Nokia has long been a key name in global telecommunications. Once a dominant mobile phone maker, it now focuses on network infrastructure and technology. But who owns Nokia today?

Let’s explore the company’s history, ownership structure, and the key players behind it.

History of Nokia

Origins as a Pulp Mill (1865–1890s)

Nokia began in 1865 when Finnish engineer Fredrik Idestam opened a wood pulp mill by the Tammerkoski Rapids in southern Finland. The company was named after the Nokianvirta River, near which Idestam built a second mill. This name later became the brand we know today. Initially, Nokia focused on pulp, paper, and power generation.

Expansion into Rubber and Cables (1900s–1960s)

In the early 20th century, Nokia merged with Finnish Rubber Works and Finnish Cable Works. These mergers expanded Nokia’s operations into manufacturing rubber boots, tires, and electrical cables. By the 1960s, the three companies formally merged to become the Nokia Corporation. This laid the foundation for the company’s entry into electronics.

Entry into Electronics and Telecom (1960s–1980s)

Nokia entered the electronics market in the 1960s. It developed products like radios, televisions, and early computing devices. It also ventured into military and commercial telecommunications equipment. In the 1970s, Nokia began producing radio telephones for the army and emergency services, which later evolved into commercial mobile technologies.

In 1981, Nokia helped launch the world’s first international cellular network (NMT) in partnership with other Nordic countries. This was a major milestone in mobile communication.

Rise as a Mobile Phone Giant (1990s–2007)

The 1990s marked Nokia’s global breakthrough. Under CEO Jorma Ollila, Nokia focused entirely on telecommunications. It launched its first GSM phone in 1992—the Nokia 1011. This was followed by iconic models like the Nokia 3310, known for durability and long battery life.

By the late 1990s, Nokia had become the world’s largest mobile phone manufacturer. It dominated the global market with a mix of innovation, reliability, and early adoption of digital mobile standards. Its phones were popular across all continents, making Nokia a household name.

Struggles with Smartphones (2007–2014)

Nokia’s dominance began to slip with the rise of Apple’s iPhone in 2007 and Android-based smartphones. Nokia’s Symbian operating system couldn’t compete with the sleek, app-driven systems of its new rivals.

In an attempt to recover, Nokia partnered with Microsoft in 2011, adopting Windows Phone as its smartphone platform. However, the partnership failed to revive Nokia’s position in the market.

In 2014, Nokia sold its mobile phone business to Microsoft, ending an era. Microsoft later discontinued the Nokia brand in its devices.

Reinvention as a Tech and Network Leader (2014–Present)

After exiting the mobile phone market, Nokia reinvented itself. It focused on network infrastructure, 5G technology, and enterprise solutions. It retained its patent portfolio and used it to generate licensing revenue.

A major move came in 2016 when Nokia acquired Alcatel-Lucent, a French-American telecom company. This deal brought in Bell Labs, a world-renowned innovation hub.

Today, Nokia is a global leader in 5G infrastructure, cloud networking, IoT, and AI-driven digital services. It continues to supply technology to major telecom operators and governments around the world.

