Darden Restaurants is one of the largest full-service restaurant operators in the United States. If you’re wondering who owns Darden Restaurants, this article covers its ownership structure, major brands, revenue, and leadership in detail.

Darden Restaurants Company Profile

Darden Restaurants, Inc. is one of the largest full-service restaurant companies in the world. It operates multiple well-known brands that cater to various segments of the dining market, from casual to fine dining. With its headquarters based in Orlando, Florida, Darden has a broad footprint across the United States and continues to expand selectively.

Company Overview

Darden is publicly traded on the New York Stock Exchange under the symbol “DRI.” As of 2025, it owns and manages over 1,900 restaurant locations. The company employs more than 180,000 people and serves millions of customers each week.

Darden focuses on long-term brand development, strong customer service, and consistent operational efficiency. It combines centralized corporate strategy with distinct brand management, allowing each chain to maintain its unique identity.

Founders

Darden’s legacy began with William “Bill” Darden, who opened his first restaurant, The Green Frog, in Waycross, Georgia, in 1938 at the age of 19. He founded Red Lobster in 1968 in Lakeland, Florida, which marked the birth of what would later become Darden Restaurants.

Red Lobster quickly gained popularity for its accessible seafood menu and family-friendly atmosphere. General Mills acquired the concept in 1970, establishing its restaurant division with Bill Darden as a key figure. His vision for affordable, high-quality dining laid the foundation for future brands under the Darden umbrella.

Major Milestones

1968 – Bill Darden opens the first Red Lobster in Lakeland, Florida. It becomes the core of a future restaurant empire.

1970 – General Mills acquires Red Lobster and establishes its restaurant division, which would grow to include other concepts over time.

1982 – The first Olive Garden opens in Orlando, Florida. It quickly becomes one of the most successful Italian-American dining chains in the U.S.

1995 – General Mills spins off its restaurant division into an independent, publicly traded company named Darden Restaurants, Inc. This move allows Darden to focus entirely on restaurant operations.

2007 – Darden acquires Rarest Hospitality, adding The Capital Grille and LongHorn Steakhouse to its portfolio, expanding into the fine dining and steakhouse segments.

2012 – The company adds Yard House, a beer-centric, upscale casual brand, further diversifying its offerings.

2017 – Darden acquires Cheddar’s Scratch Kitchen, a fast-growing comfort food chain known for affordable, made-from-scratch meals.

2021–2025 – Darden focuses on technology upgrades, data-driven customer experiences, and operational resilience, especially in response to changing consumer behavior post-COVID-19.

Over the decades, Darden has evolved from a single seafood restaurant to a powerful portfolio of brands. Its ability to integrate new acquisitions, retain customer loyalty, and maintain operational control sets it apart in the competitive dining industry.

Who Owns Darden Restaurants: Major Shareholders

Darden Restaurants is a publicly traded company listed on the New York Stock Exchange under the ticker symbol “DRI.” It is not owned by a single person or entity but by thousands of shareholders. These include institutional investors, retail investors, and company insiders.

The largest shareholders are typically institutional investors such as asset management firms and mutual fund companies. These entities own large blocks of shares and often influence company decisions through voting rights. Retail investors, including individual shareholders, also contribute to ownership but have limited influence.

Here’s a detailed overview of the largest shareholders of Darden Restaurants:

| Shareholder Name | Ownership (%) | Approx. Shares Held | Investor Type |

|---|---|---|---|

| Capital Research & Management (CRMC) | 12.8% | ~14.9 million | Institutional (Active) |

| Vanguard Group, Inc. | 11.8% | ~13.7 million | Institutional (Passive) |

| Capital International Investors | 8.7% | ~10 million | Institutional (Active) |

| BlackRock, Inc. | 7.3% | ~8.6 million | Institutional (Passive) |

| State Street Global Advisors | 4.1% | ~4.8 million | Institutional (Passive) |

| Charles Schwab Investment Mgmt. | 3.4% | ~4 million | Institutional (Passive) |

