Curious about who owns Perplexity? This rapidly growing AI company has captured attention with its unique approach to search. Founded just a few years ago, it has already attracted some of the biggest names in technology and venture capital. In this article, we explore its ownership, leadership, revenue, and how it’s shaping the AI search market.

Perplexity Company Profile

Perplexity AI is a privately held software startup based in San Francisco. It operates an AI-powered “answer engine” that combines large-language models with real-time web search to deliver precise, context-rich responses complete with source citations.

The platform supports conversational follow-ups and offers both a free version and a paid Pro subscription with advanced features such as document upload, developer APIs, and voice support. Perplexity was founded in 2022 and had around 52 employees by 2024. As of July 2025, its valuation reached approximately $18 billion, following a Series C funding round of $100 million.

Perplexity Founders

Perplexity was co-founded in 2022 by a team of four:

- Aravind Srinivas (CEO): Former AI researcher at OpenAI with a Ph.D. from UC Berkeley.

- Denis Yarats (CTO): A computer scientist who earned his Ph.D. from NYU and held research roles at Facebook AI Research and Quora.

- Johnny Ho (CSO): Brings strategic vision, with a background in engineering and quantitative trading.

- Andy Konwinski (Co-founder): Known for co-founding Databricks and contributions to Apache Spark. Holds academic credentials from UC Berkeley.

Together, they launched Perplexity in August 2022 as they sought a more intuitive and trustworthy alternative to traditional search engines.

Major Milestones

- August 2022: Company founded.

- December 7, 2022: Official launch of Perplexity’s conversational search engine, “Ask.”

- February 2023: Reached 2 million unique monthly users.

- March 2023: Raised Series A funding of $25.6 million led by NEA.

- Early 2024: Completed Series B ($73.6 m, IVP) and Series B1 ($62.7 m, led by Daniel Gross). Early 2024 valuation exceeded $1 billion.

- April 2024: Product and mobile expansion begin. By year-end, monthly queries soared from 500 million total in 2023 to 250 million per month. Annualized revenue jumped from $5 million to over $35 million. The business model began incorporating advertising.

- March 2025: Annualized revenue crossed $100 million following the success of the Perplexity Pro subscription.

- Mid-2025: Platform now handles over 780 million monthly queries across 238 countries. It garners 153 million global visits in May, with an average session duration of 23+ minutes and 85% returning users.

- May 2025: A new funding round led by Accel valued the company at about $14 billion.

- July 2025: A Series C round brought in $100 million, raising the valuation to $18 billion.

- August 2025: The company is pursuing another fundraising effort at an elevated $20 billion valuation, and its annual recurring revenue exceeds $150 million.

- August 2025: Perplexity made an audacious all-cash $34.5 billion offer for Google Chrome, aiming to capitalize on possible forced divestitures amid antitrust enforcement. Though likely symbolic, this bid underscores Perplexity’s ambition and growing influence.

