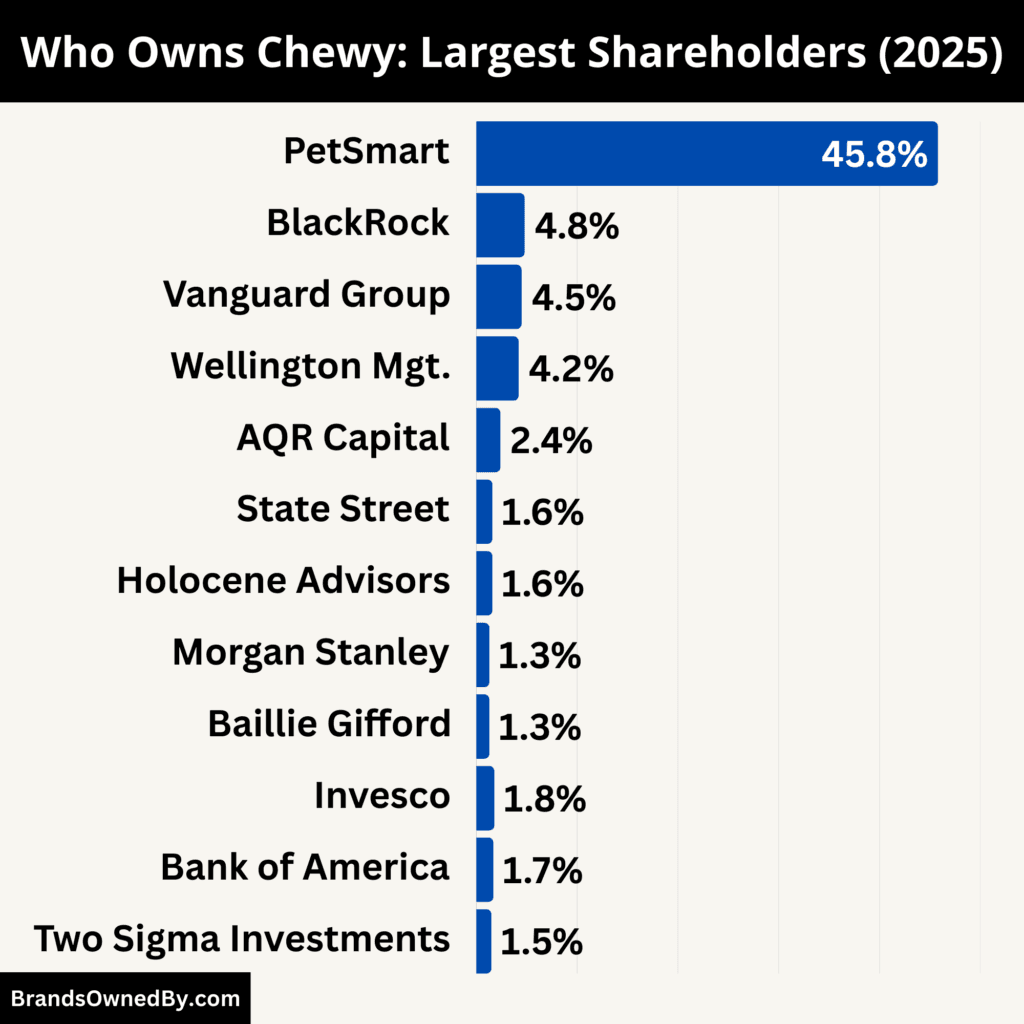

- Chewy is a publicly traded company with a mixed ownership structure, combining a controlling private-equity stake held through BC Partners / PetSmart and significant institutional investors.

- BC Partners remains the largest shareholder, controlling approximately 45.8% of Chewy’s shares, giving it substantial influence over strategic decisions and board matters.

- Major institutional shareholders include BlackRock (4.8%), Vanguard (4.5%), Wellington Management (4.2%), and other investment firms, which provide financial backing and governance oversight but do not control daily operations.

