National Amusements is a powerful and lesser-known force behind some of the biggest names in media. Many people ask, who owns National Amusements because of its crucial role in shaping global entertainment. The company serves as the parent of Paramount Global and plays a central role in controlling CBS, MTV, and other iconic media brands.

National Amusements Company Profile

National Amusements, Inc. is a privately held American media holding company headquartered in Norwood, Massachusetts. It is best known for being the majority voting shareholder of Paramount Global—the media conglomerate that owns CBS, MTV, Nickelodeon, Paramount Pictures, and streaming services like Paramount+ and Pluto TV.

Although it began as a movie theater chain, National Amusements evolved into a powerful corporate entity that influences the global entertainment industry. Its control over Paramount Global gives it strategic influence over television, film, digital content, and publishing sectors (until 2023).

As of 2025, Shari Redstone is the company’s President and Chairwoman. She is the daughter of the late media mogul Sumner Redstone, who built the company into the media powerhouse it is today.

National Amusements continues to play a central role in the direction of U.S. media, shaping boardroom decisions at Paramount Global and driving corporate strategies across all its subsidiaries.

Company Details

- Name: National Amusements, Inc.

- Type: Private (family-owned)

- Founded: 1936

- Headquarters: Norwood, Massachusetts, United States

- President & Chairwoman: Shari Redstone

- Industry Focus: Media ownership, theater operations (minor), and corporate governance

- Ownership: Redstone family via private trusts

- Key Holding: Paramount Global (controlling ~80% of voting shares).

National Amusements itself owns only a small number of operational movie theaters today, mostly in the northeastern U.S., South America (Showcase Cinemas), and the U.K. However, its core value lies in its ownership stake in Paramount Global, which has a market capitalization in the tens of billions as of 2025.

Founders of National Amusements

National Amusements was founded in 1936 by Michael Redstone (born Max Rothstein), an immigrant and businessman. He started the company as a drive-in movie theater business under the name “Northeast Theater Corporation.”

Later, his son Sumner Redstone joined and dramatically expanded the company during the 1950s–1980s. Under Sumner’s leadership, the company transitioned from a regional cinema business into a global media powerhouse.

Sumner rebranded the company as “National Amusements” and orchestrated a series of high-profile acquisitions. These include the landmark purchase of Viacom in the 1980s and the later acquisition and merger of CBS and Paramount.

Major Milestones in National Amusements’ History

1936 – Founding

Michael Redstone launches the company with a single drive-in theater in Massachusetts.

1954 – Sumner Redstone Joins

Sumner takes an active role in expanding the company’s cinema operations across the U.S.

1987 – Acquires Viacom

National Amusements, under Sumner’s leadership, acquires Viacom, then a cable and syndication company.

1994 – Acquires Paramount Pictures

Viacom (owned by National Amusements) buys Paramount Communications, adding Paramount Pictures and Simon & Schuster to its portfolio.

2000 – CBS and Viacom Merger

Viacom merges with CBS, creating one of the largest media companies in the world.

2006 – CBS and Viacom Split

The company separates CBS and Viacom into two independent publicly traded entities, but both remain controlled by National Amusements.

2019 – Viacom and CBS Re-merge

Under Shari Redstone’s leadership, the two companies remerged as ViacomCBS, later renamed Paramount Global in 2022.

2020 – Sumner Redstone Dies:

Sumner passes away at age 97. Shari Redstone assumes full leadership.

2023 – Simon & Schuster Sold

Paramount Global sells Simon & Schuster to KKR, narrowing its focus on entertainment and digital content.

2025 – Strategic Restructuring and Sale Talks

National Amusements begins exploring strategic options, including the potential sale of its controlling stake in Paramount Global, as market pressures and streaming competition intensify.

