Pop Mart has taken the world by storm with its collectible art toys and blind boxes. As curiosity grows around the business behind this creative phenomenon, many fans and investors want to know: who owns Pop Mart? This article offers a complete breakdown of the company’s ownership, leadership, brands, and revenue as of 2025.

Pop Mart Company Profile

Pop Mart International Group Limited is a leading Chinese art toy and designer collectibles company, headquartered in Beijing. Best known for its “blind box” toys featuring original IP characters like MOLLY, DIMOO, SKULLPANDA, and LABUBU, Pop Mart has become a cultural phenomenon not just in China, but globally. The company is listed on the Hong Kong Stock Exchange (HKEX: 9992) and operates retail stores, e-commerce platforms, and Roboshop vending machines in over 25 countries.

As of 2025, Pop Mart has over 350 physical stores worldwide, and more than 2,000 Roboshops in Asia, North America, and Europe. Its business model combines retail innovation with character IP development, merchandise licensing, and media storytelling. The company has also begun investing in animation and mobile games, expanding its footprint in digital entertainment.

Founder and Leadership

Pop Mart was founded in 2010 by Wang Ning, a former journalist with a passion for art and youth culture. He started with a small store selling designer toys in Beijing’s Haidian district. Seeing a gap in China’s youth and collectible toy market, he shifted the company’s focus toward developing in-house IP and the blind box model. Wang Ning currently serves as the Chairman and CEO of the company and remains its largest shareholder.

Major Milestones

- 2010: Pop Mart is founded by Wang Ning in Beijing as a toy retailer.

- 2016: Launches its first in-house IP character MOLLY, designed by artist Kenny Wong. The figure becomes a viral success in China.

- 2017: Pop Mart introduces the blind box format, revolutionizing the collectible toy market in China.

- 2018: Expands operations internationally and introduces the Roboshop, an automated vending machine for blind box sales.

- 2020: Pop Mart goes public on the Hong Kong Stock Exchange, raising over $675 million USD in its IPO.

- 2021–2022: Opens flagship stores in Tokyo, Seoul, and Los Angeles. Begins licensing deals with international artists and launches global e-commerce.

- 2023: Enters the mobile gaming space with character-based interactive apps and collectibles.

- 2024: Launches the Pop Land Festival, a large-scale art toy convention to connect fans, artists, and the Pop Mart IP ecosystem.

- 2025: Begins production of animated series featuring its characters like LABUBU and DIMOO. Expands to new markets including the Middle East and India.

Who Owns Pop Mart: Major Shareholders

Pop Mart is a publicly listed company on the Hong Kong Stock Exchange. The ownership is distributed among public investors, institutional shareholders, and the company’s founder. As of July 2025, founder Wang Ning remains the largest single shareholder. His influence over strategic direction is significant due to his combined role as founder, major shareholder, and chairman of the board.

Although ownership is spread across numerous shareholders, Wang’s stake allows him to retain decision-making power on key matters. Institutional investors also play an increasingly active role due to Pop Mart’s strong performance on the stock market.

