CBS is one of the most recognized media companies in the United States. From primetime dramas to news broadcasts, CBS has shaped American entertainment for decades. But who owns CBS today, and how has its ownership evolved over time? In this article, we’ll explore the full story behind CBS, its parent company, major stakeholders, and financial profile.

CBS Company Profile

CBS, short for Columbia Broadcasting System, is one of the oldest and most influential television and media networks in the United States. It is currently operated as a core division of Paramount Global, a major global media conglomerate.

Founding and Early History

CBS was founded in 1927 as the United Independent Broadcasters by Arthur Judson, a talent agent and music industry executive. The company was later renamed the Columbia Broadcasting System after being acquired by William S. Paley in 1928. Under Paley’s leadership, CBS quickly grew into one of the leading radio networks in the U.S. and later transitioned into television broadcasting by the late 1940s.

Company Details

- Full Name: Columbia Broadcasting System (CBS)

- Founded: 1927

- Headquarters: New York City, New York, USA

- Current Owner: Paramount Global (NASDAQ: PARA)

- Parent Company Headquarters: New York City, New York

- Key Divisions: CBS Entertainment, CBS News, CBS Sports, CBS Studios, CBS Television Stations, Paramount+

- CEO of CBS Entertainment Group: George Cheeks (as of 2025)

- Broadcast Reach: Over 200 affiliated and owned television stations in the U.S.

- Global Access: Content available internationally via Paramount+ and licensed partners.

Major Milestones in CBS History

1928 – William S. Paley acquires CBS and transforms it from a struggling radio network into a national powerhouse.

1930s–40s – CBS becomes a dominant force in radio, launching iconic programs and establishing its own news division.

1941 – CBS becomes one of the first networks to begin commercial television broadcasting.

1951 – Launch of I Love Lucy, which revolutionizes television production and syndication.

1960s–70s – Expansion into TV news and investigative journalism. 60 Minutes debuts in 1968, becoming one of the most successful news programs in TV history.

1995 – Acquired by Westinghouse Electric Corporation, which later renamed itself CBS Corporation.

2000 – CBS merges with Viacom, owned by Sumner Redstone’s National Amusements.

2006 – CBS Corporation is spun off from Viacom as a separate publicly traded company.

2019 – CBS and Viacom merge again, forming ViacomCBS.

2022 – ViacomCBS is rebranded as Paramount Global, positioning CBS as a key brand within a broader digital and international media strategy.

2023–2025 – CBS content becomes central to Paramount+’s growth strategy as the streaming service expands globally. CBS also invests heavily in sports rights and live events, securing long-term NFL and NCAA contracts.

