Pfizer is one of the largest pharmaceutical companies in the world. Many people often ask who owns Pfizer, as it plays a major role in healthcare and medicine worldwide. The company is not owned by a single person but rather by a large group of shareholders, including institutional investors, mutual funds, and individual investors.

Pfizer Company Profile

Pfizer Inc. is a global pharmaceutical and biotechnology leader. It discovers, develops, manufactures, and markets prescription medicines, vaccines, and consumer healthcare products. The company is headquartered in New York City and employs around 81,000 people worldwide, with a market capitalization of approximately $148 billion.

Its portfolio spans major therapeutic areas such as oncology, rare diseases, vaccines, internal medicine, and inflammation & immunology.

Founders

Pfizer was founded in 1849 by cousins Charles Pfizer, a chemist, and Charles F. Erhart, a confectioner. They established “Charles Pfizer & Company” in Brooklyn, New York, initially producing santonin, an antiparasitic compound. This early success laid the foundation for what would become a global health care giant.

Major Milestones

Pfizer’s evolution from a small chemical business to a global pharmaceutical powerhouse is marked by numerous milestones:

- Late 19th Century Expansion

In 1882, Pfizer opened its first facility outside New York in Chicago. By 1906, annual sales exceeded $3 million. - Innovation in Fermentation

In the 1930s, Pfizer became a world leader in vitamin C production using fermentation. This expertise enabled its rapid scale-up of penicillin production during World War II, making Pfizer the largest producer of the “miracle drug” and earning the Army-Navy “E” Award in 1943. - Pharmaceutical Expansion & Antibiotics

In 1950, Pfizer launched Terramycin, its first pharmaceutical sold in the U.S. under its own name, and began global expansion into markets including Belgium, Brazil, England, and Mexico. - Global Operations and Diversification

The company continued international expansion through the 1950s and beyond, establishing R&D labs and manufacturing sites worldwide. - Blockbuster Drugs & Mergers

Pfizer launched Viagra in 1998, a breakthrough in erectile dysfunction treatment. In 2000, Pfizer merged with Warner-Lambert, gaining control of the blockbuster drug Lipitor. - Expanding Portfolio

Acquisitions continued to shape Pfizer’s growth:- Wyeth in 2009, expanding vaccines and biologics.

- Pharmacia in 2003, adding Celebrex.

- Hospira in 2015, boosting biosimilars and injectables.

- Array BioPharma in 2019, enhancing oncology.

- Seagen in 2023, further strengthening cancer treatment offerings.

- BioPharma Focus & Recent Growth

Pfizer’s revenue in 2025 is expected to range between $61–64 billion, driven by advancements in R&D, margin improvements, and commercial excellence. The company recently reaffirmed this guidance and emphasized pipeline execution as a strategic priority. - Commitment to Innovation & Global Health

In 2023, Pfizer invested $10.7 billion in internal R&D projects, reinforcing its innovation drive. Its mission continues with global health programs, ensuring affordable access to its medicines and vaccines worldwide.

