CarMax, Inc. is a prominent used car retailer in the United States. Established in 1993, it revolutionized the car-buying experience by offering fixed pricing and a no-haggle policy. Understanding who owns CarMax provides insight into its operations and strategic direction.

Key Takeaways

- CarMax is a public company owned by institutional investors, who hold approximately 90% of the company’s shares, providing stability and strategic oversight.

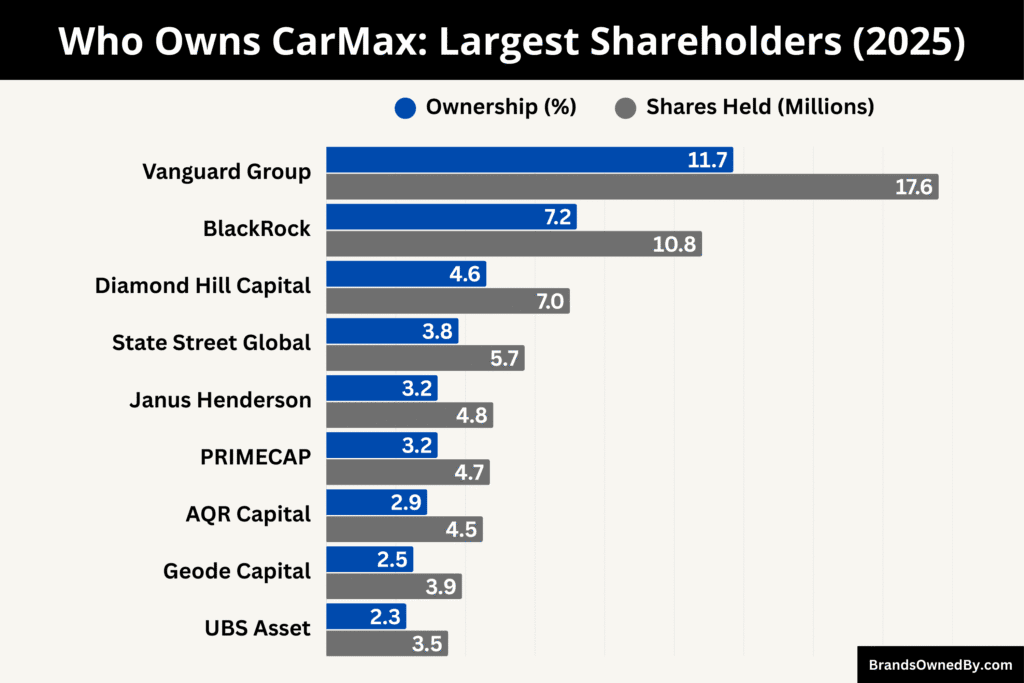

- Vanguard Group is the largest shareholder with 11.7% (17.56 million shares), followed by BlackRock (7.22%) and other major investment firms like Diamond Hill, State Street, and Janus Henderson.

- Insider ownership is minimal, at around 0.48% (0.72 million shares), ensuring that corporate control remains largely with institutional and retail investors.

- Individual and retail shareholders hold 23.21% (34.68 million shares), contributing to broad public participation and accountability in company decisions.

CarMax Company Profile

CarMax, Inc., headquartered in Richmond, Virginia, is the largest retailer of used cars in the United States.

As of 2025, the company operates 253 retail locations across 41 states and employs over 30,000 associates. CarMax offers a transparent, no-haggle pricing model and a 10-day money-back guarantee, setting it apart from traditional dealerships. In fiscal year 2025, CarMax sold approximately 790,000 used vehicles and 540,000 wholesale vehicles at its auctions.

The company also provides financing options through CarMax Auto Finance, which originated more than $8 billion in receivables during fiscal 2025.

Founders and Origin

CarMax was co-founded by Richard L. “Rick” Sharp and William Austin Ligon in 1993. Sharp, then CEO of Circuit City, and Ligon, the company’s Senior Vice President of Planning, envisioned a new approach to used car retailing that would emphasize transparency, customer service, and a no-haggle pricing model. Their collaboration led to the creation of CarMax, which was developed under the project name “Project X” within Circuit City. The first CarMax store opened in Richmond, Virginia, in September 1993, marking the beginning of a new era in the automotive retail industry.