| Raymond James Financial | 3.1% | ~3.6 million | Institutional (Active) |

| Geode Capital Management | 2.5% | ~2.9 million | Institutional (Passive) |

| Newport Trust Company | 1.6% | ~1.9 million | Institutional (Trustee) |

| JPMorgan Asset Management | 1.6% | ~1.9 million | Institutional (Active) |

| EARNEST Partners | 1.37% | ~1.6 million | Institutional |

| UBS Asset Management | 1.31% | ~1.5 million | Institutional |

| Northern Trust Global | 1.23% | ~1.44 million | Institutional |

| Citadel Advisors | 1.17% | ~1.37 million | Institutional (Hedge Fund) |

| Wellington Management Group | 1.25% | ~1.45 million | Institutional |

| Dimensional Fund Advisors | 1.09% | ~1.27 million | Institutional |

| Invesco Capital | 0.97% | ~1.13 million | Institutional |

| Peter A. Feld | 9.9% | ~11.6 million | Individual Insider |

| Corporate Insiders (Execs & Board) | 0.4–0.5% | ~0.5 million (combined) | Insider (Management) |

Capital Research & Management Company (CRMC)

CRMC, via its World Investors division, is Darden’s largest shareholder. It controls approximately 12.7–12.8% of total shares, translating to about 14.9 million shares held at the end of 2024.

As part of the influential Capital Group, CRMC plays an active governance role. It typically casts decisive votes on board elections and major corporate policies. Historically, CRMC backed Darden’s strategic acquisitions, including the stake in Cheddar’s Scratch Kitchen, signaling long-term support for brand expansion.

The Vanguard Group, Inc.

Vanguard is Darden’s second-largest institutional investor. It holds roughly 11.7–11.8%, about 13.7 million shares as of late 2024. As a passive investor, Vanguard seldom intervenes but exerts influence through proxy votes on compensation plans and sustainability policies. Its long-term stable ownership reflects consistent confidence in Darden’s operational model and brand portfolio.

Capital International Investors

Often grouped under the Capital Group umbrella but standing separately from CRMC, Capital International Investors owns about 8.6–8.7% — around 10 million shares. This makes it the third-largest institutional stakeholder. It supports Darden’s strategic governance and has backed management in vote resolutions concerning executive appointments and corporate strategy.

BlackRock, Inc.

BlackRock holds around 7.3%, approximately 8.3–8.6 million shares. As the world’s largest asset manager, BlackRock plays a significant yet traditionally passive role. Their holdings have remained stable or slightly reduced in recent years. They do, however, vote actively on ESG matters and governance issues. BlackRock’s continued investment aligns with Darden’s commitment to shareholder returns and corporate responsibility.

State Street Global Advisors

State Street owns about 4.1%, roughly 4.8 million shares. It acts as a stabilizer in institutional ownership. While typically passive, State Street supports executive compensation plans and occasionally raises concerns in areas such as environmental or social governance, though it remains aligned with management.

Charles Schwab Investment Management

Charles Schwab manages around 3.4%, about 4 million shares . Its passive strategy mirrors Vanguard and BlackRock. Schwab’s relatively smaller holdings still contribute to the board’s support of growth strategy. They also favor shareholder-friendly policies like dividend payouts and share buybacks.

Raymond James Financial (Asset Management Division)

This firm holds approximately 3.1%, or roughly 3.6 million shares . Raymond James often leans “semi-activist,” examining portfolio companies closely. But in the case of Darden, it acts as a supportive institutional voice focused on operational performance and shareholder value.

Geode Capital Management

Geode owns around 2.4–2.5%, totaling about 2.8–3 million shares . This entity is mostly passive. It values Darden’s stable revenue streams and distribution policies. Geode’s stake is modest but contributes to the broader institutional ownership base.

Newport Trust Company

This trustee firm holds around 1.6%, or 1.9 million shares, as of end‑2024 . Newport is often a custodian for family offices and smaller funds. It’s unlikely to seek changes but votes in line with institutional consensus and governance proposals.

