Monster Energy is one of the world’s most recognized energy drink brands. With its claw-mark logo and edgy branding, it has gained global popularity. But many wonder, who owns Monster and controls this powerful beverage empire? In this article, we explore the history, ownership, and companies tied to Monster Beverage Corporation.

History of Monster Energy

Monster Energy was originally developed by Hansen Natural Company. Hansen started as a juice company in the 1930s, focusing on natural sodas and juices. The company changed direction in 2002 when it launched the Monster Energy drink. The brand was an instant hit in the energy drink market, competing directly with Red Bull.

Due to the massive success of the Monster product line, Hansen Natural rebranded itself as Monster Beverage Corporation in 2012. Since then, it has expanded its portfolio, entered international markets, and partnered with major corporations to strengthen its distribution and presence.

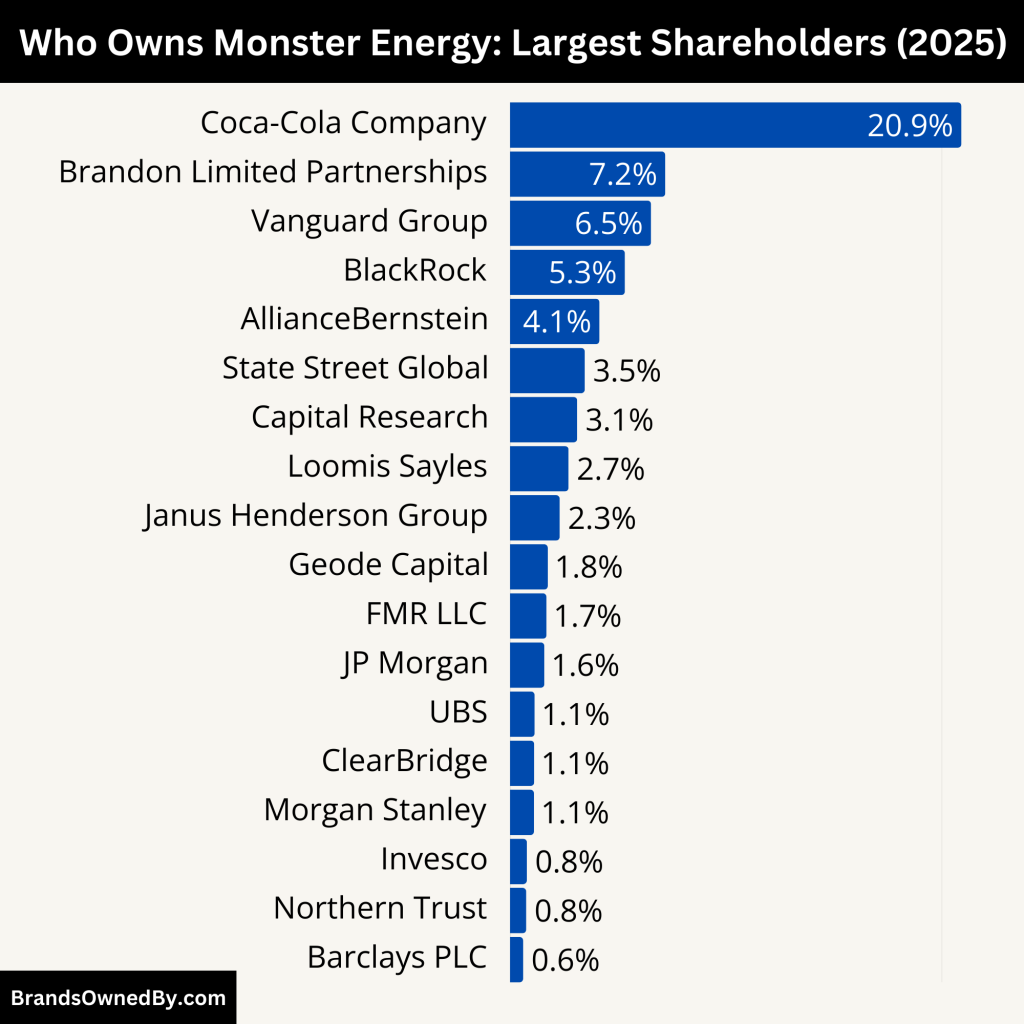

Who Owns Monster Energy: Largest Shareholders

Monster Beverage Corporation (NASDAQ: MNST) is a publicly traded company, meaning its ownership is distributed among various shareholders, including institutional investors, private entities, and individual stakeholders. As of 2025, the ownership structure is diverse, with significant holdings by major investment firms and corporations.