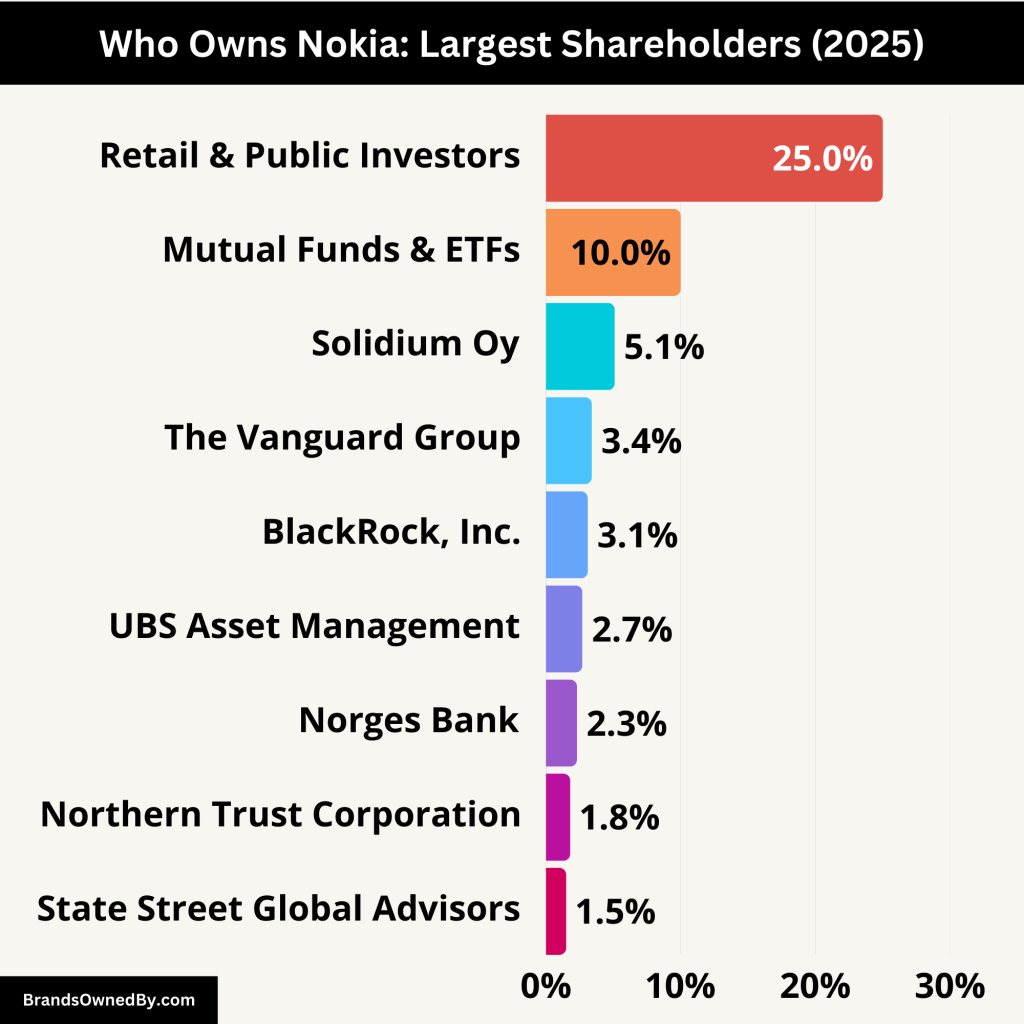

Who Owns Nokia: Major Shareholders

Nokia Corporation is a publicly traded company listed on the Helsinki Stock Exchange (HEL: NOKIA) and the New York Stock Exchange (NYSE: NOK). As a public company, it is owned by a wide range of institutional and retail investors. The Finnish government and investment firms hold significant stakes.

There is no single majority owner. However, several major institutional investors play a key role in the company’s strategic direction. The largest shareholders are mostly asset management firms and government pension funds.

Let’s take a closer look at Nokia’s top and largest shareholders:

| Shareholder | Ownership (%) | Type | Role & Influence |

|---|---|---|---|

| Solidium Oy | ~5.1% | Government Investment Arm | Largest shareholder; board representation; supports national interests |

| The Vanguard Group | ~3.4% | Asset Manager (Passive) | Voting power via index funds; supports governance and long-term strategy |

| BlackRock, Inc. | ~3.1% | Asset Manager (Passive) | Promotes ESG; voting influence through various funds |

| UBS Asset Management | ~2.7% | Institutional Investor | Long-term growth focus; supports innovation and telecom infrastructure |

| Norges Bank (Norway SWF) | ~2.3% | Sovereign Wealth Fund | Ethical investing; transparency and sustainable business practices |

| Northern Trust Corporation | ~1.8% | Institutional Investor | Focused on governance and responsible investment |

| State Street Global Advisors | ~1.5% | Asset Manager (Passive) | Proxy voting power; promotes ESG and corporate responsibility |

| Retail & Public Investors | ~25–30% | Individual Shareholders | No direct control; influence stock performance and market sentiment |

| Mutual Funds & ETFs (Various) | ~10–15% (est.) | Pooled Investment Vehicles | Include iShares, SPDR, Fidelity, etc.; influence through fund strategy and trading |

Solidium Oy (Approx. 5.1%)

Solidium Oy is a Finnish government-owned investment company. It holds about 5.1% of Nokia’s shares, making it the largest single shareholder. Solidium was created to manage the Finnish state’s investments in key companies.

