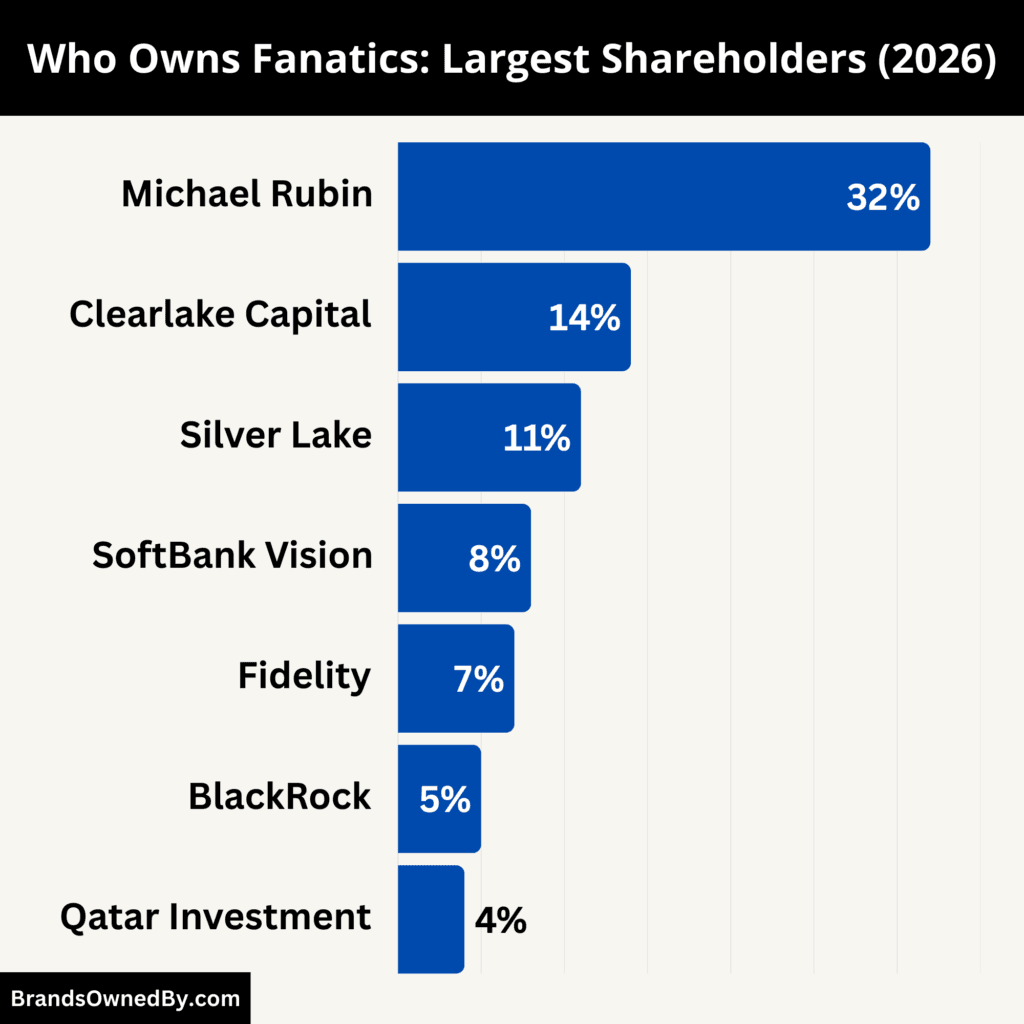

- Fanatics is a privately held, founder-controlled company led by Michael Rubin, who owns 32% of the company and holds decisive voting and strategic control as chairman and CEO.

- The largest institutional shareholders are Clearlake Capital Group (14%), Silver Lake (11%), SoftBank Vision Fund (8%), Fidelity Investments (7%), and BlackRock (5%), all holding minority but influential stakes.

- Strategic investors, including major professional sports leagues and players’ associations, collectively own 10%, aligning Fanatics’ commercial success with league and athlete interests.

