicly disclosed, but the transaction involved the transfer of approximately 98.8% of the club’s shares to The Friedkin Group along with the restructuring of existing debt.

How many times has Everton won the Premier League?

Everton have never won the Premier League since its formation in 1992.

When did Everton last win the Premier League?

Everton have not won the Premier League era title; however, they last won the old First Division (the top tier before the Premier League) in 1986–87.