Crocs is one of the most recognizable footwear brands in the world. Known for its comfort-first design and unique style, the company has a global presence and a loyal fan base. Many people ask who owns Crocs, how the company is structured, and who makes the decisions behind the brand. Let’s explore the ownership, leadership, and business profile of Crocs in detail.

Crocs Company Profile

Crocs, Inc. is a global footwear company famed for its light, cushioned casual shoes. It sells under two main brands: Crocs and HEYDUDE. Its flagship product—the Classic Clog—is made of a proprietary resin called Croslite™, known for soft cushioning and odor resistance. Since the company’s 2002 launch, it has sold over 850 million pairs across more than 85 countries.

Crocs Founders

Crocs was founded in 2002 by three Boulder, Colorado entrepreneurs: Scott Seamans, Lyndon “Duke” Hanson, and George Boedecker Jr. Inspired by a prototype boat shoe created by Foam Creations, they acquired manufacturing rights, refined the design, and launched the first model—“The Beach”—at the Fort Lauderdale Boat Show. All initial pairs sold out instantly.

Boedecker became the first CEO, Hanson led operations, and Seamans handled product design. The brand name “Crocs” was chosen to evoke the crocodile’s adaptability on land and water.

Major Milestones

Crocs’ journey is marked by several key stages:

- 2002: Launch of the first Crocs clog, “The Beach,” at the boat show—instant sell-out.

- 2005: Rebranded with the “Ugly Can Be Beautiful” campaign; prepared for IPO.

- 2006: Successful IPO on Nasdaq at $21/share, raising $208 million.

- 2008–2013: Faced financial setbacks amid economic downturn; profit warnings and restructuring ensued.

- 2016: Fashion transformation began with a high-profile collaboration by Christopher Kane at London Fashion Week.

- 2021: Celebrity endorsements (e.g., Nicki Minaj, Justin Bieber) and TikTok trends revived demand.

- 2022: Acquired lifestyle brand HEYDUDE for $2.5 billion, broadening its product lineup.

- 2024–2025: Crocs rebounded strongly, reporting solid Q4 earnings and sending its stock soaring nearly 19% amid optimistic profit forecasts.

- China expansion (2025): Became Crocs’ second-largest market; drove growth through local designs, celebrity campaigns, and Gen Z marketing.

- 2025 challenges: The brand faced headwinds from U.S. tariffs, causing share prices to drop nearly 30% and revenue anticipated to decline 9–11% for the quarter.

