Who owns MacDon?

In 2018, Linamar Corporation, a Canadian manufacturing giant, acquired MacDon Industries Ltd., a leader in agricultural harvesting equipment. This acquisition integrated MacDon into Linamar’s diverse portfolio, enhancing its presence in the agricultural sector.

History of MacDon

Founding of MacDon

MacDon was founded in 1949 in Winnipeg, Manitoba, by Tom and Bill Killbery. The company was established as a small machine shop, initially focused on producing parts for agricultural equipment. Over the years, MacDon began specializing in building self-propelled swathers, which are used for cutting crops like hay and grain.

Early Innovations and Growth

In the 1950s and 1960s, MacDon expanded its product offerings to include more advanced harvesting equipment. The company gained a reputation for producing high-quality, reliable machinery that met the growing demands of farmers. One of the key innovations during this period was the development of the first self-propelled swather, which significantly improved harvesting efficiency.

Expanding the Product Line

During the 1970s and 1980s, MacDon began focusing on draper headers and other specialized harvesting equipment. These innovations allowed the company to provide more versatile solutions to farmers, adapting to the changing needs of the agricultural industry. MacDon’s products became synonymous with quality, and the company’s reputation grew as one of the leading manufacturers of harvesting equipment.

MacDon’s Global Reach

By the 1990s, MacDon had expanded its operations beyond Canada, establishing a global presence. The company’s harvesting equipment was in demand in key agricultural markets worldwide, particularly in North America, Europe, and Australia. This global expansion allowed MacDon to solidify its position as a market leader in the agricultural machinery industry.

The Development of the FlexDraper® Header

One of the most significant innovations in MacDon’s history was the development of the FlexDraper® header in the early 2000s. This technology revolutionized the harvesting process by providing a more efficient way to cut crops, especially in challenging conditions. The FlexDraper® header became a game-changer in the industry and further cemented MacDon’s reputation for innovation.

The Acquisition by Linamar

In 2017, Linamar Corporation, a global leader in manufacturing and industrial technologies, announced its decision to acquire MacDon. The deal, valued at approximately CAD 1.2 billion, was finalized in February 2018. This acquisition allowed Linamar to expand its footprint in the agricultural sector and integrate MacDon’s advanced harvesting technology into its broader portfolio.

The acquisition marked a new era for MacDon, allowing the company to leverage Linamar’s global manufacturing capabilities and resources. Although MacDon remained a distinct brand within Linamar, the acquisition helped enhance its growth prospects and further expanded its product offerings.

Who Owns MacDon?

MacDon is owned by Linamar Corporation, which is publicly traded on the Toronto Stock Exchange under the symbol LNR. Linamar’s ownership structure includes both significant institutional investors and individual stakeholders.

The acquisition of MacDon by Linamar has led to a more complex, but stable, ownership landscape for MacDon, with decisions being influenced by Linamar’s leadership and major shareholders.

