Chase Bank is one of the largest banking institutions in the United States. Many people wonder, who owns Chase Bank and how it operates on such a massive scale. Here’s a detailed look at its ownership, structure, and more.

Chase Bank Company Profile

Chase Bank, officially known as JPMorgan Chase Bank, N.A., is one of the largest and most recognized consumer banks in the United States. It is the consumer and commercial banking arm of JPMorgan Chase & Co., a global financial holding company.

Chase Bank provides a wide array of services including checking and savings accounts, credit cards, mortgages, auto loans, business banking, and investment products. It serves over 80 million customers and has more than 4,700 branches and 15,000 ATMs across the U.S.

Founding and Evolution

Chase Bank’s roots go back to 1799 when The Manhattan Company was established in New York City. That firm later evolved into Chase Manhattan Bank, which merged with J.P. Morgan & Co. in 2000 to form JPMorgan Chase & Co.

Major Milestones

- 1799: The Manhattan Company was founded to provide clean water in New York but also received a banking charter.

- 1877: Chase National Bank was established and became a dominant force in U.S. banking.

- 1955: Chase National Bank merged with The Bank of the Manhattan Company to become Chase Manhattan Bank.

- 2000: J.P. Morgan & Co. and Chase Manhattan merged to form JPMorgan Chase & Co.

- 2004: JPMorgan Chase acquired Bank One Corporation, bringing Jamie Dimon into the company.

- 2008: During the financial crisis, JPMorgan Chase acquired Bear Stearns and Washington Mutual’s banking operations, significantly expanding its national footprint.

- 2017: JPMorgan Chase launched its digital banking services with significant investments in mobile and online platforms.

- 2021–2024: Continued tech expansion, growth in digital payment solutions, and investments in AI and cybersecurity.

Headquarters and Operations

Chase Bank is headquartered in New York City. It operates as a national bank under a federal charter. It is regulated by the Office of the Comptroller of the Currency (OCC), a branch of the U.S. Treasury.

It is known for its scale, innovation in mobile banking, and leading position in consumer credit cards. Chase issues popular credit cards like the Chase Sapphire and Freedom series. It also provides business banking and home lending services through its various branches and digital platforms.

Who Owns Chase Bank in 2025?

Chase Bank is not an independent company. It is wholly owned by JPMorgan Chase & Co., one of the largest and most influential financial holding companies in the world. As a national bank, Chase operates as a subsidiary under the full control of its parent company.

JPMorgan Chase is a publicly traded firm listed on the New York Stock Exchange under the ticker symbol JPM. The company’s ownership is spread across institutional investors, mutual funds, and individual shareholders. It is not owned by a single person, but by millions of public investors who hold shares in JPMorgan Chase.

Summary of Ownership Insights

- Ultimate Owner: JPMorgan Chase & Co.

- Shareholder Type: Public (traded on NYSE)

- Institutional Owners: Vanguard, BlackRock, State Street

- Executive Stakeholders: Jamie Dimon and senior leadership

- Control Structure: Board of Directors and executive team under JPMorgan Chase.

Parent Company: JPMorgan Chase & Co.

JPMorgan Chase & Co. is the parent organization that owns Chase Bank and multiple other financial businesses. It was formed in 2000 through the merger of Chase Manhattan Corporation and J.P. Morgan & Co.

Today, JPMorgan Chase is a financial giant with operations in investment banking, asset management, treasury services, and consumer finance. It is consistently ranked among the top global banks by assets, revenue, and market capitalization.

JPMorgan Chase employs over 290,000 people globally and serves clients in more than 100 countries. Its business is divided into segments, including:

- Consumer & Community Banking (Chase Bank)

- Corporate & Investment Bank (J.P. Morgan)

- Asset & Wealth Management

- Commercial Banking

Chase Bank represents the consumer-facing arm of this broader financial group.

Key Acquisitions Shaping Ownership and Growth

Over the years, JPMorgan Chase has grown significantly through strategic acquisitions. Several major deals have had a direct impact on Chase Bank’s scale and market position:

1. Chase Manhattan and J.P. Morgan Merger (2000)

This was the foundation of JPMorgan Chase as we know it. The merger combined Chase’s retail banking strength with J.P. Morgan’s investment banking legacy. This merger also unified both brands under one holding company, making Chase Bank a central component of the new entity.