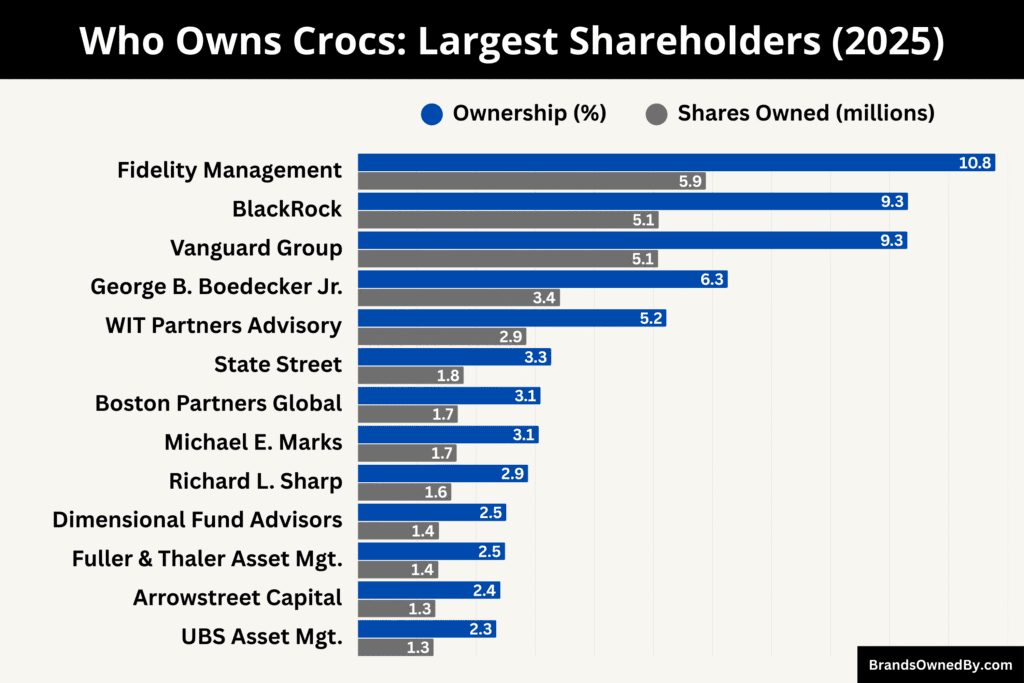

Who Owns Crocs: Major Shareholders

Crocs is a publicly traded company, which means it does not have a single owner. Instead, its ownership is divided among institutional investors, mutual funds, individual shareholders, and company insiders. The largest shareholders are global investment firms that hold significant stakes, giving them influence over corporate decisions.

Ownership is geographically diverse. The majority (over 80%) of shareholders are based in the United States. Singapore represents a notable chunk (around 10%), largely due to WIT Partners. Smaller holdings come from investors in the UK, Australia, Canada, and elsewhere. This distribution highlights Crocs’ global appeal and investor reach.

Below is a list of the largest shareholders of Crocs as of August 2025:

| Shareholder / Institution | Ownership % | Shares Owned (approx.) | Type of Shareholder | Notes on Control / Influence |

|---|---|---|---|---|

| Fidelity Management & Research (FMR) | 10.79% | 5.89 million | Institutional | Largest institutional investor, long-term focus |

| BlackRock, Inc. | 9.31% | 5.09 million | Institutional | Major asset manager, strong governance role |

| The Vanguard Group, Inc. | 9.30% | 5.08 million | Institutional | Passive index-driven, stable holder |

| WIT Partners Advisory Pte Ltd. | 5.22% | 2.85 million | Institutional | Key Asian institutional investor |

| State Street Global Advisors | 3.27% | 1.79 million | Institutional | Brings governance oversight |

| Boston Partners Global Investors | 3.09% | 1.69 million | Institutional | Value-investing focus |

| Dimensional Fund Advisors LP | 2.51% | 1.37 million | Institutional | Data-driven, long-term investor |

| Fuller & Thaler Asset Management | 2.49% | 1.36 million | Institutional | Behavioral finance approach |

| Arrowstreet Capital, LP | 2.41% | 1.31 million | Institutional | Quant-driven fund |

| UBS Asset Management AG | 2.34% | 1.28 million | Institutional | Global investment outlook |

| George B. Boedecker Jr. | 6.26% | 3.42 million | Individual / Founder | Largest individual shareholder, co-founder |

| Michael E. Marks | 3.06% | 1.67 million | Insider | Early leader, insider influence |

| Richard L. Sharp | 2.88% | 1.58 million | Insider | Long-term insider presence |

| Andrew Rees (CEO) | 2.12% | 1.16 million | Insider / Executive | CEO with direct shareholder alignment |

| Other Institutional Investors* | 1–2% each | — | Institutional | Includes AllianceBernstein, Geode, Samlyn, Citadel, LSV, Invesco, T. Rowe Price |

Fidelity Management & Research Co. (FMR LLC)

Fidelity Management & Research, part of FMR LLC, is the largest institutional shareholder of Crocs with a stake of around 10.79%, representing nearly 5.89 million shares as of March 2025. This sizable position gives Fidelity significant influence over governance and strategic direction. Its long-term investment strategy indicates confidence in Crocs’ global growth trajectory and brand strength.

BlackRock, Inc.

BlackRock holds roughly 9.31% of Crocs, equal to about 5.09 million shares as of June 2025. As one of the world’s leading asset managers, BlackRock brings global market expertise and consistent oversight. Its large passive index funds ensure it remains a stable and long-term holder, often playing a decisive role in corporate voting and policy-making.