The concept was developed by executives at Circuit City, including Richard L. Sharp, who served as CEO, and Austin Ligon, who became the first president of the company.

In 2002, CarMax was spun off from Circuit City as an independent, publicly traded company, allowing it to operate with greater autonomy and focus on its core business of used car retailing.

Major Milestones

- 1991: Circuit City initiates “Project X,” a secretive venture aimed at revolutionizing the used car retail industry.

- 1993: The first CarMax store opens in Richmond, Virginia, introducing a no-haggle pricing model and a customer-centric approach to used car sales.

- 1996: CarMax acquires its first new car franchise with Chrysler, marking its entry into new car sales.

- 1997: CarMax goes public as a tracking stock of Circuit City, gaining access to public capital markets.

- 1999: Expands to include new vehicle franchises for Mitsubishi, Toyota, and Nissan.

- 2003: Opens its first reconditioning center, improving efficiency and quality control in the vehicle preparation process.

- 2005: CarMax is ranked among the “100 Best Companies to Work For” by Fortune magazine, a distinction it would continue to earn in subsequent years.

- 2015: Begins offering an online car buying experience, expanding its reach and convenience for customers, and adapting to changing consumer preferences.

- 2021: Sale of the last new vehicle dealership in Kenosha, Wisconsin, to the Rydell Company, marking CarMax’s exit from new car sales.

- 2025: Recognized as #6 on Fortune’s Best Workplaces in Retail and #38 on PEOPLE’s Companies That Care list.

Who Owns CarMax: Major Shareholders

As of September 2025, CarMax, Inc. (NYSE: KMX) is owned by institutional investors, while a smaller portion is held by individual and retail shareholders. Institutional investors collectively hold approximately 90% of the company’s shares, reflecting CarMax’s appeal to large financial institutions. Individual shareholders and insiders account for the remaining portion, contributing to the company’s diverse ownership base.

This structure provides both stability and flexibility, allowing CarMax to operate as a publicly traded company while maintaining strong oversight from major investors.

Below is a list of the top shareholders of CarMax as of September 2025:

Vanguard Group Inc.

Vanguard Group Inc. is the largest shareholder of CarMax, holding approximately 11.7% of the company’s shares, which amounts to 17.56 million shares. Vanguard is a globally recognized asset management firm known for its long-term investment approach.

Its stake in CarMax provides a stable foundation for the company’s strategic initiatives and reflects confidence in CarMax’s business model and growth prospects. Vanguard’s involvement also allows it to influence corporate governance through voting rights at shareholder meetings.

BlackRock, Inc.

BlackRock, Inc. owns around 7.22% of CarMax, totaling 10.83 million shares. As one of the world’s leading investment management firms, BlackRock has a significant influence on the companies it invests in. Its stake in CarMax indicates strong confidence in the company’s operational efficiency and long-term growth potential.

Through its shareholder influence, BlackRock can help shape CarMax’s corporate policies and strategic direction, particularly in areas of sustainability and financial governance.

Diamond Hill Capital Management, Inc.

Diamond Hill Capital Management holds approximately 4.64% of CarMax, or 6.96 million shares.

This firm is known for its value-oriented investment philosophy, emphasizing companies with strong fundamentals and long-term potential. Diamond Hill’s investment in CarMax reflects confidence in the company’s business model and its ability to maintain profitability and market share in the competitive used car industry.

The firm actively monitors its investments and participates in corporate governance to protect shareholder value.

State Street Global Advisors, Inc.

State Street Global Advisors owns 3.78% of CarMax, which represents 5.67 million shares. As one of the world’s largest asset managers, State Street invests in companies it considers financially stable and capable of long-term growth.

Its stake in CarMax demonstrates confidence in the company’s business strategies and reinforces CarMax’s position as a leader in used car retail. State Street can exercise influence in corporate decisions through its voting rights and engagement with the board of directors.

Janus Henderson Group plc

Janus Henderson Group plc holds a 3.22% stake in CarMax, totaling 4.83 million shares. The firm focuses on active investment management and seeks companies with strong management and growth potential.

