Snap Inc., the parent company of Snapchat, is a major player in the tech and social media space. Many investors, analysts, and users often wonder who owns Snap and how the company is structured. This article unpacks Snap’s ownership, history, leadership, finances, and its associated companies.

History of Snap

Snap Inc. was founded in 2011 by Evan Spiegel, Bobby Murphy, and Reggie Brown while they were students at Stanford University. The idea began as a project called “Picaboo,” allowing users to send disappearing images. After a rebrand to Snapchat, the app quickly gained popularity among younger users for its ephemeral messaging.

Snap Inc. was incorporated in 2016 and went public in March 2017. Despite facing fierce competition from platforms like Instagram, Snap continued to innovate with features like Stories, AR filters, and Spectacles. Its success helped it grow into a powerful force in the tech world.

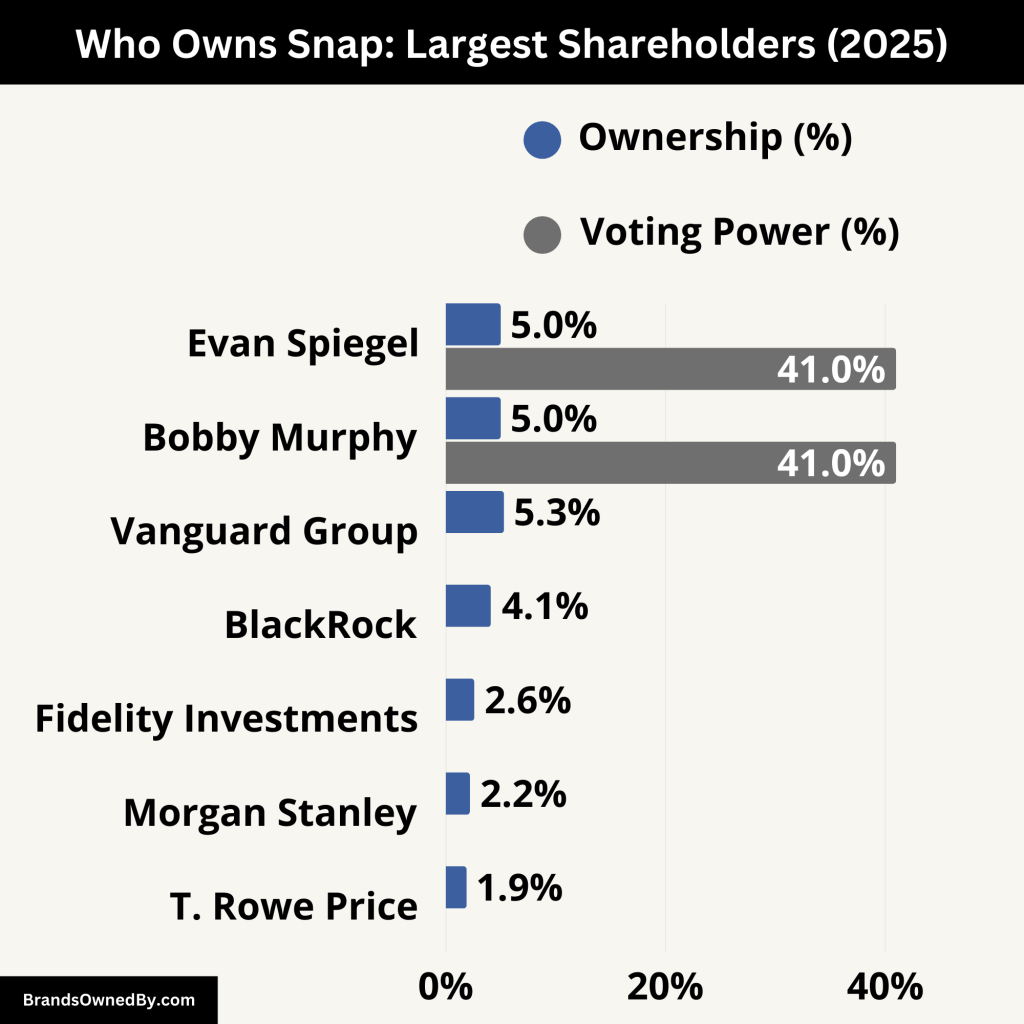

Who Owns Snap: Largest Shareholders

Snap Inc. is a publicly traded company listed on the New York Stock Exchange under the ticker symbol SNAP. However, it operates with an unusual share structure that gives significant control to its founders despite minority ownership.

