Kellanova is a new name in the food industry, but it carries a legacy that dates back over a century. In this article, we explore who owns Kellanova, how it was formed, who controls it, and what companies it owns. From its largest shareholders to its CEO, here’s everything you need to know about Kellanova.

History of Kellanova

Kellanova is a global snacking and convenience foods company that emerged from the restructuring of the iconic Kellogg Company. Its roots trace back to 1906, when Will Keith Kellogg founded the Battle Creek Toasted Corn Flake Company in Michigan. Over time, Kellogg’s became a household name in cereals and later expanded into snacks, frozen foods, and plant-based products.

Spin-off from Kellogg Company

By the early 2020s, Kellogg’s had become a diversified food giant with two major business segments:

- Global Snacking: Including brands like Pringles, Cheez-It, and Pop-Tarts.

- North America Cereal and Plant-Based Foods: Including legacy breakfast cereals such as Kellogg’s, Special K, and Eggo.

In June 2022, Kellogg Company announced a bold restructuring plan to split into three independent public companies, aiming to unlock shareholder value and allow each business to focus on its strengths. The plan was later revised to form two companies instead of three:

- Kellanova: The global snacking powerhouse.

- WK Kellogg Co: Focused on the North American cereal business.

This corporate split was finalized on October 2, 2023. From that day, Kellanova began trading independently on the New York Stock Exchange under the ticker symbol “K”, while WK Kellogg Co was listed separately as “KLG”.

Kellanova inherited the high-growth snack and convenience brands and retained the international cereal business. Its portfolio was better aligned for global expansion, faster innovation, and increased profit margins. This separation marked a new era in Kellogg’s 117-year history, allowing both businesses to define their identities and strategic priorities.

Relationship Between Kellanova and WK Kellogg Co

Kellanova and WK Kellogg Co share a historical and branding legacy. Both companies emerged from the original Kellogg Company and continue to use branding associated with the Kellogg name. Kellanova retained global snacking and international cereal, while WK Kellogg Co took on North America cereal operations.

Though they are now independent, both companies maintain a cooperative relationship in certain areas, including brand licensing and transitional services. Kellanova has a broader international focus, while WK Kellogg Co. is more concentrated in North America’s breakfast market.

Acquisition by Mars Incorporated

In a major strategic move, Mars Incorporated, a privately held global food and pet care conglomerate, announced on August 27, 2024, that it had entered into a definitive agreement to acquire Kellanova for $35.9 billion. The deal was framed as a transformative acquisition that would reshape the global snacking landscape.

Mars, known for brands like M&M’s, Snickers, and Pedigree, sought to expand further into the savory and healthy snacking categories. Kellanova’s popular snack brands, international distribution network, and innovation pipeline made it a prime target.

Mars-Kellanova Deal Timeline

- Announcement Date: August 27, 2024

- Shareholder and Regulatory Approval: Ongoing through late 2024 and early 2025

- Expected Closing Date: June 30, 2025, subject to final approvals

Under the deal, Mars will acquire all outstanding shares of Kellanova, taking it private. Shareholders of Kellanova are to receive a cash premium. The company’s CEO, Steve Cahillane, announced he would step down following the completion of the acquisition.

Once the deal is completed, Kellanova’s brands and operations will be integrated into Mars’ Global Snacking Division. This will mark the end of Kellanova as an independent public company, but its brands are expected to continue thriving under Mars’ ownership and management.

Legacy and Historical Significance

Kellanova’s formation and acquisition represent a significant chapter in the evolution of Kellogg’s century-old legacy. From a cornflake company in Michigan to a global snacking leader and now a part of one of the world’s largest private food companies, Kellanova reflects the ongoing transformation of the food industry. The spin-off allowed sharper focus and value creation, while the acquisition by Mars represents industry consolidation and strategic synergy on a global scale.

