Etsy is one of the largest online marketplaces for handmade, vintage, and unique goods. It connects millions of sellers with buyers around the world. If you’re wondering who owns Etsy, this article will walk you through the platform’s ownership, key financials, and structure in detail.

Etsy Profile

Etsy is a global online marketplace that connects millions of buyers with independent sellers offering handmade, vintage, and unique factory-manufactured items. The platform specializes in categories like crafts, jewelry, clothing, home décor, art, and collectibles. What sets Etsy apart is its focus on individuality, creativity, and small business empowerment.

Company Overview

Etsy was founded in 2005 in Brooklyn, New York, by Robert Kalin, Chris Maguire, and Haim Schoppik. The founders wanted to create a marketplace tailored for artisans and creative entrepreneurs who lacked access to large e-commerce platforms like eBay or Amazon. Etsy filled a gap by offering an easy-to-use platform that celebrated craftsmanship and community.

The company is headquartered in Brooklyn, with satellite offices in Dublin, Toronto, and Mexico City. It serves customers and sellers globally and supports multiple currencies and languages.

Etsy operates under a two-sided marketplace model: individual sellers create listings for their products, while Etsy provides the technology, payments infrastructure, advertising, and logistics tools to support transactions.

The platform charges listing fees and collects a percentage of each sale. Etsy also generates revenue from seller services such as marketing tools, shipping labels, and Etsy Ads.

Major Milestones

- 2005: Etsy was launched with a focus on handmade goods.

- 2008: Reached over 1 million registered users and became a profitable company for the first time.

- 2012: Became a certified B Corporation, committing to high social and environmental standards.

- 2015: Etsy went public with an IPO on the NASDAQ under the symbol ETSY.

- 2017: Josh Silverman was appointed CEO, leading a strategic shift toward more scalable growth.

- 2019: Acquired Reverb, a marketplace for musical instruments.

- 2021: Purchased Depop and Elo7, expanding into fashion and international markets.

- 2022–2024: Focused on platform efficiency, seller tools, and streamlining operations. Etsy later sold Depop to refocus on its core marketplace.

Etsy has evolved from a niche craft site into a major player in global e-commerce, known for supporting creative entrepreneurs and small businesses. The platform now processes billions of dollars in annual gross merchandise sales and attracts over 90 million active buyers worldwide.

