- Canada Dry is owned by Keurig Dr Pepper and operates as a brand, not as an independent company or separate legal entity.

- Ownership of Canada Dry is indirect and flows through Keurig Dr Pepper’s public shareholder base, with institutional investors holding the majority stake.

- Mondelez International remains the largest strategic shareholder in Keurig Dr Pepper, giving it significant influence over the company that owns Canada Dry.

- Strategic and operational control of Canada Dry sits with Keurig Dr Pepper’s executive leadership and board, not with individual shareholders.

Canada Dry is a historic soft drink brand known mainly for its ginger ale. It began in Toronto, Canada, in 1904. The brand quickly gained attention for producing a lighter and smoother ginger ale compared to earlier versions. This refined taste helped Canada Dry stand out in the growing carbonated beverage market.

The brand built a strong identity around purity, quality, and refreshment. Its name reflects both its Canadian origin and the “dry” taste of its ginger ale, which means less sweet and more crisp. Over time, Canada Dry expanded beyond ginger ale into tonic water, club soda, sparkling water, and flavored carbonated drinks.

Canada Dry became especially popular during the Prohibition era in the United States. Ginger ale was widely used as a mixer to improve the taste of homemade alcoholic drinks. This increased its demand and helped the brand grow internationally.

Today, Canada Dry operates as a flagship soft drink brand within Keurig Dr Pepper. It is widely distributed across North America and several global markets. The brand is positioned as both a standalone refreshment and a premium mixer beverage. Its long-standing reputation and consistent flavor profile keep it competitive in the modern beverage industry.

Canada Dry Founder

Canada Dry was founded by John James McLaughlin, a Canadian pharmacist and chemist. He was born in 1865 in Enniskillen, Ontario. Before creating Canada Dry, McLaughlin worked in the pharmaceutical industry. He specialized in producing carbonated water and soda syrups.

In the late nineteenth century, McLaughlin traveled to the United States to study advanced soda manufacturing techniques. He gained deep technical knowledge about carbonation and flavor formulation. After returning to Canada, he started his own soda water business in Toronto.

In 1904, McLaughlin perfected a new type of ginger ale. It was less sweet and more refined than traditional ginger ales. He called it “Canada Dry Pale Ginger Ale.” The drink became an instant success. Its smooth taste and premium image appealed to both everyday consumers and high society.

McLaughlin played a major role in branding and marketing the product. Canada Dry even received a royal warrant from the Governor General of Canada in 1907. This strengthened its reputation as a high-quality beverage.

After John J. McLaughlin’s death in 1914, the company continued expanding under new leadership. However, his innovation and formulation remained the foundation of the brand. His vision turned Canada Dry into one of the most recognized ginger ale brands in the world.

Ownership History

Canada Dry ownership history shows how the brand evolved from a small Canadian pharmacy business into part of a major multinational beverage company.

Founded in 1904 by John J. McLaughlin, Canada Dry began as an independent company. Over time, it changed hands through mergers and acquisitions, including ownership by Norton Simon, Dr Pepper, Cadbury Schweppes, and later Dr Pepper Snapple Group.

Today, Canada Dry is owned by Keurig Dr Pepper, following the 2018 merger that formed the current parent company.

Founding and Early Private Ownership (1904–1914)

Canada Dry was founded in 1904 by John James McLaughlin in Toronto, Ontario. In its early years, the company operated as a privately owned family business. McLaughlin personally oversaw production, formulation, and branding.

The company grew quickly due to the success of Canada Dry Pale Ginger Ale. By 1910, the drink was being exported to the United States and other markets. After McLaughlin’s death in 1914, ownership passed to his brother, Samuel McLaughlin, who was also a prominent Canadian businessman.

During this period, Canada Dry remained independently controlled. It focused on expanding distribution and building a premium brand identity.

Expansion and Public Trading (1920s–1950s)

In the 1920s, Canada Dry experienced major growth. Prohibition in the United States increased demand for ginger ale as a mixer. This significantly boosted sales and international expansion.

