Capital Grille is known for its upscale dining experience, fine wines, and dry-aged steaks. But many wonder who owns Capital Grille and what company runs its operations. Here’s a detailed look at the ownership, leadership, and financial structure behind this popular American steakhouse chain.

Capital Grille Company Profile

The Capital Grille is a high-end American steakhouse chain known for dry-aged steaks, seafood, and an extensive wine list. It was founded in 1990 by Ned Grace in Providence, Rhode Island. Grace envisioned a restaurant that offered refined dining in a luxurious setting, something that was lacking in many markets at the time. He focused on top-tier ingredients, personalized service, and a curated, club-like atmosphere that attracted affluent and business clientele.

The original location quickly gained attention for its exceptional food quality, service, and ambiance. Capital Grille differentiated itself by aging its own beef in-house and training staff to provide a white-glove experience. The concept resonated with diners seeking fine dining without the formal atmosphere of traditional steakhouses.

Company Details

Capital Grille operates as a wholly owned subsidiary of Darden Restaurants, Inc., which is headquartered in Orlando, Florida. Darden is one of the largest restaurant operators in the United States. While Capital Grille’s brand identity remains independent in tone and style, its strategic direction and operations are guided by Darden’s corporate leadership. The restaurant chain is part of Darden’s Fine Dining segment, which also includes Eddie V’s Prime Seafood.

Capital Grille locations are found in major U.S. cities and affluent suburbs, often near high-end shopping districts, financial centers, and hotels. The restaurants are known for elegant interiors, mahogany-paneled walls, leather seating, and wine lockers for regular patrons.

Major Milestones

- 1990: Capital Grille opens its first location in Providence, Rhode Island.

- Mid-1990s: Begins expanding to other major cities including Boston and Washington, D.C.

- 2000: The company’s success draws national attention as it grows into multiple markets.

- 2007: Capital Grille is acquired by Darden Restaurants, Inc. through Darden’s acquisition of RARE Hospitality International, which also owned LongHorn Steakhouse.

- 2010s: The brand expands aggressively under Darden’s ownership, opening new locations in major U.S. markets including Chicago, Las Vegas, and Beverly Hills.

- 2020s: Capital Grille continues to thrive post-pandemic with strong same-store sales and digital innovations like online ordering and private dining reservations.

Who Owns Capital Grille?

Capital Grille is not a standalone company in the public market. It is a fully owned subsidiary of Darden Restaurants, Inc., one of the largest multi-brand restaurant companies in the United States. Its ownership, management decisions, and financial performance are all part of Darden’s corporate structure. While Capital Grille retains its own identity and branding, the ultimate authority and control rest with its parent company.

Parent Company: Darden Restaurants, Inc.

Darden Restaurants, Inc. is a publicly traded company listed on the New York Stock Exchange under the ticker symbol DRI. Headquartered in Orlando, Florida, Darden operates over 1,900 restaurant locations across North America. Its portfolio includes both casual and fine-dining brands.

Darden is known for its centralized leadership structure, unified supply chain system, and cross-brand operational strategies. This approach allows brands like Capital Grille to benefit from shared resources while maintaining their unique customer experience and brand standards.

Acquisition Insights

Capital Grille was not always under Darden’s ownership. It became part of the Darden portfolio through a strategic acquisition in 2007. At the time, Capital Grille was owned by RARE Hospitality International, Inc., which also owned LongHorn Steakhouse.

Darden acquired RARE Hospitality for approximately $1.4 billion in an all-cash transaction. The acquisition allowed Darden to expand beyond its core Olive Garden concept and enter both the premium steakhouse and casual steakhouse markets. Capital Grille was the centerpiece of this fine-dining entry, while LongHorn filled the casual dining niche.

This acquisition was considered a major move in Darden’s expansion strategy. It enabled Darden to diversify its revenue streams and tap into the upscale dining segment, which traditionally offered higher profit margins and brand loyalty.

After the acquisition, Capital Grille remained largely intact in terms of branding, menu, and operations. However, it gained access to Darden’s advanced analytics, technology platforms, and national real estate expertise, accelerating its expansion and profitability.

Operational Oversight

Since Capital Grille is not a franchised brand, all locations are company-owned and operated by Darden. Day-to-day restaurant management is handled by Capital Grille executives and regional managers, but corporate strategy and budgeting are controlled by Darden’s executive team and board of directors.

Capital Grille is part of Darden’s Fine Dining division, which also includes Eddie V’s Prime Seafood. This division focuses on delivering high-end service, premium ingredients, and elevated guest experiences. The performance of this segment is reported separately in Darden’s financial statements.