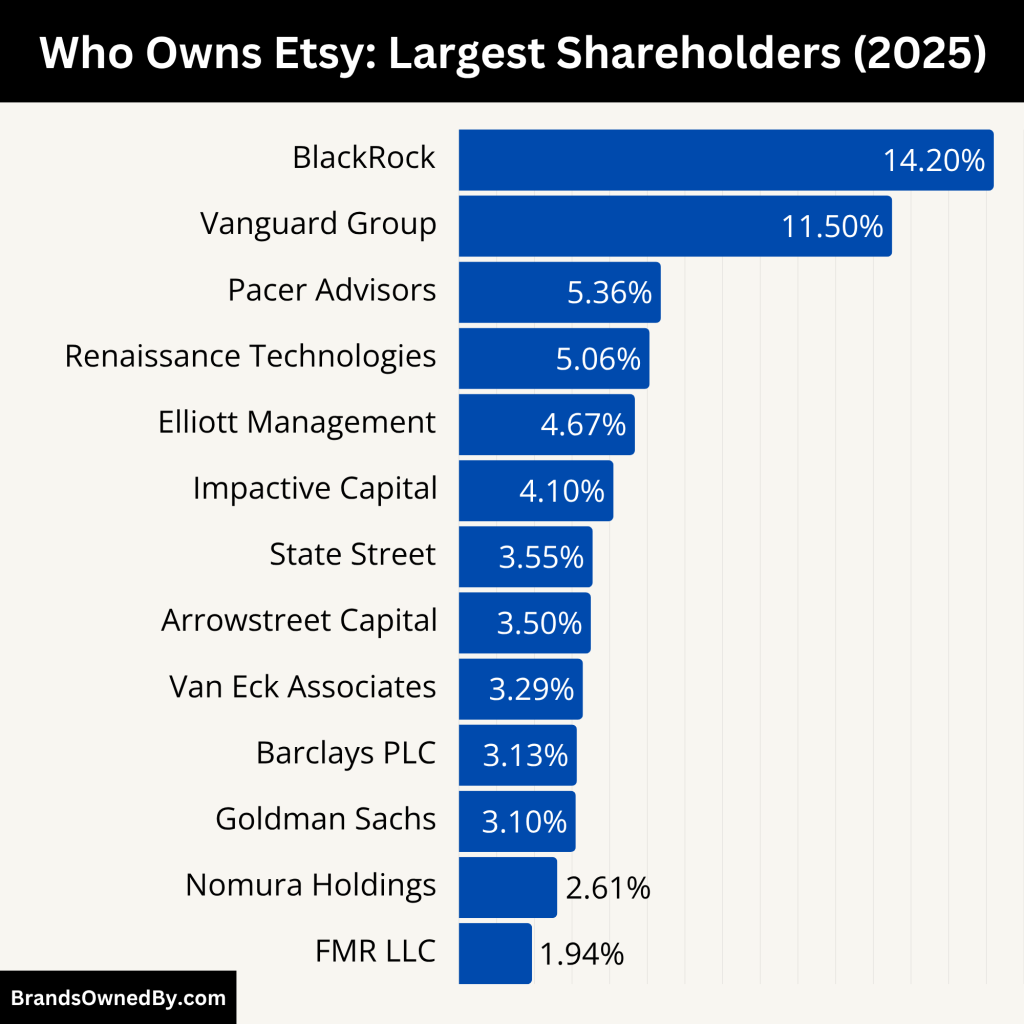

Who Owns Etsy: Largest Shareholders

As of 2025, Etsy’s ownership is primarily held by institutional investors, with the top 25 shareholders collectively owning approximately 82.44% of the company. Below is a detailed breakdown of Etsy’s major shareholders as of 2025:

| Shareholder | Ownership % | Estimated Value (USD) | Notes |

|---|---|---|---|

| BlackRock, Inc. | 14.2% | $693.3 million | Largest shareholder; influential through voting power |

| The Vanguard Group, Inc. | 11.5% | $561.9 million | Major passive investor; long-term focus |

| Pacer Advisors, Inc. | 5.36% | $261.8 million | Significant increase in 2024 holdings |

| Renaissance Technologies LLC | 5.06% | $247.5 million | Quantitative hedge fund; data-driven strategy |

| Elliott Management Corporation | 4.67% | $228.3 million | Activist investor; has board representation |

| Impactive Capital LP | 4.1% | $200.6 million | Long-term ESG-focused investor |

| State Street Global Advisors, Inc. | 3.55% | $173.6 million | Passive institutional investor |

| Arrowstreet Capital, L.P. | 3.5% | $170.9 million | Uses quantitative investment models |

| Van Eck Associates Corporation | 3.29% | $161.0 million | Increased stake in Q4 2024 |

| Barclays PLC | 3.13% | $152.8 million | Investment bank with notable stake |

| Goldman Sachs Group | 3.1% | $151.5 million | Active investor with broad exposure |

| Nomura Holdings Inc. | 2.61% | $127.7 million | Japanese firm; interest in global expansion |

| FMR LLC (Fidelity) | 1.94% | $94.8 million | Large U.S. asset manager |

| Geode Capital Management, LLC | 1.78% | $87.2 million | Manages index funds; passive investor |

| Bares Capital Management, Inc. | 1.77% | $86.4 million | Growth-focused investment firm |

| Harris Associates L.P. | 1.66% | $81.2 million | Value-focused investor |

| Davenport Asset Management | 1.63% | $79.8 million | Confident in Etsy’s fundamentals |

| Assenagon Asset Management S.A. | 1.39% | $68.0 million | Increased stake by 132.9% in late 2024 |

| Norges Bank Investment Management | 1.31% | $64.1 million | Norwegian sovereign wealth fund |

| Healthcare of Ontario Pension Plan | 1.24% | $60.7 million | Institutional, long-term investor |

| Acadian Asset Management LLC | 1.23% | $60.2 million | Quantitative and systematic investor |

| UBS Asset Management AG | 1.19% | $58.0 million | Swiss global investor |

| Findlay Park Partners LLP | 1.14% | $55.7 million | Long-term, quality-focused investor |

| Charles Schwab Investment Management | 1.06% | $51.6 million | Retail-friendly asset management firm |

| Dimensional Fund Advisors LP | 1.04% | $51.1 million | Known for academic, systematic strategies |

BlackRock, Inc. – 14.2%

BlackRock is the largest shareholder of Etsy, holding approximately 14.2% of the company’s shares, valued at around $693.3 million. As a leading global asset manager, BlackRock’s significant stake provides it with substantial influence over Etsy’s strategic decisions through shareholder voting rights.

