Nexstar Media Group is one of the largest broadcasting companies in the United States. If you are wondering who owns Nexstar Media Group, the answer involves institutional investors, individual stakeholders, and executive leadership. The company has grown into a media powerhouse with stations, networks, and digital properties across the country.

Nexstar Media Group Company Profile

Nexstar Media Group, Inc. is a large U.S. media and broadcasting company. It operates local television stations, networks, and digital media assets. As of mid-2025, it reaches over 200 owned or partner stations in 116 U.S. markets, covering about 220 million people.

Its national properties include The CW (a major broadcast network), NewsNation (a 24/7 cable news network), multicast networks like Antenna TV and Rewind TV, and it holds a 31.3% interest in TV Food Network.

Nexstar produces a large volume of programming each year. Its digital assets include local station websites, The Hill, NewsNationNow.com, among others, which together make Nexstar a top-10 U.S. digital news/information property.

Founders

Perry A. Sook is the sole founder of Nexstar Media Group. He launched the company in 1996 after purchasing WYOU in Scranton, Pennsylvania.

Before founding Nexstar, Sook built his experience across multiple roles in broadcasting. He worked in local sales, radio, and TV. He served as managing executive in several smaller station groups.

One of his early roles was with Superior Communication Group, which he helped lead before it was sold in 1995 to Sinclair Broadcast Group.

Major Milestones

Here are some key moments in Nexstar’s history and recent developments:

- 1996: Company founded with the purchase of WYOU in Scranton.

- 2003: Nexstar went public and acquired Quorum Broadcasting, which roughly doubled its station portfolio.

- 2005: Nexstar pioneered pushing for retransmission consent fees from cable and satellite providers. This became a significant revenue stream for many local broadcasters.

- 2010-2015: Nexstar carried out numerous station acquisition transactions. It also expanded digital operations and built up local broadcast/digital teams in various markets.

- 2016: The company acquired Media General’s television stations and digital media properties (71 stations), significantly increasing its reach.

- 2017: Completion of the Media General acquisition. At that point, Nexstar held about 171 stations in 100 markets.

- 2018-2019: Nexstar made its biggest acquisition to date by purchasing Tribune Media. This transaction raised its station count dramatically and reinforced its position as the largest local TV station operator in the U.S.

- 2020: Launch of NewsNation on WGN America and rebranding of WGN America to NewsNation.

- 2021: Acquisition of The Hill, the independent political digital media platform. Also, the launch of “Rewind TV” and several digital expansions.

- 2022: Closing of the acquisition of The CW Network, gaining majority control of a national broadcast network.

- 2025: Agreement to acquire Tegna for about $6.2 billion, expanding its reach significantly. Also, the formation of EdgeBeam Wireless, LLC, in collaboration with other media companies.

