The Sphere in Las Vegas, one of the most futuristic entertainment landmarks in the world, has captured global attention for its technology and design. Many people wonder — who owns the Sphere in Las Vegas? The answer connects to one of America’s most powerful entertainment families and companies.

Key Takeaways

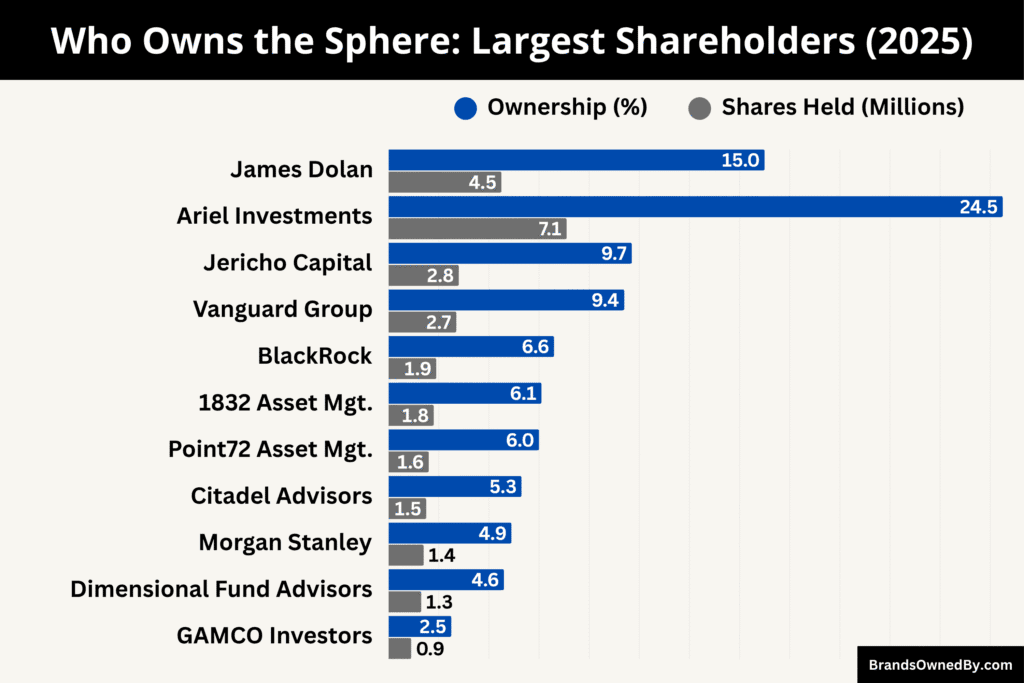

- Sphere Entertainment Co. (NYSE: SPHR), the owner of the Sphere in Las Vegas, is controlled by the Dolan family, who hold approximately 14–15% of total shares but retain over 70% of total voting power through special Class B shares, giving them decisive control over company strategy and leadership.

- Ariel Investments is the largest institutional shareholder with about 24.5% ownership of Class A shares, followed by Jericho Capital Asset Management (9.7%), Vanguard Group (9.4%), BlackRock (6.6%), and 1832 Asset Management (6.1%), all holding significant economic stakes but limited governance authority.

- Additional key holders include Point72 Asset Management (5–6%), Citadel Advisors (5.3%), and Morgan Stanley Investment Management (4.9%), contributing to broad institutional ownership exceeding 95% of the Class A float.

- The ownership structure reflects a founder-controlled yet institutionally supported company, combining the Dolan family’s long-term strategic leadership with diversified institutional investment backing Sphere Entertainment’s growth and innovation.

The Sphere Overview

The Sphere, officially called the Sphere at The Venetian Resort, is an architectural and technological marvel located in Paradise, Nevada. It was developed by Sphere Entertainment Co., a company focused on immersive entertainment experiences. The venue opened on September 29, 2023, with U2:UV Achtung Baby Live at Sphere — a concert series that marked the beginning of a new era in live entertainment.

The Sphere stands 366 feet tall and 516 feet wide, making it the world’s largest spherical structure. Its outer shell is covered with over 1.2 million LED pucks, creating the world’s largest LED display. Inside, the venue seats over 17,000 guests and features 4D motion seats, surround sound, and high-resolution visuals that wrap around the audience.