The Vanguard Group, Inc.

The Vanguard Group owns approximately 9.30%, or about 5.08 million shares, as of June 2025. Vanguard’s focus on index-based investing means its interest is closely tied to Crocs’ long-term value rather than short-term gains. As one of the largest institutional owners, it adds balance and stability to Crocs’ shareholder base.

WIT Partners Advisory Pte Ltd.

WIT Partners, based in Singapore, has become Crocs’ largest non-U.S. institutional investor. It owns around 5.22% of the company, translating to 2.85 million shares as of June 2025. Its involvement highlights Crocs’ international appeal and ensures an Asian institutional perspective within the company’s ownership mix.

State Street Global Advisors

State Street controls about 3.27%, or nearly 1.79 million shares, as of March 2025. As one of the “big three” asset managers, State Street is heavily involved in governance practices and brings institutional discipline to Crocs’ long-term growth strategies.

Boston Partners Global Investors, Inc.

Boston Partners owns around 3.09%, equivalent to 1.69 million shares as of June 2025. Known for its value-investing approach, Boston Partners plays a more selective but steady role in Crocs’ ownership, signaling confidence in the company’s brand resilience and market expansion.

Dimensional Fund Advisors LP

Dimensional Fund Advisors holds approximately 2.51%, or about 1.37 million shares as of June 2025. Its systematic and data-driven investment style contributes analytical rigor to shareholder discussions, often pushing for sustainable and evidence-based corporate strategies.

Fuller & Thaler Asset Management Inc.

Fuller & Thaler owns about 2.49%, translating to 1.36 million shares as of March 2025. This firm is known for applying behavioral finance theories in its investments, suggesting it values Crocs’ unique brand momentum and consumer-driven growth model.

Arrowstreet Capital, Limited Partnership

Arrowstreet Capital holds around 2.41%, or 1.31 million shares as of March 2025. As a quant-driven fund, it emphasizes data and algorithms in decision-making. Its position reflects a vote of confidence in Crocs’ performance consistency and international expansion opportunities.

UBS Asset Management AG

UBS Asset Management owns approximately 2.34%, which equals 1.28 million shares as of March 2025. Its global investment outlook introduces cross-border perspectives into Crocs’ shareholder structure, reinforcing international investor confidence in the brand.

George B. Boedecker Jr. (Founding Shareholder)

George B. Boedecker Jr., one of Crocs’ original founders, remains the largest individual shareholder. He holds about 6.26% of the company, equal to 3.42 million shares. His continued presence as a shareholder ensures that the company retains ties to its entrepreneurial roots and original vision.

Michael E. Marks (Insider)

Michael E. Marks, a key insider, owns roughly 3.06% of Crocs, which is about 1.67 million shares. His involvement reflects both historical leadership and ongoing influence in shaping Crocs’ governance and growth.

Richard L. Sharp (Insider)

Richard L. Sharp, another notable insider, holds around 2.88%, translating to 1.58 million shares. His stake highlights long-term confidence in the company’s strategy and ensures insider alignment with shareholders’ interests.

Andrew Rees (CEO)

Andrew Rees, the current CEO of Crocs, owns about 2.12%, or roughly 1.16 million shares. This ownership directly aligns his leadership decisions with shareholder value creation, reinforcing accountability at the executive level.

Additional Institutional Shareholders

Other significant shareholders include AllianceBernstein L.P., Samlyn Capital, Geode Capital, Citadel Advisors, LSV Asset Management, Invesco Ltd., and T. Rowe Price, each holding between 1% and 2% of Crocs. These investors, though smaller in comparison, contribute to the diversity of Crocs’ ownership base and ensure a wide range of institutional perspectives.

Who Manufactures Crocs?

Crocs primarily manufactures its footwear through a combination of in-house production and strategic outsourcing. The company designs its proprietary Croslite material, which is lightweight, durable, and provides the signature comfort of Crocs shoes.

While Crocs oversees the design, material development, and quality control in-house, much of the actual production is coordinated through its global manufacturing partners.