The Vanguard Group, Inc. – 11.5%

Vanguard holds about 11.5% of Etsy’s shares, totaling approximately $561.9 million in value. Known for its passive investment strategies, Vanguard’s substantial ownership reflects confidence in Etsy’s long-term growth prospects.

Pacer Advisors, Inc. – 5.36%

Pacer Advisors owns roughly 5.36% of Etsy, with its holdings valued at $261.8 million. The firm significantly increased its position in Etsy during the third quarter of 2024, indicating a strong belief in the company’s potential.

Renaissance Technologies LLC – 5.06%

Renaissance Technologies, a quantitative investment firm, holds about 5.06% of Etsy’s shares, valued at $247.5 million. The firm’s investment reflects its data-driven approach to identifying promising stocks.

Elliott Management Corporation – 4.67%

Elliott Management owns approximately 4.67% of Etsy, with holdings worth $228.3 million. The firm has taken an active role in Etsy’s governance, with its portfolio manager, Marc Steinberg, appointed to Etsy’s board in February 2024.

Impactive Capital LP – 4.1%

Impactive Capital holds about 4.1% of Etsy’s shares, valued at $200.6 million. The firm focuses on long-term investments in companies with potential for positive impact and value creation.

State Street Global Advisors, Inc. – 3.55%

State Street owns approximately 3.55% of Etsy, with holdings valued at $173.6 million. As one of the world’s largest asset managers, State Street’s investment indicates confidence in Etsy’s business model.

Arrowstreet Capital, Limited Partnership – 3.5%

Arrowstreet Capital holds around 3.5% of Etsy’s shares, valued at $170.9 million. The firm’s investment strategy involves quantitative analysis to identify undervalued stocks.

Van Eck Associates Corporation – 3.29%

Van Eck Associates owns about 3.29% of Etsy, with holdings worth $161.0 million. The firm increased its position in Etsy by 17.4% in the fourth quarter of 2024, reflecting growing confidence in the company’s prospects.

Barclays PLC – 3.13%

Barclays holds approximately 3.13% of Etsy’s shares, valued at $152.8 million. The investment bank’s stake signifies its belief in Etsy’s financial performance and growth trajectory.

Goldman Sachs Group – 3.1%

Goldman Sachs owns about 3.1% of Etsy, with holdings valued at $151.5 million. The firm’s investment reflects its positive outlook on Etsy’s market position.

Nomura Holdings Inc. – 2.61%

Nomura holds roughly 2.61% of Etsy’s shares, valued at $127.7 million. The Japanese financial services group’s investment indicates its confidence in Etsy’s international growth potential.

FMR LLC – 1.94%

FMR LLC, the parent company of Fidelity Investments, owns about 1.94% of Etsy, with holdings worth $94.8 million. The firm’s stake underscores its belief in Etsy’s long-term value.

Geode Capital Management, LLC – 1.78%

Geode Capital holds approximately 1.78% of Etsy’s shares, valued at $87.2 million. The firm’s investment aligns with its strategy of managing index funds and passive investments.

Bares Capital Management, Inc. – 1.77%

Bares Capital owns about 1.77% of Etsy, with holdings worth $86.4 million. The firm’s focus on long-term investments in growth companies is reflected in its stake in Etsy.

Harris Associates L.P. – 1.66%

Harris Associates holds roughly 1.66% of Etsy’s shares, valued at $81.2 million. The firm’s investment strategy emphasizes value investing in companies with strong fundamentals.

Davenport Asset Management – 1.63%

Davenport owns approximately 1.63% of Etsy, with holdings worth $79.8 million. The firm’s stake indicates its positive outlook on Etsy’s financial health.

Assenagon Asset Management S.A. – 1.39%

Assenagon holds about 1.39% of Etsy’s shares, valued at $68.0 million. The firm increased its position in Etsy by 132.9% in the fourth quarter of 2024, signaling strong confidence in the company’s future.

Norges Bank Investment Management – 1.31%

Norges Bank owns roughly 1.31% of Etsy, with holdings worth $64.1 million. As Norway’s central bank, its investment reflects a long-term perspective on Etsy’s growth.

Healthcare of Ontario Pension Plan – 1.24%

This pension plan holds about 1.24% of Etsy’s shares, valued at $60.7 million. The investment indicates confidence in Etsy’s stability and potential for returns.

Acadian Asset Management LLC – 1.23%

Acadian owns approximately 1.23% of Etsy, with holdings worth $60.2 million. The firm’s quantitative investment approach supports its stake in Etsy.

