If you’ve ever wondered who owns Wendy’s, you’re not alone. The famous fast-food chain, known for its square burgers and Frosty desserts, is more than just a restaurant brand. Behind the scenes, it is part of a large public company with influential investors shaping its future. Understanding who controls Wendy’s reveals not just its ownership structure, but also the strategies that drive its global growth.

Wendy’s Company Profile

The Wendy’s Company is a publicly traded fast-food corporation headquartered in Dublin, Ohio. It specializes in developing, operating, and franchising quick-service restaurants that serve hamburgers, chicken sandwiches, salads, French fries, and its signature Frosty desserts. The business also owns real estate for its locations and operates under the legacy brand Wendy’s International LLC.

As of early 2025, the company continues to grow steadily. In the first quarter, global systemwide sales reached $3.4 billion, with 68 net new restaurants added, and a record digital sales mix of 20.3 %.

Alongside this expansion, Wendy’s maintains a long-term growth strategy introduced at its 2025 Investor Day. The plan includes adding 1,000 net new restaurants globally by 2028 and reaching annual targets of 3 – 4 % net unit growth, 5 – 6 % systemwide sales growth, and 7 – 8 % adjusted EBITDA growth.

Founders and Early History

Wendy’s traces back to its founding on November 15, 1969, when Dave Thomas opened the first Wendy’s Old-Fashioned Hamburgers restaurant in Columbus, Ohio. He named the brand after his daughter, Melinda Lou, known as “Wendy.” The logo’s pigtails and cheerful design embodied his wish to offer fresh, made-to-order food and friendly service.

Just a year later, in 1970, Dave Thomas introduced the “Pick-Up Window” drive-through in the chain’s first freestanding store—an innovation that fueled Wendy’s rapid expansion. By 1973, he began franchising entire regions, and within 100 months, the chain had over 1,000 locations.

Thomas elevated the brand further through memorable television commercials starting in the late 1980s. His approachable, honest manner made him a national figure and gave Wendy’s a distinct identity.

Major Milestones

1969 – Founding

Dave Thomas opens the first Wendy’s Old-Fashioned Hamburgers restaurant in Columbus, Ohio, on November 15. The brand is named after his daughter Melinda Lou “Wendy” Thomas, and the logo features her image with red pigtails. The concept focuses on fresh, never-frozen beef and made-to-order meals.

1970 – First Drive-Through Window

Wendy’s introduces the “Pick-Up Window” at its first freestanding location. This innovation becomes a defining feature of the brand and revolutionizes the way customers interact with quick-service restaurants.

1973 – Franchising Expansion

Wendy’s begins franchising its restaurants across the United States. The move allows for rapid growth, reaching over 1,000 locations in just over eight years after its founding.

1979 – Salad Bar Launch

Wendy’s becomes the first major fast-food chain to introduce a salad bar nationwide, adding a fresh and healthier option for customers.

1984 – ‘Where’s the Beef?’ Campaign

Wendy’s launches its most iconic advertising campaign, featuring Clara Peller. The phrase “Where’s the Beef?” becomes a cultural catchphrase and boosts sales dramatically.

Late 1980s – Dave Thomas as Spokesperson

Dave Thomas began appearing in television commercials, giving the brand a trustworthy, down-to-earth image. His appearances continued for over 800 commercials until his death in 2002.

2006 – Merger with Arby’s Parent Company

Wendy’s merges with Triarc Companies Inc., the parent company of Arby’s. This creates the Wendy’s/Arby’s Group.

2011 – Return to Wendy’s Focus

The company sells Arby’s to focus solely on the Wendy’s brand. Around this time, Wendy’s surpasses Burger King to become the second-largest hamburger chain in the U.S. by sales.

2016 – Digital and Menu Expansion

Wendy’s begins rolling out self-order kiosks, expanding mobile ordering, and enhancing its breakfast menu to meet changing customer habits.

2020 – U.S. Breakfast Launch

Wendy’s launches breakfast nationwide, becoming a key revenue driver. The menu includes signature items like the Breakfast Baconator and Frosty-ccino.

2022 – International Growth

The company continues global expansion, with more than 7,000 restaurants worldwide, including strong growth in Asia and Latin America.

2024 – Leadership Change

Kirk Tanner, a former PepsiCo executive, becomes CEO in February, replacing Todd Penegor.

