- Wawa is privately owned, with majority control held by the founding Wood family and a significant minority stake owned by employees through an Employee Stock Ownership Plan, creating a rare hybrid ownership model at a national scale.

- Employees are major shareholders but not decision-makers, as ownership through the ESOP provides economic participation while governance and strategic control remain with the board and executive leadership.

- There are no public shareholders, private equity firms, or institutional investors, allowing Wawa to operate independently, reinvest profits internally, and avoid short-term market pressure.

Wawa, Inc. is a privately held American convenience store and fuel retailer headquartered in Wawa, Pennsylvania. The company operates more than 1,100 store locations across the East Coast of the United States.

The typical Wawa location combines convenience retail with fresh food offerings and gasoline services. Customers know Wawa for its built-to-order hoagies, specialty coffee, fresh food, and friendly customer service. Wawa also emphasizes community involvement and local engagement as part of its corporate culture. The brand has a loyal customer base that often outpaces competitors in regional satisfaction surveys.

WaWa Founders

Wawa was founded and shaped by members of the Wood family. The company’s roots trace back to early 20th-century Pennsylvania. Two individuals are central to Wawa’s origin story. George Wood established the original dairy business. His grandson, Grahame Wood, transformed that dairy operation into the modern convenience store brand known today. Their combined vision built the foundation for Wawa’s long-term success.

George Wood

George Wood was the original founder behind what would eventually become Wawa. In 1902, he purchased farmland in Delaware County, Pennsylvania. His focus was dairy farming. He emphasized quality and cleanliness at a time when food safety standards were inconsistent. Wood produced certified milk that met strict medical guidelines. This earned trust among households and hospitals.

George Wood also embraced innovation. He adopted home milk delivery, which expanded reach and reliability. The dairy operation became closely associated with the local community of Wawa, Pennsylvania. The name later became central to the brand’s identity. While George Wood did not build convenience stores himself, his emphasis on quality, trust, and community became core values that still define Wawa.

Grahame Wood

Grahame Wood was George Wood’s grandson and the visionary behind modern Wawa. By the early 1960s, he recognized that traditional dairy delivery was declining. Supermarkets were replacing door-to-door service. Instead of exiting the business, Grahame Wood chose to reinvent it.

In 1964, he opened the first Wawa Food Market in Folsom, Pennsylvania. The store sold Wawa dairy products directly to customers. It also offered everyday grocery items. This shift marked Wawa’s transition from a dairy supplier to a retail convenience business.

Grahame Wood focused on customer convenience. He emphasized friendly service, clean stores, and fresh products. Under his leadership, Wawa expanded beyond milk. Food service became central to the brand. His decisions laid the groundwork for Wawa’s later growth into a large-scale convenience and fuel retailer while remaining privately owned.

Together, George Wood and Grahame Wood built Wawa across two generations. One created the quality-first foundation. The other reimagined the business for changing consumer behavior.

Ownership Snapshot

Wawa is a privately held company. It is not listed on any stock exchange. There are no public shareholders. Ownership is not open to outside investors. This private structure allows Wawa to operate without quarterly earnings pressure. Strategic decisions are made with a long-term view rather than short-term market reactions.

Wawa has consistently chosen independence over public capital. This decision has remained unchanged even as the company scaled nationally.

Employee Stock Ownership Plan (ESOP)

A defining part of Wawa’s ownership snapshot is its Employee Stock Ownership Plan, commonly referred to as the ESOP. Through this plan, eligible employees earn ownership shares over time. These shares are typically tied to tenure and role within the company.

The ESOP makes Wawa one of the largest employee-owned private companies in the United States. Employees do not purchase shares on the open market. Ownership is earned as part of employment benefits. This structure aligns employee performance with company success and encourages long-term retention.

While employees collectively represent the largest ownership group, individual employees do not exercise direct operational control.

Wood Family Ownership

The remaining ownership stake is held by the Wood family and related family trusts. The Wood family descends from founder George Wood. Family ownership ensures continuity of values and long-term stewardship.

The family does not manage day-to-day store operations. However, it maintains influence through board representation and strategic oversight. This balance preserves the company’s original mission while allowing professional executives to run the business.

Family ownership has played a key role in keeping Wawa private and resisting acquisition offers.

Absence of External Investors

Wawa does not have private equity firms, venture capital funds, or institutional investors in its ownership structure. There are no sovereign funds or strategic corporate partners with equity stakes.

This absence of external capital reduces financial pressure and protects Wawa’s culture. Expansion decisions are internally driven. Growth is paced according to operational readiness rather than investor timelines.

Ownership and Governance Alignment

Wawa’s ownership snapshot reflects a hybrid governance model. Employees benefit economically through the ESOP. The Wood family provides continuity and vision. Professional executives handle operations and strategy.

