Microsoft, founded in 1975 by Bill Gates and Paul Allen, has grown into one of the world’s leading technology companies. Understanding who owns Microsoft involves examining its diverse shareholder base, including institutional investors, individual stakeholders, and company insiders.

History of Microsoft

Microsoft was founded on April 4, 1975, by Bill Gates and Paul Allen in Albuquerque, New Mexico. The duo saw an opportunity in the emerging personal computer market and developed a version of the BASIC programming language for the Altair 8800, one of the first microcomputers. This early success laid the foundation for Microsoft’s future growth.

In 1979, the company moved its headquarters to Bellevue, Washington. By 1980, Microsoft had signed a crucial deal with IBM to provide an operating system for its new line of personal computers. This led to the creation of MS-DOS, marking the company’s first major breakthrough.

The Rise of Windows (1981-1995)

In 1981, Microsoft officially incorporated, with Bill Gates as CEO. The same year, IBM released its first personal computer with MS-DOS as the primary operating system. MS-DOS quickly became the industry standard, securing Microsoft’s dominance in PC software.

Microsoft’s biggest revolution came in 1985 with the launch of Windows 1.0. Unlike MS-DOS, Windows offered a graphical user interface (GUI), making computers more accessible to the average user. Over the next decade, Microsoft continued to refine its Windows operating system, with Windows 3.0 (1990) and Windows 95 (1995) becoming massive successes. Windows 95 introduced several key features, including the Start menu, taskbar, and plug-and-play capabilities, solidifying Microsoft’s dominance in the PC market.

Expansion into Software and Internet (1995-2005)

The mid-1990s saw Microsoft expanding beyond operating systems. The company launched Microsoft Office, a suite of productivity software including Word, Excel, and PowerPoint. Office became a business essential and a significant revenue generator for Microsoft.

In 1995, Microsoft recognized the growing importance of the internet and launched Internet Explorer, a web browser that eventually became the default choice for Windows users. By the early 2000s, Internet Explorer dominated the browser market.

Microsoft entered the gaming industry in 2001 with the release of the Xbox, competing against Sony’s PlayStation and Nintendo’s consoles. The Xbox brand would go on to become a major player in the gaming industry.

Legal Battles and Market Dominance (2000-2010)

The late 1990s and early 2000s were marked by legal battles. In 1998, the U.S. Department of Justice filed an antitrust lawsuit against Microsoft, accusing it of monopolistic practices by bundling Internet Explorer with Windows. After years of legal battles, Microsoft settled the case in 2001, agreeing to change some of its business practices.

Despite these challenges, Microsoft continued to grow. Windows XP, released in 2001, became one of the most popular operating systems of all time. Microsoft Office 2003 and later versions cemented the company’s dominance in productivity software.

In 2007, Microsoft introduced Windows Vista, but it was met with criticism due to performance and compatibility issues. The company quickly recovered with the launch of Windows 7 in 2009, which was well-received by users and businesses alike.

Cloud Computing and New Leadership (2010-2020)

During the 2010s, Microsoft shifted its focus to cloud computing and enterprise services. In 2010, the company launched Microsoft Azure, its cloud computing platform, to compete with Amazon Web Services (AWS). Azure quickly gained traction and became one of Microsoft’s most profitable businesses.

Microsoft also introduced Office 365, a cloud-based subscription model of its Office suite. This transition from one-time purchases to subscriptions helped the company generate consistent revenue.

In 2014, Satya Nadella became CEO, replacing Steve Ballmer. Under Nadella’s leadership, Microsoft focused on innovation, cloud computing, and artificial intelligence. He spearheaded major acquisitions, including LinkedIn in 2016 for $26.2 billion and GitHub in 2018 for $7.5 billion.

Gaming and AI Expansion (2020-Present)

Microsoft continued expanding in gaming, acquiring ZeniMax Media (parent company of Bethesda) in 2021 for $7.5 billion. This gave Microsoft control over major franchises like The Elder Scrolls, Fallout, and Doom.

In 2023, Microsoft completed its biggest acquisition ever by purchasing Activision Blizzard for $68.7 billion. This move strengthened its gaming division, adding blockbuster franchises like Call of Duty and World of Warcraft to its portfolio.

The company has also made significant advancements in artificial intelligence. Through its partnership with OpenAI, Microsoft integrated AI-powered tools into its products, including AI-driven features in Microsoft 365 and Bing Search.