- Insider ownership by executives, including CEO Sumit Singh, is modest, aligning leadership with shareholder interests while ensuring that strategic control remains primarily with BC Partners and the board.

Chewy, Inc. is a major U.S. online retailer focused on pet food, supplies, healthcare, and services for pets and pet owners. It offers a wide range of products for dogs, cats, and other animals, including food, toys, accessories, medications, and wellness programs.

It is known for its strong customer service, convenient e-commerce platform, and subscription-based Autoship model that drives repeat purchases and customer loyalty. Chewy operates primarily online and has become a dominant name in the pet retail sector due to its broad product selection and reliable delivery.

The product catalog includes pet food, treats, toys, grooming supplies, and prescription and non-prescription medications. It also offers veterinary-related services such as telehealth consultations and in-person vet clinics under its Chewy Vet Care initiative.

Founders of Chewy

Chewy was founded by Ryan Cohen and Michael Day in 2011. Both men were young entrepreneurs with a shared belief that pet owners deserved a better online shopping experience. Their idea was to build a pet retailer that combined broad product choice with a highly personalized customer experience.

Ryan Cohen was the driving visionary behind Chewy. He was inspired by his own dog and the challenges of buying pet supplies online and in stores. Before Chewy, Cohen began his first business at age 15.

He learned early how customer experience and convenience could differentiate a business. When he launched Chewy, he took a personal approach. He invested heavily in customer service. Chewy mailed handwritten holiday cards. It offered round-the-clock support.

It even sent flowers to customers whose pets had died, creating emotional loyalty rarely seen in e-commerce. Cohen also pushed for rapid fulfillment and user-friendly technology that brought Amazon-style convenience to pet retail.

He faced rejection from more than 100 venture capital firms before securing Chewy’s first major funding. Early investors like Volition Capital backed the founders after seeing their conviction and customer focus. Over the first several years, Cohen helped scale Chewy’s infrastructure, supply chain, and customer base. His leadership positioned Chewy as a serious competitor in pet ecommerce.

Michael Day co-founded Chewy with Cohen and was instrumental in building the company’s operations. Day focused on logistics, fulfillment, and scaling the business. He worked alongside Cohen to secure funding, expand the product catalog, and build Chewy’s internal systems.

Together, Day and Cohen established the operational capacity that allowed Chewy to grow quickly and serve millions of pet owners nationwide. While Cohen was the public face of the brand, Day ensured the backend operations could support rapid growth.

The founders shared a common philosophy: prioritize the customer above all else. This ethos became the foundation of Chewy’s culture and a key reason for its success in a crowded marketplace.

Major Milestones

- 2011: Chewy is founded by Ryan Cohen and Michael Day with the goal of building a customer-first online pet supply platform.

- 2012: The company scales its e-commerce infrastructure and begins shipping nationwide, focusing on speed and reliability.

- 2013: Chewy secures its first major institutional investment from Volition Capital, accelerating hiring and warehouse expansion.

- 2014: Product selection expands significantly as Chewy adds thousands of new SKUs across food, toys, and accessories.

- 2015: Chewy experiences rapid customer growth and becomes one of the fastest-growing online pet retailers in the U.S.

- 2016: The company strengthens supplier partnerships and logistics operations to handle rising order volumes.

- 2017: PetSmart acquires Chewy, completing one of the largest e-commerce acquisitions in retail history. Chewy continues to operate as an independent brand.

- 2018: Leadership transition takes place. Founder Ryan Cohen steps down as CEO, and Sumit Singh assumes the role to lead operational scaling.

- 2019: Chewy completes its initial public offering and begins trading on the New York Stock Exchange under the ticker symbol CHWY.

- 2020: The company expands digital services, including online pharmacy capabilities and virtual veterinary consultations.

- 2021: Chewy celebrates ten years of operations and joins the Fortune 500, reflecting its scale and national presence.

- 2022: Chewy launches CarePlus, entering the pet insurance and wellness subscription market.

- 2023: Continued expansion of healthcare services, including increased investment in telehealth and prescription fulfillment.

