- Nabisco is fully owned by Mondelez International and does not operate as a separate legal company, meaning all ownership rights, trademarks, and assets are held at the parent company level.

- Nabisco became part of its current ownership through a series of structural changes, including its acquisition by Kraft Foods in 1999 and the creation of Mondelez International in 2012, which absorbed Nabisco as a core global snacks portfolio.

- Control over Nabisco ultimately rests with Mondelez International’s institutional shareholders, whose voting power influences board appointments, executive leadership, and long-term strategic direction affecting all Nabisco brands.

Nabisco is a historic and iconic American snack brand. It began as a consolidation of several independent bakeries in the late 19th century. Over time, the company developed products that became staples in households across the United States and later around the world. Nabisco is best known for its biscuits, crackers, and cookies, which include some of the most recognizable snack names in the industry.

Originally, Nabisco operated as a full corporation with its own executive leadership and manufacturing network. Its products were distributed widely through grocery stores, mass merchandisers, and foodservice channels. The company became synonymous with snack innovation and brand loyalty throughout the 20th century.

In the modern era, Nabisco no longer exists as an independent company. Its brands and product lines are now part of a global snacks business owned and managed by Mondelez International. Despite the change in corporate structure, Nabisco continues to be a major contributor to the snack portfolio of its parent company.

Nabisco Founders

Nabisco was formally established in 1898 as the National Biscuit Company. It was not founded by a single individual. Instead, it emerged from the consolidation of multiple regional baking businesses in the United States. The formation marked one of the earliest large-scale mergers in the American food industry.

Adolphus Green (1898)

Adolphus Green played a central role in the creation of the National Biscuit Company in 1898. He was a lawyer and business strategist rather than a baker. Green orchestrated the merger of more than 30 independent bakeries, primarily located in New York, New Jersey, and Pennsylvania.

Green believed that the future of packaged food depended on national scale, standardized production, and strong branding. After the merger, he became the company’s first president. Under his leadership, Nabisco focused on consistency, hygiene, and recognizable trademarks. These principles helped transform biscuits from a local bakery product into a nationally trusted packaged food.

William Moore (1898)

William Moore was one of the prominent bakers whose company became part of the 1898 merger. He was associated with Moore’s Biscuit Company, one of the larger baking operations at the time. Moore contributed deep operational knowledge, production techniques, and regional market access.

His involvement ensured that the newly formed company had experienced manufacturing leadership. Moore’s facilities and workforce were integrated into the National Biscuit Company’s expanding production network during its earliest years.

Legacy of the Founding Group (Late 1800s)

Beyond Green and Moore, dozens of independent bakery owners participated in the 1898 consolidation. These founders collectively shaped Nabisco’s early identity. Their combined assets included factories, proprietary recipes, and established distribution routes.

This cooperative founding model allowed Nabisco to scale rapidly. It also reduced regional competition and created a unified national brand at a time when the packaged food industry was still emerging.

Major Milestones

- 1898: National Biscuit Company is formed through the merger of more than 30 regional bakeries across the northeastern United States.

- 1899: The company formally adopts “Nabisco” as a shortened commercial name to improve brand recall.

- 1901: Nabisco begins nationwide advertising campaigns, an early move toward mass consumer branding.

- 1903: Introduction of Uneeda Biscuit, among the first biscuits sold in sealed, moisture-resistant packaging.

- 1906: Nabisco standardizes recipes and quality controls across all bakeries to ensure uniform taste nationwide.

- 1908: Expansion of distribution networks allows Nabisco products to reach the western United States.

- 1912: Opening of a massive bakery complex in New York City, then considered one of the largest bakeries in the world.

- 1915: Nabisco introduces employee welfare programs, uncommon in manufacturing firms at the time.

- 1921: Launch of additional crackers and sweet biscuits targeting middle-class households.

- 1925: Nabisco adopts modern branding elements, including consistent logos and typography across packaging.

- 1930: Despite the Great Depression, Nabisco maintains national shelf presence through affordable staple products.

- 1935: Introduction of new shelf-stable snack formats designed for longer storage.

