Squarespace is a leading platform for building websites, online stores, and personal brands. But who owns Squarespace today? Understanding its ownership reveals how the company operates, earns, and evolves in a fast-paced digital world.

Squarespace Company Profile

Squarespace is a cloud-based website builder and hosting platform. It enables users to design and manage professional sites, e-commerce stores, domains, marketing tools, and more—all without coding. By early 2025, Squarespace serves millions of entrepreneurs, creatives, and small businesses globally, holding about 7% of the top one million hosted websites.

Company Details

Founded in 2003 (or early 2004) by Anthony Casalena in his University of Maryland dorm, Squarespace began as a blog-hosting service. It raised $30,000 in initial funding from family, university grants, and early adopters. Headquartered in New York City, the company has grown to approximately 1,749 employees and operates offices worldwide.

Squarespace has transformed into a full SaaS platform offering templates, domains, e-commerce, email campaigns, scheduling, member areas, logo creation, and content design apps like Unfold.

Founders

Anthony Casalena is the sole founder and current CEO. He built the initial platform solo, serving as developer, marketer, designer, and support for years. Casalena continues to lead with majority voting control and retains a significant equity stake after taking the company private.

Major Milestones

- 2003–2004: Built in a dorm room; launched publicly with $30K seed capital

- 2006–2007: Surpassed $1 million in annual revenue; hired first employees

- 2010: Raised $38.5 M Series A led by Accel and Index Ventures

- 2014-2015: Secured $40 M from General Atlantic; hit $100 M revenue and ~550 employees

- 2014–2018: Launched major UI redesign (Version 7), drag-and-drop tools, domain sales, e-commerce, analytics, PayPal, and mobile; ran Super Bowl ads, NBA sponsorships (Knicks)

- 2019–2021: Acquired Acuity Scheduling, Unfold, and Tock; expanded into mobile apps and hospitality

- 2021: Listed on NYSE via direct listing (ticker SQSP); raised $300 M in private growth funding at $10 B valuation

- 2023: Acquired Google Domains assets (~10 M domains)

- 2024: Taken private in a ~$6.9 B deal by Permira; Casalena retained CEO position and rolled over majority stake

- 2025: Launched AI-driven SEO features and an expanded Extensions Marketplace for services like SEOSpace and TinyIMG.