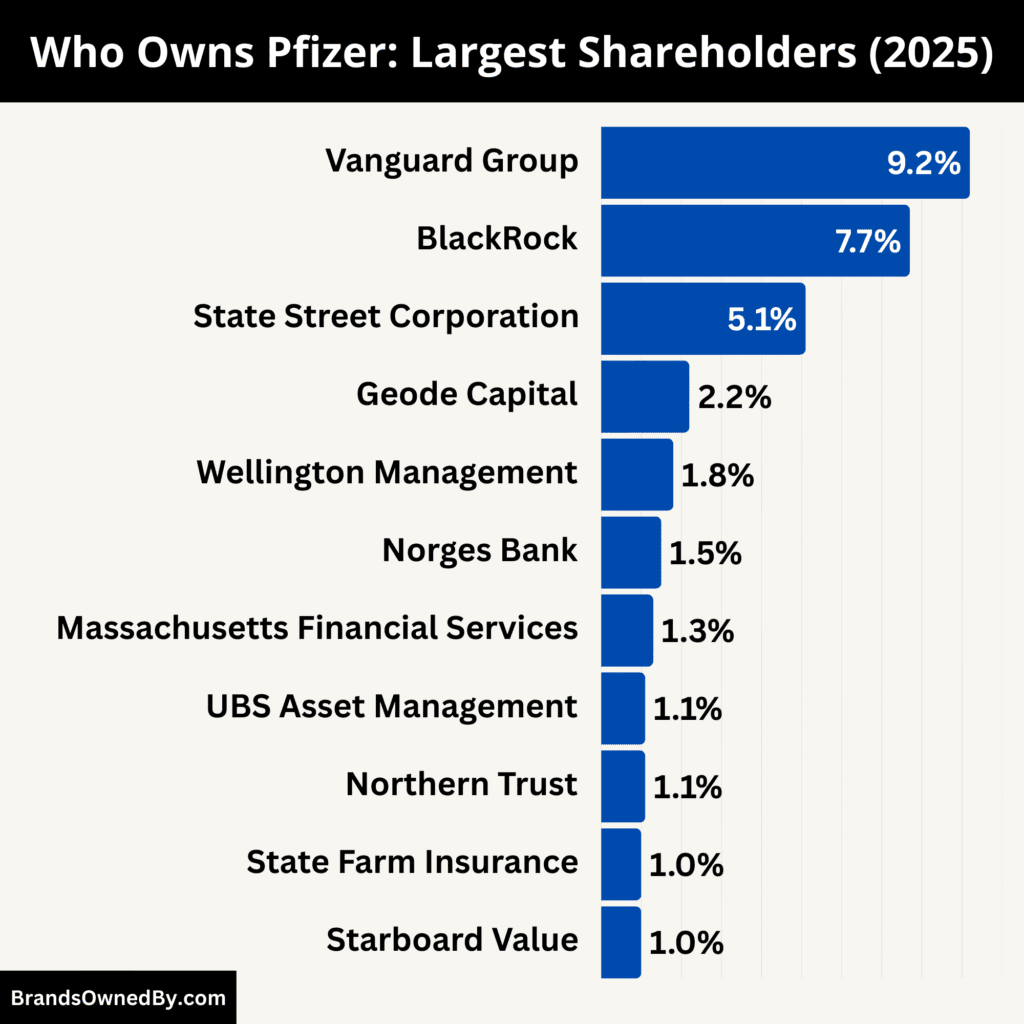

Who Owns Pfizer: Major Shareholders

Pfizer is a publicly traded company listed on the New York Stock Exchange under the ticker symbol PFE. This means ownership is divided among shareholders who buy and sell Pfizer stock. No single individual owns the company outright. Instead, institutional investors hold the largest stakes in Pfizer, giving them considerable influence.

Pfizer’s ownership is strongly tilted toward institutional investors, with passive asset managers—notably Vanguard, BlackRock, and State Street—leading. These conglomerates play a key governance role. Other institutional shareholders diversify the ownership base. Insider and retail holdings form smaller but significant portions. Meanwhile, activist pressure from Starboard adds another layer to Pfizer’s shareholder dynamics in 2025.

As of 2025, approximately 68% of its shares are held by institutional shareholders. Retail investors account for about 35%, while insider ownership remains under 0.3%.

Below is a list of the largest shareholders of Pfizer as of August 2025:

| Shareholder | Ownership % | Approx. Shares Held | Role & Influence |

|---|---|---|---|

| Vanguard Group, Inc. | ~9.2% | ~523 million | Largest shareholder; passive investor via index funds and ETFs; strong voting power |

| BlackRock, Inc. | ~5–7.7% | ~297 million | Second-largest shareholder; influence via proxy voting and ESG engagement |

| State Street Corporation | ~5.1% | ~296 million | Member of “Big Three”; passive index investor with governance influence |

| Geode Capital Management, LLC | ~2.2% | ~126 million | Sub-advisor for Vanguard; adds institutional stability through indexing |

| Wellington Management Group LLP | ~1.8% | ~103 million | Active investor; engages on long-term strategy and performance |

| Norges Bank Investment Management | ~1.5% | ~88 million | Sovereign wealth fund; focuses on sustainability and long-term growth |

| Massachusetts Financial Services (MFS) | ~1.3% | ~75 million | Mutual fund manager; active voting, tied to performance expectations |

| UBS Asset Management | ~1.1% | ~62 million | Global investor; provides European market exposure and ESG accountability |

| Northern Trust Global Investments | ~1.1% | ~61 million | Institutional investor; conservative, stable portfolio manager |

| State Farm Insurance Asset Management | ~1.0% | ~54 million | Insurance-linked asset manager; long-term and retirement-focused investor |

| Starboard Value (Activist Hedge Fund) | ~0.5–1.0%* | ~$1 billion stake | Activist investor pushing for efficiency, cost-cutting, and improved shareholder returns |

Vanguard Group, Inc.