2025 – Interim Leadership & Investor Day Goals

Ken Cook is appointed interim CEO in mid-2025 after Tanner’s departure. At its 2025 Investor Day, Wendy’s announces plans to add 1,000 net new restaurants globally by 2028, achieve 3–4% annual net unit growth, and grow digital sales, which already account for 20.3% of systemwide sales in Q1 2025.

Q1 2025 Performance

Wendy’s posts $3.4 billion in global systemwide sales and adds 68 net new restaurants. It reports record digital performance and continues expanding delivery and loyalty programs.

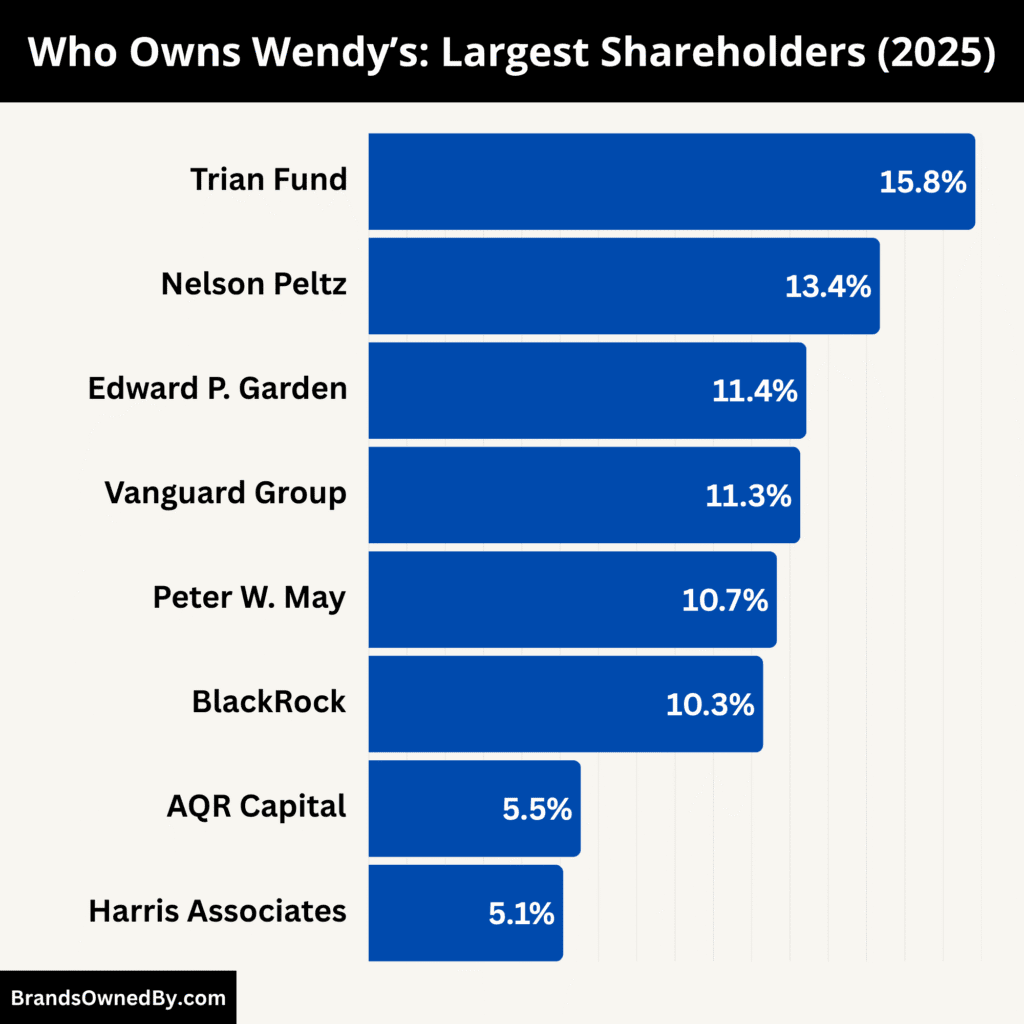

Who Owns Wendy’s: Top Shareholders

Wendy’s ownership is a mix of institutional investors, individual stakeholders, and public shareholders. The company trades on the NASDAQ under the ticker symbol WEN.