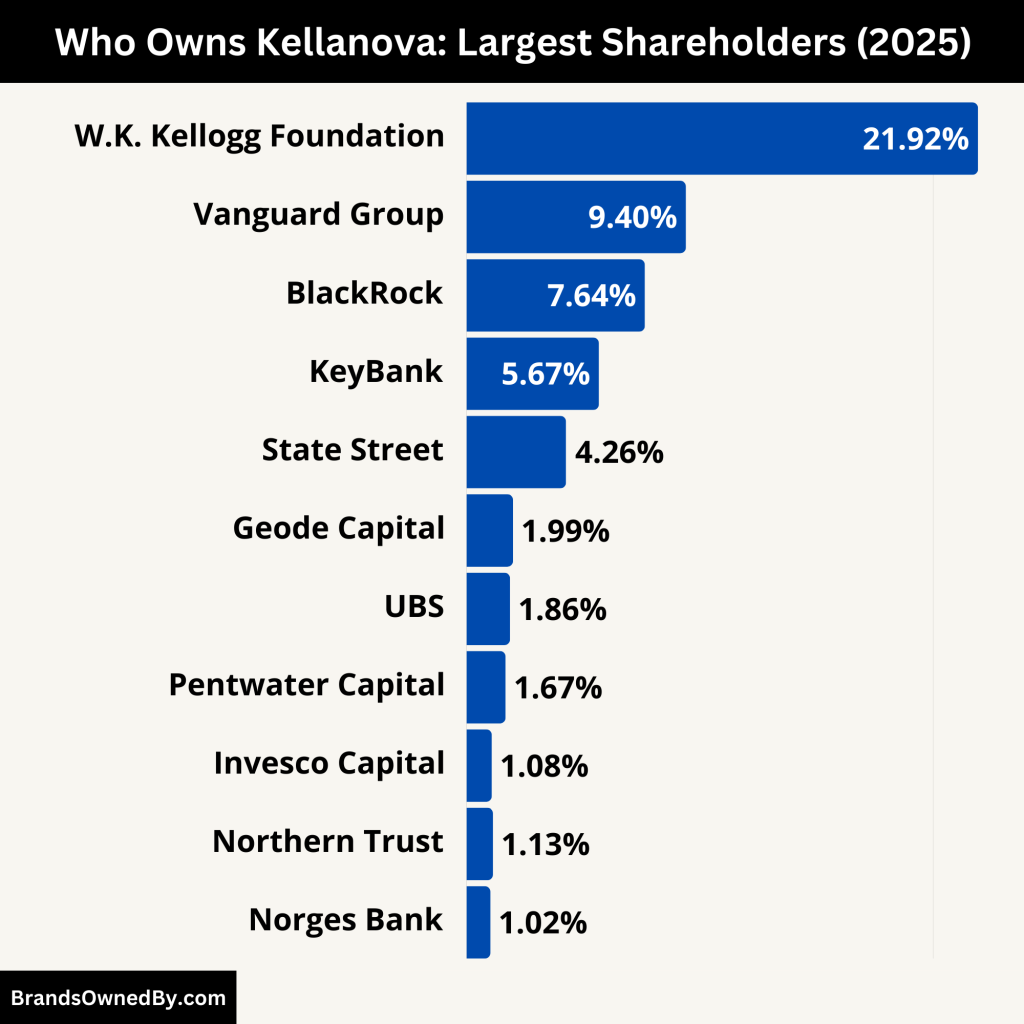

Who Owns Kellanova: Top Shareholders

As of May 2025, Kellanova (NYSE: K) is in the process of being acquired by Mars Inc. in a $36 billion all-cash deal, expected to close by mid-2025, pending regulatory approvals. Until the acquisition is finalized, Kellanova remains a publicly traded company with a diverse shareholder base.

Here’s a list of the major shareholders of Kellanova as of 2025:

| Shareholder | Ownership (%) | Estimated Value | Type | Role & Influence |

|---|---|---|---|---|

| W.K. Kellogg Foundation Trust | 21.92% | ~$6.23 billion | Philanthropic Trust | Largest shareholder; funds social initiatives; passive but influential voting power |

| The Vanguard Group, Inc. | 9.4% | ~$2.67 billion | Institutional | Passive investor; active in governance through proxy voting |

| BlackRock, Inc. | 7.64% | ~$2.17 billion | Institutional | ESG advocate; passive investment; strong governance voice |