Vanguard is Pfizer’s largest institutional shareholder, with ownership of about 9.2% of outstanding shares, equal to more than 523 million shares. As one of the world’s leading asset managers, Vanguard holds Pfizer primarily through its index funds and exchange-traded funds (ETFs). These funds represent the retirement and investment savings of millions of individuals.

Vanguard is considered a passive investor, meaning it does not directly control Pfizer’s operations. However, its significant voting power gives it influence on matters such as board elections, executive compensation, and corporate governance.

Because Vanguard’s investment model relies on long-term stability, it often supports management continuity and strategic decisions that ensure sustained shareholder value.

BlackRock, Inc.

BlackRock is Pfizer’s second-largest shareholder, with an estimated stake of between 5% and 7.7%, amounting to nearly 297 million shares. BlackRock is the largest asset manager in the world and owns Pfizer shares across its actively managed funds and its iShares ETF lineup.

BlackRock exerts influence through its proxy voting policies and governance division, which engages with Pfizer on sustainability, transparency, and corporate responsibility. While BlackRock is not a controlling shareholder, its significant ownership means Pfizer pays close attention to the company’s positions on environmental, social, and governance (ESG) matters.

State Street Corporation

State Street holds about 5.1% of Pfizer shares, or roughly 296 million shares. Like Vanguard and BlackRock, State Street is a passive institutional investor, investing mainly through index funds and retirement accounts.

As part of the “Big Three,” State Street’s influence is substantial because it helps set expectations for governance and risk management. While it does not dictate daily operations, it contributes to major corporate decisions by aligning with other institutional investors during annual voting.

Geode Capital Management, LLC

Geode Capital owns about 2.2% of Pfizer’s stock, which equates to approximately 126 million shares. Geode acts as a sub-advisor for many Vanguard funds, meaning a portion of Vanguard’s managed assets are administered through Geode.

While Geode does not play as visible a role as Vanguard, it adds another layer of institutional stability to Pfizer’s shareholder base. Its investment is part of a long-term indexing strategy rather than short-term trading.

Wellington Management Group LLP

Wellington Management controls around 1.8% of Pfizer, or nearly 103 million shares. Unlike the larger passive investors, Wellington has a more active investment approach. It is known for working closely with companies to shape long-term strategies.

This means Wellington is more likely to engage with Pfizer on product pipeline strategies, growth initiatives, and financial performance. Its influence is smaller than the Big Three, but its active management style provides balance within the ownership structure.

Norges Bank Investment Management

Norges Bank, the asset manager for Norway’s sovereign wealth fund, owns about 1.5% of Pfizer, representing around 88 million shares. This makes the Norwegian government one of Pfizer’s largest international shareholders.

Norges Bank is a long-term investor with a global outlook. Its focus lies on sustainability, corporate ethics, and long-term financial health. Pfizer benefits from this type of shareholder because it encourages steady management and responsible practices rather than short-term profit-seeking.

Massachusetts Financial Services (MFS)

MFS owns approximately 1.3% of Pfizer, or about 75 million shares. As one of the oldest U.S. mutual fund companies, MFS manages active investment portfolios on behalf of individual and institutional clients.

Unlike passive investors, MFS may be more responsive to Pfizer’s financial results and product innovation. Its voting decisions can vary based on performance expectations and shareholder returns.

UBS Asset Management

UBS Asset Management holds about 1.1% of Pfizer shares. As a global asset manager headquartered in Switzerland, UBS represents a diverse group of institutional and individual investors.

Its ownership gives Pfizer exposure to international capital markets and supports the company’s reputation among European investors. UBS generally aligns with global ESG standards, adding to Pfizer’s accountability in its operations.

Northern Trust Global Investments

Northern Trust also owns close to 1.1% of Pfizer shares. Northern Trust focuses on wealth management and institutional asset servicing.

Its investment reflects a stable, conservative approach, and while it does not wield as much power as the top shareholders, it adds diversity to the ownership profile.

State Farm Insurance Asset Management

State Farm’s investment arm owns about 1.0% of Pfizer, roughly 54 million shares. As an insurance-linked institutional investor, State Farm’s position reflects the inclusion of Pfizer stock in long-term financial and retirement portfolios.

Though relatively small, State Farm’s presence demonstrates Pfizer’s appeal as a defensive stock that balances risk with steady growth potential in the pharmaceutical industry.

Activist Investor: Starboard Value

In 2024, activist hedge fund Starboard Value began acquiring around $1 billion worth of Pfizer shares. Although its exact percentage ownership is not specified, this significant stake gives Starboard a notable voice. The fund has pushed for cost-cutting, efficiency, and better returns, putting pressure on management to accelerate shareholder value initiatives

Who is the CEO of Pfizer?

