Brighton & Hove Albion has become one of the most admired clubs in English football. Fans across the world watch the team rise with smart recruitment, a strong identity, and a modern approach to the game. Only later do many ask the bigger question: who owns Brighton and what drives this impressive progress? Understanding the club’s ownership helps explain how Brighton went from years of instability to becoming a well-run Premier League side with a long-term vision.

Key Takeaways

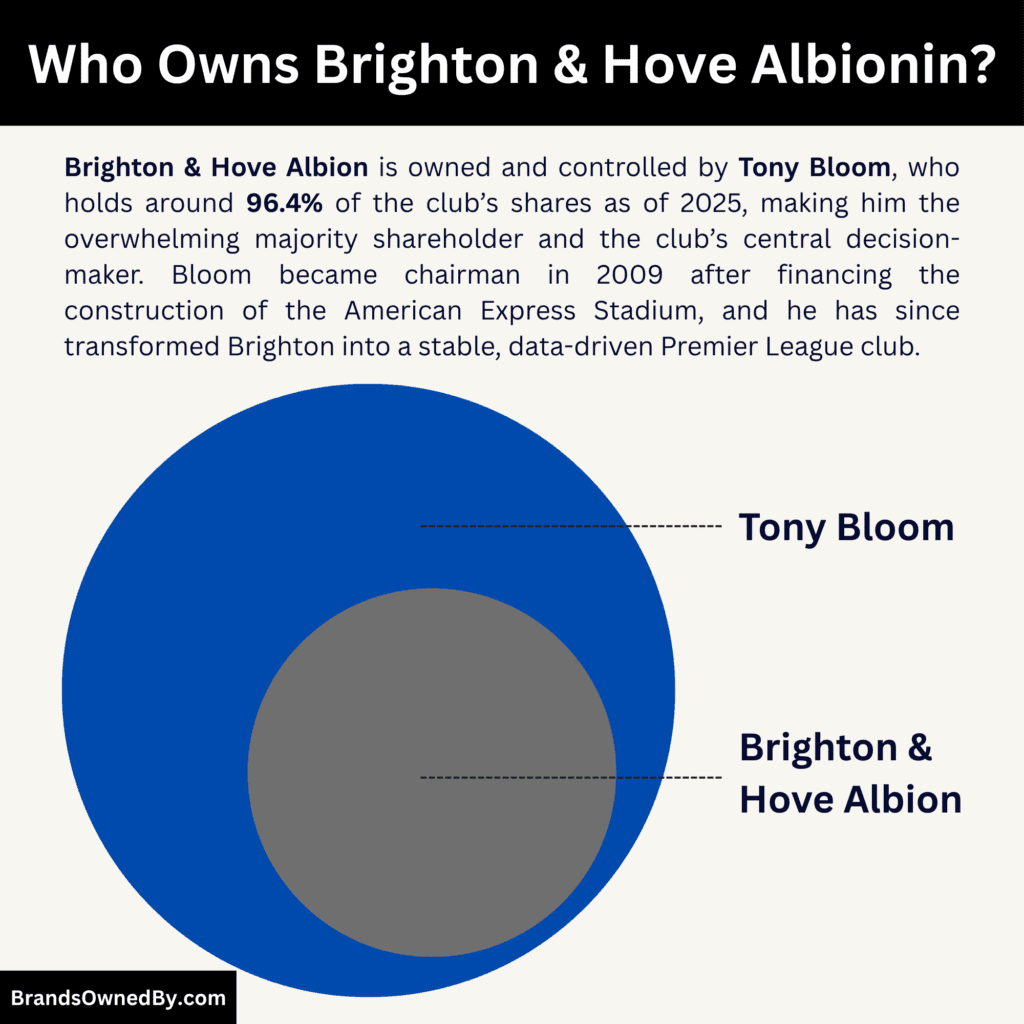

- Brighton & Hove Albion is owned and controlled by Tony Bloom, who holds approximately 96.4% of the club’s shares as of November 2025.