| KeyBank National Association | 5.67% | ~$1.61 billion | Institutional (Bank) | Active in dividend strategies; participates in proxy votes |

| State Street Global Advisors | 4.26% | ~$1.21 billion | Institutional | Strong focus on board diversity and ESG practices |

| Geode Capital Management, LLC | 1.99% | ~$565 million | Institutional | Sub-advisor for Fidelity; passive and long-term oriented |

| UBS Asset Management AG | 1.86% | ~$527 million | Institutional | Global investor; values ESG compliance |

| Pentwater Capital Management LP | 1.67% | ~$472 million | Hedge Fund | Event-driven strategy; may be acquisition-focused |

| Invesco Capital Management LLC | 1.08% | ~$306 million | Institutional | Index fund provider; supports good governance through proxy voting |

| Northern Trust Global Investments | 1.13% | ~$320 million | Institutional | Index fund investor; votes on corporate governance |

| Norges Bank Investment Management | 1.02% | ~$290 million | Sovereign Wealth Fund | Global ethical investor; supports ESG policies |

W.K. Kellogg Foundation Trust

The W.K. Kellogg Foundation Trust is Kellanova’s largest single shareholder, holding approximately 21.92% of the company’s outstanding shares, valued at over $6.2 billion in early 2025. This philanthropic trust was established by company founder W.K. Kellogg in 1930. It uses dividends and capital appreciation from Kellanova stock to fund social impact initiatives in education, health, and economic development.

While the Trust is not involved in corporate governance, its significant ownership grants it substantial voting power in shareholder meetings. The organization does not interfere with day-to-day operations but maintains a vested interest in the long-term success and ethical direction of the business.

The Vanguard Group, Inc.

Vanguard Group is the second-largest shareholder, with around 9.4% ownership in Kellanova. Vanguard manages trillions in global assets and is known for its passive investment strategies through index funds and ETFs. Its stake in Kellanova is spread across multiple funds that invest in large-cap U.S. equities.

Though Vanguard does not participate in operational decisions, it actively votes on critical shareholder matters, including board elections, executive pay, and ESG (environmental, social, and governance) issues. Vanguard’s large position means it has significant sway in any major changes proposed within Kellanova.

BlackRock, Inc.

BlackRock, the world’s largest asset manager, owns approximately 7.64% of Kellanova shares as of 2025. BlackRock, like Vanguard, invests primarily through index strategies but also offers actively managed funds. It maintains a robust governance arm that engages with companies on sustainability and transparency.

BlackRock supports long-term shareholder value and pushes for strong corporate governance practices. Its influence is exercised through proxy voting and dialogue with management, especially on environmental and social risk mitigation.

KeyBank National Association

KeyBank’s asset management division holds a notable 5.67% stake in Kellanova, which is significant given that most regional banks hold far less in individual equities. This investment aligns with KeyBank’s focus on steady, dividend-paying companies with strong brand portfolios.

KeyBank’s role is primarily financial, not strategic. However, it participates in proxy voting and monitors company performance closely. The bank’s presence as a top shareholder adds diversity to Kellanova’s investor profile.

State Street Global Advisors

State Street owns about 4.26% of Kellanova’s shares. It is one of the “big three” asset managers, along with Vanguard and BlackRock. State Street is a major player in passive investments, providing S&P 500 exposure through ETFs like SPY.

State Street emphasizes transparency, board diversity, and long-term value creation in the companies it invests in. Its consistent engagement in shareholder governance ensures it remains an influential voice, especially when it comes to social and environmental issues.

Geode Capital Management, LLC

Geode Capital Management holds nearly 1.99% of Kellanova. It is best known for managing the index funds offered by Fidelity Investments. Geode’s investment in Kellanova reflects its alignment with large-cap consumer staples companies that offer stable returns and growth potential.

Although Geode operates mostly in the background, its holdings are influential. The firm aligns with Fidelity’s long-term philosophy and adds passive investment weight to Kellanova’s institutional ownership base.

UBS Asset Management AG

UBS Asset Management, the investment division of Swiss banking giant UBS, controls approximately 1.86% of Kellanova shares. UBS’s position is part of a diversified global portfolio. The company sees Kellanova as a strong player in the international food and snacking market.