Global Manufacturing Partners

To meet worldwide demand, Crocs relies on contract manufacturers and third-party partners across Asia and other regions. Key manufacturing hubs include China, Vietnam, and Indonesia, where specialized factories produce the bulk of Crocs’ footwear.

These partners adhere to Crocs’ strict quality standards and production specifications to ensure consistency in comfort, durability, and design.

Regional Production Facilities

In addition to overseas partners, Crocs operates regional facilities that help streamline distribution and manage logistics. These facilities support large-scale orders, seasonal demand surges, and market-specific customization. By balancing global partnerships with strategic regional operations, Crocs maintains efficiency and timely delivery to its international retail network.

Quality Control and Material Innovation

While production may be outsourced, Crocs retains full control over design and material innovation. The proprietary Croslite resin is processed and molded according to strict standards to ensure each pair meets performance, comfort, and safety expectations. This approach allows Crocs to maintain a uniform brand experience worldwide, regardless of manufacturing location.

Who is the CEO of Crocs?

Andrew Rees has been steering Crocs as Chief Executive Officer since June 2017, when he also joined the Board of Directors. Before becoming CEO, he served as President starting in June 2014, playing a key role in shaping the company’s strategic turnaround and global expansion.

Rees brings over 25 years of experience in the footwear and retail industry. Before joining Crocs, he was Managing Director at L.E.K. Consulting in Boston, where he founded and led the Retail and Consumer Products Practice for 13 years.

He also held leadership roles as Vice President of Strategic Planning and Retail Operations at Reebok International and served in various capacities at Laura Ashley.

Strategic Role in Crocs’ Transformation

As CEO, Rees led Crocs through a major comeback. Under his leadership, the company narrowed its product focus, revitalized its marketing strategy, and reignited brand appeal—particularly around its signature clog. His strategic direction extended to digital initiatives, brand collaborations, and key acquisitions like HEYDUDE, all of which reshaped Crocs into a unified, multi-brand footwear company.

Adapting to Market Challenges in 2025

In 2025, Rees guided Crocs through a volatile retail environment marked by rising tariffs, cautious consumer spending, and shifting fashion trends. He has emphasized cost management, including expense cuts, inventory discipline, and reduced promotional activity to preserve brand equity. These strategic moves aimed to protect long-term profitability amid a challenging operating climate.

Vision for the Future

Rees continues to balance short-term resilience with long-term growth. He is focused on maintaining cash flow strength, enhancing brand relevance across both Crocs and HEYDUDE, and navigating external pressures with disciplined execution. His leadership remains central to steering Crocs forward in a complex, dynamic market.

Previous CEOs of Crocs

Ronald R. Snyder (2004–circa 2007)

Ronald R. Snyder took the helm as CEO in the mid-2000s, succeeding the founding management team. His leadership coincided with Crocs’ transition from startup to public company. Under his guidance, the company prepared for its IPO, completed in 2006, and began expanding its retail presence. Snyder’s tenure included navigating early brand growing pains and laying the groundwork for broader market penetration.

Gregg Ribatt (interim 2015; full CEO 2015–2017)

Gregg Ribatt served briefly as interim CEO in early 2015 before being appointed full-time later that year. Alongside Andrew Rees—who was then President—they focused on tightening operations, simplifying product lines, and reviving core brand relevance. During this period, the company shifted away from over-diversification and refocused on the classic clog, setting the stage for Crocs’ renaissance.

Andrew Rees (CEO, 2017–Present)

Andrew Rees assumed the combined role of President and CEO in 2017. His tenure marked a dramatic turnaround. He embraced digital transformation, infused fashion credibility through high-profile collaborations, and oversaw strategic acquisitions such as HEYDUDE. Rees steered Crocs from near obscurity to renewed relevance, nurturing its appeal across diverse consumer groups and global markets.

Crocs Annual Revenue and Net Worth

Annual Revenue values reflect the total sales Crocs generated each year. These figures show a clear upward trend from 2015’s $1.09 billion to around $4.10 billion in 2024–2025—highlighting significant growth, particularly during and after the pandemic.