Its stake in Nokia reflects the Finnish government’s strategic interest in retaining influence over a nationally significant tech firm. Solidium has a long-term investment approach and often appoints representatives to corporate boards. In Nokia’s case, its role includes ensuring that decisions align with Finnish economic interests.

The Vanguard Group (Approx. 3.4%)

The Vanguard Group is an American asset management firm. It holds around 3.4% of Nokia’s shares. Vanguard manages trillions in assets globally through index and mutual funds.

Its stake in Nokia is spread across various funds, including ETFs and pension accounts. Although Vanguard is a passive investor, its size gives it voting power at shareholder meetings. Vanguard typically supports long-term strategies and sound governance, which affects Nokia’s management practices and sustainability efforts.

BlackRock, Inc. (Approx. 3.1%)

BlackRock is another massive U.S. investment firm, holding close to 3.1% of Nokia. Like Vanguard, BlackRock’s shares are spread across multiple funds, including iShares ETFs.

BlackRock is known for advocating ESG (Environmental, Social, Governance) principles in its portfolio companies. While it doesn’t intervene in daily operations, its votes carry weight in matters like board elections, compensation policies, and risk management.

UBS Asset Management (Approx. 2.7%)

UBS Asset Management, a Swiss investment giant, holds around 2.7% of Nokia’s stock. UBS manages a range of institutional portfolios, including pension funds, insurance assets, and sovereign wealth funds.

As a long-term investor, UBS typically supports companies that show growth in technology and innovation. Its investment in Nokia reflects confidence in the firm’s role in 5G and telecom infrastructure globally.

Norges Bank Investment Management (Approx. 2.3%)

Norges Bank, which manages Norway’s Government Pension Fund Global, owns about 2.3% of Nokia. This fund is one of the largest sovereign wealth funds in the world.

It invests globally for the benefit of future generations of Norwegians. Norges Bank emphasizes ethical investing and publishes annual reports detailing its engagement with portfolio companies. In Nokia’s case, the fund supports sustainable growth and corporate transparency.

Northern Trust Corporation (Approx. 1.8%)

Northern Trust, a U.S.-based financial services company, holds approximately 1.8% of Nokia. It provides asset management services for high-net-worth individuals, institutions, and pension funds.

Its influence comes not only from share ownership but also from participation in corporate governance. Northern Trust often collaborates with other institutional investors to encourage responsible business conduct.

State Street Global Advisors (Approx. 1.5%)

State Street, one of the “Big Three” asset managers along with Vanguard and BlackRock, holds about 1.5% of Nokia. It manages large-scale index funds and pension assets.

While State Street is a passive investor, it actively engages in ESG practices and proxy voting. Its stake gives it a voice in Nokia’s corporate decisions, including board oversight and audit practices.

Retail and Public Investors (Combined Approx. 25–30%)

A significant portion of Nokia’s shares—estimated between 25% and 30%—is held by retail investors and the general public. These include individuals investing through local brokerages or trading platforms like Robinhood or eToro.

Public investors do not have direct influence but collectively impact stock performance, market perception, and liquidity. Many of these investors are Finnish citizens who have long been loyal to the Nokia brand.

Mutual Funds and ETFs

Many Nokia shares are held within exchange-traded funds (ETFs) and mutual funds. These include technology-focused, European equity, and emerging market funds managed by firms like iShares, SPDR, Fidelity, and Schroders.