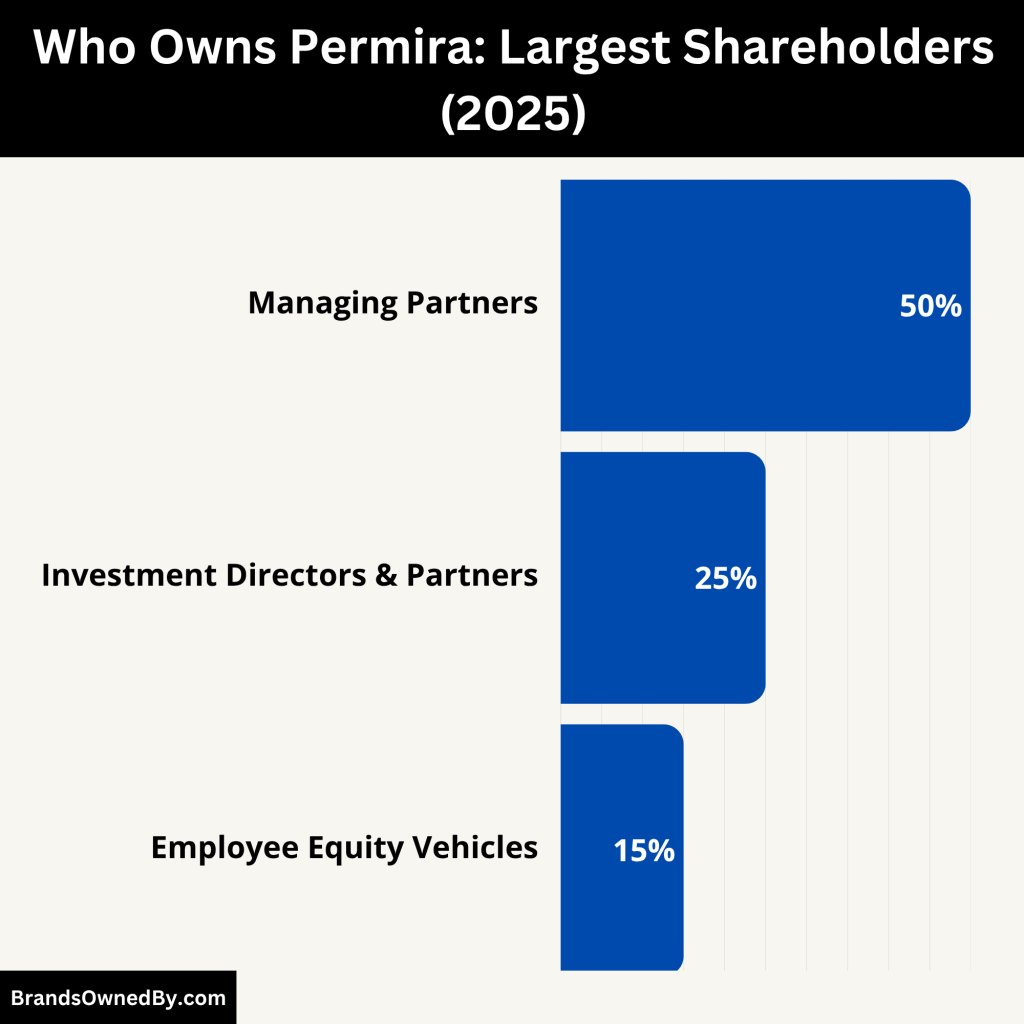

Who Owns Squarespace in 2025?

Squarespace is no longer a publicly traded company. In mid-2024, it was taken private through an all-cash acquisition by Permira, a global private equity firm. The deal was valued at $6.9 billion, making it one of the most notable tech privatizations of the year.

Parent Company: Permira

Permira is now the parent company of Squarespace. Based in Europe, Permira specializes in investing in technology, consumer, and services businesses. Its acquisition of Squarespace marked a strategic move to support the platform’s long-term growth in private markets without the short-term pressures of public shareholders.

After the acquisition, Squarespace delisted from the New York Stock Exchange and ceased public reporting of its financials. However, it continues to operate under its original brand name with the same executive leadership.

Founder’s Role and Control

Despite the acquisition, Anthony Casalena—the company’s founder and CEO—remains a significant shareholder and continues to lead the company. Casalena rolled over much of his equity stake into the new ownership structure, retaining a high level of influence over product direction and strategy.

Permira’s investment model often includes retaining founder involvement, which is true in this case. Casalena still plays a hands-on role in decisions related to product development, marketing, and innovation.

Shareholder Structure (Pre-Acquisition)

Before going private, Squarespace operated as a public company with a dual-class share structure:

- Class A shares were traded publicly and carried one vote per share.

- Class B shares, mostly held by Casalena, carried 10 votes per share and ensured his majority control.

At the time of the 2021 IPO and up to the 2024 buyout, major institutional investors included:

These investors gradually reduced their positions after the public listing, and their remaining shares were bought out in the Permira acquisition.

Acquisition Insights

The acquisition came amid a shifting landscape for tech companies. Squarespace faced pressure from larger competitors like Shopify and Wix, as well as emerging AI-driven platforms. Taking the company private gave it more freedom to pivot and expand without being scrutinized by public markets each quarter.

Permira saw strong fundamentals in Squarespace’s recurring revenue model, high margins, and loyal customer base. The firm intends to support Squarespace in expanding globally and enhancing its offerings—especially in AI, commerce, and domain services.

