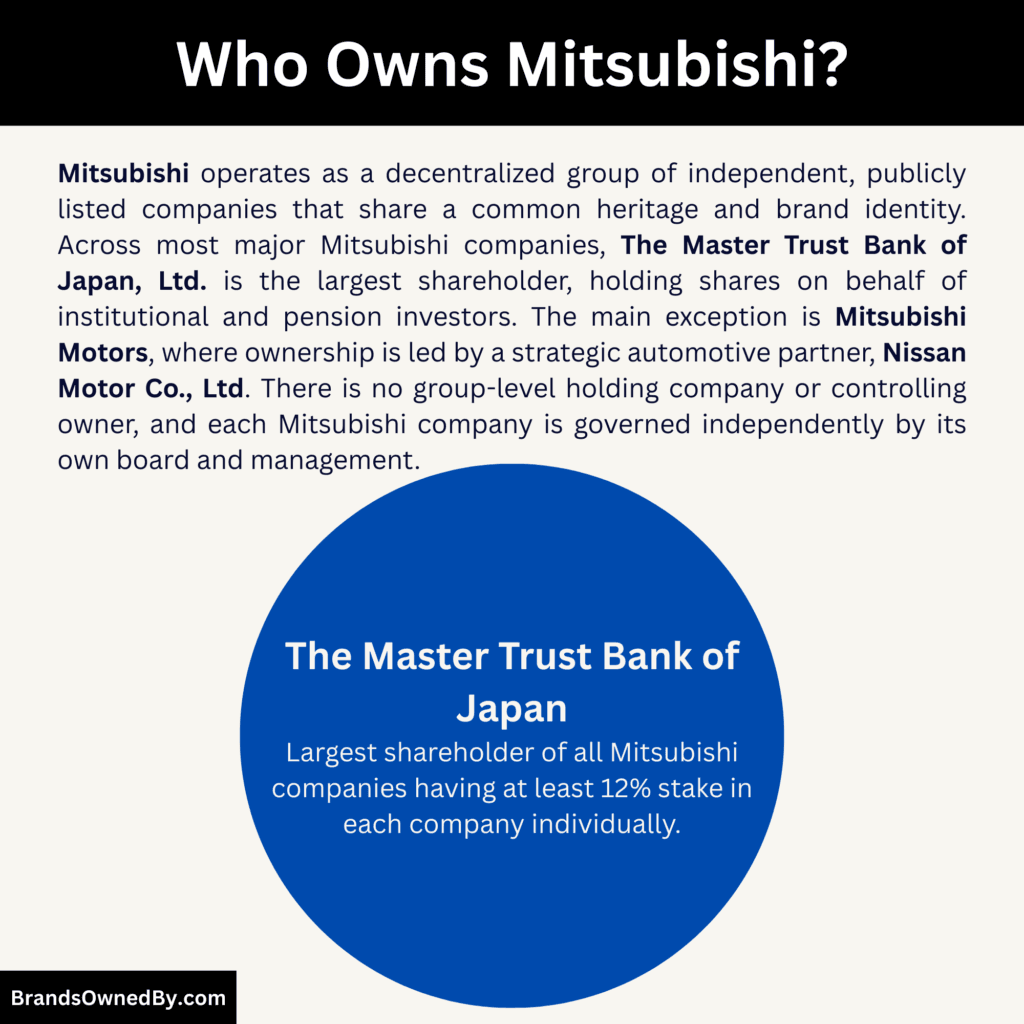

- Mitsubishi is not owned by a single company, individual, or family. It operates as a decentralized group of independent, publicly listed companies that share a common heritage and brand identity.

- Ownership across major Mitsubishi companies is dominated by institutional investors, trust banks, and public shareholders, with no single shareholder holding majority control at the group level.

- There is no Mitsubishi Group holding company or group-wide CEO. Each major Mitsubishi company is governed independently by its own board and executive leadership.

- Strategic shareholders exist in specific cases, such as Nissan’s stake in Mitsubishi Motors, but these holdings do not translate into overall control of Mitsubishi as a whole.

Mitsubishi refers to a group of autonomous Japanese multinational companies that share a common brand, corporate heritage, and historical ties. The Mitsubishi Group originated as a unified conglomerate in Japan and has grown into a network of legally independent firms.

Each major Mitsubishi entity operates in a specific industry, such as trading, heavy industry, banking, automotive, real estate, chemicals, or electronics. These companies are known for their long history, industrial breadth, and global presence. They collaborate informally through regular executive meetings, but remain separate legal and financial organizations.

The iconic Mitsubishi “three-diamond” logo symbolizes their shared origin and values.

Mitsubishi Founder

Yataro Iwasaki (1835–1885) was the visionary entrepreneur who founded what would evolve into the Mitsubishi Group. Born into a samurai family in Tosa Province (modern-day Kōchi Prefecture) on January 9, 1835, Iwasaki faced early family hardship when his ancestors relinquished their samurai status due to debt. Despite this, he pursued education and entered the service of the Tosa clan, where he gained experience in commerce.

In 1870, Iwasaki established a small shipping firm called Tsukumo Shokai with three chartered steamships. Japan was emerging from feudal isolation and rapidly modernizing, and Iwasaki positioned his firm to support this national transformation. He expanded the business from coastal shipping into international routes, securing government contracts and establishing regular services between Japanese ports and China.

Iwasaki also laid the cultural foundations of Mitsubishi business philosophy. He emphasized loyalty, teamwork, and national development. Under his leadership, the company diversified into mining, shipbuilding, and finance. Iwasaki died in 1885, but the firms he helped build continued to grow under the leadership of his brother and descendants, embedding his values into the broader Mitsubishi identity.