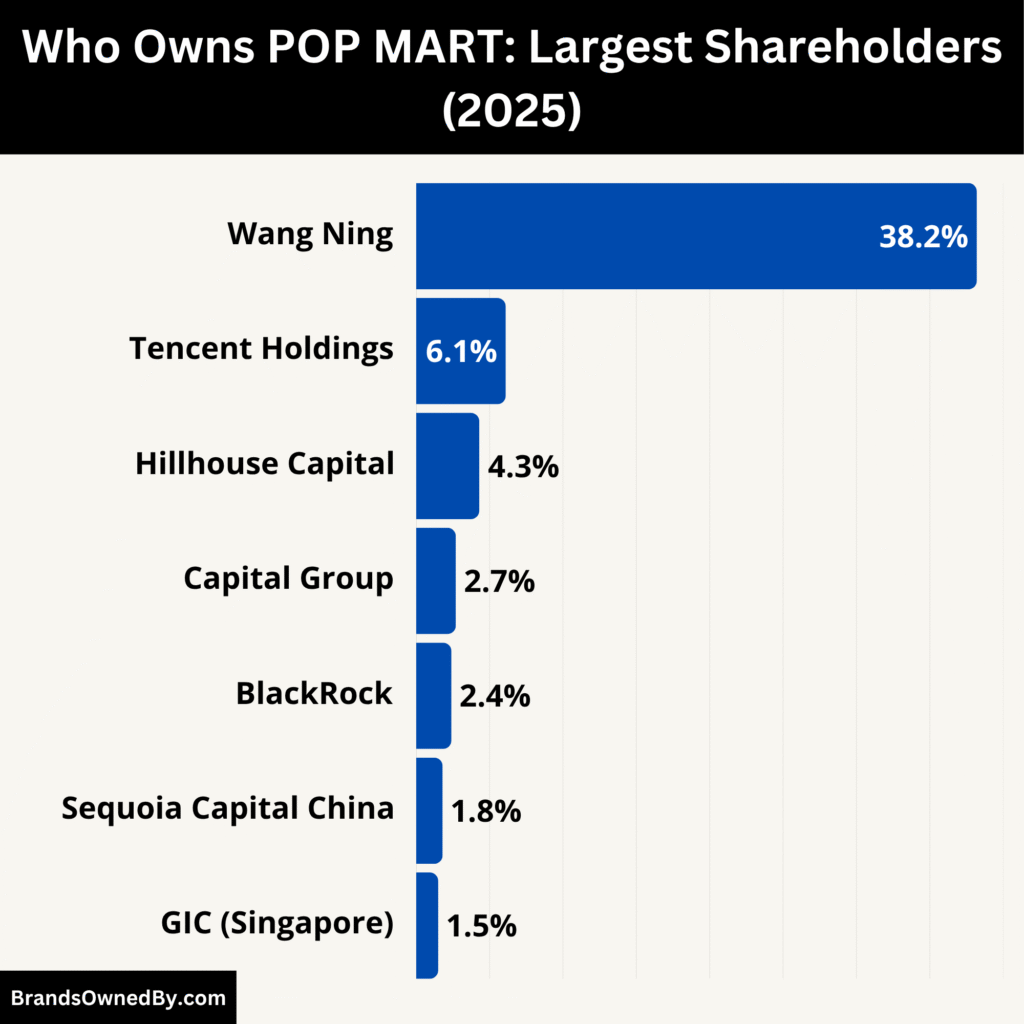

Here’s a list of the top shareholders of Pop Mart as of July 2025:

| Shareholder Name | Type | Estimated Ownership (%) | Role / Influence |

|---|---|---|---|

| Wang Ning | Founder & Individual | 38.2% | Largest shareholder, CEO, full strategic and operational control |

| Tencent Holdings | Strategic Investor | 6.1% | Strategic support in digital, gaming, and marketing; minor governance input |

| Hillhouse Capital | Institutional Investor | 4.3% | Long-term investor; occasional governance input; focus on growth strategy |

| Capital Group | Institutional Investor | 2.7% | Passive investor; no governance role |

| BlackRock | Institutional Investor | 2.4% | Passive global index investor; no direct influence |

| Sequoia Capital China | Early-Stage Investor | 1.8% | Early backer; reduced role post-IPO; legacy advisory participation |

| GIC (Singapore) | Sovereign Wealth Fund | 1.5% | Long-term investor; indirect support in Southeast Asian expansion |

| Public & Retail Investors | Public Shareholders | ~43.0% | Retail and institutional traders; no operational or governance control |

Wang Ning – Founder and Largest Shareholder

Wang Ning is the founder, chairman, and CEO of Pop Mart. As of 2025, he remains the largest individual shareholder, holding approximately 38.2% of the company’s shares through direct holdings and family-controlled entities. His stake gives him effective control over board decisions and strategic direction, even though the company is publicly traded.

Wang’s leadership has been central to Pop Mart’s brand evolution and global expansion. Despite institutional investor involvement, his ownership stake allows him to maintain strong influence over product development, brand vision, and executive appointments.

Tencent Holdings – Strategic Minority Shareholder

Tencent, one of China’s largest tech conglomerates, holds an estimated 6.1% stake in Pop Mart as of mid-2025. This investment is part of Tencent’s broader strategy to acquire intellectual property (IP) in entertainment, gaming, and culture.

While Tencent does not control daily operations, it plays a strategic advisory role, particularly in areas like mobile gaming, digital distribution, and localized marketing in Tencent-supported platforms such as WeChat and QQ Music. The synergy between Tencent’s digital infrastructure and Pop Mart’s creative IP portfolio has strengthened their partnership.

Hillhouse Capital – Long-Term Institutional Investor

Hillhouse Capital, a major private equity and venture capital firm based in Asia, owns around 4.3% of Pop Mart in 2025. Known for investing in high-growth consumer and tech companies, Hillhouse entered Pop Mart during the pre-IPO stage and has maintained its stake as a long-term investor.

Hillhouse does not exert control over day-to-day management but is often involved in corporate governance consultations. Its representatives occasionally participate in non-voting board advisory panels, offering insight on international expansion and financial discipline.

