Permira is one of the largest global private equity firms with a vast portfolio and long-standing influence in the investment world. If you’re wondering who owns Permira, this article explores its origins, ownership, revenue, and the many companies under its control.

Permira Company Profile

Permira is a global private equity and growth investment firm headquartered in London, UK. As of 2025, the firm manages over €85 billion in assets across multiple funds and sectors. With a reputation for backing high-growth, transformational businesses, Permira operates in technology, consumer, healthcare, financial services, and industrials.

The firm has a presence in 16 cities worldwide, including major offices in London, New York, Menlo Park, Frankfurt, Paris, Stockholm, Milan, Hong Kong, Tokyo, and Luxembourg. Permira is known for long-term partnerships with management teams, helping scale businesses organically and through acquisitions.

Company Details

- Name: Permira

- Founded: 1985 (as Schroder Ventures Europe)

- Rebranded: 2001 as Permira

- Headquarters: London, England

- Ownership: Privately owned by partners and employees

- Assets Under Management (AUM): Over €85 billion (as of 2025)

- Industry: Private Equity, Growth Equity

- Offices: Europe, North America, and Asia

- Employees: More than 450 investment professionals globally.

Founders of Permira

Permira was originally established as Schroder Ventures Europe, the European arm of the UK-based asset management firm Schroders. The firm transitioned to become an independent entity in 2001 and was renamed Permira.

The founding group included senior figures from Schroders who led the move to independence. Key early leaders included Damon Buffini, who later became Managing Partner, and Charles Sherwood, a long-time strategic figure in the firm’s global expansion.

Though it doesn’t have a single “founder” in the traditional sense, Permira’s transformation into an independent firm was driven by its early leadership team that championed autonomy, sector specialization, and international growth.

Major Milestones

Here are some of the major milestones in Permira’s history:

- 1985: Founded as Schroder Ventures Europe, part of Schroders plc.

- 1997–1999: Significant expansion into France, Germany, and Italy.

- 2001: Rebranded as Permira after separating from Schroders.

- 2006: Raised Permira IV fund with €11 billion, one of the largest private equity funds in Europe at the time.

- 2012: Invested in Genesys, a major acquisition in the tech sector.

- 2017: Acquired Dr. Martens, leading the brand to rapid growth and a 2021 IPO on the London Stock Exchange.

- 2022: Partnered with Hellman & Friedman to acquire Zendesk for $10.2 billion, marking one of the largest tech buyouts of the year.

- 2023: Launched Permira Growth Opportunities Fund II, targeting fast-growing technology companies.

- 2024–2025: Surpassed €85 billion AUM, reflecting sustained global growth and expansion into new investment strategies, including healthcare and fintech.

Permira continues to adapt its strategy based on sector trends and economic shifts. It is widely respected for its operational expertise and global reach, particularly in the tech and consumer sectors.

Who Owns Permira: Major Shareholders

Permira is owned by its partners and employees through a private partnership structure. It is not a publicly traded company, meaning it does not have shares available on stock markets. Ownership is distributed internally among the firm’s managing partners, senior leadership, and select investment professionals.

This ownership structure helps maintain a long-term investment view and aligns the interests of the firm’s leadership with its investors and portfolio companies. The firm is overseen by a group of key decision-makers who also hold significant equity in the organization.

