GoDaddy is one of the most recognized names in web hosting and domain registration. Many people ask, “who owns GoDaddy?” The company has gone through multiple ownership changes, including private equity buyouts and a public listing. This article explains its ownership, leadership, financials, and affiliated brands in detail.

GoDaddy Company Profile

GoDaddy is an American technology company best known for domain name registration and web hosting services. It was founded in 1997 by Bob Parsons, a former U.S. Marine turned entrepreneur. The company was initially launched as Jomax Technologies, named after a street in Arizona, and later rebranded to GoDaddy in 1999 to better align with a more consumer-friendly identity.

GoDaddy’s core mission is to empower everyday entrepreneurs and small business owners by giving them the tools to create and manage an online presence. Its offerings include domain name sales, shared and dedicated web hosting, website builders, email hosting, eCommerce solutions, SSL certificates, and digital marketing tools.

GoDaddy Founder

Bob Parsons is the sole founder of GoDaddy. He started the company using funds from the $64 million sale of his previous software business, Parsons Technology, to Intuit. Parsons ran the company as CEO until 2011, after which he stepped down from active management but remained a major shareholder for several years.

Major Milestones

- 1997: Company founded as Jomax Technologies.

- 1999: Rebranded to GoDaddy.

- Early 2000s: Gained massive attention with its controversial Super Bowl ads and aggressive marketing.

- 2005: Became the largest ICANN-accredited domain registrar.

- 2011: Bob Parsons sold a major stake to private equity firms KKR, Silver Lake, and Technology Crossover Ventures.

- 2015: GoDaddy went public with an IPO on the NYSE under the ticker symbol GDDY.

- 2017–2020: Acquired several companies, including Host Europe Group, Sucuri, and Neustar’s registry business, to expand globally and add cybersecurity and registry capabilities.

- 2019: Aman Bhutani became CEO, focusing on product innovation and digital tools for small businesses.

Company Details

- Headquarters: Tempe, Arizona, United States

- Founded: 1997

- Founder: Bob Parsons

- CEO: Aman Bhutani (as of 2025)

- Employees: Over 6,000 worldwide

- Customers: More than 20 million globally

- Domain Names Managed: Over 84 million

- Stock Ticker: GDDY (NYSE)

- Business Focus: Domain registration, web hosting, online marketing, and eCommerce solutions

GoDaddy’s business strategy has evolved from being just a domain registrar to becoming a complete digital platform for small businesses. Its user-friendly tools and large customer base have helped it maintain its position as a leader in the website services industry.

Who Owns GoDaddy: Major Shareholders

GoDaddy is a publicly traded company. That means it is owned by a combination of institutional investors, mutual funds, and individual shareholders who purchase its stock on the NYSE. No single person owns GoDaddy outright. However, some large institutional shareholders hold significant portions of the company, giving them considerable influence over business decisions.

GoDaddy’s ownership is primarily institutional (~95%), led by Vanguard, BlackRock, and Capital International. Activist investors like Starboard attract attention, while insiders (including founder Parsons and management) hold smaller but strategic stakes. Institutional investors steer corporate governance via voting rights and strategy influence, while insiders retain insight-driven control and advocacy.

Here’s a list of the largest shareholders of GoDaddy as of June 2025:

| Shareholder | Ownership % | Approx. Shares Held | Type | Notes |

|---|---|---|---|---|

| Vanguard Group, Inc. | 12.6% | ~17.7 million | Institutional | Largest shareholder; passive investor via index funds |

| BlackRock, Inc. | 9.95% | ~13.97 million | Institutional | Invests via ETFs; strong governance influence |

| Capital International Investors | 8.49% | ~11.96 million | Institutional | Top 5 holder; passive, quiet strategy |

| State Street Global Advisors | 4.91% | ~6.9 million | Institutional | Passive investor; votes on governance matters |

| Janus Henderson Investors | 5.02% | ~7.04 million | Institutional | Active fund manager |

| Morgan Stanley / Eaton Vance | 4.61% | ~6.47 million | Institutional | Strategic long-term investor |

| T. Rowe Price Associates | 2.43% | ~3.41 million | Institutional | Focus on long-term growth stocks |

