Whole Foods Market has become a global symbol of organic and natural food retail. Known for its focus on healthy living and sustainability, it has grown from a single store in Austin, Texas, to a massive retail chain. But who owns Whole Foods today? The answer reveals how the organic food movement became part of one of the world’s biggest technology companies.

Key Takeaways

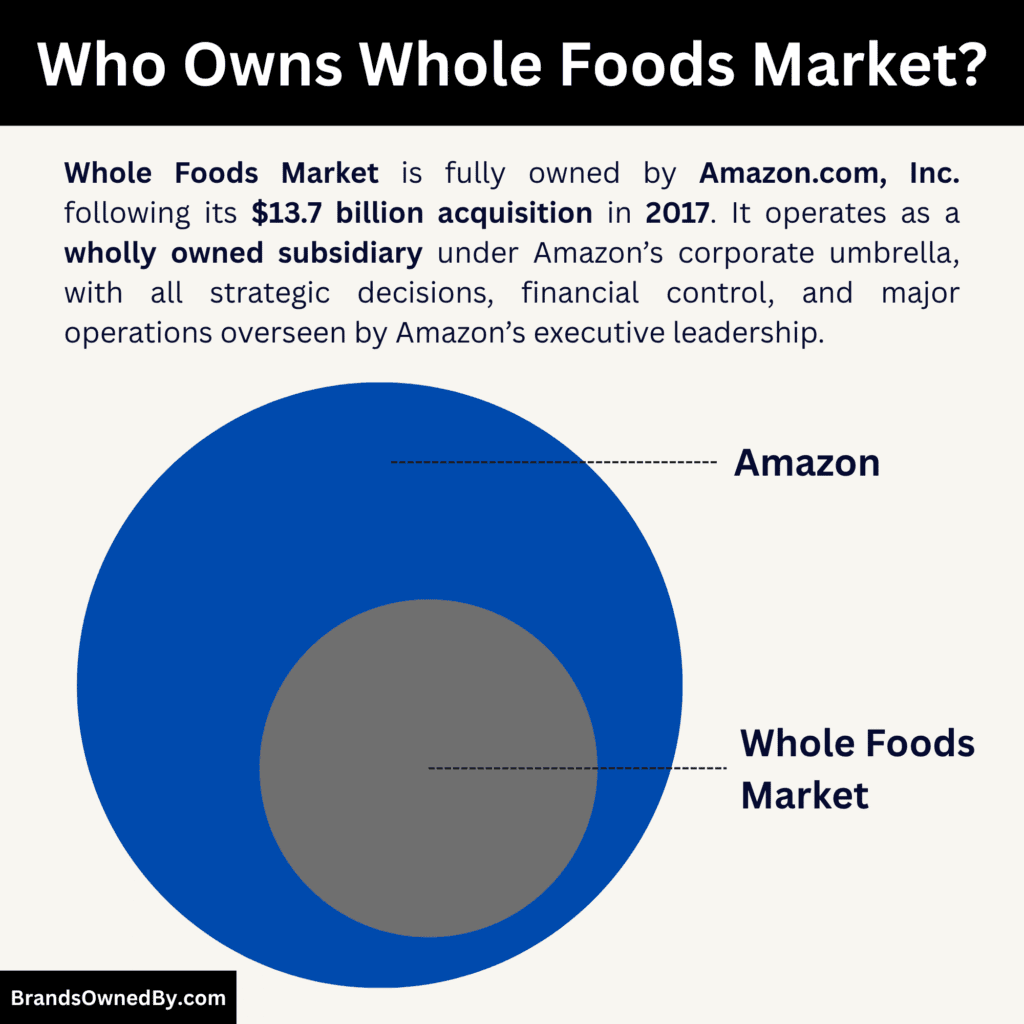

- Whole Foods Market is fully owned by Amazon.com, Inc., following its $13.7 billion acquisition in 2017, which made it a wholly owned subsidiary.

- Within Amazon, Whole Foods operates as part of the Worldwide Grocery Stores division, overseen by Jason Buechel, who reports to Amazon’s executive leadership.