UBS maintains high standards for ESG compliance in its portfolio companies. It actively participates in shareholder voting and sustainability reporting initiatives.

Pentwater Capital Management LP

Pentwater Capital, a hedge fund based in Illinois, owns about 1.67% of Kellanova shares. Pentwater is known for its event-driven investing, including mergers, acquisitions, and corporate restructures. Its stake in Kellanova could be tied to the expected $36 billion acquisition by Mars Inc., anticipated to close in mid-2025.

Unlike long-term passive funds, Pentwater may take short- to mid-term positions depending on deal developments. Its involvement hints at market speculation around the acquisition’s outcome.

Invesco Capital Management LLC

Invesco holds about 1.08% of the company through ETFs and index funds. It is one of the world’s top investment firms, providing broad market exposure to institutional and retail investors.

Invesco participates in shareholder engagement and governance via its stewardship team. Although its stake is smaller, it adds to the cumulative power of Kellanova’s institutional ownership.

Norges Bank Investment Management

Norges Bank, the manager of Norway’s sovereign wealth fund, owns roughly 1.02% of Kellanova. The fund invests globally in companies that demonstrate ethical governance and sustainability.

As a long-term investor, Norges Bank is vocal about transparency, anti-corruption practices, and board effectiveness. Its ownership adds international weight and credibility to Kellanova’s investor mix.

Northern Trust Global Investments

Northern Trust, another large asset manager, controls about 1.13% of Kellanova’s stock. It invests through global indices and retirement portfolios. Northern Trust votes on behalf of shareholders in proxy decisions and supports corporate responsibility practices.

Who is the CEO of Kellanova?

As of May 2025, Steven A. Cahillane serves as the Chairman, President, and Chief Executive Officer of Kellanova. He has held the CEO position since October 2017 and became Chairman in March 2018. Cahillane has been instrumental in steering Kellanova through significant transformations, including its spin-off from Kellogg Company and the impending acquisition by Mars Incorporated.

Career Background and Leadership Style

Before joining Kellanova, Cahillane held several prominent roles in the consumer goods industry. He was the CEO and President of The Nature’s Bounty Co., a health and wellness company, from 2014 to 2017. Prior to that, he spent seven years at The Coca-Cola Company, where he served as President of Coca-Cola Americas, overseeing a business segment with $25 billion in annual sales. His earlier career includes leadership positions at AB InBev, where he was Chief Commercial Officer, managing global marketing and commercial strategies.

Cahillane’s leadership is characterized by a focus on strategic growth, innovation, and cultural transformation. He has emphasized agility and adaptability within the organization, aligning the company’s operations with evolving consumer preferences, particularly in the health and wellness sectors. Under his guidance, Kellanova has expanded its product portfolio through strategic acquisitions and innovation, while also committing to social and environmental initiatives, such as the Kellanova Better Days™ Promise.

Decision-Making Structure and Corporate Governance

Kellanova operates under a traditional corporate governance model, with a Board of Directors overseeing the company’s strategic direction. As Chairman and CEO, Cahillane leads the Executive Committee, which is responsible for making key operational and strategic decisions. The company’s governance framework emphasizes transparency, accountability, and ethical business practices, aligning with its recognition as one of the World’s Most Ethical Companies in 2025.

Recent Developments and Future Outlook

In August 2024, Mars Incorporated announced its agreement to acquire Kellanova for $35.9 billion, with the transaction expected to close in the first half of 2025. Cahillane has expressed that this acquisition will provide Kellanova with opportunities for growth and innovation within Mars’s global snacking portfolio. He plans to step down from his role upon the completion of the merger, marking the end of a significant chapter in Kellanova’s history.

