Cash App has become one of the most widely used payment apps in the U.S., offering services from money transfers to investing. People often ask who owns Cash App and how it has grown so quickly. The answer lies in its parent company, leadership, and vision for digital finance.

Key Takeaways

- Cash App is owned and operated by Block, Inc., the fintech company co-founded by Jack Dorsey and Jim McKelvey, with Block controlling its strategic direction.

- Jack Dorsey serves as Block’s Head and Chairperson, providing overall leadership, while Cash App has its own CEO, Brian Grassadonia, who manages day-to-day operations.

- The platform operates independently within Block, offering multiple financial products such as peer-to-peer payments, investing, Bitcoin trading, and lending, making it a core revenue-generating unit.

Cash App Company Profile

Cash App is a peer-to-peer payment service owned by Block, Inc., the company formerly known as Square, Inc. It was launched in 2013 under the name Square Cash and later rebranded as Cash App. Headquartered in the United States, it has grown from a simple money transfer tool into a full digital financial platform.

The app allows users to send and receive money, use a debit card called Cash Card, create unique $Cashtags, buy and sell Bitcoin, invest in stocks, and even file taxes. It operates as one of Block’s core businesses, alongside Square, Afterpay, Spiral, TIDAL, and TBD. Cash App has become one of the most recognized fintech brands in the U.S., known for blending financial services with a user-friendly digital experience.

Founders and Origins

Cash App was created by the founders of Block, Inc. Jack Dorsey and Jim McKelvey launched the parent company in 2009, originally to help small businesses accept card payments.

In October 2013, they introduced Square Cash, which would later become Cash App.

Brian Grassadonia, an early Square executive, played an important role in the app’s launch and development. From its beginnings as a simple email-based transfer service, Cash App steadily evolved into one of the most versatile financial apps in the market.

Major Milestones

- 2009 – Square, Inc. founded by Jack Dorsey and Jim McKelvey.

- 2013 (October) – Launch of Square Cash, enabling simple peer-to-peer transfers.

- 2015 – Introduction of Square Cash for Business and $Cashtags.

- 2017 – Launch of the Cash Card, a Visa debit card linked to Cash App balances.

- 2018 – Addition of Bitcoin trading features within Cash App.

- 2019 – Stock investing launched, allowing users to buy fractional shares.

- 2020 – Cash App expands tax filing services and grows rapidly during the pandemic.

- 2021 (December) – Parent company Square, Inc. rebrands to Block, Inc. to reflect a broader vision.

- 2022 – Block completes acquisition of Afterpay, further integrating buy-now-pay-later services with Cash App.

- 2023 – Cash App introduces borrowing features, allowing eligible users to access short-term loans.

- 2024 – Cash App reaches over 57 million monthly active users, solidifying its position as one of the top fintech platforms in the U.S.

- 2025 – Increased focus on compliance and regulatory measures, while continuing to expand services in digital finance.

Who Owns Cash App?

Block, Inc. (the parent company of Cash App) is a publicly traded company. It is a business unit under Block, Inc. (formerly known as Square, Inc.). Thus, its ownership is tied to Block’s ownership. Block is a publicly traded company, and its shares are held by insiders, institutional investors, and retail shareholders.

Block maintains a dual-class share structure:

- One class (Class A) is more broadly held by institutional and individual investors.

- The other class (Class B) is held by insiders and founders and carries greater voting power per share.

This structure gives founders and insiders disproportionate control over major strategic decisions, board elections, and corporate governance.

As of 2025, insiders own a modest portion of total equity, but thanks to their Class B shares, they command a large share of voting rights. Institutional investors collectively hold a significant majority of the economic stake through Class A shares.

Retail investors also own part of the equity, but their influence is limited compared to large institutions and insiders.

Parent Company: Block, Inc.

Block, Inc. is the parent company that houses Cash App alongside other businesses such as Square’s seller solutions, Afterpay, TIDAL, Bitkey, and Proto. The rebranding to “Block” occurred in December 2021, signaling a broader ambition beyond payment services.

