Eli Lilly and Company is one of the most recognized names in pharmaceuticals, but many wonder who actually owns it. The answer isn’t tied to one person or family but to a mix of shareholders, including a historic foundation and some of the world’s biggest investment firms. This blend of ownership keeps the company grounded in its legacy while fueling its growth on a global scale.

Key Takeaways

- Eli Lilly and Company is a publicly traded global pharmaceutical leader, known for its innovative therapies in diabetes, oncology, neuroscience, and metabolic diseases.

- As a public company, its ownership is divided among institutional investors, insiders, and retail shareholders, with Lilly Endowment, Inc. as the largest single shareholder holding over 10%, giving it historic influence and significant voting power.

- Major institutional investors such as Vanguard, BlackRock, State Street, and Fidelity collectively control a substantial portion of shares, shaping corporate governance and long-term strategic direction.

- Company insiders, including executives and board members, hold a smaller but meaningful stake to align management with shareholder interests, while public and retail investors make up roughly 11–12% of ownership, ensuring market liquidity and broad participation.

Company Profile

Eli Lilly and Company (often called Lilly) is a global pharmaceutical and biotechnology leader headquartered in Indianapolis, Indiana. Founded in 1876, it has grown from a small laboratory into one of the world’s most influential drugmakers.

Lilly’s medicines are available in over 100 countries, and the company employs tens of thousands of people worldwide. Its work spans areas such as diabetes, obesity, oncology, immunology, neuroscience, and genetic medicine.

Beyond medicines, Lilly invests in advanced manufacturing and research facilities across multiple continents, reflecting its role as both a scientific innovator and a cornerstone of modern healthcare.

Founders & Origins

The company was founded on May 10, 1876, by Colonel Eli Lilly, a chemist and a veteran of the American Civil War. Lilly began operations in a small rented laboratory in Indianapolis. He started with modest capital and a few employees.

His goal was to produce high-quality medicines at a time when many so-called “patent medicines” were unreliable.

Early on, Colonel Lilly introduced innovations like gelatine-coated pills and sugar-coated tablets to make medicines more palatable and dependable. The business was incorporated formally in the early 1880s, and over time, the Lilly family remained deeply involved in its direction.

In 1937, the Lilly Endowment was created by J.K. Lilly Sr. along with his sons, using shares of the company as its founding endowment. This foundation has since played a role in preserving a link between the Lilly legacy and the company.

Major Milestones

- 1876: Colonel Eli Lilly founds the company in Indianapolis with just a handful of employees.

- 1886: Lilly introduces gelatin-coated pills, setting a new standard for quality and reliability.

- 1902: The company establishes one of the earliest industrial research laboratories in the pharmaceutical industry.

- 1923: Lilly becomes the first company to mass-produce insulin, revolutionizing diabetes treatment.

- 1940s: Lilly plays a key role in mass-producing penicillin during World War II, saving countless lives.

- 1954: The company launches Darvon, a breakthrough pain medication widely prescribed for decades.

- 1971: Lilly introduces Ceclor, a successful antibiotic used globally.

- 1982: Lilly brings Humulin to market, the world’s first commercially available human insulin created with recombinant DNA technology.

- 1987: Launch of Prozac (fluoxetine), the first blockbuster antidepressant, reshaping mental health treatment.

- 1996: Introduction of Zyprexa (olanzapine), which becomes one of the company’s top-selling drugs in psychiatry.

- 2004: Cymbalta (duloxetine) is approved, expanding Lilly’s presence in neuroscience and pain management.

- 2008: Acquisition of ImClone Systems strengthens Lilly’s oncology portfolio.

- 2014: The company acquires Novartis Animal Health, boosting its Elanco unit.

- 2019: Elanco Animal Health is spun off as an independent company, marking a strategic refocus on human medicine.

- 2020: Lilly launches antibody therapies for COVID-19, contributing to the global pandemic response.

- 2022: Approval of Mounjaro (tirzepatide) for type 2 diabetes, later expanded for obesity under the brand Zepbound.

- 2023–2024: Lilly acquires companies such as Versanis, DICE Therapeutics, Sigilon, and Akouos, adding strength in metabolic disease, immunology, and genetic therapies.