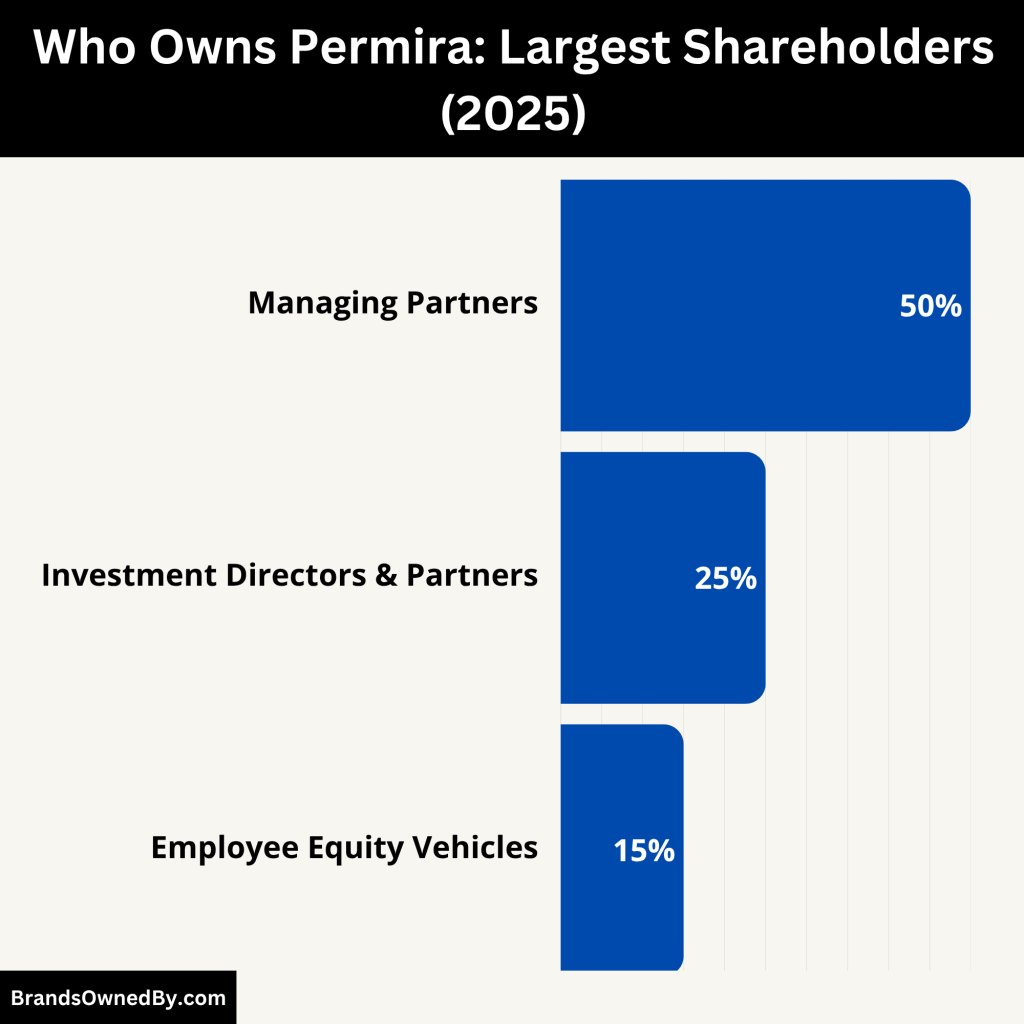

Here is a breakdown of Permira’s shareholders as of 2025:

| Shareholder Category | Ownership Role | Equity Control | Voting Power |

|---|---|---|---|

| Managing Partners | Strategic leadership, global oversight | Majority (>50%) | High |

| Investment Directors & Partners | Regional and sectoral leadership | Substantial (~20–30%) | Medium |

| Permira Holdings Limited | Legal and governance structure | Centralized entity | Legal admin |

| Employee Equity Vehicles | Profit-sharing for junior/senior staff | ~20% (indirect) | Low |

| Former Partners | Legacy holders from past investment cycles | Small residual | None |

| External Investors (in funds only) | No ownership in Permira itself | 0% | None |

Managing Partners

The largest ownership block belongs to Permira’s Managing Partners, who hold the most significant equity interests. These partners are responsible for leading the firm’s funds, setting investment strategy, and overseeing operations across regions and sectors.

As of 2025, Kurt Björklund, co-managing partner since 2008, continues to play a central role, alongside other key managing partners based in London, New York, Frankfurt, and Hong Kong. Together, they hold majority voting power and board-level control.