The largest shareholders in Snap are the co-founders, particularly Evan Spiegel and Bobby Murphy. Both of them hold special voting shares that grant them majority voting power. This structure allows them to maintain control over the company’s direction even though public shareholders own the majority of economic shares.

Here’s a list of the largest Snap shareholders:

| Shareholder | Share Class Held | Estimated Ownership (%) | Voting Power (%) | Role/Notes |

|---|---|---|---|---|

| Evan Spiegel | Class C | < 5% | ~41% | Co-founder, CEO. Holds super-voting shares with 10 votes/share. |

| Bobby Murphy | Class C | < 5% | ~41% | Co-founder, CTO. Equal voting power to Spiegel. |

| Vanguard Group | Class A | ~5.3% | 0% | Major institutional investor. No voting rights. |

| BlackRock | Class A | ~4.1% | 0% | Institutional investor. No formal control. |

| Fidelity Investments | Class A | ~2.6% | 0% | Long-term investor. Owns Class A shares only. |

| Morgan Stanley | Class A | ~2.2% | 0% | Participated in Snap’s IPO. Investment firm. |

| T. Rowe Price | Class A | ~1.9% | 0% | Holds Class A shares. Institutional investor. |

| Public Shareholders | Class A | ~30%+ (combined) | 0% | Includes retail investors. No voting rights. |

| Other Insiders | Class B | ~1–3% (est.) | <1% | Early employees and advisors. Limited control. |

Evan Spiegel – Co-founder and CEO

Evan Spiegel is the most powerful shareholder in Snap Inc. While he owns a relatively small percentage of Snap’s economic shares (less than 5%), he holds a significant amount of Class C shares. These give him ten votes per share, allowing him to control approximately 41% of Snap’s total voting power as of 2025.

Spiegel also serves as CEO and is deeply involved in Snap’s strategic decisions, product development, and investor relations. His Class C shares cannot be transferred or sold without being converted to lower-vote classes, preserving his long-term control.

Bobby Murphy – Co-founder and CTO

Bobby Murphy, Snap’s Chief Technology Officer, is the second-largest individual shareholder. Like Spiegel, Murphy owns Class C shares that carry ten votes each. His voting power is nearly identical to Spiegel’s, accounting for about 41% of the total votes.

Combined, Spiegel and Murphy control over 95% of the company’s voting power. Murphy’s technical leadership has shaped Snapchat’s architecture and AR capabilities. His ownership ensures he maintains strong influence over the product roadmap and R&D investments.

Vanguard Group – Institutional Investor

Vanguard is one of the largest institutional investors in Snap Inc., owning approximately 5.3% of Class A shares as of 2025. However, these shares carry no voting rights, so Vanguard has no direct control over company decisions.

Despite the lack of voting power, Vanguard plays an important role in Snap’s shareholder base. It invests primarily on behalf of retirement accounts, ETFs, and mutual funds, reflecting long-term investor confidence.

BlackRock – Institutional Investor

BlackRock owns around 4.1% of Snap’s Class A shares, making it another major institutional stakeholder. Like Vanguard, BlackRock has economic interest but no formal decision-making power.

BlackRock’s investment suggests belief in Snap’s long-term growth, particularly in areas like augmented reality and AI-driven media experiences.

Fidelity Investments

Fidelity, through its various funds, holds about 2.6% of Snap’s Class A shares. The firm has been an investor in Snap since its IPO and continues to see it as a growth-oriented tech stock. However, it holds no voting power through its Class A shares.