JPMorgan Asset Management

JPMorgan holds about 1.6–1.7%, equating to 1.9 million shares . They are typically supportive of Darden’s strategic direction and improvements in digital ordering and loyalty programs.

Other Institutional Shareholders

Collectively, these smaller institutions each hold between 1–1.4%. This includes:

- EARNEST Partners ~1.37% (~1.6 million shares)

- UBS Asset Management ~1.31–1.34%

- Northern Trust ~1.23%

- Citadel Advisors ~1.17%

- Wellington Management Group ~1.25%

- Dimensional Fund Advisors ~1.09%

- Invesco Capital ~0.97%

- And other mid-tier funds.

These institutions, though individually smaller, contribute to the diversity of ownership and reinforce a consensus-driven governance model.

Peter A. Feld (Individual Insider)

Peter A. Feld, a long-time insider investor, is the top individual shareholder. He owns nearly 11.6 million shares, roughly 9.9% of the company. Unlike institutional holders, Feld holds influence through active engagement. Although not a board member, his large stake grants him informal sway in strategic direction. He is often cited supporting CEO decisions and capital allocation. Importantly, Feld has historically voted in coordination with other large holders.

Corporate Insiders & Executives

Executives and board members combined hold about 0.4–0.5% of shares, as of late 2024 . Notable insider activity in late 2024:

- CFO Rajesh Vennam sold ~7,228 shares in December and retains about 10,262 shares.

- SVP Douglas Milanes sold ~7,892 shares in January, now holding ~3,914 shares.

Despite selling activity, insider holding magnitudes remain modest. Their presence aligns corporate leadership with shareholder interests through personal investment.

Who is the CEO of Darden Restaurants?

Rick Cardenas began his journey at Darden as a busser in 1984, working weekends at Red Lobster while attending the University of Central Florida. He transitioned to a corporate role in 1992, starting as an auditor in Orlando and then spent several years away in consulting—at Bain & Company and the Parthenon Group—before returning in 2001 as Director of Corporate Development.

Ascent Through Finance and Strategy

Over time, Cardenas advanced into senior leadership roles, including Senior Vice President of Strategy and Senior Vice President, Chief Financial Officer. His analytics-driven approach and strategic acumen earned him respect among colleagues, paving the way for greater responsibilities .

Appointment as CEO

In December 2021, Darden’s board unanimously elected Cardenas as the company’s fourth CEO. He officially took on the role on May 30, 2022. His appointment marked a unique leadership journey—from frontline staff to the top executive position.

Leadership Style and Achievements

Cardenas is known for his “back-to-basics” philosophy, emphasizing operational excellence and value-driven promotions. Under his leadership, Darden navigated economic challenges, posting strong same-restaurant sales growth across brands like Olive Garden (+6.9%) and LongHorn (+6.7%). He recently led the company’s divestment strategy for Bahama Breeze and expansion of digital and delivery partnerships, like pilots with Uber Direct .

Compensation and Stock Holdings

According to filings, Cardenas earns around $3.31 million annually in base salary as CEO, President, and Director. His total compensation includes performance-based incentives. As of June 2025, he personally owns approximately 58,836 shares of Darden stock, valued at over $13 million.

Public Engagement and Recognition

Cardenas rang the NYSE opening bell on May 30, 2025, in celebration of Darden’s achievements. He is also an active public spokesperson—discussing consumer trends, strategy, and financial outlook during earnings calls and interviews. His leadership earned attention both within the restaurant industry and beyond as a former busser rising to CEO.

Board and Governance Role

In addition to his CEO duties, Cardenas serves on the Darden Board of Directors. He collaborates closely with the board to align strategy, succession, and corporate governance. The board includes independent members and former executives, with Cynthia T. Jamison serving as Chair.

Previous CEOs

- Gene Lee (2015–2022): Oversaw major acquisitions like Cheddar’s and Chuy’s and strengthened digital infrastructure.

