Johnson & Johnson is a global healthcare giant. It operates in over 175 countries. The company is publicly traded on the New York Stock Exchange under the ticker symbol JNJ. Understanding who owns Johnson & Johnson provides insight into its corporate structure and governance.

Key Takeaways

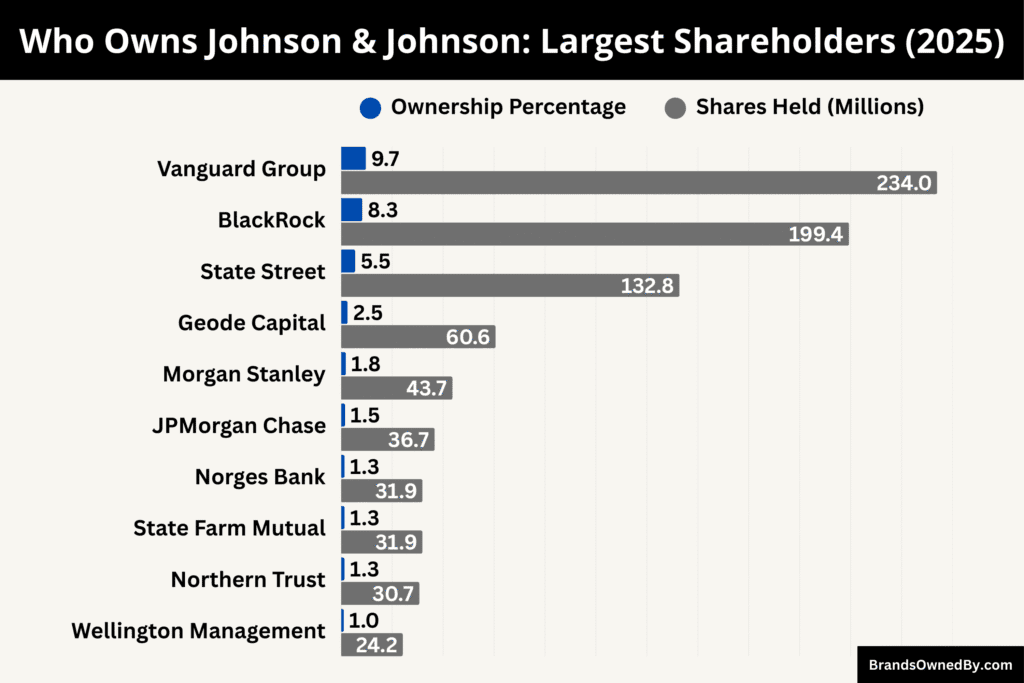

- Johnson & Johnson is a publicly traded company with ownership primarily held by institutional investors, ensuring strong governance and long-term strategic oversight.

- As of September 2025, institutional investors hold approximately 65% of shares, while the remaining 35% are publicly traded among individual and retail investors.

- The largest shareholders as of September 2025 are The Vanguard Group (233.96 million shares, 9.72%) and BlackRock, Inc. (199.37 million shares, 8.29%), giving them significant influence over corporate decisions.

- Other major institutional investors include State Street Corporation, Geode Capital, Morgan Stanley, and JPMorgan Chase, collectively holding substantial stakes that support stability and long-term growth.

Johnson & Johnson Company Profile

Johnson & Johnson (J&J) is a leading global healthcare company headquartered in New Brunswick, New Jersey. Established in 1886 by Robert Wood Johnson and his brothers James Wood Johnson and Edward Mead Johnson, the company initially focused on producing sterile surgical dressings.

Over time, J&J expanded its operations to include pharmaceuticals, medical devices, and consumer health products, becoming one of the most diversified healthcare firms worldwide.

As of 2025, Johnson & Johnson operates in over 175 countries and employs approximately 138,000 people. The company is publicly traded on the New York Stock Exchange under the ticker symbol JNJ and is a component of the Dow Jones Industrial Average and the S&P 500.