After Yataro’s death, several family members guided Mitsubishi’s growth. His brother Yanosuke Iwasaki expanded mining and trading operations. His son Hisaya Iwasaki modernized key assets and developed a corporate strategy in the early 20th century. These leaders helped transform Mitsubishi from a singular shipping concern into a broad industrial enterprise in Japan.

Ownership Snapshot

Mitsubishi does not have a single owner or parent company. The name Mitsubishi represents the Mitsubishi Group, which is a collection of independent companies rather than one unified corporation. Each major Mitsubishi company is legally separate, publicly listed, and governed by its own board and management team.

Ownership across Mitsubishi companies is therefore fragmented. There is no individual, family, or holding company that owns or controls Mitsubishi as a whole. Instead, ownership is spread across public shareholders, long-term institutional investors, and strategic partners.

Keiretsu-Based Ownership Model

Mitsubishi follows a keiretsu model. This means its core companies maintain long-standing business relationships and limited cross-shareholdings with one another. These cross-holdings are designed to promote stability, long-term cooperation, and mutual support rather than centralized control.

This structure reduces the risk of hostile takeovers. It also allows each company to operate independently while still benefiting from group alignment and shared identity.

No Central Holding Company

Unlike many global conglomerates, Mitsubishi does not operate under a central holding company. There is no “Mitsubishi Holdings” entity that owns the group. Each company uses the Mitsubishi name based on historical ties and brand agreements, not because of ownership by a parent firm.

As of January 2026, this decentralized ownership structure remains unchanged. It is one of the defining characteristics that differentiates Mitsubishi from Western conglomerates and family-controlled Asian groups.

Mitsubishi Corporation Shareholding

Mitsubishi Corporation is one of the most prominent Mitsubishi Group companies. It is publicly traded on the Tokyo Stock Exchange and has a diversified shareholder base.

- Major institutional investors include The Master Trust Bank of Japan, Ltd. with roughly 15.85% of shares held in trust accounts. Other trust allocations and retirement benefit trusts from the Master Trust also hold additional shares.

- International custodial ownership like State Street Bank and Trust Company holds a significant stake in the firm.

- Japanese institutional investors such as Meiji Yasuda Life Insurance Company and Custody Bank of Japan, Ltd. also appear among the principal holders.

Beyond domestic institutions, global investment firms like Berkshire Hathaway, Inc. also own meaningful stakes, reflecting the company’s appeal to long-term investors.

Mitsubishi Motors Shareholding

Mitsubishi Motors is another key Mitsubishi company with its own ownership profile.

- Nissan Motor Co., Ltd. is the largest shareholder, holding around 26–27% of equity in Mitsubishi Motors.

- Mitsubishi Corporation itself holds roughly 22–23%.

- Other institutional investors such as Mitsubishi UFJ Financial Group and domestic asset managers own smaller stakes.

This structure reflects the strategic alliance formed between Nissan and Mitsubishi Motors under the broader automotive collaboration known as the Renault–Nissan–Mitsubishi Alliance.

Other Mitsubishi Companies’ Ownership

Other major Mitsubishi entities also have their own shareholder compositions:

- Mitsubishi Electric is publicly traded with principal holders that include major trust banks such as The Master Trust Bank of Japan and Custody Bank of Japan, as well as global custodians like State Street and JP Morgan.

- Mitsubishi UFJ Financial Group, one of Japan’s largest banks, also has significant holdings by domestic trust banks, global custodians, and institutional investors, with Master Trust as a top holder.

- Mitsubishi Logisnext is majority-owned by Mitsubishi Heavy Industries at more than 60%. Other investors include trust banks and institutional funds.

Institutional and Strategic Shareholders

Across Mitsubishi companies, institutional ownership is dominant. Major holders include long-term trust banks, pension funds, life insurers, and global custodial banks. These entities hold shares on behalf of retirement accounts and institutional clients.

Cross-shareholdings among Mitsubishi firms reinforce the keiretsu structure, where companies maintain stable share relationships with each other rather than through a single parent corporation.

Ownership History

Mitsubishi’s ownership history is long, complex, and deeply tied to Japan’s economic transformation. Unlike many global brands that have remained under one corporate owner or family, Mitsubishi has undergone multiple structural shifts. Its ownership evolved from founder control, to family-dominated conglomerate ownership, and finally to a decentralized public ownership model.

| Time Period | Ownership Structure | Who Owned / Controlled Mitsubishi | Key Characteristics |

|---|---|---|---|

| 1870–1885 | Founder-controlled private enterprise | Yataro Iwasaki | Centralized ownership and decision-making. Privately owned. Founder exercised full control over strategy and operations. |

| 1885–1893 | Family-controlled expansion phase | Iwasaki family | Ownership passed to close family members. Rapid diversification into mining, shipbuilding, and trading. No public shareholders. |

| 1893–1930s | Zaibatsu holding company structure | Iwasaki family via Mitsubishi holding company | Central holding company owned and controlled all major subsidiaries. Profits and authority flowed upward. Strong state alignment. |

| 1930s–1945 | Pre-war consolidated conglomerate | Iwasaki family and senior executives | Highly centralized ownership. No public ownership. Heavy involvement in industrial and military production. |

| 1945–1950 | Post-war dissolution phase | None (forced breakup) | Allied Occupation dismantled the zaibatsu. Holding company dissolved. Family ownership eliminated. |

| 1950s | Early keiretsu formation | Independent former Mitsubishi companies | Companies became legally separate. Informal cooperation resumed without restoring centralized ownership. |

| 1960s–1990s | Public and institutional ownership era | Public shareholders and institutions | Companies listed on stock exchanges. Ownership diversified. Cross-shareholdings used for stability, not control. |

| 2000s–January 2026 | Mature decentralized ownership model | Market-based ownership across independent companies | No group-level owner. No family control. Each Mitsubishi company owned and governed independently within the Mitsubishi Group framework. |

Founder-Led Ownership in the Early Years

Mitsubishi was founded in 1870 by Yataro Iwasaki. At this stage, ownership was simple and highly centralized. Iwasaki personally controlled the business, which initially focused on shipping and maritime services.