- The remaining 9% is held by employees, executives, and smaller minority investors, reinforcing a long-term, founder-led ownership model with no single outside party able to override founder control.

Fanatics is a global digital sports commerce platform. It serves fans by designing, manufacturing, and selling licensed sports merchandise. This includes jerseys, fan gear, headwear, lifestyle apparel, and hard goods.

The company also operates expansive business units in trading cards and collectibles, sports betting and gaming, and fan-centric events. Fanatics partners with major professional leagues, players’ associations, colleges, and sports properties worldwide to deliver official products and experiences. It combines e-commerce, physical retail, and technology-driven services to engage fans wherever they are.

Fanatics is headquartered in Jacksonville, Florida, with additional major offices in New York City and Manchester, England. It employs tens of thousands of people and reaches millions of customers across more than 80 countries.

Fanatics Founder

Fanatics’ modern incarnation is closely tied to Michael Rubin, a serial entrepreneur and executive. Rubin did not originally found the company, but his role defines its current identity and growth.

Michael Rubin began his entrepreneurial journey long before Fanatics. He founded an apparel and logistics business called Global Sports Incorporated (GSI) in the late 1990s. This company grew into a major e-commerce entity that served numerous retail and sports partners. Rubin sold GSI to eBay in 2011 for $2.4 billion. As part of that transaction, he acquired Fanatics and related assets that eBay did not wish to retain. Rubin then focused on transforming Fanatics into a vertically integrated sports commerce leader.

The original roots of the Fanatics brand trace back to 1995 when brothers Alan and Mitchell Trager started a business called Football Fanatics in Jacksonville, Florida. That early enterprise focused on selling local team merchandise and gradually expanded into broader sports retail before Rubin acquired it and built the modern Fanatics platform.

Rubin has served as Chairman and CEO since his acquisition in 2011. Under his leadership, Fanatics continuously expanded its reach and capabilities beyond traditional merchandise.

Major Milestones

- 1995: Football Fanatics is founded in Jacksonville, Florida by brothers Alan and Mitchell Trager. The business focuses on selling licensed sports merchandise for local professional teams.

- 2000: The company expands beyond physical retail into catalog-based sales, allowing it to reach customers outside Florida.

- 2004: Football Fanatics launches its early e-commerce operations, marking its first move toward online sports retail.

- 2011: Michael Rubin acquires Fanatics as part of his exit from GSI Commerce following its sale to eBay. Fanatics is repositioned as a digital-first sports commerce company.

- 2012: Fanatics secures major partnerships with professional sports leagues and collegiate organizations, beginning its transition into a licensed merchandise powerhouse.

- 2014: The company starts vertically integrating its supply chain by taking greater control over manufacturing, fulfillment, and distribution.

- 2016: Fanatics signs long-term agreements to operate official online stores for major leagues, teams, and universities, significantly expanding its reach.

- 2017: The company introduces on-demand manufacturing, allowing customized fan gear to be produced and shipped rapidly.

- 2018: Fanatics partners with Nike and major leagues to manufacture and distribute Nike-branded fan apparel, strengthening its role as a league-level operator.

- 2019: Expansion accelerates across Europe and international markets, with new offices and logistics hubs supporting global growth.

- 2020: Fanatics acquires WinCraft, adding licensed hardgoods such as flags, banners, and accessories to its product portfolio.

- 2021: Fanatics launches Fanatics Collectibles after securing long-term trading card licenses from major sports leagues and players associations.

- 2021: Fanatics announces Fanatics Betting & Gaming, signaling its entry into regulated sports betting and iGaming.

- 2022: Fanatics acquires Topps’ trading card and collectibles business, integrating one of the most iconic brands in sports collectibles.

- 2022: The company acquires Mitchell & Ness, a heritage sports apparel brand known for throwback jerseys and vintage designs.

- 2023: Fanatics expands aggressively into international markets through acquisitions in Europe and Latin America.

- 2023: Fanatics Sportsbook launches in multiple U.S. states following the acquisition of PointsBet’s U.S. assets.