- 2024: Chewy opens its first physical veterinary clinics under the Chewy Vet Care brand, marking a shift toward hybrid online-offline services.

- 2025: The company continues investing in automated fulfillment centers and logistics technology to support long-term growth and customer experience.

Who Owns Chewy: Major Shareholders

Chewy is a publicly traded company listed on the New York Stock Exchange under the ticker symbol CHWY.

The largest owner of Chewy is PetSmart. PetSmart retained a controlling stake after Chewy’s IPO. This ownership structure gives PetSmart significant influence over Chewy’s strategic direction, board decisions, and long-term planning.

In addition to PetSmart, Chewy is owned by institutional investors, mutual funds, and public shareholders. Ownership is concentrated among large investment firms, but Chewy operates independently with its own management team.

Below is a list of the largest shareholders of Chewy as of December 2025:

PetSmart

PetSmart’s ownership of Chewy is held through entities affiliated with BC Partners, the private-equity firm that originally backed and controlled Chewy before the IPO.

As of late 2025, BC Partners PE LP remains the largest single shareholder in Chewy, holding around 45.8% of outstanding shares, though this stake has decreased over time as BC Partners has sold portions of its position in public offerings.

Despite reductions, BC Partners still exercises significant voting influence and strategic control, often through Class B shares that carry enhanced voting rights compared with publicly traded Class A shares.

This concentrated ownership position gives PetSmart (via BC Partners) continued sway over board decisions and long-term strategic direction, even as Chewy operates independently in day-to-day management.

BlackRock, Inc.

BlackRock is one of Chewy’s largest institutional investors, with approximately 4.8% of shares outstanding held by its various funds and institutional trust companies.

As a major global asset manager, BlackRock’s involvement is primarily financial rather than operational. BlackRock does not exercise direct control over executive appointment or business decisions, but as a top shareholder, it participates in governance through proxy voting on key corporate matters.

Its ownership reflects broad index and actively managed fund exposure to Chewy within diversified portfolios.

The Vanguard Group

The Vanguard Group holds roughly 4.5% of Chewy’s shares across its range of index funds and mutual funds. Like BlackRock, Vanguard’s ownership is rooted in broad institutional investment mandates.

Vanguard’s stake positions it among Chewy’s most significant public investors, giving it a voice on governance issues proportionate to its shareholding. Because Vanguard typically favors long-term investment horizons, its involvement supports stability among public investors.

Wellington Management Group

Wellington Management Group LLP is another significant institutional investor in Chewy, owning around 4.2% of outstanding shares. Wellington’s stake has grown over time through active purchases, reflecting its confidence in Chewy’s business model and market position. As an active manager, Wellington engages with companies on governance and strategic issues, though it does not have direct control over daily operations.

AQR Capital Management

AQR Capital Management LLC holds approximately 2.4% of Chewy’s shares as of late 2025. AQR is known for quantitative and long-term investment strategies. Its position in Chewy is part of broader diversified holdings, and while the stake is meaningful among institutional owners, AQR does not influence Chewy’s strategic direction directly.

State Street Corporation

State Street Global Advisors holds about 1.6% of Chewy’s stock. As a large institutional manager, State Street’s holdings are typically connected to index funds and ETFs. Its investment reflects broad market exposure, and like other institutional holders, it exercises proxy voting rights but does not participate in operational control.

Holocene Advisors

Holocene Advisors LP owns an estimated 1.6% of Chewy shares. This hedge fund’s stake reflects active investment in Chewy alongside other institutional holders. While meaningful relative to many public shareholders, Holocene’s position does not confer direct control, but it can influence governance through shareholder votes.

Morgan Stanley

Morgan Stanley is another institutional shareholder with roughly 1.3% of Chewy’s shares. Its position is held through brokerage and management accounts across client portfolios. Morgan Stanley’s role is primarily as an investor rather than a strategic decision-maker, but its stake contributes to the broader institutional ownership base.

Baillie Gifford & Co.

