HubSpot is a leading player in the marketing and CRM software industry. If you’ve ever wondered who owns HubSpot, you’re not alone. Understanding its ownership helps paint a clearer picture of its direction, control, and influence in the tech world.

HubSpot Company Profile

HubSpot is a leading software company that provides a comprehensive Customer Relationship Management (CRM) platform. It helps businesses attract leads, convert them into customers, and retain them through marketing, sales, service, and content tools—all in one place.

Founded in 2006 by Brian Halligan and Dharmesh Shah, HubSpot pioneered the concept of inbound marketing, which focuses on drawing customers in with helpful content rather than traditional outbound tactics like cold calls or ads.

The company serves over 194,000 customers in more than 120 countries as of 2025. Its products range from free CRM tools to premium enterprise solutions. These include marketing automation, email marketing, customer service, live chat, CMS (content management system), and analytics.

HubSpot operates on a freemium model, offering free tools with optional upgrades. This strategy has helped it rapidly scale its customer base and expand globally.

Major Milestones of HubSpot

- 2006: HubSpot is founded by Brian Halligan and Dharmesh Shah at MIT.

- 2007: The first version of the HubSpot platform is launched, focused on blogging and SEO.

- 2010: HubSpot raises over $33 million in funding from firms like Sequoia Capital and Google Ventures.

- 2012: HubSpot launches its first international office in Dublin, Ireland.

- 2014: The company goes public on the New York Stock Exchange under the ticker HUBS.

- 2014: HubSpot launches its free CRM product, expanding beyond marketing tools.

- 2017: Acquisition of Motion.ai adds chatbot and conversational marketing capabilities.

- 2018: Launch of Service Hub, expanding the platform into customer service.

- 2019: Acquisition of PieSync, improving third-party integrations and data syncing.

- 2021: HubSpot acquires The Hustle, a media company, to boost content marketing.

- 2021: Yamini Rangan is appointed CEO, replacing co-founder Brian Halligan.

- 2023–2024: Continued international growth with new regional offices and product enhancements, including AI-based tools.

HubSpot Company Details

- Founded: 2006

- Founders: Brian Halligan and Dharmesh Shah

- Headquarters: Cambridge, Massachusetts, USA

- CEO (2025): Yamini Rangan

- Number of Employees: Over 7,400 (as of 2025)

- Stock Ticker: HUBS (listed on NYSE)

- Primary Products:

- Marketing Hub

- Sales Hub

- Service Hub

- CMS Hub

- Operations Hub

- Business Model: Subscription-based SaaS (Software as a Service)

- Core Philosophy: Inbound marketing, customer-first approach, and scalability

HubSpot’s platform integrates all its tools into one unified system. This makes it popular with small businesses and enterprises that want seamless data flow across departments.

The company has received numerous awards and consistently ranks high in customer satisfaction and employee workplace ratings. Its focus on transparency, culture, and innovation sets it apart in the crowded SaaS market.