The company operated as a private enterprise. Capital was provided internally or through close political and commercial ties. Strategic decisions were made solely by the founder.

As Mitsubishi expanded into mining, shipbuilding, and trading, ownership remained firmly within the Iwasaki family. There was no public shareholding, no external oversight, and no separation between ownership and management.

Expansion Under Family Control

After Yataro Iwasaki’s death, ownership passed to close family members. His brother and later, his son continued to expand Mitsubishi’s operations. During this period, Mitsubishi diversified rapidly into banking, insurance, real estate, and heavy industry.

Ownership was still concentrated within the family. Control was exercised through direct ownership and managerial appointments. Mitsubishi companies were not independent entities. They functioned as divisions within a single family-controlled business empire. This phase established Mitsubishi as a core pillar of Japan’s industrial economy.

Formation of the Zaibatsu Structure

By the late 19th century, Mitsubishi formally adopted the zaibatsu model. This structure placed a holding company at the top, fully controlled by the Iwasaki family. The holding company owned controlling stakes in all major Mitsubishi businesses.

Under this system, ownership was hierarchical. Profits flowed upward to the holding company. Strategic planning, leadership appointments, and capital allocation were centralized. Mitsubishi Bank became a key financial arm that reinforced family control over industrial subsidiaries.

This period marked the peak of concentrated Mitsubishi ownership. The group operated as a single economic entity with unified ownership and direction.

Pre-War Consolidation and State Alignment

In the early 20th century, Mitsubishi strengthened its ownership position further. The group aligned closely with the Japanese state, especially in shipbuilding, mining, and military production. Ownership remained private and closed.

Public investors had no role. Mitsubishi was not publicly accountable. The family and senior executives exercised full authority. This concentration of ownership made Mitsubishi one of the most powerful economic groups in pre-war Japan.

Post-War Breakup and Loss of Family Ownership

Mitsubishi’s ownership structure changed radically after World War II. Allied Occupation authorities viewed zaibatsu groups as a threat to economic democracy. As a result, Mitsubishi’s holding company was dissolved.

Family ownership was dismantled. The Iwasaki family lost controlling stakes and formal authority. Mitsubishi businesses were split into independent companies. Shares were redistributed to employees, financial institutions, and the public.

This moment permanently ended centralized Mitsubishi ownership. It also eliminated the possibility of future family control.

Reemergence as a Keiretsu Network

During the 1950s, the former Mitsubishi companies gradually rebuilt relationships. However, they did not reunite under a holding company or common owner. Instead, they formed what is now known as the Mitsubishi Group.

Ownership during this phase became market-based. Companies listed their shares on public exchanges. Banks, trust institutions, and corporate partners became shareholders. Limited cross-shareholdings were established to maintain stability, not control.

This structure allowed cooperation without centralized ownership. Each company remained legally independent.

Shift Toward Institutional and Public Ownership

From the 1960s onward, Mitsubishi companies expanded globally and increased public float. Ownership gradually shifted toward institutional investors and long-term shareholders.

No effort was made to recreate a central ownership authority. Mitsubishi companies prioritized independence, conservative governance, and internal promotion. Ownership became widely distributed, reducing the influence of any single shareholder.

This period defined the modern Mitsubishi ownership philosophy. Stability replaced control. Cooperation replaced hierarchy.

Ownership Structure as of January 2026

As of January 2026, Mitsubishi has no founder ownership, no family control, and no group-level owner. Each Mitsubishi company is independently owned by its shareholders.

The historical transition from founder control to zaibatsu dominance, followed by enforced decentralization, explains why Mitsubishi ownership today is fragmented by design. This structure is not accidental. It is the result of more than a century of economic, political, and corporate evolution.

Who Owns Mitsubishi: Major Shareholders

Mitsubishi’s ownership structure is complex because the name refers to a group of distinct companies rather than one unified corporation. Each major Mitsubishi company has its own shareholders and ownership profile. These companies are publicly listed and their shares are held by institutional investors, strategic partners, global custodians, and individual holders. None of the Mitsubishi Group companies is controlled by a single owner.

Below is a list of the major Mitsubishi companies and their shareholders:

| Shareholder Name | Mitsubishi Company Involved | Ownership Stake (Approx.) | Shareholder Type | Role and Relevance |

|---|---|---|---|---|

| The Master Trust Bank of Japan, Ltd. (Trust Account) | Mitsubishi Corporation | 15.9% | Trust bank / institutional custodian | Largest shareholder. Holds shares on behalf of pension funds and long-term institutional investors. No direct management control. |

| State Street Bank and Trust Company | Mitsubishi Corporation | 10.3% | Global custodial bank | Represents international institutional investors. Passive ownership focused on asset management. |

| Berkshire Hathaway Inc. | Mitsubishi Corporation | 10.2% | Strategic institutional investor | Long-term strategic investor. Does not participate in management but signals strong confidence in governance and capital discipline. |

| Custody Bank of Japan, Ltd. (Trust Account) | Mitsubishi Corporation | 5.0% | Trust bank / institutional custodian | Domestic institutional ownership held through trust accounts. |

| Meiji Yasuda Life Insurance Company | Mitsubishi Corporation | 3.5% | Life insurance company | Long-term domestic institutional investor aligned with stable governance. |

