Dine Brands Global is one of America’s largest full-service dining companies. If you’ve ever visited Applebee’s or IHOP, you’ve interacted with their global brand portfolio. But who owns Dine Brands Global? In this article, we’ll explore ownership, key shareholders, leadership, revenues, and the brands it controls.

Dine Brands Global Company Profile

Dine Brands Global Inc. is a publicly traded American holding company focused on restaurant franchises. It owns and manages three major dining brands: IHOP, Applebee’s, and Fuzzy’s Taco Shop. The company operates primarily through franchising, with over 98% of its restaurants owned by franchisees. This model allows the company to scale globally while maintaining lean operations.

Company Overview

- Full Name: Dine Brands Global, Inc.

- Ticker Symbol: DIN

- Exchange: New York Stock Exchange (NYSE)

- Headquarters: Pasadena, California, United States

- Industry: Restaurant, Foodservice, Franchising

- Business Model: Asset-light franchising with licensing and royalty income

- Global Presence: Thousands of restaurants across the U.S. and in international markets

Dine Brands is considered one of the largest full-service dining franchisors in the world. It has a presence in over 20 countries and continues to explore growth in emerging markets.

Founders

The company traces its origins to Al and Jerry Lapin, who founded the International House of Pancakes (IHOP) in 1958 in Toluca Lake, Los Angeles, California. Their vision was to create a breakfast-centric restaurant that served affordable meals in a welcoming environment. IHOP’s early success laid the foundation for what would eventually become Dine Brands Global.

Applebee’s, the other flagship brand, was founded by Bill and T.J. Palmer in 1980 in Decatur, Georgia. Applebee’s focused on neighborhood-style casual dining with American cuisine.

Though Dine Brands was not directly founded by any of these individuals, it was formed as a corporate evolution and merger of these foundational restaurant concepts.

Major Milestones

- 1958: IHOP is founded by Al and Jerry Lapin in California.

- 1980: Applebee’s is founded by Bill and T.J. Palmer in Georgia.

- 2007: IHOP Corporation acquires Applebee’s International for $2.1 billion, forming the combined entity DineEquity, Inc.

- 2010s: Focus shifts to asset-light franchising, with the sale of hundreds of company-owned restaurants to franchisees.

- 2018: DineEquity rebrands to Dine Brands Global, signaling a broader strategy and global ambitions.

- 2021: John Peyton becomes CEO, bringing a renewed focus on innovation and global growth.

- 2022: Dine Brands acquires Fuzzy’s Taco Shop, a fast-casual Mexican food chain, marking its entry into the fast-casual segment.

- 2024–2025: Dine Brands expands its digital ordering systems and launches new international locations, especially in Asia and the Middle East.