Albert Bourla holds the dual role of Chairman and CEO at Pfizer as of 2025, having assumed the top leadership position in January 2019. He brings a distinct perspective shaped by his background as a veterinarian and biotechnology expert.

Born in Thessaloniki, Greece, in 1961, Bourla earned a Doctor of Veterinary Medicine (DVM) and a Ph.D. in the Biotechnology of Reproduction from Aristotle University. He began at Pfizer in 1993 in the Animal Health Division, before transitioning into various leadership roles across global markets.

Climb Through the Ranks

Before becoming CEO, Bourla served as Pfizer’s Chief Operating Officer (COO) from January 2018 to December 2018, overseeing global commercial strategy, manufacturing, and product development.

Prior to that, he held roles such as Group President of Pfizer Innovative Health and led the Global Vaccines, Oncology, and Consumer Healthcare business groups.

Leadership Style and Strategic Focus

Since 2019, Bourla has steered Pfizer toward deepening its R&D focus, emphasizing scientific innovation and prioritizing transformative therapies.

Under his direction, Pfizer responded to the COVID-19 pandemic with urgency—investing over $2 billion at risk and delivering a safe and effective vaccine in just eight months, followed by the first FDA-authorized oral antiviral drug for COVID-19.

Bourla has instilled a company ethos anchored in the Purpose Blueprint, built around four core values: Courage, Excellence, Equity, and Joy.

Strategic Leadership and Future Vision

In early 2025, Bourla highlighted Pfizer’s proactive investment in the development of its oral obesity drug, danuglipron, signaling confidence in pioneering weight-loss treatments with improved convenience over injectable medications.

He also announced plans for $500 million in additional operating expense savings in 2025, building on an earlier $4 billion cost-saving initiative.

Policy Engagements and Industry Influence

Bourla has actively navigated policy and regulatory landscapes. He engaged with government leaders—including discussions about drug pricing, tariffs, and MFN (most-favored-nation) pricing—and even held meetings to shape health policy discussions.

In February 2025, Bourla took on the role of Chair of the Board of the Pharmaceutical Research and Manufacturers of America (PhRMA), reinforcing his influence across the pharmaceutical industry.

Compensation and Stock Ownership

In 2024, Bourla’s compensation package totaled around $24.6 million, consisting of a base salary of $1.8 million, $4.8 million in stock awards, nearly $10 million in option awards, and over $7 million in non-equity incentives.

He also holds approximately 316,799 shares of Pfizer stock, representing the largest individual insider position.

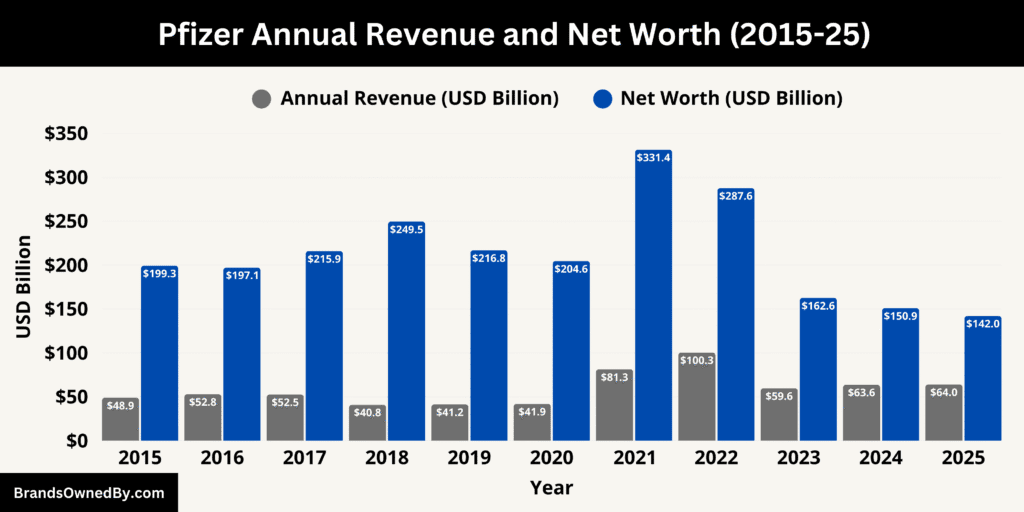

Pfizer Annual Revenue and Net Worth

Pfizer entered 2025 with a strong operational forecast, targeting stable revenue between $61–$64 billion and emphasizing the importance of ongoing cost savings—expected to reach $4.5 billion by year-end—to sustain margins amid external pressures.