- 2024: Fanatics scales its live events and fan experiences, blending commerce, collectibles, and athlete engagement into physical and digital formats.

- 2025: The company strengthens its athlete partnerships, enabling direct-to-fan product launches and exclusive merchandise drops.

- 2026: Fanatics operates as a fully integrated global sports platform spanning merchandise, collectibles, betting, and fan engagement, with direct relationships across leagues, teams, and athletes.

Who Owns Fanatics: Major Shareholders

Fanatics is a privately held global sports platform founded and controlled by Michael Rubin, who is also the company’s largest shareholder. As of 2026, Michael Rubin owns approximately 32% of Fanatics, giving him effective control over the business. He serves as chairman and CEO and holds final authority over strategy, acquisitions, and long-term direction.

The remaining ownership is distributed among major private equity firms, institutional investors, sovereign wealth funds, professional sports leagues, and employee shareholders.

Below is a list of the largest shareholders of Fanatics as of January 2026:

Understood. Below, the title in each bullet is bolded, while the explanation remains plain text and limited to 1–2 words.

- Ownership type: Private

- Founder: Michael Rubin

- Largest shareholder: Michael Rubin

- Founder ownership: 32% stake

- Control structure: Founder-led

- Decision authority: Centralized

- Voting control: Founder

- Institutional investors: Present

- Private equity role: Strategic

- League ownership: Minority

- Sovereign investors: Included

- Employee equity: Incentivized

- Board influence: Investor-backed

- Ownership stability: Long-term

- Governance model: Centralized.

Michael Rubin – 32%

Michael Rubin is the largest shareholder and the controlling owner of Fanatics, holding approximately 32% of the company.

Rubin’s stake gives him effective voting control and final authority over corporate strategy, acquisitions, and long-term vision. He founded the modern Fanatics in 2011 after acquiring the business and has remained CEO and chairman since then. His ownership is held through personal and affiliated entities, allowing him to retain control even after multiple dilution events.

Rubin’s position ensures that Fanatics remains founder-driven rather than investor-led. Major decisions, including entry into trading cards, betting, and live fan experiences, have been executed under his direct leadership.

Clearlake Capital Group – 14%

Clearlake Capital Group owns approximately 14% of Fanatics, making it the largest institutional shareholder.

Clearlake emerged as a key investor after leading a major funding round that reshaped Fanatics’ valuation and capital structure. The firm holds board representation and plays an active role in governance, particularly around operational scaling, technology integration, and capital discipline. While Clearlake does not control the company, its stake gives it significant influence over strategic planning and major transactions.

Silver Lake Partners – 11%

Silver Lake holds an estimated 11% stake in Fanatics.

Silver Lake has been involved across multiple growth stages and is one of the most influential private equity backers of the company. Its role focuses on long-term value creation, digital infrastructure, and global expansion. Silver Lake’s experience with large technology platforms aligns closely with Fanatics’ ambition to operate as a tech-enabled sports ecosystem rather than a traditional retailer.

SoftBank Vision Fund – 8%

SoftBank Vision Fund owns approximately 8% of Fanatics.

SoftBank invested during Fanatics’ rapid expansion phase, backing the company’s push into global markets and new verticals. While SoftBank does not hold board control, its stake reflects confidence in Fanatics as a category-defining sports platform. The Vision Fund’s involvement also helped position Fanatics alongside other globally scaled technology companies.

Fidelity Investments – 7%

Fidelity Investments holds about 7% of Fanatics.

Fidelity participated in several late-stage private funding rounds and represents long-term institutional capital. Its role is primarily financial rather than operational. Fidelity’s continued ownership signals institutional confidence in Fanatics’ durability, governance, and ability to generate sustained enterprise value across multiple sports-related industries.

BlackRock – 5%

BlackRock owns approximately 5% of the company.

BlackRock’s stake comes through private capital and alternative investment vehicles rather than public equity. Its involvement adds credibility to Fanatics’ institutional ownership base and reflects interest from large global asset managers in private, high-growth consumer and technology platforms.