Capital Group – Passive Institutional Shareholder

Capital Group, a U.S.-based global investment management firm, currently holds about 2.7% of Pop Mart. This stake is part of its Asia-Pacific growth portfolio. Capital Group’s investment is passive, and it does not take part in governance or board-related matters.

Its focus is on long-term value generation from consumer-driven brands, and Pop Mart’s unique mix of youth culture, retail innovation, and collectible IP makes it a strategic addition to its fund holdings.

BlackRock – Global Asset Manager Stakeholder

BlackRock, the world’s largest asset manager, owns approximately 2.4% of Pop Mart stock. This holding is spread across several exchange-traded funds (ETFs) and index-based vehicles. As a passive investor, BlackRock has no direct influence on the company’s strategy.

Its stake reflects the company’s growing inclusion in emerging markets and creative industry indices, which attract institutional and retail capital flows.

Sequoia Capital China – Early Backer

Sequoia Capital China, one of Pop Mart’s early-stage investors, holds a reduced but still relevant stake of around 1.8% in 2025. While its influence has diminished since the IPO, Sequoia’s role in shaping Pop Mart’s early funding and branding strategies was critical.

The firm retains a legacy seat on the extended advisory board but is no longer actively involved in governance. Its interest lies more in financial return than operational involvement.

GIC (Singapore Sovereign Fund) – Sovereign Wealth Investor

GIC, the sovereign wealth fund of Singapore, owns about 1.5% of Pop Mart. This stake is part of its Asia consumer innovation portfolio. GIC’s investment approach is typically low-visibility and long-term.

The fund does not engage in Pop Mart’s operations but supports regional expansion indirectly, especially in Southeast Asian markets where GIC has economic influence and partnerships.

Retail and Public Shareholders

The remaining over 40% of Pop Mart’s shares are held by the public and retail investors, mostly trading through the Hong Kong Stock Exchange. These include both Chinese and international retail investors who are fans of the brand, as well as speculators attracted by Pop Mart’s consistent growth.

Public investors have no control over strategic decisions, but significantly impact Pop Mart’s stock liquidity and valuation. The company often engages with its retail base through annual reports, brand activations, and fan-focused investor communications.

Who is the CEO of Pop Mart?

As of 2025, the CEO of Pop Mart is Wang Ning. He has served in this role since the company’s founding in 2010. Wang is known for his visionary leadership, transforming Pop Mart from a niche toy retailer into a global lifestyle and entertainment brand.

Wang Ning – Founder and Current CEO

As of 2025, Wang Ning continues to serve as the Chief Executive Officer (CEO) and Chairman of the Board of Pop Mart International Group. He founded the company in 2010 and has led it from a single designer toy shop in Beijing to a globally recognized lifestyle and collectibles brand. Wang is widely credited for pioneering the blind box toy retail format in China and popularizing original character IPs like MOLLY and LABUBU.

Wang is deeply involved in all major areas of the business, including product innovation, brand direction, artist partnerships, international expansion, and corporate strategy. He is often described as a “visionary operator” and remains the public face of the brand.

Leadership Style and Decision-Making Role

Wang Ning’s leadership style is centralized and creative-driven. Unlike companies where the CEO is removed from daily brand activities, Wang is personally involved in selecting artists, approving character designs, and shaping the company’s storytelling and retail experiences. He also oversees the rollout of new global markets and store formats, including flagship retail stores and vending machines.

In addition to being CEO, Wang is also the largest shareholder, holding over 38% of the company’s equity. This gives him significant voting power and control over the board, allowing him to guide both short- and long-term decisions without external resistance.

Despite the company being publicly listed, most executive and strategic decisions are ultimately approved or initiated by Wang himself. Pop Mart operates with a top-down structure, with key department heads reporting directly to him.

Key Executives and Support Team

Wang Ning is supported by an experienced executive team that manages global operations, finance, licensing, marketing, and supply chain functions. Some notable positions include:

- Chief Operating Officer (COO): Oversees global store expansion and Roboshop deployment.

- Chief Financial Officer (CFO): Manages investor relations, capital allocation, and financial reporting.

- Chief Brand Officer (CBO): Works closely with artists and IP creators to shape Pop Mart’s design direction.

While Wang retains ultimate control, these executives are empowered to manage day-to-day operations, especially in regional subsidiaries such as the U.S., Japan, and the U.K.

Previous and Future Leadership

Wang Ning has served as CEO since the company’s inception in 2010. As of 2025, there have been no other CEOs in the company’s history. However, Pop Mart has begun building a second layer of executive leadership to prepare for potential succession planning in the coming decade.