Baillie Gifford & Co. holds about 1.3% of Chewy’s shares. The firm is known for long-term growth investing. Baillie Gifford’s involvement is consistent with its strategy of investing in expanding companies with strong customer engagement and recurring revenue models.

Other Institutional Shareholders

Beyond the top holders, many other institutional investors hold smaller yet material positions in Chewy.

These include firms such as Invesco, Bank of America, Two Sigma, Point72, and Geode Capital Management, each owning less than 2% but collectively contributing to institutional control of the company’s public float. Collective ownership by these institutions helps support liquidity in Chewy’s stock and provides a broad investor base.

Insider Shareholders

In addition to institutional holders, Chewy’s insiders and executives own a modest share of the company. CEO Sumit Singh, along with other executives like the Chief Technology Officer and Chief Accounting Officer, collectively hold a smaller percentage of shares. Insider ownership is lower compared with institutional stakes, but it aligns key leaders with shareholder interests.

Who is the CEO of Chewy?

The Chief Executive Officer of Chewy, Inc. is Sumit Singh. He has been the CEO since March 2018 and also serves on Chewy’s Board of Directors.

As CEO, Singh leads the company’s strategy, operations, technology, and long-term growth initiatives. He is responsible for executing Chewy’s vision, including expanding customer reach, improving fulfillment infrastructure, and enhancing pet care services across the business.

Singh’s leadership has been central through Chewy’s transition to a public company and its evolution into a major online pet retailer.

Background and Career

Sumit Singh came to Chewy with deep experience in technology and operations. Prior to joining Chewy, he held leadership roles at Amazon and Dell, where he managed large-scale operations and strategic initiatives.

At Chewy, he initially served as Chief Operating Officer before being promoted to CEO. He has guided the company through pivotal milestones, including Chewy’s initial public offering (IPO) in 2019, subsequent expansion into pet healthcare services, and broader investments in technology, logistics, and customer loyalty programs.

Under his leadership, Chewy strengthened its position as a leading e-commerce platform for pet nutrition, supplies, and veterinary services.

Leadership and Decision-Making Structure

As CEO, Singh oversees the executive leadership team and works closely with Chewy’s Board of Directors to make strategic decisions.

The board includes independent directors and representatives aligned with major shareholders. Chewy’s management structure emphasizes cross-functional collaboration among technology, marketing, operations, and logistics teams. PetSmart’s controlling influence (through its ownership stake) is reflected in board composition and strategic discussions, but Singh and his leadership team handle daily operations and innovation.

Major corporate decisions such as investment in fulfillment automation, expansion into vet clinics, and membership programs are shaped by Singh’s strategic priorities.

CEO Compensation and Salary

Chewy structures executive compensation to emphasize long-term value creation rather than short-term cash payouts. As CEO, Sumit Singh’s pay package is heavily weighted toward equity-based incentives that vest over multiple years.

For the most recent disclosed fiscal year, Sumit Singh’s total compensation was approximately $29.3 million.

This compensation package included a base salary of about $1.25 million, which represents a relatively small portion of his overall pay. The largest component was stock awards valued at roughly $23.9 million, reflecting performance-based equity grants and long-term incentive plans. In addition, Singh received non-equity incentive compensation of approximately $2.7 million, tied to operational and strategic performance goals. Other compensation, including benefits and retirement contributions, totaled around $1.4 million.

The structure of this compensation highlights Chewy’s governance approach. More than three-quarters of the CEO’s pay is linked to equity performance, aligning Singh’s financial outcomes with shareholder returns and the company’s long-term growth objectives.

CEO Net Worth

As of December 2025, Sumit Singh’s estimated net worth is at least $2.5 million. This figure is based primarily on his direct ownership of Chewy shares and does not fully reflect the value of unvested restricted stock units and performance-based awards. When vested equity, deferred compensation, and long-term incentives are considered, his total personal wealth tied to Chewy is likely higher.

Singh’s continued ownership of company stock reinforces alignment between executive leadership and shareholders, ensuring that strategic decisions are made with long-term value creation in mind.