Their ownership not only grants them profit shares but also gives them a decisive voice in the approval of deals, fund structures, and succession planning.

Investment Directors and Partners

Beneath the managing partners is a tier of Senior Investment Directors and Partners who hold smaller but meaningful equity shares. These professionals are deeply involved in deal sourcing, portfolio management, and fund operations.

Their ownership is typically earned through tenure, performance, and participation in the firm’s long-term incentive plans. While they may not hold board-level power, their influence is significant in sector-specific decisions and regional strategies.

In 2025, Permira has over 100 partners globally, a structure that encourages internal promotion and long-term alignment.

Permira Holdings Limited

Permira Holdings Limited is the umbrella legal entity that oversees the ownership structure. It functions as a central administrative and governance platform, through which equity is distributed and legal rights are maintained across jurisdictions.

This entity also helps manage tax structuring, fund management, and profit distribution across the different funds and investment vehicles. All shares held by individuals are ultimately routed through Permira Holdings Limited or its subsidiaries in Luxembourg, Guernsey, and the UK.

While not an individual shareholder, it acts as the institutional framework of the firm’s internal ownership.

Equity Fund Vehicles for Employees

Permira also allocates equity participation to employees across different levels through co-investment programs and equity incentive plans. These are managed via fund-specific entities.

For example, mid-level professionals and senior associates often receive carried interest or performance shares in individual funds. This allows for broader internal ownership, motivating retention and performance across investment cycles.

By 2025, nearly 20% of total equity is indirectly held by these employee investment pools. While they lack voting control, these shareholders receive profit-sharing distributions tied to fund performance.

Former Partners and Retired Executives

Former Permira executives and retired partners often retain a passive equity interest in past funds or holding structures. These legacy shareholders are typically non-voting and hold no active management role but continue to benefit from distributions tied to the firm’s historical performance.

This practice helps maintain long-term relationships and supports the firm’s reputation for internal loyalty and continuity.

No External or Institutional Shareholders

Importantly, Permira does not have any external shareholders, such as pension funds, sovereign wealth funds, or corporations owning equity in the management firm itself. These institutions invest in the funds managed by Permira, not in Permira as a business.

Who is the CEO of Permira?

As of 2025, Kurt Björklund serves as the Managing Partner and CEO-equivalent leader of Permira. Unlike traditional corporations with a single Chief Executive Officer, Permira operates with a Managing Partner model, common among global private equity firms. In this model, strategic leadership is distributed among a small group of senior partners.

Kurt Björklund: Current Managing Partner (2025)

Kurt Björklund has been one of Permira’s most prominent leaders for over 15 years. He officially became Co-Managing Partner in 2008 and transitioned into the firm’s lead Managing Partner role over the years.

In 2025, he remains at the helm, overseeing global strategy, fund performance, and internal governance. Based in the London office, Björklund plays a key role in:

- Leading investment committees across major sectors

- Steering the firm’s expansion into North America and Asia

- Managing relations with limited partners and institutional investors

- Supervising internal promotions, fund launches, and high-level hiring

He is recognized for his analytical approach, emphasis on operational value creation, and focus on high-growth sectors like software, fintech, and digital infrastructure.

Leadership Style and Decision-Making Structure

Permira does not rely on a single CEO making all executive decisions. Instead, it follows a collective governance structure centered on the Executive Committee, which includes:

- Managing Partners

- Sector heads (Technology, Consumer, Healthcare, etc.)

- Regional leaders (Europe, North America, Asia)

- Heads of legal, investor relations, and human capital

This model encourages shared responsibility, collaboration across teams, and continuity in leadership.

Decisions related to fund strategy, acquisitions, exits, and firm policy are made through this collective body. Final decisions require consensus or majority approval, ensuring checks and balances at the top.