2. Bank One Corporation (2004)

JPMorgan Chase acquired Bank One for $58 billion. This acquisition brought in Jamie Dimon, Bank One’s CEO, who later became CEO of JPMorgan Chase. It greatly expanded Chase’s consumer banking reach, especially in the Midwest.

3. Bear Stearns (2008)

During the financial crisis, JPMorgan Chase purchased Bear Stearns, a major Wall Street investment bank. Though Bear Stearns’ business was focused on investment services, the acquisition broadened the group’s financial capabilities and boosted the parent company’s balance sheet.

4. Washington Mutual (WaMu) (2008)

In the same year, JPMorgan Chase acquired the banking operations of Washington Mutual after it failed. This deal added over $300 billion in assets and expanded Chase Bank’s branch network across California, Florida, and Texas, making it a national retail banking powerhouse.

5. WePay (2017)

Though smaller in size, this acquisition added modern fintech capabilities to Chase’s offerings. WePay provided integrated payment solutions for platforms and small businesses.

These acquisitions, especially those in 2004 and 2008, played a crucial role in making Chase Bank the largest U.S. bank by assets and one of the most visible consumer banks in the country.

Legal Structure and Regulation

Chase Bank operates under the legal name JPMorgan Chase Bank, National Association (N.A.) It is federally chartered and regulated by the Office of the Comptroller of the Currency (OCC). As a national bank, it is also a member of the Federal Reserve System and is insured by the FDIC.

The bank is integrated into JPMorgan Chase’s broader structure but maintains its own banking license and regulatory responsibilities.

Who is the CEO of Chase Bank?

As of 2025, Jamie Dimon remains the Chairman and Chief Executive Officer (CEO) of JPMorgan Chase & Co., the parent company of Chase Bank. He has held the CEO position since 2006 and is recognized as one of the most influential leaders in global finance.

Jamie Dimon’s Leadership

Under Dimon’s leadership, JPMorgan Chase has navigated significant financial events, including the 2008 financial crisis. He has been instrumental in steering the bank through various challenges and has overseen its growth into the largest U.S. bank by assets. In recent statements, Dimon has indicated that he plans to remain in his role for several more years, emphasizing his commitment to the company’s future.

Marianne Lake’s Role

Marianne Lake serves as the CEO of Consumer & Community Banking at JPMorgan Chase, which encompasses Chase Bank’s retail operations. She has been with the company since 1999, holding various leadership positions, including Chief Financial Officer and CEO of Consumer Lending. In 2021, Lake and Jennifer Piepszak were named co-heads of the Consumer & Community Banking division. Following a leadership reshuffle in 2024, Lake became the sole CEO of this division.

Succession Planning

Succession planning has been a focal point for JPMorgan Chase. While Dimon has not specified a retirement date, the company has been preparing for future leadership transitions. Potential successors have been identified, including Marianne Lake, who is considered a strong candidate due to her extensive experience within the bank. Jennifer Piepszak, previously co-CEO of Consumer & Community Banking, has transitioned to the role of Chief Operating Officer, succeeding Daniel Pinto, who is set to retire in 2026.