To support growth, Canada Dry became publicly traded. The company established manufacturing plants outside Canada, including in the United States. This marked its transition from a family-controlled enterprise to a corporation with broader shareholder ownership.

Throughout the mid-twentieth century, Canada Dry expanded its product portfolio beyond ginger ale. It introduced club soda, tonic water, and other carbonated beverages. Ownership during this time remained dispersed among shareholders through public markets.

Acquisition by Norton Simon (1960s–1970s)

In 1964, Canada Dry was acquired by Norton Simon Inc., a large American conglomerate. This marked a significant shift. The brand moved from being a primarily beverage-focused company to becoming part of a diversified corporate structure.

Under Norton Simon, Canada Dry operated alongside other consumer brands. The conglomerate strategy focused on expanding market reach and operational scale. However, ownership was no longer centered on beverage specialization.

Later, Norton Simon itself was acquired. This resulted in Canada Dry changing hands again as part of broader corporate restructuring.

Integration into Dr Pepper (1980s)

In 1982, Canada Dry merged with Dr Pepper Company. This created a stronger beverage-focused organization. The merger aligned Canada Dry with a major soft drink brand, allowing operational efficiencies and improved distribution networks.

In 1986, Dr Pepper merged with The 7UP Company. This formed Dr Pepper/Seven Up Companies. Canada Dry became part of a growing portfolio of soft drink brands competing directly with Coca-Cola and PepsiCo.

This era consolidated Canada Dry firmly within the American beverage industry.

Cadbury Schweppes Era (1990s–2008)

In 1995, Cadbury Schweppes acquired Dr Pepper/Seven Up Companies. As a result, Canada Dry became part of Cadbury Schweppes’ global beverage division.

This ownership period expanded Canada Dry’s global footprint. Cadbury Schweppes managed a wide range of beverage brands, including Schweppes, Dr Pepper, and Snapple. Canada Dry operated within this multinational framework.

In 2008, Cadbury Schweppes separated its beverage business from its confectionery operations. The beverage division became Dr Pepper Snapple Group, an independent publicly traded company.

Formation of Keurig Dr Pepper (2018–Present)

In 2018, Dr Pepper Snapple Group merged with Keurig Green Mountain. This merger created Keurig Dr Pepper. Canada Dry became part of this newly formed beverage and coffee conglomerate.

The merger combined hot beverage systems with a strong portfolio of soft drinks. It strengthened distribution capabilities and expanded product diversification.

As of 2025, Canada Dry remains a brand under Keurig Dr Pepper. The company operates as a publicly traded corporation. Ownership is distributed among institutional investors, with Mondelez International retaining a significant minority stake following the 2018 transaction.

Today, Canada Dry functions as a core brand within one of North America’s largest beverage companies. Its ownership has evolved from a small Canadian family business to part of a multinational beverage corporation.

Who Owns Canada Dry?

Canada Dry is owned by Keurig Dr Pepper as of 2026. It is not an independent company. It operates as one of the core beverage brands within the Keurig Dr Pepper portfolio. The parent company manages production, branding, distribution, and strategic direction for Canada Dry across its operating markets.

Keurig Dr Pepper is one of the largest beverage companies in North America. It owns a wide range of soft drink, water, juice, and coffee brands. Canada Dry sits within its carbonated soft drink and mixer category, where ginger ale remains a key product segment.

Parent Company: Keurig Dr Pepper

Keurig Dr Pepper was formed in 2018 after the merger between Keurig Green Mountain and Dr Pepper Snapple Group. The company combines hot beverage systems and packaged cold beverages under one corporate structure.

The company operates through a centralized governance model. Brand-level operations like Canada Dry focus on marketing and product positioning. Major decisions such as acquisitions, manufacturing strategy, and global expansion are handled at the corporate level.

Keurig Dr Pepper is publicly traded. Ownership is distributed among institutional investors, asset managers, and public shareholders. Mondelez International remains one of the largest single shareholders, holding a significant minority stake following the 2018 merger.