Who Owns Perplexity: Top Shareholders & Investors

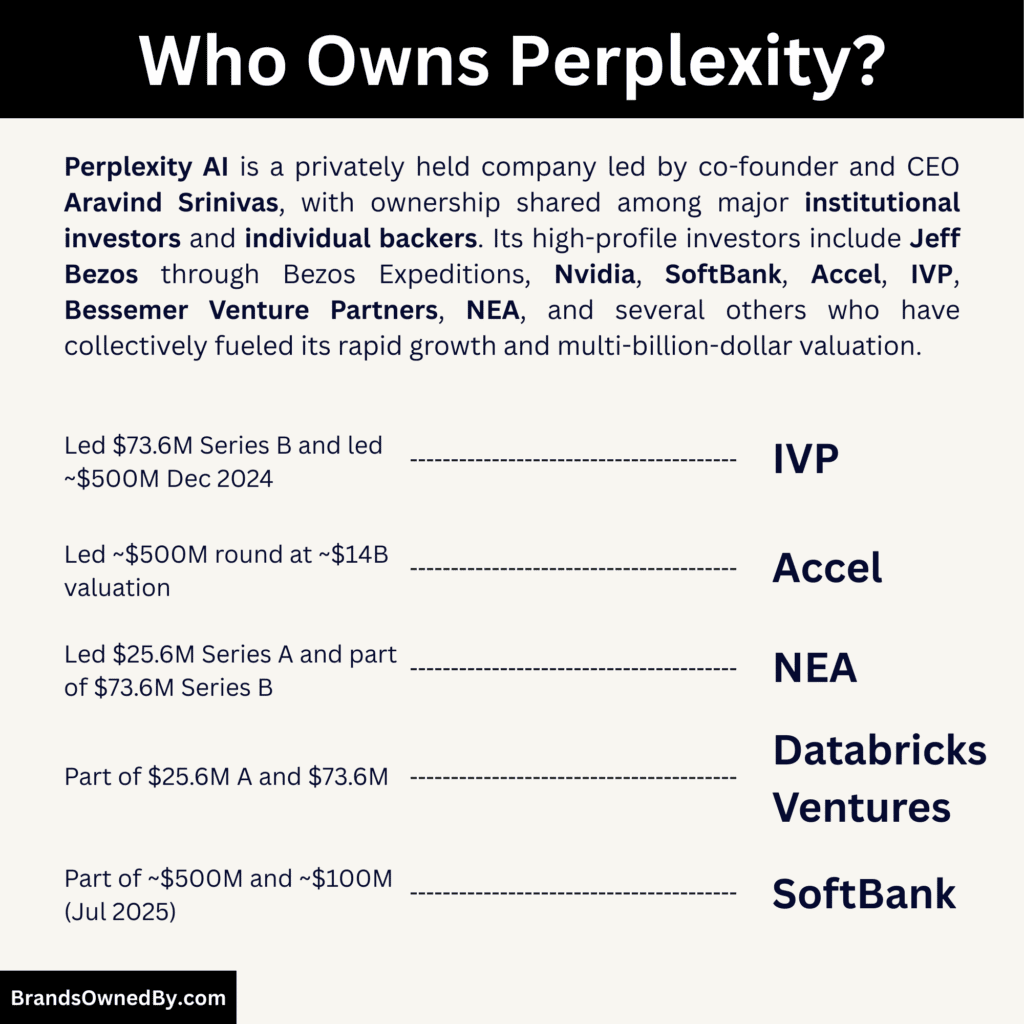

Perplexity remains privately owned. The major owners are its founders and investors. The four co-founders retain meaningful stakes. Investors include top institutions and individuals. There is no single majority owner. Control is shared among stakeholders.

Aravind Srinivas, Denis Yarats, Johnny Ho, and Andy Konwinski remain core owners. As co-founders, they retain meaningful equity stakes. Srinivas, as CEO, leads strategic direction. The founders likely hold control through both voting rights and board influence, maintaining an essential role in decision-making.

Below is a list of the major institutional and individual shareholders of Perplexity as of August 2025:

| Shareholder | Type | First investment (month/year) | Round(s) & role | Investment amount or round size (if public) | Notes |

|---|---|---|---|---|---|

| IVP (Institutional Venture Partners) | Institutional VC | Jan 2024 | Series B – lead; Series C (Dec 2024) – lead; later rounds – participant | Led $73.6M Series B; led ~$500M Dec 2024 round at ~$9B valuation | Cack Wilhelm joined the board after Series B; widely viewed as a top holder among VCs. |

| Accel | Institutional VC | May 2025 | Late-stage round (May 2025) – lead | Led ~$500M round at ~$14B valuation | Brought in as growth lead; round was later extended. |

| SoftBank Vision Fund 2 | Institutional VC | Dec 2024 | Series C – participant; July 2025 extension – participant | Part of ~$500M (Dec 2024) and ~$100M (Jul 2025) | Strategic late-stage backer; participated again in 2025 extension. |