Sphere Entertainment Co. was originally part of Madison Square Garden Entertainment Corp. (MSG Entertainment) but became an independent publicly traded company in April 2023 to focus on cutting-edge entertainment projects.

Founders and Origins

The initial concept for a spherical, next-generation entertainment venue was championed by James L. Dolan, who serves as CEO and Executive Chairman of the company. The idea emerged under the umbrella of MSG (Madison Square Garden) when planning for MSG Sphere was announced in 2018.

At inception, the project was a partnership between the Madison Square Garden Company and Las Vegas Sands Corporation, with Sands contributing the site near The Venetian Resort.

The Las Vegas Sands side provided the land (approximately 18 acres) east of The Venetian.

Architecturally, the Sphere was designed by Populous, with structural engineering by firms including Severud Associates and Walter P Moore.

The project officially broke ground in 2019, though the schedule was pushed by supply chain and logistical delays, especially during the COVID-19 pandemic.

Major Milestones

- 2018 – The concept for the Sphere is officially announced by Madison Square Garden Company (MSG), led by James L. Dolan, as a revolutionary new type of venue focused on immersive entertainment. A partnership with Las Vegas Sands Corporation secures the 18-acre site east of The Venetian Resort.

- 2019 – Groundbreaking for the Sphere takes place in Las Vegas. Architectural firm Populous leads the design, while structural engineering firms Severud Associates and Walter P Moore join the project. Construction begins on what would become the world’s largest spherical building.

- 2020–2021 – Construction slows due to the COVID-19 pandemic, supply chain disruptions, and global material shortages. Despite delays, Sphere’s key exterior framework and LED infrastructure progress steadily, with the outer shell nearing completion by late 2021.

- 2022 – Installation of the Exosphere, the massive LED exterior, begins. Testing of the display’s 1.2 million LED pucks starts mid-year, transforming the Las Vegas skyline during trial runs.

- 2023 (April) – Sphere Entertainment Co. officially completes its spin-off from Madison Square Garden Entertainment Corp., becoming a standalone public company focused on immersive experiences and technology.

- 2023 (September 29) – The Sphere officially opens with U2:UV Achtung Baby Live at Sphere, a residency that debuts its full interior visual and sound systems. The launch sets a global benchmark for live performance innovation.

- 2024 – The Sphere introduces Postcard from Earth, the first original immersive film experience developed by Sphere Studios. It becomes a permanent attraction, showcasing the venue’s in-house production capabilities. The company also partners with brands like Pepsi, Google, and Canon for global marketing collaborations.

- 2025 (Early) – The Sphere surpasses 4 million visitors since its opening and expands its immersive event lineup. Plans for smaller “mini-Sphere” venues and a London Sphere project move into active discussion stages.

- 2025 (Ongoing) – Sphere Entertainment continues expanding its technology base through Sphere Studios and explores new content partnerships and digital integration features, positioning the Sphere as a global model for immersive entertainment.

Who Owns the Sphere in Las Vegas: Major Shareholders

Sphere Entertainment Co. is the parent company behind the revolutionary Sphere in Las Vegas, serving as the driving force that conceptualized, developed, and now operates the world’s most advanced entertainment venue. It manages the Sphere Las Vegas, Sphere Studios, and MSG Networks.

Sphere Entertainment Co. is a publicly traded company. However, the control over major strategic decisions is concentrated via special share classes. The Dolan family retains control through Class B shares that carry enhanced voting power. Meanwhile, institutional investors and public shareholders hold the economic stakes through Class A shares and other equity.

Below is a list of the major shareholders of Sphere Entertainment as of October 2025:

![who owns the sphere in las vegas [infographic]](https://brandsownedby.com/wp-content/uploads/2025/10/who-owns-the-sphere-in-las-vegas-1.png)

Dolan Family / James L. Dolan

As of October 2025, the Dolan family, led by James L. Dolan, holds approximately 4.5 million shares, representing roughly 14–15% of total outstanding shares. However, because these are primarily Class B shares, which carry enhanced voting power, the family controls over 70% of total voting rights in Sphere Entertainment Co.