Under the Block umbrella, Cash App operates with some autonomy—launching features, managing product roadmaps, and marketing to consumers—while relying on Block for capital, infrastructure, compliance, and strategic direction.

Block’s business model spans multiple verticals: payments and merchant services, peer-to-peer financial services (Cash App), buy-now-pay-later via Afterpay, music and content via TIDAL, and crypto / blockchain-based operations through Bitkey and Proto. Each arm contributes to the company’s long-term vision of an interconnected digital finance ecosystem.

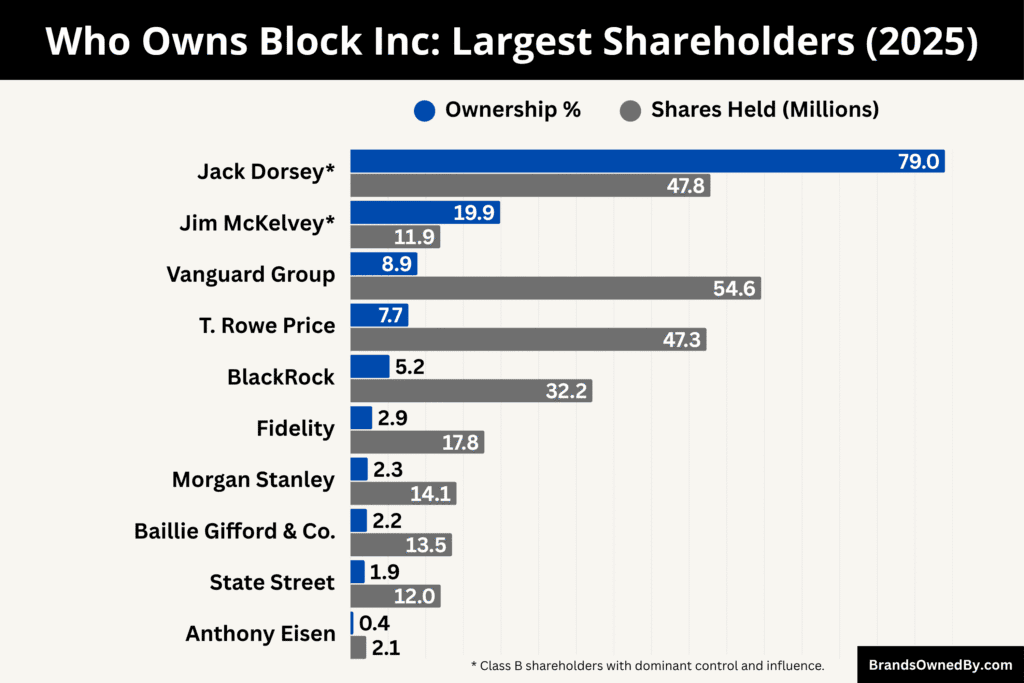

Here’s a snapshot of major stakeholders in Block, and thus indirect owners of Cash App, as of 2025:

Jack Dorsey (Insider / Founder)

Dorsey holds a large portion of Block’s Class B shares. While his economic stake may be modest relative to institutional holders, his Class B shares carry significant voting power. Through those shares, he maintains control over key decisions, board composition, and long-term strategy for Block—and by extension Cash App.

James McKelvey (Co-founder / Insider)

McKelvey holds a meaningful but considerably smaller insider stake. He also owns Class B shares, thereby retaining some influence in voting affairs. His role is more passive; he is not active in day-to-day operations but participates in governance.

Institutional Investors

Some of the top institutional shareholders include:

- Vanguard Group — One of Block’s largest Class A shareholders, holding close to 9% of the outstanding shares.

- T. Rowe Price — Another key institutional investor, with over 7% of Class A shares.

- BlackRock — Holds around 5–6%.

