Gatorade is one of the most popular sports drinks worldwide. The brand has become synonymous with hydration and performance. So, who owns Gatorade? In this article, we’ll dive into the ownership structure of Gatorade, its history, and the major shareholders behind the company.

History of Gatorade

Gatorade was created in 1965 by a team of scientists at the University of Florida. The original purpose of the drink was to help athletes stay hydrated during intense physical activity. It was developed in response to the needs of the university’s football team, whose players were suffering from dehydration.

Over the years, Gatorade gained popularity and was eventually sold to large corporations becoming the global brand we recognize today.

Who Owns Gatorade: Shareholder Details

Gatorade is currently owned by PepsiCo, a multinational food and beverage company. PepsiCo acquired Gatorade in 2001, and since then, the brand has been a crucial part of its portfolio. PepsiCo’s ownership has allowed Gatorade to expand its reach and solidify its position as the market leader in sports drinks.

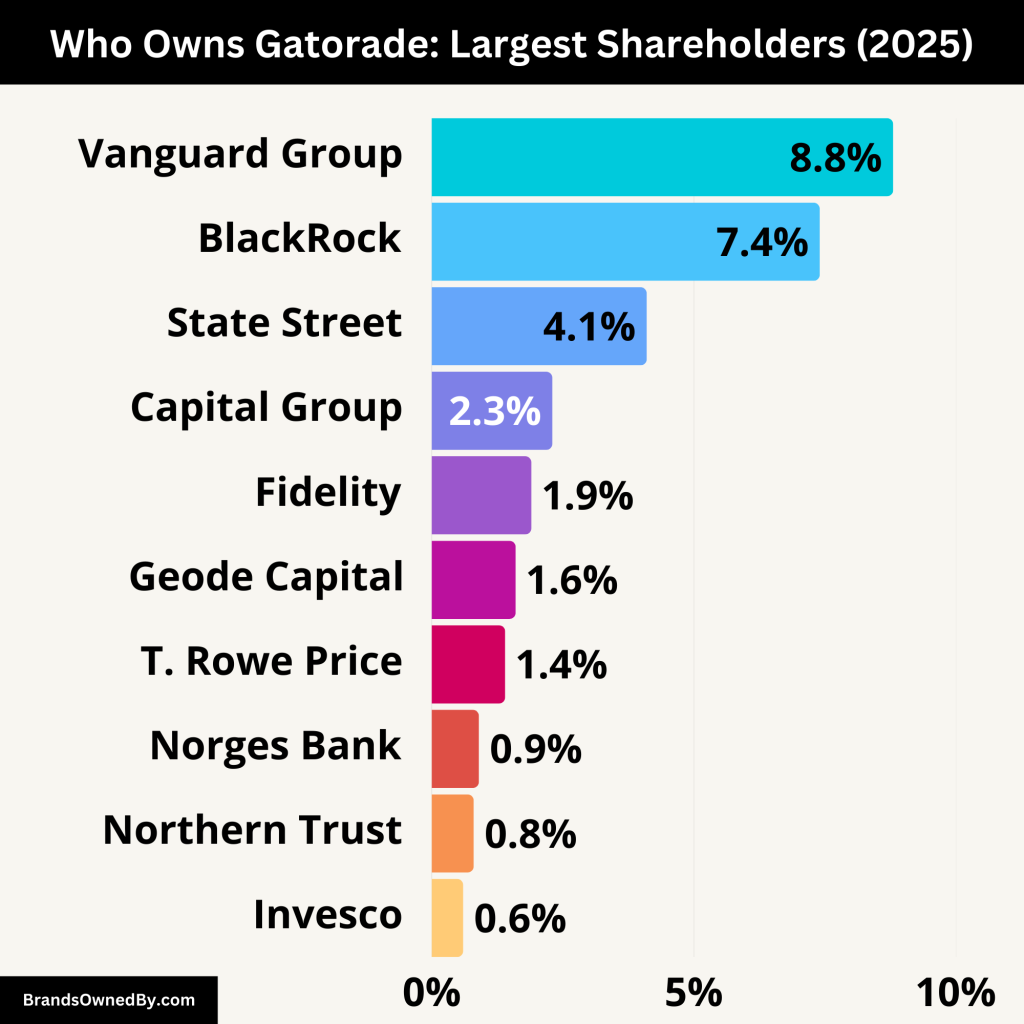

PepsiCo, as the parent company of Gatorade, has a diverse range of shareholders, from institutional investors to individual stakeholders. Below are some of the major shareholders:

