Simon Property Group is one of the most prominent names in commercial real estate. If you’re wondering who owns Simon Property Group, this article breaks down its ownership structure, financial strength, and the major companies under its portfolio.

Simon Property Group Company Profile

Simon Property Group is the world’s largest retail-focused real estate investment trust (REIT) and a dominant force in global commercial real estate. As of 2025, the company owns, manages, or has an interest in more than 200 high-quality retail properties worldwide, including malls, Premium Outlets, lifestyle centers, and international shopping destinations. The company is publicly traded on the New York Stock Exchange under the ticker symbol SPG.

Its headquarters are located in Indianapolis, Indiana. Simon’s properties are home to a wide range of retailers, from luxury fashion brands to discount outlets, attracting millions of shoppers each year.

Founders and Early History

Simon Property Group was founded in 1960 by brothers Melvin Simon and Herbert Simon. The Simons started by developing strip malls in Indiana and gradually expanded their portfolio by focusing on enclosed regional shopping malls.

The company was originally known as Melvin Simon & Associates. In 1993, it was reorganized as a REIT and renamed Simon Property Group. That same year, the company went public in what was then the largest real estate IPO in U.S. history. The IPO helped Simon access capital to expand aggressively during the retail boom of the 1990s.

Key Milestones in Simon Property Group’s Growth

1993 – IPO Launch:

Simon Property Group becomes one of the first major mall operators to go public as a REIT. The public offering raises over $840 million.

1996 – Merger with DeBartolo Realty:

The company merged with DeBartolo Realty Corporation, another major shopping center operator, creating the largest publicly traded retail REIT in the U.S.

2004 – Acquisition of Chelsea Property Group:

Simon acquired Chelsea Property Group for $3.5 billion. This move added more than 30 Premium Outlet Centers to its portfolio and marked Simon’s entrance into the outlet shopping segment.

2007 – Purchase of The Mills Corporation:

Simon acquired The Mills, gaining large-format retail and entertainment centers including Ontario Mills and Sawgrass Mills. This move diversified the property mix and brought in more experiential retail formats.

2010s – International Expansion:

Simon expanded beyond North America with shopping centers in Japan, South Korea, Mexico, and Europe. It also developed joint ventures in Canada and China.

2020 – Taubman Centers Acquisition:

Simon acquired an 80% interest in luxury mall operator Taubman Centers, gaining high-end properties like The Mall at Short Hills and The Beverly Center.

2020 – Rescue and Co-Ownership of JCPenney:

Amid retail bankruptcies during the COVID-19 pandemic, Simon partnered with Brookfield Properties to buy JCPenney out of bankruptcy, saving thousands of jobs and preserving mall traffic.

2020–2023 – Launch of SPARC Group:

Simon co-founded SPARC Group with Authentic Brands Group. SPARC manages multiple retail brands including Brooks Brothers, Forever 21, Lucky Brand, Nautica, and Aéropostale, turning Simon into a retail operator as well as a landlord.

2024 – Digital Retail and Mixed-Use Developments:

Simon significantly invested in digital integration, omnichannel retail, and redeveloping underperforming assets into mixed-use spaces. The company focused on building apartments, hotels, and office spaces alongside malls to create lifestyle destinations.

Current Status as of 2025

Today, Simon Property Group continues to lead in the global retail property market. The company generates billions in revenue annually and maintains a strong presence in major metropolitan areas. Its mixed-use strategy, brand investments, and digital modernization have positioned it well for the future of retail and real estate.

Simon is no longer just a mall operator—it is a hybrid of real estate developer, brand stakeholder, and retail innovator. The leadership of David Simon, who has served as CEO since 1995, remains central to the company’s vision and evolution.