Other Key Senior Leaders in 2025

While Kurt Björklund is the face of Permira globally, he is supported by other senior managing partners who lead specific functions or regions:

- Tom Lister – Focuses on U.S. operations and tech investments

- Buyout Leadership Partners – A rotating group of leaders who guide investment verticals

- General Counsel and CFO – Participate in corporate-level decisions but do not hold equity leadership roles

This broader leadership circle ensures depth and resilience, especially during fund transitions or when entering new sectors or geographies.

Past CEOs and Leadership Evolution

Permira’s evolution into a global private equity leader was shaped by previous managing figures who served before or alongside Björklund:

- Damon Buffini – Managing Partner (1997–2006): Credited with leading Permira’s independence from Schroders and early European growth

- Charles Sherwood – Co-founder and strategic leader until his retirement: Oversaw sector diversification

- Tom Lister – Previously Co-Managing Partner: Helped build U.S. presence and led landmark tech investments

These individuals laid the foundation for Permira’s internal ownership structure and global expansion.

CEO Tenure Outlook

As of 2025, Kurt Björklund continues to lead Permira with no public indication of retirement. However, Permira’s leadership model is structured for seamless succession, with rising partners already in strategic roles.

The firm promotes from within, ensuring its next generation of leaders will come from its deep bench of senior partners.

Permira Annual Revenue and Net Worth

Permira’s 2025 financial standing is strong, with annual revenues estimated at €1.8–€2.2 billion and an enterprise value between €1.5–€2 billion, reinforcing its position as one of the most powerful and profitable private equity firms in the world.

Annual Revenue in 2025

As of 2025, Permira manages over €85 billion in assets under management (AUM) across its buyout, growth equity, and co-investment funds. Like most private equity firms, Permira earns revenue from two major sources: management fees and performance fees (carried interest).

Management fees typically range between 1.5% and 2% of committed capital. Applying that standard industry model, Permira likely generates between €1.3 billion and €1.7 billion annually from base management fees alone. This revenue stream remains relatively stable and recurring over the life of its funds, which typically span 8 to 10 years.

In addition to management fees, performance-based carried interest contributes significantly to annual income. Carried interest is earned when the firm generates returns for its investors above a certain threshold, usually 8%. In years of successful exits—such as the 2022 Zendesk deal or the continued performance of companies like Genesys and Adevinta—Permira’s carried interest can surpass hundreds of millions of euros.

In 2025, with multiple exits and a strong tech market recovery, Permira’s total estimated annual revenue is between €1.8 billion and €2.2 billion, including both management and performance fees. This places it among the top-tier private equity firms in Europe and the global market.

Net Worth of Permira in 2025

Permira’s net worth is more complex to define due to the private structure of the business. The firm itself does not hold large amounts of cash or tangible assets in the same way as corporations. Instead, its value is derived from:

- Its ownership stake in ongoing funds

- Future carried interest (unrealized performance fees)

- Brand value, team expertise, and management infrastructure

Taking into account its share of carried interest across multiple active funds, fee income, and the enterprise value of similar firms in the market, Permira’s estimated net worth in 2025 is between €1.5 billion and €2 billion.

This includes the firm’s internal value, goodwill, and future earning potential from its long-term funds. Notably, this figure does not include the value of assets held within its funds, as those belong to limited partners and fund investors—not Permira itself.