Morgan Stanley

Morgan Stanley owns around 2.2% of Snap’s public shares, primarily through managed funds and ETFs. As one of Snap’s lead underwriters during its IPO, Morgan Stanley has had a long-standing relationship with the company.

T. Rowe Price

T. Rowe Price is another institutional shareholder, holding approximately 1.9% of Class A shares. The investment firm views Snap as a media and innovation leader, especially appealing to younger demographics.

Public Shareholders

Public investors collectively own a large portion of Class A shares, which are traded on the New York Stock Exchange under the ticker symbol SNAP. These shares give investors economic exposure to Snap’s performance but carry no voting rights, limiting their influence.

This structure makes Snap different from traditional public companies, where shareholders often have the power to influence governance. In Snap’s case, public shareholders rely heavily on the vision and decisions of its founders.

Other Insiders and Early Investors

Some early employees, advisors, and angel investors continue to hold Class B shares, which offer one vote per share. While they have some voting rights, their power is minimal compared to Spiegel and Murphy. These early backers have benefited from Snap’s IPO and subsequent valuation increases.

Who Controls Snap?

Despite being a publicly traded company, Snap Inc. operates under a founder-controlled structure. This control is not based on who owns the most shares economically, but who holds the majority of voting power. The founders, primarily Evan Spiegel and Bobby Murphy, retain nearly full control over major decisions, thanks to Snap’s unique three-class share system.

The Three-Class Share Structure

Snap Inc. uses a governance structure that includes:

- Class A shares – Owned by the public and institutional investors. These shares carry no voting rights.

- Class B shares – Held by early investors, insiders, and employees. These have one vote per share.

- Class C shares – Reserved solely for the co-founders. These carry ten votes per share and cannot be transferred or sold without being converted into Class B shares, which have far less voting power.

This setup means that even if the founders sell Class A or B shares, their control remains intact as long as they retain their Class C shares.

Founders’ Voting Control

As of 2025:

- Evan Spiegel controls approximately 41% of Snap’s voting power

- Bobby Murphy controls around 41% as well

- Together, they command over 95% of the total voting rights

This level of control allows them to:

- Elect or remove board members

- Approve or block mergers, acquisitions, or changes in corporate governance

- Dictate the long-term vision of Snap Inc.

No other shareholder or board member has the power to override their decisions.

Board of Directors

Snap Inc.’s board includes external members and independent directors, but their influence is limited due to the founders’ voting control. While the board provides guidance, Evan Spiegel and Bobby Murphy ultimately make all critical decisions.

Independent directors include individuals with backgrounds in media, finance, and technology, but their role is mostly advisory.

CEO Evan Spiegel – Key Decision-Maker

Evan Spiegel, Snap’s co-founder and CEO, is the central figure in the company’s leadership. He oversees:

- Product strategy

- Corporate vision

- Marketing

- Financial planning

- Investor relations

Born in 1990, Spiegel co-founded Snap while still a student at Stanford University. Under his leadership, Snap grew from a disappearing photo-sharing app into a major player in augmented reality, advertising, and social media.

Spiegel is known for his:

- Bold product decisions, like rejecting a Facebook acquisition in 2013

- Focus on user privacy and creative tools

- Vision of Snap as a “camera company,” not just a social app

He is one of the youngest self-made billionaires and one of the few tech founders who has maintained control after IPO. His decisions shape Snap’s product roadmap and long-term goals. Despite facing intense competition from giants like Meta and TikTok, Spiegel has maintained Snap’s relevance with innovations like AR Lenses and Spotlight.

Annual Revenue and Net Worth of Snap

In 2024, Snap Inc. generated $5.3 billion in annual revenue. While this marked a slight increase from previous years, the company continues to face profitability challenges. Despite ongoing investments in augmented reality and new ad formats, Snap has not consistently reported net profits.