Sports Leagues and Players’ Associations – 10%

Major professional sports leagues and players’ associations collectively own about 10% of Fanatics.

This group includes equity participation from the NFL, NBA, MLB, NHL, and their respective players’ unions. These stakes are strategic rather than controlling. They align Fanatics’ commercial success with the long-term interests of leagues and athletes. Equity ownership strengthens licensing partnerships, ensures long-term collaboration, and embeds Fanatics deeply into the professional sports ecosystem.

Qatar Investment Authority – 4%

Qatar Investment Authority holds roughly 4% of Fanatics.

QIA’s investment reflects sovereign interest in global sports, entertainment, and digital commerce platforms. Its role is long-term and strategic, with a focus on international brand expansion and global sports engagement. QIA does not participate in daily operations but provides stable capital support.

Employees, Executives, and Other Minority Investors – 9%

The remaining 9% of Fanatics is distributed among senior executives, employees through equity compensation plans, and smaller private investment firms.

This portion of ownership supports talent retention and aligns management incentives with company performance. It also includes legacy investors and secondary shareholders from earlier funding rounds.

Who is the CEO of Fanatics?

Michael Rubin is the Chief Executive Officer (CEO) of Fanatics. He founded the modern iteration of the company in 2011, following the acquisition of the company after the sale of his previous business.

Rubin has led Fanatics from a niche online seller into a global sports commerce platform spanning merchandise, collectibles, and betting. As CEO, he is responsible for corporate strategy, major acquisitions, board leadership, and long-term growth execution.

Rubin’s leadership style emphasizes vertical integration, aggressive expansion into new markets, and long-term partnerships with leagues, teams, and athletes. He retains effective control over the company due to his position as both CEO and the largest shareholder.

Role and Decision-Making

As CEO, Michael Rubin leads the overall strategic vision of Fanatics. His responsibilities include:

- Defining long-term growth strategy across all business lines.

- Overseeing major acquisitions and investments, such as trading cards and betting operations.

- Managing relationships with professional leagues, universities, and athletes.

- Guiding executive leadership across commerce, collectibles, and gaming units.

- Approving capital allocation and key operational decisions.

Under Rubin’s leadership, Fanatics operates through a divisional structure, with senior executives reporting to him. These include presidents or CEOs for Fanatics Commerce, Fanatics Collectibles, and Fanatics Betting & Gaming.

Compensation and Salary

As of January 2026, Michael Rubin’s annual CEO compensation is estimated at $20 million, which includes base salary, performance incentives, and other executive benefits. This figure is typical for CEOs of rapidly scaling private companies backed by major institutional investors, though exact compensation details are not publicly filed.

Royalty-style or bonus compensation tied to revenue milestones, long-term performance, or strategic exits may also apply under executive compensation agreements, though these are private to Fanatics’ internal governance and investor arrangements.

Net Worth

Michael Rubin’s net worth in January 2026 is estimated at $6.5 billion. This figure reflects his majority ownership stake in Fanatics, earnings from past ventures, and personal investments. The largest component of his wealth remains his equity in Fanatics, which is valued based on the company’s last private funding round and board-approved valuation.

Rubin’s net worth has grown substantially over the past decade due to Fanatics’ expansion into high-growth sectors such as trading cards, digital collectibles, and sports betting. His entrepreneurial track record includes founding and selling other companies prior to Fanatics, contributing to his diversified financial standing.

CEO Influence and Legacy

Michael Rubin’s tenure as CEO has shaped Fanatics into one of the most influential companies in the sports business worldwide. His strategic decisions — from securing exclusive licenses to entering adjacent verticals — have positioned the company as a market leader in fan engagement and commerce. Rubin’s dual role as founder and CEO ensures continuity of vision and execution, a central factor in Fanatics’ growth trajectory.