Who Owns HubSpot: Top Shareholders

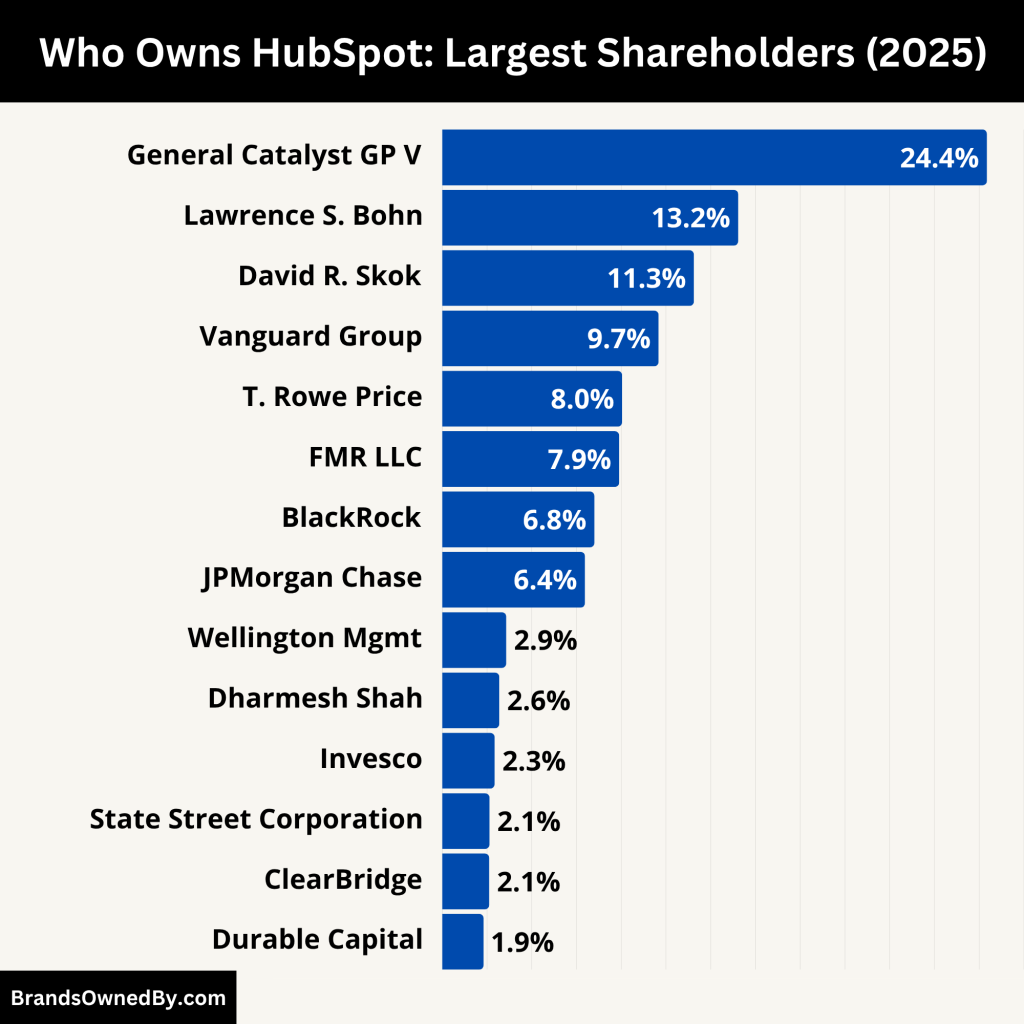

HubSpot is a publicly traded company, meaning it is owned by a mix of institutional investors, retail investors, and company insiders. The ownership is distributed across multiple parties, with no single person or entity holding a controlling stake.

The largest shareholder is General Catalyst GP V LLC. Other institutional investors include mutual funds, pension funds, and asset management firms that buy large amounts of shares.

Company insiders, such as the founders and executives, also hold a significant portion. However, they do not own a majority, which means major decisions require board and shareholder approval.

Below is the list of the major shareholders of HubSpot as of 2025:

| Shareholder | Ownership % | Approx. Shares | Estimated Value | Role / Influence |

|---|---|---|---|---|

| General Catalyst GP V LLC | 24.35% | 12.7 million | $7.74 billion | Largest shareholder; early VC backer; strong influence on strategy and board |

| Lawrence S. Bohn | 13.23% | 6.9 million | $4.2 billion | Early investor and former board member; influential in early-stage development |

| David R. Skok | 11.25% | 5.87 million | $3.57 billion | Partner at Matrix Partners; helped shape SaaS scaling strategies |

| Vanguard Group Inc. | 9.67% | 5.04 million | $3.07 billion | Large institutional investor; passive role; key voting power |

| T. Rowe Price Associates | 8.04% | 4.2 million | $2.56 billion | Long-term institutional investor; growth-focused |

| FMR LLC (Fidelity) | 7.91% | 4.13 million | $2.51 billion | Mutual fund manager; supports innovation and long-term value |

| BlackRock Inc. | 6.80% | 3.55 million | $2.16 billion | ESG-focused asset manager; high voting power at shareholder meetings |

| JPMorgan Chase & Co. | 6.38% | 3.33 million | $2.03 billion | Institutional investor; financial credibility and market influence |

| Dharmesh Shah | 2.55% | 1.32 million | $1.03 billion | Co-founder and CTO; insider with key role in innovation and culture |

| State Street Corporation | 2.11% | 1.09 million | $850 million | Passive institutional investor; supports strong governance |

| Wellington Mgmt Group LLP | 2.86% | ~1.5 million | ~$950 million | Active fund manager; strategic long-term investor |

| Invesco Ltd. | 2.34% | ~1.2 million | ~$780 million | Institutional investor with diversified portfolio |

| ClearBridge Investments | 2.10% | ~1.1 million | ~$700 million | Focused on tech growth; participates in shareholder governance |

| Durable Capital Partners | 1.85% | ~965,000 | ~$650 million | Long-hold investor; specializes in scaling mid-to-large tech firms |

General Catalyst GP V LLC

General Catalyst is the largest single shareholder of HubSpot, owning approximately 24.35% of the company. This amounts to 12.7 million shares with a market value of over $7.7 billion.