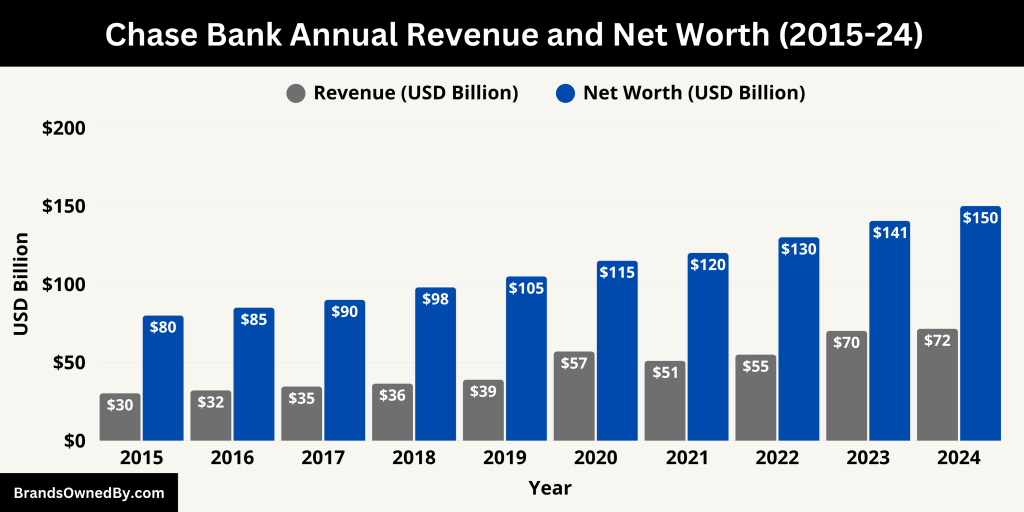

Chase Bank Annual Revenue and Net Worth

JPMorgan Chase, the parent company of Chase Bank, recorded a total net revenue of $177.6 billion in 2024, a 12 % increase from 2023’s $158.1 billion. Projections for 2025 suggest net interest income (NII) could reach around $90–94 billion.

In Q1 2025, total revenue rose to $46.0 billion, up 8 % year‑over‑year. This growth was driven by a record first-quarter performance in trading and investment banking.

Some analysts, based on projected conservative valuations, estimate the 2025 fully‑earmarked revenue at around $178 billion, a decline compared to 2024, due to normalization post-pandemic.

JPMorgan Chase posted a record net income of $58.5 billion in 2024, up 18 % from the prior year.

For the quarter ended March 31, 2025, net income reached $14.64 billion, marking a 9 % increase from Q1 2024.

Macrotrends data shows a rolling net income for the 12 months ending March 31, 2025, of $58.24 billion, representing a 20 % increase compared to the previous year.

Net Worth

As of early May 2025, JPMorgan Chase’s market capitalization stood at approximately $702 billion, underscoring its position as one of the world’s most valuable financial institutions.

Consumer & Community Banking (Chase Bank) generated $71.5 billion in net revenue in 2024, contributing strongly to overall profitability.

- Return on Equity (ROE) for the overall firm was 18 % in 2024, up from 17 % in 2023.

- Q1 2025 ROE held steady at 18 %.

Management forecasts that net interest income will remain robust in 2025, likely ranging between $90–94 billion. However, macroeconomic variables like trade tensions, regulatory changes, and interest rate shifts could impact full-year results.

Here’s a detailed overview of the annual revenue and net worth of Chase Bank from 2015-24:

| Year | Revenue (USD Billions) | Net Income (USD Billions) | Estimated Net Worth (USD Billions) |

|---|---|---|---|

| 2024 | 71.51 | 17.60 | 150.0 |

| 2023 | 70.15 | 21.23 | 140.5 |

| 2022 | 54.81 | 14.92 | 130.0 |

| 2021 | 51.20 | 14.87 | 120.0 |

| 2020 | 57.06 | 20.93 | 115.0 |

| 2019 | 38.96 | 8.22 | 105.0 |

| 2018 | 36.43 | 8.00 | 98.0 |

| 2017 | 34.55 | 7.50 | 90.0 |

| 2016 | 32.10 | 6.80 | 85.0 |

| 2015 | 30.25 | 6.50 | 80.0 |

Companies Owned by Chase Bank

As of 2025, Chase Bank (officially JPMorgan Chase Bank, N.A.) operates as a key subsidiary of JPMorgan Chase & Co., focusing on consumer and commercial banking services. While many of its operations are integrated within the broader JPMorgan Chase framework, Chase Bank maintains several distinct brands and entities under its umbrella.