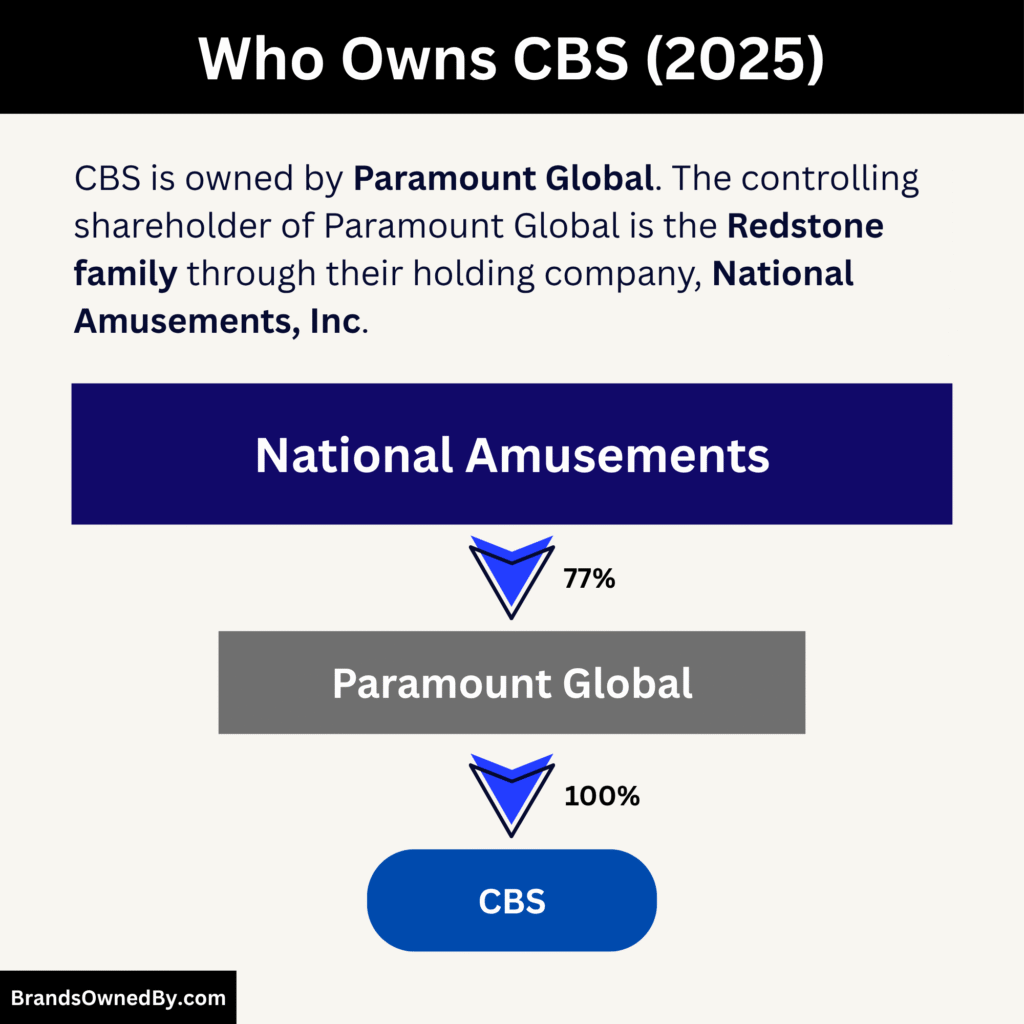

Who Owns CBS in 2025?

CBS is fully owned and operated by Paramount Global, a publicly traded multinational media conglomerate headquartered in New York City. Paramount Global owns CBS through its CBS Entertainment Group division, which also oversees CBS News, CBS Sports, CBS Studios, and CBS Television Stations. The company’s ownership has evolved through decades of acquisitions, mergers, and restructuring—especially involving Viacom and National Amusements.

Here’s a quick summary of the CBS ownership as of July 2025:

- Ticker Symbols: PARA (Class B), PARAA (Class A)

- Ownership Type: Publicly traded company

- Voting Control: Held by National Amusements

- Key Leadership: Shari Redstone (Chairwoman), George Cheeks (President and CEO of CBS)

- Headquarters of Parent Company: New York City, New York.

Parent Company: Paramount Global

Paramount Global (NASDAQ: PARA) is the direct parent company of CBS. It was formed in December 2019 following the re-merger of CBS Corporation and Viacom, both of which were originally under the control of National Amusements, Inc.

In 2022, the company was officially rebranded from ViacomCBS to Paramount Global to align with its international streaming and content strategy.

Paramount Global now owns and operates a wide range of media properties, including:

- CBS (broadcast network)

- Paramount Pictures

- Showtime

- Nickelodeon

- MTV

- Comedy Central

- BET

- Paramount+ (streaming).

CBS remains one of the flagship brands within Paramount’s portfolio, especially on the linear television and live broadcasting side.

Controlling Shareholder: National Amusements, Inc.

Paramount Global, and thus CBS, is controlled by National Amusements, Inc., a private holding company owned by the Redstone family. The company controls approximately 77% of the voting shares of Paramount Global through its Class A stock.

Shari Redstone, daughter of the late media mogul Sumner Redstone, is the current chairwoman of Paramount Global and president of National Amusements. Through this control, the Redstone family exercises significant influence over the direction of CBS and the broader company.

Acquisition and Merger History

1995 – Westinghouse Acquisition: CBS was acquired by Westinghouse Electric Corporation, which transitioned into a media company and later renamed itself CBS Corporation.

2000 – Viacom Merger: CBS Corporation was merged into Viacom, owned by National Amusements, forming one of the largest media conglomerates at the time.

2006 – Corporate Split: Viacom and CBS split into two separate entities, Viacom Inc. and CBS Corporation, but both remained under National Amusements’ control.

2019 – ViacomCBS Merger: After years of negotiation, CBS and Viacom re-merged to form ViacomCBS in December 2019.

2022 – Paramount Global Rebranding: ViacomCBS rebranded as Paramount Global to unify its global identity, especially in the streaming space through Paramount+.

Who Controls CBS?

Although CBS operates as a television and media brand under Paramount Global, the actual control over its decisions lies with a combination of executive leadership, its corporate parent, and a powerful voting structure dominated by one family.