Why Squarespace Went Private

Several reasons contributed to the decision:

- Stock performance volatility since its IPO in 2021

- Desire for long-term strategy focus without quarterly earnings pressure

- Private equity appeal for sustainable, infrastructure-heavy tech companies

- Continued founder involvement, ensuring cultural and strategic consistency

Current Status (2025)

As of 2025, Squarespace operates privately under Permira’s ownership. It remains headquartered in New York City and continues to provide website building, e-commerce, domain registration, scheduling, and marketing services. The company is expanding its AI and automation features to stay competitive in the low-code/no-code space.

There is no immediate indication of a return to public markets, as the focus remains on product innovation and global expansion.

Who is the CEO of Squarespace?

Anthony Casalena is the founder, CEO, and Chairman of Squarespace. He launched the company from his University of Maryland dorm room in 2003 and became its sole operator—even handling coding, design, and customer support in the early years. His continued leadership is reflected in his ownership of more than 20% of the company’s equity after its privatization in 2024.

Decision-Making and Strategic Vision

Casalena retains ultimate decision-making authority. This stems from his role as CEO and from rolling over a significant portion of his equity into the Permira-led acquisition. His deep involvement in product roadmap, design philosophy, and customer experience ensures a strategic consistency unmatched by new leadership.

Leadership Style and Company Culture

Casalena’s approach to leadership remains hands-on and design-focused. He regularly engages with Squarespace’s user community—known as the “Circle”—to gather feedback and iterate on product improvements. This ongoing dialogue helps shape new features, including recent innovations in AI, scheduling, and domain management.

Board Role and Governance

Following the privatization, Casalena continues to serve as Chairman of the Board. He works closely with the executive team, including CFO, CTO, and CPOs, and retains control over strategic and operational decisions through his equity stake and board position.

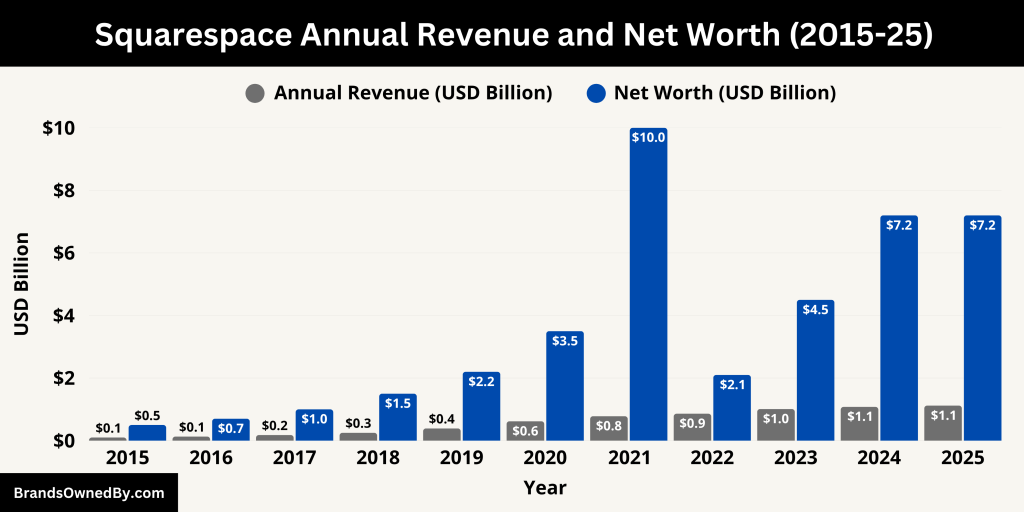

Squarespace Annual Revenue and Net Worth

By mid-2025, Squarespace has achieved an impressive annual revenue run–rate of approximately $1.12 billion. Over the prior twelve months (TTM), the company recorded around $1.11 billion in revenue, marking a strong year-over-year growth of nearly 17–19 % over 2023’s $1.01 billion figure. Revenue in Q1 2025 alone reached over $290 million, reflecting continued momentum in both subscriptions and commerce services.

Subscription-based website hosting remains Squarespace’s primary revenue stream. Presence features (design, hosting, domains) account for roughly 71 % of total revenue, while commerce tools (e‑commerce, transactions) contribute the remaining 29 %. This healthy diversification supports both creative users and merchant-focused customers.

