- Stanley 1913 is fully owned by PMI Worldwide Brands (Pacific Market International), a privately held company, meaning there are no public shareholders or stock market ownership.

- The parent company holds complete financial and strategic control over Stanley 1913, including brand direction, product development, and global expansion.

- Ownership is concentrated within private stakeholders and company leadership, allowing long-term decision-making without pressure from public investors.

Stanley 1913 is an American drinkware brand specializing in insulated bottles, tumblers, mugs, food jars, and hydration products. The brand is known for steel vacuum insulation, high durability, and long temperature retention. Its products are designed for everyday use, outdoor activities, travel, and professional environments. Stanley focuses on reusable drinkware and long product life. The brand operates globally and distributes through retail stores, online platforms, and outdoor equipment channels.

Stanley’s core product philosophy is simple. Build strong. Make it last. Keep liquids hot or cold for long hours. The brand is widely recognized for rugged construction, minimal mechanical failure, and practical design. Its product lines include Classic, Adventure, Quencher, and IceFlow. These serve both heavy-duty and lifestyle users.

Stanley 1913 Founder

Stanley 1913 was founded by William Stanley Jr. in 1913. He was an American inventor, electrical engineer, and physicist. Before creating the Stanley bottle, he made major contributions to electrical engineering. He helped develop transformer-based power distribution systems. His work influenced early electric grid technology in the United States.

William Stanley Jr. applied scientific thinking to everyday problems. He wanted a strong container that could safely hold hot liquids without breaking. At the time, insulated bottles used fragile glass liners. These broke easily and were not practical for heavy use. Stanley solved this problem by permanently fusing vacuum insulation with steel. This created the first all-steel vacuum bottle. It was stronger, safer, and more reliable.

The Original Invention

The steel vacuum bottle changed portable drinkware. It kept beverages hot or cold for long hours. It did not crack under pressure or impact. This made it useful for workers, soldiers, travelers, and outdoor users. The invention quickly gained popularity. Stanley bottles became known for toughness and reliability.

The design principle has remained consistent. Use strong materials. Maintain temperature. Ensure long-term durability. Even modern Stanley products follow the same engineering foundation created in 1913.

Brand Evolution

Stanley started as a utility-focused brand used by industrial workers and outdoor professionals. Over time, the brand expanded into lifestyle drinkware. Today, Stanley products are used in offices, gyms, homes, schools, and on travel. The brand now combines rugged performance with modern design and color options.

Despite modernization, the core identity remains unchanged. Stanley products are built for long-term use. The company emphasizes durability testing, user convenience, and practical design. This engineering-driven approach continues to define Stanley more than a century after its founding.

Ownership History

Stanley 1913 is owned by PMI Worldwide Brands, a privately held global drinkware company. The brand has changed hands over time, moving from founder-led ownership to corporate management and finally becoming part of PMI. This transition helped Stanley evolve from a traditional utility thermos maker into a global lifestyle drinkware brand while maintaining its legacy of durability and vacuum insulation.

Early Independent Years (1913–Mid 20th Century)

Stanley 1913 was founded by William Stanley Jr. in 1913 as an independent company built around his steel vacuum insulation invention. During this period, the company focused almost entirely on manufacturing strong, temperature-retaining bottles. The products were widely used by railway workers, factory employees, construction crews, and military personnel. The brand became associated with endurance, reliability, and heavy-duty performance.

Ownership remained internal during these early decades. The company operated with a manufacturing-first mindset. Product quality and durability were prioritized over rapid expansion. Stanley bottles gained long-term trust because they rarely failed in harsh conditions. This reputation became the foundation of the brand’s long-lasting market presence.

Post-Founder Corporate Continuity

After the death of William Stanley Jr., the company continued under professional management. Leadership focused on maintaining the original product standard rather than major innovation. The brand expanded gradually into consumer markets while still serving industrial and outdoor users.

During this phase, Stanley strengthened its manufacturing processes and distribution networks. Its products became widely available in North America through hardware stores, industrial suppliers, and outdoor equipment retailers. The company remained known for traditional thermos bottles, rugged mugs, and food containers. Ownership during this time stayed within corporate structures rather than individual founders.