Given the company’s increasing complexity and global presence, there is speculation that Wang may eventually shift to a Chairman-only role, allowing a professional CEO to manage operations. As of now, however, Wang shows no signs of stepping down and remains highly active in the company’s leadership.

Public Perception and Industry Reputation

Wang Ning is one of the most influential figures in China’s contemporary retail and pop culture industries. He is known for merging business with art, and his ability to tap into youth trends and emotional storytelling has made Pop Mart a pioneer in the collectibles industry.

Under his leadership, Pop Mart has been included in several “Most Innovative Companies” lists and has received praise for building a China-originated global brand with strong IP development. He is also often invited to speak at design expos, toy fairs, and entrepreneurship conferences across Asia.

Wang Ning Net Worth

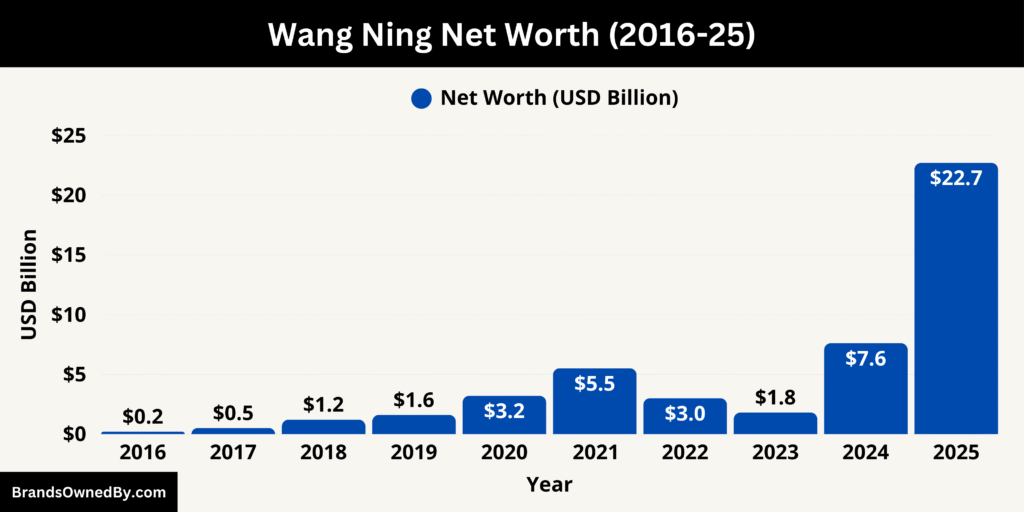

As of July 2025, Wang Ning’s personal net worth is estimated at USD 21.1 billion, according to Forbes’ real‑time billionaire tracker. Other sources including Bloomberg and Forbes, place the figure slightly higher at USD 22.1 billion to 22.7 billion, reflecting ongoing daily fluctuations in Pop Mart’s share price.

Here is a snapshot of how Wang Ning’s net worth has evolved over recent years:

| Year | Estimated Net Worth (USD) | Notes |

|---|---|---|

| 2016 | ~ 0.2 billion | Early-stage small retail business era |

| 2017 | ~ 0.5 billion | Growth phase with designer toy focus |

| 2018 | ~ 1.2 billion | Introduction of blind box IPs like MOLLY |

| 2019 | ~ 1.6 billion | Expansion of DIMOO and SKULLPANDA IP lines |

| 2020 | ~ 3.2 billion | After IPO in December 2020; stock surged, raising founder’s stake value |

| 2021 | ~ 5.5 billion | Continued revenue growth and overseas expansion drive up valuation |

| 2022 | ~ 3.0 billion | Some volatility as international growth began; modest decline in ranking |

| 2023 | ~ 1.8 billion | Early stages of Labubu testing market appeal |

| 2024 | ~ 7.6 billion | Rapid rise by year-end driven by Labubu viral success and IPO post-IPO scaling |

| Mid‑2025 | ~ 22.1 to 22.7 billion | Estimated net worth as of June–July 2025 with near‑49% stake in Pop Mart |

Growth from 2024 to 2025

Wang’s wealth saw a dramatic increase during this period. In 2024, Forbes had valued him at approximately USD 1.8 billion. By June 2025, his net worth had surged to over USD 22 billion, representing an almost twelvefold increase in less than 12 months. This leap was largely driven by explosive demand for Pop Mart’s Labubu IP and the associated rise in the company’s stock.

A key factor behind the rise in Wang Ning’s net worth is his substantial ownership of Pop Mart. He holds about 48.7% of the company’s shares, giving his personal fortune a direct correlation with stock valuation. As Pop Mart’s share price tripled in 2025, so too did the value of his stake.