| Nissan Motor Co., Ltd. | Mitsubishi Motors | 26.7% | Strategic corporate shareholder | Largest shareholder. Key alliance partner with significant strategic influence but not full control. |

| Mitsubishi Corporation | Mitsubishi Motors | 22.2% | Strategic group shareholder | Reinforces Mitsubishi Group alignment and long-term support for the automaker. |

| The Master Trust Bank of Japan, Ltd. (Trust Account) | Mitsubishi Motors | 6.8% | Trust bank / institutional custodian | Institutional ownership through pension and trust funds. |

| State Street Bank and Trust Company | Mitsubishi Motors | 3.2% | Global custodial bank | Represents overseas institutional investment. |

| Other institutional and custodial investors | Mitsubishi Motors | 8–10% (combined) | Institutional investors | Fragmented ownership with no individual controlling stake. |

| The Master Trust Bank of Japan, Ltd. (Trust Account) | Mitsubishi Electric | 15.4% | Trust bank / institutional custodian | Largest shareholder. Represents long-term institutional capital. |

| Custody Bank of Japan, Ltd. (Trust Account) | Mitsubishi Electric | 5.5% | Trust bank / institutional custodian | Domestic institutional ownership held in custody. |

| State Street Bank and related accounts | Mitsubishi Electric | 7.1% (combined) | Global custodial bank | Aggregated foreign institutional holdings. |

| Meiji Yasuda Life Insurance Company | Mitsubishi Electric | 4.0% | Life insurance company | Stable, long-term domestic institutional investor. |

| Employee Shareholding Association & others | Mitsubishi Electric | 4–5% (combined) | Employee and institutional holders | Reflects employee participation and diversified ownership. |

| The Master Trust Bank of Japan, Ltd. (Trust Account) | Mitsubishi UFJ Financial Group | 13–14% | Trust bank / institutional custodian | Largest shareholder holding pension and institutional assets. |

| Custody Bank of Japan, Ltd. (Trust Account) | Mitsubishi UFJ Financial Group | 6–7% | Trust bank / institutional custodian | Represents domestic institutional ownership. |

| Global custodial banks and institutions | Mitsubishi UFJ Financial Group | 20–25% (combined) | International institutional investors | Foreign ownership through custodial structures. |

| Public and other institutional shareholders | Mitsubishi UFJ Financial Group | Remaining majority | Public / institutional investors | Highly dispersed ownership with no controlling shareholder. |

| The Master Trust Bank of Japan, Ltd. (Trust Account) | Mitsubishi Chemical Group | 12–16% | Trust bank / institutional custodian | Largest institutional shareholder across group chemical operations. |

| Custody Bank of Japan, Ltd. (Trust Account) | Mitsubishi Chemical Group | 5–7% | Trust bank / institutional custodian | Domestic institutional ownership. |

| Domestic life insurers and institutions | Mitsubishi Chemical Group | 10–20% (combined) | Institutional investors | Long-term investment aligned with stability. |

| Public and international investors | Mitsubishi Chemical Group | Remaining shares | Public shareholders | Widely distributed ownership base. |

| The Master Trust Bank of Japan, Ltd. (Trust Account) | Mitsubishi Logistics | 12–16% | Trust bank / institutional custodian | Core institutional holder. |

| Custody Bank of Japan, Ltd. (Trust Account) | Mitsubishi Logistics | 5–7% | Trust bank / institutional custodian | Represents domestic institutional funds. |

| Public and institutional investors | Mitsubishi Logistics | Remaining shares | Public / institutional investors | No controlling owner. Ownership remains diversified. |

Mitsubishi Corporation Shareholders

Mitsubishi Corporation is one of Japan’s largest and most influential trading houses. Its ownership reflects a diverse mix of institutional investors.

The largest shareholder is The Master Trust Bank of Japan, Ltd. (Trust Account), which holds a significant portion of shares as a custodian for various institutional and pension funds.

Other major shareholders include STATE STREET BANK AND TRUST COMPANY and Custody Bank of Japan, Ltd. (Trust Account). Life insurance companies such as Meiji Yasuda Life Insurance Company occupy key positions among the top holders.

This mix of trust banks and institutional holders illustrates how Mitsubishi Corporation’s ownership is anchored in long-term investment vehicles and public market participation rather than a controlling individual entity.

Many of these shareholders act on behalf of retirement and pension funds, reinforcing the stable, market-driven ownership model that Mitsubishi Corporation has maintained for decades. Foreign institutional investors also appear among the largest holders, reflecting global interest in Mitsubishi’s diversified trading and investment operations.

Mitsubishi Motors Shareholders

Mitsubishi Motors operates as a global automobile manufacturer within the Renault–Nissan–Mitsubishi Alliance. Its ownership structure is shaped by strategic alliance agreements and market participation.

The largest shareholder is Nissan Motor Co., Ltd., which holds a sizeable equity stake. Nissan’s position reflects its role as the strategic partner that tied Mitsubishi Motors into the Alliance framework. Mitsubishi Corporation is another major stakeholder with a substantial share, reinforcing internal Mitsubishi Group linkages.

Smaller institutional investors, including major asset managers and global custodians, also hold meaningful portions of shares. While Nissan’s holding makes it the most influential shareholder, Mitsubishi Motors remains publicly traded and subject to market ownership dynamics rather than being wholly owned by its largest partner.

Recent corporate decisions have included share repurchase programs to reduce certain holdings and increase capital efficiency, indicating evolving ownership dynamics within the company’s broader investor base.

