Williams Sonoma is a leading name in home furnishings, kitchenware, and lifestyle products. For anyone wondering who owns Williams Sonoma, the answer lies in its public ownership structure and prominent institutional shareholders. Here’s a detailed breakdown of the company’s profile, ownership, revenue, and the brands it operates.

Williams Sonoma Company Profile

Williams‑Sonoma, Inc. is a leading American specialty retailer focused on premium home furnishings, kitchenware, and lifestyle products. Headquartered in San Francisco, California, the company operates a portfolio of iconic brands including Williams Sonoma, Pottery Barn, West Elm, Rejuvenation, and Mark and Graham. It serves customers globally through both e-commerce and physical stores, though more than 70% of its revenue now comes from online sales as of 2025.

Founded in 1956 by Chuck Williams, the company began as a single store selling imported French cookware in Sonoma, California. Williams later relocated the store to San Francisco, where it grew into a mail-order and retail brand. The company is now recognized as one of the most digitally advanced retailers in the United States, recently becoming a member of the S&P 500 Index in March 2025 — a major milestone in its growth journey.

Williams‑Sonoma has focused in recent years on sustainability, digital innovation, supply chain resilience, and leveraging artificial intelligence in product planning and logistics. Its ability to balance heritage craftsmanship with modern retail strategies has helped it thrive amid changing consumer habits and economic pressures.

Williams Sonoma Founders

The founder was Charles E. “Chuck” Williams. He bought a hardware store in Sonoma, California, in 1953 and converted it to sell French cookware in 1956. He moved inland to San Francisco in 1958. He launched the first catalog in 1971 and eventually expanded the brand via mail‑order.

He sold the company in 1978 to W. Howard Lester and James McMahan but continued involvement until going public in 1983.

Major Milestones of Williams‑Sonoma

- 1956 – Founded by Chuck Williams in Sonoma, California

- 1958 – Moved operations to San Francisco

- 1971 – Launched first mail-order catalog

- 1978 – Sold to W. Howard Lester and James McMahan

- 1983 – Became a public company via OTC offering

- 1985–1986 – Listed on the New York Stock Exchange (NYSE: WSM)

- 1986 – Acquired Pottery Barn from Gap Inc.

- 1999 – Launched e-commerce for all major brands

- 2002 – Introduced West Elm to target younger, urban consumers

- 2011 – Acquired Rejuvenation to expand into lighting and hardware

- 2012 – Launched Mark and Graham, a personalized gifting brand

- 2017 – Acquired Outward, a 3D imaging and augmented reality startup

- 2020–2022 – Surged in e-commerce sales during the COVID-19 pandemic

- 2023 – Achieved carbon neutrality across own operations

- 2025 – Added to the S&P 500 Index; over 70% of revenue now from digital channels.

Williams‑Sonoma, Inc. has successfully transformed from a boutique kitchen store into a global home lifestyle company, blending tradition with tech-driven retailing.