| Shareholder | Estimated Ownership (%) | Type | Role and Influence |

|---|---|---|---|

| The Vanguard Group | ~8.8% | Institutional (Passive) | Largest shareholder; influences governance through proxy voting and ESG initiatives |

| BlackRock, Inc. | ~7.4% | Institutional (Passive) | Major influence on sustainability and corporate strategy; frequently engages with management |

| State Street Corporation | ~4.1% | Institutional (Passive) | Votes on ESG and board diversity; supports long-term governance reforms |

| Capital Group (American Funds) | ~2.3% | Institutional (Active) | Engages more directly with management; supports leadership delivering long-term growth |

| Fidelity Investments | ~1.9% | Institutional (Mixed) | Combines active and passive strategies; known for research-driven investing |

| Geode Capital Management | ~1.6% | Institutional (Passive) | Manages Fidelity index funds; votes on governance issues without active engagement |

| T. Rowe Price Associates | ~1.4% | Institutional (Active) | Long-term investor; may influence business direction and executive decisions |

| Norges Bank Investment Management | ~0.9% | Sovereign Wealth Fund | Advocates for ethical investment and sustainability standards |

| Northern Trust Corporation | ~0.8% | Institutional (Passive) | Votes on shareholder proposals; supports ESG and governance best practices |

| Invesco Ltd. | ~0.6% | Institutional (Mixed) | Supports governance through proxy voting; less active publicly |

| Retail & Public Shareholders | ~25%+ | Individuals & Public | Collective voting influence; includes small investors and employee shareholders |

| PepsiCo Executives & Board Members | Small (Insider Holdings) | Internal Stakeholders | Aligns executive compensation with performance; incentivizes leadership effectiveness |

The Vanguard Group

The Vanguard Group is the single largest shareholder in PepsiCo, holding around 8.8% of the company’s outstanding shares. Vanguard is known for its passive investment approach through index funds and ETFs, such as the Vanguard Total Stock Market Index Fund.

While it doesn’t seek to control companies directly, Vanguard actively participates in shareholder meetings and votes on key governance issues, including board appointments, executive compensation, and sustainability practices.

BlackRock, Inc.

BlackRock owns about 7.4% of PepsiCo and is the second-largest shareholder. Known for its iShares ETF product line, BlackRock similarly follows a passive management style but has grown increasingly active on environmental and social issues in recent years.

Its CEO, Larry Fink, often emphasizes corporate responsibility and long-term stakeholder value. BlackRock engages with PepsiCo’s board on ESG metrics and frequently publishes public letters urging transparency and sustainability. Its voting record is closely watched across the market, and it often aligns with or challenges management depending on the issue.

State Street Corporation

State Street holds approximately 4.1% of PepsiCo. It’s another passive investment giant and offers products like the SPDR S&P 500 ETF Trust. State Street’s philosophy includes responsible stewardship, and it votes in nearly every shareholder meeting of the companies it invests in.

It generally supports management, State Street also advocates for diversity on corporate boards and increased climate-related disclosures. Its role is less visible to the public than Vanguard or BlackRock but equally important due to its voting power.

Capital Group (American Funds)

Capital Group, through its American Funds, owns about 2.3% of PepsiCo. Unlike the big three passive funds, Capital Group takes an active investment approach. Its portfolio managers conduct deep fundamental research before investing.

As an active investor, Capital Group may engage with PepsiCo management directly, influencing business strategy more overtly than passive fund giants. It tends to support leadership that delivers consistent returns but may pressure management if performance lags.