- Bloom became the majority owner in 2009 after financing the construction of the American Express Stadium and taking over the chairmanship.

- Paul Barber, the club’s CEO and Deputy Chairman, is the most notable minority shareholder with a small strategic stake that aligns leadership with ownership.

Brighton & Hove Albion F.C. Overview

Brighton & Hove Albion F.C. is a professional football club based in Brighton and Hove, East Sussex. Founded in 1901, the club has grown from a coastal regional team into an established Premier League side with a strong identity, modern infrastructure, and an increasingly global following.

Over the past century, Brighton has navigated periods of success, financial instability, relocation struggles, and significant rebuilding. The club plays its home matches at the American Express Stadium, a modern facility that transformed its fortunes when it opened in 2011.

Known as “The Seagulls,” Brighton now represents a blend of community roots, innovative football, and ambitious long-term planning driven by data-focused operations.

Founding & Early Identity

Brighton & Hove Albion was formally founded on June 24, 1901, at a meeting held in the Seven Stars pub in Ship Street, Brighton. The club originally adopted the name “Brighton & Hove United” before changing to Brighton & Hove Albion shortly afterwards.

The move to use “Albion” is associated with founder-figure John Jackson, who had links to West Bromwich Albion and suggested the name fit the new club’s ambitions.

At its inception, the club emerged from the collapse of earlier local teams — such as Brighton United (founded 1897, folded 1900) and Brighton & Hove Rangers (active around 1900) — which highlighted the demand for a stable, semi-professional club in the area.

The founders set out to run the club on more professional terms than previous efforts. They secured the use of the Sussex County Cricket Club’s ground arrangement at Hove in exchange for a share of gate receipts and stewarding duties.

The nickname “The Seagulls” was adopted in the late 1970s — before that, the team had been known as “The Dolphins” for a brief period in the mid-1970s.

Major Milestones

- 1901: Club founded after the collapse of earlier local teams, beginning its journey in the Southern League.

- 1910: Won the Southern League title and defeated Aston Villa to claim the FA Charity Shield.

- 1920: Admitted into the Football League’s newly created Third Division.

- 1933: Achieved one of the club’s highest average attendances in the pre-war period, marking strong local support.

- 1958: Became a founding member of the new national Third Division following league restructuring.

- 1972: Promoted to Division Two, signaling the rise toward top-flight football.

- 1979: Secured promotion to the First Division, entering the top tier of English football for the first time.

- 1983: Reached the FA Cup Final and forced Manchester United to a replay in a historic cup run.

- 1997: Survived relegation from the Football League on the final day amid financial crisis and fan-led resistance.

- 1999: Temporarily moved to Gillingham’s Priestfield Stadium after the sale of the Goldstone Ground.

- 2001: Returned to Brighton at Withdean Stadium and began a new chapter of rebuilding.

- 2002: Achieved back-to-back promotions, regaining second-tier status.

- 2011: Opened the American Express Community Stadium (Falmer Stadium), marking a turning point for the club’s future.

- 2017: Promoted to the Premier League after finishing second in the Championship.

- 2021: Recorded their highest Premier League points tally at the time, reflecting steady top-flight improvement.

- 2023: Finished sixth in the Premier League and qualified for European competition for the first time in club history.

- 2024: Continued building global visibility, player development success, and increased revenue streams as a Premier League mainstay.

- 2025: Entered the year with increased commercial strength, rising squad market value, and strategic investments aimed at sustaining Premier League competitiveness and global branding.

Who Owns Brighton & Hove Albion FC?

Brighton & Hove Albion is owned and controlled by Tony Bloom, the businessman, professional gambler, and lifelong Brighton supporter who has transformed the club since taking over in 2009. Unlike many Premier League teams with fragmented ownership groups, Brighton’s direction is shaped almost entirely by Bloom.

As of November 2025, nearly all strategic, financial, and football decisions flow through him making his ownership one of the most concentrated and influential structures in English football.