- 2025: Announces multi-billion investments in new U.S. manufacturing sites, including a $6.5 billion Texas facility and a large expansion in Virginia, to support next-generation obesity and diabetes medicines.

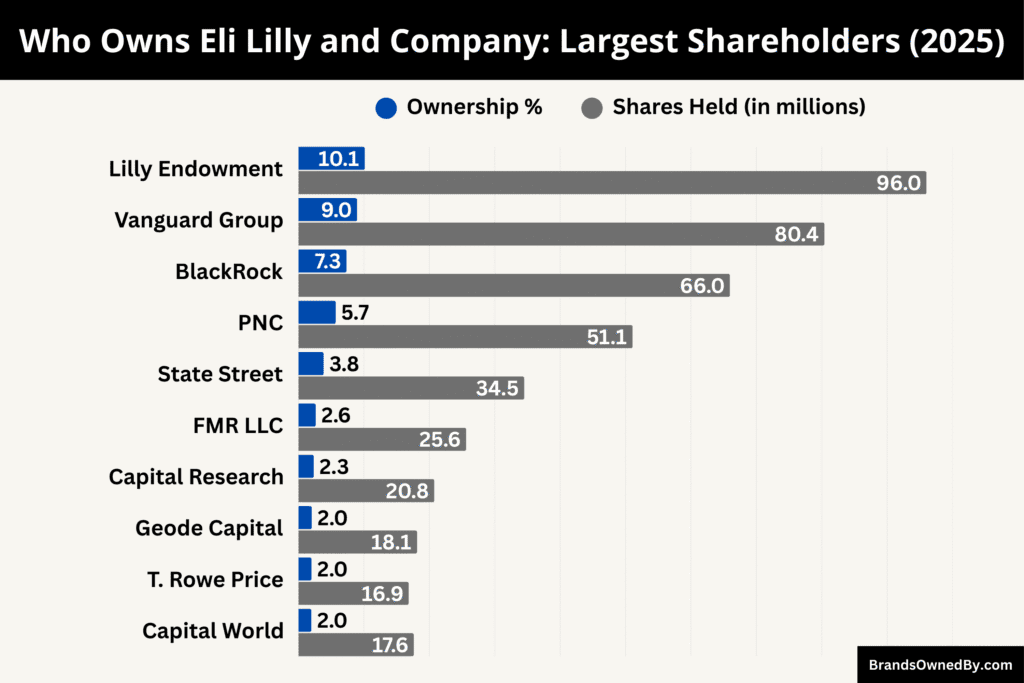

Who Owns Eli Lilly and Company: Largest Shareholders

Eli Lilly and Company is a publicly traded firm, meaning its shares are held by many investors rather than one individual. Still, certain institutions and groups possess meaningful stakes that shape governance and influence.

As of September 2025, institutional investors collectively own over 84 % of outstanding shares. The single largest stakeholder is the Lilly Endowment, a philanthropic organization originally tied to the Lilly family. Other major institutional holders include asset managers and mutual fund firms.

Here’s a list of the major shareholders of Eli Lilly and Company as of September 2025:

| Shareholder | Shares Held (millions) | Ownership % | Role/Influence |

|---|---|---|---|

| Lilly Endowment, Inc. | 96.02 | 10.13% | Largest single block, philanthropic foundation with historic ties |

| Vanguard Group, Inc. | 80.41 | 8.96% | Top institutional investor, mostly passive index funds |

| BlackRock, Inc. | 65.96 | 7.33% | Global asset manager, large passive stake, governance influence |

| PNC Financial Services Group | 51.08 | 5.69% | Large U.S. bank investor, fiduciary holdings, governance votes |

| State Street Corporation | 34.51 | 3.84% | Institutional fund manager, participates in governance oversight |

| FMR LLC (Fidelity) | 25.63 | 2.62% | Active & passive fund manager, engages in governance |

| Capital Research / Capital Global Investors | 20.76 | 2.32% | Long-term institutional investor, moderate governance role |

| Geode Capital Management | 18.13 | 2.02% | Quant/indexing investor, smaller but stable influence |

| Capital World Investors | 17.63 | 1.97% | Part of Capital Group, moderate institutional influence |

| Price T. Rowe Associates | 16.85 | 1.99% | Active asset manager, modest governance voice |

| Insiders (Executives & Board) | N/A | <1% | Executives and board alignment with shareholder value |

| Public & Retail Shareholders | N/A | 11–12% | Dispersed investors, collectively meaningful but fragmented |

Lilly Endowment, Inc.