Key Shareholders and Ownership Structure

Canada Dry does not have its own shareholders because it is not a standalone corporation. Ownership flows through Keurig Dr Pepper. The parent company’s equity is mainly held by large institutional investors.

Mondelez International is the largest strategic shareholder. It retained a major stake when it helped create the Keurig Dr Pepper structure through earlier ownership ties to the beverage business.

Other major shareholders include The Vanguard Group and BlackRock. These firms manage large investment funds and hold substantial voting power. However, they do not directly run company operations. Corporate control remains with the executive leadership and board of directors of Keurig Dr Pepper.

Acquisition and Merger Insights

Canada Dry has changed ownership multiple times through corporate acquisitions and mergers. The most important transition occurred in 2018. That year, Dr Pepper Snapple Group merged with Keurig Green Mountain to form Keurig Dr Pepper.

This merger combined a strong soft drink portfolio with a leading single-serve coffee system business. It created operational synergies, improved distribution, and expanded product diversification. Canada Dry became part of a broader beverage ecosystem rather than a standalone soda brand.

Before this, Canada Dry was part of Dr Pepper Snapple Group, which was formed in 2008 when Cadbury Schweppes separated its beverage division. Earlier still, the brand became aligned with Dr Pepper after mergers in the 1980s. These transitions gradually shifted Canada Dry from an independent beverage company to a brand within a large beverage conglomerate.

Strategic Importance Within the Parent Company

Canada Dry holds strategic value inside Keurig Dr Pepper. The brand dominates the ginger ale category in North America. It is also widely used as a mixer beverage, which supports steady demand.

The brand benefits from Keurig Dr Pepper’s large distribution network, marketing resources, and manufacturing scale. This allows Canada Dry to maintain strong shelf presence and consistent product availability. Corporate backing also supports product extensions such as flavored ginger ales and sparkling beverages.

Operational and Brand-Level Control

Although Canada Dry is owned by Keurig Dr Pepper, it operates as a managed brand rather than a separate legal entity. Brand managers oversee marketing, positioning, and product development. However, major decisions such as expansion strategy, partnerships, and investment allocation are controlled by the parent company’s executive leadership.

This structure ensures centralized control while allowing brand-level specialization. It is a common model used by large multinational beverage corporations.

Overall, Canada Dry is fully owned and controlled by Keurig Dr Pepper. Its ownership reflects decades of mergers, acquisitions, and corporate restructuring that transformed it from a small Canadian company into a flagship brand within a major beverage group.

Competitor Ownership Comparison

The ownership of Canada Dry shapes how it competes in the global beverage industry. Canada Dry operates under Keurig Dr Pepper, a North America–focused beverage company. Its key competitors are controlled by much larger global corporations. Ownership concentration, regional licensing, and portfolio strategy directly influence market power, distribution reach, and category dominance as of February 2026.

| Brand / Segment | Parent Company | Ownership Structure | Geographic Strength | Ginger Ale / Mixer Position | Competitive Advantage |

|---|---|---|---|---|---|

| Canada Dry | Keurig Dr Pepper | Public company; majority institutional ownership with Mondelez International as significant minority shareholder | Strongest in North America | Market leader in U.S. ginger ale segment | Category specialization and dominant shelf presence in U.S. |

| Schweppes (U.S.) | Keurig Dr Pepper | Same ownership as Canada Dry (U.S. rights) | United States | Strong in tonic water and mixers | Portfolio consolidation under same parent reduces domestic competition |

| Schweppes (International) | The Coca-Cola Company | Direct corporate ownership with global bottling partners | Europe, Asia, Latin America | Competes directly with Canada Dry internationally | Global distribution scale and premium mixer positioning |

| Seagram’s Ginger Ale | The Coca-Cola Company | Fully owned brand within Coca-Cola portfolio | North America and selected global markets | Direct competitor to Canada Dry | Integrated global bottling and marketing infrastructure |

| PepsiCo Carbonated Portfolio (Pepsi, 7UP Intl., etc.) | PepsiCo | Centralized global ownership combining beverages and snacks | Global presence across 200+ countries | Indirect competitor in soda shelf space | Cross-category leverage and strong global retail power |

| 7UP (U.S.) | Keurig Dr Pepper | U.S. rights owned by KDP | United States | Lemon-lime soda; indirect competitor | Domestic portfolio synergy under same ownership |

| 7UP (International) | PepsiCo | Global ownership outside U.S. | Global | Indirect competitor | Strong emerging market penetration |