| Geode Capital Management | 2.44% | ~3.42 million | Institutional | Passive index fund operator |

| Arrowstreet Capital | 2.44% | ~3.43 million | Institutional | Quantitative hedge fund |

| WCM Investment Management | 2.02–2.44% | ~3.4 million | Institutional | Value-based investment strategy |

| Starboard Value LP | 2.23–2.83% | ~2.83 million | Activist | Activist investor; former larger stake |

| Bob Parsons / Yam Special Holdings | Unknown (25% est.) | ~36 million (historic est.) | Insider | Founder and largest historical individual holder |

| Ameriprise Financial | ~2.34% | ~3.28 million | Institutional | Diversified equity fund investor |

| Wellington Management | ~2.02% | ~2.84 million | Institutional | Long-term strategy investor |

| JPMorgan Chase & Co. | ~1.38% | ~1.94 million | Institutional | Mixed portfolio fund manager |

| FMR (Fidelity) | ~1.18% | ~1.66 million | Institutional | Active in tech and growth portfolios |

| Neuberger Berman | ~1.11% | ~1.55 million | Institutional | Focus on fundamentals and sustainable earnings |

| Point72 Asset Management | ~0.37% | ~515,609 | Hedge Fund | Tactical investor with derivative exposure |

| Millennium Management | <0.02% | ~19,023 | Hedge Fund | Sharp drop in position from prior year |

| Corporate Insiders (Execs + Board) | ~0.61% (combined) | Varies | Insider | Includes CEO Aman Bhutani, CFO Mark McCaffrey; mostly through options |

Vanguard Group, Inc.

Vanguard is the largest institutional shareholder of GoDaddy, owning approximately 12.6% (about 17.7 million shares) as of September 30, 2024. Vanguard manages vast assets—over $10.4 trillion globally.

It invests chiefly through index funds and ETFs. While Vanguard does not run GoDaddy, its substantial voting power is wielded across key decisions via its funds (e.g., Vanguard Total Stock Market). Its influence centers on governance and long-term value rather than operational control.

BlackRock, Inc.

BlackRock is GoDaddy’s second-largest institutional investor, holding about 9.95% (~13.97 million shares) as of late 2024. As the world’s largest asset manager, BlackRock uses proprietary funds like iShares to invest. Its ownership grants it a voice in corporate governance, particularly through proxy votes and engagement with management on strategy.

State Street Global Advisors

State Street holds roughly 4.91% (~6.9 million shares) based on 2024 filings. As another Big Three passive fund manager, State Street’s stakes are deployed through funds like SPDR. Its governance role includes voting on board member elections and corporate proposals.

Janus Henderson Investors

Janus Henderson owns about 5.02% (~7.04 million shares) as of September 2024. This active asset manager adjusts its holdings based on performance forecasts. A slight reduction in late 2024 indicates evolving strategic outlooks.

Morgan Stanley / Eaton Vance Management

Eaton Vance, under Morgan Stanley, controls approximately 4.61% (~6.47 million shares). The firm invests through multiple funds and uses its stake to monitor GoDaddy’s operational execution and financial health.

T. Rowe Price Associates

T. Rowe Price holds around 2.43% (~3.41 million shares). Their core strategy centers on long-term growth, focusing on GoDaddy’s ability to expand digital services for small-business customers.

Geode Capital Management

Geode, with 2.44% (~3.42 million shares), invests mostly via index-based platforms. Although its involvement is passive, it contributes to institutional consensus in governance votes.

Arrowstreet Capital

Arrowstreet Capital holds about 2.44% (~3.43 million shares). As a quantitative asset manager, Arrowstreet targets data-driven value. They stay observant of earnings, stock trends, and GoDaddy’s performance metrics.

WCM Investment Management

With 2.02–2.44% (~3.4 million shares), WCM focuses on a fundamental, value-based approach. They scrutinize GoDaddy’s service portfolio and capital allocation decisions.

Starboard Value LP

Starboard Value, a notable activist investor, owns 2.23–2.83% (~2.83 million shares). Though its stake has fallen from a prior ~6%, it remains committed to pushing for board or strategic changes in order to boost shareholder returns.

Capital International Investors

This investment firm holds approximately 8.49% (~11.96 million shares) as of late 2024. Capital’s stake places it among the top five holders, though it tends to remain discreet and passive.