Revenue growth has outpaced many peers in the low-code/web-hosting space. In early 2025, the TTM revenue was about €0.97 billion, consistent with the $1.12 billion estimate given exchange rates.

Market Value & Net Worth

Following its 2024 privatization by Permira at an approximately $7.2 billion enterprise value, Squarespace exited public markets with a valuation free from stock market fluctuations. That valuation reflected a strong premium to its prior public market cap, peaking around $8 billion at its 2021 IPO and dipping to $2 billion in 2022, before rebounding to over $5 billion by 2024.

As of July 2025, the $7.2 billion figure serves as a proxy for the company’s private net worth. With no longer publicly traded shares, this enterprise value represents the total equity and debt valuation under Permira’s ownership.

Here is an overview of the historical revenue and estimated net worth (market cap or valuation) of Squarespace over the past 10 years (2015–2025):

| Year | Annual Revenue (USD) | Net Worth / Valuation (USD) | Key Notes |

|---|---|---|---|

| 2015 | $100 million | ~$500 million | Rapid post-Series B growth |

| 2016 | $130 million | ~$700 million | Continued user base expansion |

| 2017 | $180 million | ~$1 billion | Valued as a unicorn privately |

| 2018 | $250 million | ~$1.5 billion | Major product updates & team growth |

| 2019 | $385 million | ~$2.2 billion | Acquisition of Acuity Scheduling |

| 2020 | $620 million | ~$3.5 billion | COVID-19 pandemic surge in new users |

| 2021 | $784 million | $10 billion (IPO valuation) | Direct listing on NYSE (SQSP) |

| 2022 | $866 million | ~$2.1 billion | Share price declined post-IPO |

| 2023 | $1.01 billion | ~$4.5 billion | Recovered from post-IPO dip |

| 2024 | $1.08 billion | $7.2 billion (acquisition value) | Taken private by Permira |

| 2025 | $1.12 billion (est.) | ~$7.2 billion (private valuation) | Focus on AI, e-commerce tools |

Profitability & Financial Health

In 2023, Squarespace posted operating expenses of roughly $720 million against $1.01 billion in revenue, with a modest net loss near $250 million. The company’s return to private ownership allows it to focus on long-term profitability without public investor scrutiny.

As the business integrates AI features, domain acquisitions, and service expansions, profit margins are expected to improve in the coming years. Operating capital from Permira and founder Anthony Casalena supports investments in innovation rather than short-term earnings pressure.

Brands Owned by Squarespace

As of 2025, Squarespace owns and operates several brands, platforms, and acquired entities that enhance its core offerings. These companies were acquired or developed to support website creation, commerce, scheduling, domain services, and marketing capabilities.

Below is a detailed breakdown of each brand or company owned by Squarespace as of July 2025:

| Brand/Entity | Type | Year Acquired/Launched | Purpose/Function | Integration Level | Target Users |

|---|---|---|---|---|---|

| Acuity Scheduling | Acquisition | 2019 | Online appointment scheduling, calendar syncing, payment integration | Fully integrated into websites | Coaches, consultants, service providers |

| Unfold | Acquisition | 2019 | Mobile-first social media content creation tool (e.g., Instagram stories) | Standalone app, linked to brand | Creators, influencers, marketers |

| Tock | Acquisition | 2021 | Restaurant reservation, takeout, ticketing, and table management platform | Integrated with hospitality sites | Restaurants, wineries, event venues |

| Bio Sites | Internal Brand | 2021 | Mobile landing pages for social links and digital profiles | Web-based and mobile optimized | Influencers, artists, digital creators |

| Google Domains (Assets) | Acquisition (Assets Only) | 2023 (transition completed 2024) | Domain registration and management for ~10M+ domains | Deep integration into platform | All users needing domains |

| Extensions Marketplace | Internal Platform | 2020 (expanded in 2025) | Third-party apps: shipping, finance, SEO, inventory, and AI tools | Connected ecosystem | E-commerce businesses, power users |

