Understanding who owns Live Nation Entertainment helps explain how the world’s biggest live-events company operates. The company’s ownership structure is shaped by major investors, strategic partners, and long-term industry leadership. This makes Live Nation a powerful force in concerts, ticketing, and global entertainment.

Key Takeaways

- Live Nation Entertainment is a publicly traded company with no single individual owner; its ownership is dominated by major institutional investors.

- Liberty Media Corporation is the largest shareholder, controlling about 30% of the company and holding the most influence in governance.

- Other major shareholders include The Vanguard Group, BlackRock, State Street, CPPIB, and several global investment firms, each holding smaller but significant stakes.

- Management and the board, led by CEO Michael Rapino, oversee day-to-day operations while shareholders shape long-term strategy through their voting power.

Live Nation Entertainment Overview

Live Nation Entertainment, Inc. (NYSE: LYV) provides a full ecosystem around live experiences. It promotes and stages concerts and festivals. It sells tickets via its ticketing business. It also operates venues and provides sponsorship and advertising services. The company employs roughly 16,200 people globally.

Its organizational structure reflects three major segments: concerts (promotion & venues), ticketing (via its ticket platforms), and sponsorship/advertising.

Live Nation Entertainment is a global powerhouse in the live events industry. The company spans concert promotion, ticketing, venue operations, and artist management. Headquartered in Beverly Hills, California, it operates in more than 40 countries and touches virtually all aspects of live entertainment.

Founders

Live Nation Entertainment has roots that stretch back decades through several major industry shifts. The earliest foundation was laid by Robert F. X. Sillerman, who founded SFX Entertainment in 1996. His goal was to consolidate local concert promoters into a national live-events powerhouse. This strategy transformed the concert-promotion landscape and set the stage for what later became Live Nation.

In 2000, SFX was acquired by Clear Channel Communications, which absorbed its promoters, tours and venue operations. After several years of rapid growth in the live-events division, Clear Channel spun off its entertainment arm in 2005, creating the standalone company Live Nation, Inc. This spin-off marks the true beginning of Live Nation as we know it today.

The modern company took shape in 2010 when Live Nation merged with Ticketmaster Entertainment, combining the largest concert promoter with the largest ticketing platform. This merger was not led by a single founder, but by industry leaders who saw the value in a vertically integrated entertainment ecosystem. This combination created Live Nation Entertainment, the global entity operating today.

Major Milestones

- 1996 – Robert F. X. Sillerman launches SFX Entertainment, beginning the first large-scale consolidation of regional concert promoters in the United States.

- 2000 – Clear Channel Communications acquires SFX and integrates its promoter network, venues, and touring assets.

- 2005 – Clear Channel spins off its live-events division as Live Nation, Inc., creating a dedicated live-entertainment company.

- 2007 – Live Nation announces plans to build its own ticketing system, setting the stage for a vertically integrated model.

- 2008 – Ticketmaster becomes an independent public company, positioning it as a major strategic player in ticketing and event technology.

- 2010 – The landmark merger between Live Nation and Ticketmaster is completed, forming Live Nation Entertainment, one of the most influential companies in entertainment history.

- 2012–2015 – The company expands aggressively overseas, acquiring promoters, festivals and venue operators across Europe, South America and Asia.

- 2017 – Live Nation strengthens its festival portfolio by taking stakes in major events, including BottleRock and other high-profile productions.

- 2019 – The company enters a new era of global touring dominance, supporting many of the world’s biggest artists and tours.

- 2020 – The COVID-19 pandemic stops major events worldwide. Live Nation restructures, adapts its operations and shifts toward long-term resilience.

- 2021–2023 – Global touring returns at scale. Live Nation continues venue expansion, festival growth and new international partnerships.

- 2024–2025 – The company faces increased regulatory and antitrust scrutiny. Despite investigations and policy pressure, it continues expanding its global network of festivals, promoters, technology platforms and venues.

- 2026 – Live Nation enhances its digital strategy by investing in expanded fan-engagement tools, immersive event technology and upgraded ticketing systems to modernize the live-events experience.