Here’s a list of the top shareholders of Monster Energy:

| Shareholder | Ownership % | Estimated Shares | Estimated Value (USD) | Role/Notes |

|---|---|---|---|---|

| The Coca-Cola Company | 20.9% | 204 million+ | $12.3 billion+ | Largest shareholder, strategic partner, 2 board seats, global distribution |

| Vanguard Group Inc. | 6.53% | 63 million+ | $3.8 billion+ | Passive investor, strong institutional confidence |

| Brandon Limited Partnerships (1 & 2) | 7.19% (combined) | 70 million+ | $4.2 billion+ | Insider ownership (CEO & Co-CEO), long-term control |

| BlackRock Inc. | 5.32% | 51 million+ | $3.1 billion+ | Passive investor, governance influence via proxy voting |

| AllianceBernstein L.P. | 4.14% | 40 million+ | $2.4 billion+ | Active investor, long-term growth orientation |

| State Street Global Advisors | 3.46% | 33 million+ | $2 billion+ | Index fund exposure, supports governance stability |

| Capital Research and Management | 3.11% | 30 million+ | $1.8 billion+ | Active management, deep research-led investing |

| Loomis Sayles & Company | 2.71% | 26 million+ | $1.6 billion+ | Balanced growth and income strategy |

| Janus Henderson Group plc | 2.3% | 22 million+ | $1.3 billion+ | Active investor with focus on market leaders |

| Geode Capital Management | 1.75% | 17 million+ | $1 billion+ | Index fund sub-advisor (Fidelity), quantitative strategy |

| FMR LLC (Fidelity Investments) | 1.69% | 16 million+ | $989 million+ | Blend of active/passive investment strategies |

| JP Morgan Asset Management | 1.59% | 15 million+ | $929 million+ | Actively managed growth portfolio |

| UBS Asset Management AG | 1.14% | 11 million+ | $671 million+ | Active investor with earnings-focused strategy |

| ClearBridge Investments | 1.12% | 10 million+ | $658 million+ | ESG-focused long-term investor |

| Morgan Stanley Investment Management | 1.11% | 10 million+ | $649 million+ | Growth-oriented active investor |

| Invesco Capital Management | 0.78% | 7.5 million+ | $456 million+ | ETF/index fund exposure |

| Northern Trust Global Investments | 0.75% | 7.3 million+ | $438 million+ | Index-based institutional holding |

| Barclays PLC | 0.61% | 6 million+ | $366 million+ | Financial institution with diversified equity holdings |

The Coca-Cola Company – 20.9%

The Coca-Cola Company is Monster Beverage Corporation’s single largest shareholder. In 2015, Coca-Cola entered a landmark strategic partnership with Monster, acquiring a 16.7% equity stake in exchange for transferring its entire energy drink portfolio, including NOS, Full Throttle, and Burn. In return, Monster divested its non-energy drink brands like Hansen’s and Peace Tea to Coca-Cola.

Since then, Coca-Cola’s ownership has increased. As of 2025, Coca-Cola holds approximately 20.9% of Monster’s outstanding shares, amounting to over 204 million shares valued at around $12.3 billion.

This stake gives Coca-Cola the power to appoint two directors to Monster’s board. Coca-Cola also acts as Monster’s global distribution partner, enabling Monster to expand aggressively into Asia, Latin America, and Africa. Though Coca-Cola does not control Monster, it plays a crucial strategic and operational role.