This structure creates stability. It also explains why Wawa prioritizes reinvestment, employee development, and customer experience over rapid monetization. Ownership is concentrated, intentional, and aligned with long-term sustainability.

Ownership History

Wawa began as a fully family-owned enterprise. In 1902, George Wood established a dairy operation in Delaware County, Pennsylvania. Ownership at this stage was simple and centralized. The Wood family controlled all assets and operations. The focus was on dairy production and direct distribution rather than retail.

This early ownership model emphasized quality and trust. Those values later shaped how ownership decisions were made as the business evolved.

| Time Period | Ownership Structure | Key Developments | Ownership Impact |

|---|---|---|---|

| 1902–1963 | 100% Wood family ownership | Founded by George Wood as a dairy business in Pennsylvania | Centralized family control with a strong focus on quality, trust, and local relationships |

| 1964–1970s | Wood family ownership | Grahame Wood launches the first Wawa Food Market and shifts toward retail | Ownership remains private, allowing experimentation without external pressure |

| 1980s | Wood family ownership | Regional expansion beyond Pennsylvania begins | Family retains full strategic and operational control during early growth |

| 1990s | Introduction of ESOP alongside family ownership | Employee Stock Ownership Plan is established | First dilution of exclusive family ownership; employees gain economic stake |

| 2000s | Shared ownership: employees + Wood family | ESOP participation expands across workforce | Employees become a major ownership group while family maintains stewardship |

| 2010s | Mature hybrid ownership model | Professional management structure solidifies | Ownership supports long-term planning and internal reinvestment |

| 2020–2026 | Employees (via ESOP) and Wood family trusts | Continued private status with no external investors | Stable ownership, strong culture, and resistance to public listing or acquisition |

Transition From Dairy to Retail Ownership

By the mid-20th century, the dairy delivery model was declining. Under the leadership of Grahame Wood, the company shifted toward retail food markets. When the first Wawa Food Market opened in 1964, ownership remained entirely within the Wood family.

Despite the operational transformation, the family retained full control. There were no outside investors involved during this transition. This allowed the company to experiment with retail formats without external pressure.

As Wawa expanded its store count in the 1970s and 1980s, ownership stayed private and family-centered.

Introduction of Employee Ownership

A major shift in Wawa’s ownership history occurred in the 1990s. The company introduced an Employee Stock Ownership Plan. This marked the first time ownership extended beyond the founding family.

The ESOP was designed to reward long-term employees and align interests across the organization. Shares were allocated internally. They were not publicly tradable. Employees gained economic participation without influencing daily management.

This move gradually diluted exclusive family ownership while strengthening internal loyalty.

Expansion of the ESOP Stake

Over time, the employee ownership stake increased. As the ESOP expanded, employees became a central ownership group. This transition was intentional and gradual. It avoided disruption while maintaining family oversight.

By the early 2000s, Wawa had become widely recognized as an employee-owned private company. The Wood family continued to hold a significant stake. However, ownership was now shared.

This balance created a dual ownership structure that remains in place.

Preservation of Private Ownership

Despite rapid expansion, Wawa consistently rejected public listing opportunities. The leadership believed public ownership would conflict with long-term goals. Remaining private protected company culture and decision-making autonomy.

The Wood family played a key role in this stance. Employee ownership further reinforced it. Together, these factors prevented takeover attempts and private equity involvement.

Wawa’s ownership history reflects deliberate choices rather than market pressure.

Current Ownership Structure Evolution

As of 2026, Wawa’s ownership history has reached a mature phase. Employees collectively hold a substantial portion through the ESOP. The Wood family retains long-term stewardship through direct holdings and trusts.

There have been no major ownership transfers, acquisitions, or divestitures affecting control. Governance continues to evolve internally rather than through external capital events.

This history explains why Wawa operates differently from many competitors. Ownership evolved slowly. Control remained stable. Long-term thinking guided every transition.

Who Owns Wawa?