Mitsubishi Electric Shareholders

Mitsubishi Electric has a shareholder base similar to other publicly listed Mitsubishi companies. The Master Trust Bank of Japan, Ltd. (Trust Account) again appears as the largest holder, followed by Custody Bank of Japan, Ltd. (Trust Account). Institutional investors such as Meiji Yasuda Life Insurance Company, STATE STREET BANK AND TRUST COMPANY, and JPMorgan Chase Bank also rank among the top shareholders.

This mix highlights the prominence of trust banks and global custodians in holding shares on behalf of diversified institutional portfolios. Mitsubishi Electric’s institutional ownership contributes to its stable, widely held share structure, reducing the influence of any single controlling owner.

Mitsubishi UFJ Financial Group Shareholders

Mitsubishi UFJ Financial Group is one of Japan’s largest financial institutions. Its shareholder structure is dominated by institutional investors, with The Master Trust Bank of Japan, Ltd. (Trust account) holding the largest percentage. Other significant holders include Custody Bank of Japan, Ltd. (Trust account), The Bank of New York Mellon as custodian for ADR holders, and multiple large global custodial banks like State Street Bank and Trust Company.

The prevalence of trust banks in MUFG’s ownership profile underscores the long-term institutional investment culture common among major Japanese corporations. While the shareholding percentages may shift over time, the overall pattern remains one of diversified institutional ownership without a controlling individual or entity.

Other Significant Mitsubishi Company Shareholders

While the above companies are among the largest in the Mitsubishi Group, other entities such as Mitsubishi Chemical Group and Mitsubishi Logistics Corporation also follow similar ownership patterns. In these firms, institutional players like The Master Trust Bank of Japan, Ltd., Custody Bank of Japan, Ltd., and major life insurance companies consistently appear as leading shareholders.

These holdings reflect long-term investment strategies by pension and insurance funds, further illustrating the wide distribution of ownership across Mitsubishi companies.

Competitor Ownership Comparison

Comparing Mitsubishi’s ownership structure with its major global competitors helps clarify why Mitsubishi operates differently from many multinational corporations. While competitors often follow centralized, family-controlled, or holding-company-led models, Mitsubishi’s ownership is intentionally decentralized. This difference affects decision-making speed, risk appetite, governance style, and long-term strategy.

Mitsubishi vs Toyota: Decentralized Group vs Core Parent Company

Mitsubishi and Toyota Motor Corporation are both Japanese industrial giants, but their ownership structures differ significantly.

Toyota operates around a clear core entity. Toyota Motor Corporation sits at the center, with affiliated suppliers and partners forming the Toyota Group. Ownership is public, but control is strongly concentrated at the parent-company level through board influence, internal cross-shareholdings, and legacy family ties.

Mitsubishi, by contrast, has no central parent company. Mitsubishi Motors, Mitsubishi Corporation, and Mitsubishi Heavy Industries are all independent. No single Mitsubishi company can dictate strategy across the group. Ownership is more fragmented, which limits centralized authority but increases autonomy at the company level.

Mitsubishi vs Samsung: Institutional Ownership vs Family Control

A sharper contrast appears when Mitsubishi is compared with Samsung Group.

Samsung operates under strong family influence through the Lee family. Although Samsung companies are publicly listed, effective control remains concentrated through complex cross-shareholding and family-led governance. Strategic decisions often reflect top-down direction.

Mitsubishi has no controlling family. The founding Iwasaki family no longer holds ownership or influence. Instead, institutional investors, trust banks, and public shareholders dominate ownership. Decision-making follows consensus and board governance rather than family authority.

Mitsubishi vs General Electric: Network Model vs Centralized Corporation

Compared with General Electric, Mitsubishi again stands apart.

General Electric operates as a single corporate entity with centralized ownership, reporting, and governance. All business units ultimately answer to one board and executive leadership team. Shareholders own GE as one company, not as a network.

Mitsubishi functions as a corporate network. Each company has its own shareholders, board, and CEO. There is no group-wide financial reporting or consolidated ownership. This reduces efficiency in some cases but increases resilience and independence across business cycles.

Mitsubishi vs Hitachi: Loose Coordination vs Holding Structure

Another useful comparison is with Hitachi.

Hitachi transitioned into a holding-company-style structure to streamline ownership and improve capital efficiency. Subsidiaries operate under a clearer chain of command, even if they retain operational independence.

Mitsubishi deliberately avoided this path. Its companies cooperate informally through executive meetings but remain structurally independent. Ownership does not flow through a holding company, and control is not centralized.

Impact of Ownership Differences on Control

These ownership differences lead to meaningful operational contrasts.

Mitsubishi companies move cautiously. Major decisions require board consensus and alignment with long-term shareholders. Competitors with centralized ownership can act faster but often take greater risks.

Mitsubishi’s structure favors stability over speed. It reduces the likelihood of aggressive restructurings, hostile takeovers, or sudden leadership changes.

Mitsubishi’s decentralized ownership offers resilience, diversification, and independence. No single failure threatens the entire group. However, it can slow innovation and coordination compared to tightly controlled competitors.

Competitors like Toyota and Samsung benefit from clearer control structures, while Mitsubishi benefits from institutional stability and long-term orientation.

Who Controls Mitsubishi?

Mitsubishi is not controlled by a single individual, family, or parent company. The Mitsubishi Group has no group-wide CEO, chairman, or central board. Control is intentionally decentralized. Each major Mitsubishi company operates independently, with its own governance structure, executive leadership, and board of directors.

This means there is no one person who can be accurately described as “the controller of Mitsubishi” as a whole. Control exists at the individual company level, not at the group level.

Company-Level Control as the Core Model

Control within Mitsubishi exists inside each standalone company. Firms such as Mitsubishi Corporation, Mitsubishi Motors, Mitsubishi Heavy Industries, and Mitsubishi UFJ Financial Group are governed independently.