Vanguard Group Inc. – 6.53%

The Vanguard Group is the second-largest shareholder of Monster Beverage Corporation, holding approximately 6.53% of shares as of 2025. This equates to over 63 million shares worth more than $3.8 billion.

Vanguard is a passive investment manager. It does not participate in day-to-day decision-making but holds voting power during shareholder resolutions and board appointments. Its large stake is indicative of strong institutional confidence in Monster’s growth, brand equity, and financial performance.

Vanguard typically invests in companies with strong fundamentals, long-term potential, and consistent returns, which Monster has delivered over the years.

Brandon Limited Partnerships No. 2 and No. 1 – 7.19% (Combined)

The Brandon Limited Partnership No. 2 owns about 6.03%, while Brandon Limited Partnership No. 1 holds 1.16% of Monster’s shares, totaling over 70 million shares combined. These entities are connected to Rodney Sacks (CEO) and Hilton Schlosberg (Co-CEO), the long-time executives behind Monster’s rise.

These insider-owned partnerships reflect the founders’ continued belief and vested interest in the company. Their shares are typically long-held and not traded frequently. This ownership structure ensures continuity in leadership and alignment with long-term shareholder value creation.

The presence of these insider stakes supports a stable management structure, allowing Monster to maintain its aggressive branding and product development strategies.

BlackRock Inc. – 5.32%

BlackRock, the world’s largest asset manager, owns approximately 5.32% of Monster’s outstanding shares, totaling more than 51 million shares valued at over $3.1 billion.

Like Vanguard, BlackRock is a passive investor, focusing on long-term equity holdings in high-performing companies. It has no direct role in managing Monster but participates in corporate governance via proxy votes. BlackRock’s presence ensures a degree of oversight and promotes shareholder-friendly policies.

The firm often emphasizes environmental, social, and governance (ESG) performance, encouraging companies like Monster to align operations with broader sustainability goals.

AllianceBernstein L.P. – 4.14%

AllianceBernstein, a global investment firm, holds about 4.14% of Monster Beverage’s stock, equivalent to over 40 million shares valued at around $2.4 billion.

AllianceBernstein’s stake reflects a strategic belief in Monster’s ability to deliver value in the competitive energy drink sector. The firm actively manages its investments and may influence corporate governance through board representation or shareholder proposals.

It focuses on companies with strong competitive moats, and Monster’s brand dominance aligns well with this philosophy.

State Street Global Advisors – 3.46%

State Street Global Advisors, the asset management arm of State Street Corporation, owns around 3.46% of Monster shares, amounting to more than 33 million shares valued at over $2 billion.

As a major index fund provider, State Street’s investment signals Monster’s inclusion in several key indexes like the S&P 500. While State Street doesn’t directly manage Monster’s operations, it holds voting rights and can influence governance matters.

Their long-term investment strategy adds stability to Monster’s shareholder base.

Capital Research and Management Company – 3.11%

Capital Research, part of Capital Group, manages actively managed mutual funds and holds approximately 3.11% of Monster’s shares, translating to over 30 million shares worth around $1.8 billion.

Capital Research is known for long-term equity investments based on deep research. Its stake in Monster suggests a strong conviction in the company’s financials and growth trajectory. It may engage with management occasionally to align on long-term objectives.

Loomis Sayles & Company – 2.71%

Loomis Sayles, a leading institutional asset manager, owns about 2.71% of Monster’s stock. This amounts to over 26 million shares valued at more than $1.6 billion.

Loomis Sayles specializes in both growth and income-oriented portfolios. Its investment in Monster shows confidence in the beverage giant’s balance of revenue growth and profit margins.

Janus Henderson Group plc – 2.3%

Janus Henderson, a global active asset manager, holds about 2.3% of Monster’s stock, or over 22 million shares, worth around $1.3 billion.

Janus Henderson seeks investment in companies with robust fundamentals, market leadership, and steady earnings. Monster meets all these criteria, which makes it a key holding in Janus’ U.S. equity funds.

Geode Capital Management – 1.75%

Geode Capital, a quantitative investment firm and a key sub-advisor for Fidelity’s index funds, owns around 1.75% of Monster. That equates to more than 17 million shares worth nearly $1 billion.