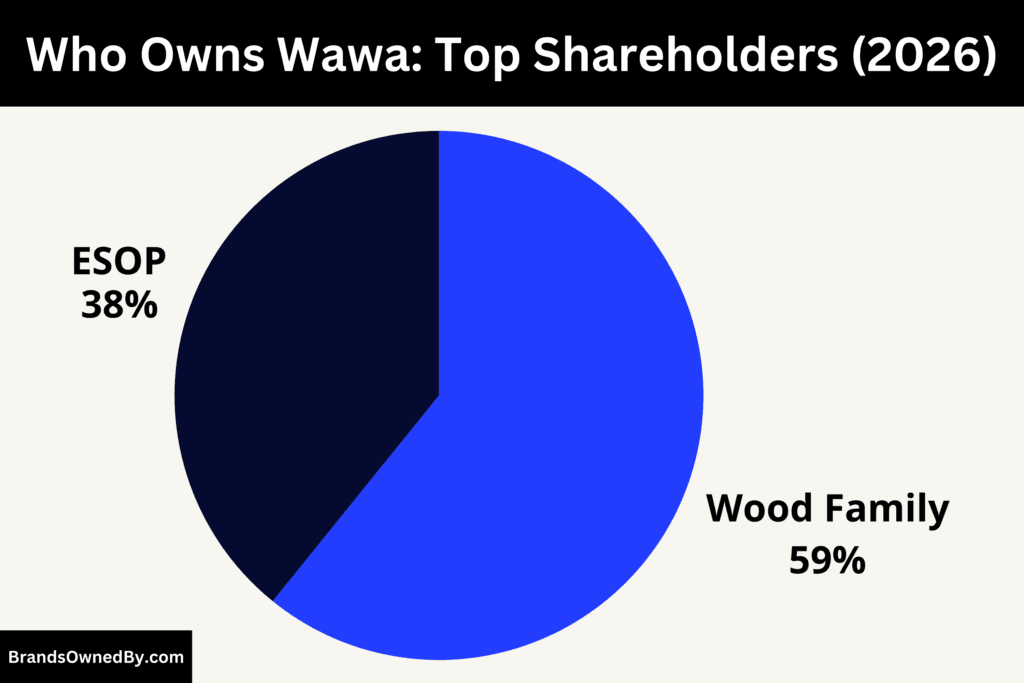

Wawa is a privately held company with a clearly defined ownership structure. Control is shared between the founding Wood family and Wawa employees. The Wood family holds the majority ownership through direct holdings and family trusts. Employees collectively own a substantial minority stake through an Employee Stock Ownership Plan. A small portion is allocated to senior executives through long-term incentive arrangements. This ownership model sets the foundation for how Wawa is governed and how decisions are made, which is explained in detail below.

Employee Stock Ownership Plan (ESOP)

Wawa’s ESOP is one of the most defining elements in its ownership story. Wawa introduced its ESOP in 1992 as a formal way to share company equity with employees. It evolved from earlier profit-sharing initiatives dating back to the late 1970s. Under the ESOP, eligible associates receive contributions in the form of Wawa stock, with allocations generally tied to tenure and compensation criteria.

As of 2026, approximately 22,000 Wawa associates participate in the ESOP, collectively holding a substantial minority stake in the company. Estimates place this employee-owned portion at approximately 38% of total ownership. These shares are not publicly traded but are privately held within the ESOP trust, supporting employee investment in the company’s long-term success without being subject to public market volatility.

The ESOP aligns employee interests with operational outcomes. By participating as shareholders, employees benefit directly from Wawa’s growth and profitability through stock allocations and retirement plan value increases. This fosters internal loyalty and a culture where employees are invested in both customer experience and business performance.

Wood Family and Descendants

The Wood family remains the most significant individual shareholder group in Wawa. Descendants of founder George Wood and his grandson Grahame Wood retain a majority ownership stake through direct holdings and family trusts. As of 2026, the Wood family and related entities collectively own approximately 59% of Wawa.

This family ownership presence has historical roots. After establishing Wawa initially as a dairy business and later transitioning to convenience retail under Grahame Wood, the family maintained private control through successive generations. Family stewardship has informed decisions on growth, corporate culture, and strategic direction. While family members do participate in governance—often through board roles or advisory positions—they do not manage day-to-day operations, which are led by professional executives.

Wood family ownership acts as an anchor for the company’s private status. It ensures that visions tied to long-term stability, community focus, and internal culture remain central to corporate strategy, free from quarterly public reporting pressures.

Executive Leadership Holdings

In addition to employees and the founding family, select members of Wawa’s executive leadership may hold direct or indirect equity interests. These holdings are typically smaller relative to the ESOP and family stakes and are aligned with performance incentive structures rather than broad ownership.

Executive equity often serves as part of compensation packages designed to align leadership decisions with shareholder value. While precise percentages are not publicly disclosed due to Wawa’s private nature, executive holdings reinforce internal commitment to company objectives and long-term performance.

Absence of Public Investors

Unlike publicly traded corporations, Wawa has no public shareholders and is not listed on any stock exchange. There are no institutional investors, private equity firms, or sovereign wealth funds in its ownership mix. Capital for expansion and operations comes from reinvested earnings and internal funding, supported by the private ownership model.

This absence of external investment pressure allows Wawa to maintain flexibility in expansion, uphold employee-owned philosophies, and prioritize customer experience over meeting investor expectations tied to public markets.