Below is an overview of the major brands and companies owned by Chase Bank:

| Brand / Entity | Description | Target Audience | Key Features / Services |

|---|---|---|---|

| Chase Private Client | Premium personalized banking and wealth management services | High-net-worth individuals | Dedicated advisors, investment strategies, exclusive perks |

| Chase Sapphire Banking | Premium banking with travel and lifestyle benefits | Affluent customers | No ATM fees, higher interest rates, exclusive events |

| Chase First Banking | Banking account designed for children and teenagers | Families with kids | Parental controls, spending limits, financial education |

| Chase Secure Banking | Low-cost checking account with no overdraft fees | Cost-conscious customers | Early direct deposit, fraud monitoring |

| Chase College Checking | Student-focused checking account | College students | No monthly fees, budgeting tools |

| Chase Business Complete Banking | Business banking tailored for small businesses | Small business owners | Same-day deposits, cash flow management |

| Chase Auto | Auto financing and loans | Vehicle buyers | New/used loans, refinancing options |

| Chase Home Lending | Mortgage and home equity lending | Homebuyers | Purchase loans, refinancing, HELOCs |

| Chase Credit Cards | Wide range of credit cards with rewards and benefits | General consumers | Sapphire, Freedom, Slate cards |

| Chase Mobile App | Digital banking platform | All customers | Mobile deposits, payments, alerts |

| Chase Online Banking | Online account management | All customers | Transfers, bill pay, statements |

| Chase Pay | Digital wallet for mobile payments | Mobile users | Secure payments, reward points |

| Chase Offers | Personalized deals and cash-back promotions | Cardholders | Merchant discounts, cash-back |

| Chase QuickDeposit | Mobile check deposit service | All customers | Remote check deposits |

| Chase QuickPay with Zelle | Peer-to-peer payments using email or mobile number | All customers | Instant money transfers |

| Chase for Business | Suite of business financial products and services | Businesses of all sizes | Business accounts, credit cards, lending |

| Chase Merchant Services | Payment processing solutions for merchants | Retailers, merchants | POS systems, online payments, fraud protection |

| Chase Ink Business Credit Cards | Credit cards tailored for small businesses | Small business owners | Rewards, employee cards, expense management |

| Chase Business Loans | Business financing options | Small and medium businesses | Lines of credit, SBA loans, term loans |

| Chase Commercial Banking | Financial services for mid-sized and large businesses | Corporations, mid-sized firms | Treasury, lending, international banking |

| Chase Private Banking | Wealth management for affluent clients | High-net-worth individuals | Investment strategies, estate planning |

| Chase Wealth Management | Investment advisory services | Investors | Retirement, education planning |

| Chase Investment Services | Brokerage and mutual funds | Investors | Portfolio management, investment products |

| Chase Retirement Services | Retirement account offerings | Individuals planning retirement | IRAs, 401(k) rollovers |

| Chase Education Planning | Education savings plans | Families | 529 plans, saving strategies |

| Chase Trust Services | Trust administration and estate planning | Estate clients | Trust creation and management |

| Chase Custody Services | Safekeeping and asset administration | Institutional and individual | Secure asset management |

| Chase Escrow Services | Secure transaction facilitation | Real estate and business | Escrow accounts, contract hold funds |

| Chase Foreign Exchange Services | Currency exchange and international payments | International clients | Currency conversion, wire transfers |

| Chase International Banking | Banking services for clients with global needs | Global customers | International accounts, wire transfers |

| Chase Safe Deposit Boxes | Secure storage for valuables | General customers | Vault storage, document safety |

| Chase Notary Services | Document notarization | Bank customers | In-branch notary services |

| Chase Financial Education Resources | Financial literacy tools and content | General public | Articles, calculators, workshops |

| Chase Community Programs | Initiatives for local development and inclusion | Communities | Grants, volunteering, partnerships |

| Chase Sponsorships and Events | Support for cultural, sports, and arts events | Community and customers | Event sponsorship, brand engagement |

| Chase Digital Innovations | Advanced digital tools and AI | All customers | AI customer service, security features |

| Chase Research and Insights | Economic and financial market analysis | Investors and clients | Reports, market trends |

| Chase Philanthropy | Charitable giving and social responsibility | Communities | Donations, workforce development |

| Chase Environmental Initiatives | Sustainability and green projects | Public and clients | Carbon footprint reduction, sustainable financing |

| Chase Diversity and Inclusion Programs | Workforce and community diversity initiatives | Employees and communities | Inclusion policies, training |