Its investment in CarMax reflects a positive view of the company’s strategic direction and ability to navigate a competitive automotive market. Janus Henderson actively engages in corporate governance matters to help ensure that the company continues to deliver shareholder value.

PRIMECAP Management Company

PRIMECAP Management Company owns 3.16% of CarMax, amounting to 4.74 million shares. PRIMECAP is known for its disciplined, long-term investment approach, focusing on high-quality companies.

Its stake in CarMax signals confidence in the company’s management and operational efficiency. PRIMECAP also has the ability to influence key corporate decisions through shareholder voting and engagement with the board.

AQR Capital Management, LLC

AQR Capital Management holds approximately 2.88% of CarMax, or 4.46 million shares. The firm employs quantitative and systematic investment strategies to identify companies with strong fundamentals. AQR’s investment reflects confidence in CarMax’s growth potential and financial stability.

It actively monitors performance metrics and participates in shareholder discussions to safeguard its investment.

Geode Capital Management, LLC

Geode Capital Management owns around 2.54% of CarMax, which is equivalent to 3.85 million shares. Geode is a global investment firm that uses systematic strategies to evaluate companies. Its stake in CarMax demonstrates belief in the company’s market position and operational stability. Geode’s involvement provides additional oversight and input on corporate governance practices.

UBS Asset Management AG

UBS Asset Management holds 2.34% of CarMax, totaling 3.51 million shares. UBS is a global financial services company that invests in firms with strong growth prospects and operational efficiency.

Its investment in CarMax highlights confidence in the company’s strategic direction and long-term profitability. UBS can influence corporate policies through shareholder voting and participation in governance initiatives.

Insider Ownership

Insider ownership of CarMax is relatively low, representing approximately 0.48% of total shares, or 0.72 million shares. This indicates that executives and board members have diversified their investments and do not dominate ownership.

While insiders maintain some influence over corporate decisions, the relatively small percentage ensures that institutional shareholders and the market largely drive strategic direction.

Individual and Retail Shareholders

Individual and retail shareholders collectively hold about 23.21% of CarMax’s shares, totaling 34.68 million shares. This broad base of ownership reflects widespread confidence in CarMax’s business model and performance.

The participation of retail investors adds stability to the stock and supports the company’s public market presence, ensuring that CarMax remains accountable to a wide audience of stakeholders.

Who is the CEO of CarMax?

William D. Nash, widely known as Bill Nash, serves as the President and Chief Executive Officer of CarMax, Inc., the largest used car retailer in the United States.

He was appointed CEO in February 2016 and has also served on the board of directors since then. Under his leadership, CarMax has continued to grow its footprint across the U.S., enhancing its digital retail capabilities, expanding store locations, and improving operational efficiency.

Nash has focused on strengthening CarMax’s reputation for transparency and customer service, guiding the company through a rapidly evolving automotive retail environment.

Early Life and Education

Bill Nash was born in the United States and developed an early interest in business and finance. He earned a Bachelor of Business Administration in accounting from James Madison University in 1991.

Early in his career, Nash became a Certified Public Accountant, gaining foundational experience in finance and management. Before joining CarMax, he worked at Phibbs, Burkholder, Geisert & Huffman, where he honed skills in auditing, corporate finance, and business operations, which would later shape his strategic approach at CarMax.

Career at CarMax

Nash joined CarMax in 1997 as an auction manager, responsible for managing vehicle auctions and inventory operations.

Over the next two decades, he advanced through various leadership roles that gave him comprehensive exposure to the company’s operations.

He served as Vice President of Auction Services, Senior Vice President of Merchandising, and Executive Vice President of Human Resources and Administrative Services.

Each role allowed him to develop expertise in key areas such as pricing, vehicle sourcing, employee management, and operational efficiency. His breadth of experience across multiple departments positioned him to lead CarMax successfully as CEO.

Leadership and Strategic Vision

As CEO, Nash has led CarMax through significant industry changes, including the rise of online car sales and shifts in consumer expectations.

He has emphasized the integration of digital and in-store experiences, enabling customers to buy or sell vehicles online while leveraging CarMax’s nationwide store network for inspections, appraisals, and delivery.