Founders

Johnson & Johnson was founded in 1886 by three brothers: Robert Wood Johnson, James Wood Johnson, and Edward Mead Johnson.

Robert Wood Johnson served as the company’s first president and was instrumental in shaping its long-term vision, focusing on innovation and employee welfare.

James Wood Johnson contributed to operations and overall management, helping establish efficient production and distribution systems.

Edward Mead Johnson oversaw sales and marketing, expanding the company’s reach in its early years.

In 1898, Edward Mead Johnson left the company to start his own business in infant and child nutrition, which later became a leading global brand.

Together, the Johnson brothers laid the foundation for what would become one of the world’s largest and most diversified healthcare companies.

Major Milestones

- 1886: Company Founded – Johnson & Johnson was founded in New Brunswick, New Jersey, by Robert Wood Johnson, James Wood Johnson, and Edward Mead Johnson, focusing on sterile surgical dressings.

- 1888: First Consumer Product Launched – The company introduced its first consumer product, a ready-to-use surgical plaster.

- 1894: First International Expansion – J&J established operations in Canada, marking its first step into global markets.

- 1943: Introduction of “Our Credo” – Robert Wood Johnson wrote the company’s guiding document emphasizing responsibility to customers, employees, communities, and shareholders.

- 1944: Company Goes Public – Johnson & Johnson went public, raising capital for expansion and research, fueling growth across multiple healthcare sectors.

- 1959: Development of First Disposable Contact Lenses – J&J expanded into ophthalmology by creating the first commercially available disposable contact lenses.

- 1961: Acquisition of McNeil Laboratories – This acquisition added Tylenol to J&J’s consumer healthcare portfolio.

- 1982: Tylenol Crisis and Safety Innovation – J&J managed the Tylenol cyanide crisis, introducing triple-seal packaging and strengthening trust in the brand.

- 2006: Acquisition of Crucell’s Vaccine Business – Expanded J&J’s vaccine portfolio, enhancing its immunology presence.

- 2012: Acquisition of Synthes – Strengthened J&J’s orthopedic and surgical device capabilities under DePuy Synthes.

- 2023: Spin-off of Consumer Health Division – J&J spun off its consumer health division into Kenvue while retaining a controlling stake.

- 2025: Acquisition of Intra-Cellular Therapies – Bolstered J&J’s neuroscience portfolio with a $14.6 billion acquisition.

- 2025: FDA Approval of Imaavy – Approved for treating generalized myasthenia gravis, enhancing J&J’s immunology portfolio.

- 2025: $55 Billion Investment in U.S. Operations – Commitment to R&D, manufacturing, and technology in the U.S. over the next four years.

- 2025: Named Most Innovative Company in Healthcare – Recognized by Fortune for outstanding innovation in healthcare.

- 2025: Advances in Alzheimer’s Research – Showcased Phase 2b posdinemab trial data at the Alzheimer’s Association International Conference, highlighting progress in neurodegenerative disease treatment.

Who Owns Johnson & Johnson: Major Shareholders

Johnson & Johnson (NYSE: JNJ) is predominantly owned by institutional investors, with a significant portion of its shares held by major asset management firms. As of September 2025, the company’s ownership structure is as follows:

- Institutional Investors: Approximately 73.57% of Johnson & Johnson’s outstanding shares are held by institutional investors, including mutual funds, pension funds, and other large financial entities.

- Individual and Insider Ownership: Individual investors and company insiders own a smaller portion of the company’s shares, with insiders holding a minimal percentage.

- Public Ownership: The remaining shares are publicly traded, allowing individual investors to purchase stock through various brokerage platforms.