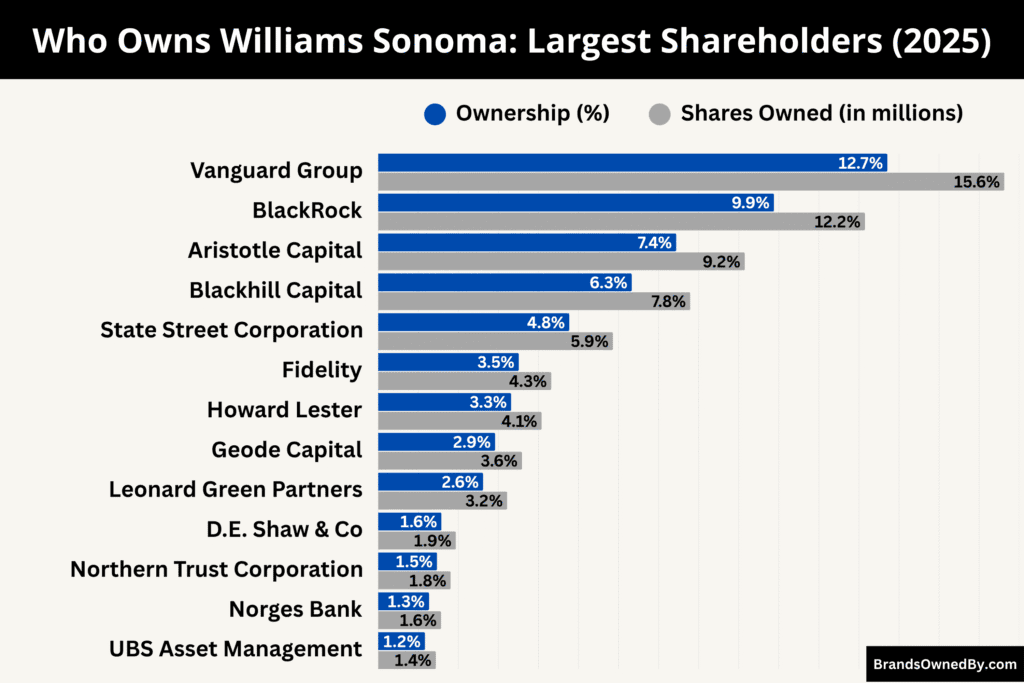

Who Owns Williams Sonoma: List of Shareholders

Williams Sonoma is a publicly traded company listed on the New York Stock Exchange under the ticker symbol WSM. It is not owned by a single individual or entity. Instead, it is owned by a broad mix of institutional investors, mutual funds, and individual shareholders.

The largest shareholders of Williams Sonoma are investment firms and asset management companies. These firms influence major business decisions by holding significant voting power.

As of August 2025, institutional investors hold about 91.9% of Williams‑Sonoma’s stock, while insiders hold around 5.7%, and retail shareholders about 2.4%.

Here’s a list of the major shareholders of Williams Sonoma as of August 2025:

| Shareholder | Ownership (%) | Shares Owned (approx.) | Type | Role & Influence |

|---|---|---|---|---|

| Vanguard Group, Inc. | 12.71% | 15.63 million | Passive (Index Funds) | Largest shareholder; significant proxy voting power |

| BlackRock, Inc. | 9.88% | 12.15 million | Passive (Index Funds) | Major voice in ESG and governance |

| Aristotle Capital Management, LLC | 7.44% | 9.15 million | Active Manager | May engage in strategic dialogue with management |

| Blackhill Capital Inc. | 6.33% | 7.79 million | Activist Hedge Fund | Pushes for financial optimization and returns |

| State Street Corporation (SSgA) | 4.77% | 5.86 million | Passive (Index Funds) | Supports governance and board elections |

| FMR LLC (Fidelity) | 3.51% | 4.32 million | Mixed (Active + Index) | Participates in governance, occasionally active |

| Geode Capital Management, LLC | 2.92% | 3.59 million | Passive | Influences through aggregate index fund votes |

| Leonard Green Partners, LP | 2.62% | 3.22 million | Private Equity | Strategic interest, may provide advisory input |

| Howard Lester (Insider) | 3.32% | 4.08 million | Insider/Founder | Legacy influence, participates in strategic direction |

| D.E. Shaw & Co., Inc. | 1.58% | 1.94 million | Quantitative Hedge Fund | Market-driven investor; typically passive |

| Northern Trust Corporation | 1.47% | 1.81 million | Institutional Custodian | Minimal direct engagement, votes in line with clients |

| Norges Bank (Norway Sovereign) | 1.27% | 1.57 million | Sovereign Wealth Fund | Long-term investor, supports sustainability initiatives |

| UBS Asset Management Americas | 1.17% | 1.44 million | Institutional Manager | Engages in governance and ESG proposals |

| Other Institutions (combined) | ~11% | ~13.5 million | Mixed | Includes Dimensional, Schwab, Goldman Sachs, etc.; mostly passive roles |

Vanguard Group, Inc.

Vanguard sits at the top as the largest institutional shareholder, owning 12.71% of Williams‑Sonoma, Inc. (about 15.63 million shares) as of August 2025.