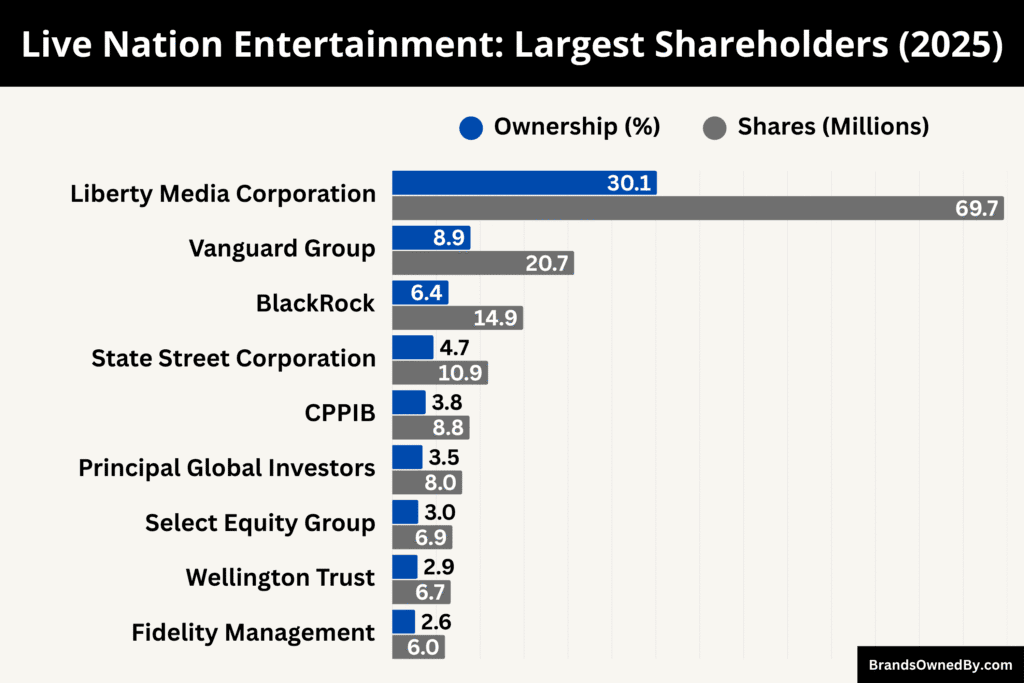

Who Owns Live Nation Entertainment: Major Shareholders

Live Nation Entertainment is a publicly traded company, which means no single individual owns it outright. Instead, ownership is distributed across institutional investors, mutual funds, and insiders.

As of November 2025, the bulk of shares is held by large institutions, giving them significant influence over governance, though not necessarily day-to-day operations. The management team and the board run the business, while major shareholders wield oversight power. Institutional ownership is estimated at around 79.5% of all shares.

Below is a list of the largest shareholders of Live Nation Entertainment as of November 2025:

| Shareholder | Approximate Ownership % | Number of Shares (approx) | Role / Notes |

|---|---|---|---|

| Liberty Media Corporation | 30.13% | 69,645,033 | Largest shareholder. Significant influence over governance and strategic direction, though not managing day-to-day operations. |

| The Vanguard Group, Inc. | 8.78%-8.95% | 20,300,000 | Major institutional investor. Primarily a passive holder, engages in governance through proxy voting and long-term holdings. |

| BlackRock, Inc. | 5.3%-6.4% | 12-15 million | Another large institutional investor. Known for active corporate governance engagement though not direct operations. |

| State Street Corporation | 4.7% | 10.9 million | Institutional investor with long-term holdings. Contributes to the stability of the investor base. |

| Canada Pension Plan Investment Board (CPPIB) | 3.8% | 8.8 million | Large pension fund managed for long-term returns. Reflects confidence in the company’s global business model. |

| Principal Global Investors LLC | 3.445% | 7.96 million | Institutional investor. Holds a meaningful stake and participates in governance oversight rather than operations. |

| Select Equity Group LP | 2.965% | 6.85 million | Smaller among major investors but still influential. Monitors the company as part of its portfolio strategy. |

| Wellington Trust Co., NA | 2.876% | 6.65 million | Institutional portfolio manager. Another sign of diversified institutional ownership rather than concentrated founder-ownership. |

| Fidelity Management & Research Co. LLC | 2.597% | 6.00 million | Major asset manager with a stake reflecting long-term institutional confidence in the company. |

Liberty Media Corporation (30%)

Liberty Media Corporation is the largest shareholder, owning roughly 30.1% of the outstanding shares (about 69.6 million shares).