UBS Asset Management AG – 1.19%

UBS holds about 1.19% of Etsy’s shares, valued at $58.0 million. The Swiss asset manager’s investment reflects its diversified portfolio strategy.

Findlay Park Partners LLP – 1.14%

Findlay Park owns roughly 1.14% of Etsy, with holdings worth $55.7 million. The firm’s focus on long-term investments in quality companies aligns with its stake in Etsy.

Charles Schwab Investment Management, Inc. – 1.06%

Charles Schwab holds approximately 1.06% of Etsy’s shares, valued at $51.6 million. The firm’s investment indicates its confidence in Etsy’s business model.

Dimensional Fund Advisors LP – 1.04%

Dimensional Fund Advisors owns about 1.04% of Etsy, with holdings worth $51.1 million. The firm’s systematic investment approach supports its stake in Etsy.

Who is the CEO of Etsy?

As of 2025, Josh Silverman continues to serve as the Chief Executive Officer (CEO) of Etsy Inc., a role he has held since May 2017. Under his leadership, Etsy has navigated significant transformations, focusing on enhancing the customer experience and reinforcing the company’s commitment to its artisan roots.

Leadership Background

Josh Silverman brings over two decades of experience in leading consumer technology companies and scaling global marketplaces. Before joining Etsy, he held prominent positions such as CEO of Skype, CEO of Shopping.com, and President of Consumer Products and Services at American Express. He also co-founded Evite, Inc., where he served as CEO. His diverse background has equipped him with a deep understanding of e-commerce dynamics and customer engagement strategies.

Strategic Initiatives and Vision

Silverman’s tenure at Etsy has been marked by a concerted effort to return the platform to its original mission of supporting creative entrepreneurs. In response to the influx of mass-produced items, he has implemented policy overhauls to ensure that products sold on Etsy maintain a “human touch,” emphasizing originality and craftsmanship. This strategic pivot aims to differentiate Etsy in a crowded e-commerce landscape dominated by giants like Amazon and emerging players such as Temu and Shein.

Additionally, Silverman has championed the integration of artificial intelligence (AI) to enhance the shopping experience. By leveraging AI, Etsy aims to provide hyper-personalized shopping experiences, mimicking the engagement strategies of social media platforms. This approach is designed to help users discover relevant products more easily, thereby increasing customer satisfaction and loyalty.

Executive Team and Organizational Changes

In December 2024, Etsy announced significant changes to its executive team to bolster growth and improve customer engagement. Kruti Patel Goyal, previously CEO of Etsy’s Depop subsidiary, was appointed as President and Chief Growth Officer. In this newly created role, she oversees Product, Marketing, Member Support, Trust and Safety, and Strategy and Operations, reporting directly to Silverman. Her appointment reflects Etsy’s commitment to unifying customer touchpoints and delivering a compelling experience for its global community of buyers and sellers.

Furthermore, Lanny Baker joined as Chief Financial Officer, bringing with him extensive experience from companies like Eventbrite, Yelp, and Monster Worldwide. Brad Minor was promoted to Chief Marketing Officer, tasked with leading Etsy’s marketing strategies to reinforce the brand’s identity and reach. These leadership changes are part of Silverman’s broader strategy to position Etsy for sustained growth and innovation in the evolving e-commerce landscape.