Below is a detailed breakdown of who controls CBS and how this power is wielded.

National Amusements: The Ultimate Controlling Entity

National Amusements, Inc. holds the majority of Class A voting shares in Paramount Global, which owns CBS. Through this voting control, National Amusements exercises significant influence over strategic decisions, including executive appointments, mergers, and long-term planning.

National Amusements is a privately held company owned by the Redstone family, and it has controlled CBS and Viacom for decades. As of 2025, Shari Redstone, daughter of the late Sumner Redstone, is the Chairwoman of Paramount Global and President of National Amusements. Her leadership plays a direct role in guiding CBS’s direction, particularly in corporate policy and high-level decisions.

Paramount Global Board of Directors

The Board of Directors of Paramount Global plays a vital role in CBS’s overall strategy. The board includes a mix of independent directors and executives, many of whom have deep experience in media, finance, and technology.

The board is responsible for overseeing the performance of CBS and other Paramount subsidiaries. It approves strategic initiatives such as streaming expansion, international partnerships, and acquisitions. The board also supervises CEO performance, including that of CBS leadership.

CBS Executive Leadership

At the division level, George Cheeks, the President and CEO of CBS, controls daily operations of the CBS Entertainment Group. This includes content development, programming, distribution, and coordination with other Paramount divisions like Paramount+ and Showtime.

Cheeks reports directly to top Paramount executives and works closely with other division heads to ensure CBS maintains its position in news, sports, and entertainment. His team includes senior VPs and department heads for areas such as CBS News, CBS Sports, and CBS Studios.

Role of Shareholders and Institutional Investors

While National Amusements holds most of the voting power, institutional investors like Vanguard, BlackRock, and State Street hold large stakes in non-voting Class B shares. These shareholders influence CBS indirectly, mainly through market pressure, investor calls, and financial performance expectations.

Although they do not make executive decisions, their presence ensures that CBS and Paramount Global remain accountable to the broader market.

Regulatory and Industry Oversight

CBS is also subject to oversight by federal regulators such as the Federal Communications Commission (FCC), especially concerning its broadcast licenses, content standards, and advertising practices. While not involved in internal decision-making, these agencies impact what CBS can broadcast and how it conducts business on a regulatory level.

Who is the CEO of CBS?

As of 2025, the CEO of CBS is George Cheeks. He serves as the President and Chief Executive Officer of CBS Entertainment Group, a division of Paramount Global. George Cheeks plays a key role in shaping CBS’s programming, business strategy, and long-term vision within a highly competitive media environment.

Background of George Cheeks

George Cheeks joined CBS in March 2020. He came from NBCUniversal, where he served as Co-Chairman of NBC Entertainment and was involved in launching the Peacock streaming platform. He also held senior roles in business affairs and content strategy at Viacom earlier in his career.

Cheeks brought with him a combination of creative, legal, and business expertise—essential qualities for managing a legacy broadcast network during the streaming transition.

Role and Responsibilities

As CEO of CBS, Cheeks oversees all areas of the CBS Entertainment Group, including:

- CBS Television Network (primetime, daytime, and late-night programming)

- CBS News (including 60 Minutes, CBS Mornings, and political coverage)

- CBS Sports (NFL, NCAA, golf, and more)

- CBS Studios (original content production)

- CBS Media Ventures (syndication and distribution)

- CBS Television Stations (local broadcast stations across the U.S.).

Cheeks is responsible for aligning these divisions with Paramount Global’s larger media and streaming strategy. He works closely with the leaders of Paramount+, Showtime, and Paramount Pictures to integrate CBS content across platforms and drive revenue from both traditional and digital sources.

Leadership Style and Strategy

George Cheeks is known for fostering collaboration across business units. Under his leadership, CBS has:

- Strengthened its sports broadcasting deals, especially with the NFL and NCAA

- Renewed hit franchises like FBI, NCIS, and Survivor

- Expanded CBS’s role in streaming through partnerships with Paramount+

- Focused on diversity in programming and talent development

- Integrated news and entertainment content for a cross-platform audience

He has also emphasized innovation while preserving CBS’s core identity as a reliable and broad-reaching broadcast network.

Reporting Structure

Cheeks reports directly to senior executives at Paramount Global, including the CEO. Cheeks is also a key member of Paramount’s senior management team and works with the Board of Directors on long-term planning.

He collaborates with other content leaders across Paramount’s brands, including Nickelodeon, MTV, and Showtime.