Tony Bloom – Majority Owner and Chairman

Tony Bloom owns approximately 96.4% of Brighton & Hove Albion as of November 2025. His stake gives him full voting power and complete strategic control over the club. Bloom does not share authority with any competing investors, meaning all major decisions — from board appointments to stadium expansion plans — run directly through him.

This ultra-concentrated control is key to Brighton’s stability. Most Premier League clubs either have divided ownership groups or multiple institutional stakeholders. Brighton does not. Bloom’s dominance ensures that long-term decisions are aligned, fast, and internally consistent.

Bloom’s journey as owner began in 2009 when he invested heavily into the club, providing the funding required to build the American Express Stadium. In exchange for this injection, he acquired the majority of the shares and replaced Dick Knight as chairman. His takeover was not a leveraged buyout — Bloom used his own capital, giving the club a healthier financial footing.

From 2009 onward, Bloom steadily increased his stake through additional equity injections and shareholder loans, eventually reaching overwhelming majority control by the mid-2010s.

In 2025, he had become not just the owner, but the architect of the club’s entire operating philosophy.

Financial Influence and Long-Term Funding

Bloom has funded Brighton through a combination of equity and long-term, interest-free shareholder loans. His financial backing has supported:

- Stadium construction

- Training ground upgrades

- Recruitment technology and analytics infrastructure

- Youth development and academy expansion

- Transfer market strategy.

Brighton’s data-driven recruitment model — now copied across Europe — exists because Bloom invested in Starlizard’s analytical methods and adapted them for football operations.

As chairman, Bloom holds ultimate authority over:

- Board composition

- CEO and sporting director hires

- Long-term football philosophy

- Infrastructure projects

- Financial policy and sustainability

- Multi-club ownership compliance.

He is deeply involved but not publicly intrusive. Bloom rarely makes media appearances, preferring to work through trusted executives such as the CEO, technical directors, and scouting leads.

Other Football Investments (2023–2025)

Bloom expanded his sporting footprint in 2025, acquiring minority stakes that do not affect Brighton’s governance but strengthen his overall football network.

- Melbourne Victory (19.1% in 2025) – expanding scouting reach into Australia and Asia.

- Heart of Midlothian (29% in 2025) – a non-voting minority stake that supports analytics and talent development.

- Royale Union Saint-Gilloise (restructured to minority stake) – aligned with UEFA regulations while maintaining collaborative pathways.

These investments do not dilute his Brighton authority. Instead, they create an interconnected scouting and development ecosystem that benefits Brighton indirectly.

Minority Shareholders

Though the club is overwhelmingly controlled by the majority owner, there are a handful of minority shareholders who hold smaller stakes and contribute to the club’s ownership structure.

Paul Barber

Paul Barber, the club’s Deputy Chairman and Chief Executive, invested in shares of Brighton in August 2025. He acquired approximately 1.5% of the total share capital, making him the second-largest individual shareholder behind the majority owner. His investment reflects long-standing service to the club and aligns his leadership role with ownership participation.

Additional Minority Holders

Specific public disclosure of other minority owners is limited. What is known: the remaining minority shareholding beyond the majority owner (who holds ~96.4%) is approximately 3.6% of the club’s equity. These shares are held by various private individuals, former board members, executives and possibly small investor groups. Their influence on governance is limited given the concentrated majority control.

Role and Influence of Minority Shareholders

Although these minority investors hold identifiable stakes, their practical influence is significantly constrained. Because the majority owner retains near-complete control over voting rights, board composition and strategic direction, the minority shareholders typically do not participate actively in governance. Their roles tend to be symbolic, representing commitment and alignment with the club’s values rather than independent power centres.