Nash has prioritized technological innovation, expanding CarMax’s online marketplace, improving inventory management systems, and enhancing customer-facing tools to provide a seamless buying experience.

His leadership has strengthened CarMax’s competitive position and reinforced the company’s commitment to transparency and customer satisfaction.

Recent Developments and Industry Impact

Under Nash’s leadership, CarMax has achieved several notable milestones. The company has expanded its footprint to over 250 stores nationwide and continued to increase sales, reaching hundreds of thousands of vehicles sold annually.

CarMax has also modernized its wholesale operations, streamlined reconditioning centers, and enhanced its financing programs.

In September 2024, Nash was appointed to the board of directors at eBay Inc., reflecting his expertise in retail, e-commerce, and operational strategy. This appointment highlights his recognition as a prominent leader in both the automotive and retail industries.

Personal Life and Philosophy

Outside of his professional role, Nash is known for his commitment to fostering a positive corporate culture and supporting community initiatives. He frequently engages with employees at all levels to promote collaboration, ethical practices, and a customer-first approach.

Nash’s leadership philosophy emphasizes long-term growth, innovation, and adaptability, aligning closely with CarMax’s values of transparency, integrity, and operational excellence. His approach has helped CarMax maintain its position as a trusted and successful leader in the used car market.

CarMax Annual Revenue and Net Worth

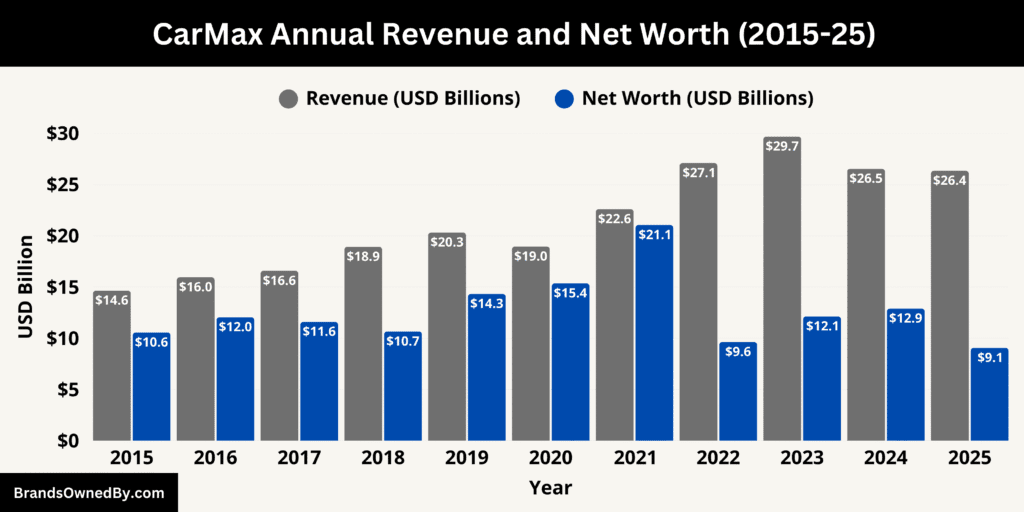

As of September 2025, CarMax, Inc. generated annual revenues of $26.35 billion while its market capitalization stood at $9.06 billion. These figures highlight CarMax’s continued prominence as the largest used car retailer in the United States. Despite challenges such as fluctuating vehicle prices and evolving consumer preferences, the company has maintained a strong financial position, combining solid revenue generation with stable profitability.

Here’s the historical revenue and net worth of CarMax from 2015-25:

| Year | Revenue (Billion USD) | Market Capitalization / Net Worth (Billion USD) |

|---|---|---|

| 2015 | 14.64 | 10.56 |

| 2016 | 15.95 | 12.04 |

| 2017 | 16.58 | 11.59 |

| 2018 | 18.92 | 10.66 |

| 2019 | 20.32 | 14.32 |

| 2020 | 18.95 | 15.35 |

| 2021 | 22.60 | 21.05 |

| 2022 | 27.10 | 9.62 |

| 2023 | 29.69 | 12.12 |

| 2024 | 26.54 | 12.89 |

| 2025 | 26.35 | 9.06 |

2025 Revenue

As of September 2025, CarMax, Inc. reported annual revenues of approximately $26.35 billion and a market capitalization of around $9.06 billion. These figures reflect CarMax’s position as the largest used car retailer in the U.S., with a strong national presence and diversified revenue streams.