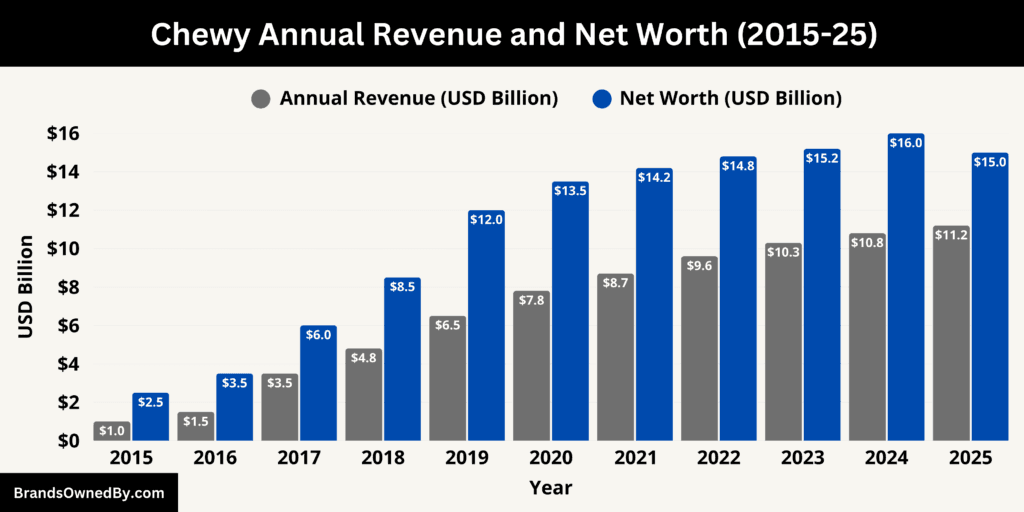

Chewy Annual Revenue and Net Worth

As of December 2025, Chewy reported a robust annual revenue of $11.2 billion and a market capitalization (net worth) of around $15 billion.

These figures highlight the company’s continued growth in the pet care e-commerce sector and its strong position among both consumers and investors. Chewy’s performance reflects expansion in recurring subscription services, pet healthcare offerings, and operational efficiency, solidifying its financial standing.

Annual Revenue

In 2025, Chewy reported annual revenue of approximately $11.2 billion. This figure represents continued growth compared with prior years, driven by several key factors.

Chewy’s Autoship subscription business remains one of the most reliable sources of recurring revenue, with a large portion of customers choosing scheduled deliveries of pet food, medications, and supplies. The company also expanded its product catalog with more private‑label brands and exclusive offerings, attracting both new and existing customers.

Chewy’s revenue mix reflects a balance between consumables such as pet food and supplies, and higher‑margin services such as Chewy Pharmacy and Chewy Vet Care. The latter includes virtual veterinary consultations, prescription fulfillment, and in‑person veterinary services through newly opened clinics.

These service lines contributed meaningfully to revenue expansion in 2025, reducing reliance on pure merchandise sales and improving customer lifetime value.

Driving this revenue growth was Chewy’s investment in fulfillment infrastructure. The company continued to expand its automated distribution centers and leverage data‑driven logistics optimization. Faster deliveries and improved customer experience directly supported higher order frequency.

Chewy’s technology investments, including mobile app enhancements and personalized recommendations, also played a role in increasing average order sizes and customer retention rates.

Profitability and Operational Strength

Chewy’s growing revenue in 2025 was accompanied by improved operational metrics. The company achieved better gross margins as private‑label products and services gained share within the overall mix.

Chewy also implemented cost efficiencies through technology‑enabled fulfillment and more effective inventory management.

While the company does not disclose net income figures in its public summaries with the same prominence as revenue, profitability trends showed positive movement, especially on an adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) basis.

Investment in pet health services and subscription products not only supported diversification but also improved predictable revenue streams. These changes enhanced Chewy’s financial resilience amid broader macroeconomic variability in consumer spending and supply chain dynamics.