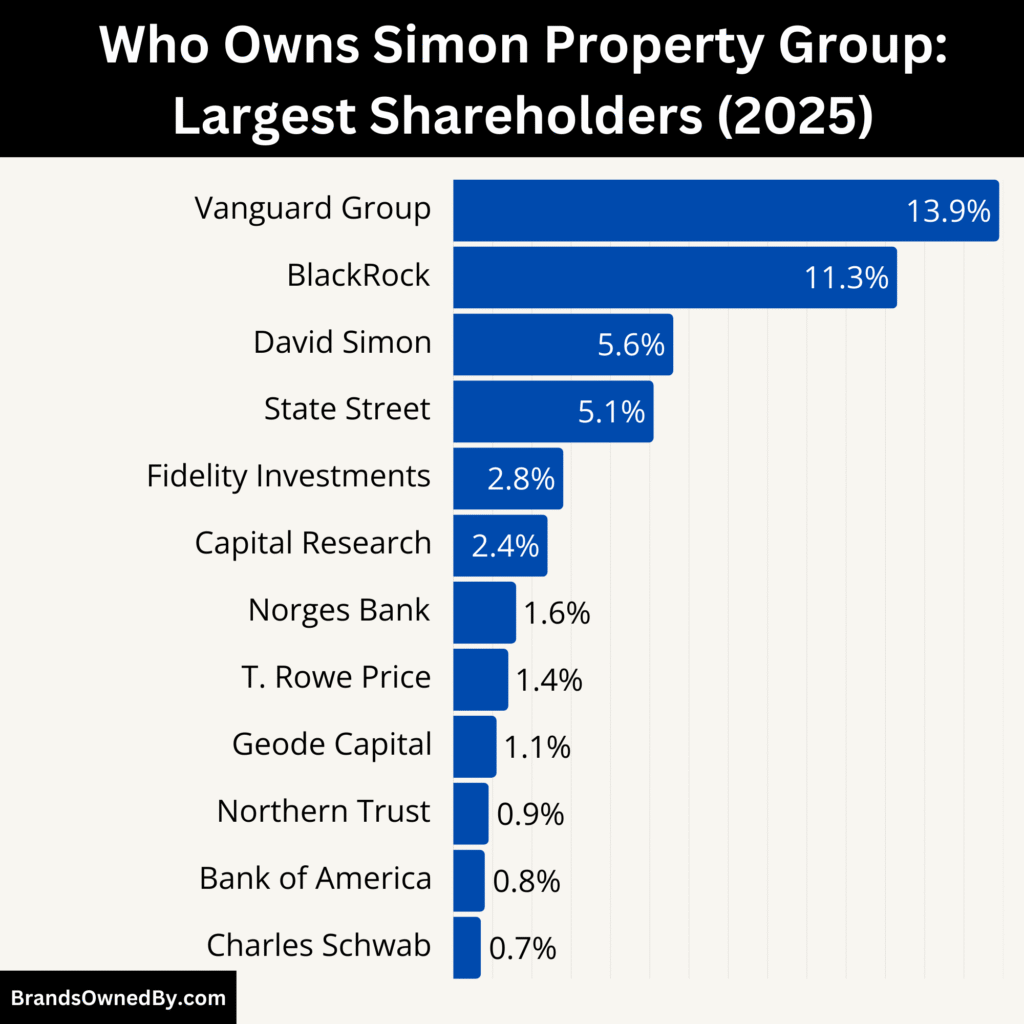

Who Owns Simon Property Group: Top Shareholders

Simon Property Group is a publicly traded real estate investment trust (REIT), and its shares are widely held by institutional investors, retail investors, and insiders. The company’s shareholder structure in 2025 reflects a balance between major asset managers, passive funds, and the founding Simon family.

Below is a list of Simon Property Group’s top shareholders as of July 2025:

| Shareholder | Ownership % | Investor Type | Investment Style | Estimated Shares Held | Influence on Governance | Role / Notes |

|---|---|---|---|---|---|---|

| Vanguard Group | 13.9% | Institutional (Asset Manager) | Passive (Index Funds) | ~45 million | High (proxy voting power) | Largest shareholder; influences board elections, policies, and executive pay |

| BlackRock Inc. | 11.3% | Institutional (Asset Manager) | Passive (ETFs & Index) | ~36.5 million | High (proxy voting power) | Key passive investor with growing ESG activism |

| David Simon | 5.6% | Insider (Executive, Family) | Active Insider Holding | ~18 million | Very High (CEO, Chairman) | Leads company strategy; family legacy; direct operational control |

| State Street Global Advisors | 5.1% | Institutional (Asset Manager) | Passive (Index Funds) | ~16.5 million | Moderate to High | Passive investor with voting rights; focuses on fiduciary governance |

| Fidelity Investments | 2.8% | Institutional (Mutual Funds) | Active (Actively Managed) | ~9 million | Moderate | Engages on performance and shareholder return issues |

| Capital Research & Management (American Funds) | 2.4% | Institutional (Active Manager) | Active (Long-Term Holding) | ~7.8 million | Moderate | Holds for long-term yield; supports board decisions |