While no single entity owns a controlling majority, the largest stakes are held by investment firms that influence corporate strategy and decisions. Ownership is widely dispersed, but a few major investors consistently shape Wendy’s direction through their voting power and long-term investments.

Here’s a list of the largest shareholders of Wendy’s as of 2025:

Trian Fund Management LP – 15.84%

Trian Fund Management LP is an activist hedge fund founded in 2005 by Nelson Peltz, Peter May, and Edward Garden. The fund specializes in strategic investments in underperforming companies, often pushing for operational improvements, cost restructuring, and leadership changes to boost shareholder value.

Trian became a major force in Wendy’s ownership after acquiring a significant stake in the early 2000s, helping orchestrate Wendy’s merger with Triarc Companies, which owned Arby’s at the time. With 15.84% ownership in 2025, Trian is Wendy’s largest institutional shareholder, giving it substantial influence over board appointments, long-term strategy, and expansion plans.

The fund’s activist approach has helped shape Wendy’s transformation into a more premium fast-food brand with improved global reach.

Nelson Peltz – 13.35%

Nelson Peltz is an American billionaire investor, co-founder of Trian Fund Management, and one of the most influential activist shareholders in the U.S. His personal 13.35% stake in Wendy’s makes him one of the single largest individual owners of any major fast-food chain.

Peltz has been involved with Wendy’s since 2008, when his investment group merged with the company. As a board member and former non-executive chairman, Peltz has been instrumental in shaping Wendy’s menu innovations, digital ordering expansion, and franchise-focused growth strategy.

Beyond Wendy’s, Peltz has served on the boards of major companies such as Procter & Gamble, Mondelez International, and The Madison Square Garden Company.

Edward P. Garden – 11.43%

Edward P. Garden, also known as Ed Garden, is another co-founder of Trian Fund Management and a long-time Wendy’s board member. His 11.43% ownership reflects both his personal investment and deep involvement in the company’s governance.

Garden is known for his expertise in financial restructuring, operational efficiency, and capital allocation strategies. He played a key role in Wendy’s refranchising initiatives, which shifted a majority of its restaurants to franchise ownership, improving margins and reducing corporate overhead. Garden has also been a vocal advocate for digital innovation and international market expansion, helping Wendy’s adapt to changing consumer preferences.

Vanguard Group – 11.27%

The Vanguard Group is one of the world’s largest asset management firms, with over $8 trillion in global assets under management. Known for its index funds and passive investment strategies, Vanguard’s 11.27% stake in Wendy’s represents its clients’ investments through mutual funds and ETFs.

While Vanguard is not an activist investor like Trian, its large holdings mean it has significant voting power in shareholder decisions. Vanguard typically supports corporate governance best practices, sustainability initiatives, and long-term growth strategies.

Its presence as a top institutional owner gives Wendy’s stability in its shareholder base and aligns with the company’s focus on consistent returns for investors.

Peter W. May – 10.66%

Peter W. May is vice chairman and a founding partner of Trian Fund Management, as well as a long-time ally of Nelson Peltz. His 10.66% stake in Wendy’s demonstrates his direct financial commitment to the company’s success.

May has been deeply involved in strategic planning, brand repositioning, and cost optimization initiatives. He has decades of experience leading consumer-focused businesses, having previously served as president and COO of Triarc Companies before the Wendy’s merger.

His role at Wendy’s has centered on ensuring operational discipline while supporting menu innovation and marketing campaigns that differentiate the brand in a crowded fast-food market.

BlackRock – 10.30%

BlackRock is the world’s largest asset management company, overseeing more than $10 trillion in assets. Its 10.30% ownership in Wendy’s reflects investments through index funds, pension funds, and institutional portfolios. While BlackRock is typically a passive investor, it has become more active in recent years on issues like climate disclosure, diversity, and corporate governance.

For Wendy’s, BlackRock’s stake ensures a large, stable institutional investor is aligned with long-term value creation. BlackRock’s voting influence means it can help shape executive pay policies, shareholder rights proposals, and sustainability reporting initiatives, all of which affect the company’s public image and investor relations.

AQR Capital Management – 5.54%

AQR Capital Management is a global investment firm known for its quantitative and systematic investment strategies. Founded in 1998, AQR uses data-driven models to identify investment opportunities across asset classes.