The company continues to navigate challenges such as fluctuating vehicle prices, inventory constraints, and shifts in consumer buying behavior while maintaining profitability and operational efficiency.

Revenue Breakdown by Segment

In 2025, CarMax generated most of its revenue from retail used vehicle sales, which accounted for roughly $11.37 billion, or 43.2% of total revenue. This segment remains the backbone of CarMax’s business, driven by the company’s no-haggle pricing model, wide inventory selection, and trusted customer experience.

Wholesale vehicle sales contributed about $2.40 billion, representing 9.1% of revenue, reflecting CarMax’s strategy of selling vehicles to dealers and other wholesale buyers.

Additionally, financial services, extended protection plans, and other ancillary services added approximately $364.8 million, or 1.4% of total revenue, showcasing the company’s ability to generate supplementary income beyond vehicle sales.

Profitability and Net Income

Despite a modest decline in total revenue compared to 2024, CarMax achieved a net income of $305.8 million in 2025, up from $285.2 million the previous year. This increase demonstrates effective cost management, improved operational efficiencies, and targeted investments in technology and customer service.

Profitability was supported by optimized reconditioning processes, enhanced inventory turnover, and data-driven pricing strategies that helped maintain margins even amid market volatility.

Net Worth

CarMax’s market capitalization of $9.06 billion as of September 2025 serves as a benchmark for its net worth and investor confidence.

While slightly lower than earlier in the year due to macroeconomic factors and competitive pressures, this valuation underscores the company’s strong market position. Institutional investors, including Vanguard, BlackRock, and State Street, continue to hold substantial stakes, providing stability and support for CarMax’s growth initiatives.

Looking ahead, CarMax is focusing on omnichannel expansion, integrating online and in-store operations to offer a seamless customer experience. The company is investing in technology platforms for inventory management, pricing optimization, and digital sales channels.

By enhancing efficiency and adapting to consumer preferences, CarMax aims to sustain its revenue growth and maintain a solid financial foundation, ensuring long-term shareholder value.

Companies Owned by CarMax

As of 2025, CarMax operates a diverse portfolio of subsidiaries, brands, and strategic acquisitions that support its position as the largest used car retailer in the United States.

Below is a list of the major brands, companies, and subsidiaries owned by CarMax as of September 2025:

| Company / Brand | Type / Function | Key Details | Headquarters / Location |

|---|---|---|---|

| CarMax Auto Superstores, Inc. | Retail | Operates nationwide used vehicle dealerships; primary revenue driver; provides no-haggle buying experience | Richmond, Virginia, USA |

| CarMax Auto Superstores West Coast, Inc. | Retail Division | Manages CarMax operations on the West Coast; adapts to regional market dynamics | California, USA |

| CarMax Business Services, LLC | Financial Services | Provides in-house vehicle financing and extended service plans; enhances customer experience and revenue | Kennesaw, Georgia, USA |

| CarMax Enterprise Services, LLC | Corporate Services | Handles IT infrastructure, HR, and supply chain management for nationwide operations; centralizes internal services | Richmond, Virginia, USA |

| Glen Allen Insurance, Ltd. | Insurance | Captive insurance company managing property, liability, and vehicle-related risks; reduces insurance costs | Bermuda |

| Edmunds.com, Inc. | Digital Platform | Acquired in 2021; offers automotive research, reviews, and pricing tools; strengthens CarMax’s online presence | Santa Monica, California, USA |

| Angel City Football Club (ACFC) | Partnership / Sponsorship | CarMax is Founding Partner and Official Used Auto Retailer; supports community initiatives and youth programs | Los Angeles, California, USA |

CarMax Auto Superstores, Inc.

CarMax Auto Superstores, Inc. is the primary retail arm of CarMax, operating the company’s nationwide network of used vehicle dealerships. These superstores are strategically located across the United States, providing customers with a wide selection of quality used cars, transparent pricing, and a no-haggle buying experience. The superstores are integral to CarMax’s business model, serving as the primary touchpoints for customer interactions and vehicle sales.