Microsoft Today

As of 2025, Microsoft is a leader in multiple industries, including software, cloud computing, gaming, and AI. With a market capitalization exceeding $3 trillion, it remains one of the most valuable and influential technology companies in the world.

Who Owns Microsoft?

Microsoft is a publicly traded company listed on the NASDAQ under the ticker symbol MSFT. Its ownership is distributed among a wide array of shareholders, from large institutional investors to individual stakeholders. This diversified ownership structure ensures that control is not concentrated in the hands of a few but is spread across various entities and individuals.

List of Major Microsoft Shareholders

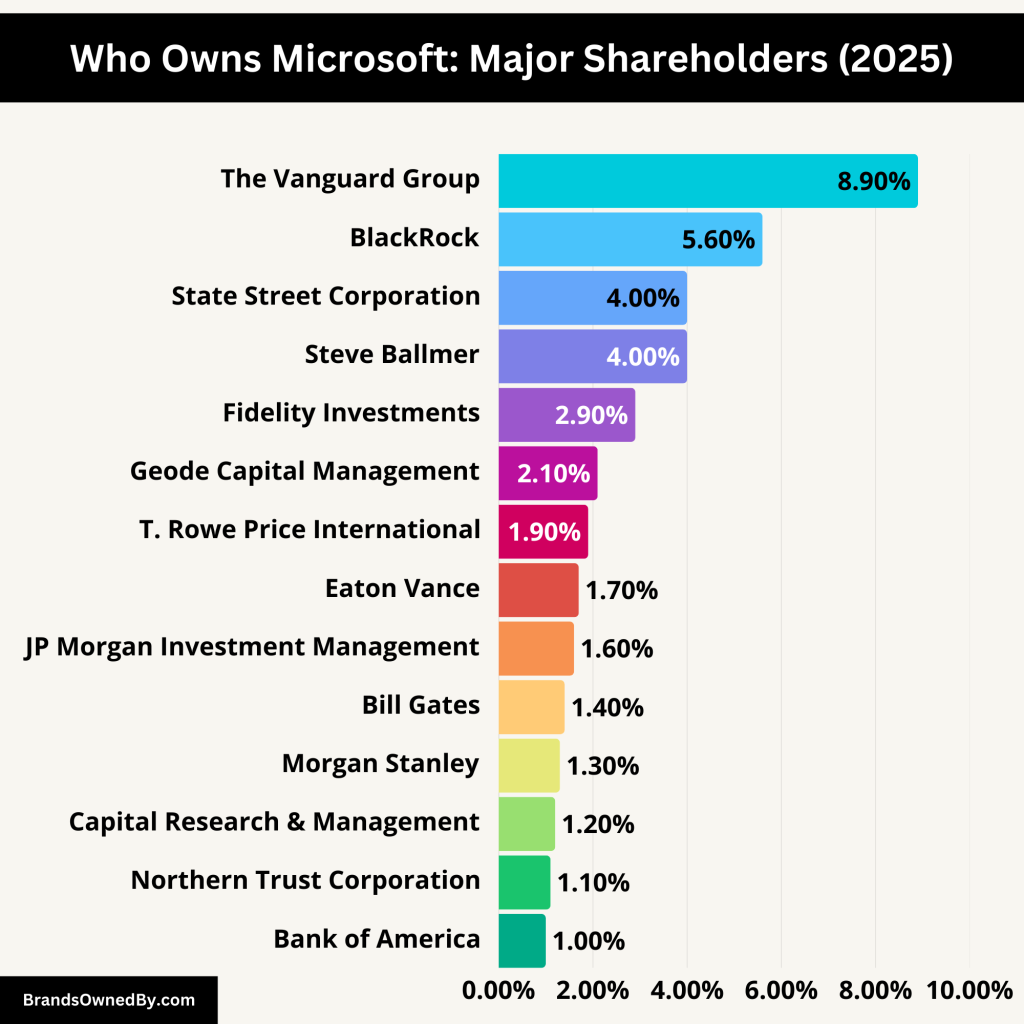

As of early 2025, the major shareholders of Microsoft include:

| Shareholder | Ownership (%) | Role & Influence |

|---|

| The Vanguard Group | 8.9% | Largest institutional shareholder; passive investor managing index funds. |

| BlackRock | 5.6% | One of the biggest asset managers; votes in shareholder meetings but does not actively control operations. |