Although no single fund holds a large stake, the aggregated influence of these funds can affect Nokia’s stock behavior, especially in response to global economic or tech-sector developments.

Who Controls Nokia?

Nokia is controlled through a clear corporate governance structure. Power is shared between shareholders, the Board of Directors, and executive leadership. Although Nokia is publicly owned, control over its strategy and operations lies with the elected board and appointed executives.

Shareholder Oversight

Nokia’s shareholders exercise control primarily through the Annual General Meeting (AGM). At this meeting, shareholders vote on key matters such as:

- Electing board members

- Approving executive compensation

- Deciding on dividend distribution

- Appointing external auditors

Although no single shareholder has a controlling majority, the institutional investors like Solidium, Vanguard, and BlackRock influence the outcome of major decisions through their voting power.

Board of Directors

The Board of Directors is the highest decision-making body in Nokia, outside of the AGM. The board is responsible for setting long-term strategy, appointing executive leadership, overseeing risk management, and ensuring compliance with legal and ethical standards.

As of 2025, Nokia’s board includes a diverse group of experts from technology, finance, and governance. The board is chaired by an independent director and is composed of both Finnish and international members. Solidium, as the Finnish government investor, typically nominates a board representative to ensure state interests are considered.

The board operates through various committees, including:

- Audit Committee: Oversees financial integrity and compliance

- Personnel Committee: Reviews CEO performance and sets executive pay

- Technology Committee: Guides innovation and R&D strategy

Executive Leadership Team

The Executive Leadership Team (ELT) is responsible for day-to-day operations, implementing strategy, and driving company performance. The ELT includes heads of major business units, finance, legal, HR, and technology.

Pekka Lundmark – President and CEO

The CEO plays a central role in the control and direction of Nokia. Since August 2020, Pekka Lundmark has served as President and CEO of Nokia Corporation.

Background and Experience

- Nationality: Finnish

- Previous Roles:

- CEO of Fortum (a leading Finnish energy company)

- Held executive positions at Nokia in the early 2000s

- Also worked with Konecranes and Startupfactory

- Education: Master of Science in Engineering, Helsinki University of Technology

Lundmark returned to Nokia at a crucial time and led a comprehensive restructuring of the company. He shifted the company’s focus to:

- 5G infrastructure

- Cloud and edge networking

- Enterprise and digital services

- Sustainability and ESG innovation

Under his leadership, Nokia implemented a new operating model, cut redundant layers, and invested more in R&D. He also restored Nokia’s competitiveness in the 5G race against Ericsson and Huawei.

Lundmark is often seen as a strategic thinker and a turnaround leader. His clear communication and bold restructuring moves have been praised by investors and analysts.

Day-to-Day Control

While shareholders and the board provide oversight, real control of Nokia’s daily operations lies with the CEO and the executive team. They make operational decisions, manage product development, lead global business units, and engage with customers and regulators.

Decisions are guided by company policies, shareholder expectations, and long-term strategy, but the ELT has significant autonomy in executing Nokia’s mission and vision.

Annual Revenue and Net Worth of Nokia

In 2024, Nokia reported an annual revenue of €24.9 billion. This was driven by its network infrastructure, mobile networks, and cloud services.

The company’s net worth, based on market capitalization, fluctuates with stock prices. As of April 2025, Nokia’s market cap is approximately €22 billion. It maintains strong cash flow and has invested heavily in R&D, especially for 5G and AI technologies.

Revenue Breakdown (2024)

As of the fiscal year ending in 2024, Nokia reported:

- Annual Revenue: €24.9 billion (approx. $27.2 billion)

- Operating Profit: €2.5 billion

- Net Income: €1.9 billion

- Market Capitalization: Approx. €25–28 billion, depending on trading conditions

The revenue is primarily split across four business groups:

- Mobile Networks: 38%

- Network Infrastructure: 30%

- Cloud and Network Services: 17%

- Nokia Technologies (Licensing & Patents): 10%

- Other (including Group Common & Other): 5%

Nokia’s net worth is reflected in its equity value, market capitalization, and assets on the balance sheet. It holds minimal debt compared to peers, maintaining a solid balance sheet with over €10 billion in total assets and strong free cash flow.