Net Worth

Chewy’s market capitalization as of December 2025 stands at $15 billion, reflecting investor confidence and the company’s scale in the competitive pet care market.

Market capitalization, or net worth as measured by total equity value, is influenced by share price performance and public investor sentiment. Chewy’s share price benefited from steady revenue growth, visible customer engagement metrics, and the expansion of high‑margin service offerings.

This level of market value places Chewy among the most valuable pure‑play e‑commerce retailers focused on pet care. Institutional investors, long‑term asset managers, and retail shareholders collectively shape the company’s market valuation.

While daily stock price fluctuations affect market capitalization, long‑term trends point toward growth rooted in revenue expansion, service diversification, and operational improvements.

Comparison with Prior Years

Comparing 2025 results with previous years underscores Chewy’s trajectory. Revenue in 2023 and 2024 showed steady increases as the company scaled its fulfillment network and introduced new services.

The 2025 revenue figure reflects both organic growth and strategic emphasis on recurring revenue lines such as Autoship and healthcare services. The progress from single‑digit billions in revenue a few years ago to more than $11 billion in 2025 highlights Chewy’s increasing market penetration and customer loyalty.

Similarly, net worth, as expressed through market capitalization, has evolved since Chewy’s IPO. While market conditions influence valuation, Chewy’s underlying business fundamentals—consistent growth, customer retention, and service innovation—have contributed to its robust valuation in 2025.

Future Outlook

Looking ahead, Chewy’s revenue and net worth are expected to remain tied to its ability to innovate around pet care services, expand fulfillment capacity, and deepen customer engagement. Continued growth in private‑label brands, healthcare offerings, and digital veterinary services could further enhance revenue diversification and margin expansion.

As the pet care market continues to grow overall, Chewy is positioned to benefit from higher consumer spending on pet nutrition, wellness, and services, which in turn could support sustained increases in both revenue and company net worth.

Brands Owned by Chewy

As of 2025, Chewy operates a portfolio of brands and entities that serve diverse pet care needs. These entities fall into categories such as internal operating divisions, private‑label brands, specialized services, and health‑oriented subsidiaries.

Below is a list of the entities and brands owned and operated by Chewy as of December 2025:

| Company / Brand / Entity | Type | Function / Description | Key Focus / Notes |

|---|---|---|---|

| Chewy.com | Core e-commerce platform | Main online retail site for pet food, supplies, and accessories | Drives majority of revenue; user-friendly, fast fulfillment, Autoship integration |

| Chewy Pharmacy | Service division | Prescription and non-prescription pet medications | Integrates with e-commerce; supports veterinary prescriptions and recurring deliveries |

| Chewy Vet Care | Healthcare services | Virtual and in-person veterinary consultations and clinics | Provides comprehensive pet care; expanding physical clinic network |

| Chewy Health Labs | Internal research & development | Develops and evaluates new pet health products | Focus on nutrition, wellness, supplements, and private-label innovation |

| American Journey | Private-label brand | Dog and cat foods, treats, nutrition products | Premium-quality nutrition at accessible prices; multiple formulations for different life stages |

| Frisco | Private-label brand | Pet accessories and supplies | Includes beds, collars, leashes, toys, grooming tools; focuses on durability and functionality |

| American Value | Private-label brand | Entry-level pet supplies | Affordable products for price-sensitive customers; basic toys, accessories, and clean-up supplies |

| GoodPup | Wellness services | Online dog training and behavior support | One-on-one training sessions; integrated into Chewy’s ecosystem for holistic pet care |

| Chewy Studios | Content & community | Educational articles, videos, training guides | Strengthens customer engagement and brand loyalty; creates authoritative pet care content |

| Autoship Program | Service division | Recurring delivery of pet products | Subscription-based revenue; improves customer retention and predictable order volume |

| Chewy Corporate Services | Internal operations | Logistics, tech platforms, analytics, customer care | Supports all brands; includes automation, data science, and fulfillment systems |

| Chewy Capital Projects | Infrastructure & projects | New fulfillment centers, automation integration | Expands logistics capacity; ensures efficient delivery and scalable operations |

Chewy.com

Chewy.com is the core e‑commerce platform of Chewy, Inc. It is the company’s primary retail channel for pet products and services. Chewy.com offers an extensive catalog of items for dogs, cats, birds, fish, small animals, and reptiles. This platform includes consumables such as food and treats, accessories like toys and grooming supplies, and recurring order options through its Autoship subscription program.