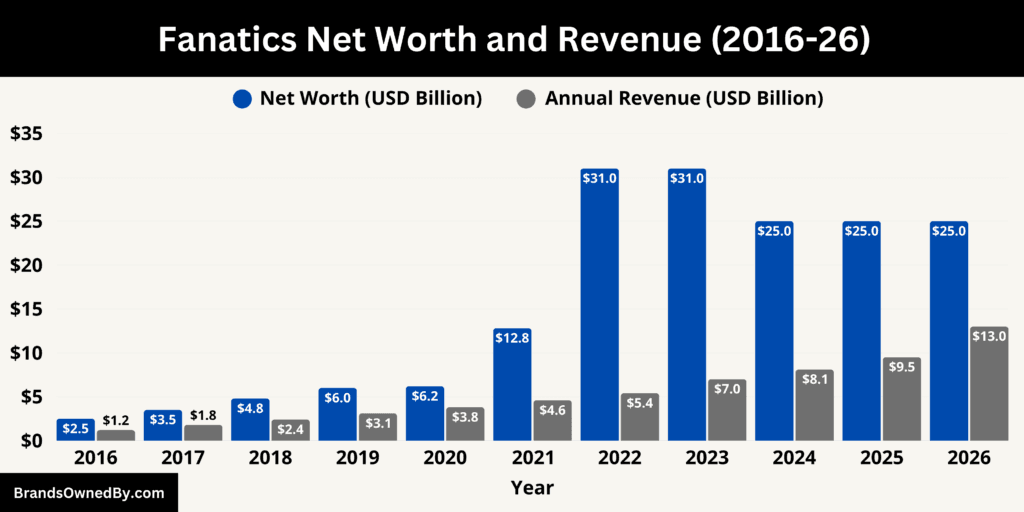

Fanatics Annual Revenue and Net Worth

As of January 2026, Fanatics is on pace to generate approximately $13 billion in annual revenue, up from $8.1 billion in 2024, driven by strong performance across merchandising, collectibles, and sports betting. Its private market net worth of about $25 billion reflects sustained investor confidence and the company’s diversified business model.

2026 Revenue Performance

Fanatics’ revenue performance over recent years shows a clear growth trajectory. In 2024, the company reported revenue of $8.1 billion, marking a 15.7 percent year-over-year increase compared to prior years. This growth was led by its core Fanatics Commerce segment, which accounted for about 77 percent of total revenue, as well as the emerging Fanatics Collectibles and Betting & Gaming segments.

Building on this momentum, Fanatics’ leadership publicly projected that the company would generate close to $12 billion in revenue in 2026, citing diversified streams and ongoing expansion in high-growth segments like collectibles and regulated betting.

More recent internal outlooks and industry estimates suggest that total revenue may further approach $13 billion in 2026 when including strong seasonal demand, international expansion, and growth from the Topps trading cards business. This projection reflects not only increases in merchandise sales but also rising contributions from Fanatics’ collectibles division — which saw revenue quadruple since its acquisition of Topps — and the betting business as it gains traction in multiple U.S. states and expands operational footprint.

In the 2024 revenue breakdown, Fanatics Commerce contributed roughly $6.2 billion (77 percent), Fanatics Collectibles accounted for about $1.6 billion (20 percent), and Fanatics Betting & Gaming generated approximately $300 million (3 percent). These segment contributions underpin the company’s scaling model, where physical merchandise remains the primary base and higher-margin digital and experiential units contribute growing fractional revenue year over year.

Segment Contribution and Growth Dynamics

Fanatics Commerce remains the largest and most established contributor to total revenue. This segment sells licensed apparel, headwear, and fan gear through official e-commerce stores and physical partnerships with leagues and teams globally. The company’s vertical integration — controlling manufacturing, distribution, and digital retail infrastructure — provides competitive cost advantages relative to traditional third-party retailers.

Fanatics Collectibles, including trading cards, has become a notable growth driver. After securing long-term licensing rights and integrating the Topps portfolio (acquired for $500 million in 2022), this segment has expanded rapidly. It saw 40 percent year-over-year growth in 2024 and is projected to continue strong performance through 2026 as global demand increases.