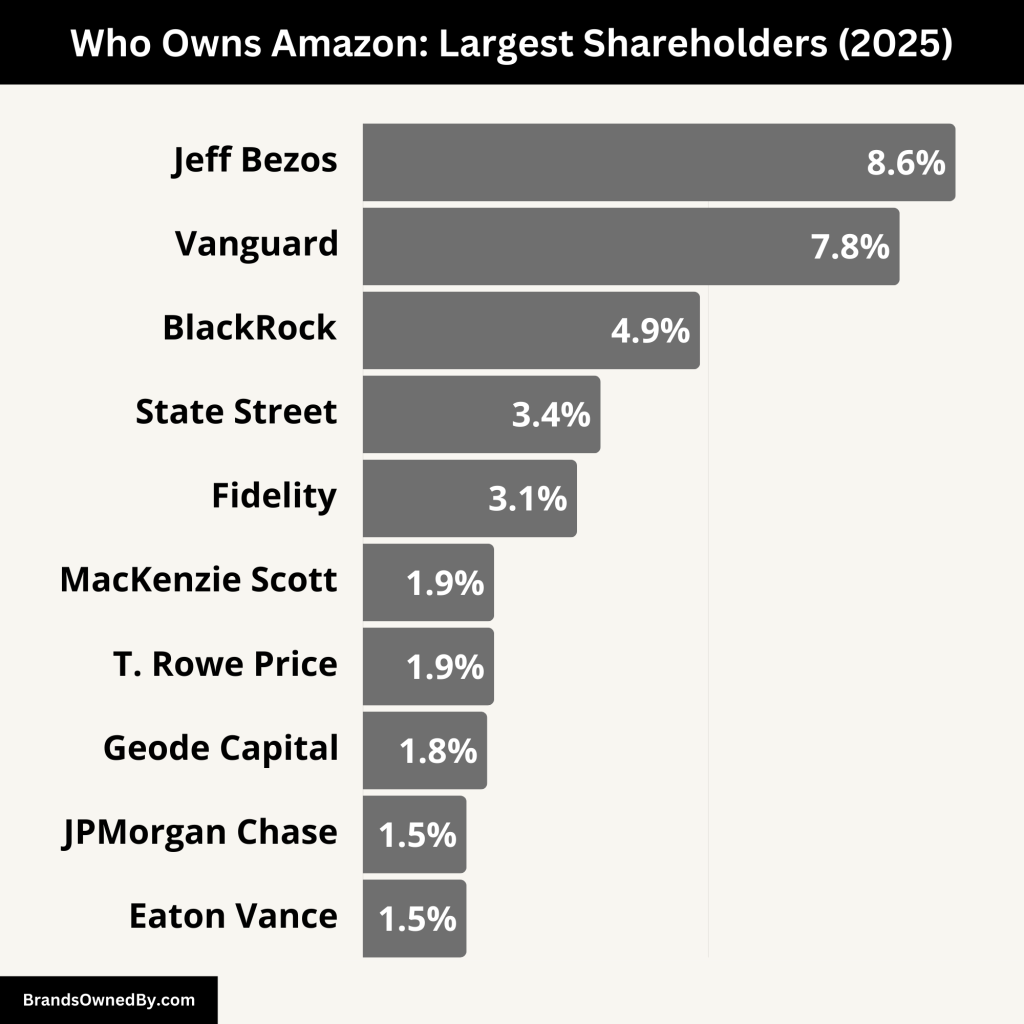

- While Whole Foods retains its brand identity and management independence, strategic decisions and financial control ultimately rest with Amazon and its shareholders, including major institutional investors such as Vanguard Group, BlackRock, and T. Rowe Price.

Whole Foods Market Profile

Whole Foods Market is a leading retailer specializing in natural and organic foods. It is headquartered in Austin, Texas. Over the years, it has grown beyond the U.S. to operate in Canada and the United Kingdom.

After its acquisition by Amazon in 2017, Whole Foods became a wholly owned subsidiary.

It focuses on high-quality, minimally processed foods free of artificial additives. The company emphasizes sustainability, local sourcing, and ethical standards in food production. Whole Foods also engages in community programs and environmental initiatives. Under Amazon, it integrates technology, delivery, and logistics more deeply into its operations.

Founders

Whole Foods was founded in 1980 by four entrepreneurs: John Mackey, Renee Lawson Hardy, Craig Weller, and Mark Skiles.

The origin story begins a little earlier — Mackey and Lawson Hardy had started a natural foods store called SaferWay. Meanwhile, Weller and Skiles ran Clarksville Natural Grocery.

The two businesses merged, and the first Whole Foods store opened on September 20, 1980.

John Mackey is perhaps the most recognized of the founders. He led the company from its inception and shaped its mission, culture, and growth trajectory. Renee Lawson Hardy contributed her early vision in the organic and health foods space. Weller and Skiles brought retail and operational experience from their existing grocery business.

The original store was relatively large for its time (over 10,000 square feet) and carried a broader range of products than many health food stores of that era. Within months, it became one of the highest–volume natural food stores in America.

Early on, a major test came in 1981 when a flood damaged the store heavily. It was rebuilt and reopened within 28 days, showing the resilience and support of the community.

Major Milestones

- 1980 – Founding and first store: Whole Foods Market was founded in Austin, Texas, by John Mackey, Renee Lawson Hardy, Craig Weller, and Mark Skiles. The first store, about 10,500 square feet, became one of the largest natural food supermarkets in the U.S. at the time.

- 1981 – Flood and recovery: A devastating flood destroyed the Austin store and most of its inventory. The founders and employees rebuilt it with the help of the community and reopened in less than a month, marking the beginning of Whole Foods’ strong local and customer-first culture.