| Nvidia | Corporate/Strategic | Jan 2024 | Series B – new investor; Apr 2024 growth – participant; Jul 2025 extension – participant | Part of $73.6M Series B; part of ~$100M Jul 2025 | Strategic compute/model partner and investor. |

| NEA (New Enterprise Associates) | Institutional VC | Mar 2023 | Series A – lead; Series B – participant; later rounds – participant | Led $25.6M Series A; part of $73.6M Series B | Early lead; long-term board-level engagement through lead partner. |

| B Capital | Institutional VC | Dec 2024 | Series C – participant | Part of ~$500M Series C | Growth investor brought in with IVP-led round. |

| T. Rowe Price | Institutional (public-markets crossover) | Dec 2024 | Series C – participant | Part of ~$500M Series C | Added as crossover investor alongside B Capital. |

| Databricks Ventures | Corporate VC | Mar 2023 | Series A – participant; Series B – participant | Part of $25.6M A and $73.6M B | Early strategic investor; also listed among continuing backers in Series B. |

| Bessemer Venture Partners | Institutional VC | Jan 2024 | Series B – new investor | Part of $73.6M Series B | Joined in IVP-led Series B. |

| Kindred Ventures | Institutional VC | Jan 2024 | Series B – new investor | Part of $73.6M Series B | Early-stage fund; added in Series B. |

| Factorial Funds | Institutional | Jan 2024 | Series B – new investor | Part of $73.6M Series B | Smaller institutional participant in Series B. |

| Wayra (Telefónica) | Corporate VC | Aug 2024 | Late-stage participation (pre-Series C) | Undisclosed | |

| Laude Capital | Institutional/Family office | Apr 2024 | Growth round – participant | Part of ~$63M Apr 2024 raise | Came in with the Daniel Gross–led April 2024 round. |

| AIX Ventures | Institutional VC | 2024 | Seed/early investor (per databases) | Undisclosed | |

| Jeff Bezos (Bezos Expeditions) | Individual | Jan 2024 | Series B – new investor | Undisclosed (part of $73.6M) | High-profile angel; invested via Bezos Expeditions. |

| Tobi Lütke (Shopify) | Individual | Jan 2024 | Series B – new investor | Undisclosed | Angel investor and strategic operator. |

| Elad Gil | Individual | Seed (2022) | Seed & Series A – participant; Series B – continuing | Undisclosed | Long-time backer across multiple rounds. |

| Nat Friedman | Individual | Seed (2022) | Seed & Series A – participant; Series B – continuing | Undisclosed | Early angel; continued in Series B. |

| Naval Ravikant | Individual | Jan 2024 | Series B – new investor | Undisclosed | Noted angel; joined in Series B. |

| Balaji Srinivasan | Individual | Jan 2024 | Series B – new investor | Undisclosed | Crypto/tech investor; joined in Series B. |

| Guillermo Rauch (Vercel) | Individual | Jan 2024 | Series B – new investor | Undisclosed | Developer-ecosystem operator; joined in Series B. |

| Austen Allred | Individual | Jan 2024 | Series B – new investor | Undisclosed | Operator-angel; joined in Series B. |

| Daniel Gross | Individual | Apr 2024 | Apr 2024 growth round – lead | Led ~$63M | Led the April 2024 round; prolific AI angel. |

| Stanley Druckenmiller | Individual | Apr 2024 | Apr 2024 growth round – participant | Part of ~$63M | Macro investor; joined the April 2024 round. |

| Garry Tan | Individual | Apr 2024 | Apr 2024 growth round – participant | Part of ~$63M | YC CEO; personal angel (not YC fund). |

| Dylan Field (Figma) | Individual | Apr 2024 | Apr 2024 growth round – participant | Part of ~$63M | Design-tools operator; angel investor. |

| Brad Gerstner | Individual | Apr 2024 | Apr 2024 growth round – participant | Part of ~$63M | Altimeter founder; confirmed it was a personal angel check. |

