Warby Parker is a well-known name in the eyewear industry. Many people often ask, who owns Warby Parker? This article explores the company’s ownership, its financial strength, leadership, and the brands it owns. Let’s dive deep into the structure of Warby Parker and see who controls this popular brand.

Warby Parker Company Profile

Warby Parker is a U.S.-based eyewear company that offers stylish, affordable prescription glasses, sunglasses, and contact lenses. The company is known for its direct-to-consumer business model, which helps keep costs low by eliminating middlemen. Warby Parker combines technology, design, and customer service to redefine how people shop for eyewear.

Founded in 2010 by Neil Blumenthal, Dave Gilboa, Andrew Hunt, and Jeffrey Raider, the company aimed to solve a simple problem: eyeglasses were too expensive. By designing products in-house and selling them directly to consumers online and in stores, Warby Parker disrupted the traditional eyewear industry.

The company is headquartered in New York City, with more than 200 retail locations across the United States and Canada. It also operates an e-commerce platform and offers virtual vision tests and at-home try-on services.

Major Milestones

- 2010 – Launch of Warby Parker: The company officially launched online, receiving over 20,000 orders in the first few weeks, overwhelming their initial inventory.

- 2011 – Home Try-On Program: Warby Parker introduced its now-famous Home Try-On service, where customers could try five frames at home before buying.

- 2013 – First Retail Store: After early success online, Warby Parker opened its first brick-and-mortar store in SoHo, New York City.

- 2015 – B Corporation Certification: Warby Parker became a certified B Corp, meaning it meets high standards of social and environmental performance, accountability, and transparency.

- 2019 – Launch of Scout: The company introduced its own brand of daily contact lenses called Scout by Warby Parker.

- 2021 – Direct Listing on NYSE: Warby Parker went public through a direct listing on the New York Stock Exchange under the ticker symbol WRBY.

- 2022–2024 – Expansion of Retail Footprint: Warby Parker expanded its retail presence to over 200 physical stores in North America.

Company Details

- Legal Structure: Warby Parker Inc. is a public benefit corporation and publicly traded on the NYSE.

- Ticker Symbol: WRBY

- Headquarters: New York City, New York, USA

- Founders: Neil Blumenthal, Dave Gilboa, Andrew Hunt, Jeffrey Raider

- Co-CEOs: Neil Blumenthal and Dave Gilboa

- Employees: Over 3,000 as of 2024

- Core Products: Prescription eyeglasses, sunglasses, contact lenses, vision tests

- Retail Model: Direct-to-consumer, both online and in company-owned physical stores.

Who Owns Warby Parker: List of Shareholders

As of May 2025, Warby Parker Inc. (NYSE: WRBY) has a diverse ownership structure comprising company insiders, institutional investors, and public shareholders.

Founders retain a special type of shares called Class B shares. These give them more voting power compared to ordinary shareholders. This dual-class share structure allows them to maintain control over company decisions.

Below is a detailed breakdown of the major shareholders of Warby Parker:

| Shareholder | Ownership (%) | Shares Held | Estimated Value (USD) | Role |

|---|---|---|---|---|

| The Vanguard Group, Inc. | 8.12% | 9,818,075 | $166.8 million | Institutional Investor |

| Durable Capital Partners LP | 7.46% | 9,017,825 | $153.2 million | Institutional Investor |

| Neil Blumenthal | 6.66% | 8,043,778 | $136.6 million | Co-Founder, Co-CEO |

| BlackRock, Inc. | 6.69% | 8,079,683 | $137.2 million | Institutional Investor |

| David Gilboa | 5.86% | 7,077,773 | $120.2 million | Co-Founder, Co-CEO |

| FMR LLC (Fidelity) | 4.78% | 5,771,291 | $98.0 million | Institutional Investor |

| D1 Capital Partners L.P. | 4.35% | 5,261,814 | $89.4 million | Institutional Investor |

| Jeffrey Raider | 3.46% | 4,186,697 | $71.1 million | Co-Founder |

| Baillie Gifford & Co. | 1.78% | 2,146,690 | $36.5 million | Institutional Investor |

| State Street Global Advisors | 1.78% | 2,146,499 | $36.5 million | Institutional Investor |

| Andrew Hunt | 1.58% | 1,913,205 | $32.5 million | Co-Founder |

| Geode Capital Management | 1.65% | 1,997,624 | $33.9 million | Institutional Investor |

| Jennison Associates LLC | 1.45% | 1,757,361 | $29.9 million | Institutional Investor |