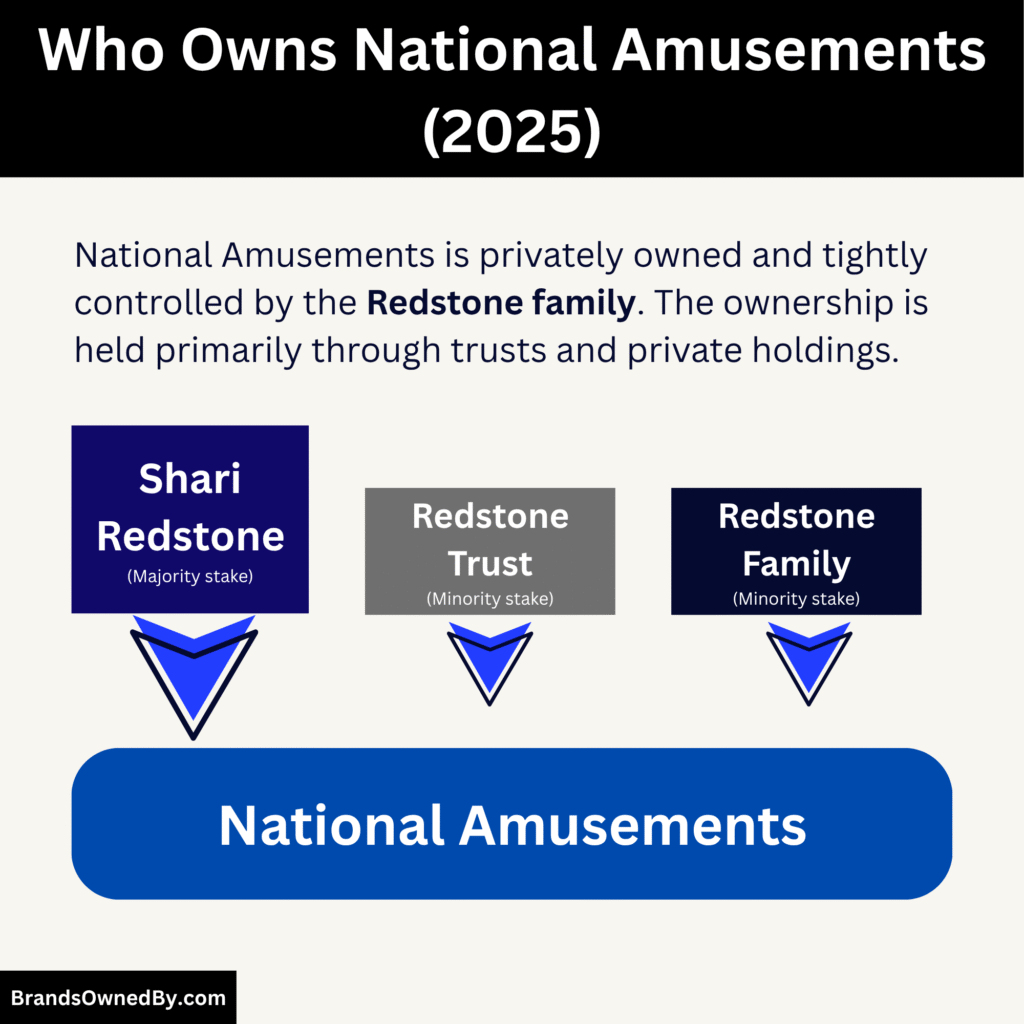

Who Owns National Amusements?

National Amusements is privately owned and tightly controlled by the Redstone family. The ownership is held primarily through trusts and private holdings. The company is not publicly traded, so its shares are not available on the stock market.

The late Sumner Redstone once controlled the majority of the company. Upon his death in 2020, his daughter, Shari Redstone, took over as the leading figure behind National Amusements. She currently serves as chairwoman of both National Amusements and Paramount Global.

Here’s a list of the top shareholders of National Amusements as of July 2025:

| Shareholder | Type | Estimated Ownership | Role / Influence |

|---|---|---|---|

| Shari Redstone | Individual | Majority (via trusts) | President of National Amusements; Chairwoman of Paramount Global; holds voting control |

| Sumner M. Redstone Trust | Family Trust | Significant minority | Established by Sumner Redstone; now controlled by Shari and trustees |

| Redstone Family Trusts (Other) | Family Trusts | Minority | Beneficiaries include other Redstone family members; limited to non-voting/equity shares |

| Yitzhak Mirilashvili | Private Investor | <5% (non-voting) | Holds a minority economic stake; no governance or voting power |

| Fiduciaries & Legal Advisors | Fiduciary roles | None (governance only) | Trustees overseeing compliance and trust administration; no direct equity |

Shari Redstone

Shari Redstone is the largest and most powerful shareholder in National Amusements. She serves as President of National Amusements and Chairwoman of Paramount Global, giving her direct oversight and decision-making authority across both entities.