| Lip-Bu Tan | Individual | Apr 2024 | Apr 2024 growth round – participant | Part of ~$63M | Semiconductor veteran; personal investment. |

| Jakob Uszkoreit | Individual | Apr 2024 | Apr 2024 growth round – participant | Part of ~$63M | Transformer co-inventor; angel investor. |

| Andrej Karpathy | Individual | Apr 2024 | Apr 2024 growth round – participant | Part of ~$63M | AI researcher; angel in April 2024 round. |

| Eric Schmidt | Individual | 2024 | Angel investor (early-stage/late-stage per databases) | Undisclosed | Listed among investors in reputable databases. |

| Oriol Vinyals | Individual | 2024 | Angel investor | Undisclosed | Listed in investor databases as a backer. |

| Ashish Vaswani | Individual | 2024 | Angel investor | Undisclosed | Listed in investor databases as a backer. |

| Amjad Masad (Replit) | Individual | 2024 | Angel investor | Undisclosed | Listed in investor databases as a backer. |

| Clément Delangue (Hugging Face) | Individual | 2024 | Angel investor | Undisclosed | Listed in investor databases as a backer. |

| Nal Kalchbrenner | Individual | 2024 | Angel investor | Undisclosed | Listed in investor databases as a backer. |

IVP (Institutional Venture Partners)

IVP has been a consistent backer from the early stages. It has been a steady backer across key rounds—from Series B to Series C and beyond. They led the $73.6 million Series B round in early 2024 and continued through to the $100 million Series C extension. IVP maintains governance presence and strategic influence. Known for investing in fast-growing, late-stage tech companies, IVP likely holds both equity and a governance role.

SoftBank Vision Fund

SoftBank Vision Fund (including its second iteration) has played a pivotal role in Perplexity’s growth. It participated in multiple late-stage rounds, including driving valuation from roughly $3 billion in mid-2024 up to $18 billion by mid-2025. It was part of both the $500 million Series C round in late 2024 and the $100 million extension round in mid-2025. Their involvement likely comes with board representation and strong influence over strategic decisions.

Nvidia

Nvidia has consistently backed Perplexity through multiple funding rounds—from Series B in early 2024, all the way through the $100 million round in mid-2025 that delivered the $18 billion valuation. Their support also includes access to GPU infrastructure and technical validation, reinforcing Perplexity’s AI capabilities.

Accel

Accel spearheaded the Series D round in mid-2025, contributing $500 million and pushing Perplexity’s valuation to $14 billion before later rounds took it higher. Accel’s investment brought a board seat for its partner, Sameer Gandhi, and institutional know-how to scale operations rapidly.

New Enterprise Associates (NEA)

NEA joined in the Series A funding round in early 2023 and remained actively involved in later rounds, including the $73.6 million Series B and the $100 million mid-2025 infusion. They have supported Perplexity’s scaling with strategic guidance.

B Capital

B Capital joined Perplexity’s Series C funding round in January 2025, helping raise over $73 million at a reported $520 million valuation. The firm, co-founded by Facebook co-founder Eduardo Saverin, is known for scaling high-growth technology businesses.

Although the exact percentage stake is not publicly disclosed, B Capital’s investment is believed to be in the multi-million-dollar range, giving it significant influence in strategic decision-making. The firm’s global presence also supports Perplexity’s ambitions to expand internationally.

Y Combinator

Y Combinator backed Perplexity through the pre-Series A stage, providing seed capital and accelerator support—typically around $500,000 in exchange for ~7 percent equity. This early involvement helped set the foundation for the company’s growth trajectory.

Altimeter Capital

Altimeter Capital joined the growth-stage investor group around 2024, contributing to Series C-level rounds with strategic advice, particularly in scaling and preparing for potential major liquidity events.