Vanguard manages low‑cost index and mutual funds. Its holdings are spread across many funds, which means it votes indirectly on behalf of millions of clients. While it takes a passive role in operations, its voting power helps shape board elections, executive compensation, and governance policies.

BlackRock, Inc.

BlackRock is close behind, holding about 9.88% (roughly 12.15 million shares) as of August 2025. That stake dropped by over 22% from the prior quarter, reflecting repositioning or profit‑taking.

Like Vanguard, BlackRock is a passive investor, but its influence comes through high‑level proxy voting and proposals tied to ESG and board governance strategies.

Aristotle Capital Management, LLC

Aristotle holds approximately 7.44% of the company (about 9.15 million shares) as of August 2025, a slight 0.43% increase over prior filings.

As an active asset manager, Aristotle tends to take a more engaged stance. It may reach out to management about strategic matters like margins, growth initiatives, or capital allocation to protect client returns.

Blackhill Capital Inc.

Blackhill Capital owns 6.33% (approximately 7.79 million shares) as of August 2025. As an activist hedge fund, Blackhill often pressures for financial discipline, changes in share repurchase programs, or cost restructuring to unlock value for shareholders.

State Street Corporation (SSgA)

State Street holds 4.77% (about 5.86 million shares) as of August 2025, with holdings up over 11% in the prior quarter. As part of the Big Three passive managers, its voting power supports routine governance proposals and board re‑elections. It seldom pushes activist campaigns, focusing instead on stewardship.

FMR LLC (Fidelity)

FMR, or Fidelity, owns 3.51% (roughly 4.32 million shares). This represented a notable drop of over 25% vs. prior quarters. Fidelity invests through both actively‑managed funds and index vehicles. It influences policy through mutual fund voting and may engage in strategic dialogues if concerns arise.

Geode Capital Management, LLC

Geode holds 2.92% (~3.59 million shares), up roughly 34% in the latest quarter. This firm tends to follow passive investment strategies, though its rising stake may increase its role in shareholder votes and proxies tied to ESG and governance resolutions.

Leonard Green Partners, LP

Leonard Green owns 2.62% (about 3.22 million shares) as of August 2025, with no change from the prior quarter. As a private equity firm, it may have strategic insight or advisory influence, though it doesn’t run operations day‑to‑day.

D. E. Shaw & Co., Inc.

D. E. Shaw holds 1.58% (approx. 1.94 million shares), up 24.7% quarter‑on‑quarter. As a quantitative and algorithmic investor, it rarely intervenes directly, but sizable stake growth suggests a strong belief in long‑term value.

Northern Trust Corporation

Northern Trust owns 1.47% (~1.81 million shares), a small decline versus prior reporting. The firm typically acts as a fiduciary for institutional clients and votes en masse on routine proposals, with limited strategic engagement.

Norges Bank Investment Management

Norges Bank (Norway’s sovereign fund) holds 1.27% (~1.57 million shares) as of August 2025. As a long‑term investor focused on value and governance, it may support sustainability initiatives and long-term strategic oversight.

UBS Asset Management Americas

UBS AM owns 1.17% (~1.44 million shares), up 34% in Q1 2025. UBS is active in fiduciary management and votes across governance matters, occasionally filing proposals or supporting ESG initiatives.

Additional Notable Institutions

Other significant holders owning between 1.0% and 1.2% include Dimensional Fund Advisors, First Trust Advisors, Amvescap, Morgan Stanley, Renaissance Technologies, Charles Schwab, Qube Research, Jane Street, and Goldman Sachs, each holding roughly 1.0–1.1% of outstanding shares as of August 2025.

Howard Lester (Legacy Insider)

Howard Lester owns 3.32% of shares (approx. 4.08 million shares) as an individual insider shareholder. As a former CEO and a pivotal figure in taking the company public, he retains legacy influence, often through board representation and proxy voting on key governance matters.

Who is the CEO of Williams Sonoma?