Canada Dry vs Schweppes Ownership

In the United States, both Canada Dry and Schweppes are owned by Keurig Dr Pepper. This gives the company consolidated control over two of the strongest mixer and ginger ale brands in the U.S. beverage market. The strategy is deliberate. Canada Dry is positioned as a smoother, premium ginger ale, while Schweppes focuses more on tonic water and classic mixers. This reduces internal brand conflict and maximizes shelf dominance.

Outside the United States, ownership diverges. Schweppes is largely owned and distributed by The Coca-Cola Company across Europe, Asia, and several international markets. This creates direct competition globally between Coca-Cola-controlled Schweppes and Keurig Dr Pepper’s Canada Dry. The split ownership of Schweppes is one of the most unique competitive structures in the beverage industry and significantly shapes regional market battles.

Canada Dry vs Coca-Cola Ginger Ale and Mixer Brands

The Coca-Cola Company remains the largest global competitor in the mixer and carbonated beverage segment. Coca-Cola owns and distributes Seagram’s Ginger Ale in key markets, along with Schweppes internationally. Unlike Canada Dry, Coca-Cola operates under a tightly integrated global ownership and bottling system.

This ownership model allows Coca-Cola to scale products faster across regions. It also enables synchronized global branding and production. Canada Dry, under Keurig Dr Pepper, has stronger category leadership in North America. However, Coca-Cola maintains broader international reach and deeper penetration in emerging markets.

As of February 2026, Coca-Cola continues strengthening its premium mixer category. It focuses on higher-margin tonic water and cocktail mixers, where Schweppes competes directly with Canada Dry in several non-U.S. regions.

Canada Dry vs PepsiCo Beverage Ownership

PepsiCo competes with Canada Dry primarily through its broader carbonated beverage ecosystem rather than direct ginger ale dominance. PepsiCo owns major global brands such as Pepsi, Mountain Dew, and Mirinda. It also controls 7UP outside the United States, while Keurig Dr Pepper owns U.S. rights to 7UP.

PepsiCo’s ownership structure is highly centralized and globally diversified. Unlike Keurig Dr Pepper, PepsiCo operates a dual-engine model combining beverages and snack foods. This gives PepsiCo cross-category leverage, retail bargaining power, and stronger global distribution infrastructure.

Although PepsiCo is not the global leader in ginger ale, its distribution strength and brand ecosystem allow it to compete indirectly with Canada Dry in shelf space, retail positioning, and consumer reach across multiple beverage categories.

Structural Ownership Differences

Keurig Dr Pepper operates with concentrated regional strength. Its ownership is dominated by institutional investors and strategic shareholders, with Mondelez International retaining a notable minority stake. The company focuses heavily on North America, where Canada Dry holds category leadership in ginger ale.

Coca-Cola follows a globally centralized ownership and franchised bottling structure. Most core brands remain directly controlled by the parent company. This enables large-scale international expansion, consistent branding, and market penetration across more than 200 countries.

PepsiCo operates a fully integrated ownership model combining beverages and food products. This diversified structure reduces risk and strengthens global supply chain influence. PepsiCo’s broader product ecosystem allows it to dominate shelf presence even in markets where it does not lead in ginger ale specifically.

Competitive Impact of Ownership

Ownership structure directly determines competitive positioning. Canada Dry benefits from focused category leadership and strong brand loyalty in North America under Keurig Dr Pepper. The shared U.S. ownership of Schweppes strengthens its dominance in mixers and tonic beverages.