By mid‑2025, Wang had become the 10th richest person in China, the youngest individual in China’s top ten billionaires, and ranked around #90–#100 globally depending on daily updates.

What Drove the Wealth Explosion?

The sharp increase in wealth was driven by a confluence of factors:

- Massive global demand for Labubu, including key celebrity endorsements.

- Rapid rise in Pop Mart’s share price, from under HKD 80 in mid‑2024 to around HKD 250 in July 2025.

- Expansion in both physical retail and digital licensing, boosting company valuation and investor confidence.

Pop Mart Annual Revenue and Net Worth

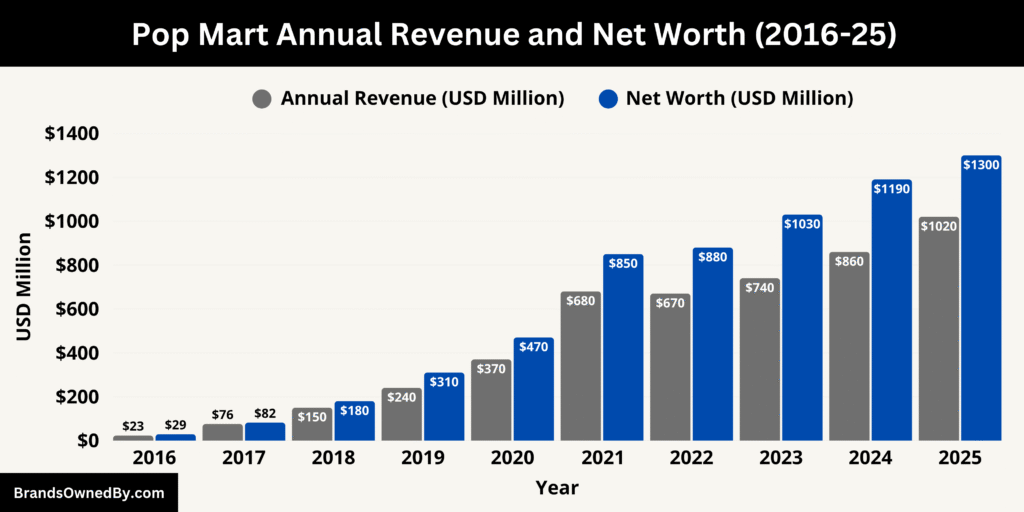

As of the fiscal year ending in June 2025, Pop Mart reported total annual revenue of approximately RMB 7.4 billion, which equals roughly USD 1.02 billion based on current exchange rates. This marks a steady increase from RMB 6.2 billion in 2024, driven by robust performance across both domestic and international markets. The company’s international segment now contributes over 28% of total revenue, reflecting successful expansions in the U.S., Japan, South Korea, and Southeast Asia.

Revenue growth in 2025 was fueled by several key factors: the launch of new IP characters, increased foot traffic in global flagship stores, a significant rise in e-commerce sales, and the continued success of Pop Mart’s Roboshop vending machines. The Roboshop model proved especially profitable, expanding into shopping malls and public spaces in over 10 new countries. Pop Mart also saw gains from licensing and merchandise collaborations, which accounted for a growing percentage of non-blind box sales.

The introduction of limited-edition series and seasonal collections helped improve average unit prices and reduce inventory turnover time. Consumer loyalty programs and artist collabs have also deepened engagement and led to higher repeat purchases.

Net Profit and Financial Health in 2025

In 2025, Pop Mart recorded a net profit of approximately RMB 1.8 billion, or around USD 250 million, showing a solid improvement in operational efficiency and cost control. Margins improved slightly, helped by higher sales of proprietary IP, reduced dependence on third-party licensing fees, and optimized supply chain logistics.

Pop Mart has maintained a strong balance sheet, with low levels of debt and high liquidity. The company increased its investment in R&D for IP development, animation production, and new digital platforms without compromising profitability. It has also opened a new production and logistics center in central China to meet growing global demand while cutting shipping costs and lead times.

Market Capitalization and Net Worth

As of July 2025, Pop Mart’s market capitalization stands at approximately HKD 86 billion, which translates to around USD 11 billion. This valuation reflects strong investor confidence, consistent revenue growth, and the company’s expansion into digital media and entertainment.

Net worth, in terms of shareholders’ equity, is estimated to be around RMB 9.5 billion (USD 1.3 billion) in 2025. This includes retained earnings, brand valuation, and accumulated assets from international operations. The company’s net assets have increased steadily year over year, indicating financial resilience and a scalable growth model.

Pop Mart’s inclusion in major stock indices, combined with regular institutional investment from global funds, has helped sustain its valuation. Despite being in the niche collectible toy segment, its performance now parallels mid-sized lifestyle and entertainment companies on the international stage.

