Berkshire Hathaway is one of the most valuable companies in the world, widely known for its diverse investments and leadership under Warren Buffett. But many still ask, who owns Berkshire?

The answer isn’t as simple as naming one person. This article explores the history, ownership, leadership, revenue, and major companies under Berkshire Hathaway.

History of Berkshire Hathaway

Berkshire Hathaway began as a textile manufacturing company in the 19th century. It was originally formed from the merger of two New England firms—Berkshire Fine Spinning Associates and Hathaway Manufacturing Company—in 1955.

Warren Buffett started buying shares in the company in the early 1960s. By 1965, he had taken control of it.

The textile operations eventually failed, but Buffett used Berkshire Hathaway’s shell to build a massive holding company. Over the decades, he acquired insurance businesses and reinvested the float into stocks and other businesses. This strategy transformed Berkshire into a global giant.

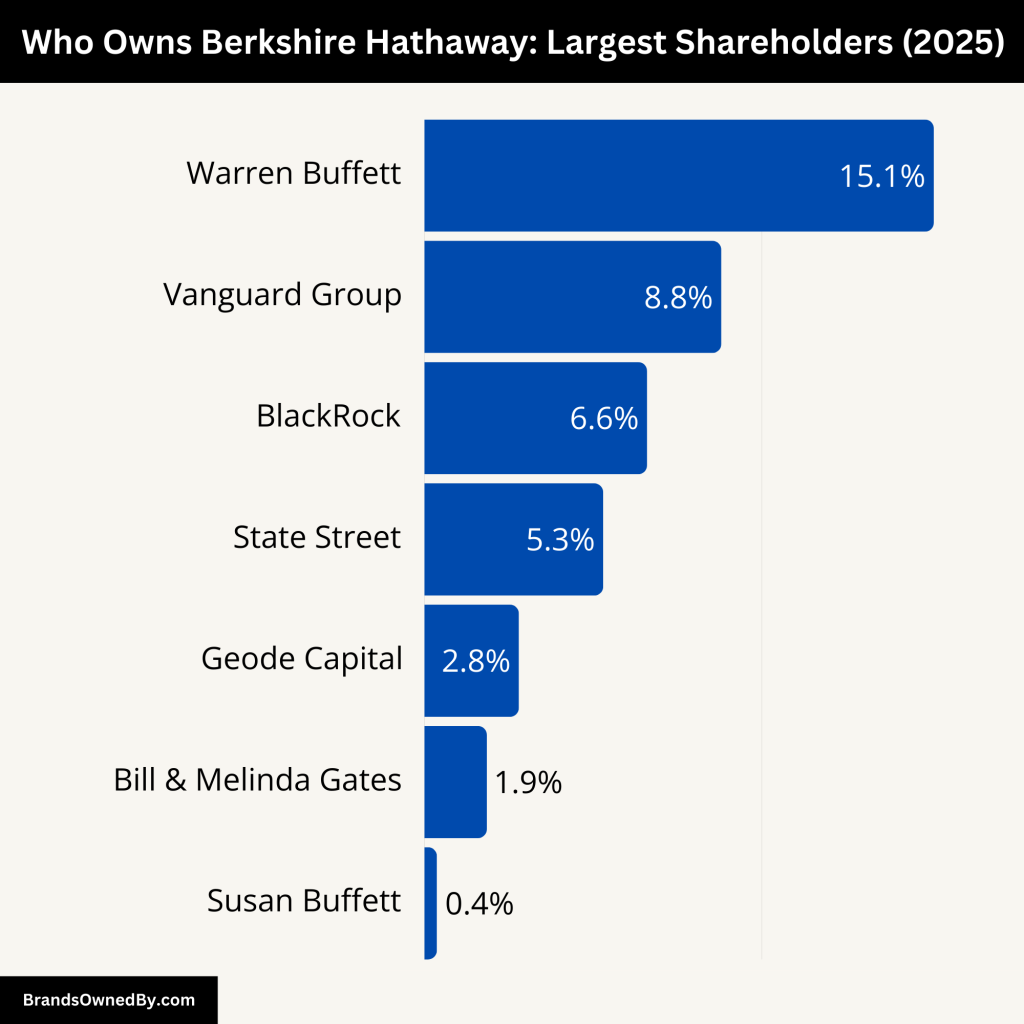

Who Owns Berkshire Hathaway: Top Shareholders

Berkshire Hathaway is a publicly traded company listed on the New York Stock Exchange under the tickers BRK.A and BRK.B. While thousands of shareholders own pieces of the company, the largest and most influential owner is Warren Buffett. He holds a significant share of the voting power due to his ownership of Class A shares.

Buffett’s voting control gives him major influence, but technically, no single person or entity “owns” Berkshire Hathaway outright. It is owned collectively by its shareholders.

Below is a breakdown of the major shareholders of Berkshire Hathaway:

| Shareholder | Estimated Ownership % | Share Class Focus | Role / Influence |

|---|---|---|---|

| Warren Buffett | ~15.1% (38.4% of Class A) | Class A | Largest individual shareholder; holds ~30% voting power; Chairman & CEO |

| Vanguard Group | ~8.8% | Primarily Class B | Largest institutional shareholder; passive investor |

| BlackRock | ~6.6% | Primarily Class B | Major institutional investor; passive, no direct influence |

| State Street Corporation | ~5.3% | Primarily Class B | Part of the “Big Three”; passive shareholder |

| Geode Capital Management | ~2.8% | Class B | Institutional investor; passive holding strategy |

| Bill & Melinda Gates Foundation | ~1.85% | Mixed | Stake from Buffett’s donations; no operational role |

| Susan Buffett | ~0.37% | Mixed | Buffett family member; minor influence; not involved in operations |

| Ajit Jain | Not publicly disclosed | Mixed | Longtime executive; holds significant shares from compensation |

Warren Buffett