Laura J. Alber has been CEO, President, and a member of the Board of Directors at Williams‑Sonoma, Inc. since 2010. She successfully succeeded W. Howard Lester, the retiring CEO. Alber began her career at Williams‑Sonoma in 1995 and steadily rose through leadership roles before becoming CEO.

Alber started at Williams‑Sonoma as a senior buyer for Pottery Barn. She then managed the Pottery Barn catalog operation, evolving it into a major business unit. From 2002 to 2006, she served as President of Pottery Barn and, in 2006, became President of the broader Williams‑Sonoma division, overseeing supply chain, logistics, international expansion, and operations.

As CEO and board director, Alber guides major strategy decisions, supported by a leadership team including roles such as Chief Financial Officer (Jeff Howie), Chief Technology Officer (Sameer Hassan), and Chief Talent Officer (Karalyn Smith). The board of directors provides oversight on compensation, governance, and corporate strategy.

Leadership Style and Strategic Vision

Under her leadership, Williams‑Sonoma adopted a digital‑first but not digital‑only retail strategy. Online channels generate over 70% of direct‑to‑consumer revenue, while physical stores continue to deliver experiential value.

Alber has emphasized consistent pricing over frequent promotions to build customer trust and avoid conditioning shoppers to wait for discounts.

Alber has overseen the launch and success of several key brands:

- Pottery Barn Kids, conceived while she was pregnant, became a major growth driver.

- Expanded lines such as PBteen, West Elm, Rejuvenation, and Mark and Graham were launched or scaled under her leadership.

Under Alber’s tenure, Williams‑Sonoma returned to consistent growth:

- Q1 2025 underlying EPS of $1.85 and revenue of $1.73 billion, both beating expectations, despite margin pressure.

- Ahead of the 2024 holiday season, the company raised its earnings outlook and launched a $1 billion stock repurchase plan.

Compensation and Governance Role

Laura Alber’s total compensation for fiscal 2024 was approximately $27.7 million, up 17% year-over-year. Around 58% of her total pay is performance-based, with strong PSU payouts tied to growth and cash flow metrics.

She continues to serve on Williams‑Sonoma’s board and exercises strategic oversight on key governance decisions.

Legacy and Industry Recognition

Alber is one of the longest-serving female CEOs of a Fortune 500 company. She has built a reputation for bold retail innovation, maintaining a strong brand identity while delivering growth across digital and physical channels. She is celebrated for fostering a values-based, inclusive culture, with many senior leaders in the organization being women.

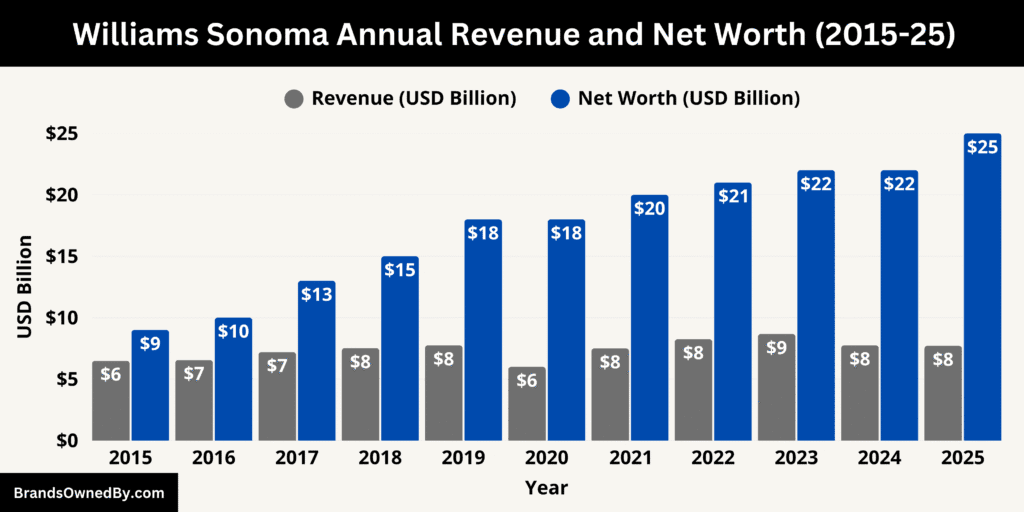

Williams Sonoma Annual Revenue and Net Worth

Williams‑Sonoma generated $7.7–7.8 billion in revenue in fiscal 2025, delivering $1.125 billion in net income, translating to roughly 15 % profit margins and EPS of $8.91. The company’s market capitalization reflects its scale and investor confidence, at around $25 billion as of August 2025.