Integration Into Larger Business Structures

As the global consumer goods sector consolidated, Stanley moved into broader corporate ownership frameworks. This was common for legacy manufacturing brands seeking scale and distribution strength. The company benefited from improved production capacity, supply chain access, and wider retail presence.

However, brand identity during this stage remained conservative. Stanley focused mainly on functional drinkware rather than design or lifestyle positioning. The brand retained strong loyalty among workers, campers, and outdoor users but had limited appeal in modern consumer segments.

Acquisition by Pacific Market International (PMI)

A major transformation began when Pacific Market International (PMI) acquired Stanley 1913. PMI specializes in insulated drinkware and hydration solutions. After the acquisition, Stanley became the flagship brand within PMI’s global portfolio.

PMI invested heavily in product innovation, brand redesign, and global expansion. Stanley shifted from a traditional outdoor thermos brand to a broader hydration and lifestyle brand. New product categories were introduced. Design aesthetics improved. The company began focusing on everyday users, commuters, and younger consumers alongside its traditional base.

PMI also strengthened manufacturing systems, global sourcing, and retail partnerships. Stanley products became more visible across supermarkets, online platforms, and lifestyle retailers. This marked the beginning of Stanley’s modern growth phase.

Brand Reinvention and Global Expansion

Under PMI ownership, Stanley entered a period of strong transformation. The company modernized product lines while preserving its durability-focused heritage. Collections such as Classic, Adventure, Quencher, and IceFlow expanded the brand’s reach across multiple customer segments.

Marketing shifted toward community engagement and consumer culture. Stanley products became widely used in daily routines, travel, fitness, and home use. The company improved product ergonomics, color variety, and usability while maintaining long temperature retention and rugged build quality.

Global distribution expanded significantly. Stanley products reached markets across Europe, Asia, and other regions. Supply chain integration allowed faster product rollout and broader retail availability. This phase positioned Stanley as both a performance and lifestyle brand.

Current Ownership Structure

Today, Stanley 1913 is fully owned by PMI Worldwide Brands, a privately held company. There are no public shareholders. Ownership remains concentrated among private stakeholders and corporate leadership.

This private ownership model allows long-term strategic planning. PMI focuses on brand building, product innovation, and global market expansion without short-term market pressure. Stanley continues to grow as the most important brand within PMI’s portfolio while maintaining its century-old identity rooted in durability, engineering, and vacuum insulation technology.

Who Owns Stanley 1913?

Stanley 1913 is owned by PMI Worldwide Brands (Pacific Market International), a privately held drinkware company headquartered in Seattle, United States. Stanley operates as a wholly owned flagship brand under PMI. The parent company controls strategy, product development, manufacturing partnerships, global expansion, and brand positioning.

Parent Company: PMI Worldwide Brands

PMI Worldwide Brands (Pacific Market International) is the parent company of Stanley 1913. It was founded in 1983 by Hamish Maxwell and is headquartered in Seattle, United States. PMI is a privately held consumer goods company focused on insulated drinkware, hydration products, and reusable food containers.

As of February 2026, Stanley 1913 is PMI’s flagship and most important brand. The company also owns Aladdin and Migo, but Stanley drives most of PMI’s global growth and brand recognition. PMI operates in more than 50 countries through retail, wholesale, and e-commerce channels. The company manages product design, engineering, global supply chain, and brand strategy from its U.S. headquarters.

Scott Henderson serves as CEO (as of 2025–2026). He oversees global operations and long-term growth. Stanley brand President Terence Reilly leads brand strategy and market expansion. PMI focuses on durability engineering, reusable products, and long product life. As a private company, it does not disclose financials or ownership details publicly. Stanley remains the core driver of PMI’s global drinkware business.

Acquisition of Stanley 1913

Stanley 1913 was acquired by PMI Worldwide Brands in 2002 from its previous corporate ownership, connected to the legacy Stanley-branded business structure. After the sale, the drinkware brand became fully independent from the industrial tools business.

The exact acquisition price was not publicly disclosed because PMI is a private company and the transaction was structured privately. However, industry reports at the time indicated the deal was a strategic brand acquisition rather than a large-scale industrial transaction. The value was primarily based on brand heritage, product patents, and global distribution potential rather than revenue scale.

Strategic Purpose of the Acquisition

The 2002 acquisition was a turning point for Stanley. Before the deal, Stanley was mainly known for its classic green steel thermos used by workers, military personnel, and outdoor users. Product innovation had slowed. The brand was strong but narrow in market reach.