Fidelity Investments

Fidelity holds roughly 1.9% of PepsiCo shares across several mutual funds. It is one of the largest privately owned investment managers in the world and is known for a combination of active and passive strategies. Fidelity’s portfolio managers often take long-term positions in high-quality companies like PepsiCo.

The firm’s analysts regularly meet with company executives, giving it insights into internal performance. Though not highly activist, Fidelity votes on corporate governance and compensation policies in line with shareholder interests.

Northern Trust Corporation

Northern Trust owns about 0.8% of PepsiCo. It is a major custodian and asset manager for institutional clients, such as pension funds and endowments. Northern Trust follows a largely passive and quantitative investment strategy. While it has a smaller stake, the firm still exercises proxy voting rights and supports ESG disclosures and risk management policies. It is also involved in financial oversight for clients whose funds are invested in PepsiCo.

Geode Capital Management

Geode Capital owns nearly 1.6% of PepsiCo. It operates as a sub-advisor to many Fidelity index funds, including the Fidelity 500 Index Fund. While not a household name, Geode manages hundreds of billions in assets.

Its role is entirely passive, mirroring the S&P 500 and other benchmarks. Geode typically supports management unless there are strong reasons to vote otherwise, such as governance or ethical concerns raised by shareholders.

Norges Bank Investment Management (Norway’s Sovereign Wealth Fund)

Norges Bank Investment Management, which manages Norway’s Government Pension Fund Global, holds about 0.9% of PepsiCo. This fund is known for taking ethical investment stances and publicly discloses its expectations on climate risk, human rights, and board effectiveness.

Although its stake in PepsiCo is small relative to U.S. institutions, its international reputation gives it weight. It may vote against management if the company fails to align with globally accepted standards on sustainability and ethical operations.

T. Rowe Price Associates

T. Rowe Price owns around 1.4% of PepsiCo. The firm is known for its disciplined investment process and typically takes long-term positions in blue-chip stocks. T. Rowe Price fund managers conduct deep company analysis and may offer informal feedback to executives.

Their support is usually tied to financial performance, leadership quality, and capital allocation. If necessary, they may advocate for changes, especially if growth slows or margins decline.

Invesco Ltd.

Invesco manages around 0.6% of PepsiCo shares through actively and passively managed funds. Known for products like the Invesco QQQ ETF, the firm maintains diversified exposure to consumer staples. While it’s not a leading voice in governance, Invesco engages on shareholder resolutions and contributes to overall voting trends during annual general meetings. Its weight adds to the collective voice of mid-tier institutions.

Public and Retail Shareholders

Retail investors, including individual stockholders, employees, and those who own PepsiCo stock through retirement accounts, collectively own about 25% or more of the company.

These shareholders do not typically organize or campaign, but they vote via proxy statements sent out annually. Their ownership base provides liquidity and market stability. The cumulative weight of retail votes can make a difference, especially when institutional investors are divided.

PepsiCo Executives and Board Members

Top-level insiders, including the CEO, CFO, and members of the board of directors, collectively hold a small but strategic amount of shares. For example, CEO Ramon Laguarta holds shares valued in the millions.

These insider holdings align executive interests with shareholders and are often tied to performance-based incentive programs. While their ownership isn’t large enough to dictate outcomes, it reflects internal confidence in PepsiCo’s growth and long-term outlook.

Who Controls Gatorade?

Gatorade is a fully owned subsidiary of PepsiCo, so its operations, strategy, and leadership decisions are ultimately governed by PepsiCo’s corporate structure. Control over Gatorade rests with PepsiCo’s executive leadership team, its board of directors, and key decision-making committees.

Executive Leadership of PepsiCo

PepsiCo’s executive team oversees all its business units, including beverages, snacks, and nutrition. Gatorade falls under the beverage category, which is one of the company’s largest divisions.

Ramon Laguarta – Chairman and CEO of PepsiCo

Ramon Laguarta has been the Chairman and Chief Executive Officer of PepsiCo since October 2018. He succeeded Indra Nooyi and became the first Spanish-born CEO of the company. Laguarta has been with PepsiCo for over 25 years and previously served as CEO of PepsiCo Europe and Sub-Saharan Africa. He is fluent in multiple languages and brings a global perspective to the company’s leadership.