Lilly Endowment remains the most prominent single shareholder. As of September 2025, it holds about 96.02 million shares, equal to roughly 10.13 % of the company’s total outstanding shares. It exercises influence not through control of daily operations but by being a stable, long-term block of ownership. In September 2025, the foundation made modest share sales (for example, selling ~22,965 shares), showing occasional portfolio activity.

Because the Endowment is independent from the company’s management, its primary role is philanthropic. Yet its shareholding gives it a lasting connection to the firm and influence in major votes and board elections.

Vanguard Group, Inc.

Vanguard is among the largest institutional investors in Eli Lilly. As of September 2025, it has around 80.41 million shares, or 8.96 % of the company. Vanguard’s holdings are largely passive, held via index funds and mutual funds that track large benchmarks. It typically refrains from aggressive activism but does vote on corporate governance and board matters.

BlackRock, Inc.

BlackRock, another global asset manager, has about 65.96 million shares (approximately 7.33 %) as of September 2025. Its approach is also generally long-term and passive, though BlackRock has occasionally pushed for ESG or governance changes in companies where it holds stakes. Its large holding gives it weight in board selection and shareholder proposals.

PNC Financial Services Group

PNC holds roughly 51.08 million shares as of September 2025, representing about 5.69 % of Eli Lilly. Its stake places it among the top five institutional holders. PNC’s involvement is mostly as a fiduciary investor rather than a strategic owner focused on control. The stake gives it visibility in corporate matters, especially governance votes.

State Street Corporation

State Street’s holdings in Lilly numbered about 34.51 million shares (~3.84 %) as of September 2025. As another large institutional investor, State Street’s funds often hold shares of major corporations. Its stake is less concentrated than some others, but it participates in governance votes and corporate oversight via its role as a fund manager.

FMR LLC (Fidelity)

FMR, or Fidelity’s investment arm, holds about 25.63 million shares, equal to around 2.62 % of Lilly’s shares as of September 2025. Fidelity is known for combining active and passive strategies. Its stake gives it a voice in corporate governance, and it may support or oppose proposals in line with its broader portfolio strategies.

Capital Research / Capital Global Investors

The Capital Research group holds about 20.76 million shares, or ~2.32 %, as of September 2025. Though somewhat smaller than the top few investors, its holding is still material. This group often exercises influence through long-term investment decisions and engagement with corporate management when needed.

Geode Capital Management

Geode holds about 18.13 million shares, roughly 2.02 % of Lilly’s total as of September 2025. Its stake is less aggressive but contributes to collective institutional influence. Geode is a quant / indexing investor and tends not to push for significant structural changes alone.

Capital World Investors

Capital World Investors held about 17.63 million shares or ~1.97 % in the same period. As part of Capital Group, it invests globally and participates in governance mainly via proxy voting. Its stake gives it moderate influence.

Price T. Rowe Associates

T. Rowe Price holds around 16.85 million shares, approximately 1.99 % of the company as of September 2025. As an active asset manager, it may occasionally engage with management or support proposals tied to long-term value creation. Its size gives it a modest but nontrivial voice.

Insiders and Public Shareholders

Insiders — meaning executives, board members, and other key personnel — collectively own under 1 % of the company in aggregate. Their holdings include direct ownership, stock options, restricted stock, and other forms of equity. These positions align management’s interests with shareholders but do not give insiders dominant control over corporate decisions.

The remaining shares are held by public investors, retail shareholders, smaller funds, and other miscellaneous holders. While no single retail investor holds a large block, in aggregate these shareholders represent around 11-12 % of total share ownership based on institutional and large-holder data. Their influence is dispersed, though they can participate in proxy votes and shareholder proposals.