| Bank of New York Mellon Corp | 1.30% | 1,569,623 | $26.7 million | Institutional Investor |

| Dimensional Fund Advisors LP | 1.24% | 1,495,189 | $25.4 million | Institutional Investor |

| TimesSquare Capital Mgmt. | 1.11% | 1,345,037 | $22.8 million | Institutional Investor |

| Nuveen Asset Management LLC | ~1.75% (est.) | 2,109,103 | $51.06 million | Institutional Investor |

| Symmetry Investments LP | 0.35% | 354,454 | $8.58 million | Hedge Fund |

| Wells Fargo & Company MN | <0.10% | 63,575 | $1.54 million | Institutional Investor |

| Public Shareholders | ~6.8% (est.) | Remainder | Varies | Retail Investors |

Neil Blumenthal

Neil Blumenthal, co-founder and co-CEO, holds approximately 6.66% of Warby Parker’s shares, amounting to 8,043,778 shares valued at around $136.6 million. His significant stake underscores his continued influence and commitment to the company’s vision.

David Gilboa

David Gilboa, also a co-founder and co-CEO, owns about 5.86% of the company, equating to 7,077,773 shares worth approximately $120.2 million. His substantial ownership reflects his active role in steering the company’s strategic direction.

Jeffrey Raider

Jeffrey Raider, another co-founder, possesses roughly 3.46% of Warby Parker, with 4,186,697 shares valued at about $71.1 million. Although not involved in daily operations, his stake signifies a continued interest in the company’s success.

Andrew Hunt

Andrew Hunt, the fourth co-founder, holds approximately 1.58% of the company’s shares, totaling 1,913,205 shares valued at around $32.5 million. His investment indicates ongoing support for Warby Parker’s mission.

The Vanguard Group, Inc.

Vanguard is the largest institutional shareholder, holding 8.12% of Warby Parker, which translates to 9,818,075 shares valued at approximately $166.8 million. As a passive investment firm, Vanguard’s stake reflects confidence in the company’s long-term prospects.

Durable Capital Partners LP

Durable Capital Partners owns 7.46% of the company, amounting to 9,017,825 shares worth about $153.2 million. Their investment indicates a strong belief in Warby Parker’s growth potential.

BlackRock, Inc.

BlackRock holds 6.69% of Warby Parker, equating to 8,079,683 shares valued at approximately $137.2 million. As one of the world’s largest asset managers, BlackRock’s stake signifies substantial institutional interest.

Fidelity Investments

FMR LLC owns 4.78% of the company, with 5,771,291 shares valued at around $98.0 million. Fidelity’s involvement underscores the company’s appeal to prominent investment firms.

D1 Capital Partners L.P.

D1 Capital Partners holds 4.35% of Warby Parker, translating to 5,261,814 shares worth approximately $89.4 million. Their investment reflects confidence in the company’s strategic direction.

Baillie Gifford & Co.

Baillie Gifford owns 1.78% of the company, amounting to 2,146,690 shares valued at about $36.5 million. Known for investing in innovative companies, their stake highlights Warby Parker’s growth potential.

State Street Global Advisors, Inc.

State Street holds 1.78% of Warby Parker, with 2,146,499 shares worth approximately $36.5 million. Their investment adds to the company’s strong institutional backing.

Geode Capital Management, LLC

Geode Capital Management owns 1.65% of the company, translating to 1,997,624 shares valued at around $33.9 million. Their stake reflects a positive outlook on Warby Parker’s performance.

Jennison Associates LLC

Jennison Associates holds 1.45% of Warby Parker, equating to 1,757,361 shares worth approximately $29.9 million. Their investment indicates confidence in the company’s future growth.

Dimensional Fund Advisors LP

Dimensional Fund Advisors owns 1.24% of the company, with 1,495,189 shares valued at about $25.4 million. Their stake adds to the diverse institutional ownership.

TimesSquare Capital Management, LLC

TimesSquare Capital Management holds 1.11% of Warby Parker, amounting to 1,345,037 shares worth approximately $22.8 million. Their investment reflects a strategic interest in the company’s market position.

Bank of New York Mellon Corp

Bank of New York Mellon owns 1.3% of the company, translating to 1,569,623 shares valued at around $26.7 million. Their stake signifies confidence in Warby Parker’s financial health.

Nuveen Asset Management LLC

Nuveen holds 2,109,103 shares of Warby Parker, valued at approximately $51.06 million. Their investment underscores the company’s appeal to asset management firms.