It drives most of the company’s revenue and serves as the foundational brand under which all other services are integrated. The platform is recognized for its user‑friendly interface, fast fulfillment, and customer support that includes 24/7 service and easy returns.

Chewy Pharmacy

Chewy Pharmacy is the health and medication fulfillment arm of Chewy. This entity provides prescription and non‑prescription medications for pets, including flea and tick treatments, heartworm preventatives, and therapeutic medications. Chewy Pharmacy integrates with Chewy.com to enable seamless ordering and delivery of pet medications, often through the Autoship subscription service.

It also supports veterinarian prescriptions, ensuring that pet owners can manage ongoing treatment plans without the inconvenience of separate pharmacies. Chewy Pharmacy has grown in importance due to rising demand for pet health products and the convenience it offers over traditional brick‑and‑mortar pharmacy visits.

Chewy Vet Care

Chewy Vet Care is a healthcare services division that combines virtual and in‑person veterinary offerings. Under this entity, Chewy provides telehealth consultations through licensed veterinarians, allowing pet owners to receive medical advice, behavioral guidance, and wellness recommendations without leaving their homes.

In addition to virtual services, Chewy Vet Care operates physical veterinary clinics in select U.S. locations. These clinics provide comprehensive veterinary care, including routine checkups, vaccinations, diagnostics, and minor procedures.

The expansion into physical veterinary services reflects Chewy’s strategic move to capture more of the pet health market and deepen customer engagement beyond retail transactions.

Chewy Health Labs

Chewy Health Labs focuses on research, development, and evaluation of pet health products. This internal entity works on identifying trends in pet nutrition and wellness to develop new product lines that address specific health needs. Chewy Health Labs collaborates with veterinarians, nutritionists, and scientists to formulate products that meet regulatory standards for safety and efficacy.

While some of its output supports private‑label brands, Chewy Health Labs also contributes to broader product innovation across the company’s offerings in supplements, functional foods, and wellness categories.

American Journey

American Journey is Chewy’s flagship private‑label brand. It includes a wide range of dog and cat foods, treats, and nutrition products formulated with high‑quality ingredients.

This brand is designed to offer customers value and performance comparable to premium national brands but at more accessible prices. American Journey products are developed with a focus on balanced nutrition and are available across multiple recipes and formulations to suit different life stages, dietary needs, and breed sizes.

Frisco

Frisco is Chewy’s private‑label brand dedicated to pet accessories and supplies. The Frisco range includes collars, leashes, beds, bowls, crates, grooming tools, toys, and behavior aids.

It emphasizes durability and functionality, offering everyday essentials that compete with third‑party products sold on Chewy.com. By developing Frisco, Chewy increases control over quality and margins while providing a comprehensive selection of non‑food pet items under its own label.

American Value

American Value is positioned as Chewy’s entry‑level private‑label brand aimed at offering affordable pet supplies without compromising basic quality.

The line includes simple, cost‑effective products such as basic toys, clean‑up supplies, training pads, and everyday accessories. American Value expands Chewy’s reach to price‑sensitive customers and supports broad inventory coverage.

GoodPup

While GoodPup began as a separate online dog training service, Chewy operates related offerings that connect training and behavior support into its broader suite of services. GoodPup provides live one‑on‑one training sessions, behavioral guidance, and puppy socialization support.

Chewy integrates wellness and behavior services into its ecosystem, helping customers address both physical and behavioral needs of their pets.

Chewy Studios

Chewy Studios refers to Chewy’s internal content creation and community engagement arm. This entity produces educational articles, videos, training guides, health tips, and interactive community content.