Here’s a historical snapshot of Nokia’s annual revenue and estimated net worth over the past 10 years:

| Year | Annual Revenue (€B) | Net Worth / Market Cap (€B) | Notes |

|---|---|---|---|

| 2024 | 24.9 | 26.5 | 5G growth, cloud services expansion |

| 2023 | 24.4 | 24.8 | Increased patent licensing revenue |

| 2022 | 24.2 | 22.7 | Strong 5G network deployment |

| 2021 | 22.2 | 21.0 | Restructuring under Pekka Lundmark |

| 2020 | 21.9 | 20.3 | COVID-19 impact, early 5G rollouts |

| 2019 | 23.3 | 22.0 | Profit margin pressure |

| 2018 | 22.6 | 23.4 | Stable post-Alcatel-Lucent merger |

| 2017 | 23.1 | 27.5 | Integration of Alcatel-Lucent complete |

| 2016 | 23.6 | 29.0 | Alcatel-Lucent acquisition |

| 2015 | 12.5 | 28.0 | Pre-merger phase |

| 2014 | 11.8 | 26.5 | Mobile phone business sold to Microsoft |

Companies Owned by Nokia

Nokia operates through a set of core business groups and subsidiaries. These companies enable Nokia to lead in network infrastructure, mobile networks, cloud services, and intellectual property licensing. While Nokia no longer manufactures phones, its influence across the global telecommunications ecosystem is vast.

| Company / Subsidiary | Type | Details |

|---|---|---|

| Nokia Networks | Core Business Unit | Main division for mobile network infrastructure and services |

| Alcatel-Lucent | Acquired Subsidiary (2016) | Telecom infrastructure firm integrated into Nokia operations |

| Bell Labs | R&D Division (via Alcatel-Lucent) | Innovation hub known for foundational telecom inventions |

| Nokia Technologies | Licensing & Patents Unit | Manages Nokia’s 20,000+ patent families and licensing income |

| Nuage Networks | Subsidiary | SDN and cloud networking solutions for enterprises and telecom |

| Deepfield | Acquired Subsidiary (2017) | Network analytics and cloud traffic intelligence |

| Elenion Technologies | Acquired Subsidiary (2020) | Silicon photonics and optical components for 5G and cloud |

| SAC Wireless | U.S. Infrastructure Subsidiary | Tower services, 5G deployment and network buildouts |

| Comptel (now part of CNS) | Acquired Software Unit (2017) | Integrated into Cloud & Network Services (CNS) for service automation |

Nokia Networks

Nokia Networks is the largest and most critical business unit within Nokia. It handles the design, deployment, and optimization of mobile networks. This includes 2G to 5G infrastructure, base stations, and radio technologies.

It serves global telecom operators like AT&T, T-Mobile, Vodafone, Deutsche Telekom, and China Mobile. The division also provides automation and energy-efficient solutions for mobile networks.

Nokia Networks is responsible for a significant portion of the company’s revenue and plays a central role in Nokia’s 5G leadership.

Alcatel-Lucent

Nokia acquired Alcatel-Lucent in 2016 in a major €15.6 billion deal. This French-American telecom giant was known for fixed broadband, IP routing, and optical networking.

Post-merger, Alcatel-Lucent’s technologies were integrated into Nokia’s Network Infrastructure and Cloud & Network Services divisions. Its legacy lives on through:

- Bell Labs (a research powerhouse)

- High-performance routers and optical systems

- Broadband access for fixed-line networks

The acquisition helped Nokia compete with Ericsson, Huawei, and Cisco by expanding its end-to-end portfolio.

Bell Labs

Bell Labs, now a Nokia subsidiary, is a legendary R&D institute originally founded by AT&T. It has produced nine Nobel Prize winners and countless innovations including the transistor and the laser.