Brighton & Hove Albion Ownership History

The ownership story of Brighton & Hove Albion is a long journey filled with financial struggles, fan-led rescue efforts, periods of instability, and finally a modern era defined by stability under Tony Bloom.

| Ownership Era / Owner | Years Active | Approx. Ownership / Control | Key Actions & Impact |

|---|---|---|---|

| Founding Committee & Local Businessmen | 1901–1980s | Shared ownership among local businessmen, board members, and community figures | Ran the club in traditional early-league format. Oversaw early promotions, stadium use, and community development. |

| Various Ownership Groups (Financial Instability) | 1980s–1997 | Mixed private owners; fragmented and unstable control | Period marked by financial decline, repeated ownership changes, and eventual sale of the Goldstone Ground. |

| Dick Knight | 1997–2009 | Chairman and leading shareholder; significant influence despite limited financial power | Saved the club from collapse, led the fan-backed takeover, secured Withdean Stadium, won approval for Falmer Stadium. |

| Tony Bloom (Majority Owner & Chairman) | 2009–Present (2025) | 96.4% ownership; total strategic and financial control | Financed the Amex Stadium, built the training complex, modernized the club, introduced data-driven recruitment, achieved Premier League status and European qualification. |

| Known Minority Shareholders (Small stakes) | 2010s–2025 | 3.6% total combined minority holdings | Includes small investors and executives such as Paul Barber (approx. 1.5% as of 2025). Minimal voting influence. |

Early Foundations (1901–1970s)

When Brighton & Hove Albion was founded in 1901, it operated much like many English clubs of the era: owned and run by local businessmen, club officials, and community members. There was no single dominant owner. Instead, ownership was dispersed among board members who financed operations modestly.

This early structure was typical for lower-league English clubs, relying heavily on local support, matchday revenue, and small investor contributions. For several decades, ownership stability depended more on volunteers and local administrators than on wealthy financiers.

Turbulent Ownership and Financial Decline (1980s–1990s)

From the mid-1980s to the late 1990s, Brighton’s ownership situation became increasingly unstable.

The club struggled financially after relegation from the First Division in 1983. Ownership groups changed, finances weakened, and the club eventually faced one of the darkest periods in its history.

By the mid-90s, Brighton’s owners decided to sell the Goldstone Ground, the club’s historic home, to pay debts — a decision that sparked widespread outrage among supporters. The club was left homeless, financially broken, and on the brink of dropping out of the Football League.

Control shifted between several business figures during this time, but none provided long-term stability.

The Dick Knight Era – The Fan-Led Rescue (1997–2009)

Dick Knight emerged as the central figure in the club’s survival. A lifelong supporter and local businessman, Knight led a fan-backed movement to remove the previous ownership and take control of the club in 1997.

Under Knight:

- The club stayed alive during years in exile at Gillingham’s Priestfield Stadium.

- Brighton eventually returned to play at the temporary Withdean Stadium.

- The long battle for a permanent stadium at Falmer was fought and won.

Knight’s leadership was emotional, community-driven, and essential. He rebuilt trust, stabilized finances as best as possible, and secured government approval for a new stadium — the biggest milestone of the pre-Bloom era.

However, despite monumental efforts, Knight did not have the capital to fund the construction of the new stadium alone. Brighton needed a new financial powerhouse to take the next step.

Arrival of Tony Bloom – The Turning Point (2009)

In 2009, Tony Bloom stepped forward with a transformative offer.

Already a Brighton supporter, data-driven entrepreneur, and successful investor, Bloom offered to finance the construction of the American Express Stadium with more than £90 million of his own money.

In exchange, he received a controlling share of the club and replaced Knight as chairman.

This was a peaceful transition. Knight remained a respected figure, retaining a small shareholding and becoming honorary president, but real power shifted to Bloom.

Expansion of Bloom’s Control (2010–2025)

Over the next decade, Bloom increased his shareholding to approximately 96.4% by injecting capital, converting loans to equity, and strengthening the club’s financial base.

Under his ownership:

- Falmer Stadium opened in 2011.

- The state-of-the-art American Express Elite Football Performance Centre was built.

- The club achieved promotion to the Premier League in 2017.

- Brighton established a reputation for elite scouting, analytics, and sustainable spending.

- European qualification arrived in the 2022–23 season.

Bloom’s era is defined by long-term investment, stability, and the most successful period in the club’s history.

Ownership in 2025 – Modern, Stable, and Data-Driven

In 2025, Brighton is one of the best-run clubs in Europe.