Warren Buffett remains the largest individual shareholder of Berkshire Hathaway. He owns approximately 38.4% of the Class A voting shares, translating to a 15.1% overall economic interest in the company. Despite his philanthropic efforts, including significant donations to various foundations, Buffett retains substantial control over the company’s voting rights.

Vanguard Group

Vanguard Group is the largest institutional shareholder of Berkshire Hathaway. As of 2025, it holds approximately 8.8% of the company’s shares. Vanguard’s stake is primarily in Class B shares, reflecting its role as a passive investor on behalf of its fundholders.

BlackRock

BlackRock holds around 6.6% of Berkshire Hathaway’s shares, making it another significant institutional investor. Similar to Vanguard, BlackRock’s investment is mainly in Class B shares, and it does not exert direct influence over the company’s management decisions.

State Street Corporation

State Street Corporation owns approximately 5.3% of Berkshire Hathaway. As one of the “Big Three” institutional investors, State Street’s holdings are significant, yet it remains a passive investor without direct involvement in the company’s operations.

Bill & Melinda Gates Foundation Trust

The Bill & Melinda Gates Foundation Trust holds about 1.85% of Berkshire Hathaway. This stake was acquired through donations from Warren Buffett. While the foundation benefits financially from this investment, it does not participate in the company’s governance.

Geode Capital Management

Geode Capital Management owns approximately 2.8% of Berkshire Hathaway. As a significant institutional investor, Geode’s stake is part of its broader investment strategy across various sectors.

Susan Buffett

Susan Buffett, daughter of Warren Buffett, holds about 0.37% of Berkshire Hathaway. Her involvement reflects the Buffett family’s continued investment in the company, though she does not play an active role in its management.

Ajit Jain

Ajit Jain, Vice Chairman of Insurance Operations at Berkshire Hathaway, holds a notable number of shares. In 2024, he sold a portion of his holdings but still maintains a significant stake, reflecting his long-term commitment to the company.

Who is the CEO of Berkshire Hathaway?

As of May 2025, Berkshire Hathaway is undergoing a significant leadership transition. Warren Buffett, the legendary investor and CEO, has announced his retirement after a remarkable 60-year tenure. Greg Abel, Vice Chairman of Non-Insurance Operations, is set to assume the role of CEO at the end of 2025. This transition marks a new chapter for the conglomerate, ensuring continuity in its management and investment philosophy.

