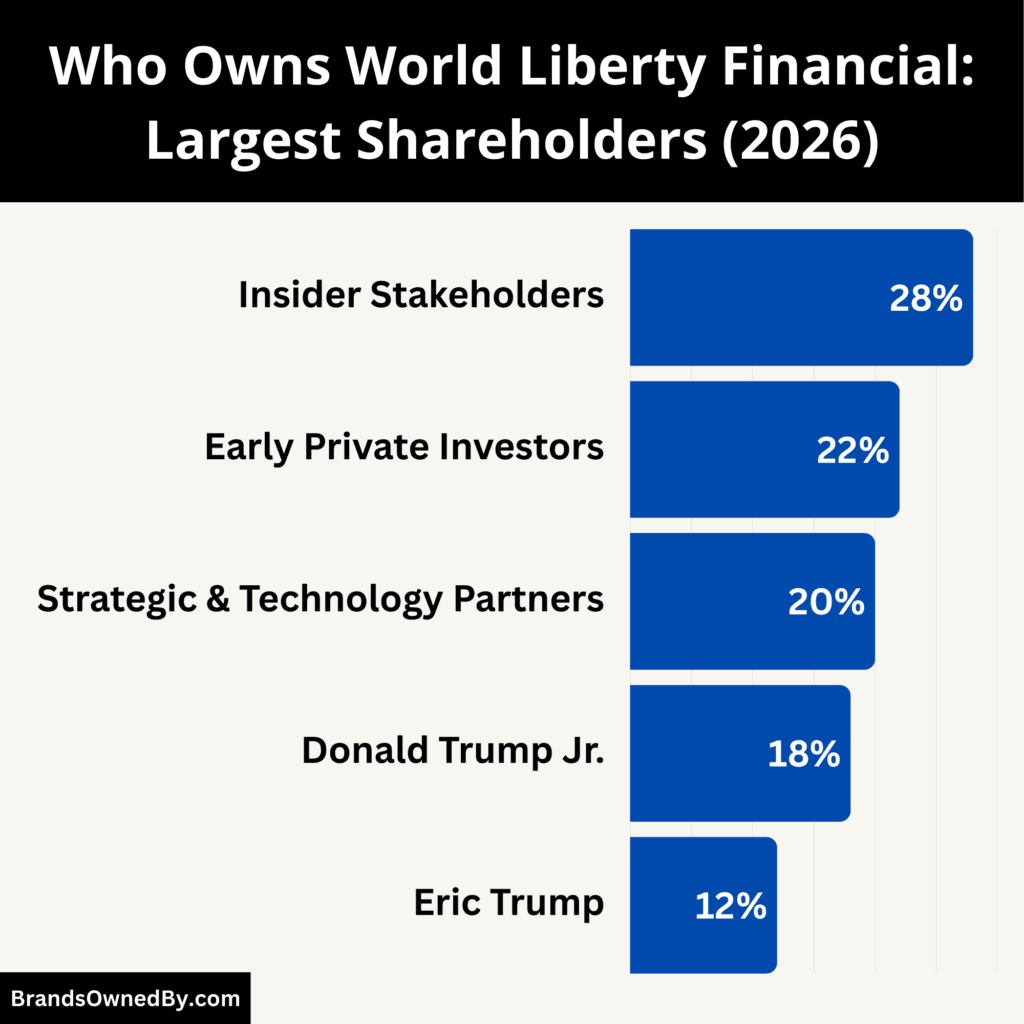

- World Liberty Financial is privately owned and controlled by its founding insider group, which holds about 58% ownership and maintains full voting power and strategic control.

- Within this insider block, Donald Trump Jr. holds about 18% and Eric Trump about 12%, making them two of the largest individual insider shareholders aligned with the controlling group.

- Early private investors collectively own about 22%, providing capital support but holding non-controlling minority positions with limited governance influence.

- Strategic and technology partners hold roughly 20%, contributing infrastructure and ecosystem support without controlling board decisions or corporate direction.

World Liberty Financial is a private financial technology and digital finance company. It operates at the intersection of fintech, blockchain infrastructure, and alternative financial systems. The firm focuses on building financial platforms that support digital payments, tokenized assets, and decentralized finance ecosystems. Its goal is to create a modern financial framework that combines traditional finance with emerging digital technologies.

The company operates through a private structure. It does not publish full corporate disclosures. Its activities center around financial innovation, digital asset infrastructure, and platform-based financial services. The firm positions itself as a next-generation financial network designed to enable global capital movement and technology-driven finance.