- Clarence Otis Jr. (2004–2015): Guided expansion of core brands and acquisition of Rarest Hospitality (LongHorn, The Capital Grille).

- Joe Lee (1995–2004): Led Darden post-spin-off growth and initial diversification.

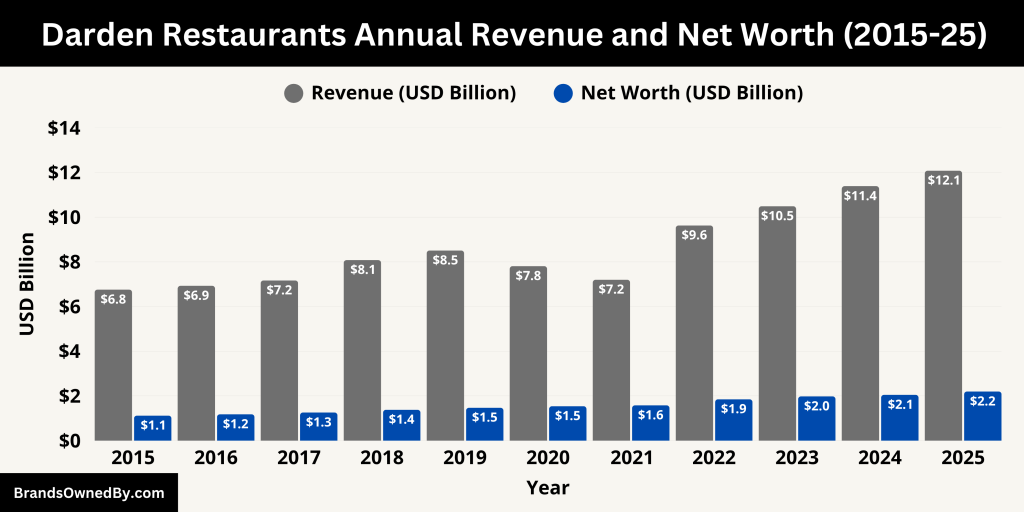

Darden Restaurants Annual Revenue and Net Worth

In the fiscal year ending May 25, 2025, Darden Restaurants reported a total revenue of $12.08 billion. This marked a strong 6.0% increase from the previous fiscal year’s revenue of $11.39 billion. The increase was primarily driven by a mix of organic growth and the full integration of newly acquired Chuy’s restaurants. Olive Garden and LongHorn Steakhouse were among the top-performing brands, contributing significant portions to the group’s sales.

The fourth quarter alone contributed $3.27 billion in revenue, representing a 10.6% rise compared to the same period in 2024. Much of this Q4 growth came from higher guest traffic, seasonal promotions, and successful pricing strategies. Darden also benefited from new restaurant openings and a broader national presence, as well as improved menu innovation and enhanced marketing efforts across its core brands.

Same-restaurant sales for the entire year rose by 2.0%, with Olive Garden and LongHorn outperforming other brands. Fine dining segments showed some softness in late fiscal 2025, while casual dining maintained momentum. Darden’s leadership credited this growth to disciplined cost management, improved labor efficiencies, and customer loyalty programs.

Net Income and Profitability in 2025

Darden Restaurants reported a net income of $1.05 billion for fiscal year 2025. This was a 2.1% increase compared to the $1.028 billion reported in 2024. Despite rising input costs and some integration expenses related to its acquisition strategy, the company maintained profitability through strong operational execution.

In the fourth quarter of 2025, Darden generated $303.8 million in net income, slightly below the $308.1 million earned in Q4 of 2024. The minor decrease was attributed to short-term costs linked to converting some underperforming Bahama Breeze locations and technology investments in digital ordering systems. Still, overall annual earnings remained strong, supporting investor confidence and long-term growth expectations.