Point72 Asset Management

Point72, run by Steven Cohen, owns about 515,609 shares (~0.37%) as of December 2024, with significant recent growth in the position. It also uses stock options linked to GoDaddy, showing more tactical, derivative-based involvement.

Millennium Management

Once a major investor, Millennium’s position dramatically dropped to just 19,023 shares by the end of 2024—the result of a sharp reduction from nearly 1 million shares. It remains active through related derivatives, but is largely scaled back.

Bob Parsons / Yam Special Holdings

Bob Parsons retains significant influence through Yam Special Holdings, yet public filings of his stake were not included in recent institutional reports. A major insider historically, his precise ownership percentage is unclear in the 2025 filings. Still, he remains the single largest insider stakeholder and former founder-director, with substantial voting power.

Other Key Institutional Holders

- Ameriprise Financial: ~2.34% (~3.28 million shares)

- Wellington Management: ~2.02% (~2.84 million shares)

- JPMorgan Chase & Co.: ~1.38% (~1.94 million shares)

- FMR (Fidelity): ~1.18% (~1.66 million shares)

- Neuberger Berman: ~1.11% (~1.55 million shares).

Numerous other institutions hold smaller stakes, including UBS, Northern Trust, and Canada Pension Plan.

Insider Holdings

Corporate insiders collectively hold only ~0.61% of total shares, including current executives like CEO Aman Bhutani and CFO Mark McCaffrey, who have recently sold portions of their holdings through scheduled transactions.

Who is the CEO of GoDaddy?

Aman Bhutani has served as GoDaddy’s Chief Executive Officer since September 2019. He brings over 20 years of experience from global technology companies. Before joining GoDaddy, he held key leadership roles at Expedia—first as Chief Technology Officer (2010–2015) and then as President of Brand Expedia Group (2015–2019).

His earlier career included technical roles at JPMorgan Chase and Washington Mutual. He holds an MBA from Lancaster University and a BA in Economics from Delhi University.

Leadership Style & Vision

Bhutani drives a leadership philosophy rooted in continual improvement and discipline, influenced by the Japanese concept of shokunin (“craftsmanship”).

He calls it “Better Every Day.” Under his leadership, GoDaddy has shifted from merely registration services to a full digital platform for small and micro-businesses, integrating AI-powered tools like GoDaddy Airo, eCommerce capabilities, and data-driven customer solutions.

Operational Structure & Decision-Making

Bhutani designed GoDaddy’s operating model around customer-focused business units (“rooms”) under one unified brand “roof.” Each unit is responsible for its own P&L, product, and go-to-market strategy, supported by shared platform services. Governance at the executive level is structured so that risk-takers (business unit leaders) hold more sway than corporate function voices (like finance or legal), ensuring entrepreneurial agility.

Board Engagement & Compensation

Bhutani is active in governance. He serves on GoDaddy’s Board and regularly engages with it, particularly on AI governance and strategic growth plans. He also sits on The New York Times Company board, bringing cross-industry insight.

As of June 2025, he owns around 431,015 GoDaddy shares, valued at roughly $78.8 million, and earns an annual salary of approximately $2.05 million.

Financial & Execution Performance

Under Bhutani’s leadership, GoDaddy reported strong Q1 2025 performance, exceeding revenue and earnings forecasts. He also oversaw a strategic $3 billion share repurchase program extending to 2027.

Bhutani credits disciplined operations and customer-focused strategy for consistent profitability and operational resilience.

Who Controls GoDaddy?

GoDaddy is governed by a Board of Directors, chaired by Brian Sharples. In 2024–25, the Board fully transitioned to annual director elections and added independent directors like Graham Smith, who enhances financial oversight through the Audit Committee. The Board oversees key areas including AI adoption, ESG priorities, and executive appointments.

Shareholder Influence

As a publicly traded company, major institutional investors—Vanguard, BlackRock, and Capital International—guide governance primarily through voting on director elections and proposals. While these firms don’t manage daily operations, their combined influence shapes strategic oversight.