Fiscal 2025 Annual Revenue

In fiscal year ending February 2, 2025, Williams‑Sonoma reported total revenue of approximately $7.71 billion. This marked a slight decline of about 0.5 % compared to fiscal 2024. However, the trailing‑12‑month revenue figure as of May 2025 rose to $7.78 billion, reflecting modest growth of around 1.6 % year-over-year.

Despite margin pressure in the first quarter, quarterly revenue of $1.73 billion exceeded forecasts and showed a 4.2 % increase from the prior year period.

Williams‑Sonoma delivered a net income of $1.125 billion for fiscal 2025, up approximately 18.5 % over the $0.95 billion earned in 2024.

Profit margins improved, with an overall operating margin reaching around 15 %, compared to 12 % in 2024, thanks to disciplined cost controls and stronger profitability from core brands. Earnings per share (EPS) rose to $8.91, above analyst expectations and up from USD 7.35 the prior year.

The company reaffirmed its full‑year outlook for 2025, projecting net revenue growth between –1.5 % and +1.5 %, with comparable brand sales expected to be flat to +3 %, depending on calendar effects like a 53rd week in 2024.

Management expects an operating margin in the high‑teens, specifically between 17.4 % and 17.8 %, inclusive of prior‑year timing effects and tariff impact.

Williams‑Sonoma Net Worth

Williams‑Sonoma’s market capitalization—or net worth in terms of equity value—is well over $25 billion as of August 2025. As of early 2025, estimates placed its market cap at about $20.9 billion.

Other data sources reported values from $21.6 billion up to $25.1 billion, depending on the specific reporting date and share price fluctuations.

Here’s Williams‑Sonoma’s annual revenue, net income, and market capitalization (net worth) over the last ten fiscal years (2015–2025):

| Fiscal Year | Revenue (USD billion) | Net Income (USD billion) | Market Cap (USD billion, approximate mid‑year) |

|---|---|---|---|

| 2015 | ~6.49† | ~0.309† | ~9 |

| 2016 | ~6.55† | ~0.310† | ~10 |

| 2017 | ~7.20† | ~0.305† | ~12–13 |

| 2018 | ~7.52† | ~0.260† | ~13–15 |

| 2019 | ~7.75† | ~0.334† | ~15–18 |

| 2020 | ~6.00† | ~0.356† | ~16–18 |

| 2021 | ~7.50† | ~0.681† | ~18–20 |

| 2022 | ~8.25† | ~1.126† | ~19–21 |

| 2023 | ~8.67† | ~1.128† | ~20–22 |

| 2024 | ~7.75 | ~0.950 | ~21–22 |

| 2025 | 7.71 | 1.125 | ~21–25 |

Companies Owned by Williams Sonoma

Here is a list of the major companies, brands, acquisitions, subsidiaries, and entities owned and operated by Williams‑Sonoma, Inc. as of August 2025:

| Brand/Entity | Year Founded/Acquired | Type | Description |

|---|---|---|---|

| Williams Sonoma | Founded 1956 | Flagship Brand | Premium cookware, kitchen tools, gourmet foods, and exclusive chef collaborations. |

| Pottery Barn | Acquired 1986 | Home Furnishing Retailer | Classic furniture and home décor for the modern home. |

| Pottery Barn Kids | Launched early 2000s | Children’s Furniture | Safe, stylish furniture and décor for babies and kids. |