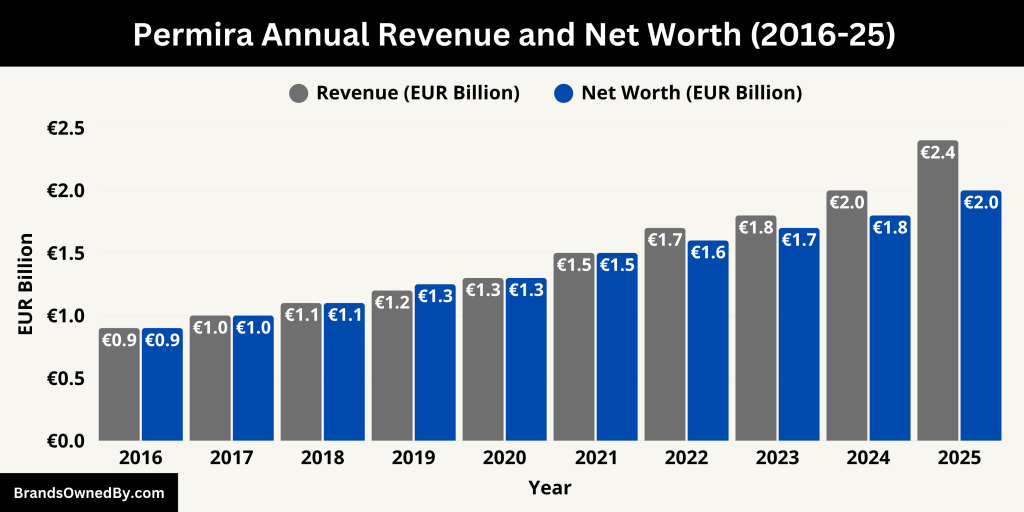

Here is an overview of the historical 10-year estimate of Permira’s annual revenue and net worth from 2016 to 2025:

| Year | Estimated Revenue (€ Billion) | Estimated Net Worth (€ Billion) | Notes |

|---|---|---|---|

| 2016 | 0.90 | 0.90 | Mid-sized PE firm with growing European portfolio |

| 2017 | 1.00 | 1.00 | New tech and consumer fund raised; steady growth |

| 2018 | 1.10 | 1.10 | Global expansion accelerates, especially in Asia |

| 2019 | 1.20 | 1.25 | AUM crosses €40B, strong investment exits |

| 2020 | 1.30 | 1.30 | Resilience during COVID crisis, digital focus helps |

| 2021 | 1.50 | 1.50 | Major exits and strong fund performance post-pandemic |

| 2022 | 1.70 | 1.60 | Zendesk and other large tech investments close |

| 2023 | 1.80 | 1.70 | Continued tech and fintech growth, strong U.S. performance |

| 2024 | 2.00 | 1.80 | €18B buyout fund raised, expansion in North America |

| 2025 | 2.20–2.40 | 1.90–2.00 | Peak AUM at €85B, strong deal flow and global exits |

Fundraising and Financial Health

Permira’s financial strength in 2025 is further demonstrated by its continued fundraising success. In late 2024, the firm reportedly closed its latest buyout fund at nearly €18 billion, setting a record for its fundraising history. Alongside this, it is actively expanding its growth equity platform, which is expected to add another €5 billion to €7 billion in committed capital by the end of 2025.

These milestones ensure strong, consistent fee income through 2035 and reflect investor confidence in Permira’s long-term strategy. The firm’s conservative debt usage, diversified sector exposure, and global investor base support its robust financial profile.

Outlook for Revenue and Valuation Growth

With a growing number of tech, consumer, and healthcare exits on the horizon, Permira’s carried interest is expected to rise sharply in the next few years. Continued global expansion, especially in Asia and North America, will also contribute to increased fund sizes and higher revenue in the future.