| Chase Employee Development Programs | Career growth and training programs | Employees | Mentorship, training, advancement |

| Chase Customer Feedback Channels | Customer engagement and feedback collection | Customers | Surveys, support services |

| Chase Fraud Protection Services | Account security and fraud monitoring | Customers | Alerts, monitoring, prevention |

| Chase Data Privacy Measures | Data protection and privacy policies | Customers | Encryption, compliance |

| Chase Cybersecurity Operations | Cyber defense and threat detection | Bank and customers | 24/7 monitoring, AI-driven security |

| Chase Customer Support Services | Multichannel customer assistance | Customers | Phone, chat, email, branch support |

| Chase ATM Network | Nationwide ATM access | Customers | Cash withdrawals, deposits, 24/7 access |

| Chase Branch Banking | Physical bank locations | Customers | In-person services, financial advice |

| Chase Student Financial Services | Student-focused banking and loans | Students | Student checking, education loans |

| Chase Small Business Support | Financial services and coaching for small businesses | Small business owners | Business accounts, credit, coaching |

| Chase Global Transfer Services | International money transfer service | International customers | Cross-border payments |

| Chase Loan Services | Personal and home loans | Consumers | Personal loans, mortgages |

| Chase Investment Tools | Digital portfolio and investment management tools | Investors | Portfolio tracking, automated investing |

| Chase Mobile Wallet Integrations | Compatibility with Apple Pay, Google Pay, Samsung Pay | Mobile users | Contactless payments |

| Chase Safe Banking for Seniors | Fraud prevention and support for elderly customers | Seniors | Scam alerts, account monitoring |

| Chase Real Estate Services | Home buying resources and mortgage support | Homebuyers | Calculators, pre-approval, refinancing |

| Chase App Integrations and APIs | Third-party app compatibility and financial data sharing | Tech-savvy users | Budgeting apps, tax tools |

Chase Private Client

Chase Private Client is a premium banking service tailored for individuals seeking personalized financial solutions. It offers dedicated financial advisors, customized investment strategies, and exclusive banking benefits. Clients benefit from a suite of services designed to manage and grow their wealth effectively.

Chase Sapphire Banking

Chase Sapphire Banking is designed for customers who desire premium banking experiences. It provides benefits such as no ATM fees worldwide, higher interest rates on savings, and exclusive event access. This offering complements the Chase Sapphire credit card line, catering to affluent clients.

Chase First Banking

Chase First Banking is an account designed for children and teenagers, aiming to teach financial literacy from a young age. Parents can monitor spending, set limits, and provide allowances, fostering responsible money management habits in their children.

Chase Secure Banking

Chase Secure Banking offers a low-cost, no-overdraft-fee account option for customers seeking straightforward banking solutions. It includes features like early direct deposit access and fraud monitoring, ensuring secure and accessible banking for all.

Chase College Checking

Chase College Checking is tailored for college students, providing them with essential banking services without monthly fees for up to five years. It supports students in managing their finances during their academic journey.

Chase Business Complete Banking

Chase Business Complete Banking caters to small business owners, offering features like same-day deposits, cash flow management tools, and access to business credit cards. It supports entrepreneurs in efficiently managing their business finances.

Chase Auto

Chase Auto provides auto financing solutions, including loans for new and used vehicles, refinancing options, and dealer partnerships. It assists customers in navigating the car buying and financing process seamlessly.

Chase Home Lending

Chase Home Lending offers mortgage solutions, including home purchase loans, refinancing options, and home equity lines of credit. It supports customers in achieving their homeownership goals with tailored lending products.

Chase Credit Cards

Chase Credit Cards encompass a diverse range of credit card products, including the popular Sapphire, Freedom, and Slate lines. These cards offer various rewards programs, travel benefits, and credit-building opportunities to meet different customer needs.

Chase Mobile App

The Chase Mobile App provides customers with a comprehensive digital banking experience. Features include mobile check deposit, account management, bill payments, and real-time transaction alerts, ensuring convenient banking on the go.

Chase Online Banking

Chase Online Banking offers customers the ability to manage their accounts, pay bills, transfer funds, and access statements through a secure online platform. It enhances the banking experience by providing 24/7 access to essential services.