Pfizer Revenue

Pfizer projects its total revenue for the full year 2025 to fall within the range of $61 billion to $64 billion. This guidance reflects expected revenue from COVID-19-related products to be largely consistent with 2024, after adjusting for a one-time $1.2 billion Paxlovid-related revenue recognized in 2024.

The company anticipates flat to modest 5% operational growth compared to the 2024 baseline. That baseline excludes non-recurring items, ensuring the forecast focuses on recurring business performance and operational momentum.

The guidance also takes into account approximately $1 billion in headwinds linked to regulatory changes under the Inflation Reduction Act affecting Medicare Part D benefits. Despite this, strategic cost efficiencies are expected to support margin resilience by year-end.

Net Income

For the trailing twelve months ending March 31, 2025, Pfizer reported net income of $7.88 billion, which marks a dramatic decline compared to the previous year. However, on an annual basis, Pfizer’s net income in 2024 was $8.03 billion, up sharply from just $2.12 billion in 2023, showcasing a strong rebound after the COVID-related fluctuations.

Pfizer Net Worth

As of mid-August 2025, Pfizer’s estimated market capitalization ranges between $142 billion and $143 billion. CompaniesMarketCap reports a market value of $142.33 billion, reflecting a 5.65% decline from the previous year. Other reputable sources place the figure around $142.9 billion, confirming Pfizer’s position as approximately the world’s 125th most valuable publicly traded company.

Macrotrends and StockAnalysis corroborate this valuation, with figures hovering near $142.7 billion, marking a roughly 18% drop year-over-year.

Market Cap Fluctuations and Context

This figure represents a notable contraction from earlier years when Pfizer’s market capitalization exceeded $150 billion. For instance, in 2024 it stood at $150.85 billion, and it had reached highs upwards of $331 billion in 2021 due to heightened pandemic-era expectations.

Compared to its industry peers, Pfizer remains significantly smaller than leaders like Johnson & Johnson or Eli Lilly, highlighting the competitive and cyclical nature of pharmaceutical valuations.

Trends Over Time

Pfizer’s market value history reflects both sharp spikes and steep declines. The surge in 2020–2021 coincided with the launch and global rollout of its COVID-19 vaccine. As demand stabilized, its valuation retracted steadily. The current plateau around $142–143 billion signals normalization—indicative of market adjustment to post-pandemic realities.

At this valuation, Pfizer is firmly in the upper tier of large-cap pharmaceutical firms, though it no longer tops the list. Its ranking around #124 to #129 globally, depending on the data source, underscores its scale—but also shows how it has ceded ground to faster-growing peers in recent years.

Companies Owned by Pfizer

Pfizer is one of the largest pharmaceutical companies in the world, and over its long history, it has acquired, merged with, and developed numerous companies and brands.

As of 2025, Pfizer operates a wide portfolio of businesses and product divisions that strengthen its presence in vaccines, oncology, rare diseases, immunology, and consumer health.

Below are the major companies, acquisitions, and brands owned by Pfizer:

| Brand/Company | Year Acquired/Launched | Therapeutic Area/Industry | Key Product/Focus | 2025 Significance |

|---|---|---|---|---|

| Prevnar (Prevnar 13 / Prevnar 20) | Acquired via Wyeth (2009) | Vaccines | Pneumococcal conjugate vaccines | Still a cornerstone vaccine with global immunization programs; Prevnar 20 drives growth. |

| Comirnaty (COVID-19 Vaccine) | Launched 2020 (with BioNTech) | Vaccines / mRNA | COVID-19 mRNA vaccine | Pfizer’s most high-profile product during the pandemic; foundation for future mRNA pipeline. |

| Paxlovid | Launched 2021 | Antivirals | Oral COVID-19 treatment | Helped reduce hospitalizations; still used in vulnerable groups. |

| Ibrance | Approved 2015 | Oncology | CDK4/6 inhibitor for breast cancer | A blockbuster cancer therapy, central to Pfizer’s oncology portfolio. |

| Xtandi | Acquired via Medivation (2016) | Oncology | Prostate cancer therapy | Leading drug for advanced prostate cancer, co-developed with Astellas. |

| Eucrisa | Acquired via Anacor (2016) | Dermatology | Eczema treatment | Non-steroidal topical option; important in dermatology expansion. |