Crocs’ net worth has shifted notably in 2025. From a high of over $6 billion in the early months, it declined to a more tempered valuation in the $4.5–$5.9 billion range by August.

Crocs Revenue 2025

Crocs achieved a new milestone by reporting annual revenues of $4.1 billion for the full year 2024. This figure marked a 4% increase compared to the previous year, highlighting steady growth despite evolving market conditions.

CEO Andrew Rees emphasized that stronger performance from the core Crocs brand and improved demand in markets like China contributed to this record result. The strong cash flow generated allowed the company to enhance shareholder returns and reduce debt.

Trailing Twelve-Month Revenue to Mid-2025

Continuing into 2025, Crocs sustained its momentum with solid revenue figures. For the twelve months ending June 30, 2025, total revenue stood at $4.14 billion. Revenue in the second quarter alone reached approximately $1.1 billion, representing a healthy 22.6% increase over the prior quarter.

While Crocs enjoyed revenue gains, its market valuation has experienced pressure. Over the past year, the market cap declined significantly—by over 40%—reflecting broader investor caution amid uncertain consumer trends and tariff challenges.

Crocs has taken substantial strides to return cash to shareholders. Since 2019, the company has repurchased approximately $2.1 billion worth of shares—equal to about 37% of its market cap at that time. In February 2025, the board authorized an additional $1 billion for share buybacks, with roughly $1.3 billion now available.

Here’s an overview of Crocs’ net worth and annual revenue for the last 10 years from 2015-25:

| Year | Annual Revenue (USD billions) | Market Cap / Net Worth (USD billions) |

|---|---|---|

| 2015 | 1.09 | 0.75 |

| 2016 | 1.04 | 0.50 |

| 2017 | 1.02 | 0.88 |

| 2018 | 1.09 | 1.90 |

| 2019 | 1.23 | 2.85 |

| 2020 | 1.39 | 4.22 |

| 2021 | 2.31 | 7.54–7.67 |

| 2022 | 3.55 | 6.69–6.70 |

| 2023 | 3.96 | 5.65–5.66 |

| 2024 | 4.10 | 6.14–8.25 |

| 2025 (TTM) | 4.10 | 5.92 (as of July 2025) |

Crocs Net Worth 2025

Around August 2025, Crocs’ market valuation—a reflection of its overall net worth as perceived by the stock market—varied depending on the source. Some platforms estimated the company’s market capitalization at approximately $5.92 billion.

Another data point indicated a valuation near $4.55 billion. These variations are tied to differences in snapshot dates and valuation methodologies, but they consistently place Crocs in the $4.5 billion to $4.6 billion range.

This year, Crocs has experienced notable volatility in market value. Valuation ranged from as low as $4.17 billion to $4.37 billion in early to mid-August. Others even recorded a figure as low as $4.19 billion around August 11. These shifts highlight investor sensitivity to changing trends, tariffs, and economic factors.

Earlier in 2025, especially around January, some sources placed Crocs’ market valuation as high as $6.12 billion, although others suggested figures closer to $6.41 billion.

By mid-year, those figures had contracted significantly, reflecting a drop of more than 40% compared to the beginning of the year.

Companies Owned by Crocs

Crocs does not only operate under its main brand. It also owns other footwear companies that expand its market reach.

Below is a list of the major companies and brands owned by Crocs as of 2025:

| Company / Brand | Type | Key Focus / Role | Notes / Details |

|---|---|---|---|

| Crocs | Flagship Brand | Footwear | Signature clogs, sandals, boots, and collaborations; central brand driving global recognition and sales |

| HEYDUDE | Acquired Brand | Casual Footwear | Acquired in 2021; lightweight and comfortable shoes; broadens Crocs’ product portfolio |

| Jibbitz | Accessories Brand | Customization | Handles global distribution of Crocs products; key to international market growth |

| Ra Footwear | Subsidiary Brand | Sustainable Footwear | Focus on eco-friendly materials and manufacturing; aligns with Crocs’ sustainability strategy |