PMI acquired Stanley with a long-term repositioning strategy. The goal was to transform Stanley from a legacy industrial thermos brand into a modern global drinkware brand. PMI focused on three major changes:

Product diversification. Stanley expanded beyond traditional vacuum bottles into mugs, hydration bottles, food jars, and modern insulated drinkware.

Design modernization. PMI refreshed product ergonomics, lid systems, materials, and finish options while preserving durability.

Global expansion. Stanley products moved beyond hardware and outdoor stores into mainstream retail, lifestyle stores, and international markets.

Post-Acquisition Growth and Brand Reinvention

From 2002 onward, PMI gradually rebuilt Stanley’s product portfolio and market positioning. Manufacturing partnerships were expanded globally to improve efficiency and quality control. Distribution widened into large retailers and global e-commerce channels.

In the 2010s and early 2020s, Stanley entered a new growth phase. The brand shifted into lifestyle hydration. Modern product lines such as Quencher, IceFlow, and expanded Adventure collections were introduced. These products targeted everyday users, commuters, and younger consumers while maintaining the brand’s rugged heritage.

The transformation significantly increased Stanley’s global presence and cultural relevance. The brand moved from a niche outdoor identity to mainstream consumer adoption without losing its durability-focused reputation.

Ownership Structure Today

PMI Worldwide Brands remains privately owned. Stanley 1913 is not a public company and has no public shareholders. The brand operates as a fully controlled internal division of PMI. Ownership is concentrated among private stakeholders and the senior leadership of the parent company.

Because PMI is private, it does not disclose equity distribution, valuation, or internal ownership percentages. However, Stanley remains the central brand driving the company’s global growth and long-term strategy.

Stanley 1913 is the most strategically important asset within PMI Worldwide Brands. The brand shapes PMI’s global market identity and product innovation roadmap. Stanley’s expansion into lifestyle drinkware and hydration significantly strengthened PMI’s competitive position in the global drinkware market.

The acquisition in 2002 laid the foundation for Stanley’s modern success. Under PMI, the brand evolved from a traditional industrial thermos maker into one of the most recognized drinkware brands worldwide.

Competitor Ownership Comparison

Stanley 1913 operates in the global insulated drinkware and hydration market. Its biggest competitors include Yeti, Hydro Flask, Contigo, and Thermos. Each brand has a different ownership model. These structures influence strategy, innovation speed, and market positioning.

| Brand | Parent Company / Owner | Ownership Type | Strategic Focus | Key Impact on Competition |

|---|---|---|---|---|

| Stanley 1913 | PMI Worldwide Brands (Pacific Market International) | Private | Premium insulated drinkware and lifestyle hydration | Long-term strategy, fast decisions, strong brand focus |

| Yeti | YETI Holdings, Inc. | Public | Premium outdoor and lifestyle gear | Must meet investor expectations, strong capital access |

| Hydro Flask | Helen of Troy Limited | Public | Lifestyle hydration and consumer products | Strategy aligned with broader corporate portfolio |

| Contigo | Newell Brands | Public | Mass-market drinkware and household products | Large-scale distribution, diversified brand focus |

| Thermos | Thermos L.L.C. (under Nippon Sanso Holdings) | Private (subsidiary) | Traditional insulated containers and global distribution | Legacy brand strength, slower lifestyle repositioning |

Yeti Ownership Structure

Yeti is owned by YETI Holdings, Inc., a publicly traded company listed on the New York Stock Exchange. Ownership is spread across institutional investors, mutual funds, and retail shareholders. Major institutional holders include large asset management firms that control significant voting power.

Because Yeti is public, it must report quarterly earnings, financial performance, and shareholder updates. Strategic decisions are influenced by market expectations and investor pressure. This differs from Stanley, which operates under private ownership and focuses on long-term brand strategy without public reporting requirements.

Hydro Flask Ownership Structure

Hydro Flask is owned by Helen of Troy Limited, a publicly traded consumer products company. Helen of Troy manages a portfolio of lifestyle and household brands across health, beauty, and home categories. Hydro Flask operates as a brand division within this larger corporate structure.