- 1984 – Regional expansion begins: Whole Foods opened new stores in Houston and Dallas, starting its expansion across Texas.

- 1988 – First store outside Texas: The company opened its first store outside the state by acquiring Whole Food Company in New Orleans, Louisiana. This set the stage for national expansion.

- 1992 – Public listing: Whole Foods Market went public on January 23, 1992, with its stock listed on NASDAQ under the ticker symbol WFM. The IPO provided capital for further growth across the U.S.

- 1993–1996 – Aggressive expansion and acquisitions: During this period, Whole Foods acquired multiple regional chains, including Bread & Circus (New England), Mrs. Gooch’s (California), and Fresh Fields (Mid-Atlantic and Midwest). These moves solidified Whole Foods’ presence nationwide.

- 1998 – Launch of private-label products: Whole Foods introduced its own line of branded products, later known as the “365 Everyday Value” brand, which became one of the best-selling organic product lines in North America.

- 2002 – International expansion to Canada: Whole Foods opened its first Canadian store in Toronto, marking its first international move.

- 2004 – Expansion into the United Kingdom: The company entered the U.K. by acquiring the Fresh & Wild chain, opening the first London Whole Foods Market in Kensington.

- 2007 – Acquisition of Wild Oats Markets: Whole Foods acquired its competitor, Wild Oats Markets, for $565 million, adding dozens of stores. The deal was reviewed by the U.S. Federal Trade Commission but eventually approved.

- 2011 – Milestone of 300 stores: Whole Foods celebrated its 300th store opening, cementing its status as the largest natural foods retailer in the U.S.

- 2013 – Continued growth and global recognition: By this year, Whole Foods had more than 360 stores and had become one of Fortune magazine’s “100 Best Companies to Work For” for the 16th consecutive year.

- 2015 – Launch of 365 by Whole Foods Market: Whole Foods introduced its “365” store concept aimed at younger, value-conscious customers. The first store opened in Los Angeles in 2016.

- 2017 – Amazon acquisition: In a landmark deal, Amazon.com, Inc. acquired Whole Foods Market for $13.7 billion. This acquisition gave Amazon a major physical retail presence and integrated Whole Foods with Amazon Prime, offering discounts and delivery services.

- 2019 – Digital transformation: Whole Foods deepened its integration with Amazon’s technology. Prime members began receiving exclusive in-store deals, and Amazon Lockers were installed in many stores. The brand also expanded its online ordering and grocery delivery through Amazon Fresh.

- 2020 – COVID-19 pandemic adjustments: During the pandemic, Whole Foods rapidly expanded curbside pickup, contactless shopping, and online grocery delivery. It also implemented stricter sanitation and employee safety protocols across all stores.

- 2021 – Expansion of delivery network: Whole Foods became a key hub for Amazon Fresh operations. Several new fulfillment centers were opened to handle increased online demand.

- 2022 – Leadership transition: John Mackey stepped down after over 40 years as CEO. Jason Buechel, who had served as COO, took over, focusing on digital innovation and operational efficiency.

- 2023 – Technological integration: Whole Foods tested “Just Walk Out” cashierless technology in select stores, a system first used by Amazon Go. It also rolled out expanded private-label product lines and increased sustainability targets.

- 2024 – Store restructuring and global optimization: Whole Foods announced the closure of several underperforming stores in the U.K. and some in the U.S. to streamline operations. The company focused on remodeling core stores and enhancing the customer experience through AI-driven inventory management.

- 2025 – Labor movement and future plans: In 2025, a Whole Foods store in Philadelphia became the first in the chain to vote for union representation, signaling a shift in workforce dynamics. Whole Foods also announced plans to open new stores in suburban markets and smaller cities, aiming to reach 600 stores globally within the next few years.

Who Owns Whole Foods?

As of 2025, Whole Foods Market is owned entirely by Amazon.com, Inc., one of the world’s largest technology and e-commerce companies. The ownership marks a significant milestone in retail history, representing the merging of organic food retail and digital innovation. Whole Foods continues to operate as a wholly owned subsidiary under Amazon’s corporate structure but maintains its own brand identity, leadership, and culture.

The acquisition has allowed Whole Foods to leverage Amazon’s technological capabilities, logistics expertise, and vast customer network. It also positioned Amazon as a key player in the grocery industry—one that bridges both physical and digital retail channels.

Here’s a summary of its ownership:

- Parent Company: Amazon.com, Inc.

- Acquisition Year: 2017

- Purchase Value: $13.7 billion (all-cash deal)

- Ownership Type: Wholly owned subsidiary

- CEO: Jason Buechel (as of October 2025)

- Headquarters: Austin, Texas.

Parent Company: Amazon.com, Inc.