Ownership has shifted from early community boards → crisis-era instability → fan-driven survival → modern, strategic leadership under Tony Bloom.

Bloom’s near-total control ensures stability and clarity.

What began as a community club in 1901 has transformed into a global football operation with a single majority owner guiding long-term vision, investment strategy, and football identity.

Tony Bloom Net Worth

Tony Bloom has an estimated net worth of around £1.3 billion as of November 2025. His wealth is not built from a single industry but from a combination of data-driven betting syndicates, private investments, real estate, and long-term business ventures. Bloom’s financial strength is unique because it is rooted in analytical expertise rather than inheritance or traditional corporate wealth, making him one of the most unconventional owners in the Premier League.

Sources of Wealth

Here’s how Tony Bloom makes money and generates wealth:

Starlizard – The Core of His Fortune

Starlizard, founded by Bloom, is widely regarded as the most sophisticated sports betting and analytics consultancy in Europe. It uses proprietary models, real-time statistical algorithms, and predictive analysis to identify value in global sports markets.

Key factors that make Starlizard a major wealth generator:

- Scale of operation: It functions more like a hedge fund than a typical betting company, handling extremely large stakes on behalf of private clients.

- Predictive models: Starlizard employs mathematicians, data scientists, statisticians, and traders to build models that outperform public betting markets.

- Low-risk, high-volume strategy: The company aims for small, consistent percentage returns on very large transaction volumes, leading to compounding profits.

- Global scope: It covers football, tennis, rugby, and other international sports, giving it constant activity across seasons.

This business is secretive, privately held, and highly profitable — forming the backbone of Bloom’s wealth since the early 2000s.

Private Investments & Venture Capital

Bloom has diversified into several investment sectors, including:

- Tech and analytics – businesses tied to data modeling, AI decision systems, and forecasting technology.

- Sports companies – advisory and technology firms aligned with performance analysis.

- Gaming-related enterprises – further expanding the predictive and statistical strengths he built his career.

- Startups – although private, he is known to back high-capability teams with strong mathematical or engineering backgrounds.

These investments create multiple income streams while reinforcing his core expertise in analytics and predictive markets.

Real Estate Portfolio

Bloom’s wealth includes a significant (but mostly private) real estate portfolio.

His holdings extend across:

- London commercial and residential properties

- High-value units in Brighton and Hove

- Strategic investments in properties connected to business ventures

- Real estate is tied to his international interests.

Property acts as the stabilizing asset class in his portfolio, balancing the volatility of betting markets.

Football Investments & Multi-Club Holdings

Although Brighton is his primary sporting asset, Bloom expanded into other clubs between 2023 and 2025:

- Melbourne Victory (19.1% stake in 2025)

- Heart of Midlothian (29% non-voting stake in 2025)

- Royale Union Saint-Gilloise (restructured to minority stake for UEFA compliance).

While football ownership does not generate immediate liquid wealth, the growing valuations of these clubs add meaningful long-term value to Bloom’s financial profile.

Evolution of Bloom’s Net Worth Over Time

Bloom’s net worth did not spike suddenly — it grew consistently over decades.

- 1990s: Built early capital through gambling and mathematics-driven betting strategies.

- 2000–2010: Starlizard scaled into a serious analytics firm, greatly increasing his wealth.

- 2009: Invested more than £90m into Brighton’s stadium project, signalling substantial financial capability.

- 2010–2020: Brighton’s growth, Premier League promotion (2017), and asset value increases strengthened his financial standing.

- 2020–2025: Expanded into multi-club investments, with Brighton’s valuation surpassing £650m, indirectly boosting his net worth.

Net Worth in the Context of Premier League Owners

Bloom is not the richest Premier League owner, but he is:

- One of the most hands-on

- One of the most analytically skilled

- One of the few self-made billionaires

- One of the smallest ownership groups (almost entirely self-owned).

This gives Brighton the advantage of a coherent vision, quick decision-making, and no external board conflict, something most clubs cannot replicate.