Insider & Founder Influence

Founder Bob Parsons retains significant insider influence via Yam Special Holdings, despite no longer leading daily operations. Meanwhile, Aman Bhutani and GoDaddy’s executive team hold insider equity and contribute to governance through board exposure and strategic planning sessions.

Governance & Accountability

GoDaddy has enhanced transparency and accountability through regular stockholder engagement, ESG disclosures, and updated governance structures. The move to annual board elections and heightened oversight of AI and sustainability reflect a modernized governance approach.

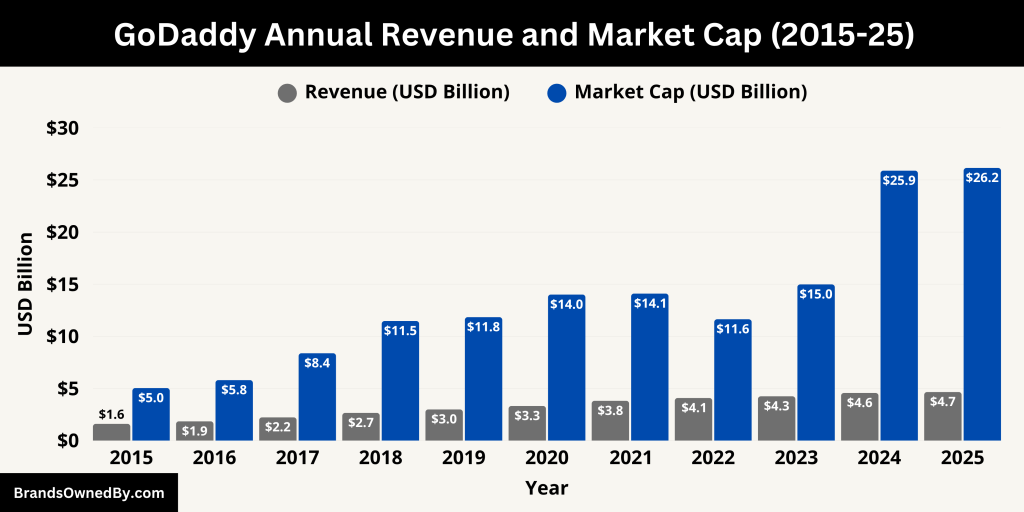

GoDaddy Annual Revenue and Net Worth

In 2025, GoDaddy reported strong financial performance driven by steady growth across its business lines. For the trailing twelve months, the company generated approximately $4.66 billion in total revenue, which marked a 7.7% year-over-year increase. In the first quarter alone, GoDaddy earned around $1.19 billion, up from $1.1 billion in Q1 2024. This growth came largely from the expansion of its Applications & Commerce segment, which includes services like website builders, eCommerce tools, and marketing platforms.

Here’s a quick summary of the financial metrics of GoDaddy as of June 2025:

| Metric | Value |

|---|---|

| Market Cap | ~$26 billion |

| Enterprise Value (EV) | ~$29 billion |

| P/S Ratio | ~5.5 |

| Operating Margin (Q1) | 21% |

| EBITDA Margin (NEBITDA) | 31% |

| Free Cash Flow (2024) | $1.356 billion |

| Free Cash Flow (2025e) | ≥ $1.5 billion |

The company’s two core business areas contributed distinctly. The Core Platform segment, which includes domain registrations and hosting, brought in around $2.92 billion, representing roughly 63.8% of total revenue. This area grew modestly, by about 3.4% year-over-year. In contrast, Applications & Commerce contributed around $1.65 billion, or 36.2%, and posted an impressive 15.6% year-over-year growth. This reflects GoDaddy’s ongoing pivot toward value-added services that support small business operations beyond just web presence.

Looking ahead, GoDaddy expects to generate between $4.86 billion and $4.94 billion in revenue by the end of 2025. The company forecasts low single-digit growth for the Core Platform and mid-teens growth for Applications & Commerce.

Profitability and Cash Flow Performance

GoDaddy’s profitability has remained healthy in 2025. The company reported net income of $219.5 million in the first quarter alone, supported by a solid operating margin of 21%. Additionally, normalized EBITDA (earnings before interest, taxes, depreciation, and amortization) reached $364.4 million, reflecting a strong 31% margin.