Past CEOs of CBS

Several prominent figures have held the CEO or President role at CBS before George Cheeks:

- Les Moonves (1995–2018): A highly influential executive, Moonves led CBS during a period of major growth but resigned amid misconduct allegations in 2018.

- Joseph Ianniello (2018–2020): Served as Acting CEO following Moonves’ exit and helped prepare CBS for the Viacom merger.

- Kelly Kahl (CBS Entertainment President, 2017–2023): Although not CEO, he oversaw programming strategy until his departure in 2023.

Influence in the Media Industry

George Cheeks is considered one of the most powerful media executives in the U.S. As of 2025, he continues to lead CBS during a time of transformation, managing the network’s legacy operations while positioning it for future success in the digital streaming era.

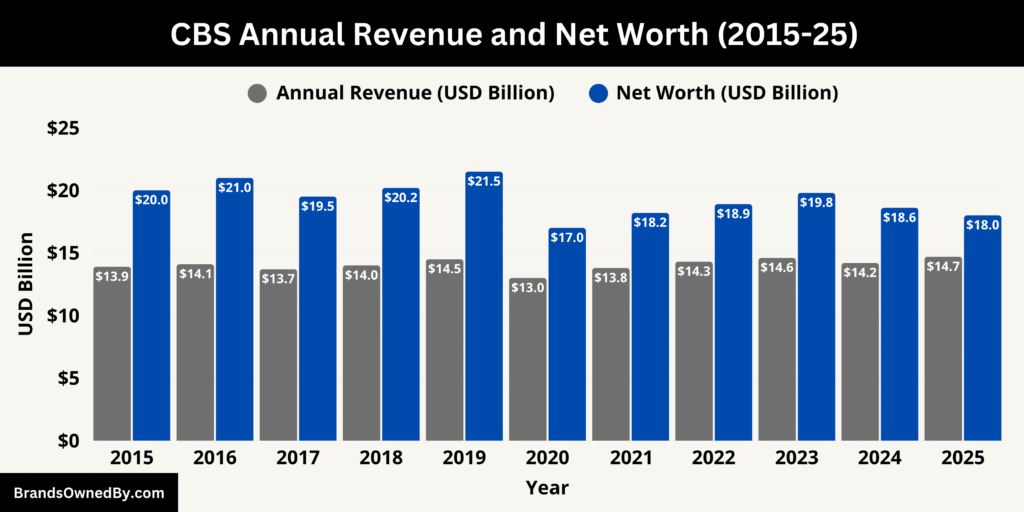

CBS Annual Revenue and Net Worth

CBS remains a major revenue-generating engine for its parent company, Paramount Global. Its financial performance in 2025 reflects the network’s continued dominance in advertising, sports broadcasting, syndication, and streaming content.

Annual Revenue

As of fiscal year 2025, CBS generated an estimated $14.7 billion in revenue, contributing nearly half of the domestic media earnings for Paramount Global. This figure includes income from national television advertising, local station revenue, content licensing, syndication, and its contribution to streaming platforms like Paramount+.

CBS experienced revenue growth in 2025 due to multiple factors. A major driver was the continued success of live sports programming, including the NFL, NCAA March Madness, and PGA Tour, all of which command premium ad rates. Additionally, CBS saw strong performance from its primetime scripted lineup, and its reality shows like Survivor and Big Brother maintained high ratings.

The network’s syndicated programming, especially through CBS Media Ventures, also remained highly profitable. Shows such as Inside Edition and Entertainment Tonight delivered steady returns across local markets.

Growth in digital advertising and increased licensing to Paramount+ helped diversify income beyond traditional broadcast. CBS also struck new content deals with international platforms, further expanding its global footprint.

Contribution to Paramount Global’s Financials

CBS is one of the most valuable assets within Paramount Global, which reported total 2025 revenues of approximately $30.2 billion. The CBS division consistently delivers stable cash flow and acts as a foundation for Paramount’s content pipeline, especially for live and episodic content.

CBS’s high-margin properties, including 60 Minutes and NFL broadcasts, helped offset streaming-related losses in other parts of Paramount’s business. Its reliable income stream makes it a core pillar of the company’s earnings structure.

Net Worth of CBS

As of July 2025, CBS has an estimated net worth of around $18 billion. This estimate reflects its brand equity, content library, affiliate network, owned-and-operated stations, and sports broadcast rights.

The CBS brand remains one of the most recognized in American media. Its content archives—including decades of programming, news footage, and sports rights—hold long-term licensing and streaming value. The brand’s integration into Paramount Global further enhances its overall valuation as part of a diversified portfolio.