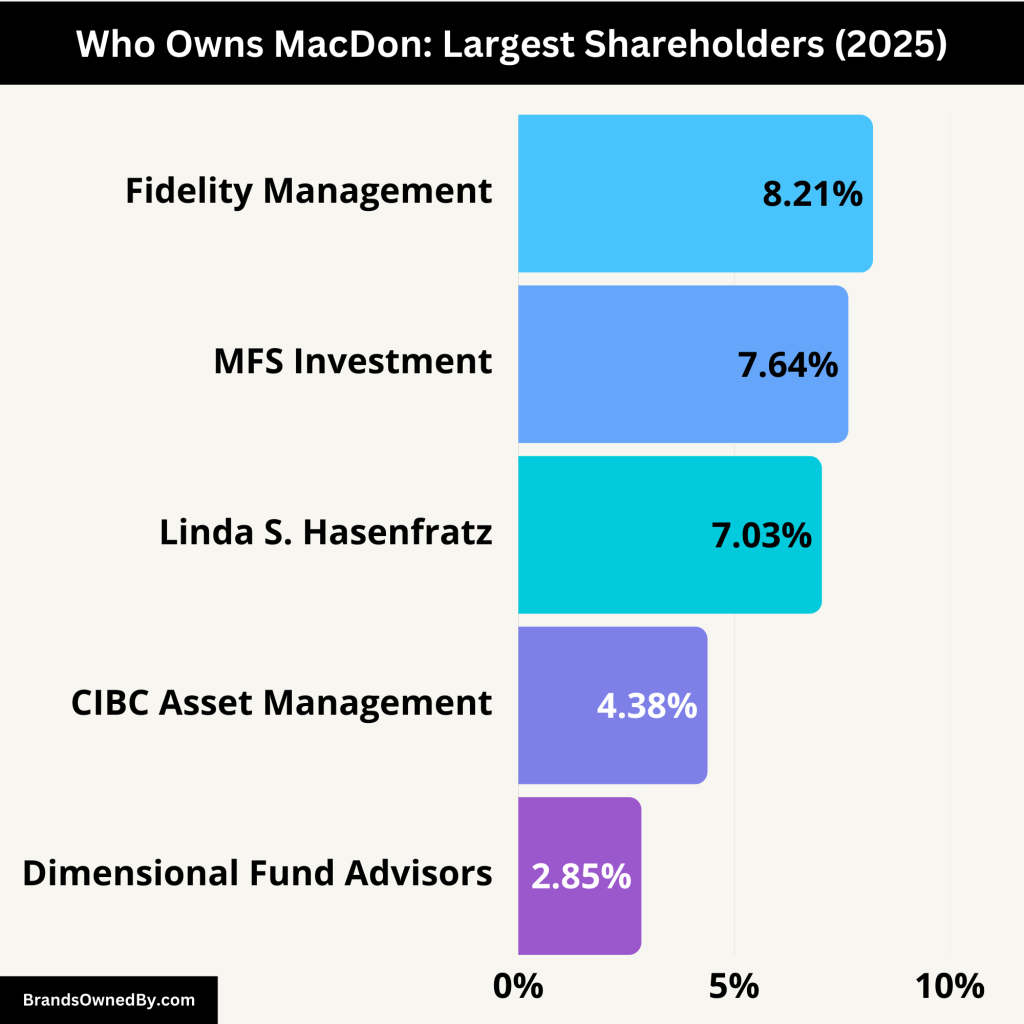

Below is a list of major shareholders of Linamar (the parent company of MacDon):

| Shareholder | Ownership Percentage | Role/Description |

|---|---|---|

| Linda S. Hasenfratz | 7.03% | Executive Chair of Linamar. Key individual shareholder with significant influence on company decisions. |

| Fidelity Management & Research | 8.21% | Institutional investor, major stakeholding in Linamar, reflects confidence in the company’s long-term growth. |

| MFS Investment Management Canada | 7.64% | Institutional investor, contributing to strategic direction, especially in sectors like agriculture and manufacturing. |

| CIBC Asset Management | 4.38% | Institutional investor, focuses on long-term investments in large companies like Linamar, impacting MacDon’s growth. |

| Dimensional Fund Advisors | 2.85% | Global investment management firm, known for its long-term and data-driven investment approach in Linamar. |

| Ontario Teachers’ Pension Plan | Not specified | Significant institutional investor, helps ensure stability and long-term growth strategy for Linamar and MacDon. |

| Other Institutional Investors | Collective: Various | Includes mutual funds, hedge funds, and insurance companies, each holding a portion of Linamar’s shares. |

Linda S. Hasenfratz: Executive Chair of Linamar

Linda S. Hasenfratz, the Executive Chair of Linamar, holds one of the largest individual stakes in the company. As of the latest reports, Hasenfratz controls approximately 7.03% of Linamar’s outstanding shares. Her leadership has been a driving force behind Linamar’s growth and expansion, including its acquisition of MacDon.

Hasenfratz is known for her strong strategic vision, having led Linamar through multiple acquisitions, including MacDon. As a significant shareholder, her influence is pivotal in decision-making, ensuring that the company continues to thrive in the manufacturing and agricultural sectors.

Fidelity Management & Research

Fidelity Management & Research, an investment management firm, is one of the most notable institutional investors in Linamar. The firm holds about 8.21% of Linamar’s shares. Fidelity is known for making large, long-term investments in companies that show strong growth potential.

Fidelity’s stake in Linamar, and by extension in MacDon, reflects their confidence in Linamar’s ability to grow in sectors like agriculture, automotive, and industrial manufacturing. The firm’s large ownership ensures it has a voice in major company decisions, including those involving MacDon.

MFS Investment Management Canada

MFS Investment Management Canada is another key institutional investor in Linamar, owning around 7.64% of the company’s shares. MFS is a global asset manager known for its focus on long-term investments. Its stake in Linamar suggests confidence in the company’s diversified business model, which now includes MacDon.

With MFS holding a significant percentage of Linamar’s shares, its views on the company’s direction play a role in shaping Linamar’s strategic decisions, especially with regard to the integration of MacDon into the broader Linamar portfolio.