This large stake gives Liberty Media substantial influence in Live Nation’s governance—board composition, major policies and the ability to shape strategic direction. Although Liberty is not involved in Live Nation’s daily operations, its ownership aligns it with the success of live entertainment and ticketing. The stake also reflects Liberty’s broader focus on entertainment investments.

The Vanguard Group, Inc. (8.9%)

The Vanguard Group, Inc. holds approximately 8.9% of shares (around 20.7 million shares) in the company.

Vanguard’s role is that of a major asset manager and index fund provider. While its stake is large, it generally operates as a passive investor, focusing on long-term hold rather than operational control. Vanguard’s influence comes through voting its shares at annual meetings and engaging on governance issues when needed.

BlackRock, Inc. (6.4%)

BlackRock, Inc. is another meaningful institutional investor in Live Nation, holding approximately 6% of the company (over 14 million shares) as of 2025. BlackRock is known for using its influence in corporate governance through proxy voting and engagements with companies it invests in.

Although it does not run Live Nation, its size means it is a noticeable stakeholder in any significant strategic or governance event.

State Street Corporation (4.7%)

State Street Corporation holds around 4.7% of Live Nation (about 10.9 million shares) according to recent data.

Like the other large institutions, State Street’s role is primarily as a long-term shareholder rather than an active manager. Its participation contributes to the broad institutional base of ownership and implies that Live Nation can count on a stable investor base.

Canada Pension Plan Investment Board (3.8%)

Canada Pension Plan Investment Board (CPPIB) holds approximately 3.8% of the shares (about 8.8 million shares).

As a large pension fund, CPPIB invests with a long-term horizon and aims for sustainable returns. Its stake reflects confidence in Live Nation’s business model and global scale. While smaller than the largest holders, its role signals institutional confidence in the live-entertainment sector.

Principal Global Investors LLC (3.45%)

Principal Global Investors LLC owns about 3.45% of Live Nation (roughly 7.96 million shares). Though its stake is smaller, it is still significant among the institutional investor set. Principal Global Investors exercises its influence through engagements on strategy and governance while trusting Live Nation’s management to execute business plans.

Select Equity Group LP (2.96%)

Select Equity Group LP holds about 2.96% of Live Nation (around 6.85 million shares). As an investment firm, Select Equity looks for value opportunities and may monitor Live Nation’s performance for growth and risk. While it does not dominate governance, its stake places it among the more engaged institutional owners.

Wellington Trust Co., NA (2.88%)

Wellington Trust Co., NA has around 2.88% ownership (approx. 6.65 million shares). Wellington is known for its portfolio management for large institutional clients. Its stake signals that Live Nation is a component of diversified institutional holdings rather than a speculative investment.

Fidelity Management & Research Co. LLC (2.60%)

Fidelity Management & Research Co. LLC owns about 2.60% of Live Nation (roughly 6.0 million shares). Fidelity is another major asset manager whose holdings reflect institutional commitment to Live Nation’s long-term live-entertainment business.

Additional Institutional Investors

Beyond the aforementioned major shareholders, other institutional investors such as Principal Financial Group Inc., Independent Franchise Partners LLP, and Geode Capital Management LLC also hold multi-hundred-million-dollar stakes in Live Nation.

These investors may not have as large a percentage individually, but collectively they reinforce the strong institutional ownership of the company.

Who is the CEO of Live Nation Entertainment?

Michael Rapino is the long-standing President and Chief Executive Officer of Live Nation Entertainment. He has led the company since 2005, guiding it through the 2010 merger with Ticketmaster and transforming it into the world’s largest live-entertainment business. Rapino is known for his long-term vision, aggressive expansion strategy, and emphasis on vertical integration across concerts, venues, ticketing and artist management.

Background and Early Career

Rapino was born in Thunder Bay, Canada, and began his career in marketing and artist development. Before joining Live Nation, he worked in artist management and concert promotion, gaining hands-on experience in touring, booking and event execution.

His rise through the industry gave him a deep understanding of the live-events ecosystem, which later shaped Live Nation’s strategic direction.