Darden also retained its status as a high-margin operator within the restaurant industry. Gross margin for 2025 stood at 21.9%, while operating margin reached 11.7%, and net profit margin came in at 8.7%. These healthy margins reflect the company’s strong pricing discipline, labor optimization, and supply chain efficiency.

Market Capitalization and Net Worth

As of June 2025, Darden Restaurants’ market capitalization was valued at approximately $26.4 billion. This figure represents a nearly 45% increase compared to the same period in 2024, driven by improved earnings, optimistic investor sentiment, and solid forward guidance. On some platforms, estimates of market cap ranged from $25.4 billion to $26.3 billion, but all pointed to a consistent upward trajectory in valuation.

In terms of book value, Darden’s total net assets (shareholders’ equity) reached $2.2 billion. This value reflects the company’s accumulated profits, asset base, and minimal debt exposure. Darden continues to maintain a strong balance sheet, giving it the financial flexibility to invest in new locations, technology platforms, and return capital to shareholders through dividends and share buybacks.

Cash Flow and Capital Allocation

Free cash flow remained solid in 2025, totaling approximately $1.05 billion. Darden used this strong cash position to support ongoing capital investment and shareholder returns. During the fourth quarter, the company announced a new $1 billion share repurchase program, replacing its prior authorization. The company also increased its quarterly dividend, underscoring confidence in future earnings.

Darden’s ability to generate free cash flow year after year has been a cornerstone of its financial strength. It enables the company to weather economic shifts, fund acquisitions, and consistently reward shareholders. Additionally, a prudent capital allocation approach has kept its debt-to-equity ratio conservative, maintaining investor trust.

Here is a detailed overview of the Darden Restaurants’ annual revenue and net worth over the last 11 fiscal years:

| Fiscal Year Ending | Revenue (US $ B) | Net Income (US $ B) | Book Value / Net Worth (US $ B) |