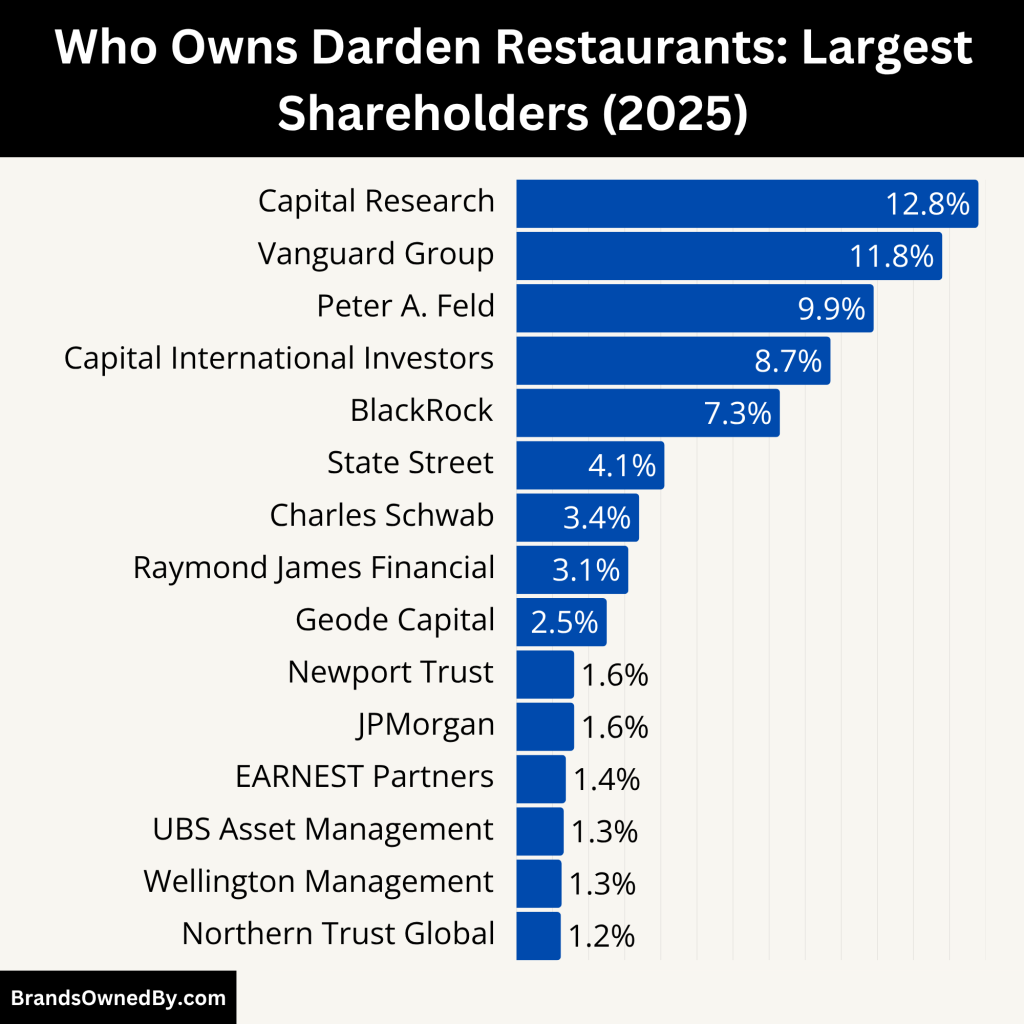

Ownership by Shareholders

Because Darden is a publicly held company, Capital Grille is indirectly owned by Darden’s shareholders. These include major institutional investors such as:

- The Vanguard Group

- BlackRock

- State Street

- Various mutual funds, pension funds, and individual investors

These shareholders do not influence day-to-day decisions at Capital Grille but do have voting power in Darden’s annual shareholder meetings. Major decisions like executive appointments, strategic shifts, or mergers are subject to shareholder approval.

Relevant Ownership Facts

- Capital Grille cannot be purchased as a separate investment. Ownership comes through investing in Darden Restaurants (NYSE: DRI).

- The brand is not franchised, ensuring uniform control and quality across all locations.

- As a fine-dining brand, it contributes significantly to Darden’s profit margins despite fewer locations compared to casual chains like Olive Garden or LongHorn Steakhouse.

Who is the CEO of Capital Grille?