How His Wealth Shapes Brighton

Bloom’s financial strength allows Brighton to:

- Operate sustainably without excessive debt

- Maintain world-class recruitment analytics

- Retain top executives and expand data teams

- Invest in a stadium, a training ground, and youth development

- Resist short-term financial pressure that affects most mid-table clubs

His fortune, and the way he built it, is directly connected to Brighton’s identity: smart, data-driven, stable, and forward-thinking.

Brighton & Hove Albion FC Net Worth

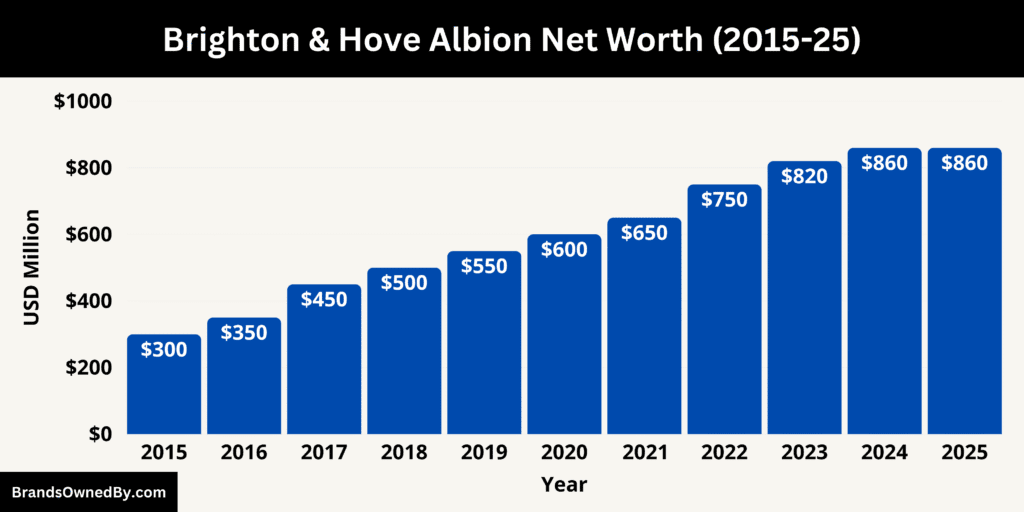

As of November 2025, Brighton & Hove Albion is valued at around $860 million. This places Brighton among the most financially healthy and efficiently run clubs in the Premier League, despite operating in one of the league’s smallest local markets.

Brighton’s valuation showcases its transformation from a once-struggling lower-league side into a modern, globally recognized football brand. The valuation includes tangible assets such as the American Express Stadium and the Elite Football Performance Centre, and intangible assets such as brand equity, intellectual property, scouting networks, academy talent, and digital reach.

The Premier League’s global broadcasting structure significantly boosts the club’s valuation. Even clubs outside the traditional “big six” benefit from the league’s worldwide popularity, and Brighton has leveraged this platform exceptionally well by maintaining competitive performances and building a recognizable football identity.

Revenue Streams and Financial Drivers

Brighton generates revenue from broadcasting, matchday income, commercial partnerships, and player trading. Broadcasting remains the largest driver. Participation in the Premier League ensures a stable annual distribution, regardless of league position, and international broadcasting continues expanding Brighton’s global audience.

Matchday income is supported by strong attendance at the American Express Stadium, which provides modern hospitality, sponsorship zones, and high-yield matchday facilities. While Brighton’s local population is smaller than many Premier League cities, the club’s modern stadium design maximizes revenue per seat and attracts consistent fan turnout.

Commercial revenue has grown substantially. The club has strengthened relationships with long-term sponsors, expanded its digital retail business, and capitalized on its rise in global visibility. Brighton’s playing style, recruitment success, and notable European qualification in recent seasons have increased international brand recognition, leading to stronger sponsorship proposals and global partnerships.

Player trading has become another major contributor to the club’s financial performance. Brighton’s data-driven recruitment model identifies undervalued talent, develops those players, and later sells them for significant profit. These reinvestments not only sustain competitive performance but also increase overall franchise value by proving the club’s ability to generate repeatable, high-margin returns.