Its 5.54% stake in Wendy’s represents a significant institutional interest and signals confidence in the company’s financial health and growth trajectory. While AQR is not an activist investor, its decisions are based on rigorous financial modeling, meaning Wendy’s performance metrics, profitability trends, and market positioning likely influenced AQR’s sustained holding. The firm’s involvement adds diversity to Wendy’s institutional investor base.

Harris Associates – 5.08%

Harris Associates is an investment management firm best known for its Oakmark Funds, which focus on value investing. With 5.08% ownership in Wendy’s, Harris Associates seeks long-term capital appreciation through investing in undervalued companies with strong growth potential.

The firm typically takes a patient approach, holding shares for years while working with company management to unlock value. Harris’s investment suggests it views Wendy’s as a brand with durable competitive advantages, strong cash flow potential, and room for further international expansion. Its philosophy aligns with Wendy’s emphasis on quality, branding, and shareholder returns.

Who is the CEO of Wendy’s?

Ken Cook took over as Interim Chief Executive Officer on July 18, 2025, while retaining his role as Chief Financial Officer. The Wendy’s Board entrusted him with this dual leadership position during an important transition phase.

Before joining Wendy’s, Cook spent 20 years at UPS, rising through senior financial and strategic roles. His responsibilities included leading Financial Planning and Analysis and serving as CFO for UPS’s U.S. Domestic segment, providing him with deep expertise in operational efficiency, financial discipline, and global logistics.

As CFO since December 2024, Cook co-developed Wendy’s long-term growth strategy. His familiarity with the company’s expansion plans, digital initiatives, and operational goals made him a natural choice for Interim CEO. His leadership ensures momentum continues as the company searches for a permanent CEO.

Under Cook’s interim leadership, Wendy’s is simplifying promotional strategies to reduce customer confusion and drive effectiveness amid softening U.S. sales. He’s shifting focus toward core strengths such as new chicken offerings, beverage innovation, and franchisee collaboration to stabilize performance and restore confidence.

Kirk Tanner – Former CEO (February 2024 – July 18, 2025)

Kirk Tanner had led Wendy’s as CEO since February 2024. A veteran of PepsiCo with strong experience in brand-building, he oversaw several strategic innovations.

Key Initiatives Under Tanner

- Introduced AI-enabled drive-thru ordering technology across hundreds of locations.

- Launched ambitious global growth targets, aiming for 1,000 new restaurants by 2028 and a menu refresh with fresh ingredient emphasis.

However, his tenure faced some headwinds as U.S. same-store sales declined, prompting calls for stronger store remodels and sharper promotional focus.

Tanner departed on July 18, 2025, to become CEO of The Hershey Company, prompting the appointment of Ken Cook as interim leader.

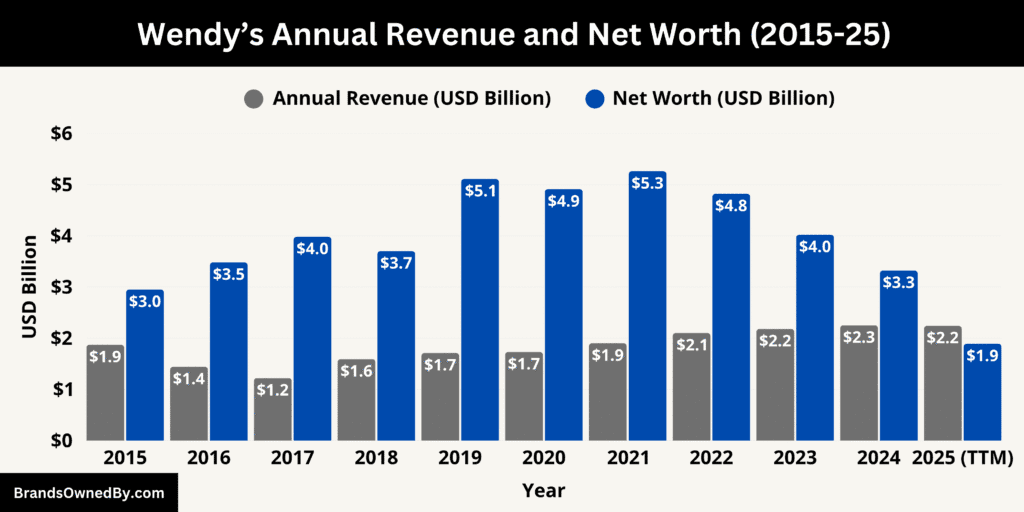

Wendy’s Annual Revenue and Net Worth

In fiscal year 2024, Wendy’s posted annual revenue of approximately $2.25 billion, marking steady growth from the previous year and continuing a multi-year upward trend. Net income for the full year was around $194.4 million, supported by improved margins and international expansion. The company implemented a new capital allocation policy, committing to return a significant portion of earnings—50% to 60% of adjusted net income—as dividends and share repurchases.