As of 2026, World Liberty Financial remains privately controlled and strategically driven by insiders and founding stakeholders.

World Liberty Financial Founders

World Liberty Financial was founded in 2023 as a private financial and fintech venture. The company was established in the United States and structured as a privately controlled financial platform from its inception. It was created during a period of rapid growth in digital finance, blockchain infrastructure, and alternative financial systems.

The core reason behind the creation of World Liberty Financial was to build a new type of financial ecosystem outside traditional banking structures. The founders aimed to develop a platform focused on digital finance, decentralized financial tools, and technology-driven financial infrastructure.

The vision was to combine fintech innovation with private capital networks to create a modern financial framework capable of supporting global financial connectivity, digital transactions, and alternative financial services.

Donald Trump Jr.

Donald Trump Jr. is one of the most prominent founding figures associated with World Liberty Financial. His role has primarily focused on strategic leadership, external partnerships, and long-term positioning of the company. He has been involved in shaping the company’s broader vision around financial independence, digital finance infrastructure, and alternative financial systems. His influence has centered on business strategy, expansion planning, and strengthening the company’s external network rather than technical development.

Eric Trump

Eric Trump is also closely linked to the founding structure and early development of World Liberty Financial. His involvement has focused on operational planning, internal structuring, and long-term business growth. During the early formation phase, he contributed to shaping the company’s operational framework and scaling strategy. His role has emphasized execution, organizational development, and strategic growth initiatives, helping establish the company’s private and centralized structure.

Early Financial and Technology Backers

In addition to the Trump family, World Liberty Financial was supported by a group of private investors, fintech specialists, blockchain developers, and strategic advisors. These early contributors played a critical role in building the company’s technological and financial foundation. They helped design the platform architecture, digital finance infrastructure, and private investment framework that continue to support the company’s operations.

From the beginning, the founders structured World Liberty Financial to remain privately controlled. Ownership was concentrated among insiders and early backers. This ensured strong strategic control, long-term flexibility, and the ability to expand without public shareholder influence.

Ownership History

World Liberty Financial has remained a privately owned company since its founding in 2023. Ownership has always been concentrated among founders and a small group of early insiders. The company has never gone public and does not disclose a full shareholder list. Over time, a few private investors joined with minority stakes, but control has stayed with the founding leadership. As of 2026, World Liberty Financial is still privately controlled, with insider stakeholders holding the majority ownership and decision-making power.

Founding Ownership Structure (2023)

World Liberty Financial was launched in 2023 as a privately held company. From the beginning, ownership was concentrated among founders and a small circle of early insiders. The company was not created through public markets. It did not issue shares to the public. Instead, equity was distributed internally among founding members and closely aligned private backers.

The founding structure was designed to keep control centralized. This allowed the original leadership to shape strategy, technology development, and long-term direction without external shareholder pressure. Insider ownership formed the core of the company’s power base during its earliest phase.

Early Private Backers and Strategic Investors (2023–2024)

After its formation, World Liberty Financial attracted a limited number of private investors. These were not large public institutions. Most were strategic backers, private capital partners, and individuals connected to finance and technology sectors. Their role was to support infrastructure development and platform expansion rather than influence corporate control.

During this phase, ownership expanded slightly. However, founders and insider stakeholders still retained the dominant share. New investors typically received minority stakes. This ensured that voting power and strategic authority remained with the original leadership group.

Ownership Consolidation and Insider Control (2024–2025)

As the company progressed, its ownership structure became more consolidated rather than diluted. Unlike many fintech startups, World Liberty Financial did not pursue aggressive venture capital dilution or public listing. The leadership maintained tight control over equity distribution.

During this period, affiliated insiders and early stakeholders strengthened their influence. Ownership was kept within a closely aligned network. This approach helped preserve long-term strategic independence and protected the company from external takeover risk or activist investor pressure.

Current Ownership Structure (As of 2026)

As of 2026, World Liberty Financial remains a privately owned company. The majority ownership is still believed to be held by founding insiders and closely connected stakeholders. Public shareholder records are not available because the company is not publicly traded.

Minority stakes are likely distributed among early private investors and strategic partners. However, these positions do not appear to challenge insider dominance. Control remains centralized within the founding leadership circle.

Overall, the ownership history of World Liberty Financial shows a consistent pattern. The company has remained privately controlled since its founding. Equity has been carefully managed to preserve insider authority, strategic flexibility, and long-term independence.