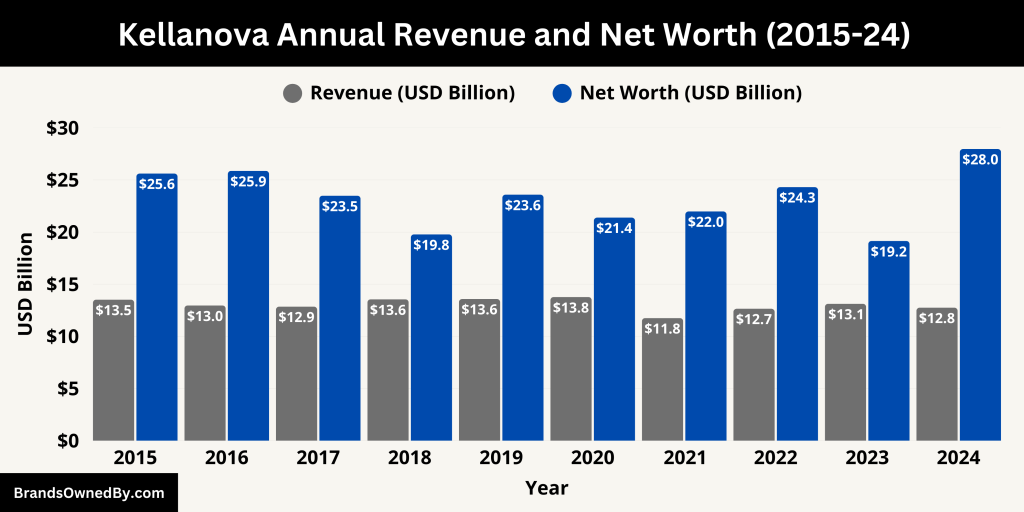

Annual Revenue and Net Worth of Kellanova

In the fiscal year ending December 31, 2025, Kellanova reported annual revenue of $13.15 billion, reflecting a 3.15% increase from the previous year’s $12.75 billion.

This growth underscores the company’s strong market presence and the enduring popularity of its flagship brands, including Pringles, Cheez-It, and Pop-Tarts. The company’s ability to innovate and adapt to consumer preferences has played a crucial role in sustaining its revenue trajectory.

2025 Net Worth (Market Capitalization)

As of May 6, 2025, Kellanova’s market capitalization stood at approximately $28.64 billion. This valuation reflects investor confidence in the company’s strategic direction and its consistent financial performance.

The company’s net income for the year 2024 was reported at $1.34 billion, with an operating income of $1.87 billion. These figures highlight Kellanova’s operational efficiency and its ability to generate substantial profits from its revenue base.

Kellanova’s financial health is further evidenced by its strong balance sheet, with total assets amounting to $15.6 billion and equity of $3.78 billion as of the end of 2024. These metrics indicate a solid foundation for future growth and resilience in the face of market fluctuations.

Here’s a detailed breakdown of the historical revenue and net worth of Kellanova from 2015-24:

| Year | Revenue (USD Billion) | Market Capitalization (USD Billion) |

|---|---|---|

| 2024 | 12.75 | 27.97 |

| 2023 | 13.12 | 19.15 |

| 2022 | 12.65 | 24.31 |

| 2021 | 11.75 | 21.98 |

| 2020 | 13.77 | 21.39 |

| 2019 | 13.58 | 23.59 |

| 2018 | 13.55 | 19.78 |

| 2017 | 12.85 | 23.49 |

| 2016 | 12.96 | 25.87 |

| 2015 | 13.52 | 25.61 |

Companies Owned by Kellanova

As of 2025, Kellanova boasts a diverse portfolio of globally recognized brands across various food categories. Below is an in-depth look at the major companies and brands owned by Kellanova:

| Brand/Company | Category | Product Type | Year Acquired/Launched | Key Highlights |

|---|---|---|---|---|

| Pringles | Snacks | Potato crisps | 2012 (Acquired) | Known for its stacked chips in a canister; global brand present in 140+ countries. |

| Cheez-It | Snacks | Baked cheese crackers | 1921 (Legacy brand) | Top-selling snack cracker in the U.S.; expanded into snack mixes. |

| Pop-Tarts | Breakfast/Snack | Toaster pastries | 1964 (Launched) | Staple American breakfast item; numerous flavors and seasonal variants. |

| Rice Krispies Treats | Snack/Dessert | Marshmallow and cereal squares | 1995 (Commercially sold) | Ready-to-eat snack based on the homemade treat. |

| RXBAR | Health & Nutrition | Protein bars | 2017 (Acquired) | Transparent ingredient list; caters to health-focused consumers. |