Under Laguarta’s leadership, PepsiCo has focused on:

- Expanding its health and wellness portfolio (including innovation in Gatorade’s product line)

- Investing in digital transformation and sustainability

- Strengthening the company’s global footprint

Laguarta directly influences Gatorade’s direction through strategic planning, resource allocation, marketing, and global brand development.

Beverage Division Leadership

Gatorade is part of PepsiCo’s North America Beverage (NAB) unit. This division includes other major beverage brands like Pepsi, Mountain Dew, and Aquafina.

- Greg Lyons, Chief Marketing Officer of PepsiCo Beverages North America, plays a key role in Gatorade’s branding and advertising strategies.

- Kirk Tanner, who previously led NAB until early 2024, helped expand the Gatorade portfolio with new products like Gatorade Zero and Bolt24.

While the CEO oversees corporate strategy, product-level decisions, innovation, and marketing are managed within the beverage division. Gatorade’s leadership collaborates closely with PepsiCo executives to align with overall company goals.

Board of Directors

PepsiCo’s Board of Directors is responsible for overall governance and oversight. The board approves major initiatives, including mergers, acquisitions, and capital expenditures. It ensures that PepsiCo, including its brands like Gatorade, operates in the best interest of shareholders.

The board includes experienced professionals from various industries, including consumer goods, finance, and technology. Some prominent members include:

- Michelle Gass – CEO of Levi Strauss (board member of PepsiCo)

- Robert Ford – Chairman and CEO of Abbott Laboratories

- Shona Brown – Former SVP of Google

The board committees, such as the Audit, Compensation, and Nominating committees, also help shape executive incentives and corporate risk management.

Shareholder Influence

Large institutional shareholders like Vanguard and BlackRock hold significant voting power at annual meetings. While they don’t run day-to-day operations, their influence is seen in board elections, executive pay approvals, and major company resolutions. They indirectly shape Gatorade’s future by influencing how PepsiCo is governed.

Strategic Committees and Innovation Teams

Gatorade also benefits from specialized innovation teams within PepsiCo that focus on R&D, product development, and health sciences. These teams support the development of new Gatorade products, like protein bars, energy chews, and low-sugar variants.

In summary, while Gatorade operates under its own brand identity, the strategic and operational control comes from PepsiCo’s executive leadership, its beverage division heads, the board of directors, and its major institutional investors.

Annual Revenue and Net Worth of Gatorade

Gatorade is a significant contributor to PepsiCo’s overall revenue. In 2023, Gatorade’s global sales were estimated at over $5 billion. The brand’s dominance in the sports drink market, alongside its innovative marketing strategies, has contributed to its strong financial performance.

In 2024, PepsiCo reported net revenue of $91.85 billion, reflecting a modest 0.4% increase from 2023. This growth was influenced by foreign exchange headwinds and subdued performance in certain segments. For 2025, PepsiCo projects low-single-digit revenue growth and mid-single-digit core earnings growth, supported by international expansion and productivity initiatives.

Gatorade’s Financial Performance

As a key brand within PepsiCo’s beverage portfolio, Gatorade contributes significantly to the company’s revenue.

In 2024, Gatorade’s estimated annual revenue was approximately $6.7 billion, maintaining its position as a leading sports drink brand in the United States. The brand’s performance is bolstered by product innovation and strong market presence.

Gatorade continues to dominate the U.S. sports drink market, holding a substantial market share.

In 2024, Gatorade’s sales in the U.S. were estimated at $6.7 billion, underscoring its leadership in the category. The brand’s success is attributed to its extensive product range and strong consumer loyalty.