Amazon, founded by Jeff Bezos in 1994 and headquartered in Seattle, Washington, is best known for revolutionizing online retail. Over time, it expanded into cloud computing, artificial intelligence, streaming, and now physical grocery stores.

Whole Foods became Amazon’s largest physical retail operation after the acquisition, complementing its Amazon Fresh and Amazon Go store models.

Amazon manages Whole Foods as part of its “Physical Stores” segment, which also includes Amazon Fresh supermarkets and its other in-person retail operations. However, Whole Foods retains a degree of independence in branding, sourcing, and leadership decisions.

Acquisition Details

In June 2017, Amazon announced it would acquire Whole Foods Market for approximately $13.7 billion in an all-cash transaction, including the company’s debt. The deal officially closed in August 2017, marking one of Amazon’s largest acquisitions ever.

At the time of the acquisition, Whole Foods had more than 460 stores across the United States, Canada, and the United Kingdom. Amazon paid $42 per share—a 27% premium over Whole Foods’ stock price prior to the announcement. After the deal, Whole Foods was delisted from NASDAQ and became a private subsidiary under Amazon’s ownership.

The acquisition transformed both companies. For Whole Foods, it brought major technological and operational changes.

For Amazon, it offered a strategic foothold in the grocery and physical retail market. Key developments following the acquisition included:

- Integration with Amazon Prime: Whole Foods began offering exclusive discounts and delivery benefits to Amazon Prime members, encouraging customer loyalty and cross-platform engagement.

- Digital innovation: Whole Foods implemented advanced analytics, AI-based inventory systems, and digital shelf labels powered by Amazon technology.

- Delivery and pickup expansion: Through Amazon Fresh and Whole Foods Market online, the company expanded grocery delivery and pickup services to hundreds of cities.

- Pricing strategy: Amazon lowered prices on several staple products, addressing Whole Foods’ “Whole Paycheck” reputation while maintaining its commitment to quality and sourcing integrity.

- Operational efficiency: Amazon’s logistics expertise optimized Whole Foods’ supply chain and warehouse management, reducing costs and increasing speed.

Post-Acquisition Structure and Oversight

Whole Foods operates as a distinct entity under the Amazon corporate umbrella. The company’s CEO, Jason Buechel, leads its executive team and reports to Amazon’s retail division leadership. Strategic decisions—particularly those involving pricing, technology integration, and customer experience—are coordinated with Amazon’s top executives.

While Amazon provides capital and infrastructure support, Whole Foods maintains control over its store operations, supplier relationships, and brand standards. This dual approach allows it to retain the authentic “natural food” identity that made it famous while benefiting from Amazon’s global scale.

Strategic Importance to Amazon

Whole Foods plays a critical role in Amazon’s long-term retail and logistics strategy. It bridges the gap between online convenience and physical retail experience—an essential component of Amazon’s “omnichannel” model. Whole Foods stores are not only grocery destinations but also serve as local pickup points, delivery hubs, and brand touchpoints for Amazon’s broader ecosystem.

As of 2025, Amazon is expanding Whole Foods’ reach into suburban and smaller city markets, while experimenting with hybrid formats that blend Whole Foods and Amazon Fresh features. The synergy between the two brands continues to redefine how consumers buy groceries, blending technology, quality, and accessibility.

Who is the CEO of Whole Foods?

As of 2025, Jason Buechel is the Chief Executive Officer of Whole Foods Market. In January 2025, he also took on an expanded responsibility as Vice President of Amazon’s Worldwide Grocery Stores, overseeing Amazon’s grocery brands such as Whole Foods, Amazon Fresh, Amazon Go, and other related operations.

He now reports to Doug Herrington, CEO of Amazon’s Worldwide Stores division.

Even with the expanded role, Buechel retains direct oversight of Whole Foods’ strategy, operations, and culture.

Career Path and Internal Progression

Jason Buechel joined Whole Foods in 2013 as Global Vice President and Chief Information Officer (CIO). In that role, he led major digital transformation efforts, IT infrastructure, data systems, and innovation initiatives across the company.

Later, he served as Chief Operating Officer (COO) for the company. In that position, he oversaw store operations, supply chain, distribution, real estate, design, human resources, and related functions.

In September 2022, Buechel formally succeeded John Mackey (co-founder) as CEO of Whole Foods.

Leadership Style and Vision

Buechel is known for combining technology orientation with retail and grocery expertise. He emphasizes making natural and organic food more accessible and affordable.

Under his leadership, Whole Foods has pursued a vision titled “Growing with Purpose”, focusing on enhancing customer experience, investing in team members, improving performance, and expanding reach.

He often engages with team members, suppliers, and communities to shape strategy. In 2022, he conducted a “Whole Conversations Tour” to listen to stakeholder feedback before rolling out the vision.

Buechel also champions sustainability, supply-chain transparency, and innovation in store formats and logistics.