| Pottery Barn Teen | Launched early 2000s | Teen Lifestyle Brand | Trendy furniture and décor targeted toward teenagers. |

| West Elm | Launched 2002 | Modern Lifestyle Brand | Contemporary, sustainable furniture and home accessories. |

| Rejuvenation | Acquired 2011 | Lighting & Hardware | Vintage-style lighting, furniture, and architectural hardware. |

| Mark and Graham | Launched 2012 | Personalized Goods Brand | Custom monogrammed gifts, accessories, and décor. |

| Outward Inc. | Acquired 2017 | Tech Subsidiary | 3D imaging, augmented reality, and visualization tools for online shopping. |

| Home Delivery Group | Internal Development | Logistics & Fulfillment | Manages warehousing and last-mile delivery of furniture and large items. |

| West Elm Local | Concept launched ~2018 | Local Retail Initiative | Community-driven pop-ups showcasing regional artisans and products. |

| West Elm Work | Launched ~2019 | Commercial Interiors | Office and hospitality furniture solutions for professional clients. |

| Exclusive Partnerships | Ongoing | Licensing/Collaborations | Co-branded and seasonal collaborations with chefs, designers, and food brands. |

Pottery Barn

Pottery Barn is Williams‑Sonoma’s flagship furniture and home décor brand. Acquired in 1986, it specializes in classic, quality furnishings, textiles, and accessories. The brand operates strong physical store presence across the U.S. and Canada, and benefits from a robust online platform. Pottery Barn and its sub‑brands—Pottery Barn Kids and Pottery Barn Teen—have consistently contributed over one quarter of total company revenue.

Pottery Barn Kids & Pottery Barn Teen

These sister brands were developed to serve children’s and teen lifestyle needs. Pottery Barn Kids launched in the early 2000s and Pottery Barn Teen shortly after. They offer safe, durable, stylish furniture, bedding, and décor for younger age groups. The brands enjoy loyal repeat customer bases and benefit from cross‑brand promotions and curated birthday and school‑ready gift collections.

West Elm

West Elm, launched in 2002 and fully integrated under Williams‑Sonoma ownership, targets modern, urban consumers. The brand emphasizes sustainable materials, fair‑trade production, and stylish contemporary design. It maintains standalone stores in major metro areas, alongside a strong DTC (direct‑to‑consumer) online operation. West Elm has been a key growth driver in younger demographics, especially through furniture customization and local artisan collaborations.

Williams Sonoma (Flagship Brand)

The original Williams Sonoma brand remains the company’s identity for cookware, kitchen tools, specialty foods, and gourmet items. It operates retail stores and seasonal pop‑ups as well as a major e‑commerce channel. The brand is known for its cooking classes, exclusive celebrity chef products, and loyalty programs. Its premium positioning and heritage reputation continue to anchor the company’s retail strategy.

Rejuvenation

Acquired in 2011, Rejuvenation focuses on handcrafted lighting fixtures, door hardware, and aged brass design elements. It caters to customers interested in vintage aesthetics and historic home restorations. The brand operates both online and through physical showrooms, and it often collaborates on heritage design projects or historic preservation initiatives.

Mark and Graham

Launched in 2012, Mark and Graham is a personalized gifting and accessories brand. It offers monogrammed bags, stationery, leather goods, and home décor items. The brand is known for its customization interface and curated gift collections for weddings, corporate events, and holiday seasons, blending personalization with quality design.

West Elm Local

An offshoot of West Elm, this experimental concept focuses on hyper‑local, community‑based retail. West Elm Local showcases inventory by local artisans and rotating regional merchandise. It aims to strengthen ties with local design communities and offer customers curated, place‑based selections. The trial stores blend retail and event space for community engagement.

Outward (Technology and 3D Imaging Platform)

Purchased in 2017, Outward is a subsidiary specializing in three‑dimensional catalog design and augmented reality shopping experiences. It supports furniture visualization tools across the Williams‑Sonoma portfolio, especially for West Elm and Pottery Barn. The platform enables customers to preview products in their home environments via smartphone apps or online 3D views, improving conversion and reducing returns.