Below is a list of the top shareholders of Johnson & Johnson as of September 2025:

| Shareholder | Number of Shares Held (Millions) | Ownership Percentage | Notes / Details |

|---|---|---|---|

| The Vanguard Group | 233.96 | 9.72% | Largest institutional shareholder, passive investment strategy, significant influence in governance and long-term strategy. |

| BlackRock, Inc. | 199.37 | 8.29% | Major global asset manager, participates in governance decisions, invests in long-term stability and growth. |

| State Street Corporation | 132.80 | 5.50% | Prominent asset manager, influence on board appointments, executive compensation, and corporate responsibility policies. |

| Geode Capital Management | 60.60 | 2.52% | Quantitative investment firm, stake reflects long-term growth potential, participates in shareholder governance. |

| Morgan Stanley | 43.70 | 1.82% | Global financial services firm, invests in companies with strong fundamentals, monitors strategic direction. |

| JPMorgan Chase & Co. | 36.70 | 1.52% | Leading financial services firm, investment reflects confidence in J&J’s financial health and strategy. |

| State Farm Mutual Automobile Insurance | 31.90 | 1.32% | Long-term investor focusing on stable and profitable assets. |

| Norges Bank Investment Management | 31.90 | 1.33% | Manages Norway’s sovereign wealth fund, invests for stability and sustainable performance. |

| Northern Trust Corporation | 30.70 | 1.28% | Wealth management and asset servicing firm, stake reflects confidence in J&J’s performance. |

| Wellington Management Group | 24.20 | 1.01% | Private investment management firm, invests for long-term growth and shareholder value. |

The Vanguard Group

The Vanguard Group is the largest institutional shareholder of Johnson & Johnson, holding around 233.96 million shares, which accounts for approximately 9.72% of the company’s outstanding shares.

Vanguard is known for its passive investment strategies and plays a significant role in managing index funds and exchange-traded funds (ETFs). The firm’s substantial stake in J&J indicates strong confidence in the company’s financial stability, governance, and long-term growth prospects.

Vanguard’s influence, though passive, contributes to the company’s strategic direction through shareholder voting and engagement on governance matters.

BlackRock, Inc.

BlackRock holds roughly 199.37 million shares of Johnson & Johnson, representing 8.29% of the total outstanding shares.

As one of the largest global asset management firms, BlackRock’s investment in J&J underscores the company’s importance in institutional portfolios and highlights its reputation for consistent financial performance. BlackRock participates actively in shareholder meetings, exercising influence over key governance and strategic decisions, although its approach is largely aligned with long-term value creation.

State Street Corporation

State Street Corporation owns about 132.80 million shares, equating to 5.50% ownership in Johnson & Johnson. The firm is a major asset manager with significant global reach, and its stake in J&J reflects confidence in the company’s diversified business model and strong market position.

State Street, through its advisory and voting processes, can impact governance decisions, particularly those related to executive compensation, board appointments, and corporate responsibility policies.

Geode Capital Management

Geode Capital Management holds approximately 60.60 million shares, or 2.52% of Johnson & Johnson. Known for its data-driven investment strategies, Geode evaluates companies based on long-term performance and risk-adjusted returns. Its stake in J&J reflects a belief in the company’s potential for sustainable growth and reliable shareholder returns.

While smaller than Vanguard or BlackRock, Geode’s investment is a meaningful part of its diversified portfolio strategy.

Morgan Stanley

Morgan Stanley holds approximately 43.70 million shares, representing 1.82% of Johnson & Johnson’s outstanding shares. As a global financial services firm, Morgan Stanley invests in companies with strong fundamentals and stable growth potential.

Its stake in J&J reflects confidence in the company’s diversified business model and financial health. Morgan Stanley participates in corporate governance primarily through shareholder voting, influencing board decisions and supporting long-term shareholder value creation.

JPMorgan Chase & Co.

JPMorgan Chase owns around 36.70 million shares of Johnson & Johnson, representing 1.52% of the company. As a global financial services leader, JPMorgan invests in companies with strong fundamentals, and its stake in J&J signals confidence in the company’s financial health and strategic positioning.