Coca-Cola leverages global ownership concentration to dominate international beverage markets. Its control over Schweppes outside the U.S. gives it a direct competitive channel against Canada Dry globally. PepsiCo uses diversification and distribution scale to compete indirectly through category dominance and retail power.

As of February 2026, Canada Dry remains the leading ginger ale brand in North America. However, Coca-Cola and PepsiCo continue to hold broader global beverage leadership due to ownership scale, infrastructure, and international reach.

Who Controls Canada Dry?

As of February 2026, Canada Dry is controlled through Keurig Dr Pepper’s centralized governance system. Tim Cofer, as CEO, holds ultimate executive authority. The Board of Directors provides oversight and approves strategic decisions. Institutional shareholders influence governance but do not manage operations.

Canada Dry’s day-to-day marketing and product execution are handled within the beverage division. However, financial, strategic, and capital control remain firmly at the corporate level.

Corporate Governance and Decision-Making Authority

Keurig Dr Pepper operates under a centralized corporate governance model. Canada Dry is part of the U.S. Refreshment Beverages segment. However, segment classification does not mean autonomy. All major brand decisions require executive and board-level oversight.

The Board of Directors sets enterprise-wide priorities. This includes:

- Portfolio growth targets

- Margin performance thresholds

- Capital expenditure approvals

- Supply chain investments

- Major pricing strategy shifts.

If Canada Dry launches a new product extension or packaging format, it must align with enterprise revenue and profitability goals. Manufacturing expansions or ingredient sourcing changes require corporate approval because they affect the system-wide cost structure.

The governance model ensures that Canada Dry supports overall shareholder returns rather than operating independently based on brand-level objectives alone.

CEO Control and Strategic Direction

As of February 2026, Tim Cofer serves as Chief Executive Officer of Keurig Dr Pepper. The CEO holds direct authority over all brands within the company, including Canada Dry.

Executive authority includes:

- Determining long-term category focus (carbonated soft drinks vs. ready-to-drink coffee vs. water)

- Approving annual marketing investment levels

- Setting pricing discipline across the beverage portfolio

- Evaluating brand performance metrics

- Overseeing innovation pipelines.

For Canada Dry, this means ginger ale positioning, premium mixer expansion, flavor extensions, and packaging innovation must align with the broader beverage strategy set by the CEO and executive committee.

The CEO also oversees enterprise-wide cost management. If raw material costs increase, corporate leadership may adjust pricing strategy or promotional cadence across brands, including Canada Dry.

Executive Committee and Segment Oversight

Beyond the CEO, Canada Dry is influenced by the executive leadership team responsible for U.S. Refreshment Beverages. This includes senior leaders overseeing commercial strategy, supply chain operations, and brand marketing execution.

Operational control at this level includes:

- National distribution planning

- Retail negotiation strategy

- Production scheduling across bottling partners

- Marketing campaign deployment

- Inventory and demand forecasting.

However, these leaders operate within financial targets and capital budgets approved by corporate leadership. They cannot independently alter long-term capital investments or change strategic direction without executive authorization.

Role of Institutional Shareholders in Control

Keurig Dr Pepper is publicly traded. Major institutional shareholders include Mondelez International, The Vanguard Group, and BlackRock. These entities hold significant equity stakes and voting rights.

Mondelez International remains a notable strategic shareholder due to the 2018 merger structure that formed Keurig Dr Pepper. However, it does not directly manage operations.

Institutional investors influence control indirectly through:

- Voting on board appointments

- Approving executive compensation packages

- Supporting or challenging major acquisitions

- Exercising shareholder governance rights.

Operational control remains with management. Shareholders shape governance outcomes but do not direct day-to-day brand strategy for Canada Dry.

Operational Control at the Brand Level

At the brand level, Canada Dry has dedicated brand managers and marketing leadership. These teams are responsible for:

- Consumer positioning

- Advertising execution

- Flavor development testing

- Seasonal campaign rollout

- Retail merchandising strategy.

However, brand-level control is tactical, not strategic. If Canada Dry proposes expanding into a new international market, the initiative must pass corporate financial scrutiny. If margins underperform, executive leadership can reduce marketing budgets or shift promotional emphasis.