Under public ownership, Hydro Flask follows a corporate level strategy set by Helen of Troy. Investment decisions, expansion, and product development align with broader portfolio goals. In contrast, Stanley receives highly focused attention from PMI because it is the flagship brand of a smaller, brand-centered company.

Contigo Ownership Structure

Contigo is owned by Newell Brands, a large publicly traded consumer goods corporation. Newell owns many household and lifestyle brands across writing instruments, kitchenware, baby products, and appliances. Contigo operates as one brand among many within Newell’s diversified portfolio.

Because of this structure, Contigo competes in a mass-market segment with broad distribution and large-scale production. Strategic focus is spread across multiple brands, unlike Stanley, where PMI concentrates heavily on drinkware and hydration innovation.

Thermos Ownership Structure

Thermos is owned by Thermos L.L.C., which operates under the Japanese corporation Taiyo Nippon Sanso (part of Nippon Sanso Holdings). Thermos remains privately controlled within a large industrial gas and technology group. The brand focuses heavily on traditional insulated containers and global distribution.

Compared to Stanley, Thermos has a longer legacy but has been slower in lifestyle repositioning and modern consumer branding. Stanley, under PMI, has moved more aggressively into design-led hydration and cultural branding.

Private vs Public Ownership Impact

Stanley 1913 stands out because it is owned by a private company, PMI Worldwide Brands. Most of its major competitors operate under publicly traded corporations. Private ownership gives Stanley several strategic advantages.

PMI can invest in long-term brand building without pressure from quarterly earnings. Product innovation cycles can be longer and more experimental. Decision making is faster because there are no external shareholders. This flexibility helped Stanley transition from a traditional thermos brand into a global lifestyle drinkware leader.

Public competitors benefit from larger capital access and scale. However, they must balance shareholder expectations, which can slow strategic shifts. Stanley’s private structure allows deeper brand focus and faster market adaptation.

Who Controls Stanley 1913?

Stanley 1913 is controlled by its parent company, PMI Worldwide Brands (Pacific Market International). The brand does not function as an independent public corporation. All major strategic, operational, and financial decisions are directed by PMI’s executive leadership. Control covers brand positioning, product engineering, manufacturing strategy, global expansion, and long-term growth planning.

Parent Company Authority

PMI Worldwide Brands holds full ownership and ultimate authority over Stanley 1913. The brand operates as a core internal division rather than a separate listed entity. This means PMI leadership approves major investments, product roadmap decisions, global expansion plans, and brand direction.

PMI manages centralized control from its headquarters in Seattle, United States. Key functions under this authority include product engineering, durability and thermal performance testing, global sourcing, supply chain management, sustainability strategy, and international distribution. This centralized governance ensures Stanley maintains consistent product quality, brand identity, and global market positioning.

Because PMI is privately owned, it is not required to answer to public shareholders. This allows the company to prioritize long-term brand building, product durability, and innovation rather than short-term financial targets.

CEO and Executive Leadership

The Chief Executive Officer of PMI Worldwide Brands is Scott Henderson (as of 2025–2026). He oversees global corporate strategy, operations, product innovation direction, and international growth. His leadership focuses on strengthening Stanley’s global dominance in insulated drinkware and lifestyle hydration while preserving its durability-driven heritage.

Terence Reilly serves as President of the Stanley brand. He leads brand strategy, product positioning, marketing execution, and consumer growth. His role includes expanding Stanley into lifestyle hydration, strengthening retail and global market presence, and maintaining the brand’s premium positioning. Under this leadership structure, Stanley’s product innovation and global influence have significantly expanded.

The executive leadership team collectively controls major decisions involving new product categories, manufacturing strategy, international expansion, and long-term brand direction.

Corporate Decision-Making Structure

Stanley operates within PMI’s structured corporate governance model. Decision-making authority flows from the executive level into specialized operational divisions. Each division manages a core business function while aligning with overall corporate strategy.

Product and engineering teams handle materials research, durability testing, insulation performance, and product lifecycle design. Marketing and brand strategy teams control positioning, consumer engagement, and global brand consistency. Supply chain and operations divisions manage manufacturing partnerships, sourcing networks, logistics, and quality assurance.

Major strategic moves such as entering new markets, launching new product platforms, or scaling production require executive-level approval. This structured approach ensures operational efficiency while maintaining tight brand and quality control.