Challenges and Strategic Moves

Taking over from a long-time founder like John Mackey posed its own challenges. Buechel has been navigating the balance between preserving Whole Foods’ legacy and accelerating integration with Amazon’s technological and logistical backbone.

In 2025, Buechel’s expanded role signals Amazon’s intent to unify grocery operations more tightly. He now leads the reorganization of Amazon’s grocery business, aiming to reduce duplication between Whole Foods and Amazon Fresh/Go operations and streamline leadership across grocery brands.

An internal memo reveals that he is putting in place a new leadership team, combining talent from Whole Foods and Amazon. The goal is to simplify processes and integrate tools, technology, and strategy across the grocery ecosystem.

Educational Background and Personal Interests

Jason Buechel holds a bachelor’s degree from the University of Wisconsin–Milwaukee.

Outside work, he is an avid runner, hiker, and traveler. He values work-life balance and often speaks about the connection between food, community, and environment.

His upbringing has connections to food and agriculture; in a recent podcast, he mentioned that his grandparents were dairy farmers — a background that helps him relate to farming, sourcing, and food ethics.

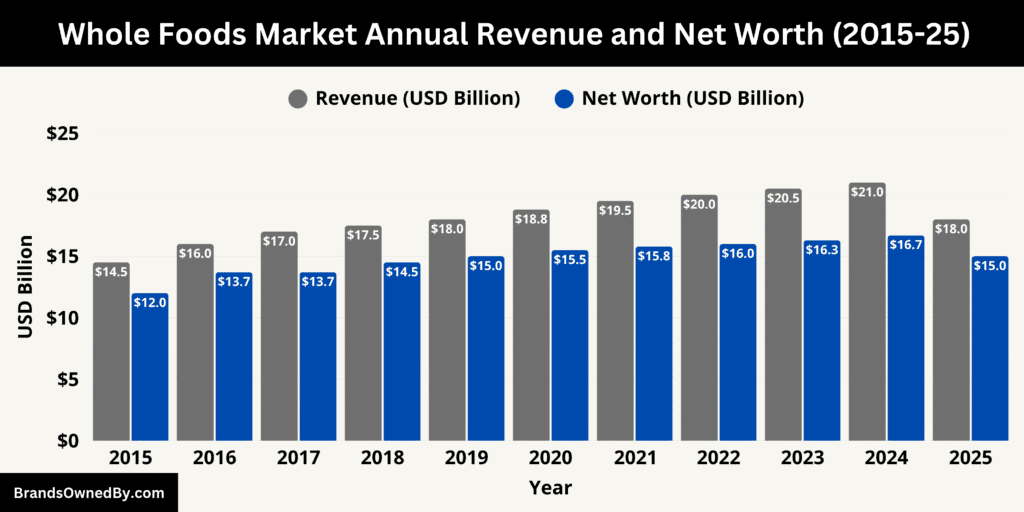

Whole Foods Market Annual Revenue and Net Worth

As of October 2025, Whole Foods continues to be a critical contributor to Amazon’s grocery business. Its estimated revenue is now between $17 billion and $18 billion annually. Its valuation or net worth as an operating asset within Amazon is estimated at $15 billion or higher, depending on internal allocations, brand strength, and synergy value.

Below is an overview of the historical revenue and net worth of Whole Foods Market:

| Year | Estimated Revenue (USD billions) | Estimated Net Worth / Valuation (USD billions) | Notes / Basis for Estimate |

|---|---|---|---|

| 2015 | ~ 14.5 | ~ 12.0 | Before Amazon acquisition, public company; valuation based on market multiples |

| 2016 | ~ 16.0 | 13.7 | Actual year just before acquisition; acquisition price $13.7 billion serves as valuation |

| 2017 | ~ 17.0* | 13.7 | Acquisition closed in 2017; revenue for full year partly consolidated by Amazon |

| 2018 | ~ 17.5 | ~ 14.5 | Analysts estimate modest growth; valuation adjusts upward due to synergy |

| 2019 | ~ 18.0 | ~ 15.0 | Continued organic growth under Amazon ownership |

| 2020 | ~ 18.8 | ~ 15.5 | Growth aided by pandemic and increased grocery demand |

| 2021 | ~ 19.5 | ~ 15.8 | Steady expansion, greater integration with Amazon logistics |

| 2022 | ~ 20.0 | ~ 16.0 | Leadership transition, further efficiency gains factored in |

| 2023 | ~ 20.5 | ~ 16.3 | Marginal growth, consolidation, pricing pressures |

| 2024 | ~ 21.0 | ~ 16.7 | Estimates before full public data; stronger margins and brand strength |

| 2025 | ~ 17.0 – 18.0 | ~ 15.0 | Current estimates in this year’s context |

Revenue Performance in 2025

Whole Foods’ revenue is not broken out separately in Amazon’s financial reports. Instead, it falls under Amazon’s “Physical Stores” segment, which aggregates sales from Whole Foods, Amazon Fresh, Amazon Go, and other brick-and-mortar retail operations. Still, analysts and industry observers estimate Whole Foods brings in roughly $17–18 billion annually as of 2025.