| Eggo | Breakfast | Frozen waffles, pancakes, French toast | 1953 (Launched) | Dominates frozen waffle category in the U.S.; known for “Leggo my Eggo” slogan. |

| MorningStar Farms | Plant-Based Foods | Veggie burgers and meat alternatives | 1975 (Launched) | One of the oldest vegetarian food brands in the U.S. |

| Incogmeato | Plant-Based Foods | Meat-like vegan products | 2020 (Launched) | Sub-brand of MorningStar Farms; realistic plant-based meats. |

| Gardenburger | Plant-Based Foods | Veggie burgers | 1993 (Acquired) | Pioneered early meat substitute products. |

| Nutri-Grain | Breakfast/Snack | Cereal bars | 1991 (Launched) | Positioned as a healthy, convenient on-the-go breakfast. |

| Special K | Breakfast/Wellness | Cereal, bars, shakes | 1955 (Launched) | Health-focused; linked to weight management. |

| Coco Pops | Cereal | Chocolate rice cereal | 1958 (Launched) | Chocolate-flavored puffed rice cereal; highly popular among kids. |

| Frosties | Cereal | Sugar-coated cornflakes | 1952 (Launched) | Known as Frosted Flakes in the U.S.; Tony the Tiger mascot. |

| Zucaritas | Cereal | Latin American Frosties | Regional brand | Spanish-language version of Frosties; culturally adapted marketing. |

| Krave | Cereal | Chocolate-filled cereal | 2012 (Launched in U.S.) | Youth-targeted with indulgent flavors. |

| Miel Pops | Cereal | Honey-flavored cereal balls | 1990s (Launched) | Popular in Europe, Middle East; crunchy and sweet profile. |

| Crunchy Nut | Cereal | Nut-flavored cornflakes | 1980 (Launched in UK) | Known for its sweet and nutty flavor; widely sold in UK and global markets. |

Pringles

Acquired from Procter & Gamble in 2012 for $2.7 billion, Pringles is a leading global potato crisps brand. Known for its distinctive saddle-shaped chips and iconic canister packaging, Pringles has a strong international presence, appealing to a wide demographic with various flavors and limited-edition offerings.

Cheez-It

Cheez-It is a popular cheese cracker brand in the United States, known for its square-shaped, baked snack crackers made with real cheese. The brand has expanded its product line to include various flavors and snack mixes, maintaining a strong market position in the savory snack segment.

Pop-Tarts

Pop-Tarts are toaster pastries with a sugary filling sealed inside two layers of thin, rectangular pastry crust. Introduced in the 1960s, they have become a staple breakfast item, especially among children and teenagers, with numerous flavors and seasonal varieties.

Rice Krispies Treats

Rice Krispies Treats are a dessert snack made from Rice Krispies cereal and marshmallows. They are a popular homemade and commercially packaged treat, known for their chewy texture and sweet taste.

RXBAR

Acquired in 2017 for $600 million, RXBAR is a protein bar brand that emphasizes simple ingredients and transparency. Each bar lists its core ingredients on the front of the packaging, catering to health-conscious consumers seeking high-protein, low-sugar snacks.

Eggo

Eggo is a brand of frozen waffles, pancakes, and French toast. Known for their convenience and taste, Eggo products are a popular breakfast choice in North America, with the brand gaining renewed popularity through cultural references in media.

MorningStar Farms

MorningStar Farms is a brand specializing in vegetarian and vegan food products, including meat substitutes like veggie burgers, sausages, and chicken nuggets. The brand caters to the growing demand for plant-based protein options.

Incogmeato

Incogmeato is a sub-brand of MorningStar Farms, offering plant-based meat alternatives designed to closely mimic the taste and texture of traditional meat products. The line includes items like plant-based burgers, sausages, and chicken tenders.

Gardenburger

Gardenburger is one of the original veggie burger brands, offering a variety of plant-based patties made from vegetables, grains, and legumes. The brand focuses on providing flavorful vegetarian options for consumers seeking meatless meals.

Nutri-Grain

Nutri-Grain is a brand of cereal bars and breakfast bars made with whole grains and fruit fillings. Marketed as a convenient and nutritious on-the-go breakfast option, Nutri-Grain bars are popular among busy consumers.