This control structure gives James Dolan and the family full authority over board appointments, strategic planning, and executive decisions. Even though institutional investors own the bulk of economic shares, the Dolans’ special voting class allows them to steer corporate governance.

The family’s ownership has remained consistent since the 2023 spin-off from MSG Entertainment, ensuring continuity in leadership and long-term vision for the Sphere’s development and expansion.

Ariel Investments

Ariel Investments is one of the largest institutional holders of Sphere Entertainment Co., with an estimated 7.1 million shares, equal to about 24.5% of the Class A float. As a long-term value investor, Ariel’s focus is on strategic stability and sustainable growth rather than short-term activism.

While Ariel holds a significant economic stake, its voting influence is limited due to the Class B share structure controlled by the Dolans. Still, its presence gives it weight in governance matters involving Class A shares and provides oversight through shareholder engagement.

Jericho Capital Asset Management

Jericho Capital Asset Management owns approximately 2.8 million shares, representing nearly 9.7% of the Class A shares. Jericho is known for concentrated investments in technology, telecom, and entertainment sectors.

The firm has been an active investor since 2024 and often advocates for operational efficiency and transparency. While Jericho cannot challenge the Dolans’ voting majority, it plays a crucial role as an engaged economic stakeholder influencing financial and strategic discussions.

Vanguard Group

The Vanguard Group holds around 2.7 million shares, or roughly 9.4% of Class A shares. Vanguard is primarily a passive investor through its index and exchange-traded funds. Its investment reflects broad confidence from global institutional markets rather than direct strategic involvement.

Although Vanguard’s shares give it voting rights on general corporate matters, its stewardship is typically exercised via proxy votes aligned with long-term governance standards rather than activism.

BlackRock

BlackRock, another global asset management firm, owns about 1.9 million shares, equivalent to 6.6% of the Class A shares. Like Vanguard, BlackRock’s investment is mainly held through its passive and institutional funds.

BlackRock uses its position to engage on governance, sustainability, and shareholder rights, but does not seek to influence day-to-day management. Its holding demonstrates institutional confidence in Sphere Entertainment’s long-term potential as a next-generation entertainment platform.

1832 Asset Management

1832 Asset Management, a Canadian institutional investor, holds roughly 1.8 million shares, or about 6.1% of outstanding Class A shares. The firm is known for its active investment strategy and often participates in governance discussions across its portfolio companies.

Its position in Sphere Entertainment provides additional institutional balance and represents a steady, long-term investment rather than speculative trading.

Point72 Asset Management

Point72, the hedge fund led by Steve Cohen, holds around 1.6 million shares, representing approximately 5–6% of Sphere Entertainment’s publicly traded shares.

Point72 has shown interest in entertainment and technology ventures with strong innovation potential. Although its stake does not come with enhanced voting rights, the firm’s involvement has symbolic weight, drawing broader market attention and supporting liquidity for Sphere’s stock.

Citadel Advisors

Citadel Advisors, managed by billionaire Ken Griffin, owns about 1.5 million shares, translating to roughly 5.3% of the total Class A float.

Citadel’s investment strategy is typically driven by quantitative and event-driven opportunities. Its presence among Sphere Entertainment’s major shareholders indicates confidence in the company’s growth trajectory, though it has no role in corporate control.

Morgan Stanley Investment Management

Morgan Stanley Investment Management holds close to 1.4 million shares, or approximately 4.9% of the company’s public float. The firm invests primarily on behalf of institutional and retail clients.

Its stake reinforces mainstream financial sector interest in Sphere Entertainment and adds depth to the company’s institutional investor base. Morgan Stanley typically engages through governance reviews rather than active influence.

Dimensional Fund Advisors

Dimensional Fund Advisors, a quantitative investment firm, holds an estimated 1.3 million shares, equal to about 4.6% of the public float. DFA invests systematically based on factor models and maintains long-term positions.