This growth has been fueled by several post-acquisition developments. Under its integration with Amazon, Whole Foods has enhanced its online presence, offering grocery delivery, pickup, and bundling deals for Prime members. It has also redesigned store layouts, expanded private label offerings (such as its 365 line), and leveraged Amazon’s supply chain to reduce costs. Moreover, Whole Foods has seen over 40 % cumulative sales growth since 2017.

In 2024, reports suggested that Whole Foods’ revenue had grown to about $22 billion (when considering U.S. operations alone) before moderating somewhat in projection estimates. Its margins are tighter than typical technology businesses, but the emphasis has been on volume, operational efficiency, and integration synergies more than on high profit margins.

Valuation and Net Worth as an Asset

Industry valuation models place the standalone worth of Whole Foods at $15 billion or more as of October 2025, taking into account brand equity, real estate holdings, growth potential, and its role within Amazon’s logistics network.

When Amazon acquired Whole Foods in 2017, the purchase price was $13.7 billion in cash. Over time, the value has been driven upward by revenue growth, integration benefits, and cross-channel capabilities. Some models suggest that the multiple grocery and natural food brands today would place Whole Foods’ value even higher if it were a standalone public entity.

Because Whole Foods’ infrastructure, store footprint, and urban locations double as micro-fulfillment and last-mile delivery hubs for Amazon, part of its “value” is intrinsic to Amazon’s broader retail and logistics strategy. Thus, its contribution to Amazon’s total enterprise value is greater than just its direct revenue or brand valuation.

Margins, Costs, and Profitability

While Whole Foods generates strong top-line numbers, profit margins in grocery are thin. Cost pressures—such as labor, food spoilage, supply chain inflation, and competition—constrain operating margins. Under Amazon’s ownership, many cost components have been optimized. Shared warehousing, integrated logistics, and data-driven inventory forecasting have trimmed wastage and improved store-level profitability.

Amazon does not publicly disclose Whole Foods’ net income margin, but analysts estimate it operates at single-digit percent margins (after attributing shared expenses). Over time, the goal has been to increase operating leverage: driving growth in sales volume and reducing fixed cost ratios through better integration.

Strategic Value Beyond Revenue

Whole Foods’ worth to Amazon is not only in its revenue and net profit. Its real strategic value lies in its urban store locations, brand reputation, and role as a link between digital and physical retail. Its stores serve as pickup and delivery hubs, enabling seamless grocery delivery in increasingly dense markets. The brand also provides a trust anchor for customers seeking quality and premium organic offerings, which can crossover to Amazon’s broader ecosystem.

Moreover, Whole Foods supports Amazon’s push to expand grocery services in smaller markets and suburban areas by serving as a model for store operation, supplier relationships, and customer loyalty. Its consistency in quality and reputation helps maintain Amazon’s brand image in the food space.

Brands Owned by Whole Foods Market

As of 2025, Whole Foods Market owns and operates several in-house brands, subsidiaries, and exclusive product lines that strengthen its position in the premium grocery and organic food industry. Below is a list of the major brands owned by Whole Foods Market as of October 2025:

| Brand / Entity | Year Founded / Acquired | Category / Type | Description & Focus | Current Status (as of 2025) |

|---|---|---|---|---|

| 365 by Whole Foods Market | 2015 (launched) | Private-label grocery brand | Affordable everyday essentials line offering food, pantry, and household products under Whole Foods’ quality standards. | Core private label; expanded online and in-store. |

| Whole Foods Market Exclusive Brand | 2018 (established) | Premium private-label brand | Premium, chef-inspired grocery and specialty food range emphasizing artisanal ingredients and sustainability. | Flagship in-store premium label; expanding into new categories. |

| Whole Paws | 2013 (introduced) | Pet food & care brand | Natural and premium pet food line offering dry and wet foods, treats, and pet accessories. | Active and growing; distributed in stores and on Amazon. |

| Whole Catch | 2010s (introduced) | Seafood brand | Whole Foods’ responsible seafood brand offering sustainably sourced fresh and frozen fish. | Core seafood private label; updated with traceable sourcing policies. |

| Whole Foods Market Bakery & Prepared Foods | Ongoing (in-house division) | In-store operations | In-store bakery and chef-prepared foods division producing fresh meals, bread, and baked goods. | Fully operational in all stores; key traffic driver. |

| Whole Foods Coffee (formerly Allegro Coffee) | Acquired 1997 (as Allegro) | Coffee & beverage brand | Specialty coffee line rebranded from Allegro Coffee to unify under Whole Foods’ identity. | Operating under new Whole Foods Coffee name; Allegro legacy retained internally. |