Each company has:

- Its own CEO and executive committee

- Its own board of directors

- Its own shareholders and voting structure

Strategic decisions are made within each company, based on board approval and shareholder accountability. No Mitsubishi company has legal authority over another.

Role of the CEO in Mitsubishi Companies

While there is no Mitsubishi Group CEO, each major company is led by a CEO or President who exercises operational control within that company.

For example, the CEO of Mitsubishi Corporation controls corporate strategy, investments, acquisitions, and capital allocation for that company only. The same applies to the CEOs of Mitsubishi Motors or Mitsubishi UFJ Financial Group. These executives are appointed by their respective boards, not by a group authority.

Historically, Mitsubishi companies favor internal promotion. CEOs typically rise through decades of service within the organization. This creates continuity and reinforces conservative, long-term decision-making.

Board of Directors and Consensus Governance

Boards of directors play a central role in controlling Mitsubishi companies. Boards are composed of internal executives and external independent directors. Major decisions require board approval, limiting unilateral executive control.

Mitsubishi governance emphasizes consensus. Decisions are often debated extensively before approval. This reduces risk but can slow execution compared to companies with dominant founders or controlling shareholders.

Independent directors have gained greater influence over time, especially after corporate governance reforms in Japan. This has strengthened oversight and reduced insider dominance.

Influence of Major Institutional Shareholders

Although institutional investors do not manage day-to-day operations, they exert indirect control through voting rights and governance expectations. Large trust banks and institutional shareholders influence:

- Board appointments

- Executive compensation frameworks

- Capital allocation discipline

However, because ownership is fragmented, no single shareholder can impose control. Influence is collective rather than concentrated.

The Friday Conference and Informal Coordination

One of the most distinctive elements of Mitsubishi control is the Friday Conference. This is an informal meeting of senior executives from major Mitsubishi companies.

The conference has no legal authority. It cannot issue binding decisions. Its role is coordination, information sharing, and alignment on long-term issues such as governance standards, reputational risk, and macroeconomic trends.

This forum allows Mitsubishi companies to act cohesively without centralized control. It is a soft-power mechanism rather than a command structure.

Absence of Family or Founder Control

Unlike many Asian conglomerates, Mitsubishi is not controlled by its founding family. The Iwasaki family no longer holds ownership stakes or governance roles across the group.

This absence of family control fundamentally shapes how Mitsubishi is governed. Authority flows through boards and executives rather than bloodlines or legacy ownership. This distinguishes Mitsubishi from groups like Samsung or Tata.

Control in Strategic Subsidiaries and Alliances

In certain companies, strategic partners exert greater influence. A clear example is Mitsubishi Motors, where Nissan is the largest shareholder. In this case, control is shared and influenced by alliance agreements.

Even here, Mitsubishi Motors remains a publicly listed company with its own board. Strategic influence does not equate to full control.

Companies Owned by Mitsubishi

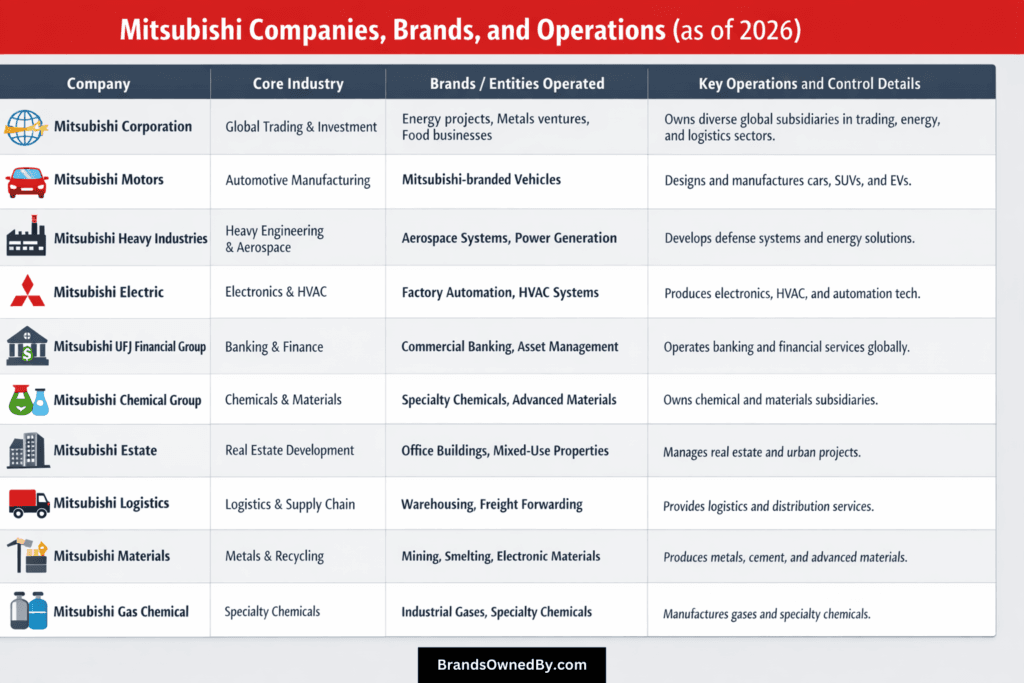

Mitsubishi does not operate through a single parent company. Instead, multiple independent Mitsubishi-branded companies own, operate, and control their own subsidiaries, brands, mergers, acquisitions, and business entities.