Warren Buffett: The Outgoing CEO

Warren Buffett, born in 1930, has been at the helm of Berkshire Hathaway since 1965. Under his leadership, the company transformed from a struggling textile manufacturer into a diversified conglomerate with holdings in insurance, utilities, railroads, and various other sectors. Buffett’s investment acumen earned him the moniker “Oracle of Omaha.” Even after stepping down as CEO, he will remain involved in the company as a non-executive chairman, providing guidance and oversight.

Greg Abel: The Incoming CEO

Greg Abel, born in 1962 in Edmonton, Alberta, Canada, has been with Berkshire Hathaway since 2000, following the company’s acquisition of MidAmerican Energy Holdings, now known as Berkshire Hathaway Energy (BHE). He became CEO of BHE in 2008 and was appointed Vice Chairman of Non-Insurance Operations at Berkshire Hathaway in 2018. Abel’s responsibilities have included overseeing a wide range of Berkshire’s businesses, such as BNSF Railway, Dairy Queen, and See’s Candies. Known for his operational expertise and strategic thinking, Abel is set to take over as CEO at the end of 2025.

Shareholder Control

Berkshire Hathaway is a publicly traded company with a diverse shareholder base. As of 2025, Warren Buffett remains the largest individual shareholder, owning approximately 38.4% of the Class A voting shares, which translates to a 15.1% overall economic interest in the company. Despite his retirement as CEO, Buffett’s significant shareholding ensures he retains considerable influence over the company’s direction.

Institutional investors also hold substantial stakes in Berkshire Hathaway. The Vanguard Group is the largest institutional shareholder, owning about 8.8% of the company’s shares. Other major institutional shareholders include BlackRock (approximately 6.6%) and State Street Corporation (around 5.3%). These entities primarily hold Class B shares and are considered passive investors, meaning they do not actively participate in the company’s management.

Board of Directors and Management Structure

Berkshire Hathaway’s governance is overseen by a board of directors comprising experienced professionals. Key members include:

- Warren Buffett: Chairman (non-executive)

- Greg Abel: Vice Chairman of Non-Insurance Operations

- Ajit Jain: Vice Chairman of Insurance Operations

- Howard Buffett: Board Member and son of Warren Buffett

- Susan Alice Buffett: Board Member and daughter of Warren Buffett

- Kenneth Chenault: Board Member and former CEO of American Express.

This board structure ensures a balance between continuity and fresh perspectives, with family members and seasoned executives contributing to the company’s strategic decisions.

Investment Management

Berkshire Hathaway’s investment portfolio is managed by Todd Combs and Ted Weschler, both of whom were hired by Buffett in the early 2010s. Combs, born in 1971, is also the CEO of GEICO, a Berkshire subsidiary. Weschler, born in 1962, has a background in hedge fund management. Together, they are responsible for a significant portion of Berkshire’s equity investments and are considered potential future Chief Investment Officers.