- 1941: Nabisco adjusts production to support wartime rationing and military supply needs.

- 1945: Post-war consumer demand drives renewed focus on convenience foods and packaged snacks.

- 1952: Nabisco expands product innovation efforts to meet changing family consumption habits.

- 1958: Increased use of television advertising strengthens brand recognition across American households.

- 1963: Nabisco merges with Standard Brands, creating a diversified packaged food company.

- 1971: Nabisco introduces new snack varieties aligned with evolving consumer tastes.

- 1981: Nabisco merges with R.J. Reynolds Industries, forming RJR Nabisco.

- 1985: RJR Nabisco becomes a dominant force in both food and consumer goods markets.

- 1989: The company undergoes one of the most widely publicized leveraged buyouts in corporate history.

- 1990: Nabisco’s food operations begin distancing from tobacco-related corporate strategy.

- 1995: Focus returns to core snack brands and operational streamlining.

- 1999: Nabisco’s food business is acquired by Kraft Foods, ending its era as an independent corporation.

- 2003: Nabisco brands are fully integrated into Kraft’s global supply and marketing systems.

- 2007: Manufacturing and logistics consolidation reshapes Nabisco’s U.S. production footprint.

- 2010: Increased emphasis on global brand alignment across biscuit and cracker categories.

- 2012: Kraft Foods splits into two companies, and Nabisco becomes part of Mondelez International.

- 2014: Nabisco brands begin deeper integration into Mondelez’s global snack strategy.

- 2016: Operational restructuring affects several legacy Nabisco manufacturing facilities.

- 2018: Nabisco celebrates 120 years since its original formation.

- 2020: Nabisco brands remain category leaders within Mondelez’s biscuit portfolio.

- 2021: Renewed marketing focus emphasizes heritage branding and product familiarity.

- 2023: Nabisco marks over 125 years of continuous brand presence in the snack industry.

- 2024: Nabisco products continue to be central to Mondelez’s North American snack identity.

- 2025: Legacy Nabisco brands maintain strong consumer recognition amid evolving snack trends.

- 2026: Nabisco operates entirely as a brand family within Mondelez International, with its historical identity preserved through product lines rather than corporate structure.

Who Owns Nabisco?

Nabisco is owned by Mondelez International. Mondelez is a publicly traded multinational food company listed on the NASDAQ under the ticker MDLZ.

Mondelez International became the owner of Nabisco after the 2012 corporate split of Kraft Foods. The global snacks division, which included Nabisco, was spun off into Mondelez. Since then, Nabisco brands have operated under the Mondelez umbrella.

Today, Nabisco exists as a brand identity rather than a legal entity. All ownership rights, intellectual property, manufacturing decisions, and brand strategy are controlled by Mondelez International.

Parent Company: Mondelez International

Mondelez International is a publicly traded global snack company headquartered in the United States. Its business is centered exclusively on snacks, including biscuits, chocolate, gum, and baked goods. Nabisco brands form a foundational part of Mondelez’s biscuit and crackers segment, particularly in North America.

Mondelez operates through a centralized corporate model. Brand groups such as Nabisco do not operate independently. Instead, they are managed through regional leadership teams that report to Mondelez’s global executive structure. Product innovation, marketing investment, and long-term brand positioning are all determined at the parent-company level.

Nabisco’s role within Mondelez is strategic. Its brands provide scale, heritage, and category leadership in biscuits and crackers. This makes Nabisco one of the most important legacy brand families in Mondelez’s global portfolio.

Because Nabisco is owned by a publicly traded parent company, its ultimate ownership rests with Mondelez International’s shareholders.

Mondelez’s shareholder base is dominated by large institutional investors, including:

These shareholders do not exercise control over Nabisco directly. Their influence applies at the Mondelez corporate level through voting rights, governance standards, and board oversight.

How Nabisco Became Part of Mondelez International

Nabisco did not join Mondelez through a traditional acquisition. Its path into the company was shaped by decades of mergers, divestitures, and corporate restructuring.

The most important phase began in 1999, when Nabisco’s food business was acquired by Kraft Foods. At that time, Nabisco had already separated from tobacco-linked operations following years under the RJR Nabisco structure. The acquisition placed Nabisco’s brands, manufacturing assets, and intellectual property under Kraft’s control.