General Catalyst is a venture capital firm that invested in HubSpot during its early growth phase. The firm is known for backing high-growth technology startups. Its large stake gives it substantial voting power in shareholder meetings and a strong influence on long-term strategic decisions. Though it does not engage in day-to-day operations, it often works behind the scenes to shape the board composition and executive leadership.

Its continued holding over the years reflects strong confidence in HubSpot’s trajectory and strategic roadmap.

Lawrence S. Bohn

Lawrence Bohn, a seasoned venture capitalist affiliated with General Catalyst, owns approximately 13.23% of HubSpot, which equals about 6.9 million shares worth $4.2 billion.

Bohn was an early investor in HubSpot and has remained a long-term backer of the company. He previously served as a board member, providing governance oversight and strategic input during critical growth phases.

His individual stake, combined with General Catalyst’s stake, strengthens the firm’s overall influence. Bohn’s involvement highlights the importance of early-stage capital in HubSpot’s success and ongoing evolution.

David R. Skok

David Skok is another influential early investor and venture capitalist. He holds around 11.25% of HubSpot, translating to 5.87 million shares valued at $3.57 billion.

Skok is a partner at Matrix Partners, a well-known venture capital firm. He has been instrumental in mentoring the company through its various growth stages, including product expansion and sales model transformation.

Though not actively managing HubSpot, Skok’s influence is felt through advisory roles and board participation. His focus on SaaS metrics and enterprise scaling played a key role in shaping HubSpot’s go-to-market strategy.

Vanguard Group Inc.

The Vanguard Group, one of the largest asset management firms globally, owns 9.67% of HubSpot, which is approximately 5.04 million shares, worth around $3.07 billion.

Vanguard is a passive institutional investor, meaning it doesn’t interfere in daily management but votes during shareholder meetings. Its investment in HubSpot is part of broader ETF and mutual fund portfolios. The firm supports sustainable growth, sound governance, and long-term profitability.

Although Vanguard doesn’t take an activist role, its significant holding adds weight to shareholder decisions and board elections.

T. Rowe Price Associates Inc.

T. Rowe Price holds roughly 8.04% of HubSpot, owning 4.2 million shares valued at $2.56 billion.

T. Rowe Price is known for growth-focused investment strategies. Its interest in HubSpot underscores the company’s potential in the CRM and SaaS industry. As a long-term investor, it plays a quiet but meaningful role in shaping shareholder sentiment and board accountability.

The firm typically collaborates with management teams to ensure value creation and transparent governance.

FMR LLC (Fidelity Investments)

FMR LLC, the parent company of Fidelity Investments, owns about 7.91% of HubSpot, amounting to 4.13 million shares worth approximately $2.51 billion.

Fidelity manages a variety of mutual funds that hold equity positions in growth-oriented tech companies. The firm’s stake in HubSpot reflects high confidence in the company’s product innovation, customer acquisition model, and financial performance.

Fidelity’s analysts often influence market perception, and the firm participates in important proxy votes affecting corporate governance.

BlackRock Inc.

BlackRock owns around 6.80% of HubSpot, translating to 3.55 million shares valued at $2.16 billion.

As the largest asset manager in the world, BlackRock’s involvement signals solid institutional support. BlackRock is committed to ESG (Environmental, Social, and Governance) standards and often engages with companies on sustainability and corporate responsibility issues.

While it does not actively manage the company, its sheer size and capital base mean that its votes carry weight during major corporate decisions.

JPMorgan Chase & Co.

JPMorgan Chase & Co. holds about 6.38% of HubSpot, equaling 3.33 million shares worth around $2.03 billion.

This stake is part of the investment arm of JPMorgan, which includes mutual funds and asset management portfolios. JPMorgan’s holding adds financial credibility and signals strong institutional confidence in HubSpot’s future cash flows and scalability.

The firm may provide additional financial services like underwriting, advisory, or liquidity support to HubSpot in the capital markets.