| Norges Bank Investment Management | 1.6% | Sovereign Wealth Fund | Long-Term Value Investor | ~5.2 million | Low to Moderate | Active in ESG oversight; represents Norway’s oil fund |

| T. Rowe Price | 1.4% | Institutional (Mutual Funds) | Active (Growth/Value Funds) | ~4.5 million | Low to Moderate | Focused on dividends and yield; limited engagement |

| Geode Capital Management | 1.1% | Institutional (Index Manager) | Passive (Index Tracking) | ~3.6 million | Low | Primarily manages index portfolios for Fidelity |

| Northern Trust Corp | 0.9% | Institutional (Custodian, Funds) | Passive/Hybrid | ~2.9 million | Low | Trustee and investment advisor; minor governance role |

| Bank of America Global Research | 0.8% | Institutional (Private Equity/Fund) | Active | ~2.6 million | Low to Moderate | Invests via REIT funds and private RE portfolios |

| Charles Schwab Investment Management | 0.7% | Institutional (Fund Manager) | Passive | ~2.3 million | Low | Passive retail-facing index fund manager |

| Dimensional Fund Advisors | 0.6% | Institutional (Quantitative) | Passive/Rules-Based | ~2 million | Low | Uses factor-based investing; rarely intervenes |

| Retail Investors & Others | ~47.8% | Mixed (Individuals, Small Funds) | Mixed | ~154 million | Low (individually), Collective Impact | Retail investors, pension funds, hedge funds; highly fragmented ownership |

David Simon (Individual Insider Shareholder)

David Simon, the current Chairman and CEO, is the largest individual shareholder of Simon Property Group. As of 2025, he owns an estimated 5.6% of the total outstanding shares through direct holdings, stock awards, and trust-managed family shares.

Though his stake is smaller than that of some institutional investors, his influence is far greater. As CEO since 1995 and a key figure in the company’s transformation and growth, David Simon holds significant control over the company’s direction. He plays an active role in strategic decisions, acquisitions, and long-term development plans. His leadership is often considered a stabilizing force for investors.

Vanguard Group (Institutional Shareholder)

Vanguard Group is the largest institutional shareholder, owning approximately 13.9% of Simon Property Group as of Q1 2025. Vanguard manages multiple index and ETF funds, many of which include Simon Property Group due to its REIT status and S&P 500 inclusion.

Although Vanguard is a passive investor and does not directly participate in day-to-day decisions, its voting power during shareholder meetings gives it considerable influence on governance matters such as board elections and executive compensation.

BlackRock Inc. (Institutional Shareholder)

BlackRock is the second-largest institutional investor in Simon Property Group, holding around 11.3% of total shares. Similar to Vanguard, BlackRock’s stake is spread across its iShares ETFs, mutual funds, and institutional portfolios.

As a passive investor, BlackRock does not interfere with operations but holds strong influence through proxy voting. The firm often aligns with management on key decisions but occasionally supports governance reforms and sustainability efforts.

State Street Global Advisors (Institutional Shareholder)

State Street owns about 5.1% of Simon Property Group in 2025. It is one of the “Big Three” passive asset managers along with Vanguard and BlackRock. Its holdings are primarily via index funds and real estate-focused investment vehicles.

While passive in investment approach, State Street regularly participates in proxy voting and can influence board-level decisions if governance or performance concerns arise.

Fidelity Investments

Fidelity Investments holds approximately 2.8% of Simon Property Group through actively managed mutual funds. Unlike the passive giants, Fidelity’s fund managers may engage more closely with management on financial performance and growth strategy.

Fidelity does not control the company but is considered a medium-sized stakeholder with moderate influence.

Capital Research & Management Company

Capital Group, through its American Funds division, owns an estimated 2.4% of Simon Property Group in 2025. The firm tends to take long-term positions in blue-chip companies, and its presence in Simon’s shareholder base reflects confidence in its fundamentals.

Capital Group participates in voting and occasionally engages in corporate governance and sustainability matters.

Norges Bank Investment Management (Norwegian Sovereign Wealth Fund)

As of 2025, Norges Bank owns about 1.6% of Simon Property Group. It invests globally in large-cap companies and holds Simon as part of its global real estate and U.S. equities allocation.

Though its stake is relatively small, Norges Bank is vocal on ESG (environmental, social, and governance) practices and can influence voting outcomes on related proposals.

T. Rowe Price

T. Rowe Price holds approximately 1.4% of Simon Property Group through its growth and income-oriented mutual funds. It’s considered a long-term investor with occasional engagement on performance and shareholder return issues.