Its holding demonstrates diversified institutional confidence but carries no controlling power. DFA’s influence is passive and focused on ensuring corporate accountability to shareholders through governance standards.

GAMCO Investors

GAMCO Investors, led by Mario Gabelli, holds around 0.9 million shares, accounting for roughly 2.5% of Sphere Entertainment’s shares. GAMCO is a traditional value investor known for advocating shareholder returns and transparency.

While its stake is moderate, GAMCO often participates in proxy discussions and may propose governance improvements or capital-allocation refinements to enhance shareholder value.

Gabelli Funds

Gabelli Funds, affiliated with GAMCO, owns approximately 0.55 million shares, representing about 1.5% of Sphere Entertainment’s shares. The funds share the same long-term investment approach and emphasize prudent management practices.

Although their holdings are smaller, Gabelli Funds’ involvement adds credibility to the company’s investor mix and signals trust from seasoned value managers.

Landscape Capital Management

Landscape Capital Management holds about 0.18 million shares, representing roughly 0.5% of Sphere Entertainment’s total shares. As a quantitative hedge fund, Landscape’s investment is primarily a part of diversified portfolios seeking exposure to entertainment and media innovation.

Its influence is minimal individually, but collectively, such funds add liquidity and market stability to the stock.

Canada Pension Plan Investment Board

The Canada Pension Plan Investment Board holds approximately 0.06 million shares, or around 0.17% of the total shares outstanding. CPP’s investment represents a long-term institutional interest in stable, innovative businesses with global reach.

Although small, CPP’s presence signals international investor confidence in Sphere Entertainment’s growth and operational performance.

Insider Ownership

Executives and non-Dolan board members collectively hold between 4% and 6% of the company’s outstanding shares, primarily in the form of restricted stock units (RSUs) and stock options.

These holdings align executive interests with shareholder value. While they do not carry substantial voting weight compared to the Dolan family’s Class B shares, they ensure leadership remains financially invested in the company’s long-term success.

Who is the CEO of the Sphere?

The CEO of Sphere Entertainment Co. is James L. Dolan, who holds the title Executive Chairman and Chief Executive Officer. In this dual role, he is responsible for setting the company’s overall vision, guiding strategic growth, and overseeing daily operations across all business units. His mandate covers everything from developing immersive content and technology to managing the flagship Sphere venue in Las Vegas and supervising subsidiary operations like MSG Networks.

Background and Previous Leadership

Dolan has led major media and entertainment companies for decades. Before Sphere, he served as CEO of Cablevision Systems Corporation (until 2016) and previously headed Rainbow Media Holdings, which became AMC Networks. His long experience in media, venues, and content production gives him a strong foundation for managing an immersive entertainment business.

As part of his broader portfolio, Dolan also serves as CEO of Madison Square Garden Entertainment Corp. and Madison Square Garden Sports Corp., roles he continues concurrently with his Sphere leadership. This overlap allows him to leverage synergies across sports, venue management, broadcasting, and immersive entertainment.

Decision-Making Structure and Influence

Under Dolan’s leadership, strategic decisions tend to reflect a long-term vision that blends technology, storytelling, and spectacle. Because the Dolan family controls the majority of voting power through Class B shares, Dolan’s influence is reinforced structurally. This means even though many economic shares are held by institutions, Dolan’s direction often carries final authority in matters like board appointments, new venue planning, and content development.

While Dolan is the primary leader, he works with an executive team, board of directors, and operational officers (such as a President or COO) who manage day-to-day business units. These teams allow the company to scale operations, manage partner relationships, and deliver immersive technologies without bottlenecking all decisions through the CEO.

Vision and Recent Initiatives

Under Dolan, Sphere Entertainment has pursued bold projects and expansion plans. For example, he has led the push to build smaller “mini-Sphere” venues to broaden the company’s reach beyond Las Vegas.

In 2025, Dolan oversaw the launch of an immersive 4D adaptation of The Wizard of Oz tailored to the Sphere’s unique format. This demonstrates his focus on integrating content innovation with venue technology.

Dolan has also expanded global ambitions. He has publicly stated his intent to build new Spheres in cosmopolitan markets (such as Abu Dhabi) and apply the Sphere concept to other cities.