Through a series of family trusts and personal holdings, Shari controls approximately 80% of the voting shares of Paramount Global via National Amusements. This includes both direct ownership in National Amusements Inc. and significant influence over the Redstone Family Trusts, from which she inherited voting power after the death of her father, Sumner Redstone.

Her control is not merely symbolic. She has led key strategic moves such as the re-merger of CBS and Viacom, the renaming to Paramount Global, and the 2023 sale of Simon & Schuster.

In 2025, she remains the key decision-maker, with strong legal and financial authority over the company’s structure and strategy.

Sumner M. Redstone Trust

Established before his death in 2020, the Sumner M. Redstone Trust was the primary vehicle through which the late media mogul maintained control over National Amusements and, by extension, Viacom and CBS.

After Sumner’s passing, control of the trust passed to Shari Redstone and a small group of fiduciaries appointed during Sumner’s lifetime. As of 2025, the trust continues to hold a significant percentage of National Amusements shares, although much of the voting control has already shifted to Shari.

The trust’s remaining assets are governed by a board of trustees, which includes legal advisors and Redstone family representatives. These trustees are mostly aligned with Shari’s leadership and decisions.

Redstone Family Trusts (Other)

In addition to the Sumner M. Redstone Trust, there are multiple other Redstone family trusts created over the years to manage and distribute wealth within the family. These include trusts benefiting Shari Redstone, her children, and other extended family members.

These trusts hold non-voting shares and residual equity in National Amusements. While they don’t possess direct control over corporate decisions, they benefit from dividends and long-term asset value. Some of these trusts were created for estate planning, tax efficiency, and legal continuity.

As of 2025, they hold a minority of National Amusements’ ownership structure and are not active in management or governance.

Yitzhak Mirilashvili (Minority Stake)

In 2024, it was disclosed that Yitzhak Mirilashvili, a Russian-Israeli entrepreneur and media investor, quietly acquired a small minority economic stake in National Amusements. This investment came during a strategic review phase, when the company was reportedly exploring financing options.

Mirilashvili’s stake is believed to be non-voting and under 5%, acquired through a private equity vehicle. While he does not have any board seat or voting influence, his investment reflects outside interest in the company’s potential monetization or restructuring moves.

Legal and Financial Advisors (Fiduciary Roles)

While not shareholders in the traditional sense, a small group of legal fiduciaries and financial advisors tied to the Redstone trusts hold temporary power in overseeing governance, estate distribution, and long-term trust administration.

These roles were appointed during Sumner Redstone’s life and were confirmed in probate after his death. As of 2025, these advisors do not hold equity, but their presence ensures compliance, regulatory transparency, and trust law continuity.

National Amusements’ Merger with Skydance Media

In July 2024, Skydance Media and Paramount Global (controlled by National Amusements) announced a definitive merger agreement valued at about $8 billion, forming a new entity dubbed New Paramount with an enterprise value around $28 billion.

The deal involves two major steps: first, Skydance buys National Amusements for $2.4 billion in cash; next, Paramount Global merges into Skydance in a stock-for-stock transaction worth $4.75 billion, with existing Paramount shareholders receiving cash and equity.

Deal Structure & Leadership Transition

- Phase 1: Skydance and its investors purchase National Amusements from Redstone for $2.4 billion.

- Phase 2: Paramount Global merges into Skydance; Paramount shareholders receive $4.5 billion in cash and shares; an additional $1.5 billion in primary capital boosts the merged company.

- Leadership roles: Skydance CEO David Ellison becomes chairman and CEO of the merged company. Jeff Shell (ex-NBCU) attains the new President title.

Regulatory Progress & Hurdles

- Approved by the SEC and European Commission (EC) in February 2025.

- The FCC review is still underway as of mid‑2025, with discussions focusing on broadcast license transfers and content guidelines.

- Timeline adjustments: original close expected H1 2025; extended automatically in April 2025 to July, and again in July 2025 to October 4, 2025.