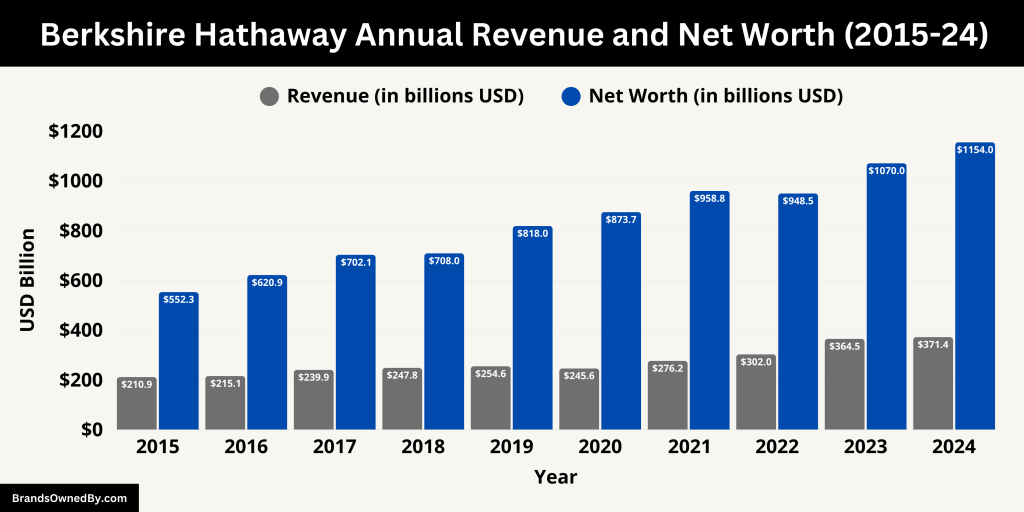

Annual Revenue and Net Worth of Berkshire Hathaway

In the fiscal year 2024, Berkshire Hathaway reported a total revenue of $371.43 billion, marking a 1.9% increase from the previous year’s $364.48 billion. This growth underscores the company’s resilience across its diverse portfolio, which includes insurance, energy, transportation, and manufacturing sectors.

The company achieved a net income of $88.995 billion in 2024, a slight decrease from $96.223 billion in 2023. This decline is attributed to various market factors, including fluctuations in investment gains.

As of early 2025, Berkshire Hathaway’s market capitalization has reached approximately $1.08 trillion, positioning it among the most valuable companies globally. This valuation reflects investor confidence in the company’s long-term strategy and financial health.

Additionally, the company’s cash reserves have grown to $334.2 billion, providing substantial liquidity for future investments and acquisitions.

Below is a table summarizing Berkshire Hathaway’s annual revenue, net income, and net worth over the past decade:

| Year | Revenue (in billions USD) | Net Income (USD Billion) | Net Worth (in billions USD) |

| 2024 | $371.43 | $89.00 | $1,154 |

| 2023 | $364.48 | $96.22 | $1,069.98 |

| 2022 | $302.02 | -$22.82 | $948.45 |

| 2021 | $276.19 | $89.80 | $958.78 |

| 2020 | $245.58 | $42.52 | $873.73 |

| 2019 | $254.62 | $81.42 | $818 |

| 2018 | $247.84 | $4.02 | $708 |

| 2017 | $239.93 | $44.94 | $702.10 |

| 2016 | $215.11 | $24.07 | $620.85 |

| 2015 | $210.94 | $24.08 | $552.26 |

Companies Owned by Berkshire Hathaway

Berkshire Hathaway owns over 60 companies outright and holds minority stakes in many others. Here are some of the major companies owned by Berkshire Hathaway:

| Company/Brand | Ownership Stake | Description |

|---|---|---|

| BNSF Railway | 100% | Acquired in 2010, BNSF Railway is one of North America’s largest freight railroad networks, operating approximately 32,500 miles of track. It plays a crucial role in transporting goods across the United States, supporting industries from agriculture to manufacturing. |

| GEICO | 100% | GEICO (Government Employees Insurance Company) is a leading auto insurer in the United States. Known for its direct-to-consumer model and memorable advertising campaigns, GEICO has been a wholly owned subsidiary of Berkshire Hathaway since 1996. |

| Berkshire Hathaway Energy | 100% | Berkshire Hathaway Energy (BHE) is a global energy company involved in the generation, transmission, and distribution of electricity and natural gas. With a focus on renewable energy, BHE serves millions of customers across the United States, Canada, and the United Kingdom. |

| Berkshire Hathaway Reinsurance Group | 100% | This division provides reinsurance solutions for property, casualty, life, and health insurance. It plays a significant role in Berkshire Hathaway’s insurance operations, offering large-scale risk coverage to clients worldwide. |

| McLane Company | 100% | McLane is a supply chain services company providing grocery and foodservice supply chain solutions. It serves convenience stores, mass merchants, drug stores, and chain restaurants throughout the United States. Berkshire Hathaway acquired McLane from Walmart in 2003. |