With this framework in place, Wendy’s announced plans for up to $200 million in share buybacks during 2025, signaling confidence in its long-term financial position. This strong fiscal performance laid the groundwork for growth, though the outlook for 2025 was tempered by a cautious consumer environment.

Q1 2025 Financial Performance

Wendy’s started 2025 with a mixed performance in the first quarter. Revenue fell slightly to $523.5 million, down approximately 2.1% from Q1 2024, while net income dropped more sharply to $39.2 million, a 6.7% decline. Margins faced pressure from weak U.S. same-store traffic, rising input costs, and inflation.

However, Wendy’s added 68 net new restaurants globally and continued to expand its digital footprint, with digital sales reaching a record 20.3% of total systemwide sales. In response to softer trends, Wendy’s revised its full-year revenue growth projection from a prior forecast of 2–3% to a more conservative outlook of flat to potentially a 2% decline, reflecting near-term consumer softness.

Trailing 12-Month Perspective

Looking at a trailing twelve-month horizon through Q1 2025, Wendy’s achieved total revenue of about $2.24 billion. Though this represents modest year-over-year growth of around 2%, it illustrates resilience amid challenging market conditions.

This sum includes global same-store and new unit contributions, but also reflects the increasing weight of digital and franchise revenue streams. While not traditionally measured by “net worth” in the corporate sense, Wendy’s equity and retained earnings remain buoyed by consistent operating cash flow and disciplined capital returns.

Wendy’s Net Worth

As of early August 2025, Wendy’s market capitalization stands at approximately $1.89 billion, based on a share price near $9.82–$10.09 and about 192 million shares outstanding. This reflects how investors collectively value the entire company at that point in time, speaking to both market sentiment and company performance.

This figure represents a substantial decline—around 40% year-over-year—from a market capitalization of roughly $3.13 billion at the end of 2024. That drop highlights investor caution amid softening same-store sales, promotional fatigue, and economic headwinds affecting the quick-service restaurant sector.

Beyond market cap, Wendy’s enterprise value offers broader insight into its overall worth, including debt and cash considerations.

As of August 2025, its enterprise value is estimated at around $5.6 billion. This underscores the company’s total valuation when factoring in financial obligations and cash reserves—a fuller measure than market cap alone.

Companies Owned by Wendy’s

Here’s a list of the major brands and companies owned by Wendy’s in 2025:

Wendy’s

Wendy’s is the company’s core and flagship brand. This is the name customers know — the red-headed girl logo, the square burger patty, and the Frosty dessert. The Wendy’s brand covers company-owned restaurants, franchised locations, brand standards, and the customer-facing product and marketing strategy worldwide.

Operational responsibility revolves around menu development, brand identity, marketing campaigns, supply-chain standards and the global design template known as the “Global Next Gen” restaurant format. Wendy’s central organization sets quality and operational standards that franchisees must meet; it also runs company stores that serve as test kitchens for menu innovations and remodel prototypes.

The brand is the seat of Wendy’s intellectual property — trademarks, recipes, the “Quality Is Our Recipe” ethos — and is the primary revenue generator through royalties, franchise fees, and direct store sales.

Wendy’s First Kitchen

In markets such as Japan, Wendy’s ownership footprint includes a distinct entity that operates a joint concept under the First Kitchen name (often marketed as Wendy’s First Kitchen).

This unit emerged through acquisitions and local rebranding in Japan and represents a hybrid approach: it blends Wendy’s global menu and standards with the regional menu variety and flavors that First Kitchen customers expect, such as flavored fries, pasta, and local favorites.

The Japan operation functions as both company-owned stores and a franchising platform in that market. It provides Wendy’s with a local operating arm that manages supply chains, real estate, and localized marketing — enabling the brand to scale in a market with different tastes and retail dynamics than North America.