| Member Areas | Internal Feature | 2020 | Create gated content, memberships, and private learning areas | Embedded in Squarespace platform | Educators, coaches, membership-based businesses |

| Email Campaigns | Internal Product | 2019 | Branded email marketing with templates, automation, and analytics | Built into dashboard | Small businesses, online stores, bloggers |

| Logo Maker | Internal Tool | 2018 | DIY logo creation with download options and customization | Integrated into branding tools | Startups, freelancers, new businesses |

| Fluid Engine | Proprietary Tech | 2022 | Advanced drag-and-drop visual editor with mobile flexibility and grid controls | Core layout system | All website users, especially designers |

Acuity Scheduling

Acuity Scheduling was acquired by Squarespace in 2019. It is an online appointment scheduling software that allows businesses to automate bookings, confirmations, cancellations, and reminders. It integrates deeply with Squarespace websites, especially for service-based industries like coaching, salons, personal training, and healthcare. Users can embed Acuity’s calendar directly into their site, collect payments during scheduling, and manage availability in real-time. It remains one of the most used tools for solopreneurs and small businesses operating through Squarespace.

Unfold

Unfold is a mobile app for creating social media content, primarily used for Instagram and TikTok stories. Squarespace acquired Unfold to help users develop high-quality branded visual content on mobile devices. It offers customizable story templates, branding tools, and content packs designed for personal brands, influencers, and online businesses. Unfold complements Squarespace’s web-based offerings by extending visual design into mobile-first platforms.

Tock

Tock was acquired in 2021 to support restaurants, wineries, and hospitality businesses. It offers reservation and table management, ticketed events, takeout ordering, and dynamic pricing. With Tock, Squarespace expanded into the hospitality and experience-based business market. This acquisition has allowed Squarespace customers in the food and beverage sector to integrate online reservations and prepaid dining directly through their websites.

Bio Sites (by Squarespace)

Bio Sites is a lightweight, mobile-first web tool launched by Squarespace as a competitor to Linktree. It allows users—especially creators, influencers, and artists—to create a simple landing page with links to all their platforms. These bio pages are fully customizable and serve as digital business cards or profile hubs. Bio Sites support integration with Squarespace’s analytics and commerce features for further personalization and engagement tracking.

Google Domains (Acquired Assets)

In a major strategic move in 2023, Squarespace entered an agreement to acquire assets from Google Domains. By 2024, the transition was complete. Squarespace now manages over 10 million domain registrations from former Google Domains users. This acquisition significantly expanded Squarespace’s footprint in the domain registration business and made it one of the top domain registrars globally. Customers can now purchase, transfer, and manage domains directly through Squarespace, including those acquired from Google’s portfolio.

Squarespace Extensions Marketplace

While not a standalone company, the Extensions Marketplace operates as an integrated ecosystem for third-party apps and tools. Launched to allow more flexibility for commerce users, it includes services for shipping, finance, analytics, inventory management, and SEO. Notable integrations include Printful, QuickBooks, and ShipStation. As of 2025, Squarespace has expanded this marketplace to support more global vendors and AI-powered tools.

Member Areas

Squarespace developed Member Areas as a native feature that allows site owners to create subscription-based content, gated learning modules, and exclusive communities. Although not a separate company, it functions like a brand within the platform and is widely used by coaches, educators, and membership businesses. It supports recurring billing, private content delivery, and flexible membership tiers.

Squarespace Email Campaigns

Email Campaigns is Squarespace’s built-in email marketing tool. Launched in 2019 and continually updated, it allows users to create branded newsletters, automated welcome emails, and promotional messages. It integrates seamlessly with the website builder and e-commerce platform, helping businesses connect with customers using consistent branding and analytics tracking. While not an acquired company, it operates as a branded service within the Squarespace ecosystem.