Who is the CEO of Eli Lilly and Company?

David A. Ricks serves as both chairman and chief executive officer of Eli Lilly and Company. He has held the CEO role since January 2017 and became chair of the board later in that year. He is a long-time Lilly veteran, carrying significant institutional knowledge across many parts of the company.

The Current CEO: David A. Ricks

Ricks joined Eli Lilly in 1996 as a business development associate. Over time, he moved through roles in U.S. marketing and sales. He then advanced into international leadership, managing Lilly Canada and later Lilly China.

Before ascending to CEO, he led Lilly USA (the company’s largest segment) and was president of Lilly Bio-Medicines, which combined drug development and commercialization across immunology, neuroscience, and pain.

This broad experience across territories and business units helped prepare him for overseeing Lilly’s global operations.

Leadership Style & Strategic Focus

Ricks is often described as a steady, execution-oriented leader who emphasizes speed, discipline, and scientific rigor. Under his leadership, the company has pushed aggressively into metabolic / obesity therapies, aiming to compete vigorously in that space. He also values internal collaboration between R&D, manufacturing, and commercialization units, and has prioritized building domestic manufacturing capacity to support future growth.

He maintains visibility across the organization — not only at the executive level — and is known to engage regularly with operations on the ground.

Key Decisions & Milestones Under His Tenure

- Under Ricks, Lilly pivoted more strongly into GLP-1 / incretin / metabolic medicines, with Mounjaro (for diabetes) and later Zepbound (for obesity) becoming central to its growth strategy.

- He has overseen major acquisitions and expansions in future-oriented fields like genetic medicine, immunology, and novel modalities.

- In 2025, under his watch, Lilly announced a multibillion-dollar U.S. manufacturing build-out: a $6.5 billion Texas facility and large expansions in Virginia to support next-generation therapies.

- Ricks also took a public stance on policy matters: he has spoken about drug affordability, tax and regulation reform, and securing domestic supply chains for essential medicines.

- In August 2025, he personally purchased over $1 million worth of Lilly shares in the open market—his first such public purchase since 2019—signaling confidence in the company’s outlook even after a stock dip.

Board Role & Outside Engagement

As chair, Ricks leads the board’s agenda and link between governance and operations. His dual role gives him influence both as chief operator and as board leader.

Beyond Lilly, he sits on the boards of Adobe and the Business Roundtable. He participates in industry and policy organizations, including PhRMA (formerly chair), the CEO Steering Committee of the International Federation of Pharmaceutical Manufacturers & Associations, and U.S. patent/innovation councils. He also engages regionally in Indiana civic and economic efforts.

Predecessors & Succession

Before Ricks, Lilly’s CEO was John C. Lechleiter, who served from 2008 to 2016. Lechleiter came from within Lilly’s ranks (a chemist by training) and led the company through substantial drug development and globalization phases.

Earlier CEOs included leaders like Sidney Taurel and Randall Tobias, each marking phases of expansion, restructuring, and globalization. Planning for CEO succession has long been part of Lilly’s governance culture, balancing internal depth with external oversight.