Wendy Restaurant, Inc.

Wendy Restaurant, Inc. and similarly named U.S. operating subsidiaries are the legal vehicles that hold and operate company-owned restaurants in the United States. These entities are responsible for payroll, leases, vendor contracts, and day-to-day restaurant operations for the small percentage of Wendy’s locations still owned by the company.

They also act as centralized operational hubs for piloting new technologies, testing labor and service models, and implementing supply-chain changes before broader rollouts. From a corporate governance perspective, these subsidiaries allow The Wendy’s Company to isolate operating risk from other corporate activities while reporting performance at the consolidated level.

Wendy’s Restaurants of Canada Inc.

Wendy’s maintains an organizational arm dedicated to Canada through Wendy’s Restaurants of Canada Inc. and related Canadian advertising and legal entities. This group administers franchising relationships, local marketing programs, advertising buys, and regulatory compliance for Canadian operations.

The Canadian unit also manages national promotions, co-op advertising dollars and centralized vendor agreements specific to that market. For investors and management, the Canada division acts as a semi-autonomous geographic cluster that contributes regionally distinct revenue and margins and allows the parent company to tailor cash flow and expansion plans to the Canadian retail landscape.

Wendy’s Digital, LLC

Wendy’s Digital, LLC houses the company’s technology, digital ordering, loyalty, mobile app, delivery partnerships, and data analytics teams. As digital channels grew into a substantial portion of systemwide sales, Wendy’s folded those activities into a discrete legal and operating structure to accelerate innovation, protect technology IP, and centralize digital investments.

This entity negotiates partnerships with third-party delivery platforms, manages the Wendy’s app and loyalty program, integrates point-of-sale and kitchen display systems, and runs experiments in AI-enabled features and voice ordering.

By separating digital operations into a subsidiary, Wendy’s can also allocate capital and measure ROI for digital initiatives without entangling traditional restaurant P&Ls.

Wendy’s Global, Inc.

Wendy’s Global, Inc. and similarly named international subsidiaries (for example, Wendy’s Restaurants (Asia) Limited, Wendy’s Singapore Pte. Ltd., Wendy’s Eurasia, and others) are the corporate arms that own Wendy’s international franchise rights, manage master franchise agreements, and support regional development partners.

These entities handle country-level licensing, development pipelines, real estate approvals, and local brand rollout strategies. They also coordinate training programs, supply chain sourcing for non-U.S. markets, and localized product testing.

Through these subsidiarie,s Wendy’s can push unit expansion abroad while protecting the core IP and maintaining control over brand execution at scale.

Wendy’s Global Financing LP and Wendy’s Funding, LLC

A set of financing and treasury subsidiaries — commonly named Wendy’s Global Financing LP, Wendy’s Funding, LLC, and related special-purpose entities — centralize the company’s capital activities. These entities handle debt issuance, lease financing, treasury management, interest rate hedges, and intercompany loans.

They make it easier to structure corporate debt, securitize royalties or receivables when needed, and manage the consolidated company’s capital structure. For example, these finance subsidiaries can issue obligations or enter credit arrangements that are ring-fenced for specific financing projects without exposing operating subsidiaries directly to the same contractual burdens.

The Wendy’s National/Canadian Advertising Programs

Advertising and marketing are administered through consolidated advertising affiliates such as The Wendy’s National Advertising Program, Inc., and Wendy’s Canadian Advertising Program, Inc.

These subsidiaries collect co-op advertising funds from franchisees, plan national brand campaigns, contract with creative agencies, and ensure consistent messaging.

They also run measurement and media buying, negotiate sponsorship deals, and support local marketing initiatives through structured co-op rules. Keeping advertising within subsidiaries gives Wendy’s tighter control over brand spend, campaign timing, and ROI tracking, while providing franchisees with a central service that reduces duplication and cost.

Quality Is Our Recipe, LLC

The company maintains corporate entities whose primary purpose is to own brand trademarks, recipes, proprietary processes, and other intellectual property — commonly referenced by names tied to Wendy’s long-standing motto (“Quality Is Our Recipe”) or similar.