Here is the historical 10-year revenue and estimated net worth for CBS from 2015 to 2025:

| Year | Estimated Annual Revenue | Estimated Net Worth | Notes |

|---|---|---|---|

| 2015 | $13.9 billion | $20 billion | CBS Corporation was operating independently. Strong ad revenue from NFL and hit shows. |

| 2016 | $14.1 billion | $21 billion | Growth driven by political advertising and streaming licensing. |

| 2017 | $13.7 billion | $19.5 billion | Minor dip in ad revenue, offset by syndication growth. |

| 2018 | $14.0 billion | $20.2 billion | Steady earnings despite executive leadership changes. |

| 2019 | $14.5 billion | $21.5 billion | Re-merger with Viacom announced in late 2019. |

| 2020 | $13.0 billion | $17 billion | Pandemic impacted advertising and live sports. ViacomCBS formed. |

| 2021 | $13.8 billion | $18.2 billion | Recovery with return of live events and sports. |

| 2022 | $14.3 billion | $18.9 billion | CBS All Access rebranded into Paramount+. Stable syndication income. |

| 2023 | $14.6 billion | $19.8 billion | High ad rates from sports; streaming revenue increases. |

| 2024 | $14.2 billion | $18.6 billion | Small decline due to linear TV slowdown, offset by international licensing. |

| 2025 | $14.7 billion | $18 billion | CBS thrives on sports deals, franchise renewals, and syndication growth. |

Financial Outlook

In 2025, CBS continues to maintain a strong financial position despite industry-wide pressures from cord-cutting and declining traditional TV viewership. By expanding its digital and international content strategies and securing long-term sports deals, CBS has remained competitive in a shifting landscape.

Analysts expect CBS’s earnings stability to continue, supported by a mix of advertiser demand, content sales, and its strategic role in Paramount Global’s streaming ambitions.

CBS Market Share and Competitors

CBS holds a strong position in broadcast TV and is growing in streaming, but it faces fierce competition from Disney, Netflix, and Warner Bros. Discovery. Its success hinges on leveraging live sports, iconic franchises, and cost-effective streaming strategies to close the gap with rivals.

CBS’s Market Share

CBS is one of the leading broadcast networks in the U.S., with an estimated 20% share of the traditional TV audience and a growing presence in streaming via Paramount+ and Pluto TV.

Broadcast Television

Primetime Viewership: ~30% market share (leader among U.S. broadcasters).

- Strengths: Hit shows like NCIS, Young Sheldon, and 60 Minutes.

- Live sports: NFL games and NCAA March Madness.

Advertising Revenue: ~25% of the U.S. broadcast TV ad market.

- Strengths: High ratings for live events (e.g., Super Bowl, Grammys).

Streaming (Paramount+)

U.S. Market Share: ~6% (as of 2023).

- Subscribers: 63 million globally (Q3 2023).

- Strengths: Exclusive CBS content (Star Trek, Yellowstone prequels) and live sports.

Free Streaming (Pluto TV):

- Market Share: ~3% of U.S. ad-supported streaming.

- Monthly Active Users: 80 million globally.

News Division

CBS News: ~20% of the U.S. broadcast news market.

- Strengths: 60 Minutes, CBS Evening News, and Face the Nation.

Top Competitors

CBS competes with legacy broadcasters, cable networks, and streaming platforms. Below are its top rivals, their market share, and strengths:

1. Comcast (NBCUniversal)

Broadcast TV Market Share: ~28%.

- Strengths: NBC’s Sunday Night Football, The Voice, and Today Show.

Streaming (Peacock)

- Market Share: ~7% of U.S. streaming.

- Subscribers: 28 million (Q3 2023).

- Strengths: Exclusive Premier League soccer and Universal films.

2. Disney (ABC/ESPN)

Broadcast TV Market Share: ~25%.

- Strengths: ABC’s Grey’s Anatomy, Dancing with the Stars, and ESPN’s live sports.

Streaming (Disney+, Hulu, ESPN+)

- Market Share: ~25% of U.S. streaming.

- Subscribers: 220 million globally (Disney+ and Hulu combined, Q3 2023).

- Strengths: Marvel, Star Wars, and Pixar franchises.

3. Warner Bros. Discovery (HBO Max/Discovery+)

Broadcast TV Market Share: ~20%.

- Strengths: CNN, TNT, and TBS cable networks.