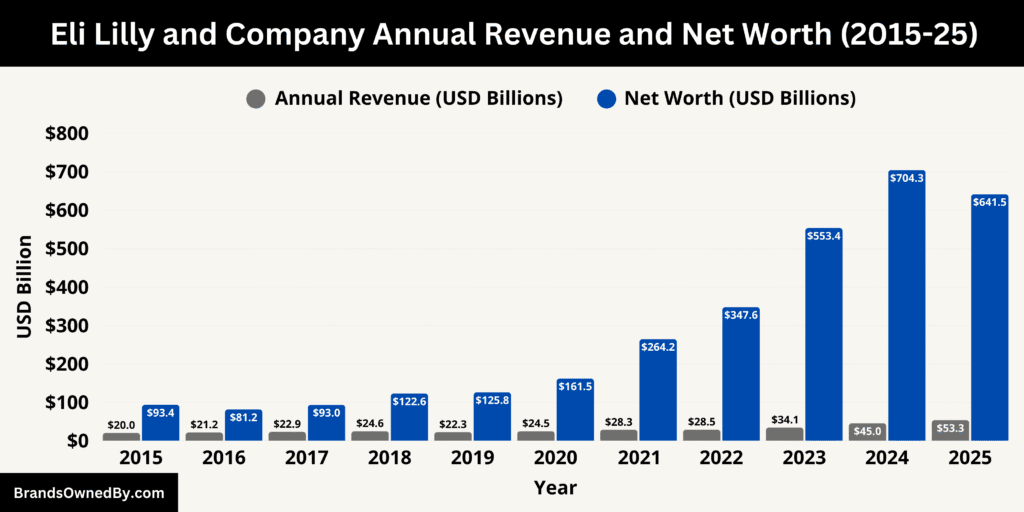

Eli Lilly Annual Revenue and Net Worth

As of September 2025, Eli Lilly and Company reported trailing twelve-month revenue of about $53.26 billion. Its market capitalization, often treated as its net worth in financial terms, stood at $641.5 billion. This reflects not only strong sales performance but also investor confidence in the company’s long-term growth potential, especially in obesity and diabetes care.

Here’s a breakdown of the historical revenue and net worth of Eli Lilly and Company:

| Year | Annual Revenue (USD Billions) | Market Capitalization / Net Worth (USD Billions) |

|---|---|---|

| 2015 | 19.96 | 93.4 |

| 2016 | 21.22 | 81.2 |

| 2017 | 22.87 | 93.0 |

| 2018 | ~24.56 | 122.6 |

| 2019 | 22.32 | 125.8 |

| 2020 | 24.54 | 161.5 |

| 2021 | 28.32 | 264.2 |

| 2022 | 28.54 | 347.6 |

| 2023 | 34.12 | 553.4 |

| 2024 | 45.04 | ~704.3 |

| 2025 (est.) | 53.26 (TTM) | 641.5 |

2025 Revenue Trends and Drivers

The $53.26 billion in TTM revenue reflects broad-based growth across Lilly’s product lines and geographies. That revenue figure represents roughly a 36–37 % year-over-year increase. The growth is anchored especially in its diabetes and obesity portfolio, notably drugs like Mounjaro and Zepbound, which have become central pillars of the company’s expansion. Quarterly revenue in Q2 2025 alone rose to $15.56 billion, up 38 % from the same quarter in 2024.

Lilly’s strategy to invest heavily in manufacturing and reduce supply chain risk supports this revenue growth. New facility expansions in Texas and Virginia are meant to scale production for its next wave of therapies. Investments in acquisitions and alliances have also added to Lilly’s pipeline and allowed it to monetize complementary technologies faster.

While U.S. sales remain a substantial portion, international markets continue to show importance. The company has pushed launches, regulatory approvals, and partnerships abroad to diversify its revenue streams. The metabolic / GLP-1 / incretin category is high growth globally, and Lilly is positioning itself to capture more share in those international markets.

Net Worth

As of September 2025, Lilly’s market cap is estimated to be $641.5 billion. This places it among the highest-valued pharmaceutical companies in the world. The valuation reflects not only current earnings and sales but also investor confidence in Lilly’s long-term growth and pipeline.

That valuation has seen fluctuations. Earlier in the year, Lilly’s market cap touched even higher levels, but some pullbacks in share price brought the range into the mid-$600 billion territory. Nonetheless, it remains at a level that underscores the market’s view of Lilly as a dominant and future-oriented player in health care.

This market valuation also confers power in capital markets: Lilly can raise debt at favorable terms, issue equity if needed, or pursue large acquisitions with confidence that its share price backs those moves. It also sets a benchmark for stakeholders to measure performance — management must justify that high valuation through execution, innovation, and disciplined financial metrics.

Companies Owned by Eli Lilly and Company

As of 2025, Eli Lilly owns a diverse portfolio of subsidiaries, brands, and research entities. These include commercial medicines, biotechnology companies, and gene therapy ventures. Each plays a role in strengthening Lilly’s leadership in pharmaceuticals and future-focused therapies.