James Dolan Salary

Under his contract, Dolan receives a base salary of at least $230,000 annually as CEO of Sphere Entertainment.

In addition, his compensation package includes a target bonus opportunity equal to 200% of his base salary (i.e., twice the base) depending on performance metrics.

Beyond salary and bonus, Dolan’s total compensation in recent years is heavily weighted toward equity, stock options, and other incentive awards. For example, reports show his total compensation for a period reached around $27.44 million, with only a small fraction representing base salary.

He also sometimes gets long-term equity awards, stock options, or grants contingent on performance and shareholder approval.

Because those equity awards can fluctuate in value depending on the company’s stock performance, his real total compensation can vary significantly year to year.

James Dolan Net Worth

As of October 2025, James Dolan has an estimated net worth of well over $2 billion.

His wealth is derived not only from his executive roles and compensation but also from holdings in MSG Entertainment, MSG Sports, the Sphere, and other media assets.

Other, more conservative estimates based on public holdings suggest a lower figure (tens of millions), depending on disclosure of shareholdings.

Because many assets are privately held, leveraged, or illiquid, the true number may differ — but public estimates converge toward a multi-billion net worth.

Sphere Annual Revenue and Net Worth

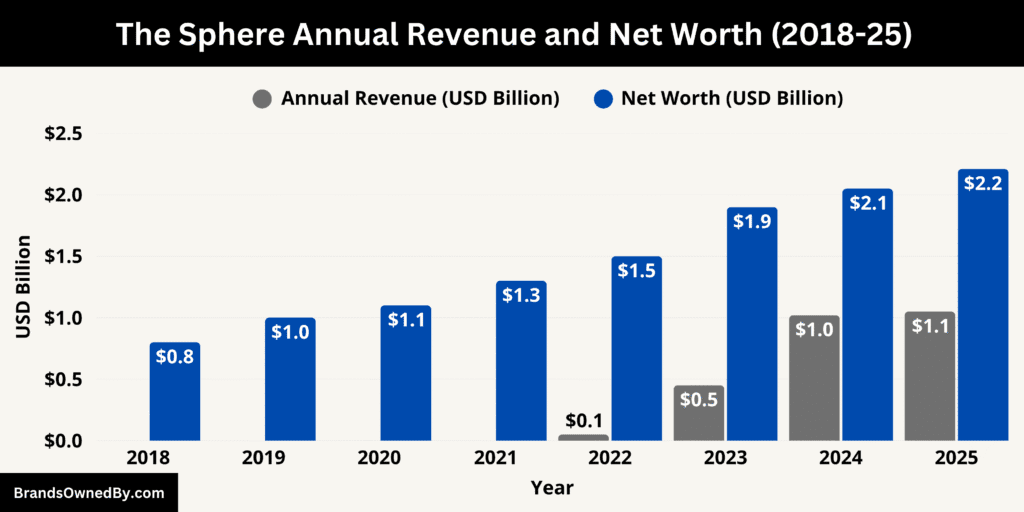

As of October 2025, Sphere Entertainment Co. — the parent company of the Sphere in Las Vegas — continues to strengthen its position as one of the most technologically advanced entertainment firms in the world. The company has reported annual revenue of approximately $1.05 billion and an estimated corporate net worth of around $2.21 billion, reflecting the rising global interest in immersive experiences and the success of its flagship Las Vegas venue. These numbers underscore Sphere Entertainment’s rapid evolution from a bold concept into a financially thriving enterprise.

2025 Revenue Performance

Sphere Entertainment’s financial performance in 2025 highlights the growing commercial impact of its immersive entertainment model. The company’s total revenue exceeded $1.05 billion, a steady increase over 2024. The majority of this revenue came from the Sphere segment, which includes ticket sales, residencies, corporate events, sponsorships, and experiential films such as Postcard from Earth. The venue’s ability to host large-scale concerts, live broadcasts, and branded activations has turned it into a year-round revenue generator.