| Whole Body | 2000s (introduced) | Health & wellness brand | Whole Foods’ supplement, vitamin, and personal care line emphasizing clean ingredients. | Available in stores and online; part of private label portfolio. |

| Whole Foods Market UK (Fresh & Wild Ltd.) | Acquired 2004 | International retail subsidiary | Operates Whole Foods stores in the UK under the Fresh & Wild legal entity. | Active; localized assortment and private labels. |

| Whole Trade Guarantee Program | 2007 (launched) | Ethical sourcing initiative | Whole Foods’ fair trade and supplier development program ensuring social and environmental standards. | Continues as a brand and certification program across categories. |

| Local Producer and Supplier Accelerator Programs | 2016 (launched) | Partnership & incubation programs | Initiatives that help small producers launch exclusive products and scale through Whole Foods stores. | Expanding; key driver of new brand introductions. |

365 by Whole Foods Market

365 by Whole Foods Market is Whole Foods’ largest and most visible private-label umbrella. Launched in the mid-2010s as a lower-cost, design-forward brand and store format, 365 evolved into a broad portfolio of everyday grocery items, pantry staples, frozen foods, snacks, beverages, and household essentials sold in Whole Foods stores and through Amazon channels.

In 2025, the 365 name remains central to Whole Foods’ value strategy: it is positioned to offer quality standards consistent with Whole Foods’ sourcing rules while delivering lower price points that appeal to cost-conscious shoppers and Prime members.

The line is managed centrally by Whole Foods’ Exclusive Brands team, but many SKUs are produced by co-packers and third-party manufacturers under contract, allowing rapid product innovation and scale without Whole Foods owning manufacturing facilities.

Whole Foods Market Exclusive Brand

The Whole Foods Market Exclusive Brand is the company’s premium private-label family that sits alongside 365. Where 365 focuses on value, the Exclusive Brand emphasizes culinary-driven flavor profiles, artisanal ingredients, and more specialty categories such as prepared sauces, chef-led meal components, and chef partnerships.

In 2025, Whole Foods expanded this portfolio into more categories—plant-based alternatives, specialty dairy, and impulse-purchase items—and began rolling select Exclusive Brand SKUs into Amazon Fresh and international partner channels. The Exclusive Brand operates as a merchandising and product development arm within Whole Foods and is central to the retailer’s efforts to differentiate itself from other grocers on quality and unique products.

Whole Paws

Whole Paws is Whole Foods’ in-house pet food and pet care line. Introduced to capture the fast-growing premium pet segment, Whole Paws includes dry and wet foods for dogs and cats, treats, and select pet care accessories.

In 2025, Whole Paws is sold across the Whole Foods store network and through Amazon’s grocery channels, and it is positioned as a natural, ingredient-forward option with limited-ingredient recipes and clear sourcing claims. Product development is handled by Whole Foods’ private-label team with formulations manufactured by contract partners; packaging and marketing emphasize trusted ingredients and third-party quality assurances where applicable.

Whole Catch

Whole Catch is the seafood label used by Whole Foods to brand responsibly sourced fish and seafood products. The line reflects Whole Foods’ longstanding animal-welfare and sustainable-sourcing standards for seafood.

In 2025, Whole Catch encompasses fresh fillets, frozen seafood, and value-added items like pre-seasoned fish and ready-to-cook trays. Whole Foods continues to update Whole Catch sourcing policies to align with evolving sustainability frameworks and to meet customer expectations for traceability and ethical fisheries practices.

Whole Foods Market Bakery & Prepared Foods

Not a separate legal company, the Bakery and Prepared Foods departments operate as branded in-store entities across the chain. These departments produce bread, pastries, meals, salads, hot bars, and in-store chef-prepared items under the Whole Foods name and localized store banners.

In 2025, the company continues to invest in these operations as a point of differentiation: fresh, made-in-store offerings drive foot traffic and higher basket sizes. Whole Foods’ prepared foods teams work with category leads to standardize core recipes while allowing local stores to highlight regional suppliers and chef partnerships.

Whole Foods Coffee (formerly Allegro Coffee)

Allegro Coffee was acquired by Whole Foods in 1997 and served for years as the chain’s house coffee brand. Beginning in 2023, Whole Foods undertook a rebranding of its in-house coffee offerings, retiring the Allegro label in many retail applications and folding the product into a unified Whole Foods Coffee (or Whole Foods Market Coffee) identity.

As of 2025, coffee blends and single-origin offerings that trace back to the Allegro acquisition are sold under Whole Foods’ in-house coffee branding. Supply relationships and specialty sourcing remain, but packaging and merchandising emphasize the Whole Foods private-label strategy.

Whole Body

Whole Body is the private-label line that covers vitamins, supplements, and some personal care/beauty items sold by Whole Foods. Positioned to meet the chain’s ingredient and ethical sourcing standards, Whole Body SKUs offer customers an alternative to national supplement brands with clear labeling and Whole Foods’ quality criteria.