Dharmesh Shah

Dharmesh Shah, co-founder and current CTO of HubSpot, owns around 2.55% of the company. That’s approximately 1.32 million shares valued at $1.03 billion.

Unlike institutional investors, Shah is an insider with a significant role in product development and company culture. His ownership reflects both his founding role and his continued involvement in strategic decisions. As a board member and executive, Shah helps guide technology innovation and platform strategy.

His long-term commitment sends a strong signal of internal confidence to investors and customers alike.

State Street Corporation

State Street owns approximately 2.11% of HubSpot, or 1.09 million shares, valued at roughly $850 million.

As one of the “Big Three” institutional investors (alongside BlackRock and Vanguard), State Street is a passive investor focused on long-term value creation. The firm uses its voting power to promote strong governance and risk management.

While not directly involved in company management, its holdings reflect mainstream institutional trust in HubSpot’s stability.

Other Notable Shareholders

Several other institutional and mutual fund investors hold smaller but still significant stakes in HubSpot. These include:

- Wellington Management Group LLP – Approx. 2.86%

- Invesco Ltd. – Around 2.34%

- ClearBridge Investments LLC – About 2.10%

- Durable Capital Partners LP – Roughly 1.85%

These firms add to the diversified base of professional shareholders. While none of them individually hold controlling stakes, together they represent a strong foundation of financial backing and market validation.

Who is the CEO of HubSpot?

As of 2025, Yamini Rangan serves as the Chief Executive Officer (CEO) of HubSpot. She assumed this role in September 2021, following her tenure as the company’s first-ever Chief Customer Officer. Rangan’s leadership is characterized by a strong emphasis on customer-centricity, operational excellence, and empathetic management.

Professional Background

Yamini Rangan brings over 25 years of experience in the technology sector, with a focus on product marketing, sales, and strategy. Before joining HubSpot, she held several key positions at prominent tech companies:

- Dropbox: As Chief Customer Officer, Rangan was responsible for embedding a customer-focused approach across the organization.

- Workday: Serving as Vice President of Sales Strategy and Operations, she played a pivotal role in quadrupling the company’s revenue and scaling its sales operations.

- SAP: Rangan held various customer-facing leadership roles, contributing to significant deals and strategic initiatives.

Her extensive experience across these organizations has equipped her with a deep understanding of customer needs and business operations.

Leadership Style and Philosophy

Rangan’s leadership style is rooted in empathy, curiosity, and a commitment to customer success. She believes in leading with authenticity and fostering a culture where employees feel valued and empowered. Her approach emphasizes the importance of understanding team members’ challenges and aspirations, promoting a supportive and inclusive work environment.

Under her guidance, HubSpot has implemented initiatives aimed at enhancing employee well-being and productivity, such as the “Global Week of Rest” and “No Internal Meeting Fridays.” These programs reflect her dedication to creating a balanced and sustainable workplace culture.

Strategic Initiatives and Achievements

Since taking the helm, Rangan has steered HubSpot through significant growth and innovation. Notably, she has overseen the integration of artificial intelligence (AI) across HubSpot’s platform, aiming to transform it into an AI-first customer relationship management (CRM) solution.

In 2024, the company introduced “Breeze,” an AI engine designed to automate tasks and enhance customer engagement. Additionally, HubSpot acquired B2B intelligence provider Clearbit for $150 million to bolster its AI capabilities.

These strategic moves have positioned HubSpot as a leader in leveraging AI to drive customer success and operational efficiency.

Educational Background and Recognitions

Rangan holds a Bachelor’s degree in Electronics Engineering, a Master’s in Computer Engineering, and an MBA from the Haas School of Business at the University of California, Berkeley. Her academic background complements her extensive professional experience, providing a strong foundation for her leadership role.

Her contributions to the tech industry have been widely recognized. In 2019, she was named one of the “Most Influential Women in Business” by the San Francisco Business Times. In 2022, she was honored as the “Best CEO for Women” by Comparably. These accolades underscore her impact as a leader committed to excellence and inclusivity.