Chase Pay

Chase Pay is a digital wallet service that allows customers to make secure payments using their mobile devices. It integrates with various merchants and platforms, facilitating seamless transactions and reward point accumulation.

Chase Offers

Chase Offers provides customers with personalized deals and cash-back opportunities from participating merchants. By activating offers through the Chase Mobile App or online banking, customers can save money on everyday purchases.

Chase QuickDeposit

Chase QuickDeposit enables customers to deposit checks remotely using their mobile devices. This feature enhances convenience by allowing deposits without visiting a branch or ATM.

Chase QuickPay with Zelle

Chase QuickPay with Zelle allows customers to send and receive money quickly and securely using just an email address or mobile number. It’s integrated into the Chase Mobile App and online banking for easy access.

Chase for Business

Chase for Business offers a suite of financial products and services tailored for businesses of all sizes. This includes business checking and savings accounts, credit cards, merchant services, and lending solutions to support business growth.

Chase Merchant Services

Chase Merchant Services provides payment processing solutions for businesses, enabling them to accept credit and debit card payments. It offers point-of-sale systems, online payment gateways, and fraud protection tools.

Chase Ink Business Credit Cards

Chase Ink Business Credit Cards are designed for small business owners, offering rewards on business-related expenses, expense tracking tools, and employee card options to manage company spending effectively.

Chase Business Loans

Chase Business Loans offer financing options for businesses, including lines of credit, term loans, and SBA loans. These products help businesses manage cash flow, invest in growth opportunities, and cover operational expenses.

Chase Commercial Banking

Chase Commercial Banking serves mid-sized businesses and corporations, providing services such as treasury management, commercial lending, and international banking solutions to support complex financial needs.

Chase Private Banking

Chase Private Banking offers personalized wealth management services to high-net-worth individuals. Clients receive tailored investment strategies, estate planning, and access to exclusive financial products.

Chase Wealth Management

Chase Wealth Management provides investment advisory services, helping clients plan for retirement, education, and other financial goals through personalized strategies and a range of investment products.

Chase Investment Services

Chase Investment Services offers brokerage accounts, mutual funds, and other investment vehicles to help clients build and manage their investment portfolios in alignment with their financial objectives.

Chase Retirement Services

Chase Retirement Services assists clients in planning for retirement by offering IRAs, 401(k) rollovers, and retirement planning tools to ensure financial security in later years.

Chase Education Planning

Chase Education Planning provides resources and accounts, such as 529 plans, to help families save for education expenses, ensuring that clients can support their children’s academic aspirations.

Chase Trust Services

Chase Trust Services offers trust administration and estate planning solutions, helping clients manage and protect their assets for future generations through customized trust structures.

Chase Custody Services

Chase Custody Services provides safekeeping and administrative services for clients’ financial assets, ensuring secure and efficient management of investment holdings.

Chase Escrow Services

Chase Escrow Services facilitates secure transactions by holding funds in escrow accounts until contractual obligations are met, commonly used in real estate and business deals.

Chase Foreign Exchange Services

Chase Foreign Exchange Services offers currency exchange and international payment solutions for individuals and businesses, supporting global financial transactions.

Chase International Banking

Chase International Banking provides services for clients with global financial needs, including international accounts, wire transfers, and foreign currency management.

Chase Safe Deposit Boxes

Chase Safe Deposit Boxes offer secure storage for valuable items and documents within bank vaults, providing clients with peace of mind regarding their possessions.

Chase Notary Services

Chase Notary Services are available at select branches, allowing clients to have documents notarized conveniently as part of their banking experience.

Chase Financial Education Resources

Chase provides financial education resources, including articles, calculators, and workshops, to help clients make informed financial decisions and improve their financial literacy.

Chase Community Programs

Chase engages in community programs and initiatives aimed at supporting local development, financial inclusion, and economic empowerment through grants, volunteering, and partnerships.

Chase Sponsorships and Events

Chase participates in various sponsorships and events, including sports, arts, and cultural activities, to connect with communities and enhance brand presence.