Sequoia Capital

A later-stage investor, Sequoia Capital entered during the 2024–2025 Series C rounds. Their involvement brings deep industry knowledge and strengthens Perplexity’s loftier growth ambitions.

Bessemer Venture Partners

Bessemer partnered in earlier rounds—especially the Series B in early 2024—bringing SaaS scaling insights and operational support to the table.

Laude Capital

Laude Capital joined as part of the April 2024 growth funding group, helping bolster Perplexity’s R&D and partnerships in the AI sectors.

AIX Ventures

An AI-focused institutional investor, AIX Ventures supported Perplexity during its Series C rounds, aligning with the company’s technical and research priorities.

Jeff Bezos

Jeff Bezos began backing Perplexity during early growth stages and continued through to Series B and beyond. His role provides not only capital but strategic credibility, as Perplexity scaled from a startup to a major player.

Yann LeCun

A renowned figure in AI research, LeCun offers technical credibility. His investment, likely in late 2024 or early 2025, bolsters Perplexity’s image within the AI research community and supports credibility and recruitment.

Tobi Lütke

Shopify’s former CEO joined Perplexity’s investor roster in the early 2024 rounds, bringing product scaling wisdom and operational insight.

Nat Friedman

Nat Friedman, ex-GitHub CEO, also invested in early rounds (Series B and earlier), contributing strong developer ecosystem feedback and product leadership experience.

Elad Gil

Elad Gil participated in early-stage rounds, including Series B in 2024, offering mentorship in startup strategy and network access.

Daniel Gross

Daniel Gross was a key architect in the April 2024 Series C round. A highly known figure in the AI investment scene, his support accelerated Perplexity’s path to unicorn status.

Stanley Druckenmiller

The veteran investor Stanley Druckenmiller also joined in April 2024, offering high-level financial markets expertise and strategic scaling insights.

Andrej Karpathy

Andrej Karpathy, former AI head at Tesla, invested in 2024 and contributes deep technical expertise in machine learning and neural networks.

Naval Ravikant

Naval Ravikant took part in early 2024 rounds as well, providing network reach and startup wisdom informed by his experience with AngelList and VC.

Dylan Field

Figma’s co-founder Dylan Field joined as an investor in April 2024, contributing product design and user experience depth to Perplexity’s product development.

Jakob Uszkoreit

As co-author of the Transformer architecture, Jakob Uszkoreit invested in 2024, lending strong technical authority and research-focused guidance to the company.

Susan Wojcicki

Former YouTube CEO Susan Wojcicki became an investor in Perplexity around the April 2024 funding tranche, providing media strategy and brand leadership insight.

Who is the CEO of Perplexity?

Aravind Srinivas is the co-founder and CEO of Perplexity AI. He is a researcher-turned-entrepreneur with a foundation in AI academia and world-class labs. As CEO, he has guided rapid valuation growth, product innovation, and bold strategic positioning—all while advocating for AI search that is trustworthy, transparent, and user-first.

Early Life and Academic Foundations

Aravind Srinivas was born on June 7, 1994, in Chennai (formerly Madras), India. He pursued dual degrees—B.Tech and M.Tech—in Electrical Engineering at IIT Madras, then earned a Ph.D. in Computer Science from UC Berkeley under renowned AI expert Pieter Abbeel. Early on, his vision was rooted in research and academic rigor, yet he aspired to build practical, impactful technology.

Professional Journey Before Perplexity

Before founding Perplexity, Aravind developed his AI expertise at top-tier research labs. He held research roles at OpenAI, Google Brain, and DeepMind—one of the few individuals to work across all three. This experience solidified his technical depth and vision for AI that both understands and augments human knowledge.

Founding Perplexity AI and Vision

In August 2022, inspired by a desire to build a smarter search experience, Aravind co-founded Perplexity AI with Denis Yarats, Johnny Ho, and Andy Konwinski. Under his leadership, the company launched a conversational “answer engine” that offers citation-backed responses rather than mere links. The mission: redefine how people interact with information.