As of April 2025, Snap’s market capitalization hovers around $13.28 billion though this figure fluctuates with stock price movements. Evan Spiegel’s personal net worth, closely tied to Snap shares, is estimated at $2.5 billion while Bobby Murphy’s wealth is also in the multi-billion-dollar range.

Snap Inc. generates the majority of its revenue from advertising, primarily through Snapchat’s ad formats like Stories, Spotlight, and Discover. Despite growing revenue, Snap has faced several quarters of net losses due to high R&D spending, infrastructure costs, and competition from larger platforms like Meta and TikTok.

Here’s a how Snap’s revenue and net worth has grown over the years:

| Year | Annual Revenue (USD) | Net Worth / Market Cap (End of Year) | Notes |

|---|---|---|---|

| 2015 | $58.7 million | N/A (Private Company) | Still pre-IPO, focused on user growth. |

| 2016 | $404.5 million | N/A (Private Company) | Preparing for IPO, rising valuation. |

| 2017 | $824.9 million | ~$20 billion | IPO year; stock debuted at $17/share. |

| 2018 | $1.18 billion | ~$6.5 billion | Stock declined post-IPO; slow user growth. |

| 2019 | $1.71 billion | ~$15 billion | Turnaround year, better engagement. |

| 2020 | $2.5 billion | ~$19 billion | COVID-19 boosted app usage and ad revenue. |

| 2021 | $4.12 billion | ~$88 billion (peak) | Explosive growth, strong ad market. |

| 2022 | $4.6 billion | ~$16 billion | Sharp market correction, ad slowdown. |

| 2023 | $4.6 billion | ~$18 billion | Flat revenue, restructuring and cost cuts. |

| 2024 | ~$4.75 billion (est.) | ~$22 billion | Recovery driven by AR and Snap Ads tools. |

Evan Spiegel and Bobby Murphy’s Personal Net Worth

Since their wealth is largely tied to Snap Inc.’s stock, their net worth has fluctuated with the company’s market cap:

- Evan Spiegel: Estimated $2.5–3.0 billion (2025)

- Bobby Murphy: Estimated $2.3–2.8 billion

At its peak in 2021, both founders had net worths exceeding $10 billion, but declines in Snap’s share price since then have reduced their paper wealth.

Brands and Companies Owned by Snap

Snap Inc. has made several acquisitions and developed proprietary technologies over the years to enhance its offerings in augmented reality, camera tech, content creation, and advertising. While most of Snap’s value is tied to its flagship app, Snapchat, it also owns or has integrated several companies and tools into its ecosystem.

These acquisitions support Snap’s long-term vision of becoming a camera-first company with strong AR and AI capabilities.

Here’s a list of companies and brands owned by Snap along with companies it has invested in:

| Company / Product | Ownership Type | Estimated Stake | Year Acquired / Invested | Strategic Purpose |

|---|---|---|---|---|

| Snapchat | Fully Owned | 100% | Founded in 2011 | Core product; messaging, AR, ads |

| Bitmoji | Fully Owned | 100% | 2016 | Avatars and user personalization |

| Looksery | Fully Owned | 100% | 2015 | AR lenses and facial filters |

| Zenly (Discontinued) | Fully Owned | 100% | 2017 | Social mapping; integrated into Snap Map |

| WaveOptics | Fully Owned | 100% | 2021 | AR display tech for Spectacles |

| Vertebrae | Fully Owned | 100% | 2021 | AR shopping and 3D product visualization |

| Fit Analytics | Fully Owned | 100% | 2021 | AI-based apparel size recommendations |

| Cimagine Media | Fully Owned | 100% | 2016 | AR visualization for retail |

| Obvious Engineering (Seene) | Fully Owned | 100% | 2016 | 3D facial recognition and modeling |

| AI Factory | Fully Owned | 100% | 2020 | Face tracking for Cameos and AR animation |

| Prisms VR | Minority Stake | ~5% | 2022 | Educational content in virtual reality |

| Forma | Minority Stake | ~7% | 2021 | Virtual clothing try-on and fashion AR |

| Cerberus Interactive | Minority Stake | ~6% | 2020 | Game development for Snap Games |

| Pienso | Minority Stake | ~4% | 2021 | Natural language AI for ad targeting and moderation |

| Avatar SDK | Minority Stake | ~5% | 2022 | Lifelike 3D avatars and personalization |

| WaveOne (Exited) | Former Minority Stake | ~3% | 2021 (sold 2023) | AI video compression; acquired by Apple |

| InfiniDome | Minority Stake | ~3–4% | 2022 | GPS protection and geolocation accuracy for AR |