The firm engages with J&J primarily through passive oversight and governance advocacy in line with long-term shareholder value creation.

Norges Bank Investment Management

Managing Norway’s sovereign wealth fund, Norges Bank Investment Management, holds approximately 31.90 million shares, or 1.33% of Johnson & Johnson. This investment aligns with the fund’s mandate to maintain stable, long-term investments in profitable companies.

Norges Bank participates in shareholder voting to support corporate governance practices that ensure sustainable performance and risk management.

State Farm Mutual Automobile Insurance Company

State Farm Mutual Automobile Insurance Company owns about 31.90 million shares, accounting for 1.32% of Johnson & Johnson’s outstanding shares. As a long-term investor, State Farm prioritizes stable, profitable holdings in its portfolio. Its investment in J&J underscores the company’s appeal as a reliable and diversified healthcare leader, providing consistent returns and financial security.

Northern Trust Corporation

Northern Trust Corporation owns around 30.70 million shares, equating to 1.28% ownership of Johnson & Johnson. Known for its wealth management and asset servicing services, Northern Trust’s investment in J&J demonstrates trust in the company’s steady performance and market leadership. The firm engages with the company on governance matters, emphasizing long-term stability and accountability.

Wellington Management Group

Wellington Management Group holds approximately 24.20 million shares, or 1.01% of Johnson & Johnson’s shares.

As a private investment management firm, Wellington focuses on long-term growth and sustainable value. Its investment in J&J highlights confidence in the company’s research, development, and product innovation across pharmaceuticals, medical devices, and consumer health segments.

Individual and Insider Ownership

Individual shareholders and company insiders hold a smaller portion of Johnson & Johnson’s shares compared to institutional investors.

Executives and board members may own shares through personal investments or compensation programs, aligning their interests with those of other shareholders. Insider ownership, though limited, ensures that management has a vested interest in the company’s performance and long-term value creation.

The remaining shares of Johnson & Johnson are publicly traded, allowing individual investors to buy and sell stock on the open market. Public ownership provides liquidity and ensures that a wide range of investors can participate in the company’s growth and financial success.

Who is the CEO of Johnson & Johnson?

As of September 2025, Joaquín Duato serves as the Chairman and Chief Executive Officer (CEO) of Johnson & Johnson. He has led the company since January 2022, overseeing its global operations across pharmaceuticals, medical devices, and consumer health.

Duato has been instrumental in guiding J&J through strategic transformations, including the spin-off of its consumer health division into Kenvue, and focuses on innovation, growth, and long-term shareholder value.

Early Life and Education

Joaquín Duato was born in April 1962 in Valencia, Spain, into a family deeply connected to healthcare. His mother was a nurse, his grandfather a pediatrician, and his grandmother a pharmacist.

Duato studied business and management internationally, earning an MBA from ESADE Business School in Barcelona and a Master of International Management from the Thunderbird School of Global Management in Arizona. Fluent in multiple languages, he combines a global perspective with deep healthcare industry knowledge.

Career at Johnson & Johnson

Duato joined Johnson & Johnson in 1989 at Janssen Pharmaceuticals in Spain.

After relocating to the U.S. in 2002, he rose through the ranks, becoming Executive Vice President and Worldwide Chairman of Pharmaceuticals in 2011. He revitalized J&J’s pharmaceutical division, strengthening its product pipeline and global operations.

By 2018, he was Vice Chairman of the Executive Committee, overseeing pharmaceuticals, consumer health, technology, and supply chain operations.

Appointment as CEO and Chairman

Duato was named CEO in August 2021 and officially assumed the role in January 2022. In January 2023, he also became Chairman of the Board. Under his leadership, Johnson & Johnson has focused on breakthrough innovation, global expansion, and efficiency improvements.

His strategic guidance was key in the 2023 spin-off of the consumer health business into Kenvue, allowing J&J to concentrate on pharmaceuticals and medical devices.