Infrastructure and Asset Value

The American Express Stadium is one of Brighton’s most important assets. The club’s relocation to this modern facility in 2011 marked a turning point in its financial trajectory. The stadium’s design, hospitality areas, training facilities, and broadcast-ready infrastructure all contribute directly to its valuation.

Brighton also owns one of the Premier League’s most advanced training complexes: the American Express Elite Football Performance Centre. This facility plays a vital role in player development, sports science, and recruitment integration, and its long-term investment value continues to appreciate as the club nurtures more academy graduates and first-team talent.

Brand assets also form a growing part of the club’s net worth. These include international fanbase expansion, social media reach, global merchandising, digital content platforms, and the club’s reputation for excellence in coaching, recruitment, and analytics.

Profitability and Long-Term Financial Health

Brighton has reported strong financial results in recent seasons, including standout profits driven by player sales and stable Premier League revenue. The club’s business philosophy prioritizes sustainability, meaning Brighton does not overspend on wages or transfer fees, even during successful campaigns.

This conservative and highly analytical approach ensures that the club remains financially secure, avoids unnecessary debt, and gradually increases overall valuation. Few Premier League clubs manage to grow so consistently while maintaining financial discipline, and this is one reason Brighton’s net worth continues to rise year after year.

Growth Potential and Financial Outlook

Looking ahead, Brighton’s valuation is positioned to grow further. The club has already established a strong reputation for developing players, attracting global talent, and expanding its international footprint. Additional European appearances, continued on-field competitiveness, and brand expansion into new markets will naturally push its valuation higher.

The combination of a wealthy owner, a data-focused football model, modern infrastructure, and a global league platform gives Brighton significant financial momentum. With smart management and continued Premier League stability, the club’s net worth is expected to increase steadily through the second half of the decade.

Brighton & Hove Albion Leadership

Brighton & Hove Albion operates under a leadership structure designed for stability, long-term planning, and data-driven decision-making. In 2025, the club is recognized as one of the most efficiently managed teams in the Premier League, with a leadership group that blends football expertise, corporate management, analytics, and strategic oversight.

Chairman: Tony Bloom

Tony Bloom serves as the Chairman and the driving force behind the club’s leadership model. Beyond his majority ownership, Bloom sets the strategic direction for football operations, infrastructure development, long-term planning, and financial sustainability.

He is deeply involved in high-level decisions such as stadium expansion, the recruitment framework, major executive appointments, and the development of Brighton’s global football network. Bloom’s analytical background shapes the club’s identity: disciplined, data-focused, and built for long-term growth rather than short-term impulses.

Deputy Chairman & CEO: Paul Barber

Paul Barber is one of the most respected chief executives in the Premier League and serves as Deputy Chairman and Chief Executive Officer. He provides day-to-day operational leadership across the entire club, including commercial strategy, media, revenue development, compliance, fan experience, and internal governance.

Under Barber’s leadership, Brighton has grown into a financially stable and commercially strong Premier League club. In 2025, Barber also became a minority shareholder, strengthening his long-term commitment to the club and aligning leadership with ownership.

Technical Leadership & Football Operations

Brighton’s football operations are structured to maximize data analysis, recruitment intelligence, and coaching continuity. This is one of the pillars of the club’s success.

Technical Director / Sporting Executive

The club’s technical leadership oversees scouting, analytics integration, academy development, player pathway management, and recruitment strategy. Brighton is known globally for its data-driven scouting model, which identifies undervalued or emerging talent across Europe, South America, and increasingly, Asia and Africa.

This department works directly under the strategic guidance of Tony Bloom and operates one of the largest and most advanced data teams in English football.

Head Coach / First-Team Manager

The head coach (2025 appointment depending on current manager status) handles on-pitch decisions, match strategy, player development, and first-team performance. Brighton hires managers who align with the club’s tactical philosophy — possession-based football, pressing principles, and player development.