Fanatics Betting & Gaming, while still smaller relative to commerce and collectibles, is expanding as sports wagering becomes legal in additional jurisdictions. This unit contributes recurring revenue through net gaming revenue and market engagement. While the segment is early in its maturation curve, company leadership has stated that betting could contribute a substantial portion of total profits in the coming years as operational scale improves.

Net Worth

In the private market, Fanatics’ valuation — effectively its net worth as a company — has evolved with successive funding rounds and shareholder transactions. In December 2022, the company raised $700 million in new capital, resulting in a valuation of $31 billion.

More recent private secondary market activity and an employee share sale program in 2024 placed the company’s valuation at approximately $25 billion. This figure is widely referenced in private market reporting as a current valuation estimate, reflecting both continued investor demand and market conditions.

This valuation is significant for a privately held company that combines large merchandise operations with rapidly growing digital business units and emerging regulated gaming. It positions Fanatics among the largest privately owned companies in the global sports and entertainment landscape.

Brands Owned by Fanatics

Below is a list of the core brands owned by Fanatics as of January 2026:

| Company / Brand | Type | Year Integrated | Core Function | Key Details |

|---|---|---|---|---|

| Fanatics Commerce | Operating division | 2011 | Sports merchandise | Core business unit managing licensed apparel, headwear, hardgoods, manufacturing, fulfillment, and official league/team stores globally. |

| Fanatics Collectibles | Operating division | 2021 | Trading cards & collectibles | Oversees physical and digital collectibles, licensing, production cycles, authentication, and secondary-market services. |

| Fanatics Betting & Gaming | Operating division | 2021 | Sports betting & gaming | Runs Fanatics Sportsbook, wagering platforms, loyalty integration, and regulated gaming operations across U.S. markets. |

| Topps | Brand | 2022 | Trading cards | Historic trading card brand covering baseball, football, entertainment, and specialty sets; fully integrated under Fanatics Collectibles. |

| Bowman | Brand (Topps) | 2022 | Prospect trading cards | Premium baseball prospect card brand focused on early player discovery and collector demand. |

| Mitchell & Ness | Brand | 2022 | Heritage apparel | Premium throwback jerseys and lifestyle sportswear brand targeting collectors and fashion-focused fans. |

| WinCraft | Brand | 2020 | Licensed hardgoods | Produces flags, banners, drinkware, seat cushions, and fan accessories for teams and venues. |

| PWCC | Platform | 2021 | Collectibles marketplace | Auction and consignment platform for high-value trading cards and memorabilia, including grading and authentication services. |

| Fanatics Sportsbook | Brand | 2023 | Sports wagering | Consumer-facing sportsbook brand launched using acquired U.S. betting assets and Fanatics’ customer ecosystem. |

| PointsBet U.S. Assets | Acquired assets | 2023 | Betting infrastructure | Provided state licenses, technology stack, and customer base to accelerate Fanatics Sportsbook rollout. |

| Fanatics Events | Operating unit | 2024 | Live fan experiences | Organizes card shows, fan festivals, athlete appearances, and exclusive product-drop events. |

| Fanatics Collect | Platform | 2023 | Digital collectibles | Manages limited-edition drops, digital items, collector programs, and physical–digital product integration. |

| EPI (Italy) | Regional subsidiary | 2023 | European distribution | Supports localized manufacturing, sourcing, and distribution across European sports markets. |

| Fex Pro | Regional subsidiary | 2023 | Latin America wholesale | Expands Fanatics’ reach across Latin American leagues, teams, and retail partners. |

| Fanatics Manufacturing & Fulfillment | Internal operations | 2014 | Supply chain | In-house production, printing, customization, and logistics enabling rapid turnaround and on-demand merchandise. |

| Fanatics Retail Operations | Operating unit | 2016 | Venue retail | Manages in-stadium and event-based retail stores for leagues, teams, and global sports events. |

Fanatics Commerce

Fanatics Commerce is the company’s original and largest operating division. It designs, manufactures, and sells licensed apparel, headwear, and hardgoods through direct-to-consumer channels, team and league stores, and wholesale partners.