| State Street Corporation | 4.0% | Major financial services firm; holds shares through index funds. |

| Steve Ballmer | 4.0% | Former Microsoft CEO (2000-2014); owns a significant individual stake. |

| Fidelity Investments | 2.9% | Investment management firm; holds Microsoft stock in various mutual funds. |

| Geode Capital Management | 2.1% | Passive investment firm managing index fund-based portfolios. |

| T. Rowe Price International | 1.9% | Actively managed investment firm focusing on technology growth. |

| Eaton Vance | 1.7% | Asset management firm specializing in tax-managed and fixed-income investments. |

| JP Morgan Investment Management | 1.6% | Part of JP Morgan Chase; invests in high-growth technology companies. |

| Bill Gates | 1.4% | Microsoft co-founder; retains a stake despite reducing holdings for philanthropy. |

| Morgan Stanley | 1.3% | Major financial services firm with investments in tech stocks. |

| Capital Research & Management | 1.2% | Investment management firm known for long-term stock holdings. |

| Northern Trust Corporation | 1.1% | Wealth management and investment firm holding Microsoft stock in diversified funds. |

| Bank of America | 1.0% | Large financial institution investing in Microsoft as part of its tech-focused funds. |

The Vanguard Group

The Vanguard Group is the largest shareholder of Microsoft, holding approximately 8.9% of the company’s shares. Vanguard is a global investment management firm known for its mutual funds and exchange-traded funds (ETFs). It operates as a passive investor, meaning it does not directly influence Microsoft’s operations but holds shares on behalf of millions of individual investors. Vanguard’s large stake in Microsoft reflects its confidence in the company’s long-term growth and financial stability.

BlackRock

BlackRock owns around 5.6% of Microsoft. The company manages trillions of dollars in assets and has a significant presence in global financial markets. BlackRock’s investment in Microsoft aligns with its strategy of holding shares in strong, technology-driven companies. While BlackRock does not control Microsoft, its voting power allows it to influence corporate decisions through shareholder meetings and governance policies.

State Street Corporation

State Street Corporation holds about 4.0% of Microsoft’s stock. It is a major financial services and investment management firm that provides asset management, research, and trading services. Like Vanguard and BlackRock, State Street is a passive investor, managing Microsoft shares through its index funds. Its stake in Microsoft highlights the company’s strong position in the global stock market.

Steve Ballmer

Steve Ballmer, former CEO of Microsoft, remains one of the company’s largest individual shareholders, with approximately 4.0% ownership. Ballmer led Microsoft from 2000 to 2014, overseeing major product launches such as Windows XP, Xbox, and Office 365. Since retiring, he has focused on philanthropy and sports, owning the Los Angeles Clippers NBA team. Despite stepping away from management, his stake in Microsoft reflects his lasting financial interest in the company’s success.

Fidelity Investments

Fidelity Investments owns around 2.9% of Microsoft’s shares. As a multinational financial services corporation, Fidelity manages investment portfolios for millions of clients worldwide. Microsoft’s consistent growth and strong dividend payouts make it an attractive stock for Fidelity’s funds. Fidelity’s stake further strengthens institutional investor confidence in Microsoft’s long-term value.

Geode Capital Management

Geode Capital Management holds 2.1% of Microsoft’s stock. It is an investment management firm specializing in index funds and passive investment strategies. Geode operates as a sub-advisor to larger financial institutions, managing assets on behalf of investors. Its stake in Microsoft is part of its broader strategy to include leading technology firms in its portfolios.

T. Rowe Price International

T. Rowe Price International owns about 1.9% of Microsoft. It is a global asset management firm known for its active investment strategies. Unlike passive investors, T. Rowe Price actively manages its holdings, making strategic decisions based on market conditions. Its investment in Microsoft is driven by the company’s strong earnings growth, innovation in cloud computing, and leadership in AI technologies.

Eaton Vance

Eaton Vance, a subsidiary of Morgan Stanley, holds 1.7% of Microsoft’s stock. It is a leading investment firm specializing in asset management, tax-managed investing, and fixed-income strategies. Eaton Vance’s stake in Microsoft is part of its long-term investment in high-performing technology companies.

JP Morgan Investment Management

JP Morgan Investment Management owns 1.6% of Microsoft. As part of the global banking giant JP Morgan Chase, the firm provides wealth management and investment services to institutional and individual investors. Microsoft’s strong financial performance and global presence make it a key holding in JP Morgan’s technology-focused investment portfolios.