It aims to strengthen customer relationships, enhance brand loyalty, and provide authoritative guidance on pet care topics. Chewy Studios works closely with veterinarians and subject matter experts to curate content that resonates with pet owners at various stages of ownership.

Autoship Program

The Autoship Program is a recurring revenue business unit within Chewy that allows customers to schedule automatic deliveries of products on a regular basis. While not a standalone legal entity, it operates as a service division that contributes significantly to Chewy’s financial performance.

The program improves customer retention and ensures predictable order volumes. Customers can set frequency, modify orders, and adjust quantities easily through their online accounts.

Chewy Corporate Services

Chewy Corporate Services encompasses internal support functions such as logistics management, technology platforms, data analytics, customer care operations, and fulfillment systems.

This entity supports all customer‑facing brands and services by maintaining efficient backend operations. Investments in automation, warehouse robotics, and data science reside within this operational arm, enabling Chewy to scale fulfillment and improve customer experience.

Chewy Capital Projects

Chewy Capital Projects refers to the company’s enterprise initiatives focused on infrastructure growth. Under this entity, Chewy manages new fulfillment center construction, automation integration, and expanded service footprints.

Projects in 2025 include the expansion of automated distribution centers in Texas and other logistics hubs. Chewy Capital Projects ensures that the company can meet rising demand while controlling delivery speed and cost efficiency.

Final Thoughts

Understanding who owns Chewy provides insight into how the company operates and where it is headed.

PetSmart remains the controlling shareholder, while Chewy functions as a public company with independent leadership. Institutional investors support long-term growth, but strategic control stays concentrated.

Chewy’s ownership structure allows it to balance stability with innovation in the evolving pet care market.

FAQs

Who is Chewy owned by?

Chewy is a publicly traded company, but its largest controlling shareholder is BC Partners through its investment in PetSmart. A majority of the remaining shares are held by institutional investors like BlackRock, Vanguard, and Wellington Management, with a smaller portion owned by company insiders.

Who is the largest shareholder of Chewy?

The largest shareholder of Chewy is BC Partners / PetSmart entities, holding approximately 45.8% of the company’s outstanding shares. This gives them significant influence over strategic and board-level decisions.

Is Chewy still owned by PetSmart?

Chewy operates independently but is still partially owned by PetSmart through BC Partners, which retains its controlling stake. Chewy functions as a separate entity under its own management and brand.

How much did Ryan Cohen sell Chewy?

Ryan Cohen, co-founder of Chewy, sold most of his stake prior to the company’s IPO and stepped down as CEO in 2018. Exact sale amounts are not publicly disclosed in full, but he significantly reduced his ownership while retaining influence through his early leadership legacy.

Is Chewy owned by Amazon?

No, Chewy is not owned by Amazon. It is an independent publicly traded company with its own management and investors.

Is Chewy a public company?

Yes, Chewy is a public company, listed on the New York Stock Exchange under the ticker CHWY since its IPO in 2019.

Does Warren Buffett own Chewy stock?

As of December 2025, Warren Buffett or Berkshire Hathaway does not hold a significant position in Chewy, so he is not considered a shareholder.

Who manufactures Chewy products?

Chewy products, including private-label brands like American Journey, Frisco, and American Value, are manufactured by third-party suppliers contracted by Chewy. Chewy oversees quality, formulation, and sourcing but does not operate its own manufacturing plants.

Who is the founder of Chewy?

Chewy was founded by Ryan Cohen and Michael Day in 2011. Cohen focused on the customer experience and e-commerce vision, while Day contributed operational expertise.

What is the Chewy company controversy?

Chewy has faced controversies primarily related to logistics, employee working conditions, and customer service issues during periods of rapid growth. Some controversies also arose from executive stock sales and leadership transitions, which drew attention from investors and analysts. Overall, these incidents are typical of large e-commerce companies scaling quickly and have been largely managed with operational improvements and corporate governance measures.