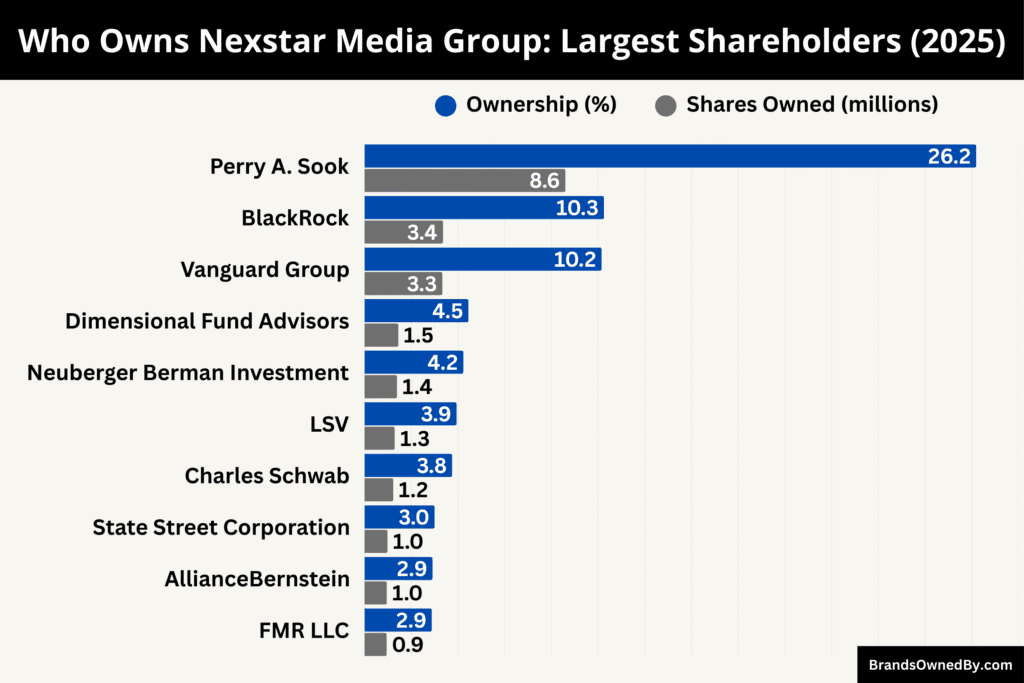

Who Owns Nexstar Media Group: Top Shareholders

Nexstar Media Group is a publicly traded company listed on NASDAQ under the ticker NXST. Its ownership is spread across institutional investors, mutual funds, insiders, and retail shareholders.

As of September 2025, institutional investors collectively hold over 92% of Nexstar’s outstanding stock. Founder Perry A. Sook remains the most influential individual shareholder due to his large insider stake. This ownership structure gives institutions voting strength in governance matters while keeping day-to-day leadership firmly with Sook and the executive team.

Below is an overview of the largest shareholders of the Nexstar Media Group as of September 2025:

| Shareholder | Percentage Stake | Shares Owned (Approx.) | Ownership Type | Influence & Control |

|---|---|---|---|---|

| Perry A. Sook (Founder & CEO) | 26.19% | 8.6 million | Insider/Executive | Largest individual owner, strong voting power, strategic leadership role. |

| BlackRock, Inc. | 10.25% | 3.36 million | Institutional | Top asset manager, key influence on governance and board-level matters. |

| The Vanguard Group, Inc. | 10.15% | 3.33 million | Institutional | Long-term investor, strong voting block in favor of transparency and stability. |

| Dimensional Fund Advisors LP | 4.45% | 1.45 million | Institutional | Long-term value investor, focused on governance and consistent returns. |

| Neuberger Berman Investment Advisers | 4.23% | 1.39 million | Institutional | Independent firm, supports efficient operations and long-term earnings growth. |

| LSV Asset Management | 3.94% | 1.29 million | Institutional | Quantitative investor, focuses on undervalued companies, adds voting weight. |

| Charles Schwab Investment Management | 3.75% | 1.23 million | Institutional/ETFs | Represents aggregated retail investors, aligns with governance-focused policies. |

| State Street Corporation | 3.00% | 985,000 | Institutional | Passive investor, influential in proxy voting and corporate reforms. |

| AllianceBernstein L.P. | 2.91% | 953,000 | Institutional | Active investor, engages on strategy, profitability, and governance issues. |

| FMR LLC (Fidelity Investments) | 2.88% | 945,000 | Institutional | Major mutual fund manager, supports capital efficiency and shareholder value. |

| Other Institutions & Public Shareholders | ~28.25% | 9.3 million | Institutional/Public | Smaller funds, trusts, and retail shareholders combined; limited individual control. |

Perry A. Sook – Founder and Chairman

Perry A. Sook, the founder, chairman, and CEO, owns about 26.19% of Nexstar Media Group, which equals roughly 8.6 million shares as of September 2025.

His insider holding makes him the single most influential individual owner. Because of his executive leadership role, he not only participates in shareholder votes but also sets the company’s strategic direction. His control allows him to balance institutional influence and maintain the company’s original vision of aggressive growth through acquisitions and digital expansion.

BlackRock, Inc.

BlackRock is the largest institutional shareholder in Nexstar, holding about 10.25%, which translates to approximately 3.36 million shares. As the world’s biggest asset manager, BlackRock does not intervene in daily operations but exerts major influence through proxy voting and corporate governance initiatives.

Its stake ensures it has a significant say in issues like executive compensation, board elections, and shareholder rights.

The Vanguard Group, Inc.

Vanguard owns around 10.15% of Nexstar Media Group, or about 3.33 million shares. Vanguard’s position makes it almost equal to BlackRock in influence. It uses its voting power to push for stability, transparency, and sustainable shareholder returns.

Vanguard’s investment signals strong long-term confidence in Nexstar’s revenue model, especially its broadcasting and digital operations.