Free cash flow generation continues to be a strength. GoDaddy closed 2024 with $1.356 billion in free cash flow and has guided toward at least $1.5 billion in free cash flow for 2025. This solid liquidity gives the company room to reinvest, reduce debt, and return value to shareholders.

Strategic Share Buybacks

GoDaddy has used its financial strength to conduct large-scale share repurchases. In 2024, it completed a substantial buyback program that reduced its share count by over 25%. Building on this, the company initiated a new $3 billion repurchase program set to run through 2027. This move is designed to enhance earnings per share and deliver long-term value to investors, a strategy supported by its robust free cash flow.

Net Worth and Market Capitalization

As of June 2025, GoDaddy’s market capitalization stands between $25.8 billion and $26.1 billion, reflecting a significant increase of over 35% compared to mid-2024. This growth is attributed to consistent revenue gains, increased profitability, and investor confidence in the company’s expanding digital service offerings.

In terms of enterprise value—which includes debt—GoDaddy is valued at approximately $28.9 billion. This figure positions the company among the top-tier firms in the digital services and domain registration sector. With a price-to-sales (P/S) ratio of 5.5, GoDaddy is considered a premium player, signaling strong investor expectations for sustained growth.

Below is an overview of the annual revenue and net worth of GoDaddy from 2015-25:

| Year | Revenue (USD Billion) | YoY % Chg | Market Cap (USD Billion) | YoY % Chg |

|---|---|---|---|---|

| 2015 | 1.607 | — | 5.04 | — |

| 2016 | 1.848 | +14.9% | 5.80 | +15.0% |

| 2017 | 2.232 | +20.8% | 8.38 | +44.5% |

| 2018 | 2.660 | +19.2% | 11.47 | +36.8% |

| 2019 | 2.988 | +12.3% | 11.84 | +3.5% |

| 2020 | 3.317 | +11.0% | 14.01 | +18.3% |

| 2021 | 3.816 | +15.1% | 14.10 | +0.7% |

| 2022 | 4.091 | +7.2% | 11.64 | −17.4% |

| 2023 | 4.254 | +4.0% | 14.98 | +28.6% |

| 2024 | 4.573 | +7.5% | 25.89 (≈ 25.9) | +90.6% |

| 2025 TTM | 4.659 | +7.7% | 26.15 | ~+1% |

Companies Owned by GoDaddy

GoDaddy has acquired several businesses to expand its offerings. These companies help support their mission to empower everyday entrepreneurs. Here’s a list of the major companies and brands owned by GoDaddy as of June 2025:

| Company/Brand | Year Acquired | Core Offering | Status/Integration | Notable Impact |

|---|---|---|---|---|

| Host Europe Group | 2016 | European web hosting & domains | Operates under GoDaddy with brand identity retained | Expanded GoDaddy’s European market reach |

| Sucuri | 2017 | Website security & malware protection | Integrated as security service provider | Strengthened GoDaddy’s cybersecurity suite |

| ManageWP | 2016 | WordPress management tools | Bundled with GoDaddy Pro | Enabled bulk WordPress management for developers |

| Main Street Hub | 2018 | Social media & customer engagement tools | Retains branding; integrated in marketing suite | Enhanced digital marketing services for SMBs |

| Plasso | 2018 | Digital payments & subscriptions | Core part of GoDaddy Payments | Introduced recurring payment tools |

| Cognate | 2018 | Trademark protection via blockchain | Integrated in IP protection offerings | Provided brand authentication tools |

| Sellbrite | 2019 | Multi-channel eCommerce inventory tools | Integrated into commerce tools | Improved multichannel retail management |

| Over (GoDaddy Studio) | 2020 | Design and content creation app | Rebranded as GoDaddy Studio | Added creative tools for marketing & branding |

| Uniregistry | 2020 | Domain registrar & aftermarket marketplace | Merged into domain platform | Expanded domain sales and aftermarket services |

| Neustar Registry | 2020 | Domain registry operations (TLDs) | Rebranded as GoDaddy Registry | Added backend registry services |

| Poynt (GoDaddy Payments) | 2020 | POS & online payment solutions | Rebranded and integrated | Created full-service payment ecosystem |

| Pagely | 2021 | Managed WordPress hosting for enterprises | Supports GoDaddy Pro/enterprise clients | Strengthened GoDaddy’s premium hosting infrastructure |

| DNAcademy | 2022 | Domain name investment education platform | Integrated into GoDaddy Pro | Provided domain investment training |

| Dan.com | 2022 | Domain buying/selling marketplace | Fully integrated with GoDaddy | Enhanced global aftermarket domain transactions |