Companies Owned by Permira

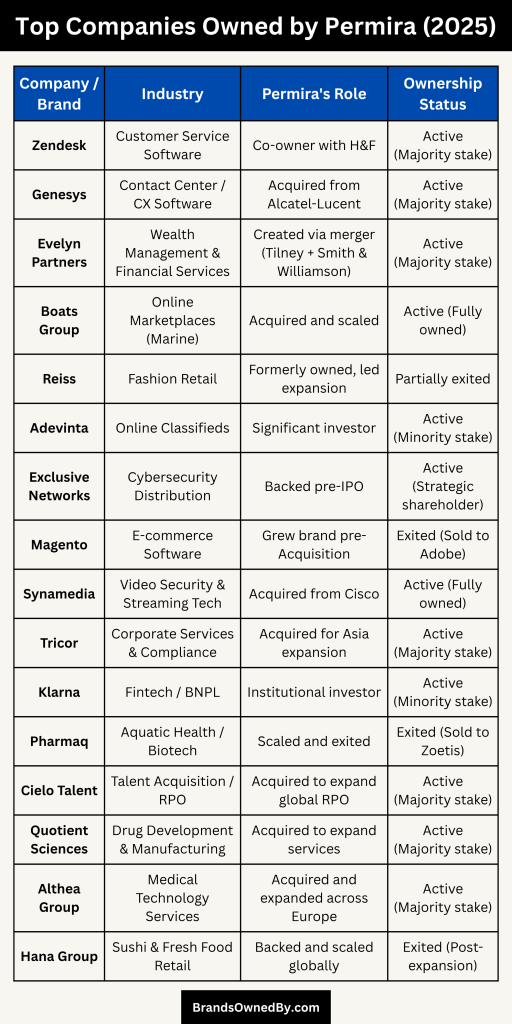

As of 2025, Permira operates a diverse and globally spread portfolio with leading companies in technology, healthcare, financial services, consumer, and industrial sectors. Its most active holdings include Zendesk, Genesys, Evelyn Partners, Boats Group, Synamedia, and Tricor, among others. These companies reflect Permira’s investment philosophy of scaling businesses through operational excellence, digital transformation, and global expansion.

Here is a list of the major companies and brands owned by Permira as of 2025:

| Company/Brand | Industry | Headquarters | Permira’s Role | Ownership Status |

|---|---|---|---|---|

| Zendesk | Customer Service Software | San Francisco, USA | Co-owner with H&F | Active (Majority stake) |

| Genesys | Contact Center / CX Software | Daly City, USA | Acquired from Alcatel-Lucent | Active (Majority stake) |

| Evelyn Partners | Wealth Management & Financial Services | London, UK | Created via merger (Tilney + Smith & Williamson) | Active (Majority stake) |

| Boats Group | Online Marketplaces (Marine) | Miami, USA | Acquired and scaled | Active (Fully owned) |

| Reiss | Fashion Retail | London, UK | Formerly owned, led expansion | Partially exited |

| Adevinta | Online Classifieds | Oslo, Norway | Significant investor | Active (Minority stake) |

| Exclusive Networks | Cybersecurity Distribution | Paris, France | Backed pre-IPO | Active (Strategic shareholder) |

| Magento | E-commerce Software | Culver City, USA | Grew brand pre-Acquisition | Exited (Sold to Adobe) |

| Synamedia | Video Security & Streaming Tech | London, UK | Acquired from Cisco | Active (Fully owned) |

| Tricor | Corporate Services & Compliance | Hong Kong | Acquired for Asia expansion | Active (Majority stake) |

| Klarna | Fintech / BNPL | Stockholm, Sweden | Institutional investor | Active (Minority stake) |

| Pharmaq | Aquatic Health / Biotech | Oslo, Norway | Scaled and exited | Exited (Sold to Zoetis) |

| Cielo Talent | Talent Acquisition / RPO | Brookfield, USA | Acquired to expand global RPO | Active (Majority stake) |

| Quotient Sciences | Drug Development & Manufacturing | Nottingham, UK | Acquired to expand services | Active (Majority stake) |

| Althea Group | Medical Technology Services | Milan, Italy | Acquired and expanded across Europe | Active (Majority stake) |

| Hana Group | Sushi & Fresh Food Retail | Paris, France | Backed and scaled globally | Exited (Post-expansion) |

Zendesk

Permira, in partnership with Hellman & Friedman, acquired Zendesk in 2022 in a deal valued at $10.2 billion. Zendesk is a global customer service and CRM software company. Under Permira’s ownership, Zendesk has expanded its AI capabilities, improved customer engagement tools, and entered new enterprise markets. The company continues to operate independently with its original brand identity and is a flagship asset in Permira’s technology portfolio.