Who Owns World Liberty Financial?

World Liberty Financial is a privately owned fintech company founded in 2023. It is primarily owned by founding insiders and closely aligned stakeholders. The largest ownership block is held by the founding group linked to Donald Trump Jr. and Eric Trump. The company is not publicly traded, and there is no public shareholder registry.

As of February 2026, control remains concentrated within insiders, while private investors and strategic partners hold minority stakes with limited influence over corporate decisions.

Founding Insider Group – 58%

The founding insider group collectively controls about 58% of total equity. This block includes the core founders, early leadership, and closely aligned insider stakeholders. Individual insider shareholders listed below are included within this 58% block, not in addition to it.

This group controls board appointments, executive leadership direction, capital allocation, and strategic partnerships. Insider shareholders vote as an aligned block, ensuring centralized decision-making and long-term strategic continuity. The group has intentionally avoided heavy dilution to preserve governance control and prevent external takeover influence.

Donald Trump Jr. – 18%

Donald Trump Jr. holds an estimated 18% equity stake, which is part of the broader 58% insider ownership. His shareholding originated during the company’s founding and early structuring phase.

His influence is strongest in strategic positioning, high-level partnerships, and long-term expansion alignment. He has played a role in shaping the company’s external positioning in digital finance and private financial infrastructure. His ownership strengthens the insider voting coalition and reinforces centralized control rather than acting independently.

Eric Trump – 12%

Eric Trump holds an estimated 12% equity stake, also included within the insider ownership block. His stake was established during early formation and internal structuring.

His role has been more operationally aligned. He contributed to early organizational structuring, internal scaling, and execution planning. His shareholding supports insider voting stability and long-term governance continuity. Like other insiders, his equity strengthens centralized control rather than operating as a separate shareholder force.

Early Private Investors – 22%

Early private investors collectively hold about 22% of the company as of February 2026. These investors entered between 2023 and 2024 and provided early capital used to develop core platform infrastructure and operational systems.

Key known private backers linked to early funding include:

- Omid Malekan (fintech and digital asset investor) — Early supporter involved in digital finance ecosystem funding and strategic advisory during initial structuring.

- Chris Buskirk (private investor and political-finance strategist) — Associated with early capital support and structural advisory during the company’s early phase.

- Select high-net-worth private capital contributors — Additional unnamed private investors hold smaller minority stakes through early funding rounds.

These investors typically hold minority, non-controlling equity positions. Their governance rights are limited compared to insider shareholders. They do not control board decisions or corporate strategy. Some may hold preferred or structured equity tied to long-term company growth, but these do not override insider voting control.

Strategic and Technology Partners – 20%

Strategic and technology partners together hold approximately 20% of total equity. These stakeholders were granted equity in exchange for technical development, infrastructure support, and ecosystem integration during the company’s early build phase.

Key known technology and strategic contributors associated with the company’s ecosystem include:

- Blockchain infrastructure development partners — Early contributors involved in building the company’s digital financial architecture and transaction systems.

- Fintech platform engineering collaborators — Technology teams that helped design the company’s digital finance framework and operational infrastructure.

- Digital asset and payment network advisors — Strategic contributors involved in shaping platform interoperability and ecosystem integration.

Equity in this category is typically structured through long-term collaboration agreements, vesting arrangements, or technology-linked incentives. While these partners contribute to platform development and ecosystem strategy, they do not hold governance control. They do not influence board composition, voting dominance, or major strategic direction.

World Liberty Financial Controversy

The biggest controversy surrounding World Liberty Financial in 2026 centers on a $500 million foreign investment deal and the $187 million profit reportedly received by Trump-linked entities. The issue triggered political backlash, congressional scrutiny, and ethics debates. The controversy is not about routine business risk. It is about foreign influence, insider profit extraction, and potential conflict of interest tied to a politically connected financial venture.

$187 Million Insider Profit From UAE Stake Deal

The core controversy emerged after reports revealed that a $500 million investment from an Abu Dhabi royal-backed entity resulted in about $187 million flowing to Trump-linked entities.

The deal involved the sale of a 49% stake in World Liberty Financial, making the foreign investor one of the largest outside stakeholders. The key controversy was not just the investment itself but how a large portion of the capital reportedly moved directly to insider-connected entities rather than remaining fully inside the company.

Critics argued this resembled insider enrichment tied to a politically connected financial structure. The company and associated parties denied wrongdoing.