Duato emphasizes servant leadership, transparency, and fostering a collaborative corporate culture. He believes in empowering employees, encouraging innovation, and maintaining ethical practices in all business areas.

His strategy revolves around leveraging advanced technologies—such as AI, robotics, and cell therapy—to drive healthcare breakthroughs. Duato also prioritizes sustainable business practices, focusing on long-term value creation for shareholders, patients, and society. He encourages cross-functional collaboration and data-driven decision-making to accelerate growth and maintain J&J’s global leadership.

Compensation

As of 2025, Joaquín Duato’s total compensation reflects his pivotal role in guiding one of the world’s largest healthcare companies. He earned approximately $28.4 million in 2023, including base salary, performance bonuses, stock options, and other incentives.

This represents a significant increase from prior years and aligns his interests with long-term company performance.

Duato’s compensation structure is designed to reward innovation, operational excellence, and strategic achievements that contribute to sustainable growth and shareholder value.

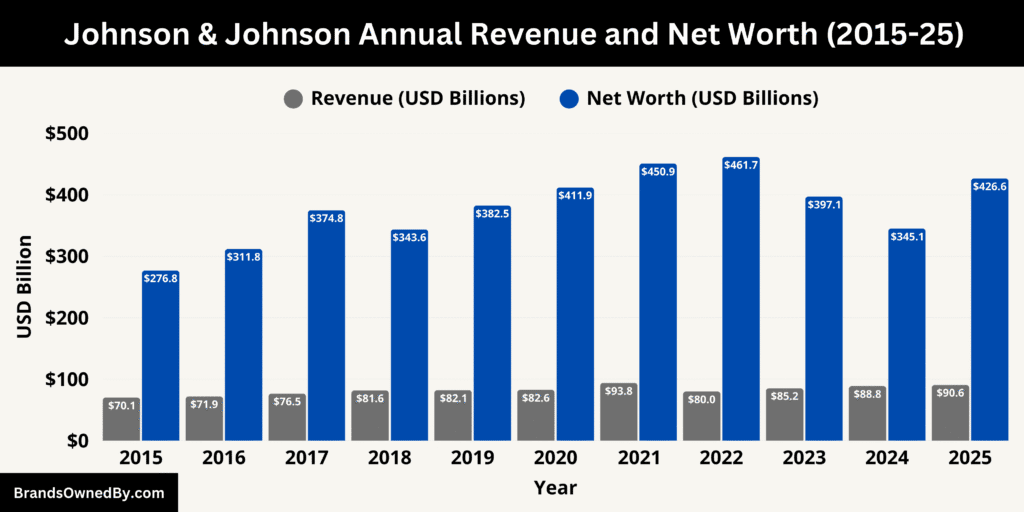

Johnson & Johnson Annual Revenue and Net Worth

As of September 2025, Johnson & Johnson reported a total revenue of approximately $90.6 billion, representing a 4.7% increase from 2024.

The growth is driven primarily by the pharmaceutical and medical device segments following the 2023 spin-off of its consumer health division, Kenvue.

The company’s market capitalization, reflecting its net worth, stands at around $426.6 billion as of September 2025, making it one of the largest and most valuable healthcare companies globally. This strong financial position demonstrates investor confidence in J&J’s diversified portfolio and long-term growth strategy.

Here’s a detailed overview of the historical revenue and net worth of Johnson & Johnson from 2015-25:

| Year | Revenue (USD Billions) | Net Worth (Market Cap, USD Billions) |

|---|---|---|

| 2015 | 70.1 | 276.8 |

| 2016 | 71.9 | 311.8 |

| 2017 | 76.5 | 374.8 |

| 2018 | 81.6 | 343.6 |

| 2019 | 82.1 | 382.5 |

| 2020 | 82.6 | 411.9 |

| 2021 | 93.8 | 450.9 |

| 2022 | 80.0 | 461.7 |

| 2023 | 85.2 | 397.1 |

| 2024 | 88.8 | 345.1 |

| 2025 | 90.6 | 426.6 |

Revenue Performance

Johnson & Johnson’s revenue in 2025 was heavily influenced by the performance of its pharmaceutical segment, which continues to be the largest contributor. Treatments in oncology, immunology, neuroscience, and vaccines experienced strong global demand, particularly in emerging markets.