| Vyndaqel / Vyndamax | Approved 2019 | Rare Diseases | ATTR-CM treatment | First-in-class therapy; revenue growing rapidly worldwide. |

| Upjohn (Generic Medicines) | Merged with Mylan to form Viatris (2020) | Generics & Off-Patent | Generic portfolio | Spun off from Pfizer; allowed Pfizer to focus on innovative drugs. |

| Hospira | Acquired 2015 | Injectables & Biosimilars | Infusion therapies & biosimilars | Expanded Pfizer’s hospital products and biosimilars. |

| Wyeth | Acquired 2009 | Vaccines, Biologics, Consumer Health | Brought Prevnar, Enbrel rights (outside U.S.), and biologics expertise | Strengthened vaccine and biologics division. |

| Warner-Lambert | Acquired 2000 | Pharmaceuticals | Brought Lipitor | Lipitor became world’s best-selling drug, establishing Pfizer as a pharma giant. |

| Pharmacia | Acquired 2003 | Pharmaceuticals / Oncology | Brought Celebrex & oncology pipeline | Strengthened oncology and arthritis treatment portfolio. |

| King Pharmaceuticals | Acquired 2011 | Specialty Pharma | Pain treatments & animal health | Expanded in pain management and later contributed to Zoetis spin-off. |

| Array BioPharma | Acquired 2019 | Oncology | Targeted cancer therapies | Strengthened precision oncology drug development. |

| Arena Pharmaceuticals | Acquired 2022 | Immunology | Treatments for IBD, cardiovascular & dermatology | Boosted inflammation and immunology pipeline. |

| Seagen (Acquisition Announced 2022, Completed 2023) | Oncology | Antibody-drug conjugates | Cutting-edge cancer therapies | Landmark $43 billion acquisition; makes Pfizer a top oncology powerhouse. |

Wyeth

Wyeth was acquired by Pfizer in 2009 in a deal worth $68 billion, one of the largest pharmaceutical mergers in history. Wyeth brought Pfizer a robust pipeline in vaccines, biologics, and consumer healthcare products. This acquisition also added the blockbuster vaccine Prevnar to Pfizer’s portfolio, strengthening its global vaccine division. Wyeth’s legacy continues to influence Pfizer’s current vaccine and biologics business.

Hospira

Hospira was acquired in 2015 for nearly $17 billion. It was a global leader in injectable drugs, biosimilars, and infusion technologies. The acquisition expanded Pfizer’s footprint in sterile injectables and positioned the company as a strong competitor in biosimilars, a fast-growing sector in the pharmaceutical industry. Hospira remains an integral part of Pfizer’s hospital and specialty care division.

Seagen

In 2023, Pfizer completed the $43 billion acquisition of Seagen, a biotechnology company specializing in antibody-drug conjugates (ADCs) for cancer treatment. This was one of Pfizer’s largest-ever acquisitions, cementing its place as a leader in oncology. Seagen’s pipeline added a new generation of targeted cancer therapies to Pfizer’s oncology division, significantly enhancing future revenue streams.

Array BioPharma

Array BioPharma was acquired in 2019 for $11.4 billion. The company specialized in oncology, particularly targeted cancer therapies. With Array’s expertise, Pfizer strengthened its position in precision oncology, adding innovative therapies for conditions such as melanoma and colorectal cancer. Array’s drug combinations continue to play a central role in Pfizer’s oncology portfolio.

Medivation

Pfizer acquired Medivation in 2016 for $14 billion. Medivation was best known for Xtandi, a blockbuster prostate cancer drug. The acquisition strengthened Pfizer’s oncology pipeline and provided it with a strong presence in the lucrative cancer treatment market.

Anacor Pharmaceuticals

In 2016, Pfizer acquired Anacor for $5.2 billion. Anacor specialized in dermatology and inflammation. Its most notable product was Eucrisa (crisaborole), a non-steroidal topical treatment for eczema. This acquisition gave Pfizer a foothold in the dermatology market.

King Pharmaceuticals

King Pharmaceuticals was acquired in 2010 for $3.6 billion. The acquisition expanded Pfizer’s presence in pain management and specialty pharmaceuticals. King also brought Pfizer the animal health business that was later spun off into Zoetis.

Arena Pharmaceuticals

In 2021, Pfizer acquired Arena Pharmaceuticals for $6.7 billion. Arena specialized in immuno-inflammatory diseases, bringing innovative treatments for conditions such as Crohn’s disease, ulcerative colitis, and atopic dermatitis into Pfizer’s portfolio.