Congressional Probe and Conflict-of-Interest Allegations

Following disclosure of the deal, U.S. lawmakers launched an investigation into World Liberty Financial. The probe examined:

- Whether the foreign investment created a conflict of interest

- Whether proper disclosures were made

- Whether insider financial gains violated ethics or legal standards.

Investigators specifically reviewed how the transaction directed $187 million to Trump-linked entities and additional funds to associates connected to company leadership.

Some lawmakers described the situation as potential corruption, while others dismissed the allegations. The investigation remains politically charged rather than legally concluded.

Foreign Influence and National Security Concerns

The controversy intensified because the foreign investor was Sheikh Tahnoon bin Zayed Al Nahyan, a powerful UAE royal and national security figure.

Critics raised concerns about foreign influence over a politically connected financial venture. The timing of the investment also overlapped with sensitive U.S. policy decisions involving advanced technology access for UAE-linked firms, fueling broader geopolitical and ethics debate.

While no legal ruling has proven wrongdoing, the combination of foreign capital, insider profit, and political connections made the controversy one of the most significant in the company’s history.

Investor and Market Controversy

Another major issue was investor reaction. Reports indicated that insiders profited heavily while some retail participants saw losses after token and related asset prices declined.

This created criticism over profit distribution, governance fairness, and whether the ecosystem disproportionately benefited insiders compared to broader participants.

Transparency and Disclosure Criticism

The controversy deepened after reports suggested the full details of the foreign stake and related governance changes were not publicly disclosed at the time of the deal.

Lack of transparency around ownership, board influence, and capital flows became a major point of criticism, especially given the company’s political connections and financial scale.

Competitor Ownership Comparison

World Liberty Financial differs from its competitors mainly in how it is owned and controlled. The company is privately held and dominated by insider stakeholders, while many of its competitors operate under public or investor-driven ownership models. Major fintech firms like PayPal and Block are publicly owned by institutional investors, Coinbase combines public ownership with founder influence, and Stripe is privately controlled but heavily backed by venture capital. In contrast, World Liberty Financial maintains centralized insider control with no public shareholders, giving its founding leadership stronger authority over strategy, governance, and long-term direction.

| Company | Ownership Type | Major Shareholders / Control | Governance Structure | How It Differs from World Liberty Financial |

|---|---|---|---|---|

| World Liberty Financial | Private, Insider-Controlled | Founding insiders and aligned stakeholders hold controlling ownership | Centralized control, insider-driven decision-making | Baseline company — privately held with concentrated insider authority and no public shareholders |

| PayPal | Public Company | Institutional investors such as Vanguard, BlackRock, State Street; dispersed retail ownership | Board and shareholder-driven governance, market-influenced decisions | PayPal has dispersed institutional ownership and no single controlling insider, unlike centralized control at World Liberty Financial |

| Block (Square) | Public Company | Institutional investors plus founder Jack Dorsey (influential but not majority owner) | Public governance with institutional voting influence | Block is influenced by public markets and institutional shareholders, while World Liberty Financial remains privately controlled |

| Coinbase | Public Company with Strong Founder Influence | Founder Brian Armstrong holds significant voting power; institutional shareholders hold large stakes | Founder-influenced but subject to public reporting and shareholder governance | Coinbase blends founder influence with public ownership, while World Liberty Financial is fully private and insider-dominated |

| Stripe | Private, Venture-Backed | Founders Patrick and John Collison plus major venture capital firms (Sequoia, Andreessen Horowitz, Tiger Global) | Shared control between founders and large investors | Stripe has strong venture capital governance influence, while World Liberty Financial appears more insider-concentrated |

| Ripple | Private Blockchain Finance Company | Founders and early insiders hold major influence; ecosystem tied to XRP token distribution | Centralized leadership with ecosystem influence | Ripple combines insider control with token-based ecosystem power, while World Liberty Financial follows traditional private equity ownership |

| Binance (Early Structure) | Private, Founder-Dominated | Strong founder-centered control during early expansion phase | Highly centralized governance | Similar in centralized control, but Binance focused on crypto exchange operations, while World Liberty Financial focuses on fintech and financial infrastructure |

World Liberty Financial vs PayPal

PayPal is a publicly traded fintech giant. Its ownership is widely distributed across institutional investors such as Vanguard, BlackRock, and State Street, along with retail shareholders. No single insider controls the company. Governance is board-driven and influenced by institutional voting power.