Here’s a list of the major brands and companies owned by Eli Lilly and Company as of September 2025:

| Company / Brand | Type | Therapeutic / Focus Area | Acquisition / Launch Year | Role in Lilly |

|---|---|---|---|---|

| ImClone Systems | Subsidiary | Oncology, targeted therapies | Acquired 2008 | Integrated into Lilly’s oncology R&D and commercial operations |

| Avid Radiopharmaceuticals | Subsidiary | Diagnostics, PET imaging | Acquired 2010 | Supports imaging and precision diagnostics for therapeutic development |

| Prevail Therapeutics | Subsidiary | Gene therapy, neurodegenerative diseases | Acquired 2021 | Develops AAV-based therapies for CNS disorders |

| Sigilon Therapeutics | Subsidiary | Cell-based biologics | Acquired 2020 | Long-acting cell therapeutics platform integrated into Lilly biologics |

| DICE Therapeutics | Subsidiary | Oral small molecules, immunology | Acquired 2021 | Supports autoimmune and inflammatory disease portfolio |

| Versanis Bio | Subsidiary | Cardiometabolic, obesity | Acquired 2021 | Strengthens metabolic research, complementary to GLP-1 therapies |

| Morphic Therapeutic | Subsidiary | Oral small molecules, IBD | Acquired 2024 | Oral integrin therapies for gastrointestinal disorders |

| Akouos | Subsidiary | Gene therapy, hearing disorders | Acquired 2021 | Develops AAV-based therapies for auditory conditions |

| Disarm Therapeutics | Subsidiary | Neuroprotection, axonal degeneration | Acquired 2020 | Research platform for neurodegenerative disease therapies |

| Verve Therapeutics | Subsidiary | Gene editing, cardiovascular | Acquired 2025 | CRISPR-based therapies targeting lipid and cardiovascular risk |

| Mounjaro | Brand | Diabetes, incretin therapy | Launched 2022 | Key revenue driver in diabetes care |

| Zepbound | Brand | Obesity, dual-agonist therapy | Launched 2024 | Rapid-growth obesity therapy, complements Mounjaro |

| Trulicity | Brand | Diabetes, GLP-1 therapy | Launched 2014 | Established GLP-1 therapy brand in diabetes care |

| Humalog | Brand | Insulin | Launched 1996 | Core insulin therapy, globally prescribed |

| Humulin | Brand | Insulin | Launched 1982 | Cornerstone human insulin brand, long-standing |

| Prozac | Brand | Antidepressant | Launched 1987 | Legacy neuroscience therapy |

| Cymbalta | Brand | Antidepressant & pain | Launched 2004 | Contributes to neuroscience and pain management |

| Zyprexa | Brand | Antipsychotic | Launched 1996 | Psychiatric therapy, historically top-selling |

| Cialis | Brand | Erectile dysfunction / BPH | Acquired via partnership 2003 | Key legacy product, historically major revenue contributor |

ImClone Systems

ImClone became part of Eli Lilly through acquisition and is integrated into Lilly’s oncology efforts. The unit brought key cancer assets and development expertise, and its programs now sit inside Lilly’s broader oncology research and commercial teams. ImClone’s legacy products and research platforms strengthened Lilly’s ability to develop targeted oncology medicines and accelerated cross-program collaboration in biologics and small molecules.

Avid Radiopharmaceuticals

Avid Radiopharmaceuticals operates as Lilly’s diagnostics and imaging subsidiary focused on PET tracers and radiopharmaceutical tools. Under Lilly, Avid’s imaging agents for neurodegenerative disease and oncology have been developed and commercialized alongside therapeutic programs. These diagnostics help Lilly link precision imaging to therapeutic outcomes and improve patient selection in clinical trials.

Prevail Therapeutics

Prevail is Lilly’s gene-therapy focused subsidiary working on AAV-based approaches for neurodegenerative diseases. Since becoming part of Lilly, Prevail’s research and manufacturing capabilities have been folded into Lilly’s genetic medicine strategy, supporting one-time and disease-modifying candidates aimed at slowing or preventing progression in disorders such as Parkinson’s and other CNS conditions.