Strategic & Financial Motivations

Paramount and National Amusements have faced streaming losses, cable cord‑cutting, and mounting debt. The merger provides:

- A fresh capital infusion and debt relief.

- $2 billion+ in expected annual cost synergies.

- Combined film, TV, animation, sports, and gaming portfolios.

Shari Redstone’s Role & Payout

- As the controlling shareholder, Shari Redstone initiated the sale to stabilize and reposition Paramount. She will receive more than $500 million, including $350 million for her stake and $180 million in pension/severance.

- She retains perks such as private jet use and Central Park apartment post‑deal, and promises to remain a company advocate (though off the board).

Risk Factors & Deal Uncertainties

- The delay stems from a high‑profile $20 billion lawsuit filed by the former U.S. President against CBS/60 Minutes.

- Political issues: questions over editorial independence, media bias, and FCC scrutiny.

- If regulatory approval doesn’t occur by October 4, 2025 (after extensions), either party can walk away with a $400 million breakup fee, unless blocked by regulators.

What Happens After Closing?

- New entity: rebranded Paramount Skydance Corporation or New Paramount.

- Ellison and Shell lead; a refreshed management team installs roles across streaming, TV, and original content.

- Strategic priorities include streaming convergence (e.g., Paramount+ + Pluto), major cost savings, and expanding into animation, sports, and gaming.

Who is the CEO of National Amusements?

Shari Ellin Redstone currently holds the combined roles of Chairwoman, President, and Chief Executive Officer at National Amusements. She succeeded her father, Sumner Redstone, and now leads the privately held company that controls Paramount Global.

Career Path & Leadership Role

Shari has been President of National Amusements since 1999, guiding its strategic direction. She became Chairwoman and CEO following Sumner’s death in 2020.

She is responsible for all major corporate decisions. Under her leadership, the company orchestrated the re-merger of Viacom and CBS in 2019, renamed the holding as Paramount Global in 2022, and negotiated the pending Skydance merger.

Responsibilities & Decision-Making

As CEO, Shari oversees financial strategy, trust structures, and media holdings. She holds ~77–80% of the voting power in Paramount Global, giving her full control over board appointments, executive hiring, major strategic moves, and asset sales. She is also tasked with managing trust governance and succession planning.

Recent Developments (2025)

In 2025, Shari has been actively navigating corporate governance challenges. The ISS recommended shareholders vote against her board re-election at Paramount due to concerns over capital structure. She also recently underwent treatment for thyroid cancer, but continues in her corporate role.

Strategic Moves

She led National Amusements into the $8.4 billion Skydance merger, aiming to stabilize and redefine its media empire. She will step down from the Paramount board post-merger but remains an influential advocate and retains significant ownership perks.

National Amusements Annual Revenue and Net Worth

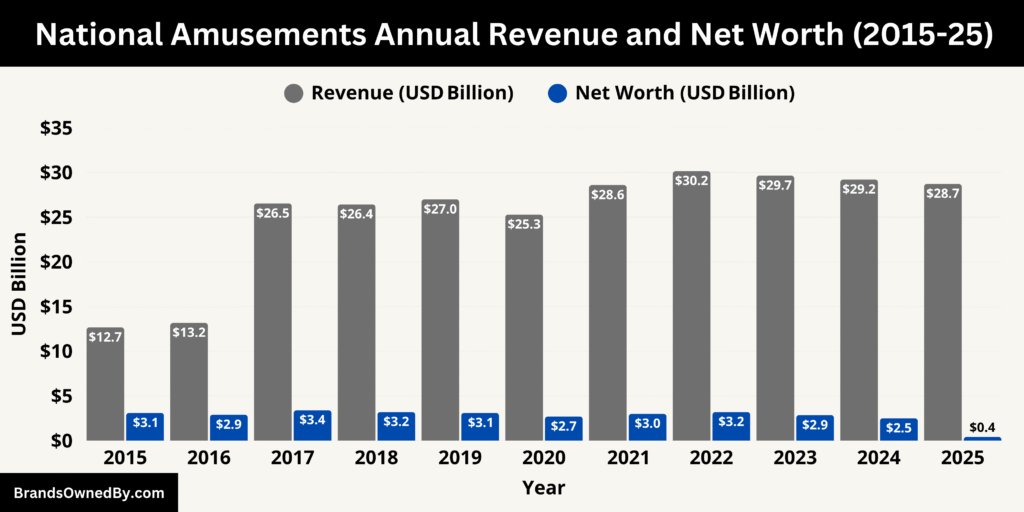

As of July 2025, National Amusements has a minimum net worth of $416 million based on public holdings, carries $650 million in debt, and oversees $28.7 billion in annual revenues through Paramount Global.