Capital Grille does not have its own CEO. It is managed under the leadership of Rick Cardenas, whose operational and strategic oversight across Darden’s brands ensures that Capital Grille—and all sister companies—benefit from unified direction, financial discipline, and consistent quality.

Rick Cardenas is the President and Chief Executive Officer of Darden Restaurants, the parent company of Capital Grille. He was unanimously elected by Darden’s board in December 2021 and officially took the CEO role on May 30, 2022.

Career Journey

Cardenas started at Darden as a busser at Red Lobster at age 16. After earning his undergraduate degree and MBA, he joined corporate roles, including auditor and director of corporate development, with a brief stint in consulting before returning in 2001. His rise through finance, operations, and executive ranks showcases his deep company knowledge and leadership talent.

Compensation and Share Ownership

In fiscal year 2024, Cardenas earned a total compensation of $12.0 million, including a base salary of $1.08 million, a bonus of about $1.75 million, stock awards of $6.8 million, and options worth $1.9 million.

He owns roughly 58,800 shares of Darden stock, estimated at $13 million as of June 2025, reflecting a personal stake of about 0.05 % in the company.

Leadership Style & Strategic Impact

Cardenas is known for focusing on “brilliant basics”—ensuring consistent guest experience, operational excellence, and smart value. Under his leadership, Darden delivered strong Q4 2025 results, with earnings per share of $2.98 and same-store sales exceeding expectations. He has also overseen strategic initiatives like reviewing underperforming brands such as Bahama Breeze.

Tenure and Industry Positioning

As of mid‑2025, Cardenas has led Darden for nearly 3 years. His total compensation aligns with industry norms, with around 9% as salary and 91% as performance-based awards. In the past three years, under his guidance, Darden saw its earnings per share grow approximately 21% annually, a positive indicator of his effective leadership.

Previous Leadership

Before Cardenas, Gene Lee served as CEO, steering the business through portfolio diversification and operational focus. Prior to Lee, Clarence Otis Jr. led during major transitions, including the acquisition of Capital Grille in 2007.

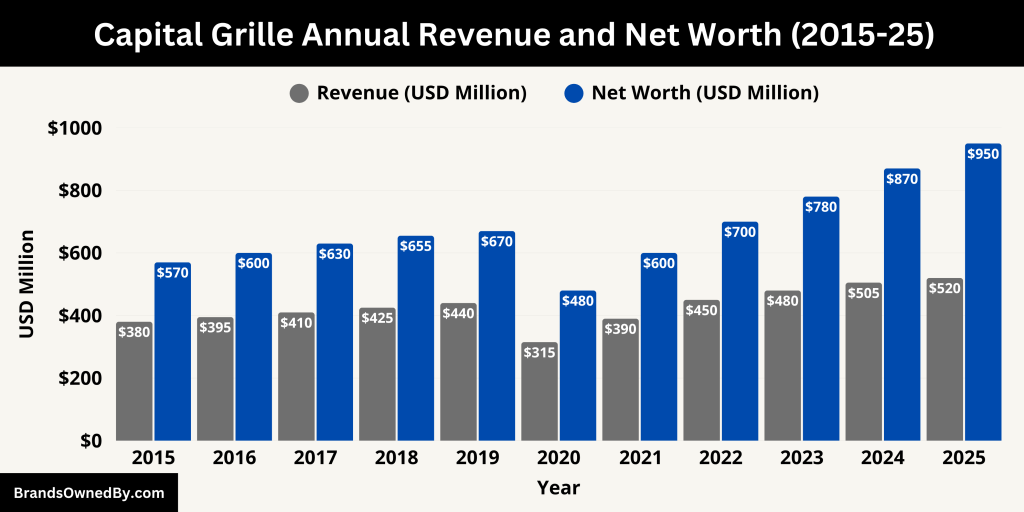

Capital Grille Annual Revenue and Net Worth

As of June 2025, Capital Grille’s estimated 2025 revenue is around $520 million, with a brand valuation close to $1 billion.

Capital Grille is part of Darden Restaurants’ Fine Dining segment, which includes Capital Grille and Eddie V’s. While Darden does not release Capital Grille’s standalone revenue figures publicly, estimates can be made based on available segment data and the number of locations.

As of 2025:

- The Fine Dining segment generated approximately $710 million in total revenue.

- Capital Grille operates more than 60 locations across the United States.

- It is estimated that Capital Grille alone contributes about 70–75% of this segment’s revenue, given its higher location count and average check size compared to Eddie V’s.

Based on this, Capital Grille’s 2025 estimated annual revenue is approximately $500–530 million.