Other Retail and Institutional Investors

The remaining over 50% of Simon Property Group’s shares are held by a combination of:

- Retail investors (individuals)

- Hedge funds and private investment firms

- Pension funds

- International investment firms

No single entity among these holds more than 1% individually. However, collectively, they form a significant part of the shareholder base and contribute to market liquidity.

Who is the CEO of Simon Property Group?

As of 2025, David Simon is the Chairman, Chief Executive Officer, and President of Simon Property Group. He has been the face of the company’s transformation from a traditional mall developer into a global retail and real estate powerhouse. His leadership is closely tied to the company’s strategic direction, investor confidence, and operational success.

David Simon’s Background

David Simon is the son of co-founder Melvin Simon. He joined the company in the early 1990s and played a key role in taking Simon Property Group public in 1993. He became CEO in 1995 and Chairman in 2007. David Simon holds an MBA from Columbia University and a B.S. from Indiana University.

Under his leadership, Simon Property Group expanded into outlets, acquired high-end mall operators, ventured into brand ownership, and diversified into mixed-use real estate development. He is recognized for his forward-thinking approach to retail trends, including e-commerce integration and experiential shopping.

Key Achievements as CEO

- Led the 1993 IPO that created the largest retail REIT in the U.S.

- Oversaw major acquisitions including Chelsea Property Group (2004), The Mills Corporation (2007), and Taubman Centers (2020).

- Pivoted into retail brand ownership by co-founding SPARC Group with Authentic Brands Group.

- Rescued iconic brands like JCPenney, Brooks Brothers, and Forever 21 during the 2020 retail crisis.

- Expanded internationally into Asia, Canada, Mexico, and Europe.

- Transformed malls into mixed-use hubs by adding apartments, hotels, and offices to key locations.

As of 2025, David Simon is one of the longest-serving CEOs in the real estate industry, with a tenure spanning over 30 years.

Executive Decision-Making and Governance Structure

Simon Property Group operates with a centralized decision-making structure. The CEO, in coordination with the Board of Directors and the executive team, sets strategic direction, oversees acquisitions, manages investor relations, and drives innovation.

David Simon chairs the executive committee and leads key functions such as finance, real estate development, legal strategy, and partnerships. The board is composed of independent directors, but Simon’s influence as both CEO and Chairman provides him significant authority.

Past CEOs of Simon Property Group

Simon Property Group has had only one CEO since its IPO—David Simon. Prior to the public listing, the company was operated by Melvin and Herbert Simon, who managed the firm under its original name, Melvin Simon & Associates.

- Melvin Simon (Founder): Served as a guiding force in the company’s early years and helped shape its early developments and partnerships.

- David Simon (1995–Present): Became CEO after the IPO and has remained in this position for over three decades.

Simon Property Group’s long-term CEO leadership is rare in the REIT sector and contributes to its consistency in performance and strategic execution.

Leadership Legacy

David Simon is regarded as one of the most influential figures in modern retail real estate. In 2025, he continues to navigate challenges in retail disruption, mall reconfiguration, and digital transformation. His leadership style is defined by bold acquisitions, operational discipline, and adaptability.

He remains deeply involved in daily operations and long-term planning. His continued presence as CEO signals stability for shareholders and partners.