The unit operates official online stores for major professional leagues, hundreds of teams, and collegiate partners. It also runs manufacturing and fulfillment centers that enable on-demand and large-scale production. Commerce is the operational backbone that supplies retail inventory to Fanatics’ global e-commerce sites and venue retail operations.

The business emphasizes vertical integration—owning the design, production, inventory and digital storefronts—to compress lead times, reduce third-party margins, and capture more revenue per sale.

Fanatics Collectibles

Fanatics Collectibles is the corporate arm that manages trading cards, physical collectibles, and digital collectible initiatives. Created after Fanatics secured licensing arrangements with major leagues and players’ associations, this unit integrates card manufacturing, brand stewardship (for acquired collectibles brands), drops and marketplace activity, and authentication services.

It oversees licensed product creation cycles from concept to pack release, and it operates collector services such as grading, authentication, and secondary-market offerings through related entities. Collectibles is a strategic growth engine for higher-margin, repeat-purchase consumer behavior and for driving long-term fan engagement.

Fanatics Betting & Gaming

Fanatics Betting & Gaming operates Fanatics’ sportsbook and gaming products. The unit launched to leverage Fanatics’ fan database and league relationships to acquire customers at scale in regulated U.S. markets.

It operates mobile and retail sportsbook fronts, loyalty integration with commerce channels, and marketing programs that tie betting offers to merchandise and collectibles. The business focuses on product localization, compliance, and building proprietary customer acquisition funnels tied to team and athlete partnerships. It also integrates data and CRM systems to cross-sell between commerce and wagering customers.

Topps

Topps is Fanatics Collectibles’ flagship brand acquisition in trading cards and collectibles. Acquired and folded into Fanatics’ collectibles portfolio, Topps brought historic brands such as Topps flagship sets and the Bowman line.

Under Fanatics, Topps’ physical and digital product lines were modernized with new production capacity and integrated distribution through Fanatics’ commerce platform. Topps remains one of the primary consumer-facing brands for baseball, football and entertainment trading cards, with Fanatics managing licensing, product calendars, and retail distribution for Topps properties.

Mitchell & Ness

Mitchell & Ness operates as a heritage and lifestyle apparel brand within Fanatics Commerce. Acquired to expand Fanatics’ premium and nostalgia apparel offerings, Mitchell & Ness supplies throwback jerseys, licensed retro apparel, and streetwear collaborations.

The brand is positioned as a high-value label that complements Fanatics’ mass-market merchandise. Fanatics retains Mitchell & Ness as a distinct brand identity, using its heritage cache to reach consumers who prioritize vintage and premium sportswear.

WinCraft

WinCraft is Fanatics’ hardgoods and accessories brand. Acquired to broaden non-apparel product offerings, WinCraft produces licensed flags, banners, seat cushions, drinkware, and assorted fan accessories.

Integration into Fanatics Commerce enables the company to offer a more comprehensive product assortment for stadium retail, e-commerce bundles, and promotional merchandising programs.

PWCC

PWCC is a collectibles auction and marketplace business incorporated under Fanatics Collectibles following acquisition. PWCC operates auction platforms, consignment services, and authentication infrastructures tailored to high-value trading cards and memorabilia.

Under Fanatics, PWCC’s marketplace capabilities support secondary market liquidity and complement primary releases from Topps and Fanatics Collectibles, enabling a fuller value chain from mint production to resale.

PointsBet U.S. Assets

Fanatics acquired the U.S. businesses and technology assets of a regulated sportsbook operator and integrated those assets into Fanatics Betting & Gaming. The transaction transferred state-level licenses, customer relationships, and platform capabilities that accelerated Fanatics’ go-to-market in multiple U.S. states.

The acquired assets were migrated onto Fanatics’ sportsbook platform and rebranded under Fanatics Sportsbook in jurisdictions where regulatory approvals permitted. This acquisition provided an established installation footprint and experienced personnel to scale the betting business.