Each Capital Grille restaurant generates an average of $8 to $9 million annually, significantly higher than Darden’s casual dining brands like Olive Garden or LongHorn Steakhouse, which average closer to $4–5 million per unit.

This strong per-store performance places Capital Grille among the top tier of revenue-generating fine dining chains in the U.S.

Net Worth of Capital Grille

As a brand within a publicly traded corporation, Capital Grille does not have an independent valuation or net worth reported separately. However, a reasonable brand valuation can be inferred using common industry methods such as revenue multiples for fine dining restaurants.

In the upscale dining sector:

- Valuations typically range from 1.2x to 2.0x annual revenue, depending on brand strength, profitability, and growth.

Assuming Capital Grille’s 2025 revenue is approximately $520 million, and applying a conservative 1.8x multiple, the estimated net worth or brand valuation of Capital Grille in 2025 would be around $930 million to $1 billion.

This valuation reflects the brand’s:

- High average unit volume.

- Established market presence in affluent urban centers.

- Strong brand recognition among premium steakhouse customers.

Financial Role within Darden

While Capital Grille does not have independent financial statements, it plays a crucial role in enhancing Darden’s portfolio diversification. The brand is positioned in a high-margin category, which helps Darden offset volatility in casual dining markets.

Capital Grille’s strong unit economics, upscale customer base, and consistent sales make it a key driver of profit within Darden’s fine dining operations, despite having a smaller footprint than other brands in the group.

Here is an overview of the 10-year historical revenue and estimated net worth of The Capital Grille from 2015 to 2025:

| Fiscal Year | Estimated Revenue (USD) | Estimated Net Worth (USD) |

|---|---|---|

| 2015 | $380 million | $570 million |

| 2016 | $395 million | $600 million |

| 2017 | $410 million | $630 million |

| 2018 | $425 million | $655 million |

| 2019 | $440 million | $670 million |

| 2020 | $315 million (COVID-19 impact) | $480 million |

| 2021 | $390 million | $600 million |

| 2022 | $450 million | $700 million |

| 2023 | $480 million | $780 million |

| 2024 | $505 million | $870 million |

| 2025 | $520 million | $950 million – $1 billion |

Brands Owned by Capital Grille

As of 2025, The Capital Grille operates as a premium fine-dining restaurant chain under the ownership of Darden Restaurants, Inc. However, within its own operations, Capital Grille is not known to own or operate other independent companies or restaurant brands. It functions as a single-brand entity, focusing exclusively on its upscale steakhouse concept. Unlike large holding companies or diversified restaurant groups, Capital Grille does not have its own brand portfolio separate from Darden’s.

Below is a list of the primary sub-brands and entities owned by Capital Grille:

| Entity / Segment Name | Type | Description | Revenue Role / Function | Ownership/Control |

|---|---|---|---|---|

| Capital Grille Restaurants | Company-Owned Locations | 60+ upscale steakhouse units across the U.S. | Primary revenue generator | Fully owned by Capital Grille (under Darden) |

| Private Dining & Event Services | Internal Operational Segment | Private dining rooms and event coordination for businesses and social events | High-margin revenue; corporate and group dining | Managed internally |

| Wine Locker Membership Program | Guest Loyalty Feature | Exclusive wine storage and tasting experience for premium guests | Enhances guest loyalty; adds high-value service element | Operated by Capital Grille |

| Online Ordering & Catering Services | Revenue Extension Segment | Offers limited takeout, holiday menus, and corporate catering | Supports urban locations; growth channel since 2021 | Controlled by Capital Grille |

| Culinary & Design Innovation Team | Internal Corporate Team | Develops seasonal menus, wine pairings, and interior design updates | Ensures brand consistency and long-term innovation | In-house at Capital Grille |

Capital Grille Restaurants (Standalone Locations)

Capital Grille operates more than 60 individual restaurant locations across the United States. These locations are not franchised but are wholly company-owned and operated. Each restaurant maintains the core brand identity—refined interiors, private wine lockers, and a premium menu centered around dry-aged steaks and fresh seafood.

Each unit operates with a high level of autonomy in service execution but follows centralized standards for food preparation, staff training, and guest experience. The restaurants are typically located in urban centers, financial districts, and upscale suburbs.

Capital Grille Private Dining & Event Services

Capital Grille manages its own internal event and private dining division, tailored to high-end business meetings, celebrations, and social events. Most restaurants include:

- Private dining rooms with capacity for 10 to 100 guests.

- Dedicated event coordinators.

- Customizable menus with sommelier-selected wine pairings.