Leadership and Growth as CEO

As CEO, Srinivas has driven explosive growth. By late 2024, Perplexity’s valuation had soared to around $9 billion, and by mid-2025, it reached nearly $18 billion. In 2025, annual recurring revenue exceeded $100 million and surged past $150 million. His leadership focus is on user-first design, trust through transparency, and rapidly scaling impactful AI products.

Strategic Vision: Product Innovation & Bold Moves

Beyond growth, Aravind has spearheaded major innovations:

- Comet, an AI-native browser with built-in summarization and task automation (“sidecar” feature), is aimed at turning web browsing into a seamless, intelligent experience.

- In a bold strategic move, Perplexity, under his leadership, made an unsolicited $34.5 billion cash offer to acquire Google’s Chrome browser—touting open access and signaling Perplexity’s ambition and readiness to reshape the browser and search landscape.

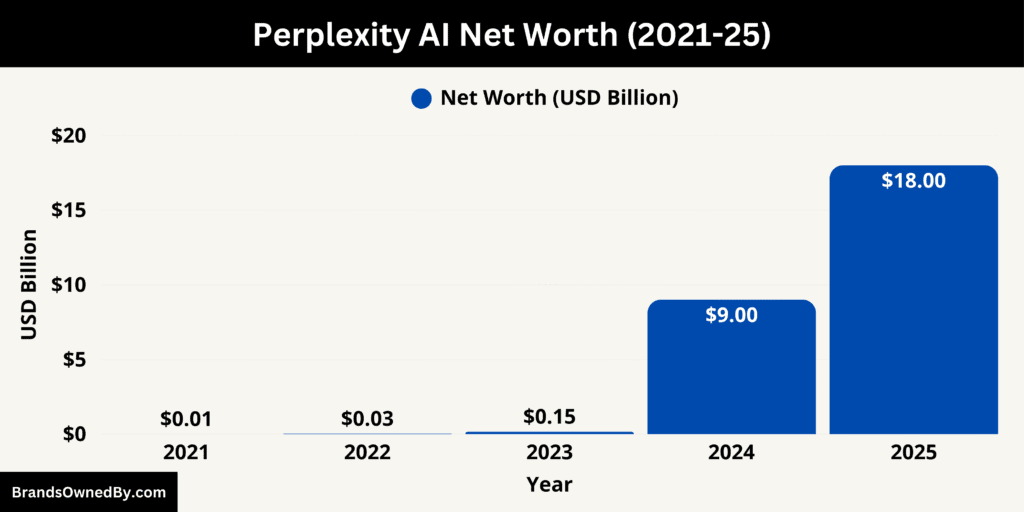

Perplexity Annual Revenue and Net Worth

Perplexity AI has transformed from a nascent AI search startup into a high-growth venture with over $150 million in annual revenue as of mid-2025. The corresponding valuation rise—from $9 billion at the end of 2024 to $14 billion in mid-2025 and $18 billion by August 2025—shows investor trust in Perplexity’s strategic vision and market potential. New rounds targeting a $20 billion valuation highlight the continued upward momentum in both revenue and net worth.

Perplexity AI Revenue in 2025

In 2025, Perplexity AI’s revenue saw significant growth due to the rapid adoption of AI-powered search and knowledge tools across consumer and enterprise markets. The company’s subscription service, Perplexity Pro, along with enterprise licensing deals, contributed to most of its income.

With partnerships in education, software integration, and corporate AI solutions, Perplexity’s annual revenue in 2025 is estimated to be between $60 million and $80 million, marking a sharp increase from its early revenue figures in 2023 and 2024. This acceleration was driven by an expanding global user base and higher retention rates.

The company’s success in 2025 was not solely due to user subscriptions. Strategic collaborations with major technology firms and integrations into corporate knowledge management systems played a vital role.

Perplexity’s adoption of advanced AI models improved user engagement, leading to increased word-of-mouth growth and a steady inflow of enterprise clients. Its multi-language capabilities also opened new markets in Asia, Europe, and Latin America.