Genesys

Permira acquired Genesys from Alcatel-Lucent in 2012 and has since developed it into one of the world’s leading customer experience and call center platforms. Genesys now serves thousands of enterprises globally with AI-driven cloud contact center solutions. Over the years, the firm helped Genesys shift from traditional on-premise systems to a modern, cloud-based architecture, significantly increasing its valuation.

Evelyn Partners

Created from the 2020 merger of Tilney and Smith & Williamson, Evelyn Partners is one of the UK’s largest wealth management and professional services firms. Permira has played a crucial role in building Evelyn into a vertically integrated firm offering investment advisory, tax planning, and financial management to high-net-worth individuals and businesses.

Boats Group

Permira acquired Boats Group, a leading online marketplace for boats, in 2016. It operates major brands including Boat Trader, YachtWorld, and boats.com. These platforms dominate online marine classifieds and attract millions of global users. Under Permira’s ownership, Boats Group expanded its reach through improved search tech, mobile app development, and international listings.

Reiss

Permira previously invested in Reiss, a UK-based premium fashion brand, and guided its global expansion strategy. Though Permira has since exited its full ownership, it helped transform Reiss into a multi-channel retailer with a growing international presence. While not currently fully owned, Reiss remains closely associated with Permira’s consumer sector investment history.

Adevinta (Stakeholder)

Permira holds a significant stake in Adevinta, a global online classifieds specialist headquartered in Norway. Adevinta operates digital platforms across Europe and Latin America, including Leboncoin, Gumtree, and OLX Brazil. Permira’s involvement supports Adevinta’s continued digital transformation, M&A activity, and international expansion strategy.

Exclusive Networks

Permira was instrumental in scaling Exclusive Networks, a global cybersecurity and cloud solutions distributor. It backed the company’s growth in over 100 countries, helping to centralize its operations and broaden its vendor and partner ecosystem. Exclusive Networks went public in Paris, but Permira continues to be an influential shareholder and strategic advisor.

Synamedia

Permira owns Synamedia, a UK-based provider of video software and security for broadcasters and media companies. Acquired from Cisco, Synamedia has since focused on pay-TV protection, streaming solutions, and piracy detection technologies. It serves clients like Comcast, Sky, and Vodafone. Permira supports its expansion into sports streaming security and OTT (over-the-top) platforms.

Tricor

Permira acquired Tricor, a leading business services provider in Asia, offering corporate governance, payroll, and compliance services to multinational clients. Headquartered in Hong Kong, Tricor is critical to Permira’s Asia strategy, helping serve businesses navigating regional regulatory environments. The firm has helped modernize Tricor’s operations and digital platforms.

Klarna (Minority Stake)

Permira has invested in Klarna, the Swedish fintech company known for its “buy now, pay later” platform. Although not a majority owner, Permira is a significant institutional investor involved in strategic scaling and international partnerships. Klarna continues to grow across Europe and North America with backing from multiple private equity firms.

Cielo Talent

Permira acquired Cielo, a global talent acquisition and recruitment process outsourcing (RPO) provider. Cielo works with Fortune 500 companies to manage recruitment strategies and workforce solutions across industries. With Permira’s support, Cielo expanded in Asia-Pacific and developed advanced recruitment analytics tools.

Quotient Sciences

Permira acquired Quotient Sciences, a UK-based drug development and clinical testing business. Quotient focuses on integrated services from formulation development to commercial manufacturing. Permira is actively helping the firm scale its U.S. operations and expand its service offerings for biotech and pharma clients.

Althea Group

Permira invested in Althea, a pan-European medical technology services company that provides equipment management, maintenance, and diagnostics to hospitals. With Permira’s backing, Althea has grown into one of Europe’s largest healthcare technology providers and continues to acquire smaller service companies across the continent.

Final Thoughts

Permira stands as one of the most respected names in private equity. Its ownership model, based on internal partnership and employee ownership, gives it strong stability and focus. The firm continues to expand its global presence and influence across sectors. If you were asking who owns Permira, the answer lies within its own leadership and partner group, not outside investors.