Dimensional Fund Advisors LP

Dimensional Fund Advisors holds approximately 4.45% of Nexstar, or about 1.45 million shares. Dimensional is known for long-term, evidence-based investing strategies.

Its role is important because it represents the interests of pension funds and institutional clients that seek stable returns. Dimensional typically votes in favor of governance policies that protect long-term growth and fair reporting practices.

Neuberger Berman Investment Advisers LLC

Neuberger Berman controls about 4.23% of the company, equaling roughly 1.39 million shares. It is a private, employee-owned firm, which makes its voting policies slightly more independent compared to the bigger firms. Neuberger’s stake helps diversify institutional influence.

The firm often supports initiatives that improve efficiency, long-term earnings, and risk management.

LSV Asset Management

LSV Asset Management owns around 3.94% of Nexstar, or about 1.29 million shares. Known for its quantitative investment approach, LSV focuses on undervalued companies.

Its presence among the top holders signals confidence in Nexstar’s valuation and future growth. LSV’s ownership matters during proxy votes, where smaller institutional voices combine to influence company governance.

Charles Schwab Investment Management, Inc.

Charles Schwab Investment Management holds about 3.75%, representing 1.23 million shares. Schwab manages assets primarily for retail investors through mutual funds and ETFs.

While its stake is not as large as Vanguard’s or BlackRock’s, its aggregated retail investor base means it often votes in alignment with broader institutional guidelines on governance and accountability.

State Street Corporation

State Street owns approximately 3.00% of Nexstar, equal to about 985,000 shares. State Street is a passive investor but has a large influence because it often votes consistently with governance reforms and institutional policies. Its ownership contributes to the block of institutions that collectively control the majority of Nexstar’s shares.

AllianceBernstein L.P.

AllianceBernstein owns roughly 2.91% of Nexstar Media Group, or about 953,000 shares. The firm is known for its active investment strategies and often seeks engagement with companies on issues related to corporate strategy, profitability, and risk management. Its ownership gives it a meaningful role in proxy decisions.

FMR LLC

FMR LLC, better known as Fidelity Investments, holds about 2.88% of Nexstar, which equals 945,000 shares. Fidelity is one of the largest U.S. mutual fund managers. Its stake reflects long-term institutional trust in Nexstar’s financial performance and business model.

Fidelity usually aligns its proxy votes with shareholder value maximization, governance improvements, and capital allocation efficiency.

Other Institutional and Public Shareholders

Other institutional investors, including smaller funds and trusts, own the remaining collective portion of Nexstar’s stock.

Together, they account for more than 20% of shares, further reinforcing the dominance of institutions in company ownership. Retail or public shareholders, by contrast, hold only a small percentage of the stock. Their influence in governance is minimal compared to large funds.

Who is the CEO of Nexstar Media Group?

The current CEO of Nexstar Media Group is Perry A. Sook, who also serves as Chairman and President. He founded the company in 1996 and has remained in the role for nearly three decades.

Under his leadership, Nexstar has grown from a single television station in Scranton, Pennsylvania, to the largest local broadcast group in the United States.

As of 2025, he continues to drive Nexstar’s strategy, including acquisitions like Tribune Media and the recently announced Tegna deal.

Leadership Role and Responsibilities

As CEO, Perry Sook oversees all of Nexstar’s major operations. This includes more than 200 local television stations, the CW Network, NewsNation, and digital platforms.

His responsibilities cover strategic planning, corporate governance, financial performance, and innovation in both traditional broadcasting and emerging technologies like ATSC 3.0. Sook also plays a critical role in investor relations and represents the company in industry associations.

Sook’s vision has consistently emphasized acquisition and expansion. He spearheaded Nexstar’s entry into national networks by acquiring majority ownership of The CW in 2022.

He also championed the launch of NewsNation, which is now one of the company’s flagship cable networks. His leadership style is aggressive yet pragmatic, focusing on scale, efficiency, and localism. These choices have positioned Nexstar as a leader not only in local broadcasting but also in digital media.

Executive Team Supporting the CEO

While Perry Sook is the central figure in leadership, he is supported by a strong executive team. Key figures include the President of Networks overseeing NewsNation and The CW, the Chief Financial Officer managing revenue and acquisitions, and divisional presidents responsible for Nexstar’s regional broadcast operations.