| Mitsubishi Company | Core Industry | Brands / Entities Operated | Key Operations and Control Details |

|---|---|---|---|

| Mitsubishi Corporation | Global trading, investment, infrastructure | Energy projects, metals ventures, food businesses, logistics platforms, automotive distribution entities | Operates as a global sogo shosha. Owns and controls hundreds of subsidiaries and affiliates worldwide. Focuses on strategic investments, joint ventures, and operating companies across energy, materials, consumer, and industrial sectors. |

| Mitsubishi Motors | Automotive manufacturing | Mitsubishi-branded passenger vehicles, SUVs, plug-in hybrids, EV platforms | Designs, manufactures, and sells vehicles globally. Owns manufacturing plants, regional sales subsidiaries, and vehicle platforms. Alliance participation does not transfer brand or subsidiary ownership. |

| Mitsubishi Heavy Industries | Heavy engineering, aerospace, defense, energy | Aerospace systems, power generation units, shipbuilding entities, industrial machinery businesses | Owns and operates advanced engineering businesses. Controls aerospace, defense, hydrogen energy, turbines, and space-related subsidiaries. Focuses on long-cycle industrial systems. |

| Mitsubishi Electric | Electronics, industrial systems | Factory automation systems, elevators, HVAC, semiconductors, railway systems | Operates global manufacturing and R&D subsidiaries. Controls industrial, infrastructure, and electronics brands under the Mitsubishi Electric name across multiple regions. |

| Mitsubishi UFJ Financial Group | Banking and financial services | Commercial banking, trust banking, securities, asset management, leasing entities | Owns and operates a full financial services ecosystem. Controls multiple banking and securities subsidiaries operating under distinct but MUFG-owned brands. |

| Mitsubishi Chemical Group | Chemicals and advanced materials | Specialty chemicals, performance materials, pharmaceutical-related entities | Owns a global portfolio of chemical and materials subsidiaries. Expanded through mergers and acquisitions in specialty and high-performance materials. |

| Mitsubishi Estate | Real estate development and management | Office buildings, mixed-use developments, residential and retail assets | Owns, develops, and manages large-scale real estate assets in Japan and overseas. Operates property management and development subsidiaries. |

| Mitsubishi Logistics | Logistics and supply chain services | Warehousing networks, freight forwarding units, port logistics entities | Owns logistics facilities and operating companies. Expanded through acquisitions of regional logistics operators, especially in Asia and Europe. |

| Mitsubishi Materials | Metals, cement, advanced materials | Mining interests, smelting operations, electronic materials units | Controls materials production from mining to advanced processing. Operates subsidiaries focused on metals, recycling, and high-performance materials. |

| Mitsubishi Gas Chemical | Specialty chemicals and industrial materials | Industrial gases, electronic materials, specialty chemical units | Owns chemical manufacturing and R&D subsidiaries. Growth driven by internal technology development and targeted niche acquisitions. |

Mitsubishi Corporation

Mitsubishi Corporation is one of Japan’s largest sogo shosha, or general trading companies. It operates as a global investment, trading, and business development firm. The company owns and operates hundreds of subsidiaries and affiliates worldwide across energy, materials, consumer, industrial, and infrastructure sectors.

Its operations span natural gas projects, renewable energy assets, metals and mining ventures, food supply chains, industrial materials, logistics platforms, and consumer businesses. Mitsubishi Corporation often acquires minority or majority stakes in operating companies rather than fully absorbing them, allowing management independence while retaining strategic control.

Major operating areas include global LNG production, copper and iron ore projects, automotive distribution networks, convenience store operations, food processing companies, and infrastructure platforms. The company continuously reshapes its portfolio through acquisitions, divestments, and joint ventures.

Mitsubishi Motors

Mitsubishi Motors is a standalone automotive manufacturer specializing in passenger vehicles, SUVs, plug-in hybrids, and electric vehicles. It owns and operates its own vehicle platforms, manufacturing facilities, and regional sales subsidiaries.

Key brands operated directly by Mitsubishi Motors include Mitsubishi-branded passenger vehicles sold globally. Popular models include SUVs and electrified vehicles designed for Asia-Pacific, Latin America, and selected European markets.

Mitsubishi Motors is part of the Renault–Nissan–Mitsubishi Alliance, but it remains an independent company. Alliance participation involves shared platforms and technology, not ownership of Mitsubishi Motors’ internal brands or subsidiaries.

Mitsubishi Heavy Industries

Mitsubishi Heavy Industries is a core industrial company focused on large-scale engineering, manufacturing, and advanced technology systems. It owns and operates businesses across aerospace, defense, power generation, shipbuilding, space systems, and industrial machinery.

Its aerospace division includes commercial aircraft components, defense aircraft, missile systems, and space launch technologies. In energy, the company develops gas turbines, hydrogen systems, carbon capture solutions, and nuclear-related infrastructure.

Mitsubishi Heavy Industries also owns specialized subsidiaries in logistics equipment, climate systems, and automation technologies. Many of these entities originated from internal reorganizations rather than external acquisitions.

Mitsubishi Electric

Mitsubishi Electric operates as a global electronics and electrical equipment manufacturer. It owns and manages a wide range of industrial, infrastructure, and consumer-facing businesses.

Its core brands operate under the Mitsubishi Electric name across factory automation systems, elevators and escalators, HVAC equipment, power semiconductors, railway systems, satellites, and defense electronics.

The company owns manufacturing and R&D subsidiaries across Asia, Europe, and the Americas. It also operates regional sales and service companies that directly represent Mitsubishi Electric products in local markets.

Mitsubishi UFJ Financial Group

Mitsubishi UFJ Financial Group is one of the world’s largest financial institutions. It operates as a full-service banking and financial services group.

Its major operating entities include commercial banking, trust banking, securities brokerage, asset management, and leasing businesses. These entities operate under distinct brand names but are wholly owned or controlled by MUFG.