Symmetry Investments LP

Symmetry Investments acquired 354,454 shares of Warby Parker, valued at about $8.58 million, representing a 0.35% stake. This new position indicates growing interest from hedge funds.

Wells Fargo & Company MN

Wells Fargo increased its holdings to 63,575 shares, worth approximately $1.54 million, reflecting a 103.4% increase in their position. This significant boost demonstrates heightened confidence in the company’s prospects.

Public Shareholders

The remaining shares are held by individual investors and the general public. While each holds a smaller percentage, collectively, they contribute to the company’s diverse ownership base and add liquidity to the stock.

Who is the CEO of Warby Parker?

As of 2025, Warby Parker continues to be led by its co-founders, Neil Blumenthal and Dave Gilboa, who serve as co-CEOs. This unique leadership structure has been a cornerstone of the company’s strategy since its inception.

Neil Blumenthal: Co-Founder and Co-CEO

Neil Blumenthal co-founded Warby Parker in 2010, bringing a strong background in social enterprise from his previous role as director of VisionSpring. At VisionSpring, he worked to provide affordable eyeglasses to underserved populations, a mission that aligns with Warby Parker’s commitment to social impact.

Blumenthal holds a BA from Tufts University and an MBA from The Wharton School of the University of Pennsylvania. He has been recognized as a Young Global Leader by the World Economic Forum and one of the 100 Most Creative People in Business by Fast Company. Beyond his role at Warby Parker, Blumenthal serves on the board of RxArt and the United Nations Foundation Global Entrepreneurs Council.

Dave Gilboa: Co-Founder and Co-CEO

Dave Gilboa, also a co-founder of Warby Parker, shares the co-CEO role with Blumenthal. Before starting Warby Parker, Gilboa worked at merchant bank Allen & Company and consulting firm Bain & Company. He holds a BS in Bioengineering from UC Berkeley and an MBA from The Wharton School. Gilboa is a founding member of the Entrepreneur Board of Venture for America and a member of the Aspen Institute’s Henry Crown Fellowship.

The Co-CEO Model

Warby Parker’s co-CEO structure is relatively uncommon in the corporate world but has proven effective for the company. Blumenthal and Gilboa emphasize clear communication and shared accountability. They sit next to each other at the company’s headquarters, facilitating constant collaboration. This arrangement allows them to divide responsibilities while maintaining alignment on strategic decisions.

Past Leadership

Since its founding, Warby Parker has maintained consistent leadership with Blumenthal and Gilboa at the helm. The other co-founders, Jeffrey Raider and Andrew Hunt, were instrumental in the company’s early development but have since moved on to other ventures. Raider co-founded the shaving brand Harry’s, while Hunt has continued his career in venture capital.

Warby Parker Annual Revenue and Net Worth

In the first quarter of 2025, Warby Parker reported net revenue of $223.8 million, marking an 11.9% increase compared to the same period in the previous year. This growth was driven by a 9% rise in active customers and a 5% increase in average revenue per customer, attributed to higher-priced frames and progressive lenses.

For the full year 2025, the company projects net revenue between $869 million and $886 million, representing an anticipated growth of approximately 13% to 15% year-over-year. This projection surpasses the previous year’s revenue of $771.3 million, which had already reflected a 15.2% increase from 2023.