Squarespace Logo Maker

Squarespace’s Logo Maker is another internally developed tool that acts as a brand identity generator. Users can create simple, customizable logos for free or as part of their subscription. It supports logo downloads in multiple file formats and is especially useful for startups and freelancers building their brand from scratch within the Squarespace platform.

Fluid Engine (Website Layout System)

Fluid Engine is not a company, but a proprietary drag-and-drop layout engine developed by Squarespace in 2022. It replaced the older layout system and added advanced positioning, grid control, and mobile customization features. It represents a major technological investment and is considered a “product brand” within Squarespace’s service suite.

Final Thoughts

Squarespace has come a long way from a dorm-room project to a multi-billion-dollar tech platform. The question of who owns Squarespace reveals a modern tech company structure. Founder Anthony Casalena remains the driving force, supported by investors and public shareholders. With consistent growth and acquisitions, Squarespace continues to expand its services and user base.

FAQs

Who owns the company Squarespace?

As of 2025, Squarespace is owned by Permira, a global private equity firm that acquired the company in 2024. However, founder and CEO Anthony Casalena remains a significant shareholder and continues to lead the company.

Who purchased Squarespace?

Permira purchased Squarespace in an all-cash transaction valued at approximately $7.2 billion. The deal was finalized in 2024, and the company was taken private.

Did Google buy Squarespace?

No, Google did not buy Squarespace. However, Squarespace acquired assets from Google Domains in 2023, transferring millions of domain registrations under its management.

Who is the largest shareholder of Squarespace?

Anthony Casalena, the company’s founder and CEO, remains the largest individual shareholder. Even after the Permira acquisition, he retained a significant ownership stake and voting power.

Is Squarespace a Google partner?

Yes, Squarespace is a Google partner in the domain registration space. It acquired domain assets from Google Domains and manages those customer accounts as part of its services.

Is Squarespace a Chinese company?

No, Squarespace is an American company. It was founded in New York and continues to operate from its headquarters in New York City.

Who runs Squarespace?

Squarespace is run by its founder and CEO, Anthony Casalena. He has led the company since its founding in 2003 and continues to serve as the top executive and strategic leader.

Who took Squarespace private?

The private equity firm Permira took Squarespace private in 2024. The acquisition was valued at $7.2 billion and resulted in the company delisting from the New York Stock Exchange.

Is Squarespace owned by Square?

No, Squarespace is not owned by Square. Square (now called Block, Inc.) is a separate fintech company. There is no ownership or operational connection between the two companies.

Why did Permira buy Squarespace?

Permira acquired Squarespace to help the company grow without the constraints of public markets. The goal was to support long-term innovation, invest in product development, and expand globally—especially in domains, commerce, and AI.

Is Squarespace a profitable company?

As of 2025, Squarespace generates strong annual revenue—over $1.1 billion. It has historically operated near break-even, occasionally posting modest losses due to heavy investment in R&D and marketing. Post-privatization, the focus has shifted toward long-term profitability.

Who founded Squarespace?

Anthony Casalena founded Squarespace in 2003 while he was a college student at the University of Maryland. He built the original platform himself and remains its CEO.

When did Squarespace go public?

Squarespace went public on May 19, 2021, via a direct listing on the New York Stock Exchange (NYSE) under the ticker symbol SQSP. The company remained public until it was acquired and taken private in 2024.

Who owns Squarespace?

Squarespace is publicly traded, but its founder Anthony Casalena holds the most voting power and remains its largest shareholder.

Is Squarespace a private or public company?

Squarespace became a public company in 2021 through a direct listing on the NYSE under the symbol SQSP.

Who is the CEO of Squarespace?

Anthony Casalena is the CEO and founder of Squarespace. He has led the company since its inception in 2003.

What companies does Squarespace own?

Squarespace owns Acuity Scheduling, Tock, Unfold, and is acquiring assets from Google Domains.

What is Squarespace’s net worth?

As of July 2025, Squarespace has a net worth of around $7.2 billion.

How does Squarespace make money?

Squarespace earns revenue through subscriptions, domain registrations, commerce tools, and marketing services.