Here’s an overview of Gatorade revenue and net worth (estimated) for the last 10 years:

| Year | Estimated Revenue (USD) | Estimated Brand Valuation (USD) |

|---|---|---|

| 2015 | $6.0 billion | $8.0 billion |

| 2016 | $6.2 billion | $8.5 billion |

| 2017 | $6.4 billion | $9.0 billion |

| 2018 | $6.6 billion | $9.5 billion |

| 2019 | $7.6 billion | $10.0 billion |

| 2020 | $6.72 billion | $10.5 billion |

| 2021 | $6.9 billion | $10.7 billion |

| 2022 | $7.1 billion | $10.9 billion |

| 2023 | $7.3 billion | $11.0 billion |

| 2024 | $6.7 billion | $11.2 billion |

Brands Owned by Gatorade

Although Gatorade is a single brand under PepsiCo, it has developed a wide array of sub-brands, product lines, and innovations to meet the needs of different types of consumers. These sub-brands are tailored for hydration, energy, recovery, and performance enhancement.

Here’s a list of the most pominent brands by Gatorade:

| Brand/Product Line | Description |

|---|---|

| Gatorade Thirst Quencher | Original and most popular sports drink, developed for hydration and electrolyte replenishment. |

| Gatorade Zero | Sugar-free version of Gatorade aimed at calorie-conscious consumers. |

| Gatorlyte | Hydration drink formulated for rapid rehydration with additional electrolytes. |

| Gx (Custom Hydration) | Customizable hydration system with pods and smart bottles. |

| Bolt24 | Premium hydration drink with antioxidants and low sugar. |

| Gatorade Protein | Post-workout shakes and bars designed for muscle recovery. |

| Gatorade Endurance | Sports drink targeted at endurance athletes with more electrolytes. |

| Gatorade Super Shake | Protein shakes designed for muscle recovery after workouts. |

| Gatorade Fit | Healthy, sugar-free hydration alternatives made with natural ingredients. |

| Gatorade Chews | Energy chews that provide quick carbohydrates for energy during sports. |

| Gatorade Prime | Pre-workout energy product in gel form for immediate fuel. |

| Gatorade Recover Whey Protein Bars | Protein bars for post-exercise recovery, providing a balanced mix of protein and carbs. |

Gatorade Thirst Quencher

This is the original and most iconic product in the Gatorade portfolio. It was developed in 1965 for the University of Florida football team to replenish electrolytes and fluids lost during games.

- Contains sodium and potassium to support hydration.

- Available in dozens of flavors.

- Widely used by athletes at all levels, from youth sports to professional leagues.

It remains the top-selling sports drink in the United States.

Gatorade Zero

Launched in 2018, Gatorade Zero was designed for consumers who want hydration without sugar or calories.

- Offers the same electrolytes as the original Gatorade.

- Appeals to fitness-conscious users, diabetics, and those managing weight.

- Quickly became one of Gatorade’s most successful product innovations.

Gatorade Zero competes with products like Vitaminwater Zero and Propel.

Gatorlyte

Gatorlyte is a rapid rehydration drink launched in 2021. It’s formulated with five electrolytes and lower sugar levels compared to the original Thirst Quencher.

- Includes magnesium, calcium, potassium, and sodium.

- Marketed as a faster recovery solution for intense athletes.

- Similar in function to electrolyte drinks like Pedialyte Sport.

It reflects Gatorade’s push toward more medically-oriented hydration products.

Gx (Gatorade Custom Hydration)

The Gx platform represents customized hydration technology for high-performance athletes.

- Features refillable squeeze bottles with concentrated Gx pods.

- Allows users to control flavor intensity and electrolyte intake.

- Includes smart bottle integrations for tracking fluid consumption.

The Gx system is widely used by elite athletes and teams in professional sports.

Bolt24

Bolt24 is a premium hydration beverage line developed for modern, wellness-focused consumers. It’s marketed as “hydration with a purpose.”

- Contains no artificial flavors, colors, or sweeteners.

- Available in variations like Bolt24 Energize (with caffeine) and Bolt24 Restore (with antioxidants and vitamins).

- Targets off-the-field recovery and daily wellness, rather than in-game hydration.

Bolt24 reflects Gatorade’s attempt to compete with lifestyle and functional beverage brands like BodyArmor and Celsius.