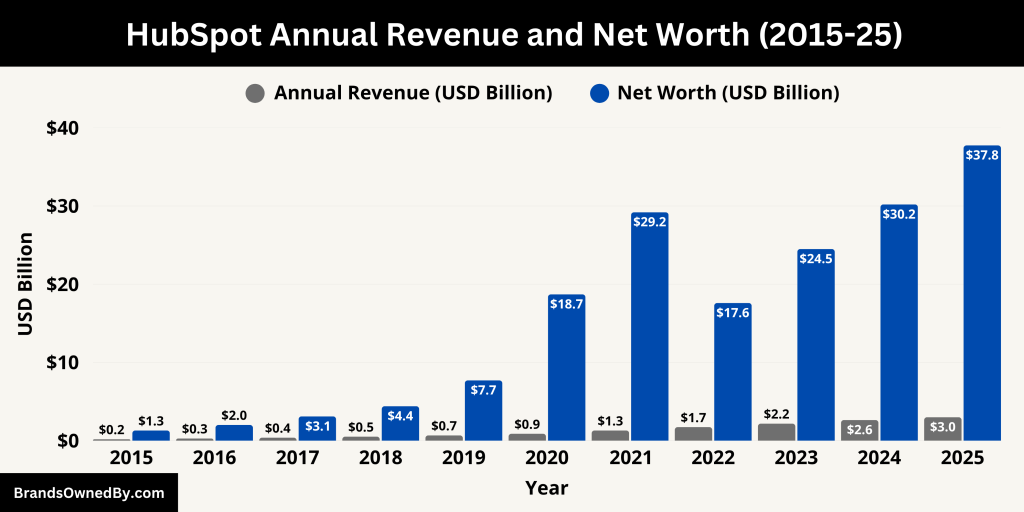

HubSpot Annual Revenue and Net Worth

In 2024, HubSpot achieved a total revenue of $2.63 billion, marking a 21% increase from the previous year’s $2.17 billion. This growth was driven by a 21% year-over-year increase in its customer base, reaching 247,939 customers by the end of the year.

The company reported a net income of $4.63 million for 2024, a significant turnaround from a net loss of $164.51 million in 2023. This positive shift reflects improved operational efficiency and a focus on profitability.

For 2025, HubSpot projects its total revenue to be in the range of $2.985 billion to $2.995 billion, representing a 14% year-over-year increase on an as-reported basis and 16% in constant currency.

The company anticipates a non-GAAP operating income between $543 million and $547 million, equating to an 18% operating profit margin. Additionally, the non-GAAP net income per common share is expected to be between $9.11 and $9.19, based on approximately 53.9 million weighted average diluted shares outstanding.

As of June 2025, HubSpot’s market capitalization stood at approximately $37.75 billion. This valuation reflects investor confidence in the company’s growth trajectory and its strategic initiatives, particularly its emphasis on integrating artificial intelligence across its platform.

Here’s a detailed overview of the annual revenue and net worth of HubSpot from 2015-25:

| Year | Annual Revenue (USD) | Net Worth / Market Cap (USD) | Notes |

|---|---|---|---|

| 2025 (Est.) | $2.99 billion (guidance) | ~$37.75 billion | Projected based on guidance from Q1 2025 earnings |

| 2024 | $2.63 billion | ~$30.2 billion | 21% YoY revenue growth, net income of $4.63M |

| 2023 | $2.17 billion | ~$24.5 billion | Continued expansion in enterprise segment |

| 2022 | $1.73 billion | ~$17.6 billion | Strong international customer acquisition |

| 2021 | $1.30 billion | ~$29.2 billion | Pandemic-era growth; stock price surged |

| 2020 | $883 million | ~$18.7 billion | Increased digital adoption during COVID-19 |

| 2019 | $674.9 million | ~$7.7 billion | Strong performance in marketing automation |

| 2018 | $513.0 million | ~$4.4 billion | Expanded ecosystem and product suites |

| 2017 | $375.6 million | ~$3.1 billion | Gains in mid-sized business adoption |

| 2016 | $271.0 million | ~$2.0 billion | Growth from freemium CRM model |

| 2015 | $181.9 million | ~$1.3 billion | Early growth stage, rising CRM awareness |

Companies Owned by HubSpot

As of 2025, HubSpot operates a diverse portfolio of companies and brands, each contributing to its mission of helping businesses grow better. These entities span various domains, including artificial intelligence, commerce, media, and data intelligence.