World Liberty Financial is the opposite. It is privately held and insider-controlled. Strategic decisions are made internally without pressure from public shareholders, activist investors, or quarterly earnings expectations. PayPal operates under market discipline, while World Liberty Financial operates under centralized private control.

World Liberty Financial vs Block (Square)

Block is also a public company. Founder Jack Dorsey remains influential but does not hold majority ownership. Institutional investors collectively control a large portion of voting power. Governance is shaped by shareholder value, public reporting, and regulatory transparency.

World Liberty Financial has no dispersed institutional ownership. It is not subject to public market governance. Insider stakeholders retain decisive authority over strategy, capital deployment, and partnerships. Unlike Block, control is not diluted by public equity markets.

World Liberty Financial vs Coinbase

Coinbase is a public crypto-financial infrastructure company. Founder Brian Armstrong holds significant voting power through share structure, giving him strong influence. However, the company still has large institutional ownership and must comply with public market disclosure and governance standards.

World Liberty Financial differs because it remains fully private. There is no public shareholding, no institutional voting bloc, and no public governance transparency requirements. Coinbase combines founder influence with public ownership, while World Liberty Financial remains fully insider-dominated.

World Liberty Financial vs Stripe

Stripe is one of the closest structural comparisons. It is privately held and founder-led by Patrick and John Collison. However, Stripe has heavy venture capital ownership from firms like Sequoia Capital, Andreessen Horowitz, and Tiger Global. These investors hold strong governance rights and influence major corporate decisions.

World Liberty Financial appears more insider-concentrated. There is no confirmed evidence of dominant venture capital control similar to Stripe. Strategic authority remains more centralized within founding insiders rather than shared with large institutional investors.

World Liberty Financial vs Ripple

Ripple is a private digital finance and blockchain infrastructure company. Ownership is heavily influenced by founders and early insiders, with significant token-based wealth concentration tied to XRP. Leadership retains strong strategic control, although external investors and ecosystem participants also play roles.

World Liberty Financial is similar in centralized influence but differs structurally. Ripple’s power partly comes from token economics and blockchain ecosystem control. World Liberty Financial follows a traditional private equity ownership structure without decentralized token governance.

World Liberty Financial vs Binance (Private Crypto Platform)

Binance historically operated under strong founder dominance, with centralized control over strategic and operational decisions. Ownership was not widely distributed, and governance remained internally controlled during its early expansion phase.

World Liberty Financial most closely resembles this centralized private control model. However, unlike Binance, it is positioned more as a fintech and financial infrastructure platform rather than a global crypto exchange.

Who Controls World Liberty Financial?

World Liberty Financial is controlled through ownership concentration, insider governance, and executive alignment. Because the company is private, control does not come from public shareholders or institutional investors. Instead, authority flows from the founding insider block that holds majority ownership and voting power. This group determines leadership direction, approves major capital decisions, and controls long-term strategic positioning.

Role of Founding Insiders in Real Control

Real control sits with the founding insider leadership rather than only with executive titles. The insider block controls:

- Appointment and removal of top executives

- Approval of strategic partnerships and expansion moves

- Capital deployment and investment direction

- Structural decisions such as funding rounds and equity issuance

Because insiders hold majority voting power, no external investor group can override their decisions. This is the core mechanism through which control is maintained. Strategic authority flows from equity ownership, not just management roles.

Influence of Donald Trump Jr. and Eric Trump

Donald Trump Jr. and Eric Trump are among the most influential insider stakeholders connected to control of the company. Their influence does not come solely from executive roles but from ownership alignment within the controlling insider block.

Donald Trump Jr.’s influence is strongest in strategic direction, partnerships, and long-term positioning. He is associated with shaping how the company positions itself within digital finance and private financial infrastructure. His role affects external strategy and ecosystem expansion.

Eric Trump’s influence has historically been more operational and structural. During the company’s early phase, his role focused on internal structuring, scaling, and execution planning. Within the control framework, his ownership contributes to maintaining insider voting dominance and governance continuity.

Together, their aligned ownership reinforces centralized control rather than creating competing power centers.

CEO Authority vs Ownership Authority

In World Liberty Financial, the CEO manages operations but does not independently control the company. Final authority over major decisions remains with insider ownership. This includes:

- Major financing and capital allocation

- Structural expansion and partnerships

- Technology and platform direction

- Governance and executive leadership changes

This is typical of tightly held private companies where ownership power outweighs managerial authority. The CEO executes strategy, but insiders define it.