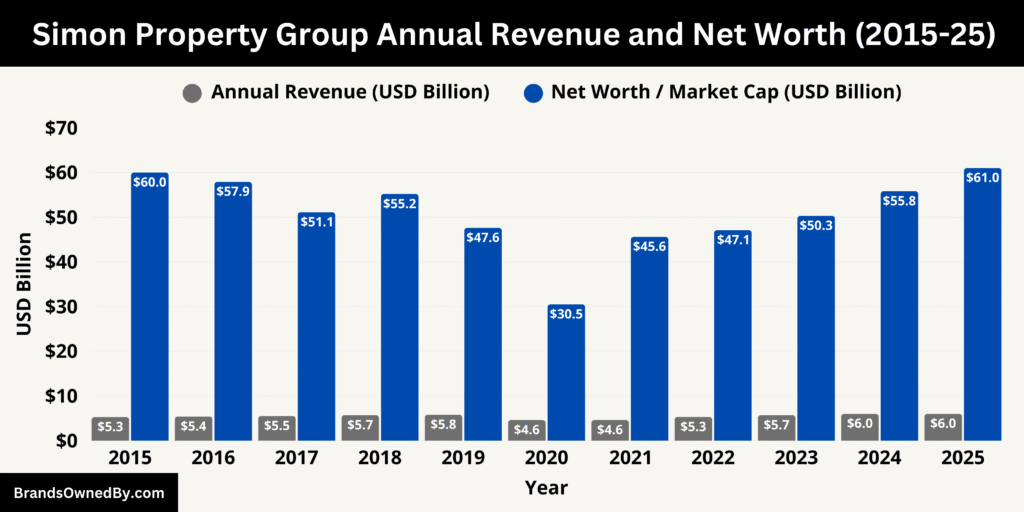

Simon Property Group Annual Revenue and Net Worth

Simon Property Group in 2025 shows steady growth in revenue and strong profitability. Its significant asset base, consistent cash flow, and strategic outlook make it a benchmark in the retail real estate sector.

2025 Annual Revenue

For the twelve months ending March 31, 2025, Simon Property Group generated approximately $5.99 billion in total revenue. This marked a solid year-over-year increase of around 4.2%, compared to $5.96 billion in 2024.

Quarterly revenue trends in early 2025 remained robust, with sales reaching $1.47 billion in Q1—a 2.1% rise from the same quarter in 2024.

Simon’s revenue is largely supported by its rental income, which includes mall leases and outlet agreements. In the trailing twelve months to March 2025, rental income accounted for about $5.45 billion, while other revenues, such as property management fees and specialty leasing contributed around $540 million. This diverse revenue mix supports healthy operating performance.

Net Income and Profitability

Net income attributable to Simon Property stood at about $2.37 billion for full-year 2024.

In Q1 2025, net income to common shareholders was reported at approximately $414 million, reflecting a decline from $732 million in the same period of 2024. This dip was due in part to temporary adjustments, including fluctuations from exchangeable bonds.

Operating margins remain strong, exceeding 50%, and net profit margins hover in the 34% range, illustrating efficient cost control. The company continues to generate substantial free cash flow, including a Q4‑2024 free cash flow of nearly $990 million, highlighting its financial flexibility.

Total Assets and Equity

As of Q1 2025, Simon Property reported total assets of approximately $36 billion, with long-term debt of $25.3 billion and total liabilities of around $29.2 billion. Tangible book value per share stood at $8.83, reflecting its strong asset base and retained earnings.

Market Capitalization and Net Worth

On July 11, 2025, Simon Property’s market capitalization (net worth) is around $61 billion, with its share price trading within a range of $136 to $190 over the prior year.

Its net worth—interpreted through equity value—remains considerable, underpinned by high-quality assets, recurring rental income, and strong investor confidence.

Here is a 10-year historical overview of Simon Property Group’s revenue and net worth (market capitalization) from 2015 to 2025:

| Year | Annual Revenue (USD) | Net Worth / Market Cap (USD) | Notes |

|---|---|---|---|

| 2025 (est.) | $5.99 billion | $61 billion | Revenue growth supported by international assets and brand partnerships |

| 2024 | $5.96 billion | $55.8 billion | Taubman acquisition fully integrated; digital leasing improved margins |

| 2023 | $5.71 billion | $50.3 billion | Bounce-back in retail; strong outlet performance post-COVID recovery |

| 2022 | $5.27 billion | $47.1 billion | Higher foot traffic and leasing post-pandemic surge |

| 2021 | $4.61 billion | $45.6 billion | Full-year recovery after 2020 closures; SPARC retail operations grew |

| 2020 | $4.60 billion | $30.5 billion | Pandemic disruption; temporary rent relief, JCPenney acquisition |

| 2019 | $5.76 billion | $47.6 billion | Pre-pandemic peak; strong earnings from Premium Outlets and Mills |

| 2018 | $5.66 billion | $55.2 billion | Focus on digital integration and international outlet growth |

| 2017 | $5.54 billion | $51.1 billion | Continued expansion in Europe and Asia |

| 2016 | $5.44 billion | $57.9 billion | High occupancy rates and strong leasing growth |

| 2015 | $5.27 billion | $60.2 billion | Strongest decade-start valuation with low retail disruption |

Forecast and Financial Outlook

Simon reaffirmed its financial guidance for full‑year 2025, projecting Real‑Estate Funds From Operations (FFO) per diluted share of $12.40 to $12.65, and net income per diluted share between $6.67 and $6.92. The company continues to benefit from solid leasing trends, improved occupancy, and steady consumer demand.