CIBC Asset Management

CIBC Asset Management is another institutional shareholder that holds 4.38% of Linamar’s shares. As one of Canada’s largest asset managers, CIBC Asset Management invests in a variety of sectors, including manufacturing, energy, and agriculture. Their stake in Linamar positions them as an influential shareholder in the company’s decisions regarding MacDon and other acquisitions.

CIBC’s role as a shareholder extends beyond financial investment. It helps steer Linamar’s strategic focus, particularly in sectors that have long-term growth prospects, like the agricultural equipment market where MacDon operates.

Dimensional Fund Advisors

Dimensional Fund Advisors (DFA) is a global investment management firm that holds 2.85% of Linamar’s shares. DFA is known for its quantitative approach to investing, focusing on long-term, value-driven investment strategies. Its stake in Linamar is reflective of its belief in the company’s operational efficiency and growth potential, especially after acquiring MacDon.

DFA’s involvement ensures that Linamar’s strategic direction takes into account data-driven insights into market trends, impacting decisions that affect MacDon’s operations and future innovations.

Ontario Teachers’ Pension Plan

Ontario Teachers’ Pension Plan (OTPP) is another significant institutional shareholder in Linamar. Although exact percentages vary, OTPP holds a substantial number of shares in Linamar, influencing its overall direction. As one of Canada’s largest pension funds, OTPP typically invests in large, stable companies with strong growth prospects. Its stake in Linamar aligns with its investment philosophy, which includes a focus on long-term sustainability.

OTPP’s involvement in Linamar adds to the stability of the company’s governance, ensuring a steady path forward, particularly in industries like agriculture where MacDon plays a key role.

Other Institutional Investors

There are also several smaller institutional investors that hold stakes in Linamar, including mutual funds, hedge funds, and insurance companies. These investors collectively hold a significant portion of Linamar’s shares, contributing to the company’s governance and strategic direction.

Their combined ownership ensures that Linamar’s decisions are made with a broad spectrum of financial interests in mind, all while guiding MacDon toward further success in the agricultural equipment market.

Who Controls MacDon?

The control of MacDon lies with Linamar Corporation, its parent company. However, the actual decision-making process involves several layers of governance. Here’s a detailed breakdown of who controls Linamar, and by extension, MacDon.

Linamar’s Executive Leadership

At the top of Linamar’s decision-making structure is the executive leadership team, which sets the overall strategy for the company, including its operations related to MacDon. The CEO and Executive Chair, Linda S. Hasenfratz, are key figures in guiding Linamar’s strategic direction.

Linda S. Hasenfratz: Executive Chair

Linda S. Hasenfratz is the Executive Chair of Linamar and is arguably the most influential person in the company. She holds around 7.03% of Linamar’s shares and has been instrumental in the company’s success, including the acquisition of MacDon. Her leadership style is characterized by strategic foresight, making her the key decision-maker when it comes to major corporate moves like acquisitions, investments, and operational changes.

As Executive Chair, Hasenfratz plays a pivotal role in overseeing the broader strategic direction of Linamar and ensures that MacDon’s operations align with Linamar’s long-term goals.

Linamar’s CEO: Lori M. L. Stillman

The CEO of Linamar, Lori M. L. Stillman, is responsible for the daily operations of the company, ensuring that the strategic plans outlined by the executive leadership are executed. While Linda S. Hasenfratz oversees the broad vision, Stillman is focused on the operational side of Linamar’s business, which includes the integration of MacDon’s operations into the overall corporate structure.

The CEO’s responsibilities include managing all of Linamar’s subsidiaries, including MacDon, making critical decisions on budgets, resource allocation, and company-wide projects. As the CEO, Stillman works closely with the board and the executive chair to ensure the company’s strategy is effectively carried out.

Linamar’s Board of Directors

The governance of Linamar is also heavily influenced by its Board of Directors, which consists of a mix of internal executives and independent directors. The board is responsible for overseeing the overall management of Linamar, ensuring that the company’s operations, including those related to MacDon, are in line with shareholder interests.

Role of the Board of Directors

The Board of Directors approves major strategic decisions, such as acquisitions, mergers, and expansions. In the case of MacDon, the board played a crucial role in approving the acquisition deal and integrating MacDon into Linamar’s operations. The board’s approval is also needed for any significant financial or strategic shifts within MacDon’s business.

The board is composed of both family members (e.g., Linda Hasenfratz) and independent members, providing a blend of oversight from the company’s founders and external perspectives. This governance structure allows Linamar to maintain strong leadership while incorporating outside expertise.