The company’s strategic acquisitions, such as Intra-Cellular Therapies and Shockwave Medical, have expanded its product pipeline and contributed to higher sales.

The medical devices segment also showed robust growth, driven by innovations in surgical robotics, cardiovascular interventions, and orthopedics.

Although the consumer health division was spun off, its continued presence as Kenvue allows J&J to focus on higher-margin, research-intensive areas. Geographical diversification further strengthened revenue, with North America remaining the largest market, followed by strong contributions from Europe and the Asia-Pacific regions.

Net Worth and Market Capitalization

Johnson & Johnson’s net worth, measured by its market capitalization, is approximately $426.6 billion as of September 2025.

This reflects a 6.4% increase compared to the previous year, highlighting the market’s confidence in the company’s financial stability and strategic direction. Strong free cash flow, consistent dividend payments, and a disciplined approach to share repurchases have reinforced investor trust. J&J’s market value is supported by its diversified revenue streams across pharmaceuticals, medical devices, and consumer health (through Kenvue), as well as its ability to innovate and adapt to changing healthcare demands.

The company’s robust balance sheet, low debt-to-equity ratio, and high credit rating further contribute to its overall net worth, enabling continued investment in research, acquisitions, and global expansion.

Companies Owned by Johnson & Johnson

Johnson & Johnson owns a diverse portfolio of companies, brands, and entities spanning pharmaceuticals, medical devices, vision care, and consumer health. The company continues to expand through strategic acquisitions, mergers, and innovative product development, maintaining its position as a global leader in healthcare.

The following is a detailed overview of the major companies, brands, and entities directly owned and operated by Johnson & Johnson as of 2025:

| Company / Brand | Acquisition Year | Key Focus / Description | Notable Products / Services |

|---|---|---|---|

| Janssen Pharmaceuticals | N/A | Development, manufacturing, and marketing of pharmaceuticals across oncology, immunology, neuroscience, infectious diseases, and vaccines | DARZALEX®, IMBRUVICA® |

| Actelion Pharmaceuticals | 2017 | Treatments for pulmonary arterial hypertension and other rare diseases | Opsumit® |

| Momenta Pharmaceuticals | 2020 | Development of therapies for autoimmune diseases | Nipocalimab (pipeline) |

| Intra-Cellular Therapies | 2025 | Central nervous system disorder therapies | Caplyta® |

| DePuy Synthes | N/A | Joint reconstruction, trauma, spinal surgery, sports medicine solutions | Orthopedic implants and devices |

| Ethicon | N/A | Surgical products including sutures, staplers, and energy-based devices | Sutures, staplers, surgical instruments |

| Biosense Webster | N/A | Cardiac electrophysiology solutions | Mapping and ablation technologies |

| Cerenovus | N/A | Neurovascular solutions for stroke and cerebrovascular conditions | Stroke intervention devices |

| Acclarent | N/A | ENT devices and solutions | Sinus balloons, airway products |

| Abiomed | 2022 | Heart pump technology and critical care devices | Impella® heart pump |

| Shockwave Medical | 2024 | Intravascular lithotripsy for calcified arteries | Coronary and peripheral artery lithotripsy devices |

| Johnson & Johnson Vision | N/A | Eye health solutions including contact lenses and surgical products | Contact lenses, cataract and refractive surgery devices |

| Johnson & Johnson Services, Inc. | N/A | Global support functions including IT, finance, HR, and legal services | Corporate and operational support |

| Janssen Global Services | N/A | Supports worldwide operations of Janssen Pharmaceuticals | Regulatory, clinical, and medical affairs services |

| Janssen Biologics | N/A | Development and manufacturing of biologic therapies | Monoclonal antibodies, protein-based therapies |

| Janssen Vaccines & Prevention | N/A | Development of vaccines and preventive therapies | Vaccines for infectious diseases |

| Janssen Therapeutics | N/A | Research, development, and commercialization of treatments | Therapies in immunology and infectious diseases |