Companies Owned by Simon Property Group

As of 2025, Simon Property Group directly owns, co-owns, or operates a broad portfolio of shopping destinations, retail-focused ventures, and brand operations. While Simon remains a real estate investment trust (REIT) at its core, it has significantly diversified into retail ownership and joint ventures to drive traffic to its properties and safeguard anchor tenants.

Below is a detailed breakdown of the companies, brands, and entities owned or operated by Simon Property Group as of July 2025:

| Entity / Brand | Type | Ownership | Role / Function | Key Properties or Brands Operated |

|---|---|---|---|---|

| Simon Malls | Retail Malls | 100% owned | Operates over 100 major regional malls in the U.S. | King of Prussia, The Galleria, Roosevelt Field |

| Simon Premium Outlets | Outlet Centers | 100% owned | Operates premium outlet centers in U.S., Canada, Asia, and Mexico | Woodbury Common, Desert Hills, Orlando Premium Outlets |

| The Mills | Super Regional Malls | 100% owned (since 2007) | Large-format shopping & entertainment centers | Sawgrass Mills, Ontario Mills, Grapevine Mills |

| Taubman Realty Group | Luxury Malls | 80% owned | High-end retail mall ownership and operations | Beverly Center, The Mall at Short Hills, Cherry Creek |

| SPARC Group | Retail Brand Operator | Co-owned with ABG (Simon holds minority equity) | Manages operations and retail stores of legacy and fashion brands | Aéropostale, Forever 21, Brooks Brothers, Lucky Brand, Nautica, Eddie Bauer |

| Aéropostale | Apparel Brand | Operated via SPARC | Teen fashion brand rescued from bankruptcy | Stores located in Simon malls and outlets |

| Forever 21 | Apparel Brand | Operated via SPARC | Youth fashion brand with a large mall presence | Reopened stores across Simon properties post-2020 |

| Brooks Brothers | Apparel Brand | Operated via SPARC | Heritage American menswear brand | Located in upscale Simon malls |

| Lucky Brand | Denim/Lifestyle Brand | Operated via SPARC | Mid-tier denim and lifestyle brand | Found in both malls and Premium Outlets |

| Nautica | Apparel Brand | Operated via SPARC | Nautical-themed sportswear and casualwear brand | Expanded presence in Premium Outlets |

| Eddie Bauer | Outdoor Apparel Brand | Operated via SPARC | Outdoor and performance lifestyle brand | Store rollouts in key outlet locations |

| JCPenney | Department Store | Co-owned (Simon + Brookfield) | Anchor tenant in Simon malls; operations stabilized post-bankruptcy | 600+ locations, significant traffic generator |

| Simon Brand Ventures | Marketing/Media Unit | Internal Division | Manages branding, loyalty, and digital engagement strategies | Simon Giftcards, digital ads, shopper programs |

| Mixed-Use Developments | Real Estate Projects | 100% owned / Co-developed | Combines retail with residential, hotel, and office spaces | Phipps Plaza (Atlanta), King of Prussia Town Center |

| International Outlets | Global Retail Assets | Joint ventures (varies) | Premium outlet centers across Canada, Japan, Korea, Malaysia, and Mexico | Toronto Premium Outlets, Gotemba, Paju, Johor Premium Outlets |

Simon Malls

Simon Malls is the flagship retail portfolio of Simon Property Group. It includes over 100 regional malls across the United States, primarily located in suburban and metropolitan areas. These properties feature leading department stores, high-end retail brands, entertainment, and dining options. Simon Malls are the core assets generating consistent rental income and foot traffic.

Simon Premium Outlets

Simon Premium Outlets is a high-performing outlet center brand with more than 90 locations in the U.S., Canada, Japan, South Korea, and Malaysia. These outlets feature luxury and premium brands offering discounted pricing. This segment has consistently outperformed traditional malls due to the value-driven shopping experience.

The Mills

The Mills is a collection of large-format retail and entertainment centers acquired by Simon in 2007. These properties include some of the highest traffic-generating retail centers in the U.S., such as Sawgrass Mills (Florida), Grapevine Mills (Texas), and Ontario Mills (California). The Mills combines outlet, full-price retail, dining, and entertainment under one roof.

Taubman Realty Group (80% Ownership)

In 2020, Simon acquired an 80% stake in Taubman Realty Group. This acquisition added 24 high-end shopping centers to Simon’s portfolio. These include iconic properties like The Mall at Short Hills (New Jersey), Beverly Center (Los Angeles), and The Mall at Green Hills (Nashville). These upscale malls serve affluent shoppers and premium brands.