Here’s a list of the major companies and brands owned by HubSpot:

| Company/Brand | Acquisition Year | Core Business / Specialty | Details / Impact on HubSpot |

|---|---|---|---|

| Rekindle | 2015 | Contact graph technology | Enhances networking and relationship-building tools. |

| Privy | 2014 | Email list growth platform | Supports e-commerce and local businesses in building email lists and online presence. |

| Motion AI | 2017 | AI user interfaces | Boosts AI-driven automation for customer interactions. |

| Evolve App | 2017 | AI-driven relationship advice | Contributed to personalization and user behavior insights. |

| Kemvi | 2017 | Artificial general intelligence | Strengthened AI-driven sales and marketing solutions. |

| PandaDoc | 2017 (investment) | Document automation software | Enhances document workflow and CRM integration. |

| Swiftype | 2017 | Search and indexing software | Improves internal search capabilities within HubSpot’s platform. |

| PieSync | 2019 | Customer data synchronization | Ensures consistent, up-to-date customer data across apps. |

| The Hustle | 2021 | Digital media company | Expands media content and audience engagement. |

| Clearbit | 2023 | B2B data intelligence | Enriches customer data for targeted marketing and sales. |

| APIHub | 2023 | API management & integrations | Enhances connectivity with third-party apps and services. |

| Hapily | 2023 | Custom app creation tools | Empowers users to build tailored solutions within HubSpot’s ecosystem. |

| Cacheflow | 2024 | B2B subscription billing & CPQ | Streamlines quote-to-cash and revenue management. |

| Frame AI | 2024 | AI conversation intelligence | Analyzes customer interactions to improve sentiment analysis and support. |

Frame AI

In January 2025, HubSpot completed the acquisition of Frame AI, an AI-powered conversation intelligence platform. Frame AI specializes in analyzing unstructured customer interaction data, such as support tickets and call transcripts, to derive actionable insights. This acquisition enhances HubSpot’s AI capabilities, particularly within its Breeze platform, by enabling a more nuanced understanding of customer sentiments and needs.

Cacheflow

In October 2024, HubSpot acquired Cacheflow, a B2B subscription billing management and configure, price, quote (CPQ) solution. Cacheflow’s tools streamline the quote-to-cash process, allowing businesses to automate revenue management and accelerate sales cycles. The integration of Cacheflow into HubSpot’s Commerce Hub expands its offerings in subscription billing and CPQ functionalities.

Clearbit

HubSpot finalized the acquisition of Clearbit, a B2B data intelligence provider, in December 2023. Clearbit offers real-time intelligence on companies and contacts, enriching customer data and enabling more targeted marketing and sales strategies. By integrating Clearbit’s capabilities, HubSpot enhances its CRM platform’s data accuracy and depth, providing users with comprehensive customer profiles.

The Hustle

In 2021, HubSpot acquired The Hustle, a media company known for its daily business and tech newsletter, podcast, and premium research content. This acquisition marked HubSpot’s entry into the media space, allowing it to engage with a broader audience and provide valuable content to its community of scaling companies.

PieSync

HubSpot acquired PieSync in November 2019. PieSync is an integration platform that synchronizes customer data across various applications, ensuring consistency and accuracy. This acquisition bolstered HubSpot’s integration capabilities, allowing users to maintain up-to-date customer information across multiple platforms seamlessly.

HubSpot Ventures

Beyond acquisitions, HubSpot operates HubSpot Ventures, its investment arm focused on early- and growth-stage software companies. HubSpot Ventures invests in businesses that align with HubSpot’s mission to help organizations grow better. The venture arm supports innovative startups that enhance customer experience and complement HubSpot’s ecosystem.

Rekindle

Acquired in 2015, Rekindle is a Boston-based technology company that developed a contact graph technology to facilitate introductions and reconnect individuals through shared connections. This acquisition aimed to enhance HubSpot’s networking and relationship-building tools.

Motion AI

In 2017, HubSpot acquired Motion AI, a company specializing in developing user interfaces for artificial intelligence. Motion AI enables businesses to build, train, and deploy AI-driven robots for various applications, including customer service and order processing. This acquisition bolstered HubSpot’s AI capabilities, particularly in automating customer interactions.

Evolve App

Also acquired in 2017, Evolve App is a mobile technology company that provides intelligent advice for dating and relationships. Leveraging machine learning, Evolve App analyzes users’ dating and relationship history to offer personalized guidance. While its primary focus is personal relationships, the underlying technology contributed to HubSpot’s understanding of user behavior and personalization strategies.