Bill Gates

Bill Gates, the co-founder of Microsoft, retains approximately 1.4% of the company’s shares. Although he has gradually reduced his stake over the years to fund philanthropic initiatives through the Bill & Melinda Gates Foundation, he remains one of Microsoft’s most well-known shareholders. His early vision and leadership helped build Microsoft into a global powerhouse, and his continued ownership reflects his connection to the company.

Morgan Stanley

Morgan Stanley holds approximately 1.3% of Microsoft’s shares. As one of the largest investment banks and financial services firms in the world, Morgan Stanley manages a diverse portfolio of stocks. Its investment in Microsoft aligns with its focus on stable, high-growth technology companies.

Capital Research & Management

Capital Research & Management owns about 1.2% of Microsoft. This investment firm is part of Capital Group, a global financial services company specializing in actively managed funds. The firm’s stake in Microsoft reflects its strategy of investing in leading technology firms with strong long-term growth potential.

Northern Trust Corporation

Northern Trust Corporation holds around 1.1% of Microsoft’s stock. It is a wealth management and financial services firm that provides investment management for institutions and high-net-worth clients. Microsoft’s strong market position makes it a key asset in Northern Trust’s diversified investment portfolio.

Bank of America

Bank of America owns about 1.0% of Microsoft’s shares. As one of the largest financial institutions in the world, Bank of America invests in major companies, including tech giants like Microsoft. The bank’s investment strategy focuses on high-performing stocks that generate consistent returns.

Other Institutional Investors

Apart from these major shareholders, several other institutional investors and hedge funds hold smaller stakes in Microsoft. Collectively, institutional investors own over 70% of Microsoft’s stock, while retail investors and company insiders hold the remaining shares. This broad distribution ensures that no single entity has complete control over Microsoft’s decision-making, maintaining a balanced governance structure.

Who Controls Microsoft?

Microsoft is controlled by a combination of its Board of Directors, executive leadership team, and major institutional shareholders. While no single entity has absolute control, the company’s governance structure ensures strategic decision-making is balanced among its leadership and shareholders.

Board of Directors

The Board of Directors plays a central role in overseeing Microsoft’s long-term vision, corporate governance, and financial performance. It consists of highly experienced business leaders from various industries. The board approves major business strategies, financial plans, acquisitions, and leadership changes. Some key members include:

- Satya Nadella (Chairman & CEO) – As Microsoft’s Chairman and CEO, Nadella has significant influence over the company’s direction. He oversees product development, global operations, and long-term strategy.

- John W. Thompson (Lead Independent Director) – Former CEO of Symantec, he provides independent oversight and advises on corporate decisions.

- Reid Hoffman – Co-founder of LinkedIn, Hoffman brings expertise in technology, networking, and business development.

- Sandra E. Peterson – Former group worldwide chairman of Johnson & Johnson, she contributes expertise in global business operations.

- Emma Walmsley – CEO of GlaxoSmithKline, she adds insight into healthcare and international business.

Executive Leadership Team

The executive leadership team is responsible for Microsoft’s daily operations and execution of business strategies. These key executives report directly to Satya Nadella:

- Amy Hood (Chief Financial Officer – CFO) – Manages Microsoft’s finances, investments, and revenue streams.

- Brad Smith (President & Chief Legal Officer) – Oversees legal affairs, government relations, and ethical business practices.

- Scott Guthrie (Executive VP, Cloud & AI) – Leads Microsoft’s cloud computing and artificial intelligence (AI) division.

- Phil Spencer (CEO, Microsoft Gaming) – Oversees Xbox and Microsoft’s gaming strategy, including game studio acquisitions.

- Rajesh Jha (Executive VP, Experiences & Devices) – Manages products like Windows, Microsoft 365, and Surface devices.

Role of Major Shareholders

Although institutional investors like Vanguard, BlackRock, and State Street own significant stakes, they do not directly control Microsoft’s day-to-day operations. However, they exercise influence through:

- Voting rights in shareholder meetings – They can vote on key issues, such as executive compensation and board member elections.

- Governance and accountability – These investors ensure Microsoft follows best business practices and delivers shareholder value.

Annual Revenue and Net Worth of Microsoft

In the fiscal year ending June 30, 2024, Microsoft reported impressive financial results. The company achieved revenues of $198.3 billion, reflecting a 14% increase from the previous year. Net income stood at $72.5 billion, marking a 17% year-over-year growth.