Home Delivery Group (Logistics and Supply Chain Unit)

This in‑house subsidiary handles fulfillment, warehousing, and last‑mile delivery for oversized items such as furniture and lighting. Established internally but operating as a branded entity, it manages logistics complexity across the U.S. network and supports same‑next‑day delivery in key urban markets. It collaborates with third‑party carriers while maintaining control over customer service standards.

West Elm Work (Commercial Interiors)

An extension of West Elm, this division serves commercial clients, including offices, coworking spaces, boutiques, and hospitality venues. West Elm Work offers trade programs, design services, and bulk commercial furniture solutions. It integrates resources from both the retail brand and internal design teams to serve professional interior projects.

Exclusive Licensing and Brand Partnerships

Williams‑Sonoma holds exclusive agreements and licensing deals with premium companies and celebrity chefs. These include branded cookware lines, seasonal food collaborations, and curated collections under the Williams Sonoma name. While not standalone companies, these partnerships extend brand reach and contribute to revenue through limited‑edition and high‑margin seasonal items.

Final Thoughts

Williams Sonoma is not owned by a single person or private group. It is a publicly traded company with a wide base of institutional and individual investors. With a diverse brand portfolio, a solid leadership team, and a strong financial base, the company continues to be a key player in the premium retail space. Whether it’s cookware, furniture, or modern home design, Williams Sonoma remains a top choice for quality-conscious consumers.

FAQs

Who is the owner of Williams-Sonoma?

Williams‑Sonoma, Inc. is a publicly traded company, meaning it is owned by its shareholders. There is no single private owner. The largest shareholder as of 2025 is The Vanguard Group, followed by BlackRock and State Street Corporation.

Is William Sonoma and Pottery Barn owned by the same people?

Yes, Pottery Barn is a brand owned by Williams‑Sonoma, Inc. They are part of the same corporate structure and operated under the same executive leadership and board of directors.

Is Williams Sonoma a publicly traded company?

Yes, Williams‑Sonoma, Inc. is a publicly traded company listed on the New York Stock Exchange (NYSE) under the ticker symbol WSM. It has been public since 1983.

What are the sister companies of Williams-Sonoma?

Sister companies and brands under the Williams‑Sonoma corporate umbrella include:

- Pottery Barn

- Pottery Barn Kids

- Pottery Barn Teen

- West Elm

- Rejuvenation

- Mark and Graham

- Outward Inc.

- West Elm Work

- West Elm Local.

Who is the largest shareholder of Williams Sonoma?

As of 2025, the largest shareholder is The Vanguard Group, which owns over 12% of the company through various funds. Vanguard has substantial voting power in shareholder decisions.

Who is West Elm owned by?

West Elm is owned by Williams‑Sonoma, Inc., which developed and launched the brand in 2002 to cater to a modern and urban demographic.

Does Williams Sonoma own Pottery Barn?

Yes, Pottery Barn is wholly owned by Williams‑Sonoma, Inc. It was acquired by the company in 1986 and has since expanded to include Pottery Barn Kids and Pottery Barn Teen.

What brands does Williams Sonoma own?

Williams‑Sonoma, Inc. owns the following brands:

- Williams Sonoma

- Pottery Barn

- Pottery Barn Kids

- Pottery Barn Teen

- West Elm

- Rejuvenation

- Mark and Graham

It also operates technology (Outward Inc.) and commercial furniture (West Elm Work) divisions.

Where is the headquarters of Williams Sonoma?

The headquarters of Williams‑Sonoma, Inc. is located in San Francisco, California, United States.

Who is the former CEO of Williams-Sonoma?

One of the most notable former CEOs is Laura J. Alber, who served as CEO from 2010 until early 2025. She played a pivotal role in growing the e-commerce segment and expanding the company’s sustainability efforts.

Who founded Williams-Sonoma?

Williams‑Sonoma was founded by Chuck Williams in 1956 in Sonoma, California. He started the business as a high-end cookware store inspired by European kitchenware he discovered during his travels in France.