| Clayton Homes | 100% | Clayton Homes is the largest builder of manufactured and modular homes in the United States. It also offers financing and insurance services, making homeownership more accessible to a broader population. |

| Benjamin Moore & Co. | 100% | Benjamin Moore is a premium paint manufacturer known for its high-quality products and wide range of colors. It operates through a network of independent retailers across North America. |

| Dairy Queen | 100% | Dairy Queen is a fast-food and soft-serve ice cream chain with thousands of locations worldwide. It offers a variety of frozen treats and quick-service meals, maintaining a strong brand presence in the food industry. |

| Duracell | 100% | Duracell is a leading manufacturer of high-performance alkaline batteries, specialty cells, and rechargeables. Its products are used in a wide range of consumer electronics and are known for their reliability and long shelf life. |

| Fruit of the Loom | 100% | Fruit of the Loom is an American company that manufactures clothing, particularly casual wear and underwear. The company’s world headquarters are located in Bowling Green, Kentucky. Since 2002, it has been a wholly owned subsidiary of Berkshire Hathaway. |

| See’s Candies | 100% | See’s Candies is a manufacturer and distributor of boxed chocolates and other confectionery products. With a strong presence on the West Coast of the United States, it is renowned for its quality and customer service. Berkshire Hathaway acquired See’s Candies in 1972. |

| NetJets | 100% | NetJets offers fractional ownership and leasing of private business jets. It provides personalized aviation services, allowing clients to experience the benefits of private aviation without the responsibilities of full aircraft ownership. |

| The Pampered Chef | 100% | The Pampered Chef is a multi-level marketing company that sells kitchen tools, food products, and cookbooks. It empowers individuals to run their own businesses by selling products through in-home cooking demonstrations and online platforms. |

| Precision Castparts Corp. | 100% | Precision Castparts is a manufacturer of complex metal components and products, serving the aerospace, power, and industrial markets. Its products are critical in high-performance applications requiring precision and durability. |

| Lubrizol Corporation | 100% | Lubrizol is a specialty chemical company producing additives for transportation, industrial lubricants, and personal care products. Its innovations enhance the performance and longevity of various products and systems. |

| Marmon Holdings | 100% | Marmon Holdings is a global industrial organization comprising more than 100 autonomous manufacturing and service businesses. Its diverse operations span sectors such as transportation, construction, and food services. |

| Forest River | 100% | Forest River manufactures recreational vehicles, cargo trailers, and buses. It offers a wide range of products catering to both commercial and personal transportation needs. |

| Johns Manville | 100% | Johns Manville is a manufacturer of insulation, roofing materials, and engineered products. Its solutions contribute to energy efficiency and sustainability in residential and commercial buildings. |

| Scott Fetzer Company | 100% | Scott Fetzer is a diversified manufacturer and marketer of products for the home, family, and industry. Its portfolio includes brands offering cleaning systems, air compressors, and educational products. Berkshire Hathaway acquired Scott Fetzer in 1986. |

| Ben Bridge Jeweler | 100% | Ben Bridge Jeweler is a high-end American jewelry retailer specializing in engagement rings, diamonds, and luxury watches. It operates over 80 stores across the United States. Berkshire Hathaway acquired Ben Bridge Jeweler in 2000. |

| RC Willey Home Furnishings | 100% | RC Willey is a home furnishings company offering furniture, electronics, appliances, and flooring. It serves customers in the Western United States through its network of retail stores. |

| Pilot Flying J | 80% | Pilot Flying J is a chain of truck stops and travel centers across North America. It provides fuel, food, and other services to professional drivers and travelers. Berkshire Hathaway acquired a majority stake in Pilot Flying J in 2023. |

| Double-H Boots | 100% | Double-H Boots manufactures western footwear. It is owned by H.H. Brown, a wholly owned subsidiary of Berkshire Hathaway. |

| Jordan’s Furniture | 100% | Jordan’s Furniture is an American furniture retailer in New England. There are currently eight retail locations and a corporate office and warehouse in East Taunton, Massachusetts. Since 1999, the company has been a wholly owned subsidiary of Berkshire Hathaway. |