Special K

Special K is a brand of breakfast cereals and meal bars targeted primarily at health-conscious consumers. The brand offers products designed to support weight management and healthy lifestyles, including cereals, protein bars, and shakes.

Coco Pops

Coco Pops, known as Cocoa Krispies in some regions, are a chocolate-flavored puffed rice cereal. Popular among children, the cereal turns milk chocolatey and is marketed with the mascot Coco the Monkey.

Frosties

Frosties, known as Frosted Flakes in North America, are sugar-coated cornflakes. The cereal is known for its sweet taste and the iconic mascot Tony the Tiger, with the catchphrase “They’re Gr-r-reat!”

Zucaritas

Zucaritas is the Latin American version of Frosted Flakes, offering the same sugar-coated cornflakes with regional branding and marketing tailored to local tastes and preferences.

Krave

Krave is a chocolate-filled cereal brand aimed at teenagers and young adults. The cereal features crispy shells with a smooth chocolate center, appealing to consumers seeking indulgent breakfast options.

Miel Pops

Miel Pops are honey-flavored puffed cereal balls popular in various European and Middle Eastern countries. The cereal is known for its sweet taste and crunchy texture, often enjoyed by children.

Crunchy Nut

Crunchy Nut is a brand of sweetened breakfast cereals made with flakes of corn and pieces of nuts, typically peanuts. The cereal is known for its crunchy texture and nutty flavor, appealing to consumers seeking a more indulgent breakfast option.

Conclusion

Kellanova is a new corporate entity, but it carries decades of brand heritage. The question of who owns Kellanova leads to a network of institutional investors, led by Vanguard and BlackRock. Under CEO Steve Cahillane, the company is navigating its own path in the global snacking sector. With strong revenue, powerful brands, and strategic leadership, Kellanova is poised for long-term success.

FAQs

Is Kellanova owned by Kellogg’s?

No, Kellanova is not owned by Kellogg’s. In 2023, Kellogg’s split into two separate companies. Kellanova was created to manage the snacks business, while Kellogg’s retained the cereal and plant-based food operations. They are now independent publicly traded companies.

Does Mars own Kellanova?

No, Mars does not own Kellanova. Mars is a separate global food company. However, Kellanova has a strategic partnership with Mars in some markets but remains independently owned and publicly traded.

Why is Kellogg’s now Kellanova?

Kellanova was formed when Kellogg’s decided to split its business into two entities in 2023. The snacks and convenience foods business became Kellanova, while the original Kellogg’s company focused on cereals and plant-based foods. This restructuring was done to allow each company to focus better on its core market.

What is the difference between Kellanova and Kellogg?

Kellanova manages the snacks and convenience foods portfolio, including brands like Pringles and Cheez-It. Kellogg continues to handle cereals and plant-based products such as Special K and MorningStar Farms. They are separate companies with distinct product focuses.

Why did Kellogg and Kellanova split?

The split was a strategic move to unlock shareholder value and allow both companies to focus more efficiently on their specific markets. It enables Kellanova to concentrate on the growing snacks sector, while Kellogg focuses on cereals and plant-based innovation.

Where is Kellanova headquarters?

Kellanova is headquartered in Chicago, Illinois, United States. This location continues the legacy of the original Kellogg company’s headquarters.

Who is buying Kellanova?

As of 2025, no entity is buying Kellanova. It remains an independent, publicly traded company listed on the New York Stock Exchange under the ticker symbol KELYA.

When will the Kellanova deal close?

There is no pending acquisition deal involving Kellanova as of 2025, so no deal closing date exists.

When is Kellanova going private?

Kellanova is currently a public company with no announced plans to go private as of 2025. It continues to operate as a publicly traded company focused on expanding its snacks portfolio.

Who owns the most shares in Kellanova?

Vanguard Group Inc. owns the largest share in Kellanova, holding around 10% of its stock.

Does Kellanova still sell cereal?

Yes, Kellanova sells cereal outside of North America. WK Kellogg Co sells cereal within the U.S., Canada, and the Caribbean.