Control Through Private Ownership

Stanley’s control structure is strongly shaped by PMI’s private ownership. There are no public shareholders, activist investors, or quarterly market pressures influencing decisions. Ownership and control remain concentrated within PMI leadership and private stakeholders.

This allows long-term investment in product durability, sustainability, and brand development. It also enables faster execution of strategic initiatives compared to publicly traded competitors. The private ownership model gives Stanley stability, strategic flexibility, and consistent leadership direction, which continue to support its global growth and brand strength.

Stanley 1913 Annual Revenue and Net Worth

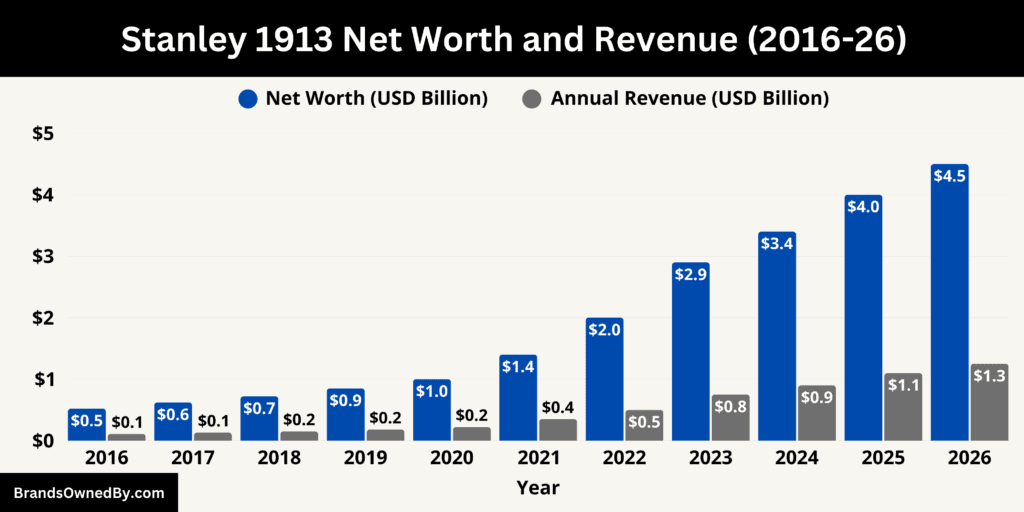

Stanley 1913 has entered a high-growth phase driven by global demand for premium insulated drinkware. As of February 2026, the brand generates an estimated $1.25 billion in annual revenue and carries an estimated business value of about $4.5 billion. Strong product demand, premium pricing, and expanding international reach continue to strengthen both revenue and brand valuation.

2026 Revenue Performance

In 2026, Stanley 1913’s estimated annual revenue reached approximately $1.25 billion, reflecting continued momentum from the brand’s global expansion and strong consumer demand. The Quencher tumbler line remains the largest contributor, accounting for nearly half of total sales. IceFlow hydration bottles and Classic insulated products also contribute significantly, supported by strong repeat purchase behavior and brand loyalty.

North America remains the dominant market, generating about $810 million, which represents roughly 65% of total revenue. Europe contributes close to $225 million, driven by expanding retail partnerships and lifestyle adoption. Asia-Pacific and other international markets together generate approximately $215 million, supported by growing demand for premium reusable drinkware and expanding online distribution.

Retail distribution continues to generate the majority of revenue, contributing about 72% of total sales through large retailers, lifestyle chains, and outdoor equipment stores. Direct-to-consumer e-commerce generates approximately $310 million, or nearly 25% of total revenue, reflecting strong digital demand and higher margins. The remaining share comes from wholesale and institutional channels.

Revenue Composition by Product Category

Insulated drinkware dominates Stanley’s revenue structure. Tumblers and hydration bottles generate approximately $900 million, representing about 72% of total revenue. Traditional vacuum bottles and thermos products contribute around $175 million. Food jars, coolers, and accessories together generate roughly $175 million.

Premium pricing and limited-edition product releases continue to support revenue growth. Stanley’s durable product design leads to strong brand loyalty, repeat purchasing, and high consumer retention. Seasonal product drops and color variants also contribute to steady demand cycles throughout the year.