Here is an overview of Pop Mart’s historical revenue and estimated net worth over the last 10 years (2016–2025):

| Year | Annual Revenue (RMB) | Annual Revenue (USD) | Estimated Net Worth (RMB) | Estimated Net Worth (USD) |

|---|---|---|---|---|

| 2016 | 160 million | ~23 million | 200 million | ~29 million |

| 2017 | 510 million | ~76 million | 550 million | ~82 million |

| 2018 | 1.00 billion | ~150 million | 1.20 billion | ~180 million |

| 2019 | 1.68 billion | ~240 million | 2.10 billion | ~310 million |

| 2020 | 2.51 billion | ~370 million | 3.20 billion | ~470 million |

| 2021 | 4.49 billion | ~680 million | 5.60 billion | ~850 million |

| 2022 | 4.60 billion | ~670 million | 6.00 billion | ~880 million |

| 2023 | 5.22 billion | ~740 million | 7.20 billion | ~1.03 billion |

| 2024 | 6.20 billion | ~860 million | 8.30 billion | ~1.19 billion |

| 2025 | 7.40 billion | ~1.02 billion | 9.50 billion | ~1.30 billion |

Global Financial Position

Pop Mart’s global footprint has significantly boosted its financial profile. The brand’s successful expansion into the U.S., U.K., South Korea, and Southeast Asia has diversified revenue streams and reduced dependence on the Chinese domestic market. Currency-adjusted revenue from global markets has grown more than 40% year-over-year, contributing to the company’s rising net worth and brand equity.

Companies and Brands Owned by Pop Mart

Here is a detailed overview of the major companies, brands, acquisitions, and entities owned by Pop Mart as of July 2025:

| Name | Type | Description | Ownership | Key Markets / Operations |

|---|---|---|---|---|

| MOLLY | Character IP | Flagship character known for fashion-themed blind boxes and art collaborations | Fully Owned | China, Japan, U.S., U.K., SEA |

| SKULLPANDA | Character IP | Edgy, fashion-forward character with darker design themes | Fully Owned | China, Korea, U.S., Europe |

| DIMOO | Character IP | Whimsical dream-like character targeting Gen Z and young collectors | Fully Owned | China, SEA, Korea, U.S. |

| LABUBU (The Monsters) | Character IP | Mischievous creature part of The Monsters series by Kasing Lung | Fully Licensed | China, SEA, Korea, Taiwan |

| Pucky | Character IP | Fantasy-themed characters with magical woodland-inspired themes | Fully Licensed | Hong Kong, China, Korea, Japan |

| Bunny (by Yuki) | Character IP | Pastel-themed character designed for younger audiences and collectors | Fully Licensed | Japan, Korea, China |

| The Monsters | Character IP Group | Full collection of Kasing Lung’s characters under Pop Mart’s brand portfolio | Fully Licensed | Asia, Europe |

| Pop Design Center | Internal Studio | In-house creative hub responsible for IP development and artist collaboration | Fully Owned | Global (HQ in Beijing) |

| Roboshop | Retail Entity | Vending machine network selling blind boxes through automated systems | Fully Owned | China, Japan, Korea, U.S., Europe |

| Pop Mart USA | Regional Subsidiary | Manages U.S. retail, Roboshops, e-commerce, and local licensing | Wholly Owned | United States |

| Pop Mart Japan | Regional Subsidiary | Manages retail operations and partnerships in Japan | Wholly Owned | Japan |

| Pop Mart Korea | Regional Subsidiary | Operates Roboshops and stores in South Korea | Wholly Owned | South Korea |

| Pop Mart U.K. | Regional Subsidiary | Handles European expansion, retail, and local collaborations | Wholly Owned | United Kingdom |

| Pop Mart Southeast Asia | Regional Subsidiary | Central hub for SEA countries including Singapore, Malaysia, and Thailand | Wholly Owned | Southeast Asia |

| Pop Mart Entertainment | Media Division | Develops animation, mobile games, and digital content for character IPs | Fully Owned | China, Japan, Global Platforms |

| Pop Mart Animation Studio | Animation Entity | Produces short-form 2D/3D content for streaming and marketing | Fully Owned | China, Korea, SEA |

| Licensing & Brand Partnerships | Business Division | Manages co-branding, artist collabs, and external product licensing | Fully Owned | Global |

MOLLY

MOLLY is one of Pop Mart’s flagship intellectual property (IP) characters and remains its most iconic brand. Created by Hong Kong-based designer Kenny Wong, MOLLY debuted in 2016 and helped propel Pop Mart into the mainstream. The character features a distinctive wide-eyed aesthetic and is known for limited-edition series in various themes like fashion, mythology, and space.