Geode’s investment represents index-based exposure to the consumer goods sector. Though it does not play an active governance role, its ownership contributes to Monster’s overall institutional stability.

FMR LLC (Fidelity Investments) – 1.69%

FMR LLC, the parent company of Fidelity Investments, holds about 1.69% of Monster Beverage’s shares. This represents over 16 million shares valued close to $989 million.

FMR uses a blend of active and passive strategies, and its position in Monster reflects a belief in the company’s sustainable earnings and dominant brand.

JP Morgan Asset Management – 1.59%

JP Morgan owns around 1.59% of Monster shares, over 15 million shares worth approximately $929 million.

Its position suggests inclusion of Monster across several actively managed portfolios, focused on consumer staples and global growth stocks.

UBS Asset Management – 1.14%

UBS Asset Management AG holds about 1.14% of Monster, translating to 11 million shares worth about $671 million. UBS typically favors companies with strong earnings predictability, market share, and consistent returns — all traits Monster demonstrates.

ClearBridge Investments – 1.12%

ClearBridge owns 1.12% of the company, or over 10 million shares valued at $658 million. Known for ESG and long-term equity strategies, ClearBridge’s presence reflects institutional confidence in Monster’s brand and leadership.

Morgan Stanley Investment Management – 1.11%

Morgan Stanley holds 1.11%, or over 10 million shares, totaling around $649 million in value. Morgan Stanley focuses on growth equities and likely views Monster as a high-potential long-term growth stock.

Other Institutional Investors

Several other major asset managers and funds also hold smaller stakes, including:

- Invesco Capital Management – 0.78%

- Northern Trust Global Investments – 0.75%

- Barclays PLC – 0.61%

Together, institutional investors control approximately 72.4% of the total equity, giving them substantial influence over corporate governance, even though no single investor (except Coca-Cola) has majority control.

Who is the CEO of Monster Energy?

As of June 13, 2025, Hilton H. Schlosberg serves as the Chief Executive Officer (CEO) of Monster Beverage Corporation. He succeeded Rodney C. Sacks, who stepped down from the co-CEO role but continues as Chairman of the Board.

Hilton H. Schlosberg: From Co-Founder to CEO

Hilton Schlosberg, born in South Africa in the early 1950s, co-founded Monster Beverage Corporation alongside Rodney Sacks. Educated at the University of the Witwatersrand in Johannesburg, Schlosberg has held several key positions within the company, including a 23-year tenure as Chief Financial Officer (CFO). He became co-CEO in 2021 and transitioned to sole CEO in 2025.

Rodney C. Sacks: Transition to Chairman

Rodney Sacks, also a South African native, co-founded Monster Beverage Corporation with Schlosberg. He served as CEO from 1990 until 2021, then as co-CEO until June 12, 2025. Post-transition, Sacks continues to serve as Chairman of the Board, focusing on strategic initiatives, marketing, innovation, and litigation until his planned retirement as an employee on December 31, 2026.

Leadership Structure and Succession Planning

The leadership transition from Sacks to Schlosberg is part of Monster Beverage’s succession planning strategy. This plan aims to ensure continuity and sustained growth for the company. Schlosberg’s extensive experience and long-standing involvement with the company position him to lead Monster Beverage into its next phase.

The company’s decision-making structure remains robust, with Schlosberg at the helm as CEO and Sacks providing guidance as Chairman. This structure supports Monster Beverage’s ongoing commitment to innovation and market leadership in the energy drink sector.

Under this leadership, Monster Beverage continues to perform strongly, with net sales increasing by 4.7% to $1.81 billion in the fourth quarter of 2024.