This structure allows the company to operate efficiently at scale while keeping decision-making aligned with Sook’s broader vision.

CEO’s Legacy and Future Outlook

As of 2025, Perry Sook’s legacy is already well established. He transformed Nexstar from a single-station operator into a media empire worth billions. His future outlook is focused on completing the Tegna acquisition, expanding NewsNation’s national footprint, and monetizing digital and spectrum-related opportunities.

With nearly 30 years at the helm, Sook remains one of the longest-serving and most influential executives in the U.S. broadcasting industry.

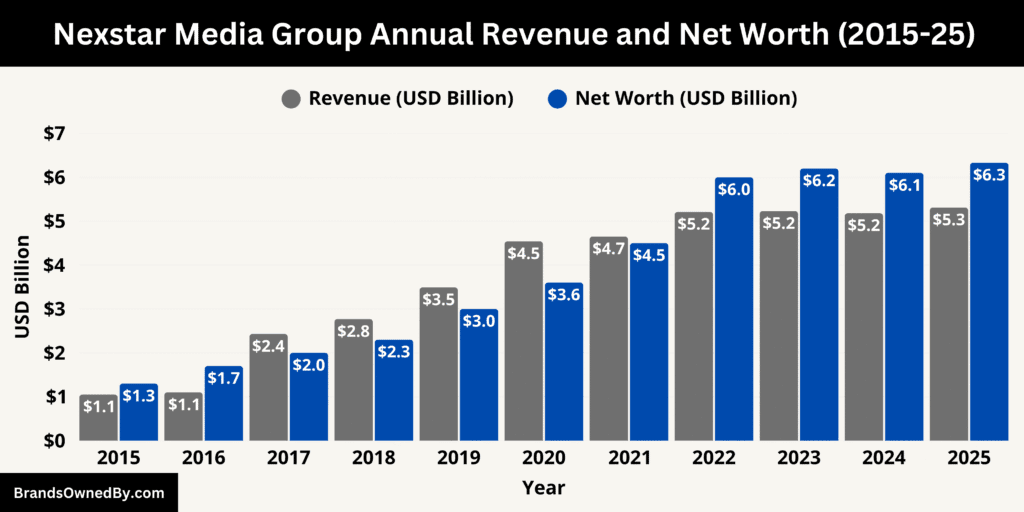

Nexstar Media Group Annual Revenue and Net Worth

As of September 2025, Nexstar Media Group reported $5.31 billion in annual revenue and holds a market capitalization of about $6.33 billion. The table below shows how both revenue and net worth have evolved during the last ten years.

Here’s an overview of the 10-year historical revenue and net worth of Nexstar Media Group:

| Year | Revenue (USD Billion) | Net Worth / Market Cap (USD Billion) | Notes |

|---|---|---|---|

| 2015 | 1.05 | 1.3 | Expansion through local station acquisitions |

| 2016 | 1.10 | 1.7 | Tribune merger talks begin; steady revenue |

| 2017 | 2.43 | 2.0 | Media General acquisition completed, revenue doubles |

| 2018 | 2.77 | 2.3 | Continued consolidation of local stations |

| 2019 | 3.49 | 3.0 | Announced Tribune Media acquisition |

| 2020 | 4.54 | 3.6 | Tribune acquisition finalized; pandemic impacts ads |

| 2021 | 4.65 | 4.5 | Growth in distribution and digital revenue |

| 2022 | 5.21 | 6.0 | Acquired majority stake in The CW Network |

| 2023 | 5.23 | 6.2 | Launch of NewsNation expansion |

| 2024 | 5.18 | 6.1 | Stable revenue in a non-election year |

| 2025 | 5.31 | 6.33 | Record scale; Tegna acquisition announcement |

Annual Revenue

As of mid-2025, Nexstar Media Group’s trailing twelve months (TTM) revenue is about $5.31 billion, showing a modest increase from the corresponding figure a year earlier.

This growth reflects ongoing strength in its broadcasting operations, network distribution, and digital platforms despite headwinds in certain segments. In the second quarter of 2025, the company reported net revenue of $1.23 billion, which was slightly lower year-over-year, due in part to lower political advertising in a non-election period.

Advertising revenue, a key component, dropped about 9% in Q2 versus the same quarter in 2024, primarily because of reduced political ad spending. Distribution revenue held more steady, with only a slight decline.