Competitor Ownership Comparison

Ownership structures across the convenience store industry vary widely. These differences directly affect how companies grow, invest, and make strategic decisions. Wawa’s combination of family stewardship and employee ownership is uncommon at scale. A deeper comparison highlights how ownership models shape long-term priorities.

| Company | Ownership Type | Primary Owners | Governance & Control | Employee Ownership | Long-Term Strategic Impact |

|---|---|---|---|---|---|

| Wawa | Private, hybrid ownership | Wood family trusts and Wawa employees | Control shared between family representatives and professional management; insulated from public market pressure | Yes, large-scale via ESOP | Prioritizes stability, culture, reinvestment, and deliberate expansion without external investor influence |

| 7-Eleven | Multinational corporate ownership | Foreign parent retail conglomerate | Strategic decisions centralized at global parent level; U.S. operations align with international objectives | No meaningful ownership | Emphasizes scale, franchising, and global efficiency over regional autonomy |

| Circle K | Public company ownership | Institutional investors and public shareholders | Board and executives accountable to shareholders; quarterly performance pressure | Minimal to none | Growth and capital allocation driven by investor expectations and market performance |

| Sheetz | Private, family-owned | Sheetz family | Highly centralized family control with fast decision-making | No large-scale ownership | Enables rapid execution but limits employee equity alignment |

| Speedway | Corporate subsidiary ownership | Parent energy or retail corporation | Operates as a portfolio asset within a larger corporate structure | None | Focus on integration, asset optimization, and corporate-level strategic goals |

Wawa: Hybrid Employee and Family Ownership

Wawa operates under a dual ownership framework. The founding Wood family retains majority control through family trusts. Employees collectively hold a large minority stake through an Employee Stock Ownership Plan. This structure blends continuity with broad internal participation.

Family ownership provides stability. It protects the company from hostile takeovers and short-term capital pressures. Employee ownership reinforces accountability at every level of the organization. Associates benefit directly from the company’s long-term success, which influences customer service, retention, and operational discipline.

Because Wawa has no outside investors, strategic decisions are internally driven. Store expansion is paced according to supply chain readiness and workforce availability rather than investor growth targets. This model prioritizes consistency, culture, and reinvestment.

7-Eleven: Global Parent Company Control

7-Eleven is owned by a large international retail group headquartered outside the United States. Ownership is centralized at the parent company level. Strategic priorities are aligned with global performance metrics.

This model emphasizes scale and standardization. Franchising is a core growth lever. Local markets often adapt to global frameworks rather than the reverse. While this approach enables rapid expansion, it limits regional autonomy.

Employees typically do not participate in equity ownership. Value creation flows upward to the parent company and its shareholders. Compared to Wawa, this structure places less emphasis on long-term regional loyalty and more on global capital efficiency.

Circle K: Public Market Ownership Pressure

Circle K operates under a publicly traded corporate parent. Ownership is widely distributed among institutional investors, hedge funds, and retail shareholders. This creates continuous market scrutiny.

Public ownership introduces quarterly reporting pressure. Capital allocation decisions must balance long-term investments with near-term earnings expectations. Store remodels, acquisitions, and divestitures are often evaluated through shareholder return metrics.

Employee ownership is minimal. Governance is heavily influenced by investor sentiment and board-level financial oversight. Compared to Wawa’s private structure, Circle K has less flexibility to prioritize culture-driven investments without immediate financial justification.

Sheetz: Family-Only Private Ownership

Sheetz remains privately owned and controlled by the Sheetz family. Like Wawa, it avoids public markets and external investors. However, ownership remains concentrated within the founding family.

This concentration enables fast decision-making. Strategic direction is unified. Growth initiatives can be executed quickly without shareholder approval. However, employees do not share in ownership at scale.

Compared to Wawa, Sheetz relies more heavily on executive leadership and family governance rather than broad employee alignment. The cultural impact differs. Incentives are primarily compensation-based rather than equity-based.

Speedway: Subsidiary-Based Corporate Ownership

Speedway operates as a subsidiary within a larger corporate organization. Ownership decisions are made at the parent level. The brand functions as one component of a broader portfolio.

This structure prioritizes operational integration. Store strategy is often tied to parent-company goals such as fuel distribution, asset optimization, or market consolidation. Local brand identity is secondary to portfolio efficiency.

Employees have limited influence on ownership or governance. Compared to Wawa, Speedway’s model emphasizes scale and cost optimization rather than long-term cultural investment.

Strategic Implications of Ownership Differences

Wawa’s ownership model supports patient growth and cultural consistency. Employee participation encourages long-term thinking at the store level. Family control ensures continuity and resistance to short-term market forces.

Competitors owned by public markets or multinational corporations operate under different incentives. Speed and scale often outweigh stability. Investor expectations influence strategic choices.

This comparison explains why Wawa’s operating style, expansion pace, and internal culture differ so sharply from many national convenience store chains.

Who Controls Wawa?

Control at Wawa is clearly structured and centralized. While ownership is shared between employees and the founding family, authority over strategy and operations rests with a defined group of leaders. Control flows through the board of directors and the executive management team, with limited involvement from shareholders in day-to-day decisions.