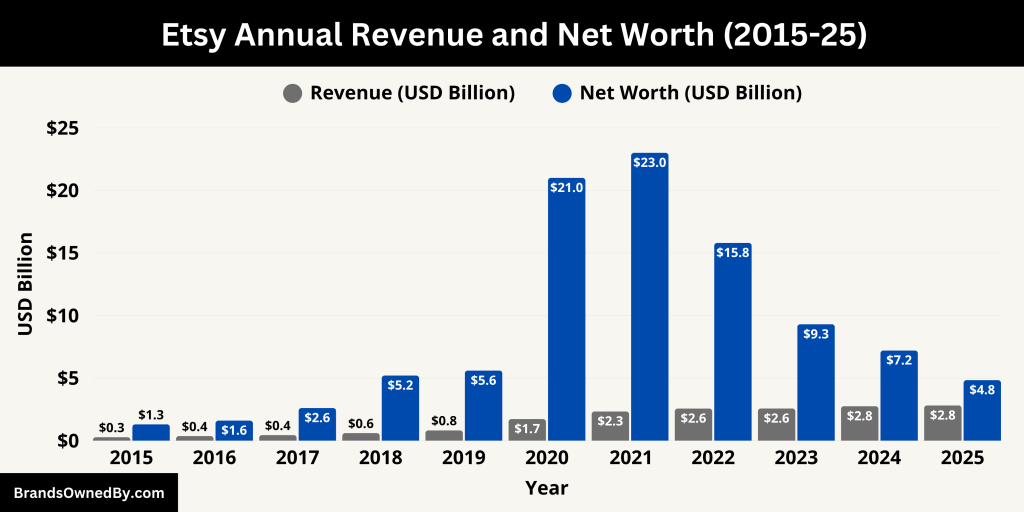

Etsy Annual Revenue and Net Worth

In 2024, Etsy reported a total revenue of $2.81 billion, marking a 2.2% increase from the previous year. This growth was primarily driven by a 4.8% rise in services revenue, totaling $787.6 million, which includes offerings like advertising and payment processing. Marketplace revenue slightly increased by 1.2% to $2.02 billion, reflecting steady performance in Etsy’s core business operations.

Etsy’s net income for 2024 stood at $303 million, maintaining stability compared to the previous year. The company achieved an adjusted EBITDA of $781.5 million, with a margin of 27.8%. Notably, Etsy converted approximately 90% of this adjusted EBITDA into free cash flow, showcasing efficient operational management.

Market Capitalization and Net Worth

As of May 2025, Etsy’s market capitalization is approximately $4.83 billion. This valuation reflects a decrease from the previous year, influenced by broader market conditions and investor sentiment.

Etsy’s Gross Merchandise Sales (GMS) for 2024 totaled $12.59 billion, a 4.4% decline year-over-year. The platform connected 8.1 million active sellers with 95.5 million active buyers, indicating a slight decrease in user engagement.

Looking ahead, Etsy aims to enhance its marketplace by focusing on personalized shopping experiences and expanding its global reach. The company plans to invest in technology and marketing to drive growth and improve customer engagement.

Below is an overview of the annual revenue and net worth of Etsy from 2015-25:

| Year | Revenue | Net Worth (Market Cap) | Notes |

|---|---|---|---|

| 2025 | $2.81 billion | $4.83 billion | Slight growth in revenue; market cap declined due to broader market trends |

| 2024 | $2.75 billion | $7.2 billion | Stable performance; investor concerns caused valuation decline |

| 2023 | $2.57 billion | $9.3 billion | Revenue growth driven by services revenue and improved ads monetization |

| 2022 | $2.56 billion | $15.8 billion | Recovery after post-pandemic normalization |

| 2021 | $2.33 billion | $23.0 billion | Pandemic-fueled e-commerce surge |

| 2020 | $1.72 billion | $21.0 billion | Major growth during COVID-19; strong demand for handmade masks, etc. |

| 2019 | $818 million | $5.6 billion | Steady growth pre-pandemic |

| 2018 | $603 million | $5.2 billion | First year crossing $600 million in revenue |

| 2017 | $441 million | $2.6 billion | Josh Silverman became CEO; shift in company focus |

| 2016 | $365 million | $1.6 billion | Modest growth; early platform expansions |

| 2015 | $274 million | $1.3 billion | First full year after IPO in April 2015 |

Companies Owned by Etsy

As of 2025, Etsy Inc. has strategically expanded its portfolio through acquisitions to enhance its presence in the global e-commerce market.

Below is a detailed overview of the companies and brands owned and operated by Etsy:

| Company/Brand | Acquisition Year | Focus Area | Operational Status | Headquarters | Key Notes |

|---|---|---|---|---|---|

| Etsy.com | N/A (Founded 2005) | Handmade, vintage items, craft supplies | Active | Brooklyn, NY, USA | Flagship marketplace with 8.1M sellers and 95.5M buyers globally |

| Reverb | 2019 | Music gear (instruments, audio gear) | Active (Independent) | Chicago, IL, USA | Largest online music gear marketplace |

| Depop | 2021 | Secondhand fashion (Gen Z audience) | Active (Independent) | London, UK | Popular for vintage and thrifted fashion; no selling fees in U.S. as of 2024 |

| Blackbird Technologies | 2016 | AI and search enhancement | Integrated | San Francisco, CA, USA | Acquired to improve Etsy’s search capabilities |

| A Little Market | 2014 | Handmade goods in France | Integrated / Retired | Paris, France | Strengthened Etsy’s reach in the French artisan community |

| Elo7 | 2021 (Sold in 2023) | Handmade & customized products (Brazil) | Sold (no longer owned) | São Paulo, Brazil | Sold to Enjoei S.A. in 2023 after 2 years of operation under Etsy |

Depop

Acquired by Etsy in June 2021 for approximately $1.6 billion, Depop is a fashion resale marketplace targeting Gen Z consumers. Headquartered in London, Depop operates independently, offering a platform for users to buy and sell secondhand clothing and accessories. In 2024, Depop removed selling fees for U.S. sellers to encourage growth in the secondhand market.