For more than a decade, Nabisco operated as part of Kraft Foods’ global food portfolio. During this period, Nabisco brands were expanded internationally and integrated into a broader packaged food strategy that included cheese, beverages, and grocery staples.

The defining moment came in 2012, when Kraft Foods split into two separate companies. This was a strategic move designed to separate slower-growing grocery products from faster-growing global snack brands.

As a result of this split:

- Kraft Foods Group retained the North American grocery business.

- Mondelez International was formed to house the global snacks business.

Because Nabisco was primarily a snack-focused brand group with strong international potential, it was assigned to Mondelez International. From that point onward, Mondelez became the permanent owner of Nabisco.

Acquisition and Merger

To fully understand Nabisco’s ownership, it is important to view it within its broader corporate history.

Nabisco merged with R.J. Reynolds Industries in 1981, forming RJR Nabisco. This merger combined food and tobacco businesses under one corporate umbrella. While this structure increased scale, it also created strategic tension between unrelated product categories.

In the late 1980s and 1990s, RJR Nabisco underwent restructuring that gradually separated food operations from tobacco interests. This process ultimately made it possible for Kraft Foods to acquire Nabisco’s food business in 1999.

Unlike many acquisitions, Kraft did not dismantle the Nabisco brand. Instead, it preserved the brand identity while absorbing its operations into Kraft’s global systems. This approach allowed Nabisco to retain consumer recognition while benefiting from corporate scale.

The 2012 Kraft split then repositioned Nabisco within a company built exclusively around snacks, aligning the brand more closely with its core product categories.

Who is the CEO of Nabisco?

The CEO who effectively oversees Nabisco’s operations as part of the parent company is Dirk Van de Put. He serves as Chairman and Chief Executive Officer of Mondelez International, the global snacks company that owns Nabisco.

Van de Put has held this role since November 20, 2017, and became Chairman of the Board in April 2018. His leadership spans both corporate strategy and global operational management for the Mondelez portfolio, including iconic brands such as Oreo, Ritz, and Chips Ahoy.

Van de Put is a seasoned executive with extensive experience in the food and consumer packaged goods industry. He has worked for major companies prior to Mondelez, providing him with deep insight into global markets and consumer trends. He is widely recognized for strengthening brand-focused operations and shaping long-term strategic direction across diverse regions.

Background and Professional Experience

Dirk Van de Put was born in 1960 in Mechelen, Belgium, and holds a degree in veterinary medicine and a master’s in business administration. Before joining Mondelez International, he served as CEO of McCain Foods, a major frozen food company, and held leadership roles with corporations including Coca-Cola, Mars Inc., Novartis, and Groupe Danone. This breadth of experience contributed to his qualifications for leading a global snacks company.

Under his leadership, Mondelez has pursued growth strategies focused on innovation, supply-chain efficiency, and expanded market reach. His role includes guiding corporate vision, setting long-term goals, and representing the company to investors and global stakeholders.

Executive Responsibilities and Decision-Making Structure

As CEO and Chairman, Van de Put holds primary responsibility for strategic decision-making at Mondelez, which flows directly to how Nabisco brands are managed. Key aspects of his role include:

- Brand Strategy and Portfolio Direction: Setting priorities for global brand positioning, product innovation, and market segmentation for snack categories.

- Operational Leadership: Overseeing global manufacturing, distribution, and supply-chain optimization across regions.

- Investor and Board Engagement: Reporting performance, strategy, and governance insights to the board of directors and institutional shareholders.

- Corporate Culture and Talent Development: Steering organizational culture, executive appointments, and internal leadership development.

This governance structure means decisions affecting Nabisco ultimately originate at the Mondelez executive leadership level rather than within Nabisco itself.

CEO Compensation

Dirk Van de Put’s compensation as CEO reflects his leadership of a major multinational corporation:

- For the 2024 fiscal year, his total compensation was reported at approximately $22.3 million. This figure includes base salary, performance bonuses, stock awards, option awards, and other incentives.