|---|---|---|---|

| 2025 | 12.08 | 1.05 | 2.20 |

| 2024 | 11.39 | 1.03 | ~2.05 |

| 2023 | 10.49 | 0.98 | ~1.98 |

| 2022 | 9.63 | 0.95 | ~1.85 |

| 2021 | 7.20 | 0.63 | ~1.58 |

| 2020 | 7.81 | –0.05 | ~1.54 |

| 2019 | 8.51 | 0.71 | ~1.47 |

| 2018 | 8.08 | 0.60 | ~1.38 |

| 2017 | 7.17 | 0.48 | ~1.26 |

| 2016 | 6.93 | 0.38 | ~1.18 |

| 2015 | 6.76 | 0.71 | ~1.12 |

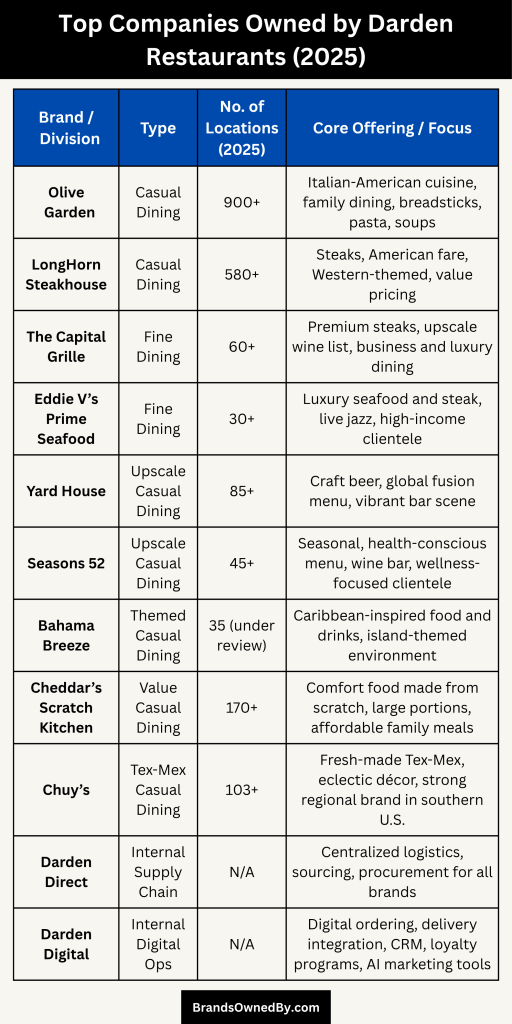

Companies Owned by Darden Restaurants

As of 2025, Darden Restaurants owns a diverse and strategically curated portfolio of dining brands, ranging from budget-friendly scratch kitchens to fine dining steak and seafood concepts. The company continues to refine its brand mix by optimizing underperforming assets like Bahama Breeze and acquiring growth-oriented chains like Chuy’s. Its wholly owned internal platforms, such as Darden Direct and Darden Digital, ensure scalability, efficiency, and responsiveness in a competitive dining landscape.

Below is a list of the major companies and brands owned by Darden Restaurants in 2025:

| Brand / Division | Type | No. of Locations (2025) | Core Offering / Focus |

|---|---|---|---|

| Olive Garden | Casual Dining | 900+ | Italian-American cuisine, family dining, breadsticks, pasta, soups |

| LongHorn Steakhouse | Casual Dining | 580+ | Steaks, American fare, Western-themed, value pricing |

| The Capital Grille | Fine Dining | 60+ | Premium steaks, upscale wine list, business and luxury dining |

| Eddie V’s Prime Seafood | Fine Dining | 30+ | Luxury seafood and steak, live jazz, high-income clientele |

| Yard House | Upscale Casual Dining | 85+ | Craft beer, global fusion menu, vibrant bar scene |

| Seasons 52 | Upscale Casual Dining | 45+ | Seasonal, health-conscious menu, wine bar, wellness-focused clientele |

| Bahama Breeze | Themed Casual Dining | 35 (under review) | Caribbean-inspired food and drinks, island-themed environment |

| Cheddar’s Scratch Kitchen | Value Casual Dining | 170+ | Comfort food made from scratch, large portions, affordable family meals |

| Chuy’s | Tex-Mex Casual Dining | 103+ | Fresh-made Tex-Mex, eclectic décor, strong regional brand in southern U.S. |

| Darden Direct | Internal Supply Chain | N/A | Centralized logistics, sourcing, procurement for all brands |

| Darden Digital | Internal Digital Ops | N/A | Digital ordering, delivery integration, CRM, loyalty programs, AI marketing tools |

Olive Garden

Olive Garden is Darden’s flagship brand and the largest full-service Italian dining chain in the United States. Known for its casual Italian-American cuisine, Olive Garden operates over 900 locations nationwide. It offers a core menu of pasta, soups, salads, and its signature breadsticks. Olive Garden has been a consistent revenue driver, contributing the highest share to Darden’s total earnings. The brand underwent a successful modernization strategy between 2022 and 2024, with updates to restaurant interiors and menu improvements to boost same-store sales and customer loyalty.

LongHorn Steakhouse

Acquired in 2007, LongHorn Steakhouse is Darden’s second-largest brand. It specializes in grilled steaks, Western-themed dining, and American-style entrees. As of 2025, there are over 580 LongHorn Steakhouse locations operating across the U.S. The brand has outperformed most peers in the steakhouse segment by maintaining affordable prices and a consistent customer experience. LongHorn has shown the highest same-restaurant sales growth within Darden’s portfolio over the last three fiscal years.

The Capital Grille

The Capital Grille is Darden’s upscale steakhouse brand known for dry-aged steaks, fine wines, and luxury dining experiences. It operates in key metropolitan markets, with over 60 locations as of 2025. The Capital Grille is a cornerstone of Darden’s fine dining segment and is positioned as a high-margin business attracting business clientele and special occasion diners. Despite broader softness in the fine dining category, The Capital Grille remains profitable and maintains strong brand equity.