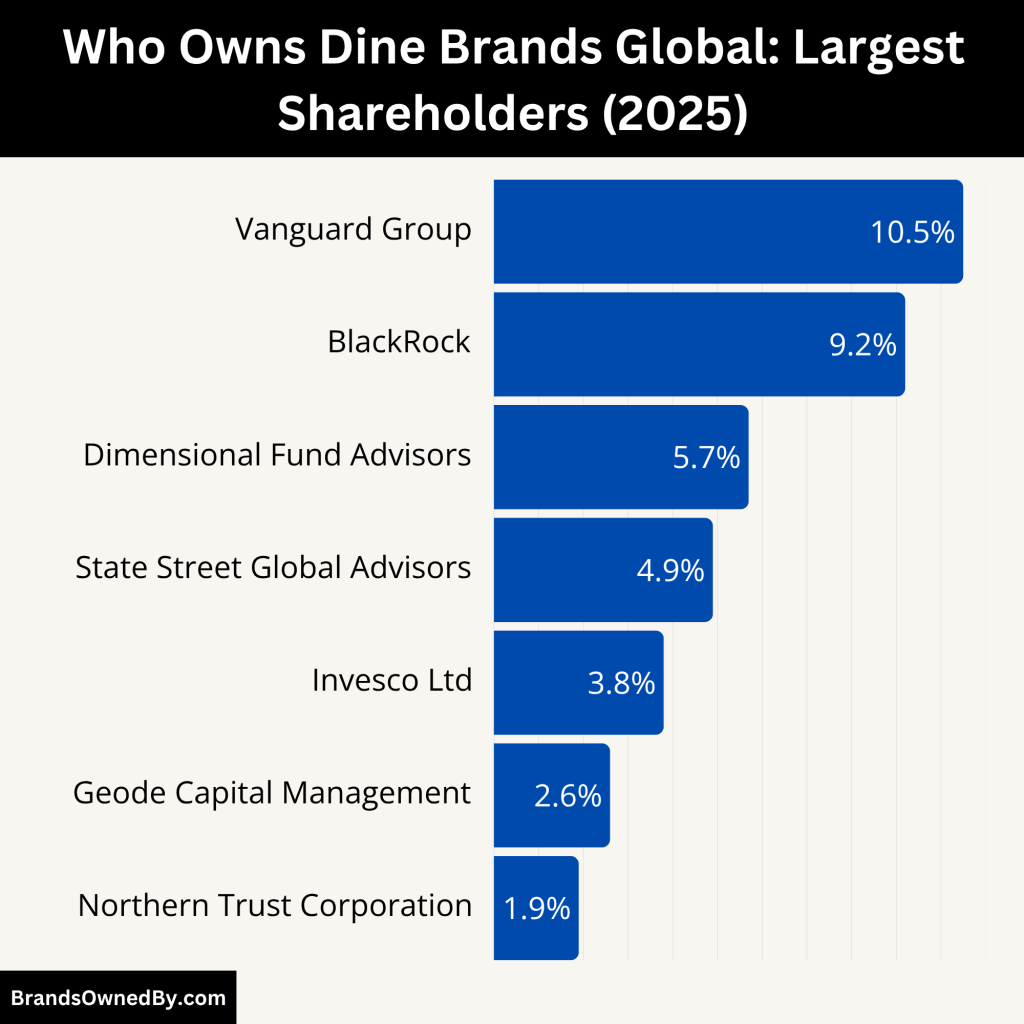

Who Owns Dine Brands Global: Major Shareholders

Dine Brands Global is a publicly traded company listed on the New York Stock Exchange under the ticker DIN. It is not privately owned or held by any single family or conglomerate. Instead, it is owned by a mix of institutional investors, mutual funds, and retail shareholders. The company’s largest shareholders are financial firms that hold equity stakes through investment portfolios.

There is no single controlling owner of Dine Brands Global. However, a few investment institutions hold significant shares and influence shareholder voting and strategy. The board of directors and executive leadership, led by the CEO, steer the company’s daily operations and long-term planning.

Summary of shareholding control:

- Institutional Investors: Over 70% combined control

- Retail Investors: Estimated at 20–25%

- Insiders/Executives: Less than 2%

- Major Voting Power: Concentrated in Vanguard, BlackRock, and Dimensional.

Here’s a list of the top shareholders of Dine Brands Global:

| Shareholder Name | Ownership % (2025) | Investor Type | Level of Influence/Control |

|---|---|---|---|

| The Vanguard Group, Inc. | 10.5% | Institutional (Passive) | Major voting power, top shareholder |

| BlackRock, Inc. | 9.2% | Institutional (Passive) | Significant governance influence |

| Dimensional Fund Advisors | 5.7% | Institutional (Passive) | Long-term investor, supports value strategies |

| State Street Global Advisors | 4.9% | Institutional (Passive) | Emphasizes ESG and governance oversight |

| Invesco Ltd. | 3.8% | Institutional (Active) | Focused on return maximization |

| Geode Capital Management | 2.6% | Institutional (Passive) | Sub-advisor to Fidelity, indexed fund investor |

| Northern Trust Corporation | 1.9% | Institutional (Passive) | Conservative governance participant |

| Insider/Executive Shareholders | <1.5% | Internal Leadership | Low ownership, aligned through compensation |

| Retail & Other Institutional | ~60%–65% combined | Mixed | Limited direct control, impacts liquidity |

The Vanguard Group, Inc.

Vanguard is the largest shareholder of Dine Brands Global. As of 2025, it owns approximately 10.5% of the company’s outstanding shares. Vanguard is a passive investment firm, meaning it does not intervene in day-to-day business operations. However, due to its significant equity stake, it holds major voting rights on strategic matters including board elections and executive compensation.