As of March 2025, Microsoft’s market capitalization surpassed $3 trillion, solidifying its position among the world’s most valuable companies.

| Fiscal Year | Revenue (USD billions) | YoY Growth (%) | Market Capitalization (USD billions) |

|---|

| 2024 | 245.12 | 15.67 | 3,235 |

| 2023 | 211.92 | 6.88 | 2,794 |

| 2022 | 198.27 | 17.96 | 1,787 |

| 2021 | 168.09 | 17.52 | 2,522 |

| 2020 | 143.02 | 12.77 | 1,681 |

| 2019 | 125.84 | 14.02 | 1,200 |

| 2018 | 110.36 | 14.29 | 780.36 |

| 2017 | 96.57 | 5.94 | 659.90 |

| 2016 | 91.15 | -2.59 | 483.16 |

| 2015 | 93.58 | 7.98 | 439.67 |

| 2014 | 86.83 | 11.68 | 381.72 |

| 2013 | 77.85 | 5.28 | 310.50 |

| 2012 | 73.72 | 5.41 | 223.66 |

| 2011 | 69.94 | 12.00 | 218.38 |

| 2010 | 62.48 | 6.92 | 234.52 |

| 2009 | 58.44 | -3.28 | 268.55 |

| 2008 | 60.42 | 18.03 | 172.92 |

| 2007 | 51.12 | 15.58 | 332.11 |

| 2006 | 44.28 | 11.26 | 291.94 |

| 2005 | 39.79 | 7.76 | 271.54 |

Microsoft’s Market Share and Competitors

Microsoft holds significant positions across various technology sectors, including operating systems, cloud computing, and productivity software.

Operating Systems

Microsoft’s Windows operating system is a dominant force in the desktop and laptop markets. As of 2025, Windows holds a 71% market share in this segment.

Competitors in Operating Systems

- Android: Primarily a mobile operating system, Android leads globally with a 46% market share across all device types.

- iOS and iPadOS: Apple’s mobile operating systems collectively hold an 18% market share worldwide.

- macOS: Apple’s desktop operating system commands a 16% market share in the desktop and laptop segment.

- Linux: Known for its use in servers and supercomputers, Linux holds a 4% market share in the desktop and laptop market.

- ChromeOS: Google’s operating system has a 2% market share in the desktop and laptop market.

Cloud Computing

Microsoft’s Azure platform is a major player in the cloud infrastructure services market, holding a 25% market share as of the first quarter of 2023.

Competitors in Cloud Computing

- Amazon Web Services (AWS): AWS leads the market with a 31% share, offering a wide range of cloud services.

- Google Cloud Platform (GCP): GCP holds an 11% market share, providing various cloud computing services.

- Alibaba Cloud: A significant player in the Asian market, Alibaba Cloud has a 7.7% market share in the Infrastructure-as-a-Service (IaaS) segment.

- IBM Cloud: IBM holds a 1.8% market share in the IaaS segment, offering cloud solutions tailored for enterprise clients.

Productivity Software

Microsoft Office dominates the business productivity software market with a 95% market share in the document editing segment and a 70% market share in the overall office suite software market.

Competitors in Productivity Software

LibreOffice: An open-source office suite that provides free alternatives to Microsoft’s offerings.

Google Workspace: Google’s suite of productivity tools, including Docs, Sheets, and Slides, offers cloud-based collaboration features.

Apple iWork: Apple’s productivity suite includes Pages, Numbers, and Keynote, designed for macOS and iOS users.

Brands Owned by Microsoft

Microsoft has expanded its portfolio through acquisitions, owning several major brands across different industries:

Windows

Windows is Microsoft’s flagship operating system, powering over 70% of desktop and laptop computers worldwide. First launched in 1985, Windows has undergone multiple iterations, with the latest version being Windows 11. It is widely used in both consumer and enterprise environments, offering a range of editions like Windows Home, Pro, and Enterprise. Windows is a core revenue driver for Microsoft, especially through licensing to PC manufacturers.

Microsoft Azure

Azure is Microsoft’s cloud computing platform, offering services in computing, networking, AI, and storage. It competes with Amazon Web Services (AWS) and Google Cloud, holding around 25% of the global cloud market. Azure is widely adopted by enterprises for hosting applications, AI development, and big data analytics. Microsoft has integrated Azure into many of its products, making it central to its cloud-first strategy.