Eddie V’s Prime Seafood

Eddie V’s is a luxury seafood and steak brand focused on a refined dining atmosphere with live jazz and premium service. It was acquired by Darden in 2011 and now operates over 30 locations. Eddie V’s targets high-income consumers and performs well in markets like Florida, Texas, and California. The brand supports Darden’s premium tier and contributes to the diversity of its restaurant offerings.

Yard House

Yard House is a contemporary American restaurant and bar concept, best known for its extensive draft beer selection and globally inspired menu. It operates over 85 locations across the U.S. As a high-volume brand catering to millennials and urban professionals, Yard House has been instrumental in capturing the upscale casual dining market. It continues to be one of Darden’s most innovative and experiential brands, particularly in entertainment districts and city centers.

Seasons 52

Seasons 52 is Darden’s fresh grill and wine bar, offering a seasonal menu with a focus on health-conscious dining. It currently operates around 45 locations. The brand has a niche following among wellness-focused diners and has recently expanded into suburban markets with updated architectural and digital ordering concepts. Though smaller in footprint, Seasons 52 offers strong per-unit performance.

Bahama Breeze (under strategic review in 2025)

Bahama Breeze is a Caribbean-themed restaurant chain that offers tropical food, drinks, and an island-inspired atmosphere. With about 35 remaining locations, the brand has seen mixed performance over the years. In 2025, Darden began evaluating a strategic review of Bahama Breeze, including potential divestitures or rebranding of select locations. Some outlets are being converted into newer concepts or closed as part of portfolio optimization.

Cheddar’s Scratch Kitchen

Cheddar’s was acquired by Darden in 2017 and is known for comfort food made from scratch at value pricing. The chain operates over 170 restaurants in mid-sized and suburban U.S. markets. Cheddar’s performs well in regions where affordability and large portion sizes drive foot traffic. In 2025, Darden completed remodeling efforts across several Cheddar’s units to align with its latest brand standards and menu consistency goals.

Chuy’s (acquired in 2024)

In one of its most recent moves, Darden acquired Chuy’s Holdings Inc. in 2024, bringing over 103 restaurants under its ownership. Chuy’s is a Tex-Mex casual dining chain known for its eclectic decor and fresh-made Mexican food. The acquisition helped Darden enter a fast-growing category while expanding geographic coverage in the southern and midwestern U.S. In 2025, integration of Chuy’s into the Darden system was underway, including HR, digital systems, and supply chain alignment.

Darden Direct

Darden Direct is an internal logistics and supply chain division responsible for procurement, food distribution, and logistics operations across all brands. It ensures consistent ingredient sourcing, reduces third-party dependency, and improves cost controls. While not a public brand, Darden Direct plays a critical role in operational efficiency and maintaining margins across all restaurants.

Darden Digital

Darden Digital oversees the company’s digital transformation initiatives, including mobile ordering, website management, and loyalty programs. In 2025, the division expanded partnerships with Uber Direct and enhanced in-house delivery for Olive Garden and LongHorn. Darden Digital is also responsible for maintaining consistency in customer data, CRM tools, and AI-based marketing.

Conclusion

Darden Restaurants is a publicly owned company with a diverse portfolio of popular dining brands. It is primarily owned by institutional investors such as Vanguard and BlackRock. With Rick Cardenas at the helm, the company continues to lead the U.S. casual dining market. Its brands, from Olive Garden to The Capital Grille, cater to a wide range of consumers. Strong revenues and strategic leadership make Darden a dominant player in the restaurant industry.

FAQs

Who are Darden’s largest shareholders?

As of 2025, the largest shareholders of Darden Restaurants are institutional investors. The top holders include Capital Research & Management Company (owning approximately 12.8%), Vanguard Group (11.8%), Capital International Investors (8.7%), and BlackRock (7.3%). Together, these firms control a significant portion of Darden’s voting power and influence corporate decisions through board representation and shareholder initiatives.

Does General Mills still own Darden?