GBT (Global Blood Therapeutics)

In 2022, Pfizer acquired Global Blood Therapeutics for $5.4 billion. GBT specialized in therapies for sickle cell disease, an underserved therapeutic area. This acquisition strengthened Pfizer’s rare disease pipeline and enhanced its reputation in treatments for hematological disorders.

Pharmacia

Pfizer merged with Pharmacia in 2003, which brought the blockbuster arthritis drug Celebrex and expanded Pfizer’s presence in specialty care. This acquisition also allowed Pfizer to access new biotechnology expertise, contributing to its long-term development strategy.

Warner-Lambert

In 2000, Pfizer merged with Warner-Lambert in a $90 billion deal. This acquisition brought the blockbuster cholesterol drug Lipitor, one of the most successful pharmaceutical products in history. The deal significantly boosted Pfizer’s revenue and positioned it as a global leader in cardiovascular medicines.

Upjohn Division (before spinoff)

Pfizer historically operated the Upjohn division, which included legacy medicines and off-patent drugs. While it was merged with Mylan in 2020 to form Viatris, Pfizer still retains rights to some legacy brands and partnerships stemming from this division.

Prevnar

Prevnar is one of Pfizer’s most successful vaccines, originally developed by Wyeth before Pfizer’s acquisition in 2009. It is a pneumococcal conjugate vaccine used to protect against pneumococcal disease, which can cause pneumonia, meningitis, and bloodstream infections. The vaccine has evolved over the years, with Prevnar 13 becoming a gold standard in immunization programs worldwide. More recently, Pfizer launched Prevnar 20, which protects against 20 serotypes of pneumococcal bacteria, expanding coverage and market potential. Prevnar is a cornerstone of Pfizer’s vaccine division, generating billions in annual revenue and playing a critical role in global public health, especially among children, the elderly, and immunocompromised populations.

Comirnaty

Comirnaty is Pfizer’s mRNA-based COVID-19 vaccine, co-developed with the German biotechnology company BioNTech. It became the first mRNA vaccine to receive emergency use authorization in December 2020 and later received full approval in multiple countries. During the peak of the COVID-19 pandemic, Comirnaty generated record-breaking sales, surpassing $36 billion in annual revenue at its height. While sales have since normalized by 2025, Comirnaty remains a vital brand, with updated formulations targeting emerging COVID-19 variants. It also positioned Pfizer as a leader in mRNA technology, laying the foundation for future vaccines against flu, RSV, and other infectious diseases.

Paxlovid

Paxlovid is Pfizer’s oral antiviral treatment for COVID-19, developed as a convenient at-home therapy for high-risk patients. It contains two components: nirmatrelvir, a protease inhibitor that blocks viral replication, and ritonavir, which boosts the effectiveness of the first component. Paxlovid played a critical role in reducing hospitalizations and deaths during COVID-19 surges. Although demand has decreased post-pandemic, it continues to generate steady revenue in 2025 as a treatment for immunocompromised individuals and those vulnerable to severe illness. Paxlovid also demonstrated Pfizer’s strength in rapid-response drug development, with regulatory approval achieved in record time.

Ibrance

Ibrance (palbociclib) is one of Pfizer’s flagship oncology drugs, approved in 2015 for the treatment of hormone receptor-positive, HER2-negative advanced breast cancer. It works as a CDK4/6 inhibitor, slowing cancer cell growth. Ibrance transformed the treatment landscape for metastatic breast cancer, becoming a blockbuster therapy and one of the top-selling drugs in Pfizer’s oncology division. Despite growing competition from rival CDK4/6 inhibitors, Ibrance continues to hold a strong market position in 2025 due to its established efficacy, safety profile, and ongoing clinical trials exploring its use in other cancer types.

Xtandi

Xtandi (enzalutamide), acquired through Pfizer’s $14 billion purchase of Medivation in 2016, is a leading therapy for prostate cancer. It is an androgen receptor inhibitor used in both metastatic and non-metastatic castration-resistant prostate cancer. Xtandi has significantly improved survival rates and quality of life for patients, making it one of the most widely prescribed prostate cancer treatments globally. By 2025, Xtandi remains a strong revenue driver in Pfizer’s oncology portfolio, benefiting from expanded approvals and increasing global demand for prostate cancer therapies.

Eucrisa

Eucrisa (crisaborole) was brought into Pfizer’s portfolio through the acquisition of Anacor Pharmaceuticals in 2016. It is a non-steroidal topical ointment for treating mild-to-moderate atopic dermatitis (eczema). Eucrisa represented Pfizer’s entry into dermatology and immuno-inflammatory conditions, complementing its existing portfolio in immunology. While competition in the eczema treatment market is strong, Eucrisa remains an important option for patients seeking steroid-free alternatives, and it continues to see steady use in pediatric and adult populations.