Sigilon Therapeutics

Sigilon brought cell-based and encapsulation technologies into Lilly’s biologics portfolio. Its platform for protected, long-acting cell therapeutics is being developed within Lilly as an avenue to deliver therapeutic proteins or engineered cells with reduced immune clearance. Integration into Lilly has enabled this technology to scale more rapidly with the company’s manufacturing resources.

DICE Therapeutics

DICE Therapeutics, acquired by Lilly, focuses on oral small molecules that modulate integrins for autoimmune and inflammatory diseases. As a Lilly subsidiary, DICE’s programs are being advanced within Lilly’s immunology and inflammation portfolio, complementing biologics with oral therapeutic options and broadening the company’s modality mix for chronic immune disorders.

Versanis Bio

Versanis is a cardiometabolic company acquired to deepen Lilly’s metabolic disease pipeline. Versanis’ activin receptor-targeting programs and cardiometabolic science were incorporated into Lilly’s obesity and metabolic research efforts. This acquisition expanded Lilly’s scientific approaches against obesity and muscle/fat biology, adding a complementary mechanism to its incretin and GLP-1 drugs.

Morphic Therapeutic

Morphic, acquired by Lilly in 2024, brought oral integrin-targeting therapies primarily aimed at inflammatory bowel disease and related conditions. Under Lilly, Morphic’s oral IBD candidate programs were positioned to complement existing biologics and to provide potentially more convenient, small-molecule options for patients with chronic gastrointestinal disorders.

Akouos

Akouos is Lilly’s gene-therapy unit focused on hearing and inner-ear disorders. The company’s AAV-based strategies for restoring or preserving hearing function were integrated with Lilly’s genetic medicine capabilities, enabling shared expertise in vector development, regulatory strategy, and trial design for rare and common auditory conditions.

Disarm Therapeutics

Disarm’s work on axonal degeneration and neuroprotection became part of Lilly’s neurology research portfolio. The acquisition provided novel targets and biologic modalities to address disease pathways in neurodegenerative disorders. Within Lilly, Disarm’s platform is being explored to create disease-modifying therapies for conditions where axonal integrity is central to clinical decline.

Verve Therapeutics

Verve, acquired in 2025, adds CRISPR-based, one-time gene-editing approaches to Lilly’s cardiovascular and genetic medicine ambitions. Verve’s programs targeting PCSK9 and other lipid-related genes are being advanced within Lilly as potential one-time treatments to reduce lifetime cardiovascular risk. This acquisition expanded Lilly’s capability in precision gene editing and positioned the company to pursue durable, preventive interventions in cardiometabolic disease.

Mounjaro

Mounjaro is Lilly’s blockbuster diabetes drug and one of the fastest-growing therapies in the company’s history. It belongs to the incretin class and is widely prescribed for type 2 diabetes. Since its launch, Mounjaro has delivered billions in revenue and positioned Lilly as a leader in metabolic health.

Zepbound

Zepbound, approved for obesity treatment, is derived from the same molecule as Mounjaro. It has quickly become one of Lilly’s most important growth drivers in 2024 and 2025. Its rapid uptake has made Lilly a dominant force in the obesity care market, with demand prompting the expansion of new manufacturing facilities.

Trulicity

Trulicity is one of Lilly’s well-known GLP-1 receptor agonists for type 2 diabetes. Although newer incretin drugs have taken the spotlight, Trulicity remains an important commercial brand with wide global use. Its role established Lilly as a trusted name in incretin therapies.

Humalog

Humalog is one of Lilly’s long-standing insulin brands, used by millions of patients worldwide. It continues to be marketed as part of Lilly’s diabetes care portfolio and remains a staple in insulin therapy, even with competitive pressure in the insulin market.

Humulin

Humulin, another major insulin brand owned by Lilly, was among the first synthetic human insulins ever developed. It continues to be prescribed globally and represents a cornerstone of Lilly’s historic leadership in diabetes treatment.

Prozac

Prozac is one of Lilly’s legacy antidepressants that became a cultural and pharmaceutical milestone. Though generic competition has reduced sales, it remains an important part of the company’s history and its legacy in neuroscience.

Cymbalta

Cymbalta is both an antidepressant and a treatment for certain types of pain. It remains a recognizable brand under Lilly and continues to contribute to its neuroscience portfolio, particularly in global markets where it still holds a strong presence.