Vanguard’s ownership gives it strong influence over corporate governance and long-term value direction. It typically supports sustainable growth, ESG integration, and shareholder-friendly practices.

BlackRock, Inc.

BlackRock holds around 9.2% of Dine Brands Global in 2025. Like Vanguard, it is a passive institutional investor with considerable influence. BlackRock supports policies around environmental responsibility and governance transparency.

It often votes in favor of long-term stability and tends to align with management when performance remains steady. BlackRock’s shares are held across multiple funds and retirement portfolios, giving it indirect control over a broad base of retail investors.

Dimensional Fund Advisors

Dimensional Fund Advisors owns approximately 5.7% of Dine Brands Global. It is a long-term investor focused on value stocks. DFA doesn’t actively engage in company operations but exercises its voting rights to support initiatives aligned with maximizing shareholder returns.

Dimensional’s presence reflects investor confidence in Dine Brands’ franchising model and recurring income strategy. Its voting pattern usually supports conservative management decisions and stability-focused leadership.

State Street Global Advisors

State Street controls about 4.9% of the company’s stock. It is another major passive investor with voting power in annual meetings and governance matters. State Street typically emphasizes board diversity, shareholder rights, and consistent financial reporting.

Though State Street does not seek direct control, its shareholding helps balance the influence of other institutions and provides a layer of investor oversight on leadership decisions.

Invesco Ltd.

Invesco holds an estimated 3.8% stake in Dine Brands Global. It is an active asset manager with interest in mid-cap and consumer discretionary companies. Invesco is known for deeper involvement in portfolio performance, often pushing for innovation, cost efficiency, and returns on equity.

While not among the top three holders, its voting power can play a pivotal role in close decisions during shareholder meetings.

Geode Capital Management

Geode Capital Management owns around 2.6% of the company. It operates mainly as a sub-advisor to Fidelity funds. Although not a vocal investor, its steady presence represents institutional confidence in Dine Brands as a stable, dividend-paying company.

Geode supports passive investing strategies, and its shares are typically held in indexed mutual funds and retirement accounts.

Northern Trust Corporation

Northern Trust holds approximately 1.9% of the stock. It provides wealth and asset management services. Its stake in Dine Brands comes through mutual funds and retirement assets. It participates in proxy votes and typically supports management proposals unless corporate performance declines.

Other Institutional and Retail Shareholders

Aside from major institutions, thousands of retail investors and smaller mutual fund managers own the remaining 60–65% combined of shares. These include pension funds, ETFs, hedge funds, and private investment accounts.

Retail shareholders typically do not influence governance decisions directly but are important in establishing stock liquidity. Together, these smaller investors benefit from dividends and long-term capital gains from Dine Brands Global’s franchising performance.

Insider and Executive Shareholding

Dine Brands executives, including board members and top-level management, hold a small percentage of shares—estimated at under 1.5% as of 2025. These holdings often come through stock compensation, performance incentives, and option grants.

CEO John Peyton holds a modest personal stake, reflecting alignment with shareholder interests. Other board members and C-suite executives also maintain equity to tie leadership performance to company value.

Who is the CEO of Dine Brands Global?

As of 2025, John Peyton leads Dine Brands Global. He stepped into the CEO position in 2021. He brings a wealth of experience in hospitality and franchise systems, having previously held senior roles at Realogy and Starwood Hotels & Resorts. Peyton’s leadership underscores a strategic shift toward innovation, digital ordering, and global expansion. His focus includes enhancing guest experience through technology, optimizing operations with data-driven insights, and supporting franchisee success internationally.

Leadership Style and Decision-Making Structure

John Peyton follows a collaborative approach. He works closely with the executive leadership team while reporting directly to the board of directors. Strategic decisions—like brand acquisitions, international growth, and tech investments—are proposed by Peyton and reviewed by the board. The board comprises independent directors and major stakeholders, ensuring balanced oversight.

Peyton emphasizes transparent communication with franchisees and investors. He regularly hosts calls with franchise partners to review performance, new initiatives, and brand standards. Within the company, his model encourages input from marketing, operations, finance, and IT teams.