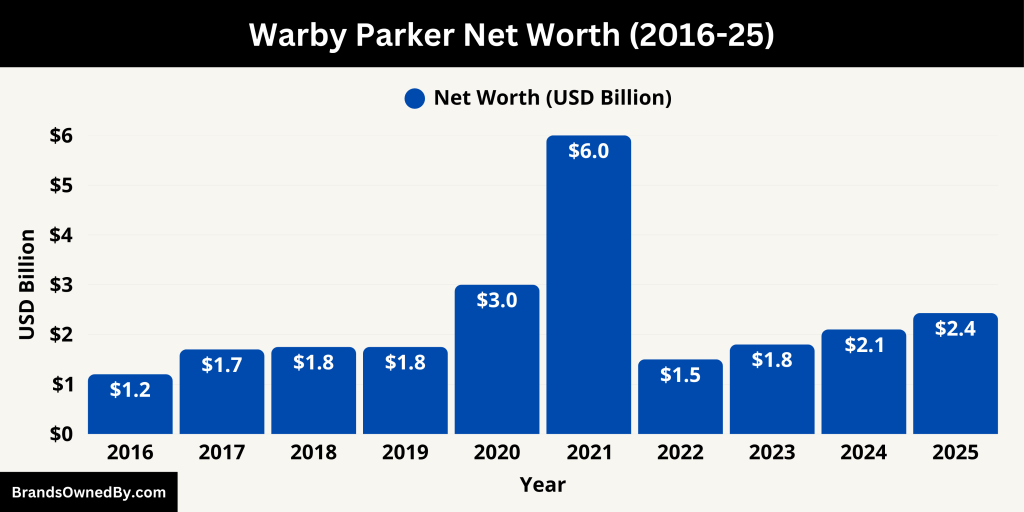

Net Worth and Market Capitalization

Warby Parker’s market capitalization, often used as a proxy for net worth, stood at approximately $2.43 billion as of May 2025. This valuation reflects investor confidence in the company’s growth trajectory and strategic initiatives, including its recent partnership with Google for AI smart glasses and expansion into Target stores.

The company’s strong cash position, with $265.1 million in cash and cash equivalents reported at the end of Q1 2025, provides a solid foundation for continued investment in innovation and expansion.

Here’s an overview of the annual revenue and net worth of Warby Parker from 2016-25:

| Year | Annual Revenue (USD) | Estimated Net Worth / Market Cap (USD) |

|---|---|---|

| 2015 | $100 million (est.) | Private company – not publicly valued |

| 2016 | $150 million (est.) | ~$1.2 billion (private valuation) |

| 2017 | $220 million (est.) | ~$1.7 billion (private valuation) |

| 2018 | $275 million (est.) | ~$1.75 billion (Series funding round) |

| 2019 | $370 million (est.) | ~$1.75 billion (unchanged private value) |

| 2020 | $393.7 million | ~$3.0 billion (valuation during funding) |

| 2021 | $540.8 million | ~$6.0 billion (IPO valuation) |

| 2022 | $598.1 million | ~$1.5 billion (market correction) |

| 2023 | $669.1 million | ~$1.8 billion |

| 2024 | $771.3 million | ~$2.1 billion |

| 2025* | Projected $869M–$886M | $2.43 billion (as of May 2025) |

Brands Owned by Warby Parker

As of 2025, Warby Parker has expanded its operations beyond its core eyewear offerings, venturing into various partnerships and brand extensions. While the company has not made any acquisitions, it has developed and operates several entities and initiatives under its brand.

Below is a detailed overview of the major companies and brands owned by Warby Parker:

| Name | Type | Launch Year | Description | Status as of 2025 |

|---|---|---|---|---|

| Scout by Warby Parker | Proprietary brand | 2019 | Brand of daily contact lenses known for comfort, hydration, and eco-friendly packaging. | Actively sold through Warby Parker’s website and stores |

| Warby Parker Press | In-house publishing | 2015 | Literary imprint releasing books and art publications reflecting the brand’s creative identity. | Active; includes multiple published works |

| Google Android XR Collaboration | Strategic partnership | 2025 | AI-powered smart glasses using Google’s Gemini assistant and Android XR OS. | In development; signals entry into smart eyewear |

| Target Shop-in-Shop Locations | Retail partnership | 2025 | Physical Warby Parker outlets inside Target stores offering eyewear, contacts, and vision exams. | First five locations opening in 2025 |

Scout by Warby Parker

Launched in 2019, Scout is Warby Parker’s proprietary brand of daily contact lenses. Designed for comfort and convenience, these lenses are made from a super-moist material that resists drying, ensuring lasting hydration throughout the day. Each lens comes in a space-saving flat pack, which uses nearly 80% less packaging than traditional daily contact packs, aligning with the company’s commitment to sustainability. Scout offers customers an affordable and high-quality alternative in the contact lens market.

Warby Parker Press

Warby Parker operates an in-house publishing imprint known as Warby Parker Press. This venture reflects the company’s literary and artistic inclinations, with its name itself inspired by characters from Jack Kerouac’s journals. The imprint has released several publications, including “50 Ways to Lose Your Glasses” (2015), an illustrated book exploring humorous scenarios of misplacing eyewear, and “The Alphabet of ART at Warby Parker” (2020), showcasing original artwork commissioned by the company from over 100 artists during its first decade. These publications reinforce Warby Parker’s brand identity and engagement with the arts.

Google Android XR Smart Glasses Collaboration

In 2025, Warby Parker partnered with Google to develop AI-powered smart glasses based on the Android XR platform, supported by Google’s Gemini AI assistant. This collaboration aims to integrate advanced technology with fashionable eyewear, offering features like real-time assistance and contextual overlays. The partnership signifies Warby Parker’s foray into the smart eyewear segment, blending functionality with style to cater to modern consumers’ needs.