Chase Digital Innovations

Chase invests in digital innovations to enhance customer experience, including AI-driven customer service, advanced security features, and user-friendly digital platforms.

Chase Research and Insights

Chase offers research and insights on economic trends, financial markets, and consumer behavior to inform clients and support strategic decision-making.

Chase Philanthropy

Chase engages in philanthropic efforts, supporting causes such as education, workforce development, and community revitalization through donations and volunteerism.

Chase Environmental Initiatives

Chase implements environmental initiatives aimed at reducing its carbon footprint, promoting sustainable practices, and supporting green projects.

Chase Diversity and Inclusion Programs

Chase promotes diversity and inclusion within its workforce and through community engagement, striving to create an equitable and inclusive environment.

Chase Employee Development Programs

Chase offers employee development programs, including training, mentorship, and career advancement opportunities, to foster professional growth.

Chase Customer Feedback Channels

Chase provides channels for customer feedback, including surveys and support services, to continuously improve its products and services based on client needs.

Chase Fraud Protection Services

Chase offers fraud protection services, including real-time alerts, account monitoring, and security features, to safeguard customers’ financial information.

Chase Data Privacy Measures

Chase implements robust data privacy measures to protect customer information. It uses advanced encryption, secure login protocols, and multifactor authentication. The bank also complies with all major data protection regulations. Customers are educated on how to safeguard their data through account alerts, privacy settings, and regular security tips. Chase continuously updates its cybersecurity infrastructure to stay ahead of evolving threats.

Chase Cybersecurity Operations

Chase’s cybersecurity operations are among the most advanced in the banking industry. It maintains a dedicated security team that monitors threats 24/7. The bank uses artificial intelligence and machine learning to detect suspicious activities in real time. Regular audits, penetration testing, and employee training reinforce a secure environment. Its proactive approach helps minimize fraud and protect client trust.

Chase Customer Support Services

Chase offers extensive customer support services through multiple channels. Customers can access help via phone, email, chat, and in-branch visits. The Chase Mobile App and website provide self-service features to resolve common issues. Additionally, Chase has specialized teams for mortgage, auto, credit card, and business account support. These services ensure that clients get timely and effective assistance.

Chase ATM Network

Chase operates one of the largest ATM networks in the United States. Customers can withdraw cash, deposit checks, and perform account transactions at thousands of locations nationwide. The ATMs support cardless access via the Chase app and offer multi-language support. Many are available 24/7, enhancing customer convenience and accessibility.

Chase Branch Banking

Chase has over 4,700 branches across the United States. These branches provide a range of services including account opening, loan consultations, and financial advice. Branch staff are trained to assist with everything from simple transactions to complex financial planning. Chase continues to upgrade its branch experiences by integrating digital kiosks and private consultation rooms.

Chase Student Financial Services

Chase offers specialized financial services for students, including education loans, checking accounts with no monthly fees, and savings programs. These services are designed to promote financial independence and literacy among young adults. Chase also partners with schools and colleges to provide workshops on budgeting, saving, and responsible credit use.

Chase Small Business Support

Chase supports small businesses with dedicated banking solutions. This includes tailored checking and savings accounts, payroll services, merchant solutions, and lines of credit. Chase also offers small business coaching, webinars, and insights on managing business finances. It is a strong advocate for entrepreneurship and economic development.

Chase Global Transfer Services

Chase provides global money transfer services through its online and mobile platforms. Customers can send money internationally with competitive exchange rates and low fees. Chase also supports international wire transfers for businesses and individuals. These services are used by travelers, international students, and businesses with cross-border operations.

Chase Loan Services

Chase offers a wide range of loan products, including personal loans, auto loans, mortgages, and home equity lines of credit. Each loan is supported with online calculators, application tracking tools, and customer education resources. Chase customizes lending solutions based on credit history, income, and long-term financial goals.

Chase Investment Tools

Through its investment arm, Chase provides digital tools for clients to manage their portfolios. These include performance tracking, financial planning calculators, and automated investing through J.P. Morgan Wealth Management. Customers can choose self-directed investing or receive guidance from licensed advisors.