No, General Mills does not own Darden Restaurants. Darden was once a subsidiary of General Mills, but it became an independent, publicly traded company in 1995 when it was spun off. Since then, Darden has operated as a standalone restaurant group listed on the New York Stock Exchange under the ticker symbol DRI.

Why did Darden sell Red Lobster?

Darden sold Red Lobster in 2014 to Golden Gate Capital for approximately $2.1 billion. The decision was driven by strategic reasons. Red Lobster was experiencing declining same-restaurant sales and profit margins. Darden’s management at the time wanted to focus on its more profitable brands, like Olive Garden and LongHorn Steakhouse. The sale also helped reduce company debt and return cash to shareholders.

What is the most popular Darden restaurant?

Olive Garden is the most popular and highest-earning restaurant brand under Darden. It has over 900 locations and generates the largest share of total company revenue. Known for its Italian-American menu, family-friendly atmosphere, and signature breadsticks, Olive Garden consistently leads Darden’s portfolio in customer traffic and brand recognition.

What are the top restaurants owned by Darden company?

The top restaurants owned and operated by Darden Restaurants include:

- Olive Garden (Italian-American casual dining)

- LongHorn Steakhouse (steak and American grill)

- The Capital Grille (upscale steakhouse)

- Cheddar’s Scratch Kitchen (value-driven comfort food)

- Yard House (craft beer and global fusion menu)

These brands form the core of Darden’s success across various dining segments including casual, upscale casual, and fine dining.

Who owns Seasons 52 restaurant?

Seasons 52 is owned by Darden Restaurants. It is an upscale casual dining concept within Darden’s portfolio, offering a seasonal menu focused on fresh, healthy, and chef-driven dishes. The brand caters to health-conscious diners and operates around 45 locations across the United States.

Who owns Olive Garden restaurants?

Darden Restaurants owns and operates all Olive Garden locations. The brand is not franchised in the U.S. and remains fully under Darden’s management. It is the company’s largest and most successful brand, known for Italian-inspired dishes and wide national presence.

Who owns LongHorn restaurant chain?

LongHorn Steakhouse is owned by Darden Restaurants. It was acquired by Darden in 2007 as part of the Rare Hospitality acquisition. LongHorn has since grown into Darden’s second-largest brand with over 580 locations nationwide.

Did Darden acquire Rare Hospitality?

Yes, Darden acquired Rare Hospitality in 2007 for approximately $1.4 billion. Rare Hospitality was the parent company of LongHorn Steakhouse and The Capital Grille. This acquisition allowed Darden to expand its portfolio into both the steakhouse and fine dining segments.

Does Darden own Chuy’s?

Yes, as of 2024, Darden acquired Chuy’s, a Tex-Mex casual dining chain. The acquisition added more than 100 Chuy’s restaurants to Darden’s portfolio. In 2025, the brand is being integrated into Darden’s operational systems, including digital platforms, HR, and supply chain management.

Who owns Darden Restaurants?

Darden Restaurants is a publicly traded company. Its largest shareholders are institutional investors like Vanguard and BlackRock.

Is Olive Garden owned by Darden?

Yes, Olive Garden is one of the major brands owned and operated by Darden Restaurants.

Does General Mills still own Darden?

No, General Mills spun off Darden in 1995. Darden has been an independent company since then.

Is Darden owned by a single company?

No, it is publicly owned with thousands of shareholders.

Who founded Darden Restaurants?

Bill Darden founded the original concept that led to Darden Restaurants, starting with Red Lobster in 1968.

What restaurant chains does Darden own?

Darden owns Olive Garden, LongHorn Steakhouse, The Capital Grille, Yard House, Eddie V’s, Bahama Breeze, Seasons 52, and Cheddar’s Scratch Kitchen.

Is Darden Restaurants a franchise?

No, most Darden-owned restaurants are company-operated, not franchised.

What is Darden’s annual revenue?

In 2024, Darden Restaurants earned approximately $11.6 billion in revenue.

Is Darden listed on the stock exchange?

Yes, Darden is listed on the New York Stock Exchange under the symbol DRI.