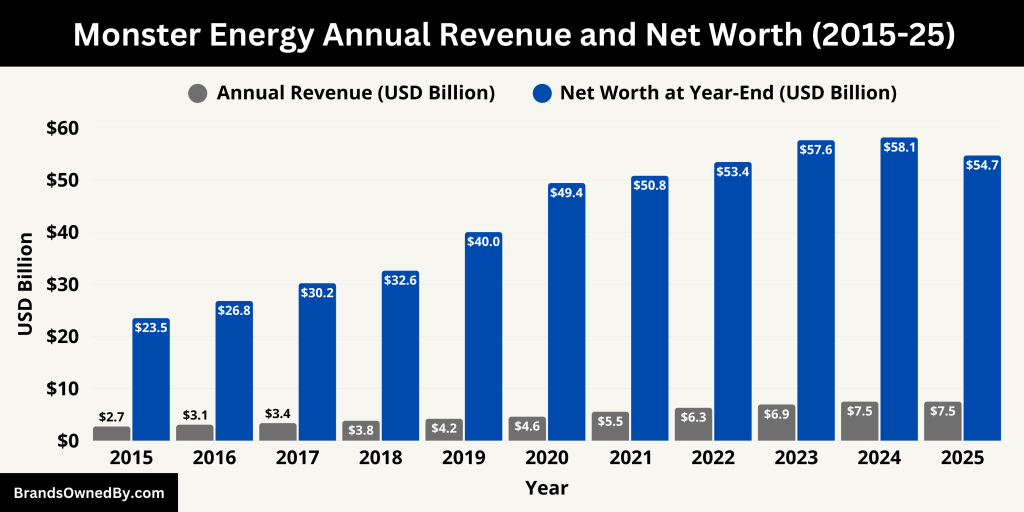

Annual Revenue and Net Worth of Monster Energy

In the fiscal year ending December 31, 2024, Monster Beverage reported net sales of $7.49 billion, marking a 4.9% increase from the previous year. This growth was primarily driven by global pricing strategies, which positively impacted net sales by approximately $107.3 million. However, unfavorable foreign currency exchange rates had a negative effect of $247.1 million on net sales. On a foreign currency-adjusted basis, net sales increased by 8.4% for the year.

The company’s gross profit margin improved to 54.0% in 2024, up from 53.1% in 2023, reflecting effective cost management and operational efficiencies.

As of May 2025, Monster Beverage’s market capitalization stood at approximately $54.70 billion. This valuation reflects the company’s strong market presence and investor confidence, despite a slight decrease of 5.86% over the past year.

The company’s enterprise value, which accounts for debt and cash, was reported at $53.60 billion, indicating a solid financial structure and the ability to invest in future growth opportunities.

Below is an overview of the Monster Beverage Corporation’s historical revenue and market capitalization (net worth) for the last 10 years (2015–2025):

| Year | Annual Revenue (USD) | Market Cap at Year-End (USD) |

|---|---|---|

| 2025 | $7.49 billion | $54.70 billion |

| 2024 | $7.49 billion | $58.14 billion |

| 2023 | $6.93 billion | $57.63 billion |

| 2022 | $6.31 billion | $53.44 billion |

| 2021 | $5.54 billion | $50.80 billion |

| 2020 | $4.60 billion | $49.40 billion |

| 2019 | $4.20 billion | $40.00 billion |

| 2018 | $3.81 billion | $32.60 billion |

| 2017 | $3.37 billion | $30.20 billion |

| 2016 | $3.05 billion | $26.80 billion |

| 2015 | $2.72 billion | $23.50 billion |

Brands and Companies Owned by Monster

Monster Beverage Corporation has expanded its portfolio significantly over the years, encompassing a diverse range of energy drinks, performance beverages, and alcoholic offerings.

Below is a detailed overview of the major brands and companies under its umbrella as of 2025:

| Brand / Company | Description | Key Features / Details | Target Market | Year Launched / Acquired |

|---|---|---|---|---|

| Monster Energy | Flagship energy drink brand with multiple product lines. | High caffeine, diverse flavors (Original, Ultra, Rehab, Java, Juice, Hydro, Reserve) | Global, young adults, athletes | 2002 |

| Reign Total Body Fuel | Fitness-focused energy drink with performance ingredients. | 300 mg caffeine, BCAAs, CoQ10, electrolytes, zero sugar | Athletes, fitness enthusiasts | 2019 |