Vyndaqel and Vyndamax

Vyndaqel (tafamidis meglumine) and Vyndamax (tafamidis) are innovative treatments for transthyretin amyloid cardiomyopathy (ATTR-CM), a rare but life-threatening disease that causes heart failure due to protein misfolding. Approved in 2019, these drugs became the first-ever therapies for ATTR-CM, giving Pfizer a dominant position in the rare disease space. They have since seen rapid adoption across global markets, with revenues crossing the billion-dollar mark annually. By 2025, Vyndaqel and Vyndamax are among Pfizer’s fastest-growing brands, underscoring the company’s commitment to rare diseases and specialty medicine.

Conclusion

Pfizer is not owned by one person but by a wide group of shareholders, with Vanguard, BlackRock, and State Street being the largest. Its leadership under CEO Albert Bourla has been pivotal, especially during the COVID-19 pandemic. With a rich history, strong revenue, and multiple acquisitions, Pfizer remains one of the most influential pharmaceutical companies in the world.

FAQs

Who founded Pfizer?

Pfizer was founded in 1849 by Charles Pfizer and Charles Erhart, two cousins from Germany who immigrated to the United States. They started the company in Brooklyn, New York, focusing on producing a new antiparasitic drug called santonin. This laid the foundation for Pfizer’s long history of pharmaceutical innovation.

Who owns Pfizer company?

Pfizer is a publicly traded company listed on the New York Stock Exchange under the ticker symbol PFE. It is not owned by a single individual or entity. Instead, its ownership is divided among institutional investors, mutual funds, pension funds, and millions of individual shareholders worldwide. The largest shareholders include Vanguard Group, BlackRock, and State Street Corporation, who hold significant stakes and influence in the company.

What does Pfizer own?

Pfizer owns a wide range of pharmaceutical products, vaccines, and therapies. Its key brands include Prevnar 20, Comirnaty (COVID-19 vaccine), Paxlovid, Ibrance, Xtandi, Vyndaqel, and Eucrisa. Beyond products, Pfizer has expanded through acquisitions of major companies such as Wyeth, Warner-Lambert, Hospira, Medivation, Array BioPharma, Arena Pharmaceuticals, and Seagen. These acquisitions have strengthened its presence in oncology, vaccines, immunology, and rare diseases.

Who owns Pfizer pharmaceutical company?

Pfizer pharmaceutical company is primarily owned by large institutional investors. The top three shareholders are Vanguard Group, BlackRock, and State Street, each managing billions of dollars in global investments. Together, these institutions hold a significant percentage of Pfizer’s shares, giving them voting rights in corporate decisions. However, no single investor has controlling ownership, which makes Pfizer an independent, publicly owned corporation.

Is Pfizer still owned by Johnson & Johnson?

No, Pfizer is not owned by Johnson & Johnson. The two are separate pharmaceutical giants with independent operations. Johnson & Johnson owns Janssen Pharmaceuticals, which is one of its subsidiaries, but it has no ownership stake in Pfizer.

Which country owns Pfizer?

Pfizer is an American company headquartered in New York City, United States. It is not owned by any single country or government. Instead, it is a global corporation with shareholders and operations spread worldwide, though it is incorporated and regulated under U.S. law.

What is Pfizer called now?

Pfizer is still called Pfizer Inc. as of 2025. The company has not changed its name since its founding. However, over the years, it has reorganized its business units and spun off divisions like Upjohn, which merged with Mylan to form Viatris in 2020.

Is Janssen owned by Pfizer?

No, Janssen is not owned by Pfizer. Janssen Pharmaceuticals is a subsidiary of Johnson & Johnson, another major pharmaceutical company. While both Pfizer and Janssen operate in similar fields, they are competitors rather than related companies.

Is Pfizer a German company?

No, Pfizer is not a German company. It was founded in Brooklyn, New York, in 1849 by German-American cousins Charles Pfizer and Charles Erhart. While its founders were German immigrants, Pfizer has always been an American company headquartered in the United States.

Is Pfizer owned by the government?

No, Pfizer is not owned by the government. It is a publicly traded company owned by private investors, institutions, and individual shareholders. However, governments around the world, including the U.S. government, have partnered with Pfizer for vaccine supply contracts and research collaborations. These agreements do not translate into ownership.