MacDon’s Executive Team

Although MacDon is fully controlled by Linamar, the day-to-day operations of MacDon are overseen by its own leadership team. The company’s President, Gary Giesbrecht, is in charge of overseeing MacDon’s operations, ensuring that its brand identity, products, and services continue to evolve within the framework established by Linamar.

Gary Giesbrecht: President of MacDon

Gary Giesbrecht leads MacDon as President and plays a crucial role in managing its day-to-day operations. Giesbrecht, along with his team, is responsible for maintaining the operational autonomy of MacDon while ensuring that the company’s activities align with Linamar’s overall strategy. His leadership focuses on product development, innovation, and market positioning for MacDon’s agricultural machinery.

While MacDon’s leadership retains control over its operational activities, significant decisions, such as financial investments and strategic shifts, are made with approval from Linamar’s executive team.

Decision-Making Process at Linamar and MacDon

Decisions within Linamar are made collaboratively between the executive leadership, the board of directors, and senior management. For MacDon, major decisions—such as product development strategies, capital expenditures, and entry into new markets—are reviewed and approved by both MacDon’s leadership and Linamar’s top executives.

MacDon’s strategic direction is aligned with Linamar’s broader corporate objectives. This means that while MacDon operates as a distinct brand, its strategies and objectives must align with Linamar’s overall business goals. This alignment ensures that MacDon’s growth contributes to Linamar’s success in the agricultural sector and beyond.

Annual Revenue and Net Worth of MacDon

In 2024, MacDon’s estimated annual revenue was approximately $502.6 million. This figure underscores MacDon’s strong market presence and its contribution to the agricultural machinery sector.

While specific net worth figures for MacDon in 2025 are not publicly disclosed but is estimated to be over $1 billion based on several indicators:

- Integration with Linamar: Since its acquisition, MacDon has benefited from Linamar’s expansive resources and strategic guidance, enhancing operational efficiencies and market reach.

- Product Innovation: MacDon’s commitment to innovation, exemplified by products like the MacDon FD2 FlexDraper, positions it favorably in a competitive market, potentially driving revenue growth.

- Market Demand: The global demand for advanced agricultural machinery remains robust, and MacDon’s reputation for quality positions it well to capitalize on this trend.

Considering these factors, it’s reasonable to anticipate that MacDon’s net worth in 2025 will reflect continued growth, aligning with industry trends and the company’s strategic initiatives.

Brands Owned by MacDon

MacDon’s strategic approach focuses on providing innovative solutions for the farming industry. While the company itself is the primary brand, it oversees various product lines and subsidiary brands that further enhance its position in the global agricultural machinery market. These brands contribute to MacDon’s growth by diversifying its product offerings, addressing different facets of farming, and maintaining its competitive edge.

MacDon

MacDon itself is one of the most recognized brands in the agricultural machinery industry, specializing in advanced harvesting equipment. With a focus on productivity and innovation, MacDon’s machines are designed to help farmers maximize efficiency and minimize waste during the harvesting process.

MacDon is known for its premium products, including:

- FlexDraper® Headers: These headers are used for efficient harvesting of crops like wheat, barley, and canola. The FlexDraper® is widely praised for its ability to adjust to uneven terrain and for its ability to reduce crop loss.

- Windrowers: These machines are used to cut, windrow, and gather crops. MacDon’s Windrowers are designed for optimal productivity in both tough conditions and large-scale operations.

- Combine Headers: MacDon’s headers are designed for high-capacity harvesting, featuring innovations that enhance their efficiency and durability in the field.

The MacDon brand continues to lead the industry in quality, providing farmers with reliable, high-performance equipment.

Hydroswing

Hydroswing, a subsidiary of MacDon, is known for its specialized hydraulic doors used in agricultural applications, particularly for barn doors and large storage facilities. Hydroswing’s products are designed to offer efficient, heavy-duty solutions that withstand the rigors of agricultural environments. These doors are especially popular in barns, storage units, and farm shops.

Hydroswing’s innovation lies in its use of hydraulics to create doors that are easy to open and close, with smooth operation and minimal maintenance. This brand adds a niche element to MacDon’s portfolio, helping to address the needs of farmers who require durable and functional storage solutions.

MileMaker

MileMaker is a brand owned by MacDon focused on producing heavy-duty, versatile trailers designed for transporting agricultural equipment. These trailers are built to handle a range of equipment, from harvesting machines to tractors, ensuring safe and efficient transport between farm locations.