Advertising and sponsorships also play a major role in revenue growth. The Exosphere, the Sphere’s LED exterior, has become a premier global advertising space, featuring high-profile brand campaigns from companies like Google, YouTube, and Pepsi. Each campaign can command millions in display revenue, contributing significantly to the company’s earnings. Additionally, Sphere Studios, the company’s content and technology arm, began generating income through licensing its proprietary visual systems and immersive production technologies to third-party clients.

On the media side, MSG Networks, which remains under Sphere Entertainment’s ownership, contributed steady revenue through regional sports broadcasting and affiliate partnerships. Together, these diversified income streams have made Sphere Entertainment one of the most dynamic entertainment companies in the U.S., blending traditional live performance economics with cutting-edge digital technology.

Net Worth

Sphere Entertainment Co.’s net worth is estimated at $2.21 billion as of October 2025. This valuation reflects the company’s assets, infrastructure, intellectual property, and brand value associated with the Sphere Las Vegas — the world’s largest and most technologically advanced entertainment venue.

The company’s market capitalization on the New York Stock Exchange (NYSE: SPHR) has grown steadily since its 2023 spin-off, driven by strong investor confidence, successful partnerships, and the consistent profitability of its Las Vegas operations.

Beyond tangible assets like the Sphere building and MSG Networks, a substantial portion of its valuation stems from proprietary technologies developed by Sphere Studios, including advanced LED systems, 16K wraparound displays, and next-generation audio technologies.

Sphere Entertainment’s brand equity and future project pipeline — including planned smaller-scale Spheres in international markets — further contribute to its valuation. The company’s financial outlook remains strong, with expanding global recognition and new business opportunities expected to enhance both revenue and net worth in the years ahead.

Historical Revenue and Net Worth

Sphere Entertainment Co. began as a concept within Madison Square Garden Company in 2018, when plans for a revolutionary spherical entertainment venue were first announced. At that time, the project had no revenue, but its estimated development value was around $800 million, reflecting early-stage investment and intellectual property potential.

By 2019, construction of the Sphere in Las Vegas had officially begun, increasing the project’s valuation to about $1 billion. The following year, 2020, saw delays due to the COVID-19 pandemic, but ongoing capital investment and site progress kept its asset value rising to approximately $1.1 billion. In 2021, as construction resumed and technology installations began, the project’s value climbed further to about $1.3 billion, even though operational revenue had yet to start.

In 2022, as the Exosphere LED exterior was installed and initial brand partnerships formed, Sphere Entertainment began generating limited revenue—around $50 million—from early sponsorship and promotional activities. The company’s valuation continued to grow, reaching roughly $1.5 billion.

A major turning point came in 2023 when Sphere Entertainment Co. officially spun off from Madison Square Garden Entertainment and opened the Sphere at The Venetian Resort in September. With a full operational launch, revenue surged to about $450 million, and the company’s net worth rose to approximately $1.9 billion.

By 2024, the Sphere had achieved global recognition as an architectural and technological marvel. With sold-out shows, immersive experiences like Postcard from Earth, and new sponsorship deals, annual revenue surpassed $1 billion, while corporate valuation increased to over $2 billion.

Companies Owned by Sphere

As of 2025, Sphere Entertainment Co. has evolved into a vertically integrated entertainment ecosystem combining venue operations, media production, technology innovation, and immersive storytelling. Its core assets — including Sphere Las Vegas, Sphere Studios, and MSG Networks — operate synergistically to create, distribute, and monetize cutting-edge entertainment.

Below are the companies owned by Sphere Entertainment Co. (the parent company of the Sphere in Las Vegas):

Sphere Las Vegas

The Sphere Las Vegas is the company’s flagship asset and the world’s most advanced entertainment venue. Opened in September 2023, the Sphere represents the core of Sphere Entertainment Co.’s identity. It stands 366 feet tall and 516 feet wide, featuring a 16K-resolution wraparound LED interior display, 4D motion seating, and an exterior surface known as the Exosphere, which serves as a dynamic digital billboard visible across the Las Vegas skyline.