Microsoft Office (Microsoft 365)

Microsoft Office, now rebranded as Microsoft 365, is a productivity suite that includes Word, Excel, PowerPoint, Outlook, and more. It is a market leader in office productivity software, used by businesses, students, and professionals globally. The transition to a subscription-based model has increased Microsoft’s recurring revenue, making it one of the company’s most profitable products.

Xbox

Xbox is Microsoft’s gaming brand, consisting of gaming consoles, services, and studios. Microsoft entered the gaming industry in 2001 with the original Xbox, followed by Xbox 360, Xbox One, and the latest Xbox Series X|S. Xbox Game Pass, a subscription service offering access to a vast library of games, has become a key revenue driver. Microsoft also owns several game development studios, including Bethesda and Activision Blizzard, strengthening its presence in the gaming sector.

Surface

Microsoft’s Surface brand represents a line of premium hardware devices, including laptops, tablets, and 2-in-1 hybrid devices. The Surface lineup includes products like the Surface Pro, Surface Laptop, and Surface Studio. Surface devices are known for their sleek design, high performance, and tight integration with Windows and Microsoft services.

Acquired in 2016 for $26.2 billion, LinkedIn is the world’s largest professional networking platform, with over 900 million users. It provides job listings, professional networking, and learning services. LinkedIn generates revenue through advertising, premium subscriptions, and recruitment tools.

GitHub

Microsoft acquired GitHub in 2018 for $7.5 billion. It is the world’s largest platform for software development collaboration, used by millions of developers for code sharing and version control. GitHub plays a key role in Microsoft’s developer outreach and supports its open-source initiatives.

Skype

Skype, acquired in 2011 for $8.5 billion, was once the leading internet communication platform. While its popularity declined with the rise of Microsoft Teams and other messaging services, it remains a widely used VoIP service for video and voice calls.

Microsoft Teams

Launched in 2017, Microsoft Teams is a collaboration and communication platform that integrates chat, video conferencing, and file sharing. It has become a preferred tool for remote work and enterprise communication, competing with Slack and Zoom.

OneDrive

OneDrive is Microsoft’s cloud storage service that allows users to store, sync, and share files across devices. It is integrated into Windows and Microsoft 365, providing seamless access to files from anywhere.

Nuance Communications

Acquired in 2022 for $19.7 billion, Nuance specializes in AI-powered speech recognition and healthcare technology. Its solutions are widely used in the medical industry for clinical documentation and voice recognition.

ZeniMax Media (Bethesda Softworks)

Microsoft acquired ZeniMax Media, the parent company of Bethesda Softworks, in 2021 for $7.5 billion. This acquisition brought major game franchises like The Elder Scrolls, Fallout, and Doom under Microsoft’s ownership, further strengthening its gaming portfolio.

Activision Blizzard

In 2023, Microsoft completed the $69 billion acquisition of Activision Blizzard, adding major gaming franchises such as Call of Duty, Warcraft, and Candy Crush to its portfolio. This acquisition solidified Microsoft as one of the top gaming companies in the world.

Conclusion

Microsoft remains one of the most influential technology companies in the world. Its ownership is diversified, with major institutional investors such as Vanguard and BlackRock holding significant stakes. While no single individual controls the company, its governance structure ensures strategic leadership under CEO Satya Nadella. Microsoft continues to dominate multiple industries, from software and cloud computing to gaming and AI. Its acquisitions and product innovations position it for sustained growth in the coming years.

FAQs

Who is the largest shareholder of Microsoft?

The largest shareholder of Microsoft is The Vanguard Group, which owns approximately 8.9% of the company.

Does Bill Gates still own Microsoft?

Bill Gates owns around 1.4% of Microsoft. While he has reduced his holdings over time, he remains a significant shareholder.

Who is Microsoft’s CEO?

Microsoft’s current CEO is Satya Nadella, who has led the company since 2014.

What is Microsoft’s net worth?

As of 2025, Microsoft’s market capitalization exceeds $3 trillion, making it one of the most valuable companies in the world.

What companies does Microsoft own?

Microsoft owns brands such as Windows, Office, Azure, LinkedIn, GitHub, Xbox, Activision Blizzard, Skype, Bing, and Nuance Communications.

Who are Microsoft’s biggest competitors?

Microsoft’s top competitors include Apple, Google, Amazon, IBM, and Salesforce, competing in various technology sectors.