Target Shop-in-Shops

Warby Parker has initiated a partnership with Target to open shop-in-shop locations within select Target stores. These dedicated spaces, staffed by Warby Parker employees, offer glasses, sunglasses, contact lenses, eye exams, and vision screenings. The first five locations are set to open in Illinois, Minnesota, New Jersey, Ohio, and Pennsylvania. This strategic move allows Warby Parker to reach a broader customer base by leveraging Target’s extensive retail footprint.

Final Thoughts

So, who owns Warby Parker? The company is publicly owned but still tightly controlled by its founders. Neil Blumenthal and Dave Gilboa retain significant voting rights. Major institutional investors also hold large stakes, but decisions remain largely in the hands of the founders.

Warby Parker has maintained a strong brand identity and leadership. It continues to innovate within the eyewear space and expand its services. Its focus remains on offering affordable, stylish, and accessible eye care to millions.

FAQs

Who are the owners of Warby Parker?

Warby Parker is owned by a mix of institutional investors, company founders, and retail shareholders. Major owners include The Vanguard Group, Durable Capital Partners, BlackRock, and co-founders Neil Blumenthal and David Gilboa. These shareholders collectively shape the company’s strategic direction.

Is Warby Parker made by Luxottica?

No, Warby Parker is not made by Luxottica. It is an independent eyewear company. Unlike many brands under Luxottica’s umbrella, Warby Parker designs, manufactures, and sells its own products directly to consumers.

Is Warby Parker its own brand?

Yes, Warby Parker is its own brand. It started as a direct-to-consumer eyewear company offering affordable and stylish glasses, and it continues to operate under its own name and identity.

Who is Warby Parker’s biggest competitor?

Warby Parker’s biggest competitors include traditional eyewear companies like EssilorLuxottica (owner of Ray-Ban and Oakley) and direct-to-consumer brands such as Zenni Optical, EyeBuyDirect, and Felix Gray.

What countries is Warby Parker in?

As of 2025, Warby Parker primarily operates in the United States and Canada, with a focus on expanding its online presence and physical stores within these markets.

Is Warby Parker made in China?

Warby Parker manufactures many of its eyewear products overseas, including in China, to balance cost efficiency with quality. The company maintains strict quality control standards regardless of manufacturing location.

Who owns Warby Parker stock?

Warby Parker stock is owned by a combination of institutional investors, company insiders, and retail shareholders. Major institutional shareholders include The Vanguard Group, Durable Capital Partners, BlackRock, and FMR LLC.

Who is the head of Warby Parker?

As of 2025, the company is led by co-CEOs Neil Blumenthal and David Gilboa, who are also co-founders. They share leadership responsibilities and guide the company’s strategic and operational decisions.

Who owns Warby Parker sunglasses?

Warby Parker sunglasses are owned and produced by Warby Parker itself. The company designs and markets its sunglasses under its own brand, separate from other eyewear conglomerates.

Is Warby Parker owned by Luxottica?

No, Warby Parker is not owned by Luxottica. It remains an independent company competing with Luxottica’s portfolio of eyewear brands.

Who is Warby Parker’s founder?

Warby Parker was founded in 2010 by Neil Blumenthal, Dave Gilboa, Andy Hunt, and Jeffrey Raider.

What is Warby Parker’s origin story?

Warby Parker was started in 2010 by four friends who wanted to create affordable, stylish eyewear while addressing the problem of expensive glasses. They launched the company with a direct-to-consumer model to cut out middlemen and improve accessibility.

Is Warby Parker publicly traded?

Yes, Warby Parker went public in 2021 and is traded on the New York Stock Exchange under the ticker symbol WRBY.

What type of company is Warby Parker?

Warby Parker is a public benefit corporation and a publicly traded company listed on the NYSE under WRBY.

Is Warby Parker still founder-led?

Yes. Neil Blumenthal and Dave Gilboa continue to lead the company as co-CEOs and maintain strong control through Class B shares.

Does Warby Parker franchise its stores?

No. All Warby Parker stores are company-owned. The company does not offer franchises.

Is Warby Parker profitable?

Warby Parker has reported losses in recent years but is moving toward profitability as it scales operations.

Does Warby Parker own any other eyewear brands?

No. Warby Parker sells products under its own brand and has not acquired other eyewear brands.