The MileMaker brand is particularly known for its innovative designs that make transportation of large machinery easier, safer, and more efficient. This product line contributes to MacDon’s ability to provide farmers with comprehensive solutions that extend beyond just harvesting equipment.

Swather Header Systems

While not a separate brand, MacDon’s Swather Header Systems are another critical aspect of the company’s product offerings. These systems are specialized headers used in swathing crops such as canola, alfalfa, and other high-value crops.

MacDon’s Swather Headers are designed for efficiency, speed, and minimal crop loss during swathing. These systems are used in conjunction with windrowers, helping farmers maximize yield and maintain the integrity of their crops during the swathing process. The advanced design of MacDon’s swather header systems ensures smooth operation and excellent cutting ability, even in tough conditions.

AutoSteer Technology

AutoSteer Technology, while more of a feature than a standalone brand, is an integral part of MacDon’s product offerings. This technology enables precise control of harvesting equipment, allowing operators to achieve optimal efficiency and accuracy in the field.

By integrating GPS and automated steering capabilities, MacDon’s AutoSteer technology minimizes overlaps, reduces input costs, and helps increase productivity. It’s available on many of MacDon’s machines, including windrowers and harvesters, providing farmers with an added layer of technological sophistication that enhances their operations.

MacDon Direct Harvesting System (DHS)

Another unique product line under the MacDon umbrella is its Direct Harvesting System (DHS), a revolutionary method that allows farmers to harvest crops without the need for swathing. The DHS technology helps reduce crop loss and improves harvesting efficiency.

The Direct Harvesting System is part of MacDon’s broader commitment to innovation, focusing on eliminating inefficiencies in the traditional harvesting process. By utilizing the DHS, farmers can harvest directly from standing crops, which improves yields and reduces the need for additional equipment, simplifying the process.

MacDon Parts and Service

MacDon Parts and Service is an important brand under the MacDon umbrella, ensuring that farmers have access to high-quality parts and maintenance services for their MacDon machinery. This brand is essential for ensuring the long-term performance and reliability of MacDon’s equipment, providing farmers with support for machine repairs and part replacements.

Massey Ferguson (MacDon Partnership)

While Massey Ferguson is a separate brand owned by AGCO Corporation, it has a strategic partnership with MacDon to provide combined header solutions. MacDon’s FlexDraper and other harvesting headers are often used with Massey Ferguson combines, creating a synergetic relationship between the two brands. This partnership allows both companies to offer farmers complete harvesting solutions, integrating MacDon’s advanced headers with Massey Ferguson’s combines.

Hesston by Massey Ferguson (MacDon Partnership)

Similar to the Massey Ferguson partnership, MacDon also works with Hesston by Massey Ferguson to provide specialized hay and forage harvesting equipment. MacDon’s swather headers and other machinery are commonly used alongside Hesston products, making them a perfect fit for farmers who require efficient harvesting solutions for hay, silage, and other forage crops.

Ag Leader Technology (MacDon Integration)

Ag Leader Technology is not a brand directly owned by MacDon but is integrated into several of MacDon’s machines.

This partnership brings advanced precision farming technology to MacDon’s equipment, including yield monitoring, auto-steering, and field mapping. Ag Leader’s technology enhances the productivity and efficiency of MacDon machinery by offering real-time data collection and analysis during harvesting operations.

MacDon Innovation Labs

MacDon also invests in MacDon Innovation Labs, a brand focused on research and development for new agricultural technologies. This initiative drives forward MacDon’s commitment to continual improvement and product innovation, aiming to meet the evolving needs of farmers.

The Innovation Labs focuses on developing new systems, machinery upgrades, and technologies that can improve harvesting processes and support sustainable farming practices.

Final Words on MacDon Ownership

Linamar’s acquisition of MacDon integrated the latter’s advanced harvesting technologies into Linamar’s diverse manufacturing portfolio. The ownership structure, with significant institutional investors and family leadership, ensures that MacDon operates within Linamar’s strategic framework while maintaining its commitment to innovation in agricultural equipment.

FAQs

Who founded MacDon?

MacDon was founded in 1949 by Tom and Bill Killbery in Winnipeg, Manitoba, Canada.

What products does MacDon manufacture?

MacDon specializes in harvesting equipment, including drapers and self-propelled windrowers.

When did Linamar acquire MacDon?

Linamar acquired MacDon in February 2018 for approximately CAD 1.2 billion.

Who controls the decision-making at MacDon?

MacDon’s strategic decisions are aligned with Linamar’s corporate objectives, with oversight from Linamar’s executive leadership and board.