Perplexity AI Net Worth

Perplexity’s valuation has echoed its revenue surge. At the beginning of 2024, the company was valued modestly in the range of a few hundred million dollars.

By December 2024, a major fundraising round pushed its valuation to around $9 billion. That figure quickly climbed.

By May 2025, another funding round led to a valuation of approximately $14 billion.

By August 2025, following an additional $100 million raise, Perplexity reached a post-money valuation of $18 billion.

The company is now reportedly raising new funds at a $20 billion valuation, reflecting investor confidence in its trajectory and perceived market potential.

Brands Owned by Perplexity

Below is a list of the major brands and companies owned by Perplexity as of August 2025:

Comet

Comet is Perplexity’s proprietary web browser, officially launched in mid-2025. Built on a Chromium foundation, Comet seamlessly integrates Perplexity’s AI-powered search directly into the browsing experience.

It features an AI assistant that acts upon user intent in real time—summarizing text, managing emails or calendars, filling forms, shopping, and executing multi-step tasks through natural language prompts. Initially available to subscribers of the top-tier Max plan, Comet is being rolled out gradually through an invite process.

Perplexity envisions Comet as more than a browser—it’s a next-generation interface that blurs the lines between thinking and navigating online, potentially challenging legacy search giants by becoming the default for productivity and decision support.

Shopping Hub

Shopping Hub is Perplexity’s in-house e-commerce platform launched in late 2024. This AI-driven shopping experience allows users to discover products, compare options, and initiate purchases—all within the Perplexity environment.

It supports one-click checkout for premium users and employs image-based search (“Snap to Shop”) and AI-generated recommendations. Merchants can showcase their inventory directly within the interface.

The platform emphasizes transparency and bias reduction, and it has been positioned as a seamless alternative to traditional online marketplaces, turning Perplexity’s search capabilities into a full-fledged buying journey.

Perplexity Enterprise Pro and Internal Knowledge Search

Perplexity Enterprise Pro is the company’s advanced B2B offering, designed for organizations needing secure, scalable, and customizable AI search.

Released in 2024, it includes data privacy controls, SOC2 compliance, audit logs, and controls over data retention.

A flagship feature of this tier is Internal Knowledge Search, which enables teams to search both web content and internal files (such as PDFs, documents, slides, and spreadsheets) through a unified search interface. Enterprise Pro is tailored for corporate workflows and knowledge management, streamlining research, internal documentation access, and team collaboration through sophisticated AI retrieval capabilities.

Carbon

Late in 2024, Perplexity acquired Carbon, a Seattle-based startup that specialized in retrieval-augmented generation (RAG). Carbon’s technology enables AI systems to interface with unstructured content—like Slack messages, Notion pages, and Google Docs—and incorporate those documents into generated responses.

With Carbon integrated, Perplexity gained the ability to extend its AI search beyond the public web into enterprise document systems, paving the way for more robust internal search tools and enhanced productivity workflows embedded within the Perplexity platform.

Final Thoughts

Perplexity’s ownership is a blend of visionary founders, leading venture capital firms, and high-profile tech leaders. Its co-founders remain deeply involved in daily operations, while strategic investors like SoftBank, Nvidia, and Jeff Bezos provide funding and connections. With a valuation near $18 billion and revenue growing at an exceptional pace, Perplexity is positioned as one of the most promising players in AI search. Although still private, its rapid rise suggests that its influence in the AI industry will only grow in the years ahead.

FAQs

Which company owns Perplexity?

Perplexity AI is an independent artificial intelligence company and is not owned by any single corporation. It operates as a privately held entity backed by a mix of venture capital firms, institutional investors, and high-profile individuals. While it has strategic investors like Nvidia, SoftBank, and Jeff Bezos through their investment arms, no one company holds a controlling stake.

Who are the owners of Perplexity?