As of 2025, Whole Body products appear in stores and on Amazon, and they are often developed with third-party manufacturers who meet Whole Foods’ quality audits and ingredient standards.

Fresh & Wild Limited

While not a separate consumer brand in the U.S., Whole Foods’ U.K. business operates under the legal trading name that traces back to the Fresh & Wild acquisition and local corporate structure. In practice, the stores in the U.K. trade as Whole Foods Market and carry the chain’s private labels (365, Exclusive Brand, Whole Paws, etc.).

As of 2025, the U.K. entity continues to run a smaller, tailored store footprint, adapting assortments and private-label mixes to local tastes while remaining part of Whole Foods’ international operations.

Whole Trade and Local Producer Programs

Whole Foods operates a set of proprietary sourcing and supplier partnership programs that function as branded initiatives rather than standalone companies. Examples include the Whole Trade Guarantee and local supplier accelerators. These programs are owned and run by Whole Foods to ensure supplier standards, fair trade practices, and to incubate small producers into national distribution.

In 2025, these programs are a core part of Whole Foods’ merchandising strategy, providing exclusive items and helping scale emerging brands onto Whole Foods shelves and into its private-label portfolios.

Whole Foods Market Exclusive Brands Accelerator and Supplier Programs

Whole Foods runs accelerator programs and supplier partnerships that, while not separate brands, create exclusive product lines and temporary sub-brands carried only in Whole Foods stores. These curated collections—often launched through seasonal programs or local vendor initiatives—allow Whole Foods to maintain a pipeline of unique products.

In 2025, the accelerator programs have grown, and Whole Foods increasingly sources products from small-batch producers under short-term exclusive agreements to refresh shelf assortments and support local economies.

Final Words

Whole Foods Market, once a pioneering independent organic grocer, is now a vital part of Amazon’s retail empire. While the company has evolved with technology and scale, it still stands by its core mission: selling quality, natural, and organic food responsibly. Under Amazon, Whole Foods has grown more efficient, tech-savvy, and accessible to millions of new customers worldwide.

FAQs

Who owns Whole Foods stores?

All Whole Foods stores are owned by Amazon.com, Inc., which purchased the grocery chain in 2017 for $13.7 billion. Since the acquisition, Whole Foods has operated as a wholly owned subsidiary of Amazon, with all its stores, assets, and brand operations under Amazon’s ownership.

What happened to Whole Foods?

Whole Foods was acquired by Amazon in 2017 and became part of the company’s retail ecosystem. After the acquisition, Whole Foods’ stock was delisted from NASDAQ, and the company transitioned from a publicly traded entity to a private subsidiary. The acquisition led to lower prices on select items, the introduction of Prime member discounts, and deeper integration with Amazon’s online grocery, logistics, and delivery network.

Does Jeff Bezos own Whole Foods?

Jeff Bezos does not personally own Whole Foods. The company is owned by Amazon.com, Inc., the corporation that Bezos founded in 1994. Bezos was Amazon’s CEO at the time of the Whole Foods acquisition in 2017, but he stepped down as CEO in 2021 to become Executive Chairman. Ownership of Whole Foods, therefore, lies with Amazon and its shareholders, not directly with Bezos.

Who is the founder of Whole Foods Market?

Whole Foods Market was founded in 1980 in Austin, Texas, by John Mackey, Renee Lawson Hardy, Craig Weller, and Mark Skiles. The company started as a single natural foods store called SaferWay, which merged with Clarksville Natural Grocery to form the first Whole Foods Market. John Mackey went on to serve as CEO for over 40 years before retiring in 2022.

Who owned Whole Foods before Amazon?

Before Amazon acquired it in 2017, Whole Foods was a publicly traded company listed on the NASDAQ under the ticker symbol WFM. Its shareholders included institutional investors such as Vanguard Group, BlackRock, Fidelity Investments, and T. Rowe Price, along with thousands of individual investors.

Why did Amazon buy Whole Foods?

Amazon bought Whole Foods to expand into physical grocery retail and strengthen its grocery delivery and distribution network. The acquisition gave Amazon an established nationwide network of high-end stores, real estate assets, and supplier relationships. It also helped the company compete with major grocery chains like Walmart and Kroger while supporting the growth of Amazon Fresh, Prime Now, and Amazon Go services.

Who manufactures Whole Foods 365 brand?

Whole Foods’ 365 by Whole Foods Market brand is managed and owned by Whole Foods itself, but the products are manufactured by third-party suppliers and co-packers. These manufacturers are carefully selected to meet Whole Foods’ quality standards, ingredient sourcing policies, and ethical requirements. The 365 line spans hundreds of categories—from pantry staples to personal care items—and remains one of the largest private-label brands in the natural foods market.