The company’s ability to manage costs, refinance debt, and generate free cash flow has helped offset some of the pressure on revenue.

Profitability, Margins, and Cash Flow

The net income for that same period was $91 million, down compared to prior periods. Adjusted EBITDA stood at $389 million.

Margins have tightened somewhat, especially the advertising margin, but efficiency measures, lower operating expenses in some areas, and reduced amortization of certain broadcast rights have helped stabilize results.

Free cash flow is positive, though lower in some quarters; operating cash flow has shown improvement.

Net Worth and Market Capitalization

In September 2025, Nexstar’s market capitalization—the total market value of its outstanding shares—is approximately $6.33 billion.

This figure represents the “net worth” of the publicly traded company in market terms. Compared to earlier years, this reflects appreciable growth, though it also comes with insecurities connected to broader industry trends, regulatory risks, and the variable nature of advertising revenue.

Nexstar’s enterprise value, which adds debt and subtracts cash from market cap, is substantially higher, pointing to significant leverage in its capital structure. Debt obligations remain a material part of its financial profile, especially with obligations related to senior secured debt and refinancing efforts.

Trends, Risks, and Outlook

Revenue growth is moderate in 2025. Non-election year political advertising is lower, which tends to reduce revenue spikes seen in election years. On the other hand, growth in distribution contracts, digital reach, and network audience (e.g., The CW and NewsNation) contributes positively.

The announced acquisition of Tegna (expected to close in 2026 pending regulatory approval) could materially increase revenue and market reach, subject to integration success and regulatory constraints.

The company’s net worth is sensitive to investor sentiment, regulatory developments (especially rules on station ownership and broadcast caps), and the broader media market’s reaction to cord-cutting, streaming competition, and advertising market softness.

Still, overall, the financial metrics suggest Nexstar remains financially robust with reasonable profitability, positive cash flow, and stable capital structure despite challenges.

Companies Owned by Nexstar Media Group

Nexstar Media Group operates a wide range of broadcast, cable, digital, and radio entities. These properties have been built through organic growth and major acquisitions.

As of 2025, the company manages more than 200 local stations, national broadcast networks, and digital news brands that make it the largest local television and multimedia group in the United States.

Below are the major companies, brands, acquisitions, and entities Nexstar owns and operates as of September 2025:

| Company/Brand | Type | Ownership % | Year Acquired/Launched | Key Details |

|---|---|---|---|---|

| The CW Network | National broadcast TV network | 75% (majority) | 2022 | Reaches 100M+ households; offers primetime shows, sports (NASCAR, ACC, WWE NXT); digital extension via CW App. |

| NewsNation | Cable news network | 100% | 2020 (rebranded from WGN America) | Positioned as balanced national news; Chicago HQ; primetime lineup expanding; available on cable, satellite, and streaming. |

| Antenna TV | Multicast TV network | 100% | 2011 (expanded via Tribune 2019) | Classic TV reruns from 1950s–1990s; distributed via digital subchannels in 150+ markets. |

| Rewind TV | Multicast TV network | 100% | 2021 | Focus on sitcoms and “feel-good” TV from 1980s–1990s; targets Gen X and millennials. |

| WGN Radio (AM 720) | Radio station | 100% | 2019 (via Tribune acquisition) | Chicago-based; news, talk, and sports; cross-platform synergy with WGN-TV and NewsNation. |

| Local TV Stations Portfolio | Local broadcast stations | 100% (owned or operated) | Various (1996–present) | 200+ stations in 116 markets; affiliates of ABC, NBC, CBS, FOX, CW, MyNetworkTV; includes KTLA (Los Angeles), WPIX (NY), WGN-TV (Chicago). |

| The Hill | Digital news brand | 100% | 2021 | Leading U.S. political news site; digital-first platform; hosts policy events and streams; integrates with NewsNation. |

| TV Food Network | Cable lifestyle channel | 31.3% (minority stake) | Prior to 2019 (retained post-Tribune deal) | Popular culinary channel; known for cooking shows and competitions; Nexstar receives equity revenue but not operational control. |

| Tribune Media | Broadcasting company (absorbed) | 100% (fully acquired) | 2019 | $7.2B acquisition; added 42 major market stations, WGN America (NewsNation), Antenna TV, and WGN Radio. |

| Planned Acquisition of Tegna | Broadcasting company (pending) | N/A (deal announced) | 2025 (pending closure) | $6.2B deal for 64 stations in 51 markets; would further expand Nexstar’s reach and political ad revenue base. |

The CW Network

Nexstar Media Group owns a 75% majority stake in The CW Network. Under that structure, it controls programming decisions, distribution agreements, ad sales, and network branding. The remaining 25% is held among partners.