The group has expanded internationally through acquisitions and strategic investments, particularly in Asia, the United States, and Europe. Despite global reach, MUFG operates independently from other Mitsubishi companies.

Mitsubishi Chemical Group

Mitsubishi Chemical Group operates as a global materials and chemicals company. It owns a portfolio of businesses covering specialty chemicals, advanced materials, pharmaceuticals, and industrial compounds.

Its operating brands include chemical materials for automotive, electronics, healthcare, and packaging industries. The company has grown significantly through mergers and acquisitions, integrating overseas specialty material firms into its global structure.

Many of its subsidiaries operate under their own brand identities while remaining fully controlled by Mitsubishi Chemical Group.

Mitsubishi Estate

Mitsubishi Estate is one of Japan’s largest real estate developers and operators. It owns and manages office buildings, mixed-use developments, residential properties, retail assets, and logistics facilities.

Its portfolio includes landmark urban developments, particularly in Tokyo’s Marunouchi district. Mitsubishi Estate also owns overseas real estate subsidiaries and investment platforms in North America, Europe, and Asia.

The company actively acquires, redevelops, and manages properties rather than acting as a passive landlord.

Mitsubishi Logistics

Mitsubishi Logistics operates end-to-end logistics services including warehousing, freight forwarding, port logistics, and supply chain solutions.

The company owns logistics facilities, distribution centers, and transport subsidiaries domestically and internationally. It has expanded through acquisitions of regional logistics operators, particularly in Asia and Europe.

Its services support both Mitsubishi companies and third-party global clients.

Mitsubishi Materials

Mitsubishi Materials focuses on metals, cement, advanced materials, and recycling businesses. It owns mining interests, smelting operations, and materials processing subsidiaries.

The company also operates advanced materials units producing electronic components, high-performance alloys, and sustainable material solutions. These businesses are operated directly or through controlled subsidiaries.

Mitsubishi Gas Chemical

Mitsubishi Gas Chemical operates specialty chemicals, industrial gases, and advanced material businesses. It owns manufacturing subsidiaries and R&D entities that serve electronics, energy, automotive, and pharmaceutical industries.

Its growth strategy relies on internal technology development combined with targeted acquisitions in specialty chemical niches.

Conclusion

Understanding who owns Mitsubishi requires looking beyond the idea of a single owner or parent company. Mitsubishi operates as a decentralized group of independent, publicly listed companies that share a common history, brand identity, and cooperative culture. Ownership is spread across institutional investors, strategic partners, and public shareholders, with no individual, family, or entity exercising group-wide control. This structure has enabled Mitsubishi to remain stable, diversified, and globally influential for more than a century, while allowing each company to pursue its own strategy, governance, and long-term growth under the broader Mitsubishi name.

FAQs

Who owns Mitsubishi Heavy Industries?

Mitsubishi Heavy Industries is a publicly listed company. It is owned by a broad mix of institutional investors and public shareholders. No single shareholder has majority control. It operates independently and is not owned by any other Mitsubishi company.

Who owns Mitsubishi HVAC?

Mitsubishi HVAC systems are primarily manufactured and sold by Mitsubishi Electric through its heating, ventilation, and air conditioning divisions. Mitsubishi Electric is publicly owned and operates independently.

Who makes Mitsubishi vehicles?

Mitsubishi vehicles are made by Mitsubishi Motors. The company designs, manufactures, and sells vehicles globally. It is part of an automotive alliance but remains an independent manufacturer.

Who owns Mitsubishi Electric Corporation?

Mitsubishi Electric is publicly owned. Its shares are held by institutional investors, trust banks, and public shareholders. No individual or company owns it outright.

Who owns Mitsubishi Corporation?

Mitsubishi Corporation is a publicly listed company. It is owned by institutional investors, long-term trust banks, and public shareholders. There is no controlling owner.

Who owns Mitsubishi Group?

No one owns Mitsubishi Group as a single entity. The Mitsubishi Group is a network of independent companies that share history and branding but do not have a parent company or group-level owner.

Who is Mitsubishi owned by?

Mitsubishi is owned by the market through its individual companies. Ownership is distributed among institutional investors, pension funds, trust banks, and public shareholders. There is no single owner of Mitsubishi.

Who makes Mitsubishi engines?

Mitsubishi engines are made by different Mitsubishi companies depending on the application. Vehicle engines are developed by Mitsubishi Motors. Industrial, marine, and aerospace engines are produced by Mitsubishi Heavy Industries. Each operates independently.

Are Mazda and Mitsubishi the same company?

No. Mazda and Mitsubishi are completely separate companies. They have no ownership relationship and operate independently.

Which company does Mitsubishi belong to?

Mitsubishi does not belong to any other company. Each Mitsubishi-branded company is independent and publicly owned. There is no parent company above Mitsubishi.

Is Hitachi owned by Mitsubishi?

No. Hitachi is not owned by Mitsubishi. Hitachi is an independent Japanese multinational with its own shareholders and governance structure.

How many companies does Mitsubishi own?

Mitsubishi does not own companies at a group level. Individually, major Mitsubishi companies own hundreds of subsidiaries and affiliates worldwide. There is no single total number because ownership exists at the company level, not the group level.

Mitsubishi is owned by which country?

Mitsubishi is a Japanese business group. Its companies are headquartered in Japan and publicly owned. It is not owned by the Japanese government or any country.

Is Mitsubishi owned by Nissan?

No. Nissan does not own Mitsubishi as a group. However, Nissan is the largest shareholder in Mitsubishi Motors specifically. This does not mean Nissan owns Mitsubishi or other Mitsubishi companies.