- Morgan Stanley, Baillie Gifford, State Street, Sands Capital, Dragoneer, and others — These hold smaller stakes but together form a large share of institutional ownership.

These institutions hold Class A shares, so their influence is largely financial and via proxy voting. They typically do not direct operations, but through their votes and proposals, they can impact governance, board elections, and major corporate decisions.

A portion of Block’s ownership is held by retail and individual shareholders. While each retail investor’s influence is small, collectively they represent a fraction of the economic interest in the company. Because of the dual-class structure, their voting power is limited compared to institutions and insiders.

Cash App Leadership

Cash App operates as one of the largest business units within Block, Inc. While Block oversees the broader ecosystem, Cash App maintains a strong leadership structure of its own.

This structure is designed to balance innovation, user growth, compliance, and financial sustainability. Leadership within Cash App works closely with Block’s executive team, ensuring the product aligns with the company’s mission of economic empowerment.

The leadership team spans executives in product, engineering, finance, operations, and legal strategy, allowing Cash App to function both independently and in harmony with Block’s long-term vision.

Jack Dorsey — Block Head & Chairperson

Jack Dorsey remains the most influential figure across Block, Inc., the parent company of Cash App. Though he no longer uses the traditional CEO title, his designation as “Block Head and Chairperson” reflects his central role. Dorsey provides the overarching vision that guides Cash App’s future direction, particularly in areas like decentralization, Bitcoin adoption, and integrating new financial technologies.

His leadership style emphasizes long-term innovation over short-term results, shaping Cash App into more than just a peer-to-peer payment app.

While day-to-day operations are delegated, Dorsey’s decisions about capital allocation, cultural priorities, and product direction carry significant weight across Cash App’s operations.

Brian Grassadonia — CEO, Cash App

Brian Grassadonia has been at the heart of Cash App since its creation. Currently serving as CEO of Cash App, he is responsible for the app’s daily operations, product strategy, and long-term user engagement. Grassadonia was among the early Square executives and helped launch Cash App in 2013, initially called Square Cash.

Under his leadership, the app evolved from a simple money transfer tool into a multi-functional platform offering debit cards, Bitcoin transactions, and stock trading. He is known for his focus on user experience and product simplicity, which has been key to Cash App’s massive adoption.

Grassadonia directly reports to Block’s leadership team and coordinates with other executives to ensure Cash App continues its rapid growth while staying compliant with financial regulations.

Amrita Ahuja — COO & CFO of Block

Amrita Ahuja holds a dual role as Chief Operating Officer and Chief Financial Officer of Block, and her influence extends deeply into Cash App’s operations. She manages financial strategy, resource allocation, and operational efficiency, ensuring Cash App receives the funding and structure needed for expansion.

Ahuja has been instrumental in helping Block navigate regulatory and market challenges, and her expertise in corporate finance plays a major role in shaping Cash App’s monetization strategies.

She also oversees risk management, compliance budgets, and investment in technology infrastructure, which are essential as Cash App continues to expand into new markets and financial services.

Owen Britton Jennings — Business Lead

Owen Britton Jennings serves as the Business Lead for Cash App, guiding its revenue model and strategic partnerships. Previously, he served as COO of Cash App until August 2024, where he was central in scaling operations and monetization efforts. In his current role, Jennings oversees partnerships with banks, payment networks, and merchant ecosystems that allow Cash App to broaden its financial footprint.

He focuses on ensuring sustainable revenue growth by balancing user acquisition with profitability. Jennings also plays a role in expanding Cash App internationally, identifying new opportunities for growth outside the United States.

His experience in business development and operations makes him a key driver of Cash App’s commercial success.

Dhanji R. Prasanna — Technology and Engineering Lead

Dhanji R. Prasanna leads technology and engineering for Cash App, ensuring its systems are scalable, reliable, and secure. With the rapid growth of Cash App’s user base, his role has become increasingly important.