Janssen Pharmaceuticals

Janssen Pharmaceuticals is the core operating company of Johnson & Johnson in the pharmaceutical space. It develops, manufactures, and markets a wide range of innovative medicines across oncology, immunology, neuroscience, infectious diseases, and vaccines.

Its portfolio includes several leading therapies such as DARZALEX® for multiple myeloma and IMBRUVICA® for blood cancers. Janssen continues to expand its research pipeline with new treatments and therapies addressing critical global health challenges.

Actelion Pharmaceuticals

Acquired in 2017, Actelion specializes in treatments for pulmonary arterial hypertension and other rare diseases. Its flagship product, Opsumit®, addresses serious cardiovascular conditions. Actelion’s ongoing research aims to develop additional therapies for rare and complex diseases, strengthening Johnson & Johnson’s presence in specialized pharmaceutical markets.

Momenta Pharmaceuticals

Momenta Pharmaceuticals, acquired in 2020, focuses on autoimmune diseases and novel therapies targeting immune system dysfunction. Its lead candidate, nipocalimab, is being developed for multiple autoimmune disorders, reflecting Johnson & Johnson’s commitment to addressing unmet medical needs in chronic and complex conditions.

Intra-Cellular Therapies

Intra-Cellular Therapies, acquired in 2025, is a company specializing in central nervous system disorders. Its lead product, Caplyta®, is approved for schizophrenia and bipolar depression. This acquisition enhances Johnson & Johnson’s neuroscience portfolio and demonstrates the company’s focus on innovative mental health therapies.

DePuy Synthes

DePuy Synthes is a global leader in orthopaedic and neuro products, providing joint reconstruction, trauma, spinal surgery, and sports medicine solutions. Its technologies and devices improve patient outcomes through advanced surgical and recovery solutions worldwide.

Ethicon

Ethicon develops and markets surgical products, including sutures, staplers, and energy-based devices. The company focuses on improving surgical techniques, advancing minimally invasive procedures, and supporting patient safety across a variety of surgical disciplines.

Biosense Webster

Biosense Webster provides innovative solutions in cardiac electrophysiology, including mapping and ablation technologies for heart rhythm disorders. Its products enable the precise diagnosis and treatment of complex cardiac arrhythmias.

Cerenovus

Cerenovus specializes in neurovascular solutions, offering devices and therapies for the treatment of stroke and other cerebrovascular conditions. Its technologies support rapid intervention and improved patient recovery outcomes.

Acclarent

Acclarent develops ENT devices and solutions, including products for sinus and airway diseases. Its innovative technologies enhance the quality of life for patients with chronic nasal and sinus conditions.

Abiomed

Abiomed, acquired in 2022, is a leader in heart pump technology. Its Impella® heart pump supports patients with severe coronary artery disease and acute heart failure, providing life-saving interventions in critical care settings.

Shockwave Medical

Acquired in 2024, Shockwave Medical specializes in intravascular lithotripsy for treating calcified coronary and peripheral artery disease. Its technology enables safer and more effective interventions for patients with complex vascular conditions.

Johnson & Johnson Vision

Johnson & Johnson Vision focuses on eye health solutions, including contact lenses and surgical products for cataract and refractive surgery. The company provides comprehensive eye care solutions to patients worldwide.

Johnson & Johnson Services, Inc.

Johnson & Johnson Services, Inc. provides global support functions such as IT, finance, human resources, and legal services. These services ensure operational efficiency across all of Johnson & Johnson’s global entities.