Streaming (Max)

- Market Share: ~10% of U.S. streaming.

- Subscribers: 95 million globally (Q3 2023).

- Strengths: HBO originals (Game of Thrones, Succession) and Discovery’s reality shows.

4. Netflix

Streaming Market Share: ~35% of U.S. streaming.

- Subscribers: 247 million globally (Q3 2023).

- Strengths: Dominant original content (Stranger Things, The Crown) and global reach.

5. Amazon Prime Video

Streaming Market Share: ~15% of U.S. streaming.

- Subscribers: 200 million globally (included with Prime membership).

- Strengths: The Lord of the Rings: The Rings of Power and NFL’s Thursday Night Football.

Competitive Strengths of CBS

Live Sports

- NFL rights (AFC games, Super Bowl) and NCAA basketball.

- Drives ad revenue and subscriber growth for Paramount+.

Iconic Franchises

- Star Trek, NCIS, and Yellowstone prequels (1923, 1883).

- Attracts loyal audiences across broadcast and streaming.

News Dominance

- 60 Minutes and CBS Evening News are trusted brands.

- High ratings for election coverage and breaking news.

Free Streaming (Pluto TV)

- Ad-supported model appeals to cost-conscious viewers.

- Complements Paramount+ by offering a lower-tier option.

Challenges and Weaknesses

Streaming Losses

- Paramount+ is not yet profitable, with $1.7B in losses in 2023.

- Lags behind Netflix and Disney+ in global reach.

Debt Burden

- Paramount Global carries $16.8B in debt (Q3 2023).

- Limits investment in content and technology.

Cord-Cutting

- Declining cable subscriptions reduce revenue from CBS-affiliated channels.

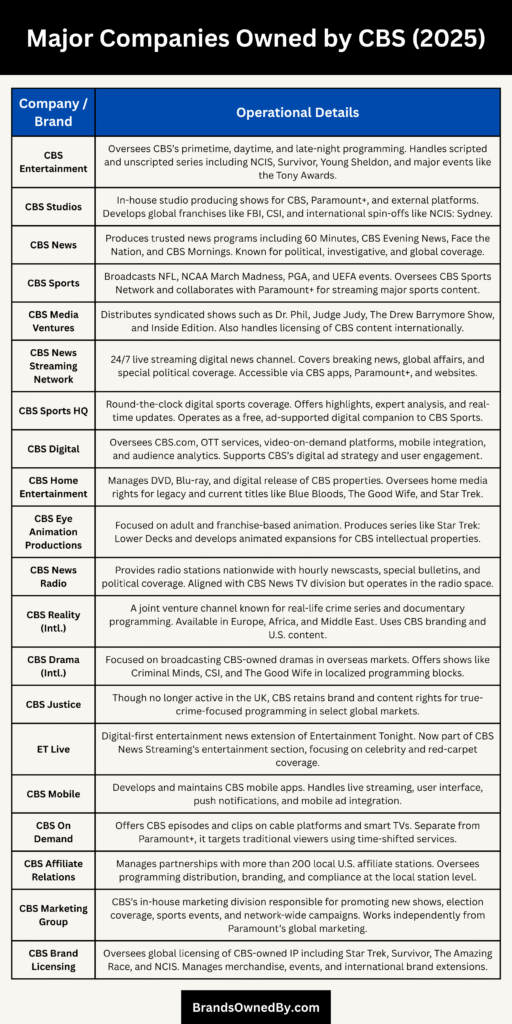

Brands Owned by CBS

CBS, as part of Paramount Global, operates under a vast portfolio of brands spanning broadcast, cable, streaming, and film. Below is a detailed look at the major brands owned by CBS as of July 2025:

| Name | Type | Function | Key Details |

|---|---|---|---|

| CBS Television Network | Broadcast Network | National television network airing primetime, daytime, news, and sports. | Reaches 97% of U.S. households with affiliate and owned stations. |

| CBS Studios | Production Studio | Develops and produces scripted and unscripted series for CBS and others. | Owns vast content library including NCIS, Star Trek, and Cheers. |

| CBS News | News Division | Produces news programs like CBS Evening News, 60 Minutes, and Face the Nation. | Operates national and international news bureaus. |

| CBS Sports | Sports Division | Covers NFL, NCAA, PGA, and other sports programming. | Owns rights to high-value sports events and operates digital sports coverage. |

| CBS Media Ventures | Syndication & Distribution | Distributes CBS-owned and third-party shows to local markets. | Handles Entertainment Tonight, Inside Edition, and The Drew Barrymore Show. |