He oversees the development of core features, the integration of new technologies, and the security measures that protect user transactions and data. Under his leadership, engineering teams have rolled out critical features such as cryptocurrency services, advanced fraud detection, and compliance automation. Prasanna’s focus is not only on innovation but also on maintaining the stability of Cash App’s infrastructure, which processes millions of transactions daily.

His ability to balance cutting-edge development with robust engineering practices is crucial for sustaining Cash App’s reputation for reliability.

Chrysty Esperanza — Chief Legal Officer and Corporate Secretary

Chrysty Esperanza serves as Chief Legal Officer and Corporate Secretary for Block, with significant oversight over Cash App’s legal and compliance operations. Her role involves managing regulatory relationships, ensuring Cash App’s services adhere to financial laws, and mitigating risks associated with expansion into areas like cryptocurrency and stock trading.

As financial regulations continue to evolve in the United States and abroad, Esperanza’s expertise helps Cash App navigate complex legal landscapes. She also supports governance structures within Block and its subsidiaries, ensuring that corporate decisions are transparent and compliant.

Her leadership ensures that Cash App continues to innovate without facing legal or regulatory setbacks.

Other Key Leadership Positions

Beyond the top executives, Cash App has a wide network of leaders in specialized roles.

- Heads of product design focus on creating user-friendly experiences that keep customers engaged.

- Trust and safety executives ensure that Cash App protects users from fraud and unauthorized activity.

- Compliance leaders oversee anti-money laundering protocols and work closely with regulators to maintain transparency.

- Product marketing leaders help position Cash App competitively in the crowded financial technology market.

Together, these roles complement the work of the primary executives, ensuring that Cash App remains one of the most trusted and innovative digital finance platforms in 2025.

Cash App Annual Revenue and Net Worth

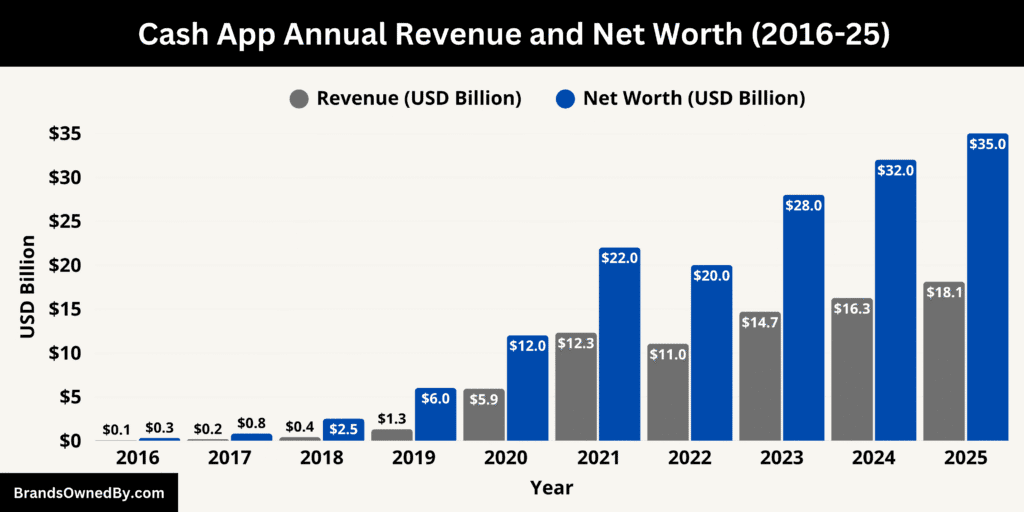

In 2025, Cash App is estimated to generate $18.1 billion in revenue. As of September 2025, the estimated net worth of Cash App is around $35 billion.