The CW delivers about 15 hours of primetime entertainment per week, plus sports programming (like NASCAR Xfinity Series, ACC sports, PBR, etc.). It also operates a streaming presence via the CW App, which offers on-demand content, library shows, and the latest episodes. Nexstar’s control of The CW gives it a major national platform beyond its local station footprint.

NewsNation

NewsNation is a national cable news network fully operated by Nexstar. It started as a rebranded version of WGN America and now positions itself with the tagline “News for All Americans.”

It draws on both a national team of journalists and Nexstar’s large network of local stations (and their newsrooms) to contribute content and reporting. NewsNation is distributed via cable and satellite platforms, digital streaming, and through its own apps and web presence (NewsNationNow, etc.), making it a growing player in national news.

Antenna TV

Antenna TV is one of Nexstar’s multicast networks carrying classic television content. Programming is mostly sitcoms and nostalgic shows from earlier decades (1950s up through 1990s). It broadcasts over-the-air via local station subchannels, reaching many U.S markets.

As a multicast network, it provides additional content options to Nexstar’s portfolios of stations and helps monetize the digital signal capacity of its broadcast stations. It appeals to audiences interested in classic, older series rather than new programming.

Rewind TV

Rewind TV is another classic television network owned by Nexstar. It launched more recently (in 2021) as a spin-off/sister network to Antenna TV. Its focus is on classic sitcoms and “feel-good” television from the 1980s and 1990s.

It is distributed via digital subchannels in many markets, often those subchannels owned by Nexstar or under agreements. Rewind TV expands Nexstar’s reach into audiences that enjoy nostalgic content, especially in non-prime evening hours or as secondary programming on local stations.

WGN Radio (Chicago)

WGN Radio (AM 720) in Chicago is one of Nexstar’s radio properties. It serves as a major local source of news, talk, entertainment, and sports in the Chicago market.

The station helps complement Nexstar’s television and digital assets in that region, offering cross-platform synergies (for instance, local news gathering, sports coverage, etc.). It remains an influential local radio station with strong brand recognition in Chicago.

Local Television Stations Portfolio

Nexstar directly owns or partners with over 200 television stations across 116 U.S. markets. These include stations affiliated with the major U.S. networks (ABC, NBC, CBS, Fox) as well as MyNetworkTV and The CW. Some are owned and operated (O&O) by Nexstar, especially after acquiring Tribune Media and taking over CW affiliates in many large markets.

Stations in flagship markets—such as WGN-TV in Chicago, KTLA in Los Angeles, WPIX in New York—are part of that group. Nexstar’s local stations are the foundation of its broadcasting revenues and the source of much of its content and local news operations.

The Hill

The Hill is a leading digital-first political news brand acquired by Nexstar in 2021. It serves as one of the most widely read political news platforms in the United States, attracting lawmakers, government officials, journalists, and professionals in business and advocacy.

It publishes breaking news, policy analysis, and opinion articles, and it hosts events and forums on key issues in Washington, D.C. In 2025, The Hill continues to expand its video and live-streaming offerings, further integrating with NewsNation and Nexstar’s digital properties.

Its role strengthens Nexstar’s reputation as not just a broadcaster but also a political news leader.

Ownership Stake in TV Food Network

Nexstar holds a 31.3% stake in the TV Food Network, making it a significant minority shareholder in one of the most popular cable channels in the U.S. The Food Network is known for its cooking competitions, culinary shows, and lifestyle programming.

Although Nexstar does not manage the network’s operations, its equity stake provides strategic value, giving the company access to revenues from one of the strongest lifestyle channels on cable television.

Acquisition of Tribune Media

In 2019, Nexstar completed its $7.2 billion acquisition of Tribune Media, the largest transaction in its history at the time. The deal added 42 local television stations in major markets such as New York (WPIX), Los Angeles (KTLA), and Chicago (WGN-TV).