CarMax Auto Superstores West Coast, Inc.

This subsidiary manages CarMax’s operations on the West Coast, overseeing the establishment and management of superstores in states such as California and Nevada. The West Coast division plays a crucial role in expanding CarMax’s market presence in the western United States, catering to a diverse customer base and adapting to regional market dynamics.

CarMax Business Services, LLC

CarMax Business Services, LLC provides financial services to CarMax customers, including vehicle financing and extended service plans. By offering these services in-house, CarMax enhances the customer experience, streamlines the purchasing process, and generates additional revenue streams. The subsidiary operates from Kennesaw, Georgia, and is a key component of CarMax’s integrated business model.

CarMax Enterprise Services, LLC

This subsidiary supports CarMax’s internal operations by providing enterprise-level services such as information technology infrastructure, human resources, and supply chain management. By centralizing these functions, CarMax ensures operational efficiency and consistency across its nationwide network of superstores.

Glen Allen Insurance, Ltd.

Glen Allen Insurance, Ltd., based in Bermuda, serves as CarMax’s captive insurance company. It provides insurance coverage for various aspects of CarMax’s operations, including property, liability, and vehicle-related risks. Having a captive insurer allows CarMax to manage its insurance costs more effectively and tailor coverage to its specific needs.

Edmunds.com, Inc.

In 2021, CarMax acquired Edmunds.com, Inc., a leading online automotive research and shopping platform, for approximately $404 million. Edmunds provides consumers with expert reviews, pricing information, and tools to compare vehicles, enhancing CarMax’s digital presence and customer engagement. The acquisition allows CarMax to offer a more comprehensive online car-buying experience and strengthens its position in the digital automotive marketplace.

Angel City Football Club (ACFC)

In February 2025, CarMax entered into a partnership with Angel City Football Club (ACFC), a professional women’s soccer team based in Los Angeles. As a Founding Partner and the Official Used Auto Retailer of ACFC, CarMax collaborates with the club to support community initiatives, promote youth sports programs, and engage with fans through various promotions and events. This partnership aligns with CarMax’s commitment to community involvement and brand visibility.

Final Words

Understanding who owns CarMax reveals a mix of institutional and individual investors guiding the company’s growth. The business continues to modernize how used cars are bought and sold, combining transparency with customer-focused services. Its strong financial performance and carefully managed operations have helped CarMax maintain its position as one of the leading used car retailers in the United States, attracting attention from both customers and investors alike.

FAQs

Who owns CarMax?

CarMax, Inc. is publicly owned, with the majority of its shares held by institutional investors. Vanguard Group is the largest shareholder, holding 11.7% of the company, followed by BlackRock, State Street, and other major investment firms. Individual and retail shareholders also own a significant portion, making CarMax a widely held public company.

Is CarMax a public company?

Yes, CarMax is a publicly traded company listed on the New York Stock Exchange under the ticker symbol KMX.

Where is CarMax’s headquarters located?

CarMax’s headquarters is located in Richmond, Virginia, United States.

Who is the founder of CarMax?

CarMax was founded in 1993 by Richard L. Sharp. The company was created as a subsidiary of Circuit City to innovate in the used car retail space.

Where is CarMax’s corporate headquarters?

CarMax’s corporate headquarters, also its main operational hub, is located in Richmond, Virginia.

What is CarMax’s mission statement?

CarMax’s mission is to “provide customers with a trusted and hassle-free car buying and selling experience, offering transparency, no-haggle pricing, and a wide selection of quality vehicles.”

Is CarMax owned by Walmart?

No, CarMax is not owned by Walmart. It is an independent publicly traded company.

Is CarMax a billion-dollar company?

Yes, CarMax is a multi-billion-dollar company, with annual revenue of approximately $26.35 billion in 2025 and a market capitalization of around $9.06 billion.

What does CarMax buy?

CarMax primarily buys used vehicles from individual sellers across the United States. The company evaluates vehicles for resale in its dealerships or wholesale operations and offers competitive cash or trade-in values to sellers.