Board of Directors and Governance Oversight

Wawa is overseen by a private board of directors. The board is responsible for long-term strategy, executive appointments, major capital decisions, and preserving the company’s private status.

The board includes members of the Wood family, who represent the founding owners, along with independent directors drawn from retail, operations, and corporate governance backgrounds. While Wawa does not publicly disclose a full, detailed board roster due to its private status, the Wood family has historically maintained board representation to ensure continuity of vision and values.

The board does not manage daily operations. Its authority is supervisory. It evaluates performance, approves expansion plans, and ensures leadership accountability.

Role of the Wood Family in Control

The Wood family remains the most influential ownership group and retains governance influence through board participation and voting rights. Family members do not operate stores or lead departments.

Their control is strategic. They act as long-term stewards of the business. This influence has been central to keeping Wawa privately held and employee-aligned. The family has consistently supported reinvestment, conservative expansion, and internal promotion rather than external acquisition or public listing.

This approach limits leadership turnover and protects Wawa from short-term financial pressure.

Chief Executive Officer and Executive Authority

Operational control rests with the chief executive officer and executive leadership team.

The current CEO is Chris Gheysens. He has served as CEO since 2013. Gheysens is also a member of the board and plays a central role in shaping strategy, expansion planning, and organizational structure.

Under his leadership, Wawa expanded into new states, modernized store formats, strengthened foodservice operations, and invested heavily in digital ordering and logistics. All major departments report up through the CEO, including operations, supply chain, technology, real estate, and human resources.

The CEO has direct authority over execution and reports to the board.

Past CEOs and Leadership Continuity

Before Chris Gheysens, Wawa was led by Howard Stoeckel, who served as CEO from 2002 to 2013. Stoeckel oversaw a period of significant regional expansion and helped scale Wawa into a large, multi-state convenience retailer while maintaining private ownership.

Earlier leadership roles were held by members of the Wood family during Wawa’s formative decades. As the company grew in size and complexity, control transitioned from family-run management to professional executives, while the family retained governance influence.

This transition allowed Wawa to combine professional management with family oversight rather than choosing one over the other.

Decision-Making Structure

Wawa follows a centralized decision-making model.

Strategic decisions are made at the corporate level by the CEO and executive team, with board approval for major initiatives. These decisions include market entry, store design, brand positioning, and long-term investment priorities.

Execution is delegated to regional and store leadership teams. This allows consistency across markets while maintaining operational flexibility at the local level.

Employee owners do not vote on strategy or leadership appointments. Their influence is economic, not managerial.

Role of Employee Ownership in Control

Employees participate in ownership through the ESOP, but they do not control the company. They do not elect the board or executives.

Instead, employee ownership supports alignment and accountability. It encourages long-term thinking and internal loyalty. Control remains centralized to avoid operational fragmentation.

This structure allows Wawa to scale efficiently while benefiting from an engaged workforce.

Wawa Annual Revenue and Net Worth

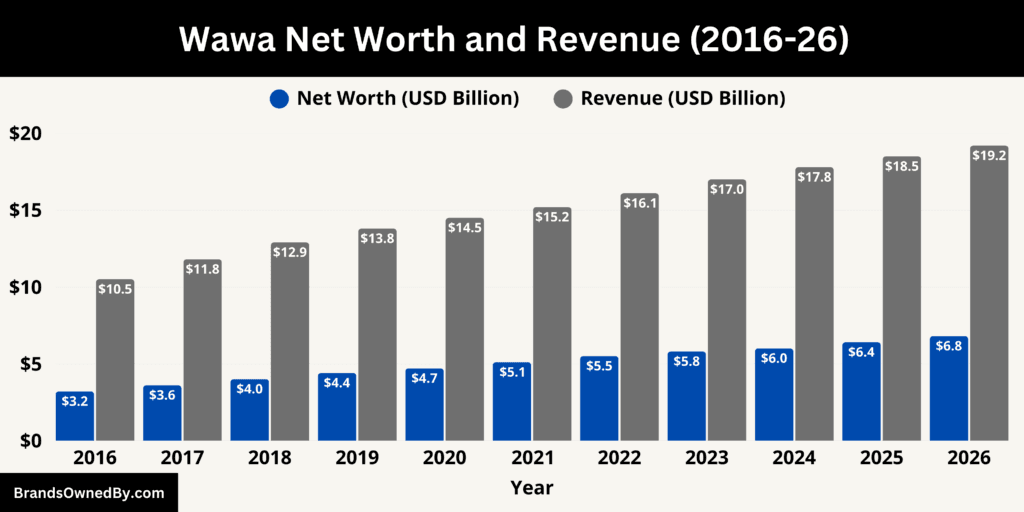

Wawa continues to show steady financial expansion driven by controlled growth and internal reinvestment. As of 2026, Wawa’s estimated annual revenue stands at approximately $19.2 billion, while its estimated net worth is around $6.8 billion as of January 2026.