The venue hosts concerts, residencies, immersive films, and branded experiences, blending art, architecture, and technology. Productions like U2: UV Achtung Baby Live at Sphere and Postcard from Earth established it as a benchmark for large-scale immersive experiences. Beyond live events, the Sphere generates revenue from advertising on the Exosphere, premium partnerships with global brands, and exclusive broadcast events. It is both a showcase of technology and a major revenue driver for the company.

Sphere Studios

Sphere Studios serves as the creative and technological hub of Sphere Entertainment Co. It was established to produce original immersive content for the Sphere Las Vegas and future venues. The studio develops advanced cinematic experiences using proprietary technologies, including the world’s first ultra-high-resolution 18K camera system known as the Big Sky Camera.

Located in Burbank, California, Sphere Studios oversees all production and visual development for immersive content. It is responsible for creating Sphere-exclusive shows such as Postcard from Earth and collaborates with artists, filmmakers, and brands to design visuals that can be displayed on the massive 160,000-square-foot LED interior. By combining storytelling, motion capture, AI-based imagery, and spatial sound engineering, Sphere Studios ensures that the venue remains technologically ahead of traditional theaters and concert arenas.

MSG Networks

MSG Networks is a regional sports and entertainment network owned and operated by Sphere Entertainment Co. The network includes MSG Network and MSG SportsNet, which broadcast live sports, original programs, and special events across the northeastern United States. It covers professional teams such as the New York Knicks (NBA) and New York Rangers (NHL), among others.

Although MSG Networks operates separately from Madison Square Garden Sports, it remains a key asset under Sphere Entertainment’s portfolio following the 2023 corporate restructuring. The network continues to generate significant advertising and affiliate revenue, supported by its loyal regional viewership and sports media rights. It also plays a strategic role in expanding Sphere’s media presence by broadcasting Sphere-related content, behind-the-scenes features, and exclusive immersive event promotions.

Sphere Experiences

Sphere Experiences is the in-house brand responsible for curating and managing the immersive film and visual content shown at the Sphere venues. It was developed to create proprietary “Sphere-only” experiences, blending cinematic storytelling with live technology. The first such production, Postcard from Earth, directed by Darren Aronofsky, became a global phenomenon and helped define the Sphere’s distinct entertainment category.

In 2025, Sphere Experiences expanded its programming lineup with new immersive visual journeys and partnerships with leading film studios and music artists. Each experience combines ultra-high-definition visuals, environmental effects, scent diffusion, and synchronized motion seating, creating multi-sensory storytelling on an unprecedented scale.

Exosphere Advertising Division

The Exosphere Advertising Division manages the marketing, sponsorship, and brand activation side of Sphere’s massive LED exterior. The Exosphere has become one of the most valuable advertising platforms in the world, displaying real-time campaigns and artistic visuals visible across Las Vegas.

Global brands like Google, YouTube, and Pepsi have launched high-profile campaigns on the Exosphere, turning it into a digital landmark. The division handles client partnerships, scheduling, and content integration, ensuring both artistic quality and commercial visibility. In 2025, the division began expanding digital advertising operations, exploring dynamic real-time displays and interactive brand integrations.

Sphere Studios Technology Group

The Sphere Studios Technology Group operates as the research and development arm within Sphere Studios, focusing on proprietary imaging, sound, and display systems. This division has developed multiple innovations, including advanced curved LED architecture, motion synchronization technology, and immersive sound environments powered by beamforming acoustics.

Its technology has been licensed to other entertainment companies and event spaces worldwide, creating an additional revenue stream for Sphere Entertainment. In 2025, the group announced new projects in AI-based content creation and holographic visual display systems intended for future Sphere venues.

Future Sphere Projects

Sphere Entertainment is actively working on expanding its venue network through Future Sphere Projects, a division responsible for global development and site exploration. As of 2025, plans for new Sphere venues are being evaluated in cities such as London, Abu Dhabi, and Tokyo. These projects aim to replicate the Las Vegas model at smaller scales while maintaining the immersive design and advanced technology of the original.

Future Sphere Projects focuses on creating a portfolio of scalable venues that can host concerts, digital events, esports, and cinematic experiences. Each proposed venue would use Sphere Studios’ proprietary systems, ensuring brand and experience consistency across locations.