EPI (Italy) and Fex Pro (Latin America)

Fanatics expanded its international commerce footprint by acquiring regional wholesale and manufacturing specialists, including an Italian sports merchandise company and a Latin American wholesaler.

These entities (operating under local brands and distribution networks) were integrated into Fanatics Commerce to improve sourcing, local customization, and distribution across Europe and Latin America. The regional acquisitions enabled faster market entry, localized assortments, and reduced cross-border logistics friction.

Fanatics Events

Fanatics Events is the division that develops and operates fan experiences, live shows, and branded events. The unit designs experiential commerce moments—fan festivals, card shows, athlete appearances and pop-up activations—that combine live attendance, exclusive product drops, and ticketed experiences.

Events are used as both revenue centers and customer-acquisition tools, creating high-value touchpoints for collectors, superfans, and corporate partners.

Fanatics Collect

Fanatics Collect is the branded platform and set of services around digital collectibles, limited drops, and collector programs. It supports product authentication, limited edition releases, subscription boxes, and digital items tied to physical products.

The platform is purpose-built to create recurring collector demand and to connect core commerce buyers with higher-margin collectible offerings.

Other Owned Labels and Operating Units

Fanatics owns and operates several internal labels that support manufacturing, logistics, retail, technology, and regional expansion. These units strengthen vertical integration and operational control.

- Fanatics Manufacturing: In-house apparel production and customization

- Fanatics Fulfillment: Warehousing and global order delivery

- Fanatics Retail: In-stadium and event-based retail stores

- Fanatics Platform Services: Data, personalization, and loyalty systems

- EPI: European sourcing and distribution

- Fex Pro: Latin America wholesale and partnerships.

Conclusion

Understanding who owns Fanatics helps explain the company’s sustained growth and strategic direction across the global sports industry. Fanatics remains a privately held, founder-controlled business led by Michael Rubin, whose ownership stake and executive authority allow the company to prioritize long-term expansion over short-term pressures. Backed by major institutional investors and strategic partners from professional sports leagues, Fanatics has built a vertically integrated platform spanning merchandise, collectibles, betting, and fan experiences. This ownership model continues to support innovation, operational control, and deep alignment with leagues, teams, and fans as the company evolves in 2026 and beyond.

FAQs

Who owns Fanatics?

Fanatics is owned and controlled by Michael Rubin, who founded the modern version of the company in 2011. As of 2026, Michael Rubin owns approximately 32% of Fanatics, making him the largest shareholder and giving him effective control. The remaining ownership is held by private equity firms, institutional investors, sports leagues, and employees.

Who owns Fanatics Sportsbook?

Fanatics Sportsbook is owned by Fanatics Betting & Gaming, which is a wholly owned operating division of Fanatics. It is not a separate or independently owned company. All sportsbook operations, licenses, and technology assets fall under Fanatics’ corporate ownership and governance.

How much did Jay-Z invest in Fanatics?

Jay-Z invested in Fanatics through its collectibles business as a strategic partner. However, the exact dollar amount of Jay-Z’s personal investment has not been publicly disclosed. He participated as part of a major funding round and also entered a strategic partnership through Roc Nation, focusing on athlete relationships and cultural branding rather than financial control.

What is the net worth of Michael Rubin?

As of January 2026, Michael Rubin’s net worth is estimated at $25 billion. The majority of his wealth is tied to his equity stake in Fanatics, along with proceeds from earlier ventures and private investments. His net worth fluctuates with Fanatics’ private valuation and long-term growth prospects.

What company owns Fanatics?

Fanatics is owned by Fanatics, Inc., a privately held company. There is no parent corporation above Fanatics. The business operates independently under its own corporate structure, with Michael Rubin serving as founder, chairman, and CEO.

Is Fanatics publicly owned?

No, Fanatics is not publicly owned. It is a private company and is not listed on any stock exchange. Its shares are held by founders, private equity firms, institutional investors, strategic partners, and employees, with no public trading of stock.