| Itochu Corporation | 9.8% | Berkshire Hathaway has invested in five major Japanese trading houses, including Itochu. As of the end of 2024, Berkshire’s investments in these companies totaled $23.5 billion, with ownership stakes raised to as high as 9.8%. |

| Marubeni Corporation | 9.8% | Similar to Itochu, Marubeni is one of the five Japanese trading houses in which Berkshire Hathaway has invested, holding up to a 9.8% stake as of the end of 2024. |

| Mitsubishi Corporation | 9.8% | Berkshire Hathaway holds up to a 9.8% stake in Mitsubishi, one of Japan’s leading trading companies, as part of its investment in Japanese trading houses. |

| Mitsui & Co., Ltd. | 9.8% | Mitsui is another of the five Japanese trading houses in which Berkshire Hathaway has invested, with ownership stakes raised to as high as 9.8% as of the end of 2024. |

| Sumitomo Corporation | 9.8% | Sumitomo is the fifth Japanese trading house in which Berkshire Hathaway holds up to a 9.8% stake, completing its investment in the group known as “sogo shosha.” |

BNSF Railway

BNSF Railway is one of the largest freight railroad networks in North America. Acquired by Berkshire Hathaway in 2010, BNSF plays a crucial role in transporting goods across the United States, supporting industries from agriculture to manufacturing. The railway operates approximately 32,500 miles of track, primarily in the western and central United States.

GEICO

GEICO (Government Employees Insurance Company) is a leading auto insurer in the United States. Known for its direct-to-consumer model and memorable advertising campaigns, GEICO has been a wholly owned subsidiary of Berkshire Hathaway since 1996.

Berkshire Hathaway Energy

Berkshire Hathaway Energy (BHE) is a global energy company involved in the generation, transmission, and distribution of electricity and natural gas. With a focus on renewable energy, BHE serves millions of customers across the United States, Canada, and the United Kingdom. BHE’s subsidiaries include PacifiCorp, MidAmerican Energy, NV Energy, and Northern Powergrid.

Berkshire Hathaway Reinsurance Group

This division provides reinsurance solutions for property, casualty, life, and health insurance. It plays a significant role in Berkshire Hathaway’s insurance operations, offering large-scale risk coverage to clients worldwide.

McLane Company

McLane is a supply chain services company providing grocery and foodservice supply chain solutions. It serves convenience stores, mass merchants, drug stores, and chain restaurants throughout the United States. Berkshire Hathaway acquired McLane from Walmart in 2003.

Clayton Homes

Clayton Homes is the largest builder of manufactured and modular homes in the United States. It also offers financing and insurance services, making homeownership more accessible to a broader population.

Benjamin Moore & Co.

Benjamin Moore is a premium paint manufacturer known for its high-quality products and wide range of colors. It operates through a network of independent retailers across North America.

Dairy Queen

Dairy Queen is a fast-food and soft-serve ice cream chain with thousands of locations worldwide. It offers a variety of frozen treats and quick-service meals, maintaining a strong brand presence in the food industry.

Duracell

Duracell is a leading manufacturer of high-performance alkaline batteries, specialty cells, and rechargeables. Its products are used in a wide range of consumer electronics and are known for their reliability and long shelf life.

Fruit of the Loom

Fruit of the Loom is an American company that manufactures clothing, particularly casual wear and underwear. The company’s world headquarters are located in Bowling Green, Kentucky. Since 2002, it has been a wholly owned subsidiary of Berkshire Hathaway.

See’s Candies

See’s Candies is a manufacturer and distributor of boxed chocolates and other confectionery products. With a strong presence on the West Coast of the United States, it is renowned for its quality and customer service. Berkshire Hathaway acquired See’s Candies in 1972.

NetJets

NetJets offers fractional ownership and leasing of private business jets. It provides personalized aviation services, allowing clients to experience the benefits of private aviation without the responsibilities of full aircraft ownership.