These IP holding subsidiaries license trademarks and recipes to operating and franchising subsidiaries. Using a dedicated holding company for IP simplifies licensing arrangements, enables clearer accounting for royalties, and strengthens legal protections for Wendy’s most valuable intangible assets.

TIMWEN Partnership

Wendy’s historically participated in structured partnerships and joint ventures for specific markets and campaigns. TIMWEN-style partnerships were used historically for Tim Hortons and other ventures; while those legacy relationships were unwound or sold years earlier, the corporate structure remains a template for the company when negotiating joint ventures.

As of 2025, Wendy’s retains the capability — through named partnership vehicles — to enter co-development or co-ownership agreements with local operators, even if the company no longer holds the old Tim Hortons assets.

Wendy’s Global Holdings

To support cross-border operations, Wendy’s maintains a network of holding and support companies in jurisdictions such as the Netherlands, Canada, Hong Kong, and others.

These subsidiaries serve tax, finance, supply-chain, and legal functions. They hold leases, route royalties, centralize European or Asia-Pacific procurement, and act as the vehicle to deploy capital and to sign franchise development agreements with multi-unit partners.

The holding structure provides flexibility for mergers, joint ventures, or asset sales while keeping operational units focused on day-to-day restaurant performance.

Conclusion

Wendy’s has grown into one of the most recognized fast-food chains worldwide through strategic branding, consistent quality, and selective expansion. Over the decades, it has adapted to changing consumer demands while maintaining its signature menu and customer appeal.

When exploring who owns Wendy’s, the answer reveals a mix of institutional investors, corporate leadership, and a rich history of business decisions that shaped its current identity. From expanding into international markets to making bold acquisitions, Wendy’s continues to strengthen its position in the fast-food industry. Its journey proves that understanding ownership is not just about stockholders—it’s about the vision, strategy, and leadership guiding the brand into the future.

FAQs

Who owns Wendy’s Canada?

Wendy’s Canada is owned and operated by The Wendy’s Company, headquartered in Dublin, Ohio, USA. However, Canadian operations are run through a network of franchisees. Wendy’s entered the Canadian market in 1975 and remains a well-established fast-food brand there.

Who owns Wendy’s company?

The Wendy’s Company is publicly traded on the NASDAQ under the ticker symbol WEN. It is owned by a mix of institutional investors, mutual funds, and individual shareholders. No single person fully owns the company.

Who is the real owner of Wendy’s?

The original founder of Wendy’s is Dave Thomas, who opened the first restaurant in 1969 in Columbus, Ohio. While he passed away in 2002, his legacy and influence remain central to the brand.

When was Wendy’s founded?

Wendy’s was founded on November 15, 1969, by Dave Thomas in Columbus, Ohio.

Who is the largest shareholder of Wendy’s?

As of 2025, the largest shareholder of The Wendy’s Company is Trian Fund Management, an investment firm led by Nelson Peltz, which owns a significant percentage of the company’s outstanding shares.

Who owns Wendy’s and Arby’s?

Wendy’s once had a controlling interest in Arby’s, but it sold most of its stake in 2011. Today, Wendy’s and Arby’s are separate companies, though they were once part of the same corporate group called Wendy’s/Arby’s Group, Inc.

Did Wendy’s own Tim Hortons?

Yes. Wendy’s acquired Tim Hortons in 1995, forming a partnership that lasted until 2006. Wendy’s eventually spun off Tim Hortons as a separate public company.

Are McDonald’s and Wendy’s owned by the same company?

No. McDonald’s and Wendy’s are completely separate corporations with no shared ownership. They are direct competitors in the global fast-food market.

What country owns Wendy’s?

Wendy’s is an American-owned company, headquartered in Dublin, Ohio, USA.

What companies does Wendy’s own?

As of 2025, Wendy’s primarily operates its own brand restaurants and franchises. The company no longer owns other major restaurant chains but focuses on its core Wendy’s operations worldwide.

Who is Wendy’s owner’s daughter?

Wendy’s is named after Melinda Lou “Wendy” Thomas-Morse, the daughter of founder Dave Thomas. She appeared in many of the brand’s commercials and has been involved in promoting the company.

Why is Wendy’s named Wendy’s?

Dave Thomas named the restaurant after his daughter, Melinda Lou Thomas. Her nickname, “Wendy,” came from her siblings’ mispronunciation of her name when she was young.