Coaches are supported by analysts, sports scientists, conditioning experts, and a full medical team, ensuring decisions are collaborative and evidence-based.

Recruitment, Analytics & Data Science Department

Brighton’s recruitment and data science division is a central part of club leadership. Its tasks include:

- Statistical modeling of player performance

- Identifying talent in undervalued markets

- Producing tactical data reports

- Forecasting player development trajectories

- Supporting multi-club scouting networks

This department is one of the reasons the club consistently discovers players who later sell for high fees, strengthening both sporting and financial performance.

Academy & Youth Development Leadership

The academy leadership focuses on producing long-term first-team talent. Brighton’s youth setup has grown significantly in the 2020s, with investments in facilities, coaching, scouting, and education programs.

Brighton’s leadership aims to build a sustainable model where academy players feed into the first team and, when needed, create profitable transfer revenue.

In 2025, more academy graduates have begun featuring in the squad due to the club’s increased emphasis on internal development.

Board and Executive Leadership

The executive board supports strategic decisions across finance, commercial operations, legal compliance, marketing, and corporate planning. Each senior executive manages a specialized department, reporting to the CEO, who then aligns operations with the club chairman’s long-term vision.

Global Football Network & Strategic Expansion

As of 2025, Brighton’s leadership strategy includes establishing links across a multi-club ecosystem through owner Tony Bloom’s minority investments in foreign clubs. These relationships provide:

- Wider scouting networks

- Loan pathways for youth players

- Greater access to emerging markets

- Collaborative data-sharing models

This keeps Brighton competitive despite having a smaller local market compared to Premier League giants.

Overall Leadership Outlook

The club’s leadership model is built on synergy: Bloom’s strategic vision, Barber’s operational excellence, strong technical directors, analytics-led recruitment, and forward-thinking coaching teams. Together, they form one of the most integrated and efficient leadership structures in English football.

This model is why Brighton remains competitive, financially stable, and consistently upward-trending as a Premier League club in 2025.

Final Thoughts

Brighton & Hove Albion’s modern success did not appear overnight. It is the result of patient investment, strong leadership, and a long-term plan that few Premier League clubs follow so consistently. When people ask who owns Brighton, they are really asking who built the foundation that supports its current achievements. Tony Bloom’s ownership transformed Brighton from a struggling lower-league club into a stable, competitive Premier League contender known for smart decision-making and data-driven football. As the club grows in value, expands its global presence, and continues to develop talent, Brighton stands as an example of what can happen when ownership, management, and strategy align. The future looks bright for the Seagulls, and the club’s rise shows no signs of slowing.

FAQs

Who owns Brighton now?

Brighton & Hove Albion is owned and controlled by Tony Bloom, who holds approximately 96.4% of the club’s shares as of 2025.

Who founded Brighton and Hove Albion?

Brighton & Hove Albion was founded in 1901 by a group of local businessmen and football enthusiasts who formed the club after the collapse of earlier teams in the city.

Who is the owner of Brighton and Hove Albion?

The owner of Brighton & Hove Albion is Tony Bloom, a lifelong supporter of the club and its chairman since 2009.

Where does Tony Bloom live?

Tony Bloom lives in the United Kingdom, primarily dividing his time between Brighton and London, though he keeps his personal life private and details of his residence are not publicly disclosed.

Who has Brighton sold to Chelsea?

Brighton has sold several players to Chelsea in recent years, including Moisés Caicedo, Marc Cucurella, and Robert Sánchez, all as part of major transfer deals.

How much did Tony Bloom buy Brighton for?

Tony Bloom did not purchase the club through a traditional acquisition fee. Instead, he gained control in 2009 by investing over £90 million of his own money to fund the construction of the American Express Stadium, which secured him the majority shareholding.

How did Tony Bloom make his money?

Tony Bloom made his fortune through professional gambling, high-stakes sports betting, and the creation of Starlizard — a data analytics and betting consultancy known for its sophisticated mathematical models. He later expanded into investments, property, and multi-club football ownership.