Host Europe Group

Host Europe Group, which includes major brands like 123 Reg, Domain Factory, and Heart Internet, was acquired by GoDaddy in December 2016 for approximately €1.8 billion. This acquisition significantly strengthened GoDaddy’s presence in Europe. It provided more localized hosting services, improved customer support, and allowed GoDaddy to leverage a robust European infrastructure. The Host Europe brand continues to operate under GoDaddy’s umbrella, maintaining its identity while benefiting from GoDaddy’s global reach.

Sucuri

In March 2017, GoDaddy acquired Sucuri, a California-based web security firm known for its malware scanning, website cleanup services, and web application firewall (WAF). Sucuri operates as a distinct brand within GoDaddy. Its team, led by founders Tony Perez and Daniel Cid, remains dedicated to delivering 24/7 site protection. Integration into GoDaddy’s platform enables customers to receive premium security services seamlessly with their hosting products.

ManageWP

ManageWP, acquired in September 2016, is a WordPress site management tool founded in Serbia. GoDaddy integrated it into its suite of WordPress services, enabling users to manage multiple WordPress installs from a single dashboard. Its features include automated backups, performance optimization, site monitoring, and uptime tracking—offered both as standalone tools and bundled in GoDaddy Pro, catering to developers and agencies.

Main Street Hub

GoDaddy’s acquisition of Main Street Hub in January 2018 brought advanced social media and customer review management tools into its ecosystem. Founded in Austin, the service helps small businesses streamline content publishing, response tracking, and engagement across platforms. Main Street Hub continues to serve clients independently but benefits from GoDaddy’s integrations, enhancing its value for entrepreneurs.

Plasso & Cognate

In September 2018, GoDaddy acquired Plasso, a SaaS platform for digital payments and subscriptions, and Cognate, a blockchain-enabled trademark and content protection firm. Plasso bolsters GoDaddy’s ability to support recurring revenue businesses, while Cognate adds blockchain tools to verify brand authenticity and protect intellectual property. Both brands continue to be offered through GoDaddy’s business solutions suite.

Sellbrite

GoDaddy purchased Sellbrite in April 2019, a multi-channel e-commerce listing platform headquartered in Pasadena. The integration helps merchants list and manage inventory across marketplaces like Amazon, eBay, and Walmart. It complements GoDaddy’s eCommerce offerings by providing centralized inventory and order management tools, positioned within its Applications & Commerce segment.

Over / GoDaddy Studio

The 2020 acquisition of Over, a South African design app, transformed into GoDaddy Studio. This creative tool with a drag-and-drop interface allows users to design marketing content—such as social posts, ads, and graphics—directly in GoDaddy’s platform. GoDaddy Studio enhances marketing service offerings for non-designers, ensuring robust visual branding tools for small businesses.

Uniregistry

In February 2020, GoDaddy acquired Uniregistry, a Cayman Islands–based domain registrar and aftermarket marketplace. The acquisition expanded GoDaddy’s aftermarket domain marketplace and added registry services. The company consolidated Uniregistry’s operations into GoDaddy’s platform to enhance domain sales channels and aftermarket support.

Neustar / GoDaddy Registry

In April 2020, GoDaddy bought Neustar’s registry business and rebranded it as GoDaddy Registry. This subsidiary now operates numerous top-level domains (TLDs) including generic and country-specific ones like .us, .biz, .club, .ink, and many more. It provides backend registry services to governments, cities, and global brands and operates independently under GoDaddy’s corporate structure.

Poynt

In December 2020, GoDaddy acquired Poynt (later rebranded as GoDaddy Payments), a commerce and payments solution provider, for about $365 million. The acquisition integrated in-person and online payment processing into GoDaddy’s business toolkit. Merchants using GoDaddy can now access a full suite of commerce solutions—from websites to physical card readers—under one roof.