Zyprexa

Zyprexa is Lilly’s antipsychotic brand, once one of its top-selling drugs. While its sales have declined due to generics, it continues to be an important part of Lilly’s psychiatric history and therapeutic development.

Cialis

Cialis, developed through partnerships and later fully commercialized under Lilly, became one of the most recognized drugs for erectile dysfunction and benign prostatic hyperplasia. It significantly contributed to Lilly’s revenue before patent expiration and remains a well-known brand associated with the company.

Final Words

Ownership of Eli Lilly and Company highlights how a century-old business can remain both independent and widely held. The Lilly Endowment preserves its family connection, while institutional investors provide the capital and influence needed to compete at the top of the industry. Together, they support a company that continues to shape modern medicine and deliver innovations that reach millions of patients worldwide.

FAQs

What country owns Eli Lilly?

Eli Lilly is an American company headquartered in Indianapolis, Indiana, USA. It is publicly traded and not owned by any single country.

What family owns Eli Lilly?

The Lilly family, primarily through the Lilly Endowment, Inc., holds the largest single block of shares. While the family maintains significant influence, the company is publicly traded and no longer family-owned in its entirety.

What are the major companies owned by Eli Lilly?

Major subsidiaries and acquisitions include ImClone Systems, Prevail Therapeutics, Sigilon Therapeutics, DICE Therapeutics, Versanis Bio, Morphic Therapeutic, Akouos, Disarm Therapeutics, and Verve Therapeutics. These units focus on oncology, gene therapy, immunology, metabolic diseases, and cardiovascular innovations.

Who are Eli Lilly’s largest shareholders?

The largest shareholder is Lilly Endowment, Inc. Other major shareholders include Vanguard Group, BlackRock, State Street, Fidelity (FMR LLC), Capital Research, Geode Capital, and Price T. Rowe Associates. Insiders hold a smaller stake, and public/retail shareholders account for roughly 11–12%.

Is Eli Lilly family-owned?

No, Eli Lilly is not family-owned. While the Lilly family retains influence via the Lilly Endowment, the company is publicly traded and controlled by a mix of institutional investors, insiders, and public shareholders.

Who owns Eli Lilly stock?

Eli Lilly stock is owned by a mix of institutional investors, insiders, and public shareholders, with Lilly Endowment holding the largest single block.

Is Eli Lilly publicly traded?

Yes, Eli Lilly is a publicly traded company listed on the New York Stock Exchange (NYSE) under the ticker LLY.

Who owns the Lilly drug company?

Ownership is shared among institutional investors, the Lilly Endowment, company insiders, and retail shareholders. No single entity fully owns the company.

Who is Eli Lilly’s parent company?

Eli Lilly has no parent company. It is an independent, publicly traded corporation.

Is Eli Lilly bigger than Pfizer?

In terms of market capitalization, as of September 2025, Eli Lilly is valued at $641.5 billion, which is comparable to Pfizer but smaller than Pfizer’s peak market cap in recent years. Revenue and portfolio size differ, with Pfizer having a broader range of products globally.

Is Eli Lilly an American company?

Yes, Eli Lilly is an American pharmaceutical company, founded and headquartered in Indianapolis, Indiana.

Which is the biggest pharma company in the world?

By market capitalization and revenue, the largest pharmaceutical companies include Pfizer, Johnson & Johnson, Roche, Novartis, and Eli Lilly. Eli Lilly ranks among the top global players, particularly in diabetes and obesity therapies.

Is Lilly buying Pfizer?

No, there is no public information indicating that Lilly is acquiring Pfizer. Both companies operate independently.

Who are the heirs of Eli Lilly?

The heirs of Eli Lilly are descendants of the founder, Eli Lilly, who control the Lilly Endowment, Inc., the largest single shareholder in the company. The Endowment is managed by professional trustees and family members.

Who runs the Lilly Endowment?

The Lilly Endowment is managed by a board of trustees, which includes family members and appointed professionals. It oversees the Endowment’s philanthropic initiatives and manages its shareholding in Eli Lilly.