Its model of long-term thinking, hands-on guidance, and sector focus keeps it competitive in the fast-moving investment world. With assets nearing €100 billion and high-profile acquisitions under its belt, Permira’s future appears strong and steady.

FAQs

Who is the owner of Permira Group?

Permira Group is privately owned by its partners and senior employees. The firm has no external or public shareholders. The largest ownership stake is held by Managing Partners, followed by senior investment professionals and employee equity funds. The firm’s leadership and ownership are tightly aligned to ensure long-term decision-making and internal control.

Is Permira a private company?

Yes, Permira is a private company. It is not listed on any stock exchange and operates as a partnership. The firm is fully independent, with no corporate parent or public ownership. Institutional investors may invest in its private equity funds, but not in Permira itself.

Does Permira own Hugo Boss?

No, Permira does not currently own Hugo Boss. Permira previously held a stake in Hugo Boss through its past investments but fully exited its position in 2015. As of 2025, Hugo Boss is no longer part of Permira’s portfolio.

How many employees does Permira have?

As of 2025, Permira employs over 450 professionals globally, including investment teams, legal, operations, fundraising, and portfolio support staff. The firm has offices in 16 cities worldwide, including London, New York, Frankfurt, Hong Kong, and Tokyo.

How big is the Permira fund?

Permira manages more than €85 billion in assets under management (AUM) across its private equity and growth equity strategies. Its most recent buyout fund, Permira VIII, closed in 2024 with nearly €18 billion in committed capital, making it one of Europe’s largest private equity funds.

Does Permira own Golden Goose?

No, Permira does not own Golden Goose. The luxury sneaker brand was previously owned by Permira but was sold to another private equity firm, Bain Capital, in 2020. As of 2025, Golden Goose is no longer in Permira’s portfolio.

Does Permira own Informatica?

No, Permira does not own Informatica. Informatica is backed by other investment firms, including TPG and Canada Pension Plan Investment Board (CPPIB). Permira has no disclosed investment in Informatica as of 2025.

Did Mimecast get sold to Permira?

Yes, Mimecast was acquired by Permira in a $5.8 billion deal in 2022. Mimecast is a cybersecurity company focused on email security and threat protection. Under Permira’s ownership, Mimecast has expanded its services into threat intelligence and compliance solutions, especially for enterprise clients.

Does Permira own Genesys?

Yes, Permira owns Genesys and has done so since 2012. Genesys is a global leader in customer experience and contact center software. Permira helped transform Genesys from a traditional call center solution into a cloud-native AI-driven platform used by major enterprises worldwide.

Why did Permira buy Squarespace?

Permira invested in Squarespace to support its transition from a public to a private company. The firm partnered with other investors to acquire Squarespace in 2024, aiming to help scale its subscription-based website building and e-commerce platform. The decision was driven by Squarespace’s strong recurring revenue, brand loyalty among small businesses, and growth potential in digital commerce.

Who owns Permira?

Permira is owned by its managing partners, employees, and senior executives through a private partnership. There are no public shareholders or external investors.

Is Permira a public company?

No, Permira is a private company. It is not listed on any stock exchange and does not have public shareholders.

Who is the CEO of Permira?

Kurt Björklund is the current CEO and Managing Partner of Permira as of 2025.

What companies does Permira own?

Permira owns or has invested in companies like Zendesk, Genesys, Boats Group, Reiss, Adevinta, Evelyn Partners, and more.

Where is Permira based?

Permira is headquartered in London, UK. It also has offices in New York, Frankfurt, Paris, Hong Kong, Tokyo, and other major cities.

How much is Permira worth?

Permira’s estimated value, based on assets under management and private estimates, is over €1.5 billion as of July 2025.

What is Permira’s investment focus?

Permira focuses on five key sectors: technology, consumer, healthcare, financial services, and industrials.