Role and Responsibilities as CEO

Rapino oversees all business segments, including concerts, venues, ticketing (via Ticketmaster), sponsorship and international expansion.

His core responsibilities include:

- Setting long-term global strategy

- Approving major acquisitions and venue deals

- Overseeing artist relationships and touring models

- Guiding technology and ticketing innovations

- Managing global operations across more than 40 countries.

Under his leadership, Live Nation has expanded deeper into festivals, acquired new promoters, added major venues, and built diversified revenue streams around live events.

Rapino reports directly to a board of directors composed of independent members and representatives from major institutional shareholders. He handles daily operations with his executive team, while the board provides oversight.

He also plays a central role in investor relations, corporate strategy and regulatory negotiations, especially during periods of industry scrutiny.

Salary and Net Worth

Michael Rapino’s compensation reflects his central role in Live Nation’s growth. For the fiscal year 2024, his total compensation was approximately $32.96 million, consisting of:

- Base salary: $3 million

- Annual bonus: $18.48 million

- Stock awards: $9.80 million

- Other compensation: $1.68 million.

In prior years, his compensation spiked significantly due to major stock-award packages and contract renewals. His pay position places him among the highest-compensated executives in the global entertainment industry.

As of November 2025, Michael Rapino’s net worth is estimated at $997 million.

The majority of his wealth comes from:

- His long-term equity stake in Live Nation

- Stock appreciation over the past decade

- Performance-based stock awards tied to company milestones.

His substantial ownership aligns him closely with shareholder interests and the long-term value of the business.

Achievements and Impact on the Industry

Under Rapino’s leadership, Live Nation has:

- Become the world’s dominant concert promoter

- Expanded into major global markets across Europe, Asia, Latin America, and the Middle East

- Strengthened its festival portfolio with high-profile acquisitions

- Modernized Ticketmaster’s technology and infrastructure

- Invested heavily in venue ownership and operations

- Enhanced artist services through management divisions and touring partnerships.

His strategies helped build a vertically integrated model that reshaped how live events are organized, sold, and monetized.

Leadership Style

Rapino is known for a relationship-driven leadership approach, especially with artists, promoters, and venue partners. He focuses on:

- Long-term artist partnerships

- Data-driven touring strategy

- Expansion into emerging markets

- Technology upgrades in ticketing and fan engagement

- Creating consistent global touring platforms.

This approach has helped Live Nation strengthen its position as the primary partner for many top global artists.

Past CEOs of the Company

While Rapino has led Live Nation for nearly two decades, the predecessor entities had their own leaders, including:

- Irving Azoff – Executive Chairman and CEO of Ticketmaster, later Executive Chairman of Live Nation Entertainment after the merger

- Senior executives from the Clear Channel Entertainment division prior to the 2005 spin-off.

These transitions set the stage for Rapino’s unified leadership once the merged entity was established.