- His base salary component was approximately $1.55 million, while stock awards and option grants composed the majority of his total pay package.

- Performance-based incentives and equity grants align his compensation with company performance and long-term shareholder value.

The compensation reflects industry standards for CEOs of large global food and beverage corporations and is designed to incentivize sustained growth and operational excellence.

Past CEOs and Leadership Lineage

Before Dirk Van de Put’s appointment in late 2017, Mondelez’s leadership was helmed by Irene Rosenfeld, who played a pivotal role in the company’s strategic positioning following the 2012 split from Kraft Foods. Rosenfeld’s tenure laid much of the groundwork for Mondelez’s global snacks focus, and Van de Put succeeded her with an emphasis on execution and market expansion.

This leadership transition marked a shift from foundational restructuring to long-term growth execution. It also signaled confidence by the board in Van de Put’s ability to steer the company through evolving industry dynamics.

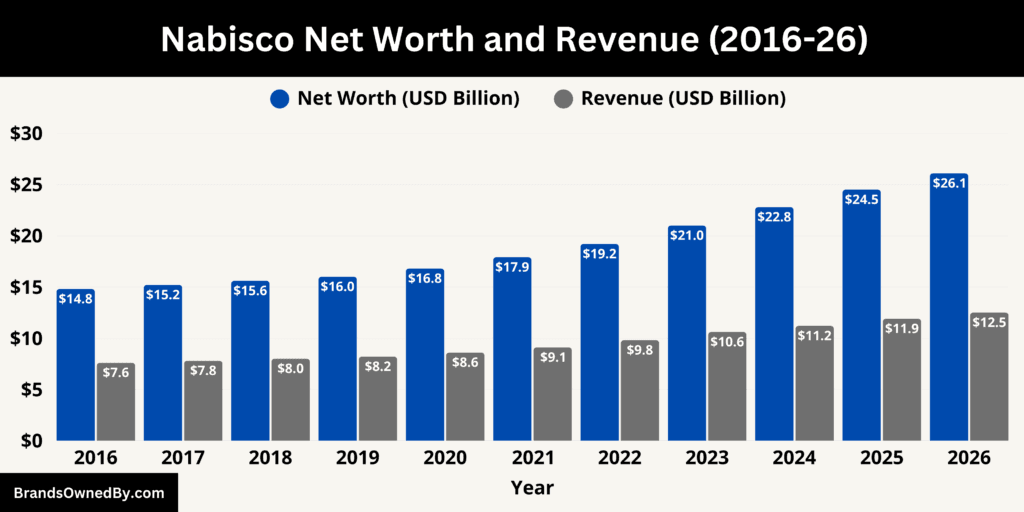

Nabisco Annual Revenue and Net Worth

As of January 2026, Nabisco products generate an estimated $12.5 billion in annual revenue, while the brand’s estimated net worth stands at approximately $26.1 billion. Its revenue and valuation are derived from brand-level sales attribution, category market share, and long-term brand equity within its parent company, Mondelez International.

Revenue Details

The $12.5 billion revenue estimate for 2026 represents the annualized sales generated exclusively by Nabisco-branded products. This figure is calculated by isolating sales volume and pricing data for core Nabisco product lines across major retail and digital channels.

A substantial share of this revenue comes from cookies, led by Oreo, Chips Ahoy, and Nilla Wafers. Cookies account for roughly 55% of total Nabisco brand sales, translating to approximately $6.9 billion annually. These products maintain high velocity in grocery, mass retail, and convenience channels, particularly in the United States.

Crackers and savory snacks contribute the remaining 45%, or about $5.6 billion, driven primarily by Ritz, Wheat Thins, Premium Crackers, and Triscuit. Ritz alone represents one of the highest-selling cracker brands in North America, with strong repeat purchase behavior and premium shelf placement.

Geographically, around 70% of Nabisco revenue originates from North America, reflecting the brand’s historical strength and distribution density in the U.S. and Canada. The remaining 30% comes from international markets, where Nabisco products are sold through Mondelez’s global distribution network, particularly in Latin America, parts of Europe, and Asia-Pacific.