Below is an overview of the historical revenue and net worth of Cash App for the last 10 years:

| Year | Cash App Revenue (USD) | Estimated Net Worth / Valuation (USD) |

|---|---|---|

| 2016 | ~0.05 billion | ~0.3 billion |

| 2017 | ~0.15 billion | ~0.8 billion |

| 2018 | ~0.40 billion | ~2.5 billion |

| 2019 | ~1.30 billion | ~6.0 billion |

| 2020 | ~5.90 billion | ~12.0 billion |

| 2021 | ~12.30 billion | ~22.0 billion |

| 2022 | ~11.03 billion | ~20.0 billion |

| 2023 | ~14.68 billion | ~28.0 billion |

| 2024 | ~16.25 billion | ~32.0 billion |

| 2025 | ~18.10 billion | ~35.0 billion |

Revenue

Cash App’s revenue in 2024 was about $16.2 billion, with a strong contribution coming from Bitcoin transactions, service fees (instant deposits, subscriptions, boosts), and its debit card operations.

In 2025, revenue is projected to rise to $18.1 billion, which suggests continued expansion in core financial services, improved monetization, and growth in its crypto business.

The mix of revenue sources is shifting gradually.

While Bitcoin trading still represents a large portion, other streams—such as card interchange, lending, and subscription features—are steadily gaining share. This diversification is important for stabilizing margins in times when crypto activity fluctuates.

Gross Profit and Margins

Cash App’s gross profit has grown substantially in recent years. In 2024, it reported a gross profit of roughly $5.24 billion. That marks strong margin performance, considering the operational, compliance, and infrastructure costs needed to support a large fintech platform.

As Cash App scales and unit costs decline, margins are expected to improve further—or at least remain stable—if the company can manage risk, fraud, and variable costs effectively. Analysts expect gross profit growth in 2025 to continue, with improved operating leverage playing a key role.

Net Worth

As of September 2025, the estimated net worth of Cash App is around $35 billion mark.

This inferred valuation depends heavily on expectations: sustainable growth, profit stability, regulatory risk, and the degree to which non-crypto revenue can gain share. Its implied value is also tied to how much investors believe Cash App will remain central to Block’s future earnings.

The app’s growth has been fueled by its diversified financial services, including peer-to-peer payments, debit card operations, stock trading, Bitcoin transactions, and lending features.

Over the last decade, Cash App has expanded from a simple money transfer tool into a robust digital financial ecosystem, steadily increasing its revenue and implied valuation.

Outlook and Risks

Going forward, Cash App’s ability to maintain growth in revenue and profit will be key to supporting or increasing its implied valuation. Key opportunities are expansion of lending and credit products, further growth of non-crypto streams, leveraging its large user base for cross-selling, and scaling card usage.

However, risks are real. Fluctuations in crypto markets can disproportionately affect revenue. Regulatory pressure—especially around payments, crypto, and financial compliance—can impose costs or limit certain features. Competition from other fintech and neobank platforms adds pressure.

How well Cash App executes on diversification and risk mitigation will determine whether it can sustain—or raise—its implied net worth in the years ahead.

Brands Owned by Cash App

As of 2025, Cash App operates a range of financial services, tools, and branded products that allow users to manage payments, investments, cryptocurrency, savings, and rewards—all within a single mobile platform.

Below is a list of the major brands and divisions owned by Cash App as of September 2025:

| Brand / Service | Description | Key Features / Highlights | Year Launched |

|---|---|---|---|

| Cash App | Core platform for peer-to-peer payments, mobile banking, and financial services | Send/receive money, pay bills, manage balances, mobile-first interface | 2013 |

| Cash App Investing | Brokerage service integrated into Cash App | Buy fractional shares and ETFs, educational tools, real-time market insights | 2018 |

| Cash App Borrow | Short-term lending service | Loans up to $200, automatic repayment, integrated risk management | 2020 |

| Cash App Taxes | Free tax filing service | File federal/state taxes, direct deposit refunds, import Cash App transactions | 2021 |

| Cash App Card | Customizable debit card | ATM withdrawals, online/in-store purchases, personalized $Cashtags, direct deposit | 2017 |