Janssen Global Services

Janssen Global Services supports the worldwide operations of Janssen Pharmaceuticals by providing regulatory, clinical, and medical affairs services. This helps facilitate global expansion and compliance.

Janssen Biologics

Janssen Biologics develops and manufactures biologic therapies, including monoclonal antibodies and other protein-based treatments. These efforts strengthen Johnson & Johnson’s pipeline of innovative therapies.

Janssen Vaccines & Prevention

This entity develops vaccines and preventive therapies for infectious diseases, supporting global public health initiatives and rapid outbreak responses.

Janssen Therapeutics

Janssen Therapeutics manages research, development, and commercialization of treatments in key therapeutic areas, including immunology and infectious diseases, expanding access to innovative medicines worldwide.

Final Words

Johnson & Johnson remains a powerhouse in healthcare, driven by a mix of institutional investors, individual shareholders, and company insiders. Its leadership and diverse portfolio continue to shape the industry. Knowing who owns Johnson & Johnson provides insight into how the company maintains its position and pursues long-term growth and innovation.

FAQs

Who currently owns Johnson & Johnson?

Johnson & Johnson is a publicly traded company, meaning it is owned by its shareholders. As of September 2025, the majority of shares are held by institutional investors, while the remaining shares are publicly traded among individual investors.

Who is the majority owner of Johnson & Johnson?

There is no single majority owner of Johnson & Johnson. The largest shareholders are institutional investors, with The Vanguard Group holding 9.72% and BlackRock, Inc. holding 8.29% of the company’s shares. Collectively, institutional investors hold around 65% of total shares.

Does the Johnson family own Johnson & Johnson?

No, the Johnson family does not own Johnson & Johnson. The company is publicly traded and controlled by institutional and public shareholders rather than the founding family.

Who is the owner of Johnson & Johnson products?

All Johnson & Johnson products are owned and operated by the company itself. This includes pharmaceuticals, medical devices, and consumer health brands.

Is Johnson a family company?

No, Johnson & Johnson is not a family-owned company. It was founded by the Johnson brothers in 1886, but it has been a publicly traded corporation for decades.

Who are J&J’s top 10 shareholders?

As of September 2025, the top 10 shareholders of Johnson & Johnson are:

- The Vanguard Group – 233.96 million shares (9.72%)

- BlackRock, Inc. – 199.37 million shares (8.29%)

- State Street Corporation – 132.80 million shares (5.50%)

- Geode Capital Management – 60.60 million shares (2.52%)

- Morgan Stanley – 43.70 million shares (1.82%)

- JPMorgan Chase & Co. – 36.70 million shares (1.52%)

- State Farm Mutual Automobile Insurance – 31.90 million shares (1.32%)

- Norges Bank Investment Management – 31.90 million shares (1.33%)

- Northern Trust Corporation – 30.70 million shares (1.28%)

- Wellington Management Group – 24.20 million shares (1.01%).

Who owns Johnson’s vaccine company?

Johnson & Johnson’s vaccine operations are owned by the company itself, under its Janssen Pharmaceuticals division, which develops, manufactures, and markets vaccines and preventive therapies globally.

Who is the founder of Johnson & Johnson?

Johnson & Johnson was founded in 1886 by Robert Wood Johnson, James Wood Johnson, and Edward Mead Johnson.

Where was Johnson founded?

Johnson & Johnson was founded in New Brunswick, New Jersey, United States.

Does Pfizer own Johnson & Johnson?

No, Pfizer does not own Johnson & Johnson. J&J is an independent publicly traded company.

Does Joaquín Duato have a family?

Yes, Joaquín Duato, the current CEO and Chairman, has a family. While detailed personal information is private, it is known that he is married and has children.

Where is Johnson & Johnson headquartered?

Johnson & Johnson is headquartered in New Brunswick, New Jersey, United States.