Key Achievements Under Peyton

Since taking the helm, Peyton has overseen:

- The acquisition of Fuzzy’s Taco Shop in 2022.

- Expansion of digital tools, including mobile ordering and loyalty programs.

- Launch of new IHOP and Applebee’s locations in Asia and the Middle East.

- Improved same-store sales performance and franchisee satisfaction.

Past CEOs of Dine Brands Global

Stephen P. Joyce (2017–2021)

Joyce modernized the business by expanding delivery services, revamping marketing strategies, and increasing operational efficiencies. He laid the foundation for Peyton’s digital acceleration.

Julia A. Stewart (2007–2017)

Stewart led the acquisition of Applebee’s and spearheaded the transformation from IHOP Corporation to DineEquity. She focused on integrating the two brands and establishing the firm’s multi-brand identity.

Donald P. Morton (Interim, 2017)

Before Joyce, Morton served as interim CEO following Stewart’s departure. He maintained business continuity during the transition, focusing on financial discipline and franchise stability.

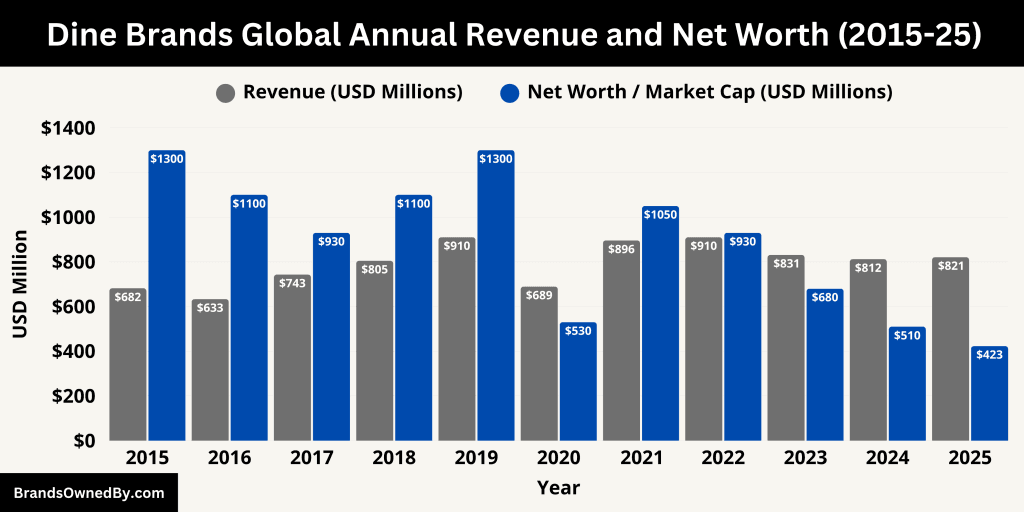

Dine Brands Global Annual Revenue and Net Worth

In calendar year 2024, Dine Brands Global reported revenue of $812.3 million, marking a 2.3% decline from the previous year’s $831.1 million. The fall was primarily due to softer franchise revenue and a dip in same-store sales at IHOP and Applebee’s.

For the 12 months ending March 31, 2025, total revenue reached $820.9 million, a marginal year-over-year decrease of 0.3%. In Q1 2025 alone, revenues climbed to $214.8 million, up 4.1% compared to Q1 2024. This growth was driven partly by the addition of 47 acquired Applebee’s restaurants.

Here’s a quick summary of the financial metrics:

| Metric | Value (2025) |

|---|---|

| Revenue (2024) | $812.3 million |

| Revenue (TTM ending Mar 31, 2025) | $820.9 million |

| Q1 2025 Revenue | $214.8 million (+4.1% YoY) |

| Market Capitalization | $423 million |

| Enterprise Value | $1.87 billion |

Revenue Breakdown

- Franchise royalties and fees continue to constitute the majority of revenue.

- Company-operated restaurants have added to sales, particularly following Q4 2024’s Applebee’s acquisitions.

- Off‑premise sales (takeout/delivery) contributed around 23% in Q1 2025.

Profitability and Cash Flow

- The company maintained strong free cash flow through 2024, despite a challenging market.

- Q1 2025 saw slightly lower earnings per share, but the asset-light franchising model supported steady capital generation.