| Cash App Boost | Rewards program for Cash App Card | Instant discounts at participating merchants, dynamic personalized offers | 2017 |

| Cash App Direct Deposit | Receive paychecks and benefits directly into Cash App | Early access to funds, split deposits, improved convenience over traditional banking | 2017 |

| Cash App Savings | Digital savings goals | Create multiple goals, automate contributions, track progress, integrate with other Cash App features | 2021 |

| Cash App Bitcoin | Buy, sell, and hold Bitcoin | Real-time market data, secure transactions, peer-to-peer Bitcoin transfers | 2018 |

| Cash App Afterpay | Buy-now-pay-later (BNPL) service | Four interest-free installments, integrates with card and rewards | 2023 |

| Cash App National Brand Campaign (“Cash In”) | Marketing campaign highlighting Cash App features | Multi-channel ads, storytelling, showcases app’s financial ecosystem | 2025 |

Cash App

Cash App is the core platform connecting all its services. It allows users to send and receive money instantly, pay bills, receive direct deposits, and access a variety of financial tools. Over the years, Cash App has introduced innovative features such as personalized usernames ($Cashtags) and mobile-first banking experiences. Its user interface focuses on simplicity and speed, helping it reach over 57 million active users in the United States by 2025. The app continuously evolves with market trends, integrating both traditional finance and digital assets under one ecosystem.

Cash App Investing

Cash App Investing provides a seamless entry point to the stock market. Users can buy fractional shares of companies and ETFs directly from the app, starting with as little as $1. This feature encourages first-time investors and allows seasoned users to diversify their portfolios without needing a traditional brokerage account. Cash App Investing also provides educational tools and real-time market insights, helping users make informed investment decisions. It has become a key driver of user engagement and retention.

Cash App Borrow

Cash App Borrow offers short-term, small-dollar loans to eligible users, typically up to $200. These loans are automatically repaid through a user’s Cash App balance, reducing late payments and simplifying the process. Borrow enables users to handle unexpected expenses while maintaining the convenience and security of the app. Over time, the feature has expanded eligibility criteria, improved approval speed, and integrated risk management systems to ensure responsible lending.

Cash App Taxes

Cash App Taxes is a free tax filing service embedded within the app, allowing users to file federal and state taxes directly from their smartphones. Designed for straightforward filings, it streamlines the tax process by automatically importing Cash App income and relevant financial transactions. Users can track refunds, receive direct deposits, and file taxes without additional software. Cash App Taxes has increased financial literacy and simplified tax management for millions of users who prefer a mobile-first experience.

Cash App Card

The Cash App Card is a customizable debit card linked to the user’s Cash App balance. It supports in-store and online purchases, ATM withdrawals, and direct deposit access. Users can personalize the card’s appearance and select unique $Cashtags for identification. The card’s integration with Cash App features such as Boost rewards provides additional value, encouraging usage while offering cashback and discounts at participating merchants. The card has become a central tool for financial activity within the Cash App ecosystem.

Cash App Boost

Boost is a rewards program built into the Cash App Card experience, offering instant discounts at participating merchants. Users can activate Boosts for specific categories like groceries, dining, or entertainment. The program incentivizes regular use of the Cash App Card and strengthens loyalty by providing tangible savings. Boosts are updated regularly, creating dynamic, personalized offers that respond to spending habits and seasonal promotions.

Cash App Direct Deposit

Direct Deposit allows users to receive paychecks, government benefits, or other recurring payments directly into their Cash App accounts. Funds are often accessible faster than traditional banking, giving users early access to their money. Users can split deposits between their Cash App balance and external accounts, increasing flexibility. This feature has grown in popularity as users seek convenient alternatives to traditional banking, further embedding Cash App into everyday financial routines.

Cash App Savings

Cash App Savings enables users to set aside funds for personal goals, emergencies, or future purchases. Users can create multiple savings goals, automate contributions, and track progress visually. The feature encourages financial discipline by separating savings from spendable balances. Cash App Savings also integrates with other app features, allowing seamless transfers between cash, investment, and spending accounts.