2025 Annual Revenue

National Amusements is a private firm and does not publish standalone revenue figures. Instead, its financial power is reflected through its majority control of Paramount Global, whose revenues closely mirror National Amusements’ performance. For the trailing twelve months ending March 31, 2025, Paramount Global reported revenues of $28.72 billion, marking a 4.5 percent decline from the previous year’s $30.15 billion. This drop reflects weaknesses across cable, streaming, and theatrical markets that National Amusements oversees.

A deeper look at quarterly performance shows Paramount’s Q1 2025 revenue was $7.19 billion, down 6.4 percent year-over-year. While revenues are modestly lower, streaming subscriber growth—including a 16 percent rise in Paramount+—and improved churn suggest stabilizing dynamics. These results have ripple effects on National Amusements’ valuation and financial health.

Net Worth and Valuation

Though privately held, National Amusements’ net worth can be estimated based on its holdings in publicly traded entities. As of mid-July 2025, it holds approximately 32 million shares of Paramount Global, valued at around $416 million.

Additionally, the company owns minor stakes in BB Liquidating Inc. and other holdings, which add a few thousand dollars to its value.

Including these holdings, National Amusements’ net worth currently stands at a minimum of $416 million, excluding non-public assets such as its real estate, legacy theater networks, and trademark rights—all contributing to its underlying worth beyond SEC-disclosed holdings.

Here’s an overview of the historical revenue and net worth of National Amusements from 2015 to 2025:

| Year | Revenue (USD Billions) | Estimated Net Worth (USD Billions) |

|---|---|---|

| 2015 | 12.67 | 3.10 |

| 2016 | 13.17 | 2.90 |

| 2017 | 26.54 | 3.40 |

| 2018 | 26.43 | 3.20 |

| 2019 | 26.99 | 3.10 |

| 2020 | 25.29 | 2.70 |

| 2021 | 28.59 | 3.00 |

| 2022 | 30.15 | 3.20 |

| 2023 | 29.65 | 2.85 |

| 2024 | 29.21 | 2.50 |

| 2025 | 28.72 (TTM) | 0.42 (pre-Skydance merger valuation) |

Debt, Liabilities, and Financial Resilience

Next to its equity stakes, National Amusements has maintained a significant debt load. Reports indicate $650 million in total debt, which includes $175 million owed to equity partners and approximately $200–275 million in working capital financing.

Ahead of the Skydance transaction, Redstone’s team cleared a $186 million loan—primarily financed by the Ellison family—to shore up finances and meet investor expectations.

Net worth calculations should thus consider the offset of liabilities. Despite owing, equity holdings in Paramount and other assets keep National Amusements in a stable financial position.

Financial Outlook

National Amusements’ future financial path is deeply linked to the Paramount–Skydance merger closing in late 2025. Under the deal, it will receive $2.4 billion in cash for its Paramount stake, likely boosting its liquidity and net worth once completed.

However, debt repayment and payout arrangements—like Shari Redstone’s expected $500+ million—will offset some gains.

Paramount’s revenue dip introduces short-term volatility, but debt refinancings, capital injections, and the merger’s financial structure suggest improving fundamentals. National Amusements, while small in standalone revenue and net worth, controls a media empire whose tens of billions in earnings underpin its true value.

Companies Owned by National Amusements

As of July 2025, National Amusements Inc. directly owns and operates a limited portfolio of companies, brands, and entertainment-related entities. While its most influential asset is its controlling stake in Paramount Global, National Amusements also operates its legacy cinema chains, holding companies, and other financial arms.