Net Worth (Market Capitalization)

Dine Brands Global’s market capitalization stood at approximately $423 million as of mid‑June 2025. This reflects the total value of its publicly traded shares.

Beyond equity, the company’s enterprise value—which includes debt and cash balance—was estimated at around $1.87 billion.

Here is a detailed 10-year historical overview of Dine Brands Global’s annual revenue and estimated net worth (market capitalization) from 2015 to 2025:

| Year | Revenue (USD Millions) | Estimated Net Worth / Market Cap (USD Millions) |

|---|---|---|

| 2025* | 820.9 (TTM est.) | 423 |

| 2024 | 812.3 | ~510 |

| 2023 | 831.1 | ~680 |

| 2022 | 910.2 | ~930 |

| 2021 | 896.0 | ~1,050 |

| 2020 | 689.3 | ~530 |

| 2019 | 910.2 | ~1,300 |

| 2018 | 804.8 | ~1,100 |

| 2017 | 743.1 | ~930 |

| 2016 | 633.3 | ~1,100 |

| 2015 | 681.9 | ~1,300 |

Companies Owned by Dine Brands Global

As of 2025, Dine Brands Global owns and operates three active consumer-facing brands and multiple internal divisions to support its global expansion. The company has maintained a focus on franchising and does not operate a large number of corporate-owned restaurants, allowing for profitability with minimal overhead.

Here are the major companies and brands owned by Dine Brands Global as of June 2025:

| Brand/Entity | Type | Description |

|---|---|---|

| IHOP | Full-service restaurant | Family-style breakfast chain, global presence |

| Applebee’s Neighborhood Grill | Casual dining | American bar-and-grill franchise, global presence |

| Fuzzy’s Taco Shop | Fast-casual dining | Tacos and Mexican fare, focused on younger customers |

| Dine Brands Global LLC | Holding/operational | Manages contracts, franchise ops, legal, marketing |

| Franchise Support Divisions | Internal departments | Support franchisees, develop new markets, enhance tech |

IHOP (International House of Pancakes)

IHOP is the original brand from which Dine Brands Global evolved. Founded in 1958, it remains the company’s flagship breakfast chain. IHOP operates over 1,700 locations worldwide in 2025, with restaurants in the United States, Mexico, the Middle East, and parts of Asia.

The brand is known for its pancakes, omelettes, and family-friendly atmosphere. It has also introduced a dinner menu and late-night hours to increase revenue per location. IHOP is almost entirely franchised, which contributes to the company’s low capital expenditure.

The company continues to experiment with new formats such as:

- IHOP Express (quick-service model for airports, travel centers, and universities)

- Flip’d by IHOP (urban fast-casual concept focused on portable breakfast and coffee)

IHOP remains the largest revenue contributor to Dine Brands through royalty streams and licensing deals.

Applebee’s Neighborhood Grill + Bar

Applebee’s was acquired by IHOP Corporation in 2007 for over $2 billion, making it one of the most significant restaurant acquisitions in U.S. history. This merger led to the formation of DineEquity (now Dine Brands Global).

As of 2025, Applebee’s operates more than 1,600 restaurants globally, including locations in the U.S., Latin America, the Middle East, and select parts of Asia. The brand positions itself as an affordable casual dining option with an “Eatin’ Good in the Neighborhood” theme. It offers burgers, steaks, appetizers, and cocktails.

Applebee’s is now 99% franchised, with most company-owned locations either refranchised or sold. The company also acquired 47 franchisee-owned Applebee’s restaurants in 2024 to improve operational consistency and test innovation in-house.

Applebee’s focuses heavily on:

- Off-premise dining (delivery and takeout)

- Bar-focused promotions

- Localized marketing strategies

Fuzzy’s Taco Shop

In late 2022, Dine Brands Global acquired Fuzzy’s Taco Shop, a fast-casual Mexican restaurant chain. This marked the company’s first expansion into the fast-casual category. As of 2025, Fuzzy’s has over 150 locations across college towns, urban centers, and southern states.

Fuzzy’s offers a youthful, energetic brand centered on street-style tacos, burritos, nachos, margaritas, and a laid-back vibe. It targets younger demographics and has gained popularity for its affordable pricing and casual bar-like setting.