Cash App Bitcoin

Cash App Bitcoin allows users to buy, sell, and hold Bitcoin directly within the app. The platform provides real-time market data, transaction tracking, and educational resources for crypto users. It also enables Bitcoin deposits, withdrawals, and peer-to-peer transfers, creating a secure and accessible entry into the cryptocurrency market. Bitcoin services have expanded Cash App’s user base and positioned the app as a mainstream gateway to digital assets.

Cash App Afterpay

Cash App Afterpay is a buy-now-pay-later (BNPL) service that allows users to make purchases and pay in four interest-free installments. It is integrated with online and in-store merchants, providing flexibility and affordability to users. By enabling installment payments, Cash App Afterpay enhances purchasing power and drives increased engagement with the app. It also integrates with Cash App Card and Boost, creating a seamless, incentivized shopping experience.

Cash App National Brand Campaign (“Cash In”)

The “Cash In” campaign, launched in 2025, is Cash App’s largest marketing initiative to date. Directed by Ramy Youssef, it highlights the practical applications of Cash App in everyday life, from budgeting and saving to investing and receiving payments. The campaign reinforces Cash App’s brand identity as a versatile, all-in-one financial platform. It leverages creative storytelling, real-life scenarios, and media across TV, social platforms, and digital advertising to reach new users and retain existing ones.

Final Words

Cash App is owned by Block, Inc., a public company led by Jack Dorsey. While institutional investors hold large stakes, Dorsey remains the driving force. Cash App’s revenue growth, combined with its expansion into Bitcoin and stock trading, has made it a cornerstone of Block’s portfolio. Understanding who owns Cash App also helps explain its innovation and influence in shaping the future of digital finance.

FAQs

Who is Cash App owned by?

Cash App is owned by Block, Inc., the financial technology company co-founded by Jack Dorsey and Jim McKelvey. It operates as a core business unit within Block, giving it strategic independence while remaining under Block’s overall control.

Is Cash App safe?

Yes, Cash App is generally considered safe for transactions. It uses encryption, fraud detection systems, and two-factor authentication to protect user accounts. However, users should avoid sending money to strangers and enable security features for added protection.

How does Cash App work, and is it safe?

Cash App works as a peer-to-peer payment platform that allows users to send and receive money instantly, invest in stocks, trade Bitcoin, and manage debit cards. It is safe when used responsibly, with security measures like PIN codes, fingerprint login, and encrypted transactions. Users should remain cautious of scams or phishing attempts.

Does Square own Cash App?

Yes, Cash App was originally launched under Square, Inc., which rebranded to Block, Inc. in 2021. Block remains the parent company and oversees Cash App’s operations.

Is Cash App publicly traded?

Cash App itself is not a publicly traded company, but its parent company, Block, Inc., is publicly traded on the NYSE under the ticker SQ.

Which bank runs Cash App?

Cash App is primarily backed by Lincoln Savings Bank for Cash Card services and is connected to other partner banks for banking operations. It is not a full bank itself but operates in partnership with regulated banks to offer financial services.

Is Cash App connected to any bank?

Yes, Cash App is connected to partner banks to provide banking services like direct deposits, debit cards, and FDIC-insured balances. Users can link their Cash App account to external bank accounts as well.

Are Cash App and PayPal owned by the same company?

No, Cash App and PayPal are owned by different companies. Cash App is owned by Block, Inc., while PayPal operates independently as its own publicly traded company under the ticker PYPL.

Who owns Cash App Bank?

Cash App Bank is effectively operated through partner banks, such as Lincoln Savings Bank. Block does not own a banking charter; it partners with regulated banks to provide banking features under the Cash App brand.

Is Cash App owned by PayPal?

No, Cash App is not owned by PayPal. They are competitors in the digital payments space, with Cash App under Block, Inc. and PayPal as a separate entity.