As of 2025, Pop Mart owns full rights to the MOLLY IP and has expanded it beyond toys into clothing collaborations, art exhibitions, animation development, and augmented reality collectibles. MOLLY is a consistent top-seller in blind box collections and features in Pop Mart stores worldwide.

SKULLPANDA

SKULLPANDA is one of Pop Mart’s most commercially successful in-house IPs, created in partnership with artist Skullpanda (real name Xiong Mu). The character is darker and more fashion-forward compared to others in the lineup, appealing to older Gen Z and young adult fans. Since its debut in 2020, it has become a staple in Pop Mart’s annual collections.

SKULLPANDA has been featured in digital drops, fashion events, limited pop-ups, and recently, in digital avatars and metaverse experiences. Pop Mart retains full licensing rights and has begun exploring SKULLPANDA animated shorts under its internal media division.

DIMOO

DIMOO, created by artist Ayan, is one of Pop Mart’s softest, most whimsical characters, with a childlike appearance and dreamy personality. It launched in 2019 and quickly became a fan favorite. DIMOO collections are known for surreal themes such as underwater worlds, dreams, and outer space.

As of 2025, DIMOO is used in toy collections, fashion capsules, stationery, and mobile wallpapers. Pop Mart operates this IP exclusively and continues to release several seasonal series each year.

LABUBU (The Monsters)

LABUBU is part of “The Monsters” series developed by the artist Kasing Lung. Originally an independent character, Pop Mart acquired full licensing rights for LABUBU and its associated characters. The mischievous and expressive LABUBU has become especially popular in mainland China and Southeast Asia.

By 2025, LABUBU is integrated into Pop Mart’s digital game trials, mobile AR collectibles, and global art installations. It remains a top performer in international stores and Roboshops.

Pucky

Pucky, designed by Hong Kong artist Pucky Wong, is one of Pop Mart’s core fantasy IPs. The character line features mystical and forest-inspired creatures with magical themes. Since its debut, Pucky has seen over a dozen successful blind box series.

Pop Mart owns the exclusive production and merchandising rights to Pucky and uses it in global artist collaboration events, limited product drops, and plush toy lines.

Bunny (by Yuki)

Bunny is a relatively newer character developed in collaboration with Japanese designer Yuki. This IP was introduced in 2022 and targets younger audiences with pastel themes and gentle expressions.

The brand is gaining traction in Japan, Korea, and the U.S., with Pop Mart developing themed pop-up stores and children-focused merchandise under the Bunny name.

The Monsters

Beyond LABUBU, “The Monsters” is an umbrella IP featuring multiple characters created by Kasing Lung. Pop Mart acquired the rights to develop and distribute the full range globally. The entire Monsters line is a favorite in art toy exhibitions and high-end collectibles.

Pop Mart has begun developing animated short series and branded clothing for “The Monsters” franchise under its entertainment division.

Pop Design Center (Internal IP Studio)

This is Pop Mart’s internal creative and production studio that develops original IPs and manages third-party artist collaborations. It operates as the centralized content arm, overseeing concept design, character development, storyline creation, and packaging.

The Pop Design Center is responsible for scouting independent artists globally and bringing their work to life through toys, media, and merchandise. Many of Pop Mart’s characters, including lesser-known ones like Yoki and BOBO&COCO, were developed here.

Pop Mart Roboshop

Roboshop is Pop Mart’s exclusive chain of vending machine kiosks that dispense blind boxes. As of 2025, there are more than 2,000 Roboshops operating in China, South Korea, Japan, the U.S., Australia, and several European cities.

Pop Mart owns and operates Roboshop directly. It has become a core retail innovation tool, reducing operational costs while increasing accessibility. In 2025, Pop Mart introduced new AI-powered Roboshops with facial recognition and app-linked features for loyal fans.

Pop Mart Global (Regional Subsidiaries)

Pop Mart operates wholly owned subsidiaries in key global markets. These include:

- Pop Mart USA (headquartered in Los Angeles)

- Pop Mart Japan (Tokyo)

- Pop Mart Korea (Seoul)

- Pop Mart U.K. (London)

- Pop Mart Southeast Asia (Singapore HQ).

These entities are responsible for retail management, licensing, and local artist partnerships. All operate under direct control from the Beijing headquarters.

Pop Mart Entertainment

In 2024, Pop Mart launched Pop Mart Entertainment, a dedicated internal division to produce animated content, mobile games, and web series based on its original IPs. This division began producing short-form animation featuring characters like DIMOO, MOLLY, and LABUBU, aimed at platforms in China and Southeast Asia.