| Tagger International | Subsidiary Brand | Fashion Footwear | Trendy footwear targeting younger demographics; complements Crocs’ offerings |

| Tidal Trade | Subsidiary Brand | International Distribution | Oversees the Japanese market, retail, and distribution |

| Crocs Asia Pte Ltd | Regional Subsidiary | Operations / Distribution | Singapore-based entity managing Southeast Asian markets |

| Crocs Australia Pty Ltd | Regional Subsidiary | Operations / Distribution | Manages Australian market operations and retail |

| Crocs Canada Inc | Regional Subsidiary | Operations / Distribution | Oversees Canadian market operations, sales, and distribution |

| Crocs France Sarl | Regional Subsidiary | Operations / Distribution | Handles French market operations, marketing, and retail |

| Crocs Germany GmbH | Regional Subsidiary | Operations / Distribution | Manages German operations, distribution, and retail network |

| Crocs Japan GK | Regional Subsidiary | Operations / Distribution | Oversees Japanese market, retail, and distribution |

| Crocs UK Holdings Ltd | Regional Subsidiary | Operations / Distribution | Manages operations, sales, and retail across the UK |

| Crocs India Pvt Ltd | Regional Subsidiary | Operations / Distribution | Oversees Indian market operations, distribution, and marketing |

| Crocs China Ltd | Regional Subsidiary | Operations / Distribution | Handles manufacturing, sales, and distribution in China |

| Crocs Mexico S de RL de CV | Regional Subsidiary | Operations / Distribution | Manages operations and retail in Mexico |

| Crocs Brazil Comércio de Calçados Ltda | Regional Subsidiary | Operations / Distribution | Oversees Brazilian market operations and distribution |

| Crocs South Africa Pty Ltd | Regional Subsidiary | Operations / Distribution | Manages South African operations, retail, and marketing |

| Crocs Vietnam LLC | Regional Subsidiary | Operations / Distribution | Handles manufacturing and distribution in Vietnam |

| Crocs Malta Global Ltd | Regional Subsidiary | Operations / Distribution | Serves as a global operations and management hub |

Crocs Brand

The flagship Crocs brand remains central to the company’s identity. Renowned for its signature clog, Crocs has diversified its product line to include sandals, boots, and collaborations with various designers and artists. The brand’s emphasis on comfort, durability, and versatility has maintained its popularity across diverse consumer segments.

HEYDUDE

Acquired in December 2021 for $2.5 billion, HEYDUDE is a casual footwear brand known for its lightweight, comfortable shoes. Post-acquisition, Crocs has worked to integrate HEYDUDE into its portfolio, aiming to expand its market reach and appeal to a broader audience. Despite initial challenges, HEYDUDE continues to be a significant part of Crocs’ strategy to diversify its offerings.

Jibbitz

Jibbitz specializes in customizable accessories for footwear, particularly charms that fit into the holes of Crocs’ clogs. Acquired in 2006, Jibbitz has become an integral part of the Crocs experience, allowing consumers to personalize their shoes and express individuality. The brand has expanded its product range to include a variety of designs, catering to different tastes and preferences.

Ra Footwear

Ra Footwear is a subsidiary of Crocs, focusing on sustainable and eco-friendly footwear solutions. The brand emphasizes the use of recycled materials and environmentally conscious manufacturing processes. Ra Footwear aligns with Crocs’ commitment to sustainability and expanding its portfolio to include more eco-friendly options.

Tagger International

Tagger International operates as a subsidiary of Crocs, specializing in the design and distribution of fashion-forward footwear. The brand targets a younger demographic, offering trendy and stylish options that complement Crocs’ existing product lines. Tagger International’s inclusion in Crocs’ portfolio reflects the company’s strategy to appeal to a broader consumer base.

Tidal Trade

Tidal Trade is a subsidiary focusing on the distribution of Crocs products in international markets. The brand plays a crucial role in expanding Crocs’ global presence, ensuring that the company’s products reach consumers across various regions. Tidal Trade’s operations are integral to Crocs’ strategy of international growth and market penetration.