Gatorade Protein

This line of post-workout recovery products includes shakes and bars that help athletes recover and rebuild muscle.

- Protein shakes contain 20g of protein per serving.

- Bars are rich in carbohydrates and protein, optimized for recovery.

- Often used as part of training nutrition routines.

The line complements Gatorade’s hydration products by supporting full-cycle athletic performance.

Gatorade Endurance

Gatorade Endurance is formulated specifically for endurance athletes, such as marathoners, triathletes, and cyclists.

- Has more electrolytes (especially sodium) than the standard formula.

- Designed for long-duration exercise and extreme heat conditions.

- Used officially in major race events like the Boston Marathon.

It’s available in specialty retailers and online, often promoted to elite runners and performance coaches.

Gatorade Super Shake

Gatorade Super Shake is a ready-to-drink protein shake targeted at athletes who need post-workout recovery in a convenient format.

- Each bottle contains around 30g of high-quality milk protein.

- Also provides carbohydrates for glycogen restoration.

- Enriched with essential vitamins and minerals.

- Marketed toward athletes with high training volume and recovery needs.

It competes with products like Muscle Milk and Core Power but leverages Gatorade’s sports science branding.

Gatorade Fit

Launched in 2022, Gatorade Fit is a healthy hydration alternative aimed at wellness-conscious consumers who avoid artificial ingredients.

- Contains no added sugar, no artificial sweeteners, no dyes.

- Made with coconut water and sea salt for natural electrolyte replenishment.

- Designed for light fitness, yoga, or daily wellness hydration.

- Comes in flavors like Watermelon Strawberry and Tropical Mango.

Gatorade Fit is PepsiCo’s response to the growing demand for clean-label functional drinks.

Gatorade Chews

Gatorade Energy Chews are portable carbohydrate sources designed for pre-workout or mid-competition energy boosts.

- Popular among runners, cyclists, and endurance athletes.

- Chews provide fast-acting carbs without needing to drink fluids.

- Typically available in small packs with flavors like Fruit Punch and Strawberry.

They are part of Gatorade’s fueling system, aligning with its drinks and recovery products.

Gatorade Prime

Gatorade Prime is part of a three-step athletic fueling system (Prime → Perform → Recover).

- Prime is a pre-workout energy pouch consumed 15 minutes before activity.

- It contains simple carbs for quick energy delivery.

- Often used in team sports for a fast energy surge before games or intense practices.

Though less prominent in retail now, Prime helped pioneer the concept of performance timing in sports nutrition.

Gatorade Recover Whey Protein Bars

This product was part of Gatorade’s earlier efforts to expand into post-exercise muscle repair solutions.

- Bars provide a balanced mix of protein and carbs.

- Targeted athletes recovering from strength training or endurance workouts.

- Available in flavors like Chocolate Chip and Peanut Butter Chocolate.

They are still used in training programs and team fueling strategies, especially at the collegiate and pro levels.

Final Words

Gatorade is owned by PepsiCo, a giant in the food and beverage industry. Through its acquisition in 2001, PepsiCo has expanded Gatorade’s reach and solidified its leadership in the sports drink market.

PepsiCo’s diverse range of shareholders and strategic control has ensured Gatorade’s continued success. With strong annual revenue and a broad portfolio of other brands, PepsiCo remains a dominant player in the global market.

FAQs

Who founded Gatorade?

Gatorade was founded by a team of researchers at the University of Florida, led by Dr. Cade, who developed the formula to help athletes stay hydrated during intense physical activity.

When did PepsiCo acquire Gatorade?

PepsiCo acquired Gatorade in 2001 for $13.4 billion, marking a major step in expanding its beverage portfolio.

Is Gatorade owned by Coca-Cola?

No, Gatorade is owned by PepsiCo, not Coca-Cola. Coca-Cola has its own sports drink, Powerade, which competes with Gatorade.

How much does PepsiCo make from Gatorade?

Gatorade generates over $5 billion in annual revenue, contributing significantly to PepsiCo’s overall financial success.