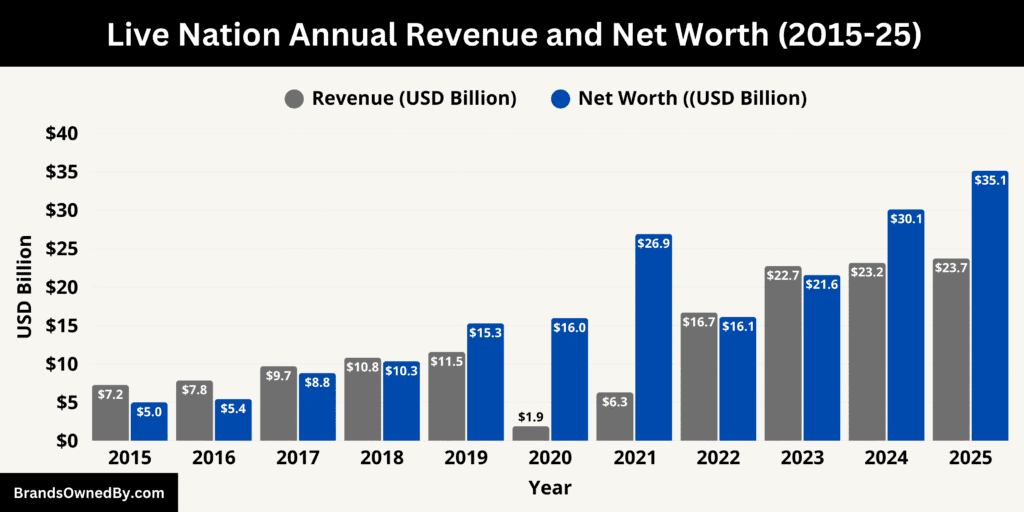

Live Nation Entertainment Annual Revenue and Net Worth

As of November 2025, Live Nation Entertainment reports annual revenue of approximately $23.72 billion and a market valuation (often used as its net worth) of about $35.13 billion. These figures highlight the scale of the company’s global operations and its continued dominance in the live-entertainment industry.

Revenue Performance in Recent Years

Live Nation’s revenue has remained strong through 2024 and into 2025. The company generated $23.15 billion in 2024 and increased this to $23.72 billion on a trailing-twelve-month basis by late 2025.

Growth has stabilized compared to earlier post-pandemic surges, but the business continues to operate at historically high levels. Concerts remain the largest revenue driver, supported by strong ticket demand, expanded global touring, higher per-show attendance, and increased fan spending at venues.

Ticketing revenue continues to grow as more events shift to digital distribution, while sponsorship and advertising benefit from the company’s expanded global footprint.

What Drives Live Nation’s Revenue

Live Nation’s revenue model is built on several pillars that reinforce each other. Concert promotion forms the core engine, generating income from tours, festivals, and venue operations. Ticketing amplifies this, with the company earning from service fees, platform distribution, and ticketing technology.

The company also benefits from on-site spending at owned or operated venues, ranging from concessions to VIP experiences. Sponsorships and brand partnerships add another layer of predictable revenue, especially at large-scale festivals and international events.

Together, these components create a diversified and resilient revenue structure, largely protected from seasonal fluctuations.

Net Worth and Market Valuation

Live Nation’s market valuation of roughly $35.13 billion as of November 2025 reflects investor confidence in the strength and longevity of the company’s integrated business model.

This valuation has steadily climbed as the live-entertainment sector recovered globally, with touring demand returning to record levels and new markets opening for major artists.

The company’s net worth is also supported by its extensive asset base, which includes long-term venue leases, strategic partnerships, event technology, and intellectual property tied to touring and festivals.

While its debt and obligations are considerable—common for large entertainment infrastructure companies—they are balanced by strong revenue visibility and global operating capacity.

Long-Term Financial Position

Live Nation’s combination of high revenue, strong recurring demand and a powerful global network positions it as one of the most financially influential entertainment companies in the world.

Its stability allows it to invest heavily in future venue development, international expansion and digital technology, ensuring continued relevance in the evolving live-events ecosystem.

Despite regulatory challenges, its financial metrics show a mature business with consistent performance, deep market penetration and a solid foundation for sustained growth.

What These Numbers Mean for the Company’s Future

The company’s financial strength provides room for major strategic moves, including acquisitions of promoters and festivals, venue upgrades and expanded digital ticketing infrastructure.

Investors tend to view Live Nation’s scale as a competitive moat, with its revenue and valuation reflecting both market dominance and long-term growth prospects.

As fan demand for live experiences continues to rise globally, Live Nation’s revenue base and net worth suggest it will remain at the center of the live-events industry for years to come.

Historical Revenue and Net Worth

Over the past decade, Live Nation Entertainment has experienced substantial shifts in both revenue and valuation, demonstrating how the company has grown, adapted and strengthened its position in the global entertainment industry.

From 2015 through 2019, the company saw steady and consistent revenue expansion. This period reflects the rise of large-scale touring, international market growth and increasing fan demand for live experiences.

By 2019, revenue exceeded $11 billion, highlighting the company’s strong upward trajectory.

The year 2020 marked a dramatic disruption. Global shutdowns caused an unprecedented collapse in live events, leading to a sharp decline in revenue. Yet, despite this operational shock, the company’s valuation held relatively firm. Investor confidence remained grounded in the expectation that live entertainment would rebound once restrictions lifted.