Crocs Subsidiaries and Global Entities

Crocs operates a network of subsidiaries and entities worldwide, facilitating its global operations and market presence. These include:

- Crocs Asia Pte Ltd (Singapore)

- Crocs Australia Pty Ltd (Australia)

- Crocs Canada Inc (Canada)

- Crocs France Sarl (France)

- Crocs Germany GmbH (Germany)

- Crocs Japan GK (Japan)

- Crocs UK Holdings Ltd (United Kingdom)

- Crocs India Pvt Ltd (India)

- Crocs China Ltd (China)

- Crocs Mexico S de RL de CV (Mexico)

- Crocs Brazil Comércio de Calçados Ltda (Brazil)

- Crocs South Africa Pty Ltd (South Africa)

- Crocs Vietnam LLC (Vietnam)

- Crocs Malta Global Ltd (Malta).

These subsidiaries manage various aspects of Crocs’ operations, including manufacturing, distribution, retail, and marketing, tailored to the specific needs and regulations of each region.

Conclusion

Crocs has established itself as a globally recognized footwear brand known for comfort, versatility, and distinctive style. Over the years, it has grown from a niche clog company into a multi-brand footwear company, expanding its offerings and global presence through innovation and strategic acquisitions. With its focus on quality, brand collaborations, and consumer appeal, Crocs continues to be a prominent and influential name in the footwear industry, maintaining popularity across diverse markets and age groups.

FAQs

Who owns Crocs company?

Crocs, Inc. is a publicly traded company, meaning it is owned by its shareholders. Ownership is distributed among institutional investors, individual investors, and company insiders. There is no single private owner controlling the company.

What companies does Crocs own?

Crocs owns several brands and subsidiaries, including HEYDUDE, Jibbitz, Ra Footwear, Tagger International, and Tidal Trade, along with a network of global subsidiaries that manage operations in markets such as China, India, Europe, and Australia.

Who manufactures Crocs?

Crocs are manufactured through a combination of in-house design and third-party manufacturing partners, primarily located in China, Vietnam, and Indonesia. The company oversees quality control and material innovation, while production facilities and contract manufacturers produce the footwear at scale.

Who established Crocs?

Crocs was established in 2002 by Lyndon “Duke” Hanson, Scott Seamans, and George Boedecker Jr. in Boulder, Colorado, USA. The company was created to offer comfortable, casual footwear for boating and outdoor activities.

Who created Crocs?

The original design of Crocs was based on a prototype called the “Beach Shoe”, which was designed by Lyndon “Duke” Hanson and George Boedecker Jr. with input from a Canadian company that initially developed the foam clog design.

Who owns Crocs stock?

Crocs stock is publicly traded on the NASDAQ under the ticker CROX. It is owned by a mix of institutional investors, individual investors, and company insiders, with ownership changing regularly through public trading.

Who invented Crocs?

Crocs were invented using a lightweight resin material called Croslite, developed by the founders with input from a Canadian company. The innovation focused on comfort, water-resistance, and lightweight wear, leading to the original clog design.

What country owns Crocs?

Crocs is an American company, founded and headquartered in Boulder, Colorado, USA. Its corporate headquarters and global management remain based in the United States.

Why are there 13 holes in Crocs?

The signature 13 holes on each Crocs shoe serve both functional and aesthetic purposes. Functionally, they provide ventilation and water drainage, making the shoes breathable and suitable for wet environments. They also allow for customization with Jibbitz charms.

What movie made Crocs famous?

Crocs gained cultural attention in the early 2000s, but their popularity spiked through celebrity endorsements, TV appearances, and viral trends, rather than a single movie. They became iconic in casual and pop culture contexts over time.

Which country designed Crocs?

Crocs were designed in the United States, specifically in Boulder, Colorado, by the founding team in 2002.

What’s Crocs’ founder’s net worth?

George Boedecker Jr., one of the founders of Crocs, has an estimated net worth in the range of hundreds of millions of dollars. His wealth is largely tied to his holdings in Crocs and the company’s growth over the years.