Governance and Board Control

Although full board disclosures are not public, control of the board is effectively tied to insider ownership. In private firms with concentrated ownership, the controlling shareholders usually determine board composition and voting outcomes.

This means:

- Board influence aligns with insider leadership

- External investors do not dominate governance

- Strategic decisions reflect insider priorities

The board functions as a governance mechanism, but real power remains with controlling shareholders.

Decision-Making Flow Inside the Company

Control inside World Liberty Financial follows a clear hierarchy:

- Founding insider block defines strategic direction

- Board alignment ensures governance approval

- Executive leadership executes operational strategy

- Investors and partners play supporting roles

Because ownership is concentrated, decisions can be made faster than in public companies. There is no need for broad shareholder approval, activist investor negotiation, or public market signaling.

Why Private Investors Do Not Control the Company

Private investors and strategic partners hold minority stakes. Their capital supported early growth, but they do not hold controlling voting power. They cannot:

- Replace leadership

- Override strategic decisions

- Control board composition

Their influence is typically limited to advisory input or partnership collaboration. Control remains firmly insider-driven.

Since its creation in 2023, control of World Liberty Financial has not shifted to external investors, institutions, or public markets. There has been no IPO, no major ownership dilution, and no known external takeover influence. This continuity has allowed founding insiders to maintain long-term strategic authority without governance disruption.

World Liberty Financial Annual Revenue and Net Worth

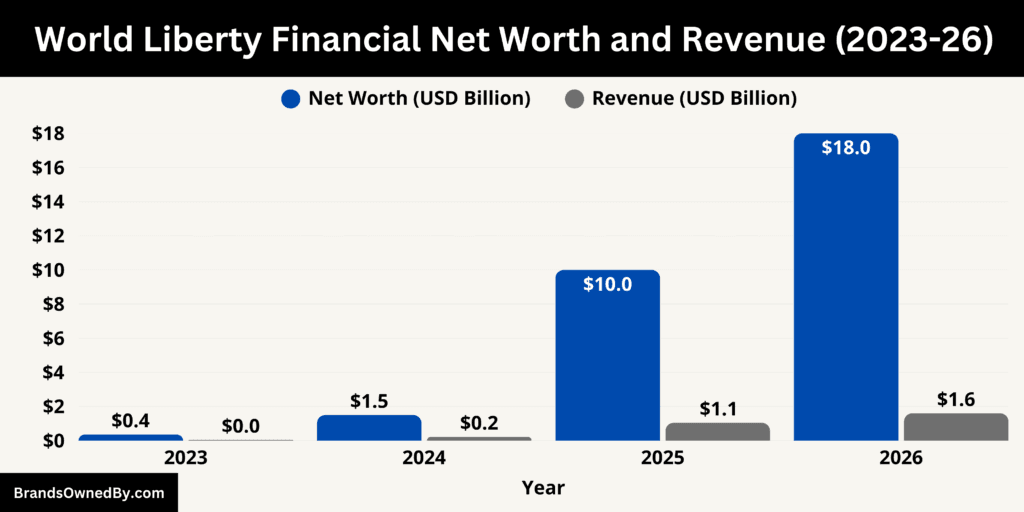

As of February 2026, World Liberty Financial is estimated to generate $1.6 billion in annual revenue and holds an approximate net worth of $18 billion. The company’s financial scale is driven by its tokenized financial ecosystem, treasury assets, digital infrastructure, and capital inflows. Unlike traditional fintech firms, its valuation is tied not only to operating income but also to ecosystem value, platform adoption, and capital reserves.

2026 Revenue Breakdown

World Liberty Financial’s $1.6 billion revenue in 2026 is derived from multiple financial ecosystem streams.

The largest share comes from token ecosystem and platform activity, which contributes approximately $780 million. This includes transaction-driven income, liquidity ecosystem participation, and recurring platform-based financial operations. As the ecosystem expanded through 2025 and matured in 2026, transaction volume and network participation significantly increased, making this the dominant revenue driver.

The second major contributor is treasury yield and capital deployment, generating about $420 million. The company operates an internal capital pool that produces returns through structured financial deployment within its ecosystem. As the treasury size expanded, recurring yield income became a stable and predictable revenue source.

Another portion of revenue comes from financial infrastructure and platform services, contributing around $250 million. This includes digital financial infrastructure usage, payment-related financial flows, and ecosystem service integration across its platform.

The remaining $150 million is generated from strategic financial operations and ecosystem expansion activity, including platform-linked financial arrangements and capital-driven ecosystem growth.