Recovery began in 2021 and accelerated quickly. Revenue surged as concerts, festivals and stadium tours returned, with the industry experiencing pent-up demand. Between 2021 and 2024, Live Nation’s revenue climbed sharply, reaching more than $23 billion as the company expanded its venue network, strengthened ticketing operations and delivered some of the highest-grossing tours in history.

During the same period, market valuation rose significantly. The company grew from a mid-single-digit billion-dollar valuation in 2015 to more than $30 billion by 2024. This rise reflects the increasing scale of its operations, its competitive advantages in ticketing and venue ownership and its powerful global brand.

Across these ten years, Live Nation’s financial evolution demonstrates its resilience, its ability to grow after major disruptions and its central role in shaping the modern live-entertainment landscape.

Companies Owned by Live Nation Entertainment

Live Nation Entertainment controls a wide portfolio of companies, brands, venues, and event divisions that support its global dominance in live entertainment. As of 2025, the company owns and operates some of the most influential names in concerts, ticketing, festivals, artist management, and event production.

Below is a list of the major companies and brands owned by Live Nation Entertainment as of November 2025:

| Company / Brand / Entity | Type | Description |

|---|---|---|

| Ticketmaster | Ticketing Platform | Handles primary and secondary ticket sales, distribution technology, venue ticketing services and digital ticketing infrastructure worldwide. |

| Live Nation Concerts | Concert Promotion Division | Produces, promotes and manages global tours, concerts, festivals and live events across more than 40 countries. |

| Artist Nation (Front Line Management) | Artist Management & Touring Partner | Manages artists, tour planning, branding, merchandising strategies and connects artist services with Live Nation’s touring and festival operations. |

| C3 Presents | Festival & Event Production Company | Operates large-scale festivals and destination events; supports Live Nation’s expansion into major outdoor and multi-day festivals. |

| Live Nation Merchandise | Merchandise & Licensing Division | Oversees artist merchandise, concert and venue merchandise operations, product licensing and global distribution of branded goods. |

| Live Nation Media & Sponsorship | Sponsorship & Advertising Division | Manages sponsorship deals, advertising inventory, brand partnerships, venue naming rights and digital promotional initiatives. |

| Live Nation Venues & Venue Operations | Venue Ownership & Operations | Owns, leases or operates amphitheatres, arenas, clubs and festival grounds; controls venue scheduling, on-site revenue and guest experiences. |

| Live Nation Festival Network | Festival Division | Oversees festival acquisitions, development and strategic management of global music festivals and promoters across multiple countries. |

| Regional Promoter Acquisitions | Promoter Holdings | Includes various promoters acquired in Europe, Latin America, Asia and the U.S., enabling expansion of the company’s touring and event footprint. |

Ticketmaster

Ticketmaster is the global ticketing platform owned and operated by Live Nation Entertainment. It handles primary ticket sales, resale, ticketing technology and event distribution for concerts, sports and live events worldwide.

As a central part of Live Nation’s vertical integration, owning Ticketmaster gives the company control over both the promotion of live events and the ticket-distribution ecosystem. This enables Live Nation to capture revenue across the live chain—from show creation to ticket sales to resale and venue servicing.

Live Nation Concerts

Live Nation Concerts is the division of Live Nation that promotes and produces live music events, artist tours and festivals across the globe. It operates in over 40 countries and works with top artists, managing the touring schedule, venue bookings and promotion logistics. Under this entity, Live Nation is not only a promoter but often owns or has lease/control of venues, enabling the company to capture more value from ticketing, sponsorship, venue operations and ancillary services.

Artist Nation (including Front Line Management)

Artist Nation is the artist-management and touring-partner arm of Live Nation. Through this entity, the company represents and works with major artists, guiding their touring strategies, branding, merchandising and global live performance campaigns. It connects the artist management side with the concert promotion side, creating synergies: artists managed by the group often perform on Live Nation promoted tours and festivals, which increases alignment and revenue flows across the ecosystem.

C3 Presents

C3 Presents is a major festival-promoter and event-production company that Live Nation acquired and now operates as part of its global events portfolio. Based in Austin, Texas, C3 Presents is known for large-scale festivals and destination events. Within Live Nation’s structure, C3 Presents allows the company to expand its festival footprint, leverage cross-promotion, and integrate ticketing and sponsorship under its broader umbrella.