| CBS Television Stations | Owned TV Stations | Owns and operates 14 full-power TV stations in major U.S. cities. | Local stations include WCBS (New York), KCBS (Los Angeles), WBBM (Chicago). |

| CBS News Streaming Network | Streaming News Channel | 24/7 live-streaming digital news service. | Delivers live coverage, breaking news, and digital-first programming. |

| CBS Entertainment | Programming Division | Manages content development and series orders for CBS primetime. | Oversees scripted dramas, comedies, reality shows, and specials. |

| CBS Daytime | Daytime Programming | Manages CBS’s soap operas and daytime talk shows. | Includes The Young and the Restless, The Bold and the Beautiful, and The Talk. |

| CBS Home Entertainment | Content Distribution | Releases CBS programming in physical and digital retail formats. | Handles DVD/Blu-ray and digital sales globally. |

| CBS Eye Animation Productions | Animation Division | In-house animation studio producing adult and short-form animated content. | Works on CBS digital and streaming animation projects. |

| CBS Audio Network | Radio News Network | Audio content and hourly newscasts distributed to affiliate radio stations. | Legacy radio news service formerly known as CBS Radio News. |

CBS Television Network

The CBS Television Network is the flagship broadcast division of CBS. It airs original scripted shows, unscripted reality series, sports events, specials, and national news. It reaches over 97% of U.S. television households through its network of owned-and-operated and affiliate stations. Flagship shows include NCIS, Blue Bloods, Survivor, and Young Sheldon. The network operates 24/7 with programming blocks covering primetime, daytime, late-night, and weekend schedules.

CBS Studios

CBS Studios is the television production arm of CBS. It produces most of the original scripted content for CBS as well as for streaming platforms like Paramount+ and other third parties. As of 2025, it is responsible for over 70 active series across genres. CBS Studios also manages a large content library of classic TV shows such as Hawaii Five-0, Cheers, The Twilight Zone, and Star Trek. It has production partnerships in both domestic and international markets.

CBS News

CBS News is the news division of CBS, delivering national and international news coverage. It produces CBS Evening News, CBS Mornings, 60 Minutes, Face the Nation, and 48 Hours. In 2025, CBS News operates both broadcast and streaming news channels, including 24/7 news service CBS News Streaming Network. It has bureaus in major cities like Washington D.C., London, and Los Angeles. CBS News also provides content to CBS-owned stations and partners.

CBS Sports

CBS Sports is the sports broadcasting division of CBS, known for covering high-profile events. It holds long-term rights for the NFL, NCAA March Madness, PGA Tour, SEC football, and other major sporting events. The division produces weekly NFL on CBS broadcasts and the long-running College Football Today. CBS Sports also operates a digital arm and collaborates with the streaming side of Paramount+ for simulcasts and exclusive events.

CBS Media Ventures

CBS Media Ventures is the domestic television distribution and syndication arm of CBS. It is the largest syndicator of first-run programming in the U.S. The division handles the syndication of popular programs such as Inside Edition, Entertainment Tonight, The Drew Barrymore Show, and reruns of Judge Judy. It also manages barter sales, advertising partnerships, and content licensing across networks and platforms.

CBS Television Stations

CBS Television Stations is a group of local broadcast stations owned and operated by CBS. As of 2025, CBS owns 14 full-power local stations in major cities including New York (WCBS), Los Angeles (KCBS), Chicago (WBBM), and San Francisco (KPIX). These stations produce local news, weather, sports, and community-focused programming. They serve as hubs for regional content and contribute to national newsgathering operations.

CBS News Streaming Network

This is a 24/7 live-streaming news channel operated directly by CBS News. Launched originally as CBSN, it has evolved into a fully integrated digital-first news service. In 2025, it offers constant live news, breaking coverage, and original reporting—accessible through smart TVs, apps, and Paramount+.

CBS Entertainment

CBS Entertainment is the programming and content development division behind the CBS Television Network. It commissions scripted dramas, comedies, reality shows, and specials. CBS Entertainment works closely with CBS Studios and external partners to develop both pilot projects and full-season series. In 2025, it manages hit franchises like FBI, NCIS, and The Amazing Race.

CBS Daytime

CBS Daytime is a long-standing programming block under the CBS Entertainment umbrella. It airs soap operas like The Young and the Restless and The Bold and the Beautiful, along with The Talk. CBS Daytime remains popular among key demographic groups and contributes meaningfully to daytime ad revenue.