Below is a detailed breakdown of the major companies and brands owned by National Amusements as of July 2025:

| Company/Brand/Entity | Type | Description | Region Operated | Ownership & Role |

|---|---|---|---|---|

| Paramount Global | Media Conglomerate | Owner of CBS, Paramount Pictures, MTV, Nickelodeon, Pluto TV, and more | Global | Controlled via ~77% of Class A voting shares |

| Showcase Cinemas | Cinema Chain | Multiplex chain under National Amusements’ exhibition group | U.S., U.K., Latin America | Directly owned and operated |

| Showcase Cinema de Lux | Premium Cinema Brand | Upscale movie theaters with recliner seating and in-theater dining | U.S. | Direct brand and sub-brand |

| Showcase SuperLux | Luxury Theater Experience | Boutique theater chain with gourmet dining and premium service | Select U.S. cities | Owned and managed |

| Multiplex Cinemas | Cinema Brand | Operates in Latin America under a localized Showcase banner | Brazil, Argentina | Direct ownership and branding |

| Cinema de Lux (UK) | Theater Brand | UK version of the premium Showcase Cinema experience | United Kingdom | Direct subsidiary of National Amusements |

| National Amusements Holding Co. | Holding Entity | Manages equity, trust structures, and Redstone family corporate interests | U.S. | Legal and financial ownership vehicle |

| Real Estate Division | Real Estate Asset Division | Owns and manages theater-related property assets | U.S. (esp. Northeast) | Owned directly |

| Trademark Portfolio | Brand IP & Licensing | Trademarks like Showcase, Cinema de Lux, SuperLux, Popcorn Club, Pretzel Depot | Global (as licensed) | IP holder and brand manager |

| MovieTickets.com (legacy) | Online Ticketing Platform | Previously a joint venture for online movie ticketing | U.S. | Equity stake held historically (legacy asset) |

| StarPass / StarPerks | Loyalty Program | Theater loyalty and reward program for frequent customers | U.S., UK | Owned and operated |

| Popcorn Club | Children’s Program | Theater engagement program for children including special events and discounts | U.S. | Branded experience owned by NAI |

| Pretzel Depot | Theater Food Brand | In-house branded pretzel and snack kiosks across Showcase theaters | U.S. | Operated within Showcase theaters |

Paramount Global

Paramount Global is the largest and most influential asset controlled by National Amusements. The company was formed after the 2019 re-merger of CBS Corporation and Viacom Inc., both of which had long been under National Amusements’ control. As of July 2025, National Amusements holds approximately 77% of Paramount Global’s Class A voting shares, giving it effective decision-making control over the media conglomerate despite owning less than 10% of the economic interest (Class B shares).

Paramount Global operates a vast media empire that includes:

- Paramount Pictures (film production and distribution)

- CBS Entertainment Group (CBS Television Network, CBS News, CBS Sports)

- Nickelodeon, MTV, Comedy Central, BET, and VH1

- Paramount+ and Pluto TV (streaming platforms)

- Simon & Schuster (until its sale in 2023)

- Paramount International Networks (overseas media operations).

National Amusements influences Paramount’s board structure, CEO appointments, and strategic direction through its voting power. This control has remained central even as the company navigates its pending acquisition by Skydance Media in 2025.

While financial pressure led National Amusements to agree to sell its controlling stake to Skydance Media (through RedBird Capital Partners and other investors), the final transfer of control is not yet complete. Therefore, as of mid-2025, Paramount Global remains a core asset directly controlled by National Amusements.

Showcase Cinemas

Showcase Cinemas is the flagship brand of National Amusements’ movie theater operations. It operates under different sub-brands such as Showcase SuperLux, Showcase Cinema de Lux, and Multiplex Cinemas, mainly in the United States, the United Kingdom, Brazil, and Argentina. As of 2025, it manages more than 900 screens across these markets. The brand continues to focus on luxury in-theater experiences, premium large-format screens, and integrated dining.

Multiplex Cinemas (Latin America)

This brand operates in Brazil and Argentina, providing mid-range cinema services under the broader Showcase branding. It is fully owned and operated by National Amusements. The company has a strong foothold in key Latin American cities, offering subtitled and dubbed versions of international films. Operations were heavily affected during the COVID-19 pandemic but rebounded gradually with improved local box office sales in 2023 and 2024.

Showcase SuperLux

This is National Amusements’ luxury theater concept. Located in high-income suburbs in the U.S., it offers upscale lounge seating, in-theater full-service dining, and boutique-style décor. It targets premium audiences and competes with brands like iPic and Alamo Drafthouse.