Elo7

Elo7, often referred to as the “Etsy of Brazil,” was acquired by Etsy in July 2021 for $212 million. Based in São Paulo, Elo7 is a leading marketplace for handmade and customized products in Brazil. The acquisition allowed Etsy to expand its footprint in Latin America, tapping into a growing market of creative entrepreneurs and buyers.

Reverb

Acquired in 2019 for $275 million, Reverb is a leading online marketplace dedicated to new, used, and vintage music gear. It connects musicians and sellers globally, offering a platform for buying and selling instruments and related equipment. Reverb operates independently while benefiting from Etsy’s shared expertise in product development, marketing, and customer support.

Blackbird Technologies

In November 2016, Etsy acquired Blackbird Technologies, an AI startup specializing in search and shopping context applications, for $32.5 million. The acquisition aimed to enhance Etsy’s search capabilities and improve the overall shopping experience on its platforms.

A Little Market

Etsy expanded its presence in France by acquiring A Little Market in June 2014. This French e-commerce site specialized in handmade goods, foods, and wine. The acquisition allowed Etsy to tap into the French market and support local artisans.

Conclusion

Etsy is a powerful platform for handmade and vintage sellers. As a publicly traded company, it is owned by major institutional shareholders like Vanguard and BlackRock. Josh Silverman has led the company successfully for several years. Etsy’s revenues and market value remain strong, and its acquisitions reflect its growth strategy. If you’re looking to understand who owns Etsy, it’s clear that control is spread across a mix of large investors and a capable executive team.

FAQs

Is Etsy a private or public company?

Etsy is a public company listed on the NASDAQ under the ticker symbol ETSY.

Who founded Etsy?

Etsy was founded in 2005 by Robert Kalin, Chris Maguire, and Haim Schoppik.

Who are the largest shareholders of Etsy?

The largest shareholders of Etsy include institutional investors like The Vanguard Group, BlackRock, and Morgan Stanley. These firms hold significant stakes, collectively owning around 30-35% of the company. Additionally, company insiders, including CEO Josh Silverman, own smaller but meaningful shares.

Is Etsy an American owned company?

Yes, Etsy is an American-owned company. It was founded and is headquartered in Brooklyn, New York, USA.

Who are the owners of Etsy?

Etsy is a publicly traded company owned by its shareholders. The largest owners are institutional investors such as The Vanguard Group, BlackRock, and Morgan Stanley, alongside retail investors and company executives.

Is Etsy part of eBay?

No, Etsy is not part of eBay. Etsy operates as an independent publicly traded company, focusing on handmade, vintage, and unique goods, whereas eBay is a separate marketplace platform.

Who are Etsy’s investors?

Etsy’s investors primarily include large institutional investment firms like The Vanguard Group, BlackRock, and Morgan Stanley. These investors hold significant shares through mutual funds and ETFs. Retail investors also participate in the ownership.

What companies has Etsy acquired?

Etsy has acquired several companies to expand its marketplace, including Reverb (music gear marketplace), Depop (fashion resale platform), Blackbird Technologies (AI and search startup), and A Little Market (French handmade goods marketplace). Etsy formerly owned Elo7, a Brazilian marketplace, which was sold in 2023.

What is the market share of Etsy?

Etsy holds a strong niche market share in the handmade, vintage, and craft supply e-commerce segment. While exact market share figures vary, Etsy dominates this specialized marketplace with millions of active sellers and buyers, competing mainly with larger general marketplaces like Amazon and niche platforms like Depop.

Who owns Etsy company?

Etsy Inc. is owned by its public shareholders, including major institutional investors such as The Vanguard Group and BlackRock, as well as individual investors and company leadership.

Is Etsy Chinese-owned?

No, Etsy is not Chinese owned. It is an American company headquartered in New York with ownership primarily by U.S.-based institutional and retail investors.

Who owns Etsy UK?

Etsy UK operations are part of Etsy Inc. ownership. The UK market is managed by Etsy’s global operations, headquartered in the USA. There is no separate UK ownership entity; the company is publicly owned through its U.S. parent company.

Where was Etsy founded?

Etsy was founded in 2005 in Brooklyn, New York, USA.