CBS Home Entertainment

CBS Home Entertainment manages the distribution of CBS content in physical and digital formats. It oversees the release of DVD, Blu-ray, and digital download versions of CBS-owned television series. The brand works with global distribution partners to bring CBS archives and new releases to retail and online platforms.

CBS Eye Animation Productions

This is CBS’s in-house animation division. It develops animated content for CBS platforms and external buyers. The studio operates as a boutique division of CBS Studios and contributes to adult animation and short-form digital projects.

CBS Audio Network

The CBS Audio Network (formerly CBS Radio News) is a radio-based news service operated under CBS News. It provides hourly newscasts, special reports, and audio content to hundreds of radio affiliates across the United States. It remains one of the oldest and most respected audio news services in the country.

Conclusion

So, who owns CBS? The answer is Paramount Global, a media powerhouse controlled by National Amusements and the Redstone family. CBS plays a key role within this conglomerate, providing valuable news, sports, and entertainment content to millions. With its long history and ongoing contributions, CBS remains one of the most influential broadcast networks in the United States.

FAQs

Who is CBS owned by?

CBS is owned by Paramount Global, a U.S.-based media and entertainment conglomerate. Paramount Global is the parent company that controls all CBS operations, including its network, studios, and news divisions.

What family owns CBS?

The Redstone family owns and controls CBS through their holding company, National Amusements, Inc., which has majority voting control in Paramount Global.

Who owns the CBS family?

The CBS family of brands—such as CBS News, CBS Sports, CBS Studios, and the CBS Television Network—is owned by Paramount Global and ultimately controlled by the Redstone family via National Amusements.

Who runs CBS?

CBS is run by George Cheeks, who is the President and CEO of CBS Entertainment Group. He oversees all of CBS’s divisions and reports to senior leadership at Paramount Global.

Who is the biggest shareholder of CBS?

The biggest shareholder of CBS is National Amusements, Inc., which owns the majority of Class A voting shares in Paramount Global, giving it effective control over CBS.

Who purchased CBS?

CBS has not been purchased recently. It merged with Viacom in 2019 to form ViacomCBS, which was later renamed Paramount Global in 2022. Both CBS and Viacom were already under the control of National Amusements before the merger.

Is YouTube buying CBS?

No, YouTube is not buying CBS. CBS remains a core part of Paramount Global. There is no public information or agreement indicating a purchase by YouTube or its parent company, Google.

Is CBS English or American?

CBS is American. It was founded in the United States and is headquartered in New York City. It is one of the oldest and most influential U.S. broadcast television networks.

Which country owns CBS?

CBS is owned and operated by a U.S.-based corporation, Paramount Global, making it an American-owned company.

Who is the owner of CBS MTV?

CBS and MTV are both owned by Paramount Global. However, they are operated as separate brands under different divisions—CBS under CBS Entertainment Group, and MTV under the Paramount Media Networks division.

Are CNN and CBS owned by the same company?

No, CNN and CBS are not owned by the same company.

- CBS is owned by Paramount Global.

- CNN is owned by Warner Bros. Discovery, a completely different media company.

Which studio owns CBS?

CBS is not owned by another studio. It owns its own production unit, CBS Studios, which produces much of its content for television and streaming.

Who owns CBS company?

The CBS company is owned by Paramount Global. The ultimate controlling shareholder is National Amusements, led by the Redstone family.

Is Paramount owned by CBS?

No, it’s the opposite. CBS is owned by Paramount Global, which is the parent company. Paramount is not owned by CBS—it is the umbrella company for CBS and several other media brands.

Who owns CBS and Paramount?

Both CBS and Paramount are owned by Paramount Global. The company is controlled by National Amusements, Inc., owned by the Redstone family.

When did Paramount acquire CBS?

Paramount Global was formed through the re-merger of Viacom and CBS in December 2019. This merger brought CBS back under the same roof as Paramount Pictures and other Viacom assets.

When did CBS get its name?

CBS got its name—Columbia Broadcasting System—in 1928, shortly after William S. Paley took over and restructured the original company (United Independent Broadcasters).

Who is the founder of CBS?

CBS was originally founded by Arthur Judson in 1927 as a radio network.

Who owns National Amusements?

Shari Redstone currently leads National Amusements, which is the controlling shareholder of Paramount Global.

Is CBS still a standalone company?

No, CBS is no longer a standalone public company. It operates as a division within Paramount Global.