Latest Financial Snapshot (2026)

Wawa generated an estimated $19.2 billion in revenue in 2026, reflecting continued year-over-year growth from its core convenience retail and fuel operations. The company’s estimated net worth in 2026 is approximately $6.8 billion, based on private-market enterprise valuation methods rather than public equity multiples.

Because Wawa is privately held, it does not publish audited financial statements. Revenue and valuation figures are derived from industry disclosures, employee ownership filings, operational scale, store count growth, and comparative private-retail valuation benchmarks.

Revenue Composition Breakdown

Wawa’s revenue is diversified across three primary operating segments.

Fuel sales account for the largest share, contributing an estimated 52–55% of total revenue. This segment is volume-driven rather than margin-driven. Fuel attracts high traffic but operates on thin margins, typically in the low single digits.

In-store food and beverage sales contribute approximately 32–35% of revenue. This is Wawa’s highest-margin segment. Made-to-order food, coffee, and private-label beverages generate materially higher profit per transaction than fuel. Foodservice has been the fastest-growing revenue contributor over the past decade.

Retail merchandise, including packaged snacks, beverages, and convenience items, contributes the remaining 10–13% of revenue. This segment provides steady incremental income and benefits from high customer visit frequency.

This mix explains why Wawa continues to invest heavily in foodservice innovation rather than relying solely on fuel economics.

Revenue Growth Drivers (2026)

Revenue growth in 2026 was driven primarily by store count expansion and same-store sales growth, not acquisitions. Wawa added new locations across Florida, North Carolina, and adjacent expansion markets. Store density increases in existing states also improved logistics efficiency.

Same-store sales growth was supported by increased food attachment rates per transaction and higher average ticket sizes, particularly in breakfast and beverage categories. Digital ordering and loyalty engagement contributed incremental volume but remain a secondary driver compared to physical store traffic.

Importantly, Wawa’s revenue growth rate remains moderate compared to public peers. This reflects intentional pacing rather than market constraint.

Net Worth and Asset Value (2026)

Wawa has an estimated net worth of approximately $6.8 billion as of January 2026. This figure reflects the cumulative value of Wawa’s owned assets, retained earnings, and long-term business equity after liabilities.

A major contributor to Wawa’s net worth is company-owned real estate. Wawa owns a large share of its store locations rather than leasing them. With more than 1,100 stores in operation, real estate holdings alone account for a significant portion of total asset value. In addition to retail sites, Wawa owns multiple large-scale distribution centers, fuel infrastructure, and logistics facilities that support its vertically integrated operations.

Wawa’s retained earnings also play a central role in net worth growth. Because the company is privately held, profits are not distributed to public shareholders. Instead, earnings are reinvested into new store construction, supply chain expansion, technology upgrades, and employee ownership accounts. This reinvestment has steadily increased total equity on the balance sheet over time.

Another component of Wawa’s net worth is brand and operational equity. Wawa operates one of the most recognized convenience brands in the United States, with exceptionally high customer loyalty in its core markets. Proprietary foodservice systems, private-label products, and internally managed fuel operations add long-term economic value that compounds year after year.

Employee ownership further anchors valuation stability. Shares held through the Employee Stock Ownership Plan are valued internally and reflect the company’s growing equity base. As the business expands and assets accumulate, the value of these shares increases, directly contributing to overall net worth without external dilution.

Taken together, Wawa’s net worth in 2026 represents more than its annual profitability. It reflects decades of asset accumulation, disciplined reinvestment, owned infrastructure, and sustained brand strength. This explains why Wawa’s net worth continues to rise steadily alongside revenue, even without public market participation or aggressive financial leverage.

Future Net Worth Outlook and Expected Growth

Wawa is positioned for steady, asset-backed net worth growth beyond 2026, rather than sharp valuation swings. Future increases in net worth are expected to be driven by physical expansion, retained earnings, and long-term operating equity.

Near-Term Outlook (2027–2028)

In the near term, Wawa’s net worth is expected to rise to approximately $7.2–$7.5 billion by 2027–2028. This growth is closely tied to new store development. Each new store adds owned land, buildings, fuel infrastructure, and long-lived operating assets. Because many locations are company-owned rather than leased, these additions directly increase balance-sheet value.

During this period, Wawa is also expected to continue investing in regional distribution and logistics facilities to support expansion into new markets. These facilities significantly increase asset value and improve long-term operating efficiency.

Medium-Term Growth Drivers

Retained earnings will remain a primary driver of net worth growth. With annual revenue approaching $20 billion and consistent operating performance, a substantial portion of profits is reinvested into infrastructure, technology, and store upgrades. These reinvestments compound year after year, increasing total equity without external dilution.