Kemvi

Acquired in 2017, Kemvi is a technology company specializing in artificial general intelligence. Kemvi developed DeepGraph, an advanced engine that enhances the B2B transaction ecosystem by learning about people, companies, and markets. This acquisition strengthened HubSpot’s AI-driven sales and marketing solutions.

PandaDoc

In 2017, HubSpot invested in PandaDoc, a comprehensive document automation software that enhances the efficiency of creating, approving, and eSigning various business documents. PandaDoc’s platform integrates seamlessly with CRM systems, improving document workflows and accelerating transaction speeds.

Privy

Acquired in 2014, Privy operates a platform designed to help small businesses build and manage their email lists. The platform offers tools such as website popups, bars, and banners to convert website traffic, as well as exit-intent features to enhance email list growth. Privy’s integration into HubSpot’s ecosystem supports e-commerce vendors and local businesses in developing their online presence.

Swiftype

Swiftype, a search and indexing company based in San Francisco, provides search software for organizations, websites, and computer programs. Notable customers include AT&T, Dr. Pepper, and HubSpot. Swiftype’s technology enhances HubSpot’s internal search capabilities, improving user experience within its platform.

APIHub

In November 2023, HubSpot acquired APIHub, a company specializing in API management and integration solutions. This acquisition aimed to enhance HubSpot’s integration capabilities, enabling seamless connectivity with various third-party applications and services.

Hapily

Acquired in 2023, Hapily is a New York City-based company that developed tools to help businesses create and manage their own applications within HubSpot’s ecosystem. This acquisition supports HubSpot’s strategy to empower users to build customized solutions tailored to their specific needs.

Final Thoughts

So, who owns HubSpot?

The answer is a mix of institutional investors, insiders, and public shareholders. No single entity controls it outright, which reflects the decentralized nature of many public tech companies.

With a strong leadership team, impressive revenue growth, and a history of smart acquisitions, HubSpot remains a major player in the SaaS and CRM space. Its structure allows for balanced decision-making and innovation.

FAQs

Is HubSpot owned by Salesforce?

No, HubSpot is not owned by Salesforce. HubSpot is an independent publicly traded company. While both companies operate in the customer relationship management (CRM) and marketing software space, they are separate entities.

Is HubSpot owned by Google?

No, HubSpot is not owned by Google. HubSpot operates independently and is publicly listed on the NASDAQ stock exchange. Google and HubSpot may collaborate in various ways, but there is no ownership relationship.

Is HubSpot a private company?

No, HubSpot is not a private company. It went public in 2014 and is listed on the NASDAQ under the ticker symbol HUBS.

Who is HubSpot’s biggest competitor?

HubSpot’s biggest competitor is Salesforce, especially in the CRM and marketing automation market. Other notable competitors include Zoho, Marketo (Adobe), and Microsoft Dynamics.

Who runs HubSpot?

HubSpot is led by its CEO Yamini Rangan (as of 2025). The company is governed by a board of directors and senior executives who oversee operations and strategic decisions.

What is HubSpot famous for?

HubSpot is famous for its all-in-one inbound marketing, sales, and customer service software platform. It pioneered inbound marketing techniques and provides tools that help businesses attract, engage, and delight customers.

Is HubSpot an Indian company?

No, HubSpot is not an Indian company. HubSpot was founded in Cambridge, Massachusetts, USA, and is headquartered there.

What is a HubSpot owner?

A HubSpot owner refers to an individual or entity that holds shares in HubSpot, thereby owning a portion of the company. Ownership can include institutional investors, founders, executives, and public shareholders.

Who funded HubSpot?

HubSpot was initially funded by venture capital firms, including General Catalyst Partners, Sequoia Capital, and Salesforce Ventures, among others, before going public in 2014.

Is HubSpot owned by Microsoft?

No, HubSpot is not owned by Microsoft. It remains an independent, publicly traded company.

When was HubSpot founded?

HubSpot was founded in 2006 by Brian Halligan and Dharmesh Shah at the Massachusetts Institute of Technology (MIT).

Is HubSpot a public company?

Yes, HubSpot is publicly traded on the New York Stock Exchange under the symbol HUBS.

Who founded HubSpot?

HubSpot was founded by Brian Halligan and Dharmesh Shah in 2006.

How much of HubSpot does Vanguard own?

Vanguard owns roughly 9–10% of HubSpot, making it the largest shareholder.

What is the net worth of HubSpot?

As of June 2025, HubSpot’s market capitalization is around $37.75 billion.