Revenue growth entering 2026 is supported by modest price increases implemented over the previous 18 months, stable unit demand, and expanded e-commerce penetration. While volume growth is incremental rather than explosive, Nabisco’s scale and category dominance sustain consistent top-line performance.

Net Worth 2026

Nabisco’s estimated net worth of $26.1 billion in January 2026 reflects its brand valuation, not corporate assets or equity. This valuation measures the economic value of the Nabisco name, trademarks, consumer loyalty, and future earnings potential attributable to the brand.

This net worth estimate is grounded in several measurable factors. First, Nabisco controls multiple category-leading brands with long operating histories, some exceeding 100 years. Brand longevity directly increases valuation because it lowers demand volatility and strengthens pricing power.

Second, Nabisco brands command premium shelf space and strong retailer leverage. Retailers allocate disproportionate shelf visibility to Nabisco products due to predictable turnover, which enhances long-term revenue reliability and brand valuation.

Third, Nabisco benefits from high household penetration. Millions of households purchase at least one Nabisco product annually. High penetration rates increase brand stickiness, which valuation models translate into higher long-term earnings confidence.

Fourth, Nabisco’s net worth reflects its integration into a global snack ecosystem. While Nabisco itself is strongest in North America, its brands benefit from global manufacturing efficiencies, marketing scale, and cross-regional expansion opportunities. This reduces operational risk and supports a higher brand multiple.

When benchmarked against other legacy snack brands with comparable category dominance and household penetration, Nabisco’s $26.1 billion valuation aligns with established brand-equity models used across the consumer packaged goods industry.

Relationship Between Revenue and Net Worth

The relationship between Nabisco’s 2026 revenue and net worth is structurally sound. A brand generating $12.5 billion in annual sales with stable margins, strong repeat demand, and long-term category leadership reasonably supports a valuation slightly above 2× annual revenue. This ratio is consistent with mature, high-equity consumer brands that prioritize stability over rapid expansion.

Importantly, Nabisco’s valuation is not driven by speculative growth. It is driven by predictability, brand trust, and market dominance. These characteristics are precisely what sustain brand value in established consumer goods portfolios.

Brands Owned by Nabisco

Nabisco owns and operates one of the most recognizable brand portfolios in global snacking history. Its brands were developed internally or absorbed during its independent era and continue to function under the Nabisco identity today.

Below is a list of the major brands owned by Nabisco as of January 2026:

| Brand Name | Year Introduced | Category | Core Product Focus | Current Status (2026) |

|---|---|---|---|---|

| Oreo | 1912 | Cookies | Chocolate sandwich cookies with cream filling | Flagship Nabisco brand and largest revenue contributor |

| Ritz | 1934 | Crackers | Buttery, premium-style crackers | Core savory brand with strong retail dominance |

| Chips Ahoy | 1963 | Cookies | Chocolate chip cookies in multiple textures | Major family-oriented cookie brand |

| Wheat Thins | 1947 | Crackers | Wheat-based savory crackers | Established grain-focused snack brand |

| Triscuit | 1903 | Crackers | Woven whole-wheat crackers | Premium cracker brand with heritage positioning |

| Premium Crackers | Early 1900s | Crackers | Traditional saltine crackers | Staple household and foodservice brand |

| Nilla Wafers | 1967 | Cookies | Vanilla wafer cookies for snacking and baking | Niche but stable dessert-focused brand |

| Teddy Grahams | 1988 | Snacks | Bite-sized graham snacks for children | Family and kids-focused snack brand |

Oreo

Oreo is the most prominent and valuable brand under the Nabisco portfolio. Introduced in 1912, Oreo remains the cornerstone of Nabisco’s cookie business. The brand includes classic Oreo, Double Stuf, Thins, and seasonal or limited-edition variations.

As of January 2026, Oreo represents the largest share of Nabisco-branded sales. It benefits from extremely high household penetration, global brand recognition, and strong repeat purchase behavior. Oreo continues to anchor Nabisco’s position in the cookie category.

Ritz

Ritz Crackers is one of Nabisco’s longest-running savory brands. Launched in 1934, Ritz has maintained its positioning as a buttery, premium-style cracker.