Tribune also brought with it the WGN America cable channel (later rebranded as NewsNation), Antenna TV, and WGN Radio. This acquisition more than doubled Nexstar’s scale and firmly established it as the largest local broadcaster in the United States.

Acquisition of The CW

In 2022, Nexstar acquired a 75% majority stake in The CW Network, gaining control from Warner Bros. Discovery and Paramount Global. This acquisition gave Nexstar a seat at the table in national entertainment programming for the first time.

By controlling The CW, Nexstar diversified its portfolio beyond local news and broadcasting into scripted entertainment, live sports, and digital distribution. The deal also included affiliate stations in key markets, which integrated into Nexstar’s existing operations.

Planned Acquisition of Tegna

In 2025, Nexstar announced its plan to acquire Tegna, a broadcasting company with 64 local television stations in 51 U.S. markets, for approximately $6.2 billion. The deal, pending regulatory approval, would further expand Nexstar’s dominance in local television and add stations in markets where it currently lacks presence.

If completed, the Tegna acquisition will increase Nexstar’s national household reach, diversify its revenue streams, and boost its political advertising potential for the 2026 and 2028 election cycles.

Final Thoughts

Nexstar Media Group has grown into the largest local television operator in the United States. Ownership of the company is spread among institutional investors, with Vanguard and BlackRock leading the way, while founder Perry Sook continues to play a central role as CEO and key shareholder. With its acquisitions, digital expansion, and strong revenue base, Nexstar is positioned as a powerful force in American media.

FAQs

When was Nexstar founded?

Nexstar Media Group was founded in 1996 by Perry A. Sook in Irving, Texas.

Who are the largest shareholders of Nexstar?

The largest shareholders of Nexstar Media Group are Perry A. Sook (founder and CEO, 26.19%), followed by major institutional investors such as BlackRock (10.25%), The Vanguard Group (10.15%), Dimensional Fund Advisors (4.45%), and Neuberger Berman (4.23%). Collectively, institutional investors own over 90% of the company’s shares, giving them significant voting power alongside Sook’s insider stake.

Who is Nexstar owned by?

Nexstar Media Group is publicly traded, meaning ownership is divided among institutional investors, mutual funds, and individual shareholders. Founder and CEO Perry A. Sook is the largest individual owner and has significant control over the company’s strategic direction.

Who owns NewsNation?

NewsNation is fully owned and operated by Nexstar Media Group. It is the company’s national cable news channel, leveraging both Nexstar’s local station network and a dedicated national newsroom.

Who is the CEO of the Nexstar Media Group?

The CEO of Nexstar Media Group is Perry A. Sook, who also serves as Chairman and President. He founded the company in 1996 and has led it since, guiding major acquisitions such as Tribune Media, The CW Network, and the planned Tegna merger.

What networks are owned by Nexstar?

Nexstar owns and operates several networks, including The CW Network (75% majority stake), NewsNation, Antenna TV, and Rewind TV. These networks cover primetime entertainment, national news, and classic television programming.

Does Nexstar own Fox in the US?

No, Nexstar does not own Fox. Some Nexstar local stations are Fox affiliates, meaning they broadcast Fox network programming in their local markets, but Fox Corporation itself is a separate entity.

Is Nexstar Media Group conservative?

Nexstar Media Group operates a broad range of local stations and national networks. NewsNation promotes itself as a non-partisan news network. While Nexstar-owned local stations may vary in editorial tone by market, the company itself is not officially affiliated with any political ideology.

Does BlackRock own Nexstar?

Yes, BlackRock, Inc. is one of Nexstar’s largest institutional shareholders, holding about 10.25% of the company’s shares as of September 2025. BlackRock does not run the company but participates in governance through shareholder voting.

Why did Nexstar pull Jimmy Kimmel?

Nexstar has occasionally chosen to preempt certain programming, including late-night shows like Jimmy Kimmel Live!, in specific markets for reasons such as local news priorities, syndication agreements, or sports coverage scheduling. These decisions are made at the station or corporate level based on viewership and advertising considerations.

Has Nexstar acquired any other companies?

Yes, Nexstar has made several major acquisitions. Key deals include the Tribune Media acquisition in 2019, which added 42 stations and WGN assets, the majority stake in The CW Network in 2022, and the planned acquisition of Tegna in 2025, which would add 64 stations if approved. These acquisitions have been central to Nexstar’s growth strategy.