Brand strength also supports future value. As Wawa enters new states, brand recognition and customer loyalty translate into predictable cash flows and durable operating equity. Proprietary foodservice systems and private-label products further strengthen this foundation.

Employee ownership contributes to valuation stability. Shares held through the ESOP continue to appreciate as company equity grows, reinforcing long-term value accumulation rather than short-term monetization.

Long-Term Outlook (Early 2030s)

Looking further ahead, if Wawa maintains its current expansion pace and conservative capital strategy, net worth could reasonably approach the $8–$9 billion range in the early 2030s. This projection assumes continued private ownership, no public listing, and no large-scale acquisitions that would materially alter the balance sheet.

Overall Trajectory

Wawa’s future net worth growth is expected to remain incremental, predictable, and asset-driven. The company’s focus on owned real estate, internal reinvestment, and disciplined expansion supports long-term value creation without reliance on public market valuation multiples or speculative growth assumptions.

Brands Owned by Wawa

Wawa operates through a tightly integrated group of wholly owned brands and internal entities. Unlike diversified conglomerates, Wawa does not pursue unrelated acquisitions or mergers. Its structure is designed to keep control, operations, and value creation inside the company.

As of January 2026, all major brands and entities listed below are directly owned and operated by Wawa itself:

| Company / Brand / Entity | Type | Primary Function | Key Details |

|---|---|---|---|

| Wawa Food Markets | Core operating company | Retail convenience stores | Operates all Wawa-branded convenience stores; manages store operations, staffing, merchandising, customer experience, and in-store foodservice programs |

| Wawa Fuel Services | Operating division | Fuel retail and infrastructure | Manages gasoline procurement, pricing strategy, fuel logistics, pump operations, and underground storage systems integrated with Wawa stores |

| Wawa Distribution and Logistics | Internal supply chain entity | Distribution and transportation | Operates company-owned distribution centers, trucking fleets, and cold-chain systems supplying food, beverages, and merchandise to stores |

| Wawa Food Manufacturing and Fresh Kitchens | Internal production entity | Food preparation and processing | Produces proprietary food components, fresh ingredients, and pre-assembled items supporting made-to-order food offerings across all locations |

| Wawa Coffee and Beverage Programs | Internal brand platform | Coffee and beverage development | Oversees coffee blends, sourcing standards, beverage recipes, equipment specifications, and seasonal drink innovation sold exclusively in Wawa stores |

| Wawa Real Estate and Store Development | Asset management entity | Real estate ownership and development | Handles site selection, land acquisition, construction, redevelopment, and property management for company-owned and leased store locations |

| Wawa Technology and Digital Platforms | Internal technology division | Digital systems and analytics | Manages mobile app, loyalty programs, digital ordering, in-store kiosks, POS systems, data infrastructure, and operational analytics |

| The Wawa Foundation | Nonprofit entity | Philanthropy and community programs | Oversees charitable giving, disaster relief, education support, and community engagement initiatives aligned with Wawa’s corporate values |

| Wawa Corporate Services | Shared services entity | Corporate support functions | Provides finance, HR, legal, compliance, procurement, training, and executive support across all Wawa operations |

Wawa Food Markets

Wawa Food Markets is the core operating entity of the company. It manages all retail convenience store locations operating under the Wawa name. This entity oversees store operations, merchandising, customer experience, staffing, and in-store systems.

Wawa Food Markets is responsible for the brand’s defining features. These include made-to-order hoagies, fresh food programs, beverage platforms, and 24-hour store formats in many locations. Store design, layout, and service standards are centrally controlled to ensure consistency across states.

This entity also manages regional operations, including district and store-level leadership, training programs, and customer engagement initiatives.

Wawa Fuel Services

Wawa Fuel Services operates the company’s gasoline and fuel infrastructure. This includes fuel procurement, pricing strategy, pump operations, and fuel-related compliance. Fuel services are fully integrated into Wawa store locations rather than operated as a separate brand.

Fuel sales represent the highest-volume revenue segment for Wawa. While margins are thin, fuel plays a strategic role by driving store traffic. Wawa Fuel Services manages relationships with suppliers, maintains underground storage systems, and oversees fuel logistics.

This entity is also responsible for expanding fuel capabilities at new store locations and upgrading existing sites.

Wawa Distribution and Logistics

Wawa owns and operates its own distribution and logistics network. This includes large-scale distribution centers that supply fresh food ingredients, packaged goods, beverages, and store supplies to retail locations.

By keeping distribution in-house, Wawa controls product quality, inventory flow, and delivery timing. This is especially critical for fresh food operations, which depend on speed and consistency.

The logistics arm also manages transportation fleets, routing systems, and cold-chain infrastructure. These assets represent a significant portion of Wawa’s long-term operational value.