Taubman properties are known for higher sales per square foot and luxury-focused leasing strategies. Simon controls the operations, leasing, and redevelopment of these assets, while the Taubman family retains a 20% interest.

Catalyst Brands (Joint Venture with Authentic Brands Group)

Simon Property Group co-founded SPARC Group (Simon Properties Authentic Retail Concepts) in partnership with Authentic Brands Group (ABG). SPARC was later merged in 2025 to form Catalyst Brands, which works as the operating entity and licensee of multiple legacy and youth apparel brands. Simon has a direct equity stake in Catalyst Brands and plays a role in managing physical retail operations of the following brands:

Aéropostale

Simon helped rescue Aéropostale from bankruptcy in 2016. It now operates hundreds of stores and e-commerce channels through SPARC.

Forever 21

After acquiring Forever 21’s assets in 2020, Simon and SPARC revived the brand. It remains a staple in Simon malls and outlet centers.

Brooks Brothers

Acquired in 2020, this heritage menswear brand was integrated into the SPARC portfolio. Many Brooks Brothers stores are located in Simon’s upscale malls.

Lucky Brand

Simon also brought Lucky Brand under SPARC’s control. The denim and lifestyle brand now has a stronger outlet presence, benefiting from Simon’s property network.

Nautica

Simon and SPARC expanded the Nautica retail footprint within Premium Outlets and select malls.

Eddie Bauer

Acquired through SPARC, Eddie Bauer’s retail stores are largely found in Simon outlet centers.

Simon’s co-ownership of SPARC ensures steady occupancy in its properties while allowing direct retail revenue participation.

JCPenney (Co-Owned via Joint Venture with Brookfield Properties)

Simon Property Group owns a significant stake in JCPenney through a joint venture with Brookfield Properties. The acquisition occurred in 2020 following JCPenney’s bankruptcy. Simon manages the real estate side, and SPARC assists in merchandising. JCPenney continues to be a major anchor tenant in Simon malls, and Simon’s involvement ensures stability in mall foot traffic.

International Retail Properties and Ventures

Simon owns and operates retail properties outside the United States, particularly in:

- Canada – Through joint ventures in Premium Outlets and malls like Toronto Premium Outlets and Montreal Premium Outlets.

- Japan & South Korea – Simon has developed and co-owns multiple Premium Outlet centers in partnership with local companies. These include Gotemba Premium Outlets and Paju Premium Outlets.

- Mexico & Malaysia – Simon has invested in Premium Outlet centers targeting tourism and cross-border retail demand.

These ventures are fully integrated into Simon’s global operating portfolio and directly contribute to its earnings.

Simon Brand Ventures

Simon Brand Ventures is the company’s internal marketing and media platform. It manages digital advertising, event partnerships, loyalty programs, and mobile commerce across all Simon properties. While not a standalone company, it operates as a strategic unit that enhances tenant visibility and monetizes mall traffic.

Mixed-Use Development Projects

Simon has increasingly expanded into mixed-use real estate development, blending retail with:

- Residential (luxury apartments, condos)

- Hospitality (hotels within mall properties)

- Office spaces

- Co-working environments

Examples include Phipps Plaza in Atlanta, which now includes a Nobu Hotel, high-end offices, and dining in addition to luxury retail.

These developments are owned and operated directly by Simon, allowing it to diversify revenue beyond traditional mall rent.

Final Thoughts

Simon Property Group remains the leading REIT in retail real estate. The company has adapted to the evolution of retail by focusing on omnichannel strategies, premium assets, and brand ownership. Institutional investors and the founding Simon family continue to guide its long-term vision. Knowing who owns Simon Property Group helps understand the scale and strategy behind one of the most successful real estate firms in the world.

FAQs

Who are the shareholders of Simon Property Group?

Simon Property Group’s shareholders include a mix of institutional investors, individual insiders, and retail investors. As of 2025, the largest institutional shareholders are Vanguard Group (13.9%), BlackRock (11.3%), and State Street Global Advisors (5.1%). CEO David Simon, son of co-founder Melvin Simon, is the largest individual shareholder, owning approximately 5.6% of the company. Other shareholders include Fidelity Investments, Capital Group, Norges Bank, and T. Rowe Price. Collectively, institutional investors own more than 70% of Simon’s outstanding shares.

What does the Simons family own?