| Bang Energy | High-caffeine, zero-sugar energy drink known for bold flavors and performance marketing. | 300 mg caffeine, BCAAs, electrolytes, social media strong | Fitness & lifestyle consumers | Acquired 2023 |

| CANarchy Craft Brewery Collective | Group of independent craft breweries offering a variety of beers. | Includes Oskar Blues, Cigar City, Deep Ellum, Perrin, Squatters & Wasatch | Craft beer drinkers, alcoholic beverage market | Acquired 2022 |

| The Beast Unleashed | Flavored malt beverage brand in the alcoholic RTD market. | Bold flavors, moderate alcohol content | Ready-to-drink alcoholic beverage consumers | Post-CANarchy acquisition |

| Nasty Beast Hard Tea | Hard iced tea brand competing in the flavored malt beverage space. | Flavored hard tea, moderate ABV, edgy branding | Young adult alcoholic beverage consumers | Launched 2024 |

| Predator Energy | Value-oriented energy drink brand targeting emerging markets. | Lower price point, simpler formula | Price-sensitive consumers in Asia, Africa, Latin America | N/A |

| Fury | Budget-friendly energy drink brand for price-sensitive markets. | Affordable, energizing taste | Budget-conscious consumers | N/A |

| American Fruits & Flavors | Flavor development company producing proprietary flavor concentrates for Monster products. | In-house flavor innovation and consistency | Internal use for Monster products | Acquired 2016 |

Monster Energy

The flagship brand, Monster Energy, is renowned for its bold flavors and high caffeine content. Introduced in 2002, it has become a staple in the energy drink market. The brand offers a variety of products, including the original Monster Energy, Monster Ultra, Java Monster, and Juice Monster. These products are distributed globally, with a strong presence in over 170 countries.

Reign Total Body Fuel

Launched in 2019, Reign Total Body Fuel targets fitness enthusiasts seeking performance-enhancing beverages. With ingredients like BCAAs, CoQ10, and electrolytes, Reign offers functional benefits alongside energy. The brand has gained popularity in North America and Europe, expanding its reach to various international markets.

Bang Energy

In July 2023, Monster Beverage acquired Bang Energy by purchasing its parent company, Vital Pharmaceuticals, for $362 million. Bang Energy is known for its zero-sugar, high-caffeine drinks and was the fourth-highest-selling energy drink in the U.S. at the time of acquisition. Post-acquisition, Monster streamlined Bang’s product offerings, focusing on core flavors and discontinuing several niche products.

CANarchy Craft Brewery Collective

In January 2022, Monster entered the alcoholic beverage market by acquiring CANarchy Craft Brewery Collective for $330 million. This acquisition included brands like Cigar City Brewing, Oskar Blues, Deep Ellum, Perrin Brewing, Squatters, and Wasatch. The move allowed Monster to diversify its portfolio and enter the craft beer and hard seltzer segments.

Predator Energy

Predator Energy is Monster’s affordable energy drink line, targeting emerging markets. Launched in select regions, it offers a cost-effective alternative without compromising on energy-boosting ingredients. The brand has seen positive reception, particularly in markets like China, where it continues to expand its presence.

Fury

Fury is another value-oriented energy drink brand under Monster’s Strategic Brands segment. It caters to consumers seeking budget-friendly options while delivering the energy and taste associated with Monster’s products. Fury has been instrumental in expanding Monster’s reach in price-sensitive markets.

NOS

Originally developed by Fuze Beverage, NOS was acquired by Monster through a strategic partnership with The Coca-Cola Company. Known for its high-performance energy drinks, NOS has a loyal customer base, particularly among motorsport enthusiasts. The brand continues to be a significant player in Monster’s portfolio.

Full Throttle

Full Throttle is a bold energy drink brand that became part of Monster’s lineup through the Coca-Cola partnership. With flavors like Original Citrus and Blue Agave, it appeals to consumers seeking a robust energy boost. Full Throttle maintains a strong presence in North America.