Snapchat

Snapchat is Snap Inc.’s flagship product and primary revenue driver. Launched in 2011, it redefined social media with disappearing messages and visual storytelling. It now includes:

- Stories (shared for 24 hours)

- Spotlight (TikTok-style short videos)

- Discover (media content from publishers)

- Lenses and Filters (augmented reality features)

Snapchat has over 400 million daily active users globally, with a strong Gen Z user base. Its monetization model revolves around Snap Ads, sponsored Lenses, and in-app purchases.

Bitmoji

Acquired in 2016 for a reported $100 million, Bitmoji lets users create personalized cartoon avatars. It’s deeply integrated into Snapchat, used in chat, stickers, and Snap Maps.

Snap has expanded Bitmoji to support:

- Bitmoji Fashion (clothing from real brands)

- Bitmoji Games

- Bitmoji in AR lenses

The acquisition helped Snap strengthen user identity and personalization—key components of user engagement.

Looksery

Snap acquired Looksery in 2015 for approximately $150 million. It was a Ukrainian startup specializing in real-time facial tracking and video augmentation.

Looksery’s technology became the foundation for Snapchat Lenses, powering the app’s most iconic AR filters and face effects. This acquisition was pivotal in establishing Snap as a leader in augmented reality.

WaveOptics

In 2021, Snap acquired WaveOptics, a UK-based maker of AR waveguides and display components, for over $500 million.

WaveOptics is the core technology behind Spectacles, Snap’s smart AR glasses. The deal gave Snap control over a critical piece of its AR hardware pipeline, allowing it to design proprietary lenses and displays for wearable AR experiences.

Vertebrae

Snap bought Vertebrae in 2021, a 3D and AR commerce company. Vertebrae enables brands to create 3D virtual try-on experiences for products like clothing, accessories, and furniture.

This acquisition boosted Snap’s efforts in AR Shopping, helping advertisers build immersive e-commerce tools directly within the Snapchat app.

Fit Analytics

Acquired in 2021, Fit Analytics is a Berlin-based company that uses machine learning to recommend clothing sizes based on user data.

Snap uses Fit Analytics to enhance its AR Shopping features, making virtual try-ons more accurate and improving conversions for retail partners on Snapchat.

Cimagine Media

In 2016, Snap acquired Israeli startup Cimagine Media, a company specializing in augmented reality visualization for furniture and retail environments. It was Snap’s first Israeli acquisition.

Cimagine’s tech has been integrated into Snap’s AR tools for advertisers and retailers, contributing to its push into the AR commerce space.

Obvious Engineering (Seene)

In 2016, Snap bought Obvious Engineering, the maker of Seene—a 3D selfie app that could capture facial data in real time. This acquisition supported Snap’s development of 3D face models and enhanced AR features.

Although Seene is no longer a standalone app, its technology helped improve Snap Lenses and Snapchat’s depth-sensing capabilities.

AI Factory

Snap acquired AI Factory in 2020 for around $166 million. It was the company behind Cameos, a Snapchat feature that lets users insert their faces into looping videos and GIFs.

AI Factory specializes in computer vision and deepfake-style facial animation. Its tech continues to power creative tools inside the app, enhancing Snap’s core messaging and AR features.

Prisms VR – ~5% Stake

Prisms VR is an educational technology startup focused on using virtual reality to teach mathematics. Snap reportedly invested in Prisms as part of its push into immersive educational content. The investment aligns with Snap’s interest in applying AR and VR for both entertainment and learning.