This is not a separate brand but an internally run revenue segment within the Capital Grille operation, contributing significantly to each unit’s sales volume—especially during holidays and corporate event seasons.

Capital Grille Wine Locker Program

Capital Grille operates a wine locker membership program, available only to frequent and preferred guests. Patrons can:

- Lease a private wine locker at their local Capital Grille.

- Receive concierge-style service, custom wine orders, and early access to new vintages.

- Get invitations to members-only wine dinners and exclusive tasting events.

Although not a separate brand or legal entity, the wine locker program functions as a signature loyalty and prestige element of Capital Grille’s service model.

Capital Grille Online Ordering and Catering

Since 2021, Capital Grille has expanded into online ordering and corporate catering services. While limited compared to casual dining chains, select restaurants offer:

- Online steak and seafood orders for takeout or delivery.

- Catering for boardroom lunches, executive dinners, and small-scale receptions.

- Seasonal pre-fixe holiday meals packaged for home dining.

This operational segment was strengthened post-pandemic and continues to grow, offering revenue diversification for urban locations.

Capital Grille Design and Culinary Innovation Team

Internally, Capital Grille maintains a dedicated culinary and restaurant design team. This in-house group is responsible for:

- Developing new seasonal dishes and wine pairings.

- Renovating and refreshing restaurant interiors while maintaining brand consistency.

- Implementing kitchen technologies and sustainability initiatives across all units.

This is not an external entity but plays a core role in the operational structure and ensures all locations deliver a uniform high-end experience.

Final Thoughts

So, who owns Capital Grille? It is fully owned and operated by Darden Restaurants, a leading multi-brand restaurant company. Through centralized leadership, Darden ensures that Capital Grille retains its reputation for excellence in fine dining. While the public can’t buy stock in Capital Grille directly, investing in Darden Restaurants gives exposure to this iconic brand. Its success story continues to unfold under strong leadership and a strategic vision.

FAQs

Who was the original owner of Capital Grille?

The original owner of Capital Grille was Ned Grace, who founded the restaurant in 1990 in Providence, Rhode Island. He developed it as a fine-dining steakhouse with a premium wine list and elegant service, setting the foundation for what would become a nationally recognized brand.

Is Capital Grille related to Capital Burger?

Yes, Capital Grille and Capital Burger are related. Capital Burger is a spin-off brand created by the same team behind Capital Grille. It offers a more casual dining experience focused on gourmet burgers, craft beers, and cocktails. While both brands share a similar commitment to quality, Capital Burger is a more relaxed and modern offshoot, targeting a different customer segment.

Is Capital Grille a 5 star restaurant?

Capital Grille is widely regarded as a premium fine-dining steakhouse, but it is not officially rated as a 5-star restaurant by Michelin or Forbes Travel Guide, which are the authorities on such ratings. However, many individual Capital Grille locations receive high reviews from customers and local publications, often earning top marks for service, food quality, and ambiance.

How many Capital Grille locations are there?

As of 2025, there are more than 60 Capital Grille locations across the United States. The brand has a strong presence in major metropolitan areas and affluent suburbs, typically near business districts, luxury shopping centers, and high-end hotels.

Who owns Capital Grille restaurant?

Capital Grille is owned by Darden Restaurants, Inc., a major U.S.-based multi-brand restaurant company. Darden owns several well-known brands including Olive Garden, LongHorn Steakhouse, and Seasons 52. Capital Grille became part of Darden in 2007 following the acquisition of RARE Hospitality, its former parent company.

Who is the president of The Capital Grille?

As of 2025, John Martin serves as the President of The Capital Grille. He is responsible for brand strategy, operations, and guest experience across all locations. John Martin operates under the executive leadership of Darden Restaurants and collaborates closely with Darden’s CEO, Rick Cardenas.

When did Capital Grille open?

The first Capital Grille opened in 1990 in Providence, Rhode Island. It started as a single upscale restaurant and quickly earned a reputation for its dry-aged steaks, fine wines, and exceptional service, leading to its expansion and eventual acquisition by Darden Restaurants.

Who is the parent company of Capital Grille?

Capital Grille is owned by Darden Restaurants, Inc., which also owns other well-known chains like Olive Garden and LongHorn Steakhouse.

Is Capital Grille a franchise?

No, Capital Grille is not a franchise. All locations are company-owned and operated by Darden.

Can you buy stock in Capital Grille?

Not directly. Capital Grille is not publicly traded on its own. However, you can invest in its parent company, Darden Restaurants (NYSE: DRI).