Pagely

GoDaddy acquired Pagely, a Tucson‑based enterprise managed WordPress host, in November 2021. Pagely brings high-end WordPress hosting infrastructure, catering to agencies and enterprise clients. It complements GoDaddy Pro and Managed WordPress offerings, delivering scalable performance, advanced support, and developer-focused tools.

DNAcademy

In March 2022, GoDaddy acquired DNAcademy, a domain education platform that offers training on buying, selling, and registering domains. The platform is integrated into GoDaddy Pro, providing professional users with learning resources to optimize domain investment and management.

Dan.com

GoDaddy added Dan.com, a Netherlands-based domain marketplace, in June 2022. Dan.com enhances domain aftermarket capabilities with escrow services, interactive search, and user-friendly transactions. Its acquisition broadens GoDaddy’s reach into international domain sales and enhances domain monetization tools.

Conclusion

GoDaddy is a public company with no single owner. It is controlled by institutional investors like Vanguard and BlackRock. The current CEO, Aman Bhutani, leads the business with a focus on innovation and entrepreneurship. GoDaddy’s revenue continues to grow, supported by its many strategic acquisitions. Anyone can become part of its ownership by purchasing shares through the stock market.

FAQs

Who is behind GoDaddy?

GoDaddy is backed by a mix of institutional investors, private equity firms, and retail shareholders. As of 2025, the largest stakeholders include Vanguard Group, BlackRock, Silver Lake Partners, and T. Rowe Price. The company operates independently and is publicly traded under the ticker symbol GDDY on the New York Stock Exchange. The leadership is managed by a board of directors and an executive team headed by CEO Aman Bhutani.

Who is the owner of GoDaddy?

No single individual owns GoDaddy. It is a publicly traded company with ownership divided among many shareholders. The largest shareholders are major asset managers like Vanguard and BlackRock, as well as private equity firm Silver Lake Partners. Each of these entities holds a significant percentage of GoDaddy’s stock but none has full control. GoDaddy is governed by its board and executive team, rather than a sole proprietor.

Is Bob Parsons a billionaire?

Yes, Bob Parsons is a billionaire. He is the founder of GoDaddy and served as its CEO until 2011. While he no longer holds an active role in the company, he accumulated substantial wealth from its success and eventual IPO. Parsons has since focused on his philanthropic work and ventures under the YAM Worldwide brand, which includes interests in real estate, motorcycles, golf, and media.

What is the GoDaddy controversy?

GoDaddy has faced several controversies over the years. One of the earliest was its founder Bob Parsons’ involvement in a 2011 elephant hunting trip, which drew criticism from animal rights activists. The company also received backlash for its sexually suggestive advertising campaigns in the 2000s. More recently, in 2020, GoDaddy was criticized for sending a fake holiday bonus email to employees during the COVID-19 pandemic, which was actually a phishing test. While the company has taken steps to improve its image, these incidents are often referenced in discussions about its corporate culture.

Who is the founder of GoDaddy?

GoDaddy was founded by Bob Parsons in 1997 in Scottsdale, Arizona. He created the company originally under the name Jomax Technologies. It was later rebranded as GoDaddy in 1999. Parsons grew the business into one of the largest domain registrars and web hosting companies in the world before stepping down as CEO in 2011.

Is GoDaddy owned by Microsoft?

No, GoDaddy is not owned by Microsoft. While the two companies have partnered in the past—especially on integrations for Microsoft 365—GoDaddy operates as a fully independent, publicly traded company. Microsoft does not own any controlling interest in GoDaddy.

Who owns GoDaddy now?

GoDaddy is owned by public shareholders. The largest owners are investment firms such as Vanguard and BlackRock.

Is GoDaddy a private or public company?

GoDaddy is a public company listed on the New York Stock Exchange under the ticker symbol GDDY.

Can I buy stock in GoDaddy?

Yes. Since GoDaddy is publicly traded, anyone can buy its stock through brokerage platforms.

Does Bob Parsons still own GoDaddy?

Bob Parsons founded GoDaddy but sold most of his stake. He no longer owns or runs the company.

What companies has GoDaddy acquired?

GoDaddy has acquired Host Europe, Sucuri, ManageWP, Main Street Hub, and Neustar’s domain registry business.