Wawa Food Manufacturing and Fresh Kitchens

Wawa operates internal food manufacturing and preparation facilities that support its made-to-order food offerings. These facilities prepare proprietary ingredients, fresh produce processing, and pre-assembled components used across stores.

This vertical integration allows Wawa to standardize taste, quality, and food safety. It also reduces reliance on third-party food processors.

These kitchens are not consumer-facing brands. They function as internal production entities that enable Wawa’s food-first convenience model.

Wawa Coffee and Beverage Programs

Wawa Coffee operates as an internal brand and product platform rather than a standalone retail chain. It encompasses coffee sourcing, roasting partnerships, blend development, and beverage system design.

Coffee is one of Wawa’s strongest traffic drivers. The company manages its own coffee recipes, equipment standards, and seasonal beverage offerings. This entity also supports cold beverages, specialty drinks, and private-label beverage innovation.

All products are sold exclusively through Wawa stores.

Wawa Real Estate and Store Development

Wawa owns a substantial portion of the land and buildings used for its stores. Wawa Real Estate manages site selection, land acquisition, construction, leasing strategy, and long-term property management.

This entity plays a critical role in expansion strategy. It evaluates traffic patterns, zoning, and market density before approving new locations. Owning real estate allows Wawa to retain asset value and maintain control over store layouts and upgrades.

Wawa Real Estate also manages redevelopment of older locations and relocation of stores into larger modern formats.

Wawa Technology and Digital Platforms

Wawa operates internal technology systems that support digital ordering, loyalty programs, mobile apps, and in-store kiosks. These platforms are developed and managed in-house or through tightly controlled partnerships.

This entity oversees point-of-sale systems, customer data infrastructure, and operational analytics. Technology investments are focused on improving order accuracy, reducing wait times, and increasing repeat visits.

Digital platforms remain fully integrated into Wawa’s retail ecosystem rather than spun off as separate brands.

The Wawa Foundation

The Wawa Foundation is the company’s charitable and community-focused entity. It manages corporate philanthropy, disaster relief support, and community engagement programs.

While not a revenue-generating business, the foundation plays a role in brand trust and employee engagement. It is fully funded and controlled by Wawa and aligns closely with the company’s community-oriented culture.

Final Thoughts

A closer look at who owns Wawa shows that its success is closely tied to its ownership structure. Being privately held and largely employee-owned has given Wawa the freedom to focus on long-term goals instead of short-term market expectations.

Family stewardship, combined with broad employee participation, has created stability, consistent leadership, and a strong internal culture. This approach explains how Wawa continues to expand carefully while protecting its brand, its workforce, and its independence in a highly competitive industry.

FAQs

Who owns Wawa corporation?

Wawa is owned by a combination of the founding Wood family and Wawa employees. The Wood family holds the controlling ownership through family trusts, while employees collectively own a large minority stake through an Employee Stock Ownership Plan. There are no public or outside investors.

Who owns Wawa stores?

All Wawa stores are owned and operated by Wawa itself. The company does not franchise its locations. Individual stores are not owned by separate operators or third parties.

Is Wawa a private company?

Yes, Wawa is a private company. It is not listed on any stock exchange and does not have publicly traded shares. Financial and governance disclosures are limited because of its private status.

Is Wawa employee-owned?

Wawa is partially employee owned. Employees collectively own a significant minority stake through an Employee Stock Ownership Plan. However, employees do not control the company or elect leadership. Ownership is economic, not managerial.

How much is the Wawa family worth?

The Wood family’s combined net worth is estimated in the $4–5 billion range as of 2026. This estimate reflects their majority ownership stake in Wawa, held primarily through family trusts rather than personal liquid assets.

Who owns Wawa in the United States?

Wawa is entirely U.S.-owned. Ownership rests with the Wood family and Wawa employees. There is no foreign parent company, no multinational owner, and no overseas controlling entity.

Why is it called Wawa?

The name “Wawa” comes from the community of Wawa, Pennsylvania, where the company’s original dairy operations were located. The word itself is derived from a Native American term meaning “Canada goose,” which later became the company’s iconic logo.

Is the first Wawa still open?

No, the first Wawa Food Market is not open as a Wawa store today. The original store opened in 1964 in Folsom, Pennsylvania. While the location is historically significant, it no longer operates as the original Wawa retail store.

Where was the first Wawa in New Jersey?

The first Wawa store in New Jersey opened in Pennsauken Township. This marked Wawa’s expansion outside Pennsylvania and laid the groundwork for its strong presence across the state.

Is Wawa American owned?

Yes, Wawa is fully American owned. The company was founded in Pennsylvania and remains owned and controlled by U.S.-based family interests and American employees.

Who owns Wawa gas stations in Florida?

Wawa gas stations in Florida are owned and operated by Wawa itself. They are not owned by separate fuel companies or franchise operators. Fuel operations are fully integrated into Wawa’s corporate structure, just like its stores in other states.