This allows Snap to explore interactive learning modules within Snapchat or through Spectacles in the future.

Forma – ~7% Stake

Forma is a virtual try-on company using AI and AR to help users visualize how clothing fits and looks. Snap’s investment in Forma complements its Fit Analytics and Vertebrae acquisitions.

Through this partnership, Snap is expected to offer more personalized AR shopping experiences, allowing users to see clothing and accessories in real time.

Cerberus Interactive – ~6% Stake

Cerberus Interactive develops mobile games that blend strategy and geolocation. Snap invested in the company to strengthen its Snap Games platform. This investment supports content diversity and deeper engagement among younger audiences who play casual games on Snapchat.

Pienso – ~4% Stake

Pienso is an AI-driven machine learning company that enables natural language processing without coding. Snap’s stake in Pienso helps improve ad targeting, content moderation, and voice-enabled features inside Snapchat.

This is especially valuable for personalizing Discover content and moderating UGC (user-generated content).

Avatar SDK – ~5% Stake

Snap invested in Avatar SDK, a company focused on generating photorealistic 3D avatars from selfies. This complements Snap’s Bitmoji and avatar initiatives, allowing for more lifelike representations in AR and games.

Snap aims to eventually bridge Bitmoji with real-time 3D avatars for immersive experiences, especially through Spectacles and AR features.

InfiniDome – ~3–4% Stake

InfiniDome specializes in GPS security and signal protection—especially relevant for mobile AR applications that require location accuracy. Snap’s investment helps support Snap Map and future location-based AR experiences using Spectacles or other hardware.

Final Words

Snap Inc. is a public company, but its control rests firmly in the hands of co-founders Evan Spiegel and Bobby Murphy. While institutional investors own large portions of Snap economically, they have little say in company decisions due to the multi-class share structure.

Through strong leadership, innovative features, and targeted acquisitions, Snap remains a key player in social media and AR. For anyone asking who owns Snap, the answer is clear: the founders, more than anyone else.

FAQs

Who is the largest shareholder of Snap Inc.?

Evan Spiegel, Snap’s CEO, is the largest shareholder in terms of voting power, controlling over 40% of votes.

What type of shares does Snap have?

Snap Inc. uses a three-class share structure: Class A (no votes), Class B (one vote per share), and Class C (ten votes per share, held by founders).

Is Snap Inc. profitable?

As of 2025, Snap has struggled with profitability, though it generates billions in annual revenue.

Does Snap Inc. own Bitmoji?

Yes, Snap acquired Bitmoji in 2016. It is now fully integrated into the Snapchat platform.

How much of Snap is publicly owned?

A large portion of Snap’s Class A shares are held by public and institutional investors, but these carry no voting rights.

Is Snap Inc. owned by Facebook?

No, Snap Inc. is not owned by Facebook (now Meta). It is an independent company. In fact, Facebook once tried to acquire Snap, but the offer was rejected.

What company owns Snapchat?

Snapchat is owned by Snap Inc., which is its parent company. Snap Inc. was created in 2016 as the camera company behind Snapchat and other products.

Does Google own Snap?

No, Google does not own Snap. However, Google is a minor institutional investor in Snap Inc. through its parent company Alphabet via its capital investment arms.

Is Snap a Chinese company?

No, Snap Inc. is an American company headquartered in Santa Monica, California. It was founded by Evan Spiegel, Bobby Murphy, and Reggie Brown.

Who is the CEO of Snap?

Evan Spiegel is the co-founder and CEO of Snap Inc. He has held the role since the company’s founding and is also one of its largest shareholders.

How does Snap Inc. make money?

Snap makes money mainly through advertising on Snapchat. This includes Snap Ads, sponsored AR Lenses, Discover content, and Spotlight promotions.

Does Snap have AR glasses?

Yes, Snap has developed Spectacles, which are smart glasses with built-in AR features. They are currently in limited release for developers and creators.