Net Worth and Brand Valuation in 2026

Stanley 1913’s estimated brand and business valuation as of February 2026 stands at approximately $4.5 billion. This valuation reflects strong brand equity, global recognition, and consistent revenue growth over the past decade. The brand’s dominant role within PMI Worldwide Brands significantly contributes to the parent company’s overall market value.

Stanley’s valuation is driven by multiple factors. These include premium positioning, strong pricing power, global distribution strength, and cultural brand influence. High consumer engagement and long product lifecycle also enhance intangible brand value. The company’s transition into lifestyle hydration has further strengthened long-term valuation prospects.

Long-Term Growth Trend (2016–2026)

Stanley’s financial trajectory shows sustained and accelerating growth. Annual revenue increased from approximately $110 million in 2016 to $1.25 billion in 2026. The sharpest growth occurred after 2020, when global demand for reusable hydration products increased and Stanley expanded into lifestyle drinkware. Strong product innovation, retail expansion, and global brand positioning played key roles in this transformation.

Brand valuation followed the same upward trajectory. Increasing global recognition, strong consumer loyalty, and rapid revenue expansion significantly boosted Stanley’s estimated business worth over the decade.

Future Revenue Forecast (2027–2030)

Based on current growth trajectory, market expansion, and product demand trends, Stanley 1913 is expected to continue expanding over the next several years:

- 2027: Estimated revenue $1.48 billion, supported by continued global expansion and strong hydration product demand

- 2028: Estimated revenue $1.72 billion, driven by international market growth and expanded product ecosystem

- 2029: Estimated revenue $1.95 billion, supported by broader distribution and increased direct-to-consumer sales

- 2030: Estimated revenue $2.20 billion, reflecting long-term brand scaling, product diversification, and global penetration.

Future growth is expected to come from deeper international expansion, continued premium product positioning, stronger digital sales channels, and sustained demand for reusable hydration products. Stanley’s strong brand equity and global market presence position it for continued long-term revenue and valuation growth.

Brands Owned by Stanley 1913

Stanley 1913 develops and manages product platforms, internal brand ecosystems, and commercial programs under the Stanley name. As of 2026, it operates several major internal product brands, platforms, and commercial entities that function as core business pillars.

| Brand / Entity | Type | Core Focus | Key Products / Functions | Strategic Role |

|---|---|---|---|---|

| Stanley Quencher | Product Platform | Everyday lifestyle hydration | High-capacity insulated tumblers, seasonal editions, limited releases | Primary revenue driver and global growth engine |

| Stanley IceFlow | Product Platform | Performance and active hydration | Flip-straw bottles, insulated hydration systems, leak-resistant tumblers | Expands presence in sports, fitness, and daily hydration |

| Stanley Classic Series | Heritage Product Platform | Traditional insulated drinkware | Steel vacuum bottles, rugged mugs, insulated food jars | Maintains legacy identity and durability-focused customer base |

| Stanley Adventure Series | Outdoor Product Platform | Travel and outdoor hydration | Compact bottles, stackable mugs, outdoor cookware, portable drinkware | Strengthens position in outdoor and travel markets |

| Stanley Food & Storage Systems | Product Segment | Temperature-controlled food transport | Insulated food jars, storage containers, portable meal solutions | Expands ecosystem beyond drinkware into food storage |

| Stanley Global Commercial Operations | Internal Operating Entity | Global product development and distribution | Engineering, durability testing, supply chain, manufacturing coordination | Supports global production, quality control, and brand expansion |

| Stanley Limited Editions & Collaborations | Commercial Program | Brand engagement and premium positioning | Special releases, co-branded collections, seasonal color variants | Drives consumer demand, brand visibility, and premium pricing |

Stanley Quencher

Stanley Quencher is the most commercially successful product platform within Stanley 1913. It has become the company’s primary revenue driver and global growth engine. The Quencher line focuses on high-capacity insulated tumblers designed for everyday hydration. These products are widely used across home, office, travel, and fitness environments.

The Quencher platform operates like a standalone commercial ecosystem within Stanley. It includes multiple size variants, seasonal editions, limited-release color collections, and collaborative drops. The platform generates a significant portion of Stanley’s annual revenue and has played a central role in transforming the brand into a global lifestyle hydration leader.

Stanley IceFlow

Stanley IceFlow is a performance-focused hydration platform designed for active and fitness-oriented consumers. It includes insulated bottles, flip-straw tumblers, and leak-resistant hydration systems. The IceFlow line targets sports, gym, commuting, and outdoor performance use.