The Simon family, primarily through David Simon, owns a substantial individual stake in Simon Property Group and holds major executive and leadership influence. While they no longer own a majority of shares, the family continues to exercise significant control over the company through David Simon’s role as Chairman and CEO. The family’s wealth is largely tied to Simon Property Group stock, legacy real estate holdings, and trust-managed investments. They do not own the entire company but are its historical founders and key decision-makers.

How rich is Simon Property Group?

As of mid-2025, Simon Property Group has a market capitalization of approximately $61 billion, making it the largest retail real estate investment trust (REIT) in the world. The company’s annual revenue is estimated at $5.99 billion, and it owns or has stakes in over 200 premier properties globally. Simon has consistently ranked among the top-performing REITs and is a Fortune 500 company. It generates strong net income, high profit margins, and billions in free cash flow annually.

Who owns Simon Family Estate?

The Simon Family Estate is privately managed and not publicly listed. It consists of the personal and legacy assets of the Simon family, originally established by Melvin Simon and Herbert Simon, the founders of Simon Property Group. The estate is separate from Simon Property Group but benefits from its long-term appreciation. Family trusts and holding entities manage their interests in company shares and other investments, including philanthropic foundations and private real estate holdings.

What are the major Simon Property Group subsidiaries?

Simon Property Group does not operate through a large network of independent subsidiaries but instead manages multiple branded platforms and entities directly. The major divisions and co-owned entities include:

- Simon Malls – traditional shopping malls

- Simon Premium Outlets – outlet centers across North America, Asia, and Mexico

- The Mills – large-scale retail and entertainment complexes

- Taubman Realty Group – luxury shopping centers (80% owned)

- SPARC Group – co-owned retail brand operator for Aéropostale, Forever 21, Brooks Brothers, and more

- Simon Brand Ventures – in-house marketing and retail technology platform

- Mixed-Use Developments – residential, hotel, and office assets integrated with retail properties

How many properties does Simon Property Group own?

As of 2025, Simon Property Group owns, manages, or has interests in over 200 properties worldwide, including:

- 100+ Simon Malls

- 90+ Premium Outlet Centers

- 15+ The Mills properties

- 20+ Taubman high-end malls

- Several international outlets and mixed-use developments

These properties span across the United States, Canada, Mexico, Japan, South Korea, Malaysia, and Europe. The portfolio includes both wholly owned and jointly held assets.

Where is Simon Property Group’s headquarters?

Simon Property Group is headquartered in Indianapolis, Indiana, United States. The corporate headquarters houses the executive leadership team, real estate development operations, marketing division, leasing offices, and investor relations.

Who is the founder of Simon Property Group?

Simon Property Group was founded by Melvin Simon and Herbert Simon in 1960. Initially named Melvin Simon & Associates, it began as a small real estate firm developing strip malls in Indiana. The company later evolved into the largest retail REIT in the world. Melvin Simon played a key role in expanding the company during the 1980s and 1990s, while Herbert Simon later focused on sports ownership and philanthropy. Their legacy continues through David Simon, Melvin’s son, who is the current CEO.

What are the Simon Property Group locations?

Simon Property Group’s locations are spread across North America, Asia, and select parts of Europe. In the U.S., it has properties in nearly every major metro area including:

- New York (Roosevelt Field, Woodbury Common)

- California (Ontario Mills, Stanford Shopping Center)

- Texas (Grapevine Mills, Houston Galleria)

- Florida (Sawgrass Mills, Dadeland Mall)

- Georgia (Phipps Plaza, Lenox Square)

- Illinois (Chicago Premium Outlets, Woodfield Mall)

Internationally, Simon operates in:

- Canada (Toronto and Montreal Premium Outlets)

- Japan (Gotemba Premium Outlets)

- South Korea (Paju Premium Outlets)

- Mexico (Querétaro and Punta Norte Premium Outlets)

- Malaysia (Johor Premium Outlets)

The company continues to expand its global presence through new joint ventures and mixed-use development projects.

Who is the majority owner of Simon Property Group?

There is no single majority owner. David Simon is the largest individual shareholder, while institutional investors like Vanguard and BlackRock hold the largest combined stake.

Is Simon Property Group a family-owned company?

It was originally founded by the Simon family, but today it is a public company. The Simon family still holds a notable influence through David Simon.

What does SPG stand for in Simon Property Group?

SPG is the stock ticker symbol for Simon Property Group on the New York Stock Exchange.

Is Simon Property Group the largest mall owner in the U.S.?

Yes, Simon is the largest mall and retail property owner in the United States by revenue and property size.