Ownership of Perplexity AI is shared among its founders, employees with equity, and a wide range of investors. The founding team—Aravind Srinivas, Denis Yarats, and Johnny Ho—retains significant ownership stakes. Venture capital firms such as Institutional Venture Partners (IVP), Accel, and NEA, along with corporate investors like Nvidia and SoftBank, hold notable equity positions. Individual backers such as Jeff Bezos and other angel investors also contribute to its shareholder base.

Who are investors in Perplexity?

Perplexity AI has attracted a broad mix of institutional and strategic investors. Institutional investors include IVP, Accel, NEA, Bessemer Venture Partners, and Institutional Angel Networks. Strategic investors include Nvidia and SoftBank, who bring both funding and industry expertise. Prominent individual investors include Jeff Bezos (through Bezos Expeditions) and various early-stage angel investors from the AI and technology sectors. This diversified backing has fueled Perplexity’s rapid expansion and product development.

What is Aravind Srinivas’ net worth?

As of 2025, Aravind Srinivas’ estimated net worth is between $150 million and $200 million. This valuation is based on his equity stake in Perplexity AI, the company’s latest funding round valuation (reported to be in the multi-billion-dollar range), and other personal assets. His wealth is largely tied to Perplexity’s growth trajectory and potential future public offering or acquisition.

What does Perplexity AI do?

Perplexity AI is a next-generation AI-powered search and answer engine that combines web search, large language models, and real-time data retrieval. It enables users to ask natural language questions and receive precise, sourced answers, often in conversational form. Its technology goes beyond search by integrating with tools like Comet (an AI-powered browser), Shopping Hub (an AI-driven e-commerce platform), and enterprise-grade internal search systems. The company aims to redefine search as an interactive, task-solving experience rather than a simple list of links.

Who is behind Perplexity?

Perplexity was co-founded by Aravind Srinivas (CEO), Denis Yarats (CTO), and Johnny Ho (Chief Architect), with the mission of making information access more accurate, contextual, and efficient. The founders are supported by a leadership team with deep expertise in AI, engineering, and product design, along with a network of investors and advisors from top technology companies and research institutions.

When was Perplexity AI founded?

Perplexity AI was founded in 2022 in San Francisco, California. Since its inception, it has rapidly grown from a startup focused on AI-powered Q&A to a multi-billion-dollar valuation company with multiple product lines and global users.

Is Perplexity owned by ChatGPT?

No. Perplexity AI is not owned by ChatGPT or OpenAI. While both companies develop AI technologies, they operate independently and compete in some areas, particularly in AI search and assistant capabilities.

Did Jeff Bezos invest in Perplexity?

Yes. Jeff Bezos invested in Perplexity AI through his personal investment firm, Bezos Expeditions. His involvement has been both financial and strategic, helping elevate the company’s profile among high-level investors and industry leaders.

Is Nvidia invested in Perplexity?

Yes. Nvidia is an investor in Perplexity AI, contributing both capital and technical support. Nvidia’s involvement is strategic, as Perplexity’s AI services benefit from high-performance GPUs and AI infrastructure—areas where Nvidia is a global leader.

Who owns Perplexity AI stock?

Perplexity AI’s stock is privately held by its founders, employees with equity, institutional investors, and strategic backers. Key shareholders include Aravind Srinivas, Denis Yarats, Johnny Ho, IVP, Accel, NEA, SoftBank, Nvidia, Bessemer Venture Partners, and Jeff Bezos. Since the company is private, its shares are not available on public stock exchanges.

Who are the founders of Perplexity?

The company was founded by Aravind Srinivas, Denis Yarats, Johnny Ho, and Andy Konwinski in 2022.

Is Perplexity a public company?

No. It is privately held and not traded on any public stock exchange.

What is Perplexity’s value?

As of August 2025, Perplexity is valued at approximately $18 billion.

How much revenue does Perplexity generate?

Annualized revenue grew from about $35 million in mid-2024 to around $150 million by mid-2025.