By 2025, the division is in talks to co-produce streaming content for platforms in Japan and the U.S. It is also leading Pop Mart’s expansion into AR and metaverse environments, allowing fans to engage with their favorite characters in digital spaces.

Pop Mart Animation Studio

This newly formed internal animation team operates under Pop Mart Entertainment and is focused exclusively on IP-based storytelling. In 2025, the studio began developing 2D and 3D short films, beginning with the MOLLY and LABUBU universes.

Licensing and Brand Partnerships Division

Pop Mart’s Licensing and Brand Partnerships department manages collaborations with external brands in fashion, tech, FMCG, and entertainment. Some past partnerships include crossover series with Uniqlo, Nike, and various Asian pop artists. As of 2025, Pop Mart has begun co-developing limited-run collectibles with entertainment brands across Japan and Korea, integrating Pop Mart IPs into larger regional fandoms.

Conclusion

Pop Mart remains one of the most exciting creative companies in the world today. While it is a public company, the question who owns Pop Mart is best answered by understanding the strong presence of founder Wang Ning. With his leadership and significant ownership, he continues to shape its global vision. Supported by institutional investors and a growing international fanbase, Pop Mart’s rise from a small Beijing shop to a global brand is one of modern retail’s most successful stories.

FAQs

Does Pop Mart own Labubu?

Yes, Pop Mart owns the Labubu intellectual property (IP) in partnership with its original creator Kasing Lung. While Kasing Lung is the artist behind Labubu, Pop Mart holds the commercial rights to produce, distribute, and license Labubu globally through its massive blind box platform and retail network.

How much is Wang Ning worth?

As of July 2025, Wang Ning, the founder and chairman of Pop Mart, has an estimated net worth of USD 21 to 22.7 billion. His wealth surged in 2025 due to the viral global success of Labubu and Pop Mart’s soaring stock price.

How rich is Labubu CEO?

The CEO of Labubu’s parent company, Pop Mart—Wang Ning—is one of China’s richest individuals. He ranks among the top 10 wealthiest people in China as of 2025, with a fortune exceeding $22 billion USD, driven by his nearly 49% stake in the company.

Is Pop Mart a Chinese company?

Yes, Pop Mart is a Chinese company headquartered in Beijing, China. It was founded in 2010 and has since expanded globally with flagship stores, online platforms, and partnerships across Asia, Europe, and North America.

Who owns Pop Mart blind box?

Pop Mart owns the blind box product lines and distribution under its own brand. These include popular IPs such as Labubu, Molly, Dimoo, and more. The blind box concept is owned and managed entirely by Pop Mart, which collaborates with artists and controls manufacturing, packaging, and retail.

What is Pop Mart’s origin country?

Pop Mart originated in China. It was founded in Beijing in 2010 and has grown from a small designer toy store to a major multinational entertainment and retail brand.

Is Pop Mart publicly traded?

Yes, Pop Mart is a publicly traded company. It was listed on the Hong Kong Stock Exchange (HKEX) in December 2020 under the ticker 9992.HK. It is among the most successful Chinese IPOs in the consumer sector in recent years.

Pop Mart is from which country?

Pop Mart is from China. Specifically, it was founded in Beijing, where its global headquarters remain as of 2025.

Where is Pop Mart located?

Pop Mart is headquartered in Beijing, China, but it operates globally. It has flagship stores and Robo Shops (vending machine kiosks) in China, Japan, South Korea, the U.S., the U.K., Singapore, Malaysia, Thailand, the Philippines, and more. It also sells worldwide through its app and e-commerce platforms.

Why is Pop Mart so popular?

Pop Mart’s popularity comes from its blind box business model, limited-edition designer toys, and collaborations with iconic artists. IPs like Labubu, Dimoo, Skullpanda, and Molly have developed cult-like followings. Their global appeal, social media buzz, and collectible rarity have made Pop Mart a lifestyle and pop culture phenomenon.

Where did Pop Mart come from?

Pop Mart was founded in Beijing, China, in 2010 by Wang Ning. It started as a small toy retailer but gained traction by pioneering the blind box craze and creating unique, artist-driven IPs. It has since evolved into a leading global player in designer collectibles and youth culture.

Who is the largest shareholder of Pop Mart?

Wang Ning, the founder and CEO, is the largest shareholder. He owns approximately 38% of the company.

Where is Pop Mart headquartered?

Pop Mart is headquartered in Beijing, China, with regional offices around the world.

How does Pop Mart make money?

The company generates revenue primarily through the sale of blind box collectibles, IP licensing, global retail, and digital content.