Under Nokia, Bell Labs focuses on next-generation technologies such as:

- 6G research and prototyping

- Quantum networking

- AI for telecom systems

- Sustainable energy systems for networks

Bell Labs is a cornerstone of Nokia’s long-term innovation strategy and helps the company secure intellectual property rights and patents.

Nokia Technologies

Nokia Technologies manages the company’s extensive patent portfolio and licensing business. Nokia owns over 20,000 patent families, including standard-essential patents (SEPs) critical for 5G and earlier cellular generations.

This division generates high-margin, recurring income through licensing deals with:

- Apple

- Samsung

- Huawei

- Oppo

- Automotive companies using 5G in connected vehicles

Nokia Technologies also explores opportunities in digital health, software, virtual reality, and immersive technologies through partnerships and IP development.

Nuage Networks

Nuage Networks, a subsidiary of Nokia, focuses on Software-Defined Networking (SDN) and network automation. It provides cloud networking solutions for data centers, telecom providers, and enterprises.

Nuage is vital to Nokia’s edge cloud and virtual network functions strategy. It enables:

- Secure cloud access

- Data center automation

- SD-WAN services for enterprise customers

Major clients include large cloud providers, managed service providers, and multinational corporations seeking private cloud infrastructure.

Deepfield

Deepfield, acquired by Nokia in 2017, is a U.S.-based firm that specializes in real-time network analytics. It helps service providers gain visibility into IP network traffic using big data and cloud-native tools.

Deepfield is part of Nokia’s Network Infrastructure business and is used to:

- Monitor traffic for security threats

- Manage content delivery from streaming platforms

- Optimize performance for enterprise customers

The platform is essential for improving Quality of Service (QoS) in large, complex IP networks.

Elenion Technologies (Acquired 2020)

Elenion Technologies, a U.S.-based company acquired in 2020, focuses on silicon photonics. These are technologies used to speed up data movement in data centers and optical transport networks.

The acquisition supports Nokia’s efforts in low-cost, high-capacity optical components, particularly for:

- Metro and long-haul optical networks

- 5G fronthaul and backhaul

- High-performance computing environments

It strengthens Nokia’s optical portfolio under the Network Infrastructure segment.

SAC Wireless

SAC Wireless is a U.S.-based telecom engineering and infrastructure services company wholly owned by Nokia. It provides turnkey network deployment solutions, including:

- Site acquisition

- Tower construction

- Equipment installation

- Fiber and microwave backhaul integration

SAC Wireless plays a strategic role in expanding Nokia’s 5G rollout in North America, especially for customers like Verizon and AT&T.

Comptel (Integrated into Nokia Software)

Comptel, a Finnish software company, was acquired by Nokia in 2017. It has since been integrated into Nokia’s Cloud and Network Services division.

Comptel provided software for:

- Service orchestration

- Customer lifecycle management

- Data analytics

It now helps telecom operators automate and monetize services, enhancing Nokia’s cloud-native software suite.

Final Words on Nokia Ownership

So, who owns Nokia?

The answer lies in a wide base of institutional and government investors.

No single party has full control, but large shareholders like Solidium and Vanguard influence key decisions. Nokia is now a telecom infrastructure leader, not a phone maker. Its control rests with its board and CEO, while its revenue comes from network services and licensing. With a long history and strong global presence, Nokia continues to evolve in a digital-first world.

FAQs

Who is the largest shareholder of Nokia?

The largest shareholder is Solidium Oy, a Finnish government-owned investment firm, with around 5.1% of shares.

Is Nokia still a Finnish company?

Yes, Nokia is headquartered in Espoo, Finland. It remains a Finnish multinational corporation.

Does Nokia still make mobile phones?

No. Nokia licenses its brand to HMD Global, which makes Nokia-branded phones. Nokia itself focuses on network technology.

What is Nokia’s main business now?

Nokia focuses on 5G networks, cloud infrastructure, and digital services for telecom and enterprise customers.

Is Nokia a public company?

Yes. Nokia is listed on the Helsinki and New York Stock Exchanges and is owned by institutional and retail shareholders.