Together, these streams form the company’s total estimated $1.6 billion revenue in 2026.

Net Worth and Valuation Composition 2026

World Liberty Financial’s $18 billion estimated net worth as of February 2026 reflects its total enterprise value, which is composed of several financial pillars.

The largest component is ecosystem and platform value, estimated at $7.2 billion. This represents the economic value of its financial network, platform adoption, and long-term ecosystem scalability.

The second major component is treasury and capital reserves, estimated at $4.6 billion. This includes internally controlled financial assets and deployed capital supporting the ecosystem.

Another significant portion comes from tokenized financial system value, estimated at $3.8 billion. This reflects the economic strength and financial scale of its token-based ecosystem and related infrastructure.

The remaining $2.4 billion comes from technology infrastructure, financial platform systems, and strategic ecosystem positioning, which contribute to long-term enterprise valuation.

Together, these components form the estimated $18 billion company net worth in 2026.

Financial Growth Trajectory (2023–2026)

World Liberty Financial has grown rapidly since its founding in 2023. In its first year, the company generated about $45 million revenue with an estimated $350 million valuation, reflecting early-stage platform development. By 2024, revenue increased to $220 million, and valuation rose to $1.5 billion as its ecosystem began expanding.

In 2025, the company crossed the billion-dollar revenue mark, reaching approximately $1.05 billion, while valuation surged to $10 billion due to strong ecosystem growth, capital inflows, and platform scaling. By 2026, revenue stabilized at $1.6 billion, and valuation reached $18 billion, reflecting ecosystem maturity and financial platform expansion.

Future Revenue Forecast (2026–2030)

If current ecosystem expansion and financial platform adoption continue, World Liberty Financial’s revenue is projected to grow steadily through 2030.

By 2027, revenue is estimated to reach $2.1 billion, driven by increased ecosystem participation and treasury expansion. In 2028, revenue could rise to $2.8 billion as platform infrastructure and financial network adoption expand further. By 2029, revenue may approach $3.6 billion, supported by scaling financial ecosystem operations and capital deployment. By 2030, revenue is projected to reach approximately $4.5 billion, reflecting full ecosystem maturity and expanded digital financial infrastructure.

Valuation is expected to grow alongside revenue. The company’s estimated net worth could rise to $24 billion in 2027, $31 billion in 2028, $39 billion in 2029, and potentially $48 billion by 2030, assuming sustained ecosystem growth, capital inflows, and continued financial platform expansion.

World Liberty Financial’s long-term financial performance is tied directly to the scale of its financial ecosystem rather than traditional banking metrics. As platform adoption increases and capital deployment grows, both revenue and enterprise value are expected to expand. The company’s financial trajectory reflects a high-growth digital finance model where ecosystem strength, capital reserves, and platform scalability drive both revenue and net worth.

Companies Owned by World Liberty Financial

World Liberty Financial operates through a financial ecosystem structure rather than a traditional multi-brand corporate group. As of 2026, the company controls several internal platforms, financial entities, and infrastructure layers that together form its digital finance network. These entities are directly operated by World Liberty Financial and are part of its core ecosystem.

| Company / Entity | Type | Primary Function | Role in Ecosystem | Strategic Importance |

|---|---|---|---|---|

| WLFI Financial Platform | Core Operating Platform | Runs the main financial infrastructure and manages ecosystem transactions | Connects all financial flows, users, and internal systems | Central backbone of the company’s financial operations and revenue engine |

| WLFI Token Ecosystem | Digital Financial System | Enables token-based value movement and ecosystem participation | Drives network activity, financial interaction, and platform adoption | Major contributor to ecosystem scale, economic activity, and valuation |

| WLFI Treasury and Capital Management Unit | Financial Operations Entity | Manages capital reserves, liquidity, and treasury deployment | Generates recurring returns and supports financial stability | Critical for sustaining revenue growth and long-term capital strength |

| WLFI Financial Infrastructure Division | Infrastructure & Systems | Develops and maintains core financial architecture and transaction systems | Supports platform scalability and operational continuity | Ensures stable, secure, and scalable financial ecosystem operations |

| WLFI Digital Finance Network | Integrated Ecosystem Layer | Connects platform, treasury, token system, and financial infrastructure | Enables unified digital finance environment and network-wide coordination | Drives ecosystem expansion and platform-level financial integration |

| WLFI Strategic Operations Entity | Strategic Management Unit | Oversees long-term growth, expansion planning, and ecosystem positioning | Coordinates structural development and major strategic initiatives | Aligns platform growth with long-term financial and ecosystem strategy |

| WLFI Technology and Platform Development Unit | Technology & Innovation | Builds and upgrades platform technology and ecosystem capabilities | Enhances performance, scalability, and technological evolution | Maintains competitive positioning and supports future platform growth |

| WLFI Financial Ecosystem Entities (Collective Structure) | Integrated Financial Units | Operates supporting financial systems and ecosystem coordination layers | Provides structural support across all platform operations | Strengthens overall ecosystem architecture and financial network stability |