Chase Mobile Wallet Integrations

Chase integrates with all major mobile wallets including Apple Pay, Google Pay, and Samsung Pay. These integrations allow customers to make contactless payments securely. Chase also offers tokenization technology to ensure card details are not shared with merchants during transactions.

Chase Safe Banking for Seniors

Chase offers safe banking programs for seniors, including scam prevention tools, personalized support, and account monitoring. Staff are trained to recognize and address elder financial abuse. Educational resources and fraud alerts help protect this vulnerable customer group.

Chase Real Estate Services

Chase provides home buying resources, mortgage calculators, neighborhood insights, and personalized rate quotes. It supports customers throughout the home buying journey—from pre-approval to closing. Chase also offers refinancing options and property equity reviews.

Chase App Integrations and APIs

Chase supports third-party app integrations through APIs, allowing customers to manage their finances across multiple platforms. These include budgeting apps, tax preparation tools, and business accounting software. Secure data sharing is ensured through encrypted and consent-driven protocols.

Final Thoughts

Chase Bank is one of the most trusted financial institutions in the U.S. It operates under the umbrella of JPMorgan Chase & Co., a publicly traded global financial giant. While Chase Bank does not have a single owner, its parent company is owned by millions of institutional and individual shareholders. The bank plays a vital role in both consumer banking and the overall economy.

FAQs

Who owns majority of Chase?

JPMorgan Chase & Co. is the parent company that owns Chase Bank. The majority ownership is held by institutional investors, including large asset management firms like Vanguard Group and BlackRock. These institutions own significant shares but no single individual owns a majority stake.

Who is behind Chase?

Chase Bank operates under JPMorgan Chase & Co., which is led by its executive management team and board of directors. The company was formed through mergers of several historic banks, combining resources and expertise over time.

Who is Chase bank under?

Chase Bank is a subsidiary of JPMorgan Chase & Co., one of the largest financial services companies globally.

Who is the Indian guy in Chase?

This likely refers to notable Indian-origin executives associated with JPMorgan Chase. One prominent figure is Asheem Singh, who has held senior roles within the company. However, Chase does not publicly highlight any single Indian individual as a key figurehead.

Does Warren Buffett own Chase?

No, Warren Buffett does not own Chase Bank. However, his company Berkshire Hathaway has occasionally invested in JPMorgan Chase & Co. shares as part of its portfolio but does not have controlling ownership.

Who is Chase backed by?

Chase Bank is backed by JPMorgan Chase & Co., a financially strong parent company with robust capital reserves and extensive global operations.

Who controls Chase Bank?

Chase Bank is controlled by the executive leadership of JPMorgan Chase & Co., including the CEO, board of directors, and major institutional shareholders.

Who is Chase Manhattan Bank founder?

Chase Manhattan Bank was formed from the merger of Chase National Bank and The Manhattan Company. The Manhattan Company was founded by Aaron Burr in 1799. Chase National Bank was founded later, in 1877.

Who is JP Morgan Chase founder?

JPMorgan Chase & Co. traces its origins to several historic banks, but the key figure behind its namesake is John Pierpont Morgan (J.P. Morgan), who was a dominant banker in the late 19th and early 20th centuries.

Where was Chase Bank founded?

Chase Bank traces its roots back to New York City, where its predecessor institutions such as The Manhattan Company and Chase National Bank were established.

What is Chase Bank founding date?

The earliest founding date linked to Chase Bank’s predecessors is 1799, when The Manhattan Company was established. Chase National Bank itself was founded in 1877.

When was JPMorgan founded?

JPMorgan & Co. was founded in 1871 by J. Pierpont Morgan and his partners. The modern JPMorgan Chase & Co. formed later through multiple mergers, including the 2000 merger of J.P. Morgan & Co. and Chase Manhattan Bank.

Who is the actual owner of Chase Bank?

Chase Bank is owned by JPMorgan Chase & Co., which is a public company. Its shareholders, including large investment firms like Vanguard and BlackRock, are the actual owners.

Is Chase Bank owned by the government?

No, Chase Bank is not owned by the government. It is a private corporation owned by public shareholders.

How does Chase Bank make money?

Chase Bank makes money through interest on loans, fees from credit cards, account fees, and merchant services.