Fuzzy’s continues to operate under its existing brand structure but benefits from Dine Brands’ franchise support system, marketing resources, and supply chain network. The company is actively working on expanding Fuzzy’s into the western U.S. and select international markets.

Dine Brands Global LLC (Operating Entity)

Dine Brands Global LLC is the legal and operational subsidiary through which the parent company manages assets, licensing agreements, and franchising deals. It doesn’t operate as a customer-facing brand but plays a central role in handling:

- Franchise agreements and fee collection

- Brand development and marketing strategy

- Real estate negotiations and leases

- Tech and operations support for IHOP, Applebee’s, and Fuzzy’s

It also manages shared services such as digital platforms, HR, training systems, and global franchisee support.

Franchise Development Units

Dine Brands has created several internal business development and franchise strategy units to handle new market entries, partner selection, and compliance across regions. These include:

- International Development Division – manages brand growth outside the U.S.

- Domestic Franchise Operations – ensures consistency across U.S.-based locations

- Off-Premise Innovation Team – focuses on improving delivery, pickup, ghost kitchens, and virtual brand integration.

Final Thoughts

Dine Brands Global is a significant player in the global restaurant industry. Its ownership is distributed among institutional shareholders like Vanguard and BlackRock, with leadership under CEO John Peyton. The company continues to grow through its three main restaurant brands: IHOP, Applebee’s, and Fuzzy’s Taco Shop. Understanding who owns Dine Brands Global helps reveal how this company makes decisions and adapts to changing consumer trends.

FAQs

Who owns DIN?

Dine Brands Global (ticker symbol: DIN) is a publicly traded company primarily owned by institutional investors. As of 2025, the largest shareholder is Msd Capital L.P., holding approximately 21% of the company’s shares. Other major institutional investors include AllianceBernstein (around 9–10%), BlackRock (approximately 8–9%), and The Vanguard Group (about 6–7%). There is no single individual owner; ownership is widely distributed among public and institutional shareholders.

Who is the CEO of Dine Brands globally?

As of 2025, the CEO of Dine Brands Global is John Peyton. He has held the position since 2021. Under his leadership, the company has expanded digital capabilities, acquired Fuzzy’s Taco Shop, and focused on international growth.

Who is the owner of IHOP?

IHOP is owned by Dine Brands Global, Inc., a publicly traded restaurant holding company. IHOP is one of the core brands operated by Dine Brands alongside Applebee’s and Fuzzy’s Taco Shop.

Who is the CFO of Dine Brands?

As of 2025, the Chief Financial Officer (CFO) of Dine Brands Global is Vance Y. Chang. He oversees financial strategy, investor relations, budgeting, and operational finance across the company’s brands.

Does McDonald’s own IHOP?

No, McDonald’s does not own IHOP. IHOP is owned by Dine Brands Global, which is a completely separate company and has no corporate relationship with McDonald’s.

Where’s Dine Brands headquartered?

Dine Brands Global is headquartered in Pasadena, California, United States. It operates from this central office to manage global operations and franchise partnerships.

Does Dine Brands own a restaurant?

Yes, Dine Brands owns and operates a limited number of company-run restaurants, primarily for testing and operational control. However, more than 98% of its locations are franchised, meaning they are owned and operated by independent franchisees.

Where is Dine Brands Global located?

Dine Brands Global is located in Pasadena, California, but it operates a global network of restaurants through its IHOP, Applebee’s, and Fuzzy’s Taco Shop brands. It has a growing presence in the Americas, the Middle East, and parts of Asia.

Who owns Dine Brands Global?

Dine Brands Global is a public company. It is primarily owned by institutional investors like Vanguard, BlackRock, and Dimensional Fund Advisors.

Is Dine Brands a franchise?

Yes, most of its restaurants are franchised. Over 98% of Applebee’s and IHOP locations are owned and operated by franchisees.

What brands does Dine Brands own?

It owns IHOP, Applebee’s, and Fuzzy’s Taco Shop.

What is the net worth of Dine Brands?

As of June 2025, its estimated net worth is $1.8 billion.

When was Dine Brands Global founded?

The original company, IHOP, was founded in 1958. Dine Brands itself was formed after the acquisition of Applebee’s in 2007.