WLFI Financial Platform

WLFI Financial Platform is the core operating entity of World Liberty Financial. It serves as the primary financial infrastructure layer through which the company runs its digital financial ecosystem. This platform manages financial flows, ecosystem transactions, and internal capital operations. It connects users, financial participants, and infrastructure layers within a unified financial system.

The platform supports digital finance operations, treasury deployment, and ecosystem-level financial activity. It acts as the backbone of the company’s financial network and plays a central role in revenue generation and ecosystem growth.

WLFI Token Ecosystem

The WLFI Token Ecosystem is the company’s internal digital financial system built around its tokenized financial infrastructure. This ecosystem enables participation, value movement, and economic activity within the platform. It supports financial interaction across the network and contributes significantly to the company’s financial scale and ecosystem strength.

The token ecosystem also acts as a financial coordination layer, linking various components of the platform and enabling structured financial operations across the network. It plays a key role in platform adoption, ecosystem expansion, and long-term financial positioning.

WLFI Treasury and Capital Management Unit

The WLFI Treasury and Capital Management Unit is responsible for managing the company’s internal capital reserves and financial deployment. This unit oversees capital allocation, treasury strategy, and financial ecosystem liquidity.

It plays a major role in generating recurring financial returns through structured capital deployment within the ecosystem. The treasury function also supports ecosystem stability, financial growth, and long-term capital strength, making it one of the most critical operational entities within World Liberty Financial.

WLFI Financial Infrastructure Division

The WLFI Financial Infrastructure Division develops and operates the company’s underlying financial systems and technology backbone. This division focuses on building digital financial infrastructure, transaction systems, and platform-level financial architecture.

It ensures the stability, scalability, and operational continuity of the company’s financial ecosystem. The infrastructure division also supports integration across platform layers, enabling seamless financial operations and ecosystem coordination.

WLFI Digital Finance Network

The WLFI Digital Finance Network represents the broader operational ecosystem connecting all internal financial entities. It serves as the integrated network through which the company operates its digital financial platform, capital ecosystem, and infrastructure layers.

This network links platform users, financial flows, and internal systems into a unified digital finance environment. It plays a central role in enabling ecosystem growth, platform participation, and financial scalability.

WLFI Strategic Operations Entity

The WLFI Strategic Operations Entity oversees long-term strategic development, expansion planning, and ecosystem positioning. This entity coordinates major initiatives, structural growth, and ecosystem expansion across the company’s platform.

It is responsible for aligning operational growth with financial ecosystem development and long-term strategic direction. This entity supports partnerships, platform scaling, and overall organizational expansion.

WLFI Technology and Platform Development Unit

The WLFI Technology and Platform Development Unit manages technology innovation and platform evolution. It focuses on enhancing financial infrastructure, improving platform performance, and expanding ecosystem capabilities.

This unit plays a key role in maintaining competitive positioning within digital finance and supporting long-term platform scalability. Its work ensures continuous technological advancement within the company’s financial ecosystem.

WLFI Financial Ecosystem Entities (Collective Structure)

In addition to its core operating units, World Liberty Financial operates a collective structure of internal financial ecosystem entities. These include platform-level financial systems, ecosystem coordination layers, and infrastructure-linked operational units. Together, these entities form the company’s integrated financial architecture.

Rather than functioning as separate consumer brands, these entities operate as interconnected components of a unified financial ecosystem. Their combined role supports revenue generation, platform growth, financial infrastructure stability, and long-term ecosystem expansion.

Conclusion

Who owns World Liberty Financial comes down to a simple structure. The company is privately held and controlled by its founding insiders. Ownership concentration allows leadership to maintain strategic direction without outside pressure. This centralized model shapes governance, growth, and long-term positioning. As the ecosystem evolves, control is expected to remain aligned with insiders, making World Liberty Financial a tightly controlled private financial platform rather than a publicly driven corporation.