Live Nation Merchandise

Live Nation Merchandise handles the branded merchandise side of the live-event business. This branch manages artist merchandise, venue merchandise operations, licensing and production of concert-related apparel and goods. By integrating merchandise, Live Nation captures additional revenue beyond tickets and sponsorships, enhancing profit margins on live events and tours.

Live Nation Media & Sponsorship

This brand/entity oversees sponsorship, advertising, and brand-partnership activities tied to events, venues, tours and festivals. It manages relationships with corporate sponsors, venue naming rights, advertising placement at live event venues and digital brand activations. With this unit, Live Nation leverages its event portfolio scale to attract and monetise brand partners globally.

Live Nation Venues & Venue Operations

Within its business operations, Live Nation owns, leases or operates a large array of venues—amphitheatres, arenas, clubs and outdoor festival sites. This category covers the venue-ownership and venue-operations arm of Live Nation. By controlling the venues, Live Nation can optimise scheduling, revenue streams (ticketing, food & beverage, VIP experiences) and integrate them with its promotion and ticketing businesses. This entity drives competitive advantage via ownership of the “real estate” of live entertainment.

Festival Acquisitions & Promoter Holdings

Live Nation’s acquisition strategy has expanded into numerous promoter companies and festival businesses around the world. Under this umbrella, the company has taken majority or controlling stakes in festival promoters, regional concert companies, international event businesses and streaming-event platforms. These acquisitions allow Live Nation to enter emerging markets, diversify its event mix, and scale its operations globally.

Final Thoughts

Live Nation Entertainment’s ownership structure reflects its scale and influence in the live-events world. While institutional investors hold most of its shares, real control comes from the leadership team and the strategic direction set by the company’s board. Knowing who owns Live Nation Entertainment gives clearer insight into how the company grows, partners, and continues shaping the global entertainment landscape.

FAQs

Who are the largest shareholders of Live Nation?

The largest shareholder of Live Nation Entertainment is Liberty Media Corporation with about 30% ownership. Other major shareholders include The Vanguard Group, BlackRock, State Street, CPPIB, Principal Global Investors, Select Equity Group, and Fidelity.

Who founded Live Nation?

Live Nation originated from the 2005 spin-off of Clear Channel’s live-events division, but its deeper roots trace back to SFX Entertainment, founded in 1996 by Robert F. X. Sillerman.

Who owns Live Nation tickets?

Live Nation tickets are sold and managed through Ticketmaster, which is fully owned and operated by Live Nation Entertainment.

Who does Live Nation own?

Live Nation owns Ticketmaster, Live Nation Concerts, Artist Nation, C3 Presents, Live Nation Merchandise, Live Nation Media & Sponsorship and a global network of venues, promoters and festival brands.

What venues are owned by Live Nation?

Live Nation owns, operates, or leases hundreds of venues worldwide, including amphitheaters, arenas, theaters, and clubs. Examples include The Fillmore venues, House of Blues locations, multiple outdoor amphitheaters across the U.S,. and various international concert halls and festival grounds.

Where is Live Nation Entertainment’s headquarters?

Live Nation Entertainment is headquartered in Beverly Hills, California, USA.

How much is the CEO of Live Nation worth?

As of November 2025, CEO Michael Rapino has an estimated net worth of $997 million.

Is Live Nation owned by BlackRock?

No. BlackRock is a major institutional shareholder but does not own or control Live Nation. Liberty Media is the largest shareholder.

Does Jay Z own Live Nation?

Jay Z does not own Live Nation. However, his company Roc Nation formed partnerships with Live Nation for touring and entertainment ventures.

Who owns Liberty Media Corporation?

Liberty Media is a publicly traded company. Its ownership is spread across institutional and retail shareholders, with no single individual owning the company outright.

Who owns Ticketmaster?

Ticketmaster is owned by Live Nation Entertainment following the 2010 merger of the two companies.

What are the major subsidiaries of Live Nation Entertainment?

Major subsidiaries include Ticketmaster, Live Nation Concerts, Artist Nation, C3 Presents, Live Nation Merchandise, Live Nation Media & Sponsorship and a large portfolio of owned or operated venues and festival entities worldwide.