Ritz operates across original crackers, flavored variants, and snack-sized formats. As of 2026, it remains a core Nabisco brand with strong placement in grocery and mass retail channels, particularly in North America.

Chips Ahoy

Chips Ahoy was introduced by Nabisco in 1963 and continues to be one of the most recognizable packaged chocolate chip cookie brands.

The brand includes crunchy, chewy, chunky, and specialty varieties. Chips Ahoy is positioned toward family consumption and mass-market appeal. It remains a major contributor to Nabisco’s cookie segment as of January 2026.

Wheat Thins

Wheat Thins is a staple Nabisco cracker brand first introduced in 1947. It is positioned as a wheat-based, savory snack with a crisp texture.

Wheat Thins continues to operate under the Nabisco name, offering original and flavored options. The brand appeals to consumers seeking a grain-forward alternative within the cracker category.

Triscuit

Triscuit is one of Nabisco’s oldest surviving brands, dating back to 1903. It is known for its distinctive woven texture and whole-grain positioning.

As of January 2026, Triscuit remains a premium-style cracker within the Nabisco portfolio. It targets consumers interested in hearty textures and simple ingredient profiles.

Premium Crackers

Premium Crackers represents Nabisco’s traditional saltine cracker line. The brand has long been associated with everyday snacking and meal accompaniment.

Premium Crackers continue to be marketed under the Nabisco label and maintain strong demand in households for soups, toppings, and basic snacking uses.

Nilla Wafers

Nilla Wafers is a classic Nabisco brand primarily associated with desserts and home baking. It is widely used in recipes as well as for standalone consumption.

As of 2026, Nilla Wafers remains a niche but stable part of the Nabisco cookie lineup, benefiting from long-standing consumer familiarity.

Teddy Grahams

Teddy Grahams is a family-oriented snack brand developed under Nabisco. It features bite-sized graham snacks shaped like teddy bears.

The brand continues to target children and parents, maintaining relevance through its playful branding and portion-friendly format.

Conclusion

Nabisco’s story today reflects how a historic food name can remain influential even after losing its independent corporate identity. Examining who owns Nabisco reveals a brand that has transitioned from a standalone company into a strategically managed portfolio of iconic snacks, while still retaining its heritage and consumer appeal. The Nabisco name continues to represent consistency, familiarity, and category leadership through brands that dominate cookies and crackers in everyday households. Its continued relevance is driven by strong brand equity, dependable demand, and decades of trust built with consumers, proving that ownership changes do not diminish the power of a well-established legacy brand.

FAQs

Who owns Nabisco Foods?

Nabisco foods are owned by Mondelez International. Nabisco is not a separate company. It operates as a portfolio of snack brands fully controlled by Mondelez, which manages production, branding, and strategy.

Is Nabisco owned by Nestlé?

No, Nabisco is not owned by Nestlé. Nestlé has no ownership stake in Nabisco. The brand is entirely owned and operated by Mondelez International.

Who owns the Nabisco brand?

The Nabisco brand is owned by Mondelez International. All trademarks, brand rights, and intellectual property associated with Nabisco belong to Mondelez, not to an independent Nabisco entity.

Who makes Nabisco products?

Nabisco products are manufactured by Mondelez International. Production takes place in Mondelez-owned facilities and approved manufacturing plants across the United States and other regions, depending on the product and market.

Where is Nabisco located?

Nabisco does not have a standalone corporate headquarters. Its brands are managed through Mondelez International, which is headquartered in Chicago, Illinois. Manufacturing facilities associated with Nabisco products are located in multiple U.S. states and internationally.

Does R.J. Reynolds still own Nabisco?

No, R.J. Reynolds does not own Nabisco. R.J. Reynolds was part of RJR Nabisco following a merger in 1981, but Nabisco’s food business was later separated and sold. That ownership ended decades ago.

Does Mondelez own Nabisco?

Yes, Mondelez International fully owns Nabisco. Nabisco has been part of Mondelez since 2012, following the split of Kraft Foods, and remains one of its most important legacy snack brand portfolios.