National Amusements Holding Company

This private financial and administrative entity is the corporate holding structure through which the Redstone family manages their investments. It holds voting control in Paramount Global through Class A shares. The company also handles inter-company cash flow, asset management, estate planning for family heirs, and negotiation of merger terms—such as the ongoing Skydance deal.

Redstone Family Trusts

While not a standalone company, several Redstone family trusts are legally housed within the National Amusements structure. These trusts manage long-term equity strategies, charitable giving arms, and succession planning. They play a key role in decisions around corporate control and shareholder actions, especially under the leadership of Shari Redstone.

National Amusements Real Estate Division

This in-house division manages real estate assets tied to former or current theater locations. Some Showcase Cinema properties are wholly owned by National Amusements, including high-value commercial real estate in Massachusetts, Rhode Island, and the UK. With the rise of streaming and declining footfall in theaters, the real estate division has become increasingly important as a fallback asset for liquidity.

National Amusements Licensing & IP Arm (Limited)

Although smaller in scale, National Amusements retains limited IP rights and licensing contracts tied to its theater branding, such as Showcase and SuperLux trademarks. These are sometimes licensed in co-branded retail or event experiences.

Conclusion

National Amusements remains one of the most influential private media holding companies in the world. While it no longer runs a large theater empire, it holds immense power through its control of Paramount Global. The Redstone family, especially Shari Redstone, plays a vital role in shaping the media landscape. For anyone wondering who owns National Amusements, the answer is simple: it’s still a family business with a massive media footprint.

FAQs

What does the Redstone family own?

The Redstone family owns and controls National Amusements, Inc., a private holding company. Through National Amusements, the family historically controlled Paramount Global, which owns major entertainment assets such as:

- Paramount Pictures

- CBS Television Network

- Nickelodeon

- MTV

- BET

- Comedy Central

- Pluto TV

- Paramount+

The Redstones also directly own Showcase Cinemas, Cinema de Lux, and other global movie theater chains through National Amusements. Despite selling a portion of their equity to pay down debt in 2023, the family (led by Shari Redstone) remains the major voting shareholder of Paramount Global via Class A shares—at least until the pending Skydance Media acquisition is finalized.

How rich is the Redstone family?

As of mid-2025, the Redstone family’s wealth has declined significantly compared to its earlier peak. Following legal disputes, estate taxes, and National Amusements’ debt burden, the family’s estimated net worth is under $500 million. Shari Redstone, who leads National Amusements, is reported to have a personal net worth of around $200–250 million, down from a high of over $1 billion in the early 2020s.

The Skydance deal may improve the family’s liquidity position, but most of the assets they once controlled are now either being sold or diluted.

What is the net worth of National Amusements?

As of July 2025, National Amusements’ estimated net worth is around $420 million. This figure is based on its remaining equity stake in Paramount Global, real estate holdings, and operating revenue from Showcase Cinemas.

This is a sharp decline from previous years when the company’s net worth exceeded $3 billion. The reduction reflects Paramount’s stock value drop, National Amusements’ debt restructuring, and reduced direct asset ownership. The expected Skydance acquisition, which includes a $2.4 billion capital injection, may restore National Amusements to a net worth closer to $2 billion, depending on how the deal is structured and completed.

Where is National Amusements’ corporate headquarters?

National Amusements is headquartered in Norwood, Massachusetts, United States. The company’s corporate offices are located just outside Boston and serve as the main administrative hub for both its theater operations and its holding company functions related to Paramount Global.

What is National Amusements?

National Amusements is a private media holding company that controls Paramount Global, including CBS, MTV, Nickelodeon, and other brands.

Who owns National Amusements?

Shari Redstone and the Redstone family own National Amusements through private trusts and direct control.

Is National Amusements a public company?

No. It is a privately held company and not listed on the stock exchange.

What does National Amusements own?

It owns the majority of voting shares in Paramount Global, which owns Paramount Pictures, CBS, MTV, Nickelodeon, and more.

What is the relationship between National Amusements and Paramount?

National Amusements owns about 77% of Paramount Global’s voting shares, giving it control over the company.