Burn

Burn is an energy drink brand with a significant presence in Europe and Asia. It offers a variety of flavors and is known for its sleek packaging and marketing campaigns targeting the nightlife and club scenes. Burn became part of Monster’s portfolio through the Coca-Cola energy brand transfer.

Mother

Mother is an energy drink brand popular in Australia and New Zealand. Acquired through the Coca-Cola partnership, Mother offers unique flavors tailored to the preferences of the Oceania market. It has established itself as a leading energy drink brand in the region.

Nalu

Nalu is a fruit-flavored energy drink brand with a strong presence in Belgium and other parts of Europe. It combines energy-boosting ingredients with refreshing fruit flavors, appealing to a broad consumer base. Nalu became part of Monster’s Strategic Brands segment through the Coca-Cola energy brand acquisition.

American Fruits & Flavors

In January 2016, Monster acquired American Fruits & Flavors for $690 million. This acquisition provided Monster with in-house flavor development capabilities, enhancing its product innovation and formulation processes. The integration of American Fruits & Flavors has been pivotal in developing new products and maintaining quality control.

The Beast Unleashed & Nasty Beast

As part of its foray into alcoholic beverages, Monster launched The Beast Unleashed, a flavored malt beverage, and Nasty Beast, a hard tea line. These products have expanded Monster’s presence in the ready-to-drink alcoholic beverage market, catering to consumers seeking alternative alcoholic options. Both brands are available across multiple U.S. states and continue to grow in popularity.

Final Thoughts

So, who owns Monster? The answer lies in its shareholders, with Coca-Cola being the largest. The company has grown from a small juice maker into a global energy drink empire. With steady leadership, strong revenue, and a growing list of brands, Monster remains one of the dominant players in the energy beverage industry.

FAQs

Who owns the majority of Monster Energy?

The Coca-Cola Company is the largest shareholder, owning nearly 19.5% of the company.

Is Monster still owned by Coke?

No, Monster Energy is not owned by The Coca-Cola Company, but Coca-Cola is a major shareholder and strategic partner. Coca-Cola owns about 19-20% of Monster Beverage Corporation’s shares and handles distribution in many regions. However, Monster operates as an independent publicly traded company.

Who owns Monster Energy drink?

Monster Energy is owned by Monster Beverage Corporation, a publicly traded company listed on NASDAQ under the ticker MNST. The largest shareholder is institutional investors, with Coca-Cola being the biggest single external shareholder with around 19-20%.

Which energy drink is owned by Coca-Cola?

Coca-Cola owns several energy drink brands directly, including NOS, Full Throttle, Burn, and Mother. These brands are separate from Monster but are sometimes distributed through partnerships.

Is Monster drink halal?

Monster Energy does not have a universal halal certification. Halal status can vary by country and product. Some specific Monster products may be halal-certified in certain markets, but consumers should check the packaging or local certifications to be sure.

Which country owns Monster?

Monster Beverage Corporation is an American company headquartered in Corona, California, USA. It was founded and continues to operate primarily from the United States.

Is Monster a Pepsi company?

No, Monster Energy is not owned or affiliated with PepsiCo. It is an independent company, publicly traded, with a significant partnership with Coca-Cola, not Pepsi.

Does Red Bull own Monster?

No, Red Bull does not own Monster Energy. Red Bull GmbH is a separate company and one of Monster’s biggest competitors in the energy drink market.

Who created Monster Energy?

Monster Energy was created by Hans Szymanski and Rodney Sacks through their company Hansen Natural Corporation, which later became Monster Beverage Corporation. They launched Monster Energy in 2002.

Who owns Monster drink company?

The Monster Beverage Corporation owns the Monster Energy drink brand. It is a publicly traded company with a broad shareholder base, with Coca-Cola being the largest single shareholder.

Who is Monster Energy drink founder?

The founders of Monster Energy drink are Hans Szymanski and Rodney Sacks. They developed the brand while leading Hansen Natural Corporation.

When was Monster Energy founded?

Monster Energy was founded and launched in 2002 by Hansen Natural Corporation, which later rebranded as Monster Beverage Corporation.