This platform strengthened Stanley’s presence in the modern hydration market. It introduced ergonomic designs, lightweight durability, and improved lid technology. IceFlow expanded Stanley’s reach beyond traditional vacuum bottles into high-frequency daily hydration use.

Stanley Classic Series

The Stanley Classic Series represents the company’s original heritage product platform. It includes traditional vacuum bottles, rugged mugs, and food jars based on the original steel vacuum insulation technology invented in 1913. This line remains strongly associated with durability, outdoor use, and long-term performance.

The Classic platform continues to serve industrial workers, outdoor professionals, and long-time brand loyalists. It reinforces Stanley’s legacy identity and maintains a stable portion of annual revenue. The design philosophy emphasizes strength, simplicity, and long product life.

Stanley Adventure Series

The Stanley Adventure Series focuses on outdoor and travel-ready drinkware and food storage. It includes compact bottles, stackable mugs, cookware, and outdoor hydration systems. This platform targets campers, hikers, travelers, and outdoor lifestyle users.

The Adventure platform supports Stanley’s position in the outdoor recreation market. It blends portability with durability and maintains the brand’s rugged performance reputation while appealing to modern outdoor consumers.

Stanley Food & Storage Systems

Stanley also operates a specialized product segment focused on insulated food jars, storage containers, and portable meal solutions. These products are designed for temperature retention, durability, and transport convenience. They are widely used in travel, work environments, and outdoor settings.

This segment supports Stanley’s broader hydration and temperature-control ecosystem. It complements drinkware by expanding into food transport and long-duration storage solutions.

Stanley Global Commercial Operations

Stanley 1913 operates a fully integrated global commercial structure. This includes product engineering, durability testing, manufacturing coordination, global sourcing, and international distribution. These operations function as internal business entities rather than separate companies.

Stanley manages product design, quality assurance, and thermal performance engineering through centralized development teams. The company operates across North America, Europe, and Asia through retail, e-commerce, and wholesale channels. This global operational infrastructure supports large-scale production and worldwide brand presence.

Stanley Brand Collaborations and Limited Platforms

Stanley also runs limited-edition collaboration programs and seasonal product platforms. These include special releases, co-branded product drops, and exclusive color collections. While not separate companies, these programs function as high-impact commercial entities within the Stanley ecosystem. They drive consumer engagement, brand visibility, and premium pricing strength.

Conclusion

Stanley 1913 remains a privately controlled global drinkware brand operated by PMI Worldwide Brands. The structure behind who owns Stanley 1913 allows the company to stay focused on durability, product engineering, and steady brand evolution. Its long-standing reputation, consistent product philosophy, and strong consumer trust continue to define the brand. Stanley 1913 stands as a rare example of a century-old product company that has stayed relevant while preserving its original purpose and identity.

FAQs

Who is Stanley 1913 owned by?

Stanley 1913 is owned by PMI Worldwide Brands (Pacific Market International), a privately held global drinkware company. The brand operates as a wholly owned flagship division under PMI, with no public shareholders.

Who legally owns the Stanley Cup?

The Stanley Cup trophy is legally owned by the National Hockey League (NHL). It is awarded annually to the NHL playoff champion and is not connected to Stanley 1913, the drinkware brand.

Where is Stanley 1913 headquarters?

Stanley 1913 operates under its parent company PMI Worldwide Brands, which is headquartered in Seattle, Washington, United States.

Are Yeti and Stanley the same company?

No, Yeti and Stanley are separate companies. Stanley 1913 is owned by PMI Worldwide Brands, while Yeti operates as a publicly traded company under YETI Holdings, Inc.

Who is the CEO of Stanley?

Stanley 1913 does not operate as a separate corporation with its own CEO. It is controlled by PMI Worldwide Brands. Scott Henderson serves as CEO of PMI (as of 2026), overseeing Stanley and the company’s global operations.

Is Stanley a British brand?

No, Stanley 1913 is not a British brand. It is an American brand founded in the United States in 1913.

Is Stanley a Japanese brand?

No, Stanley 1913 is not a Japanese brand. It is an American drinkware brand owned by a U.S.-based parent company, PMI Worldwide Brands.