The Pampered Chef

The Pampered Chef is a multi-level marketing company that sells kitchen tools, food products, and cookbooks. It empowers individuals to run their own businesses by selling products through in-home cooking demonstrations and online platforms.

Precision Castparts Corp.

Precision Castparts is a manufacturer of complex metal components and products, serving the aerospace, power, and industrial markets. Its products are critical in high-performance applications requiring precision and durability.

Lubrizol Corporation

Lubrizol is a specialty chemical company producing additives for transportation, industrial lubricants, and personal care products. Its innovations enhance the performance and longevity of various products and systems.

Marmon Holdings

Marmon Holdings is a global industrial organization comprising more than 100 autonomous manufacturing and service businesses. Its diverse operations span sectors such as transportation, construction, and food services.

Forest River

Forest River manufactures recreational vehicles, cargo trailers, and buses. It offers a wide range of products catering to both commercial and personal transportation needs.

Johns Manville

Johns Manville is a manufacturer of insulation, roofing materials, and engineered products. Its solutions contribute to energy efficiency and sustainability in residential and commercial buildings.

Scott Fetzer Company

Scott Fetzer is a diversified manufacturer and marketer of products for the home, family, and industry. Its portfolio includes brands offering cleaning systems, air compressors, and educational products. Berkshire Hathaway acquired Scott Fetzer in 1986.

Ben Bridge Jeweler

Ben Bridge Jeweler is a high-end American jewelry retailer specializing in engagement rings, diamonds, and luxury watches. It operates over 80 stores across the United States. Berkshire Hathaway acquired Ben Bridge Jeweler in 2000.

RC Willey Home Furnishings

RC Willey is a home furnishings company offering furniture, electronics, appliances, and flooring. It serves customers in the Western United States through its network of retail stores.

Pilot Flying J

Pilot Flying J is a chain of truck stops and travel centers across North America. It provides fuel, food, and other services to professional drivers and travelers. Berkshire Hathaway acquired a majority stake in Pilot Flying J in 2017 and completed the acquisition in 2023.

Double-H Boots

Double-H Boots manufactures western footwear. It is owned by H.H. Brown, a wholly owned subsidiary of Berkshire Hathaway.

Jordan’s Furniture

Jordan’s Furniture is an American furniture retailer in New England. There are currently eight retail locations and a corporate office and warehouse in East Taunton, Massachusetts. Since 1999, the company has been a wholly owned subsidiary of Berkshire Hathaway.

Final Thoughts

Understanding who owns Berkshire reveals a structure centered around long-term value and shareholder loyalty. Warren Buffett, as both a major shareholder and CEO, has played a dominant role in shaping the company’s identity. While many institutional investors hold significant stakes, control remains firmly with Buffett and his chosen successors.

Berkshire Hathaway stands out for its unique approach to capital allocation, diversified portfolio, and iconic leadership. Its decentralized model has allowed its businesses to thrive independently while still contributing to overall growth.

FAQs

Who are the largest shareholders of Berkshire Hathaway?

The largest shareholders of Berkshire Hathaway are:

- Warren Buffett: He remains the largest shareholder with approximately 16% of the total shares.

- Charlie Munger: As Buffett’s long-time business partner, Munger holds a significant share, though much smaller than Buffett’s.

- Vanguard Group: One of the largest institutional investors, Vanguard holds a significant stake in Berkshire Hathaway.

- BlackRock: Another major institutional investor with a substantial portion of Berkshire Hathaway’s shares.

- Bill & Melinda Gates Foundation Trust: The foundation holds a portion of Berkshire Hathaway shares due to donations from Warren Buffett.

Who is the owner of Berkshire Hathaway?

Berkshire Hathaway is a publicly traded company, so it has many owners in the form of shareholders. The largest individual owner is Warren Buffett, who controls a significant portion of the company, with Charlie Munger being another influential shareholder.

Does Bill Gates own part of Berkshire Hathaway?

Yes, Bill Gates owns a portion of Berkshire Hathaway, largely through the Bill & Melinda Gates Foundation Trust, which received a significant donation from Warren Buffett. While Bill Gates himself is no longer actively involved, the foundation retains its holdings.