Sphere Productions

Sphere Productions handles live event management, artist collaborations, and large-scale productions within the Sphere. It oversees coordination between performers, visual teams, and technical departments to bring immersive concerts and experiences to life.

The division also works closely with Sphere Studios to integrate live performances with digital environments, using synchronized LED backdrops and advanced projection mapping. In 2025, Sphere Productions began developing partnerships with major entertainment agencies to bring globally recognized artists into long-term Sphere residencies.

Sphere Data & Analytics

Sphere Data & Analytics is a newer division established in 2024 to analyze audience engagement, ticketing trends, and sensory experience data. Using advanced AI and machine learning, this division helps optimize event programming, pricing, and in-venue experiences.

Its findings are used to refine content design and improve operational efficiency across future Sphere locations. The division also supports corporate clients using the Sphere for branded events by providing analytics on audience reaction and interaction metrics.

Final Words

The Sphere in Las Vegas stands as a groundbreaking achievement in modern entertainment. Owned by Sphere Entertainment Co., the venue represents a new generation of live experiences where technology and creativity merge. The Sphere has redefined what an entertainment space can be, setting a new global standard for innovation and design. The answer to who owns the Sphere in Las Vegas reflects more than ownership — it reveals the vision of a company determined to transform how the world experiences performance, art, and technology.

FAQs

Who is the owner of the Sphere Las Vegas?

The Sphere in Las Vegas is owned by Sphere Entertainment Co., a publicly traded entertainment and media company listed on the New York Stock Exchange (NYSE: SPHR). The company is controlled by the Dolan family, who hold about 14–15% of total shares but retain over 70% of voting control through Class B shares.

Where is the Sphere located?

The Sphere Las Vegas is located at 255 Sands Avenue, Paradise, Nevada, adjacent to The Venetian Resort on the Las Vegas Strip. It is connected to The Venetian by a pedestrian walkway, making it easily accessible from the hotel and nearby casinos.

Who built the Las Vegas Sphere?

The Las Vegas Sphere was developed and built by Sphere Entertainment Co. in partnership with Populous, a world-renowned architecture firm specializing in large-scale venues. Construction began in 2019 and was completed in 2023. Key engineering and construction partners included AECOM, Severud Associates, and Madison Square Garden Entertainment Corp. before the company’s 2023 spin-off into Sphere Entertainment.

How much is U2 being paid for Sphere?

The band U2 reportedly earned around $10 million to $12 million per show residency deal, including revenue share from ticket sales and Sphere-branded merchandise. Their groundbreaking residency, U2: UV Achtung Baby Live at Sphere, was part of the Sphere’s 2023 grand opening series and marked one of the most lucrative live residencies in Las Vegas history.

Which hotel owns The Sphere in Las Vegas?

No hotel owns the Sphere. It is independently owned and operated by Sphere Entertainment Co., though it is built on land owned by Las Vegas Sands Corporation, the parent company of The Venetian Resort. The Venetian serves as the Sphere’s hospitality and accommodation partner but does not hold ownership in the venue.

How much of The Sphere does James Dolan own?

James L. Dolan, the CEO and Executive Chairman of Sphere Entertainment Co., personally owns a significant portion of the company through the Dolan family’s approximately 14–15% equity stake. However, because of the company’s dual-class share structure, Dolan and his family control over 70% of the company’s total voting power, giving them majority control of the Sphere’s operations and strategy.

How much did The Sphere Las Vegas cost?

The Sphere Las Vegas cost an estimated $2.3 billion to design and build, making it the most expensive entertainment venue ever constructed. The cost includes its advanced 16K interior LED display, motion seating, acoustic systems, and the massive 1.2 million LED-puck Exosphere exterior.

How much are tickets to the Sphere?

Ticket prices for the Sphere in Las Vegas vary depending on the event. Standard tickets for immersive shows like Postcard from Earth typically range from $79 to $249, while concert residencies and premium events can cost anywhere from $150 to over $500 per ticket. VIP and experiential packages, which include exclusive seating and behind-the-scenes access, are often priced higher.