Does Warren Buffett still own Dairy Queen?

Yes, Warren Buffett’s Berkshire Hathaway owns Dairy Queen through its subsidiary International Dairy Queen, Inc. Berkshire Hathaway acquired Dairy Queen in 1997.

What are Berkshire Hathaway’s top 3 holdings?

As of 2025, the top three holdings of Berkshire Hathaway are:

- Apple Inc. – Berkshire Hathaway holds a significant stake in Apple, making it the largest position in the portfolio.

- Bank of America – A long-time favorite, Berkshire owns a large portion of Bank of America.

- Coca-Cola – A staple in Berkshire’s portfolio, Coca-Cola has been a long-term investment for the company.

Who replaced Warren Buffett?

Warren Buffett has not yet been replaced as the CEO of Berkshire Hathaway. However, Gregory A. Buffett, the CEO of Berkshire Hathaway Energy, is considered a likely successor. Warren Buffett has frequently mentioned that Ajit Jain and Gregory A. Buffett are among the top candidates.

Is Berkshire Hathaway family-owned?

No, Berkshire Hathaway is not family-owned. It is a publicly traded company, meaning its ownership is spread across institutional and individual shareholders. However, Warren Buffett and his family hold a significant stake in the company.

Does Berkshire own any Microsoft?

Yes, Berkshire Hathaway holds a stake in Microsoft. It was one of the notable investments made by Warren Buffett’s firm in the past few years, especially given the importance of the tech sector.

Does Berkshire Hathaway own Toyota?

As of 2025, Berkshire Hathaway owns a stake in Toyota, but it is a relatively small percentage. Buffett’s firm made a strategic investment in Toyota as part of its diversification strategy.

What percentage of Berkshire Hathaway does Buffett own?

Warren Buffett personally owns around 16% of Berkshire Hathaway‘s total shares, making him the largest individual shareholder of the company.

Who are Berkshire Hathaway Class B shareholders?

Class B shareholders of Berkshire Hathaway are primarily individual investors who purchase the more affordable Class B shares, as opposed to the more expensive Class A shares. The ownership is quite diverse, with institutional investors like Vanguard Group and BlackRock holding significant stakes.

Who heads up Berkshire Hathaway?

Warren Buffett is the CEO of Berkshire Hathaway, and Charlie Munger serves as Vice Chairman. Warren Buffett has indicated that he plans to step down soon, with likely successors being Gregory A. Buffett or Ajit Jain.

How much of Berkshire Hathaway is in cash?

As of 2025, Berkshire Hathaway holds approximately $150 billion in cash and cash equivalents, which provides flexibility for acquisitions and investments. The cash reserve has been a key characteristic of Buffett’s strategy, allowing him to take advantage of market opportunities.

Who owns Berkshire Hathaway HomeServices?

Berkshire Hathaway HomeServices is owned by Berkshire Hathaway. It is part of the company’s real estate division, providing a full range of real estate services, including residential, commercial, and property management.

Is GEICO owned by Berkshire Hathaway?

Yes, GEICO (Government Employees Insurance Company) is owned by Berkshire Hathaway. Berkshire Hathaway acquired GEICO in 1996, and it remains one of the largest contributors to the company’s revenue.

Who owns Berkshire Hathaway Realty?

Berkshire Hathaway HomeServices is the real estate arm of Berkshire Hathaway. It is a network of real estate brokerages across North America and internationally, offering real estate services under the Berkshire Hathaway brand.

What is the difference between BRK.A and BRK.B shares?

BRK.A shares are original Class A shares with full voting rights and a high price (over $500,000 per share). BRK.B shares were introduced to make Berkshire more accessible and come with 1/10,000th of the voting power of A shares.

Does Warren Buffett still run Berkshire Hathaway?

Yes, as of 2025, Buffett is still the Chairman and CEO. However, Greg Abel has been named his successor.

Is Berkshire Hathaway a publicly traded company?

Yes, it is listed on the NYSE under the tickers BRK.A and BRK.B.