In short, brand managers execute strategy. Corporate leadership defines it.

Canada Dry Annual Revenue and Net Worth

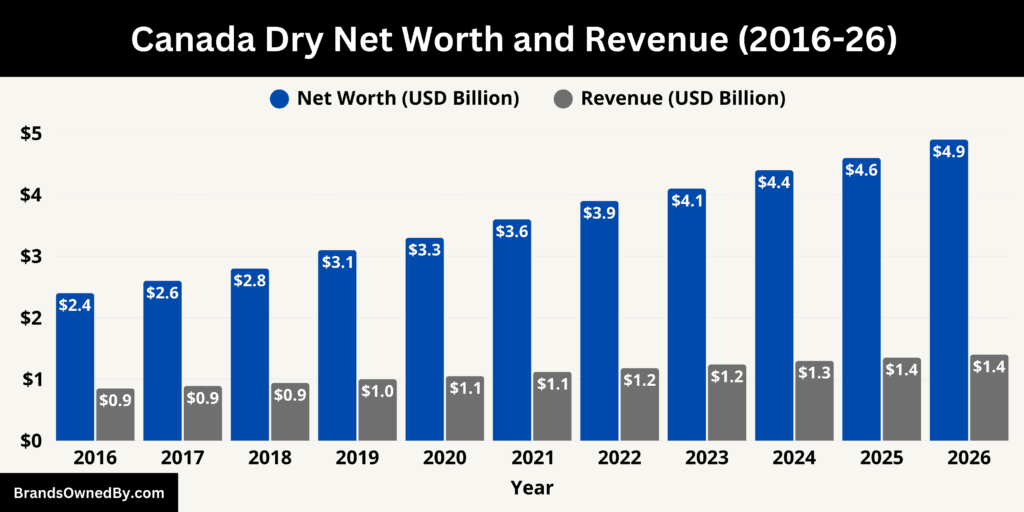

As of February 2026, Canada Dry generates an estimated $1.40 billion in annual revenue and holds an estimated brand net worth of approximately $4.9 billion. Although Canada Dry does not report standalone financial statements, industry estimates based on retail sales data, category share, and brand valuation models provide a reliable picture of its financial scale. The brand remains one of the most valuable ginger ale names in North America.

2026 Revenue Breakdown

Canada Dry’s estimated $1.40 billion revenue in 2026 is driven primarily by ginger ale, which accounts for roughly 72% of total sales. That translates to approximately $1.01 billion generated from regular, diet, zero sugar, and flavored ginger ale variants.

Tonic water and club soda contribute about 18% of revenue, or approximately $252 million. This segment benefits from premium mixer positioning, especially in retail cocktail consumption and hospitality channels.

The remaining 10%, approximately $140 million, comes from flavored sparkling beverages, seasonal limited editions, and specialty product extensions. Growth in this category has been supported by consumer preference shifts toward lighter carbonation and lower sugar options.

From a geographic perspective, approximately 85% of revenue is generated in the United States. Canada contributes roughly 10%, while the remaining 5% comes from selective international licensing markets.

Pricing and Volume Dynamics

Canada Dry’s growth in 2026 reflects a combination of modest volume expansion and pricing discipline. Average selling prices increased approximately 3% year-over-year due to broader carbonated beverage pricing adjustments across the retail sector.

Unit case volume growth is estimated at 1.5% to 2%. The majority of revenue growth has therefore been price-driven rather than volume-driven. This reflects category maturity in North America and limited international penetration compared to global beverage giants.

The brand maintains strong retail penetration across grocery chains, club stores, convenience stores, and foodservice outlets. Large pack formats and multi-can cases represent a significant portion of revenue contribution.

Historical Revenue Growth Trend

Canada Dry’s revenue has grown steadily over the past decade. In 2016, estimated revenue stood at approximately $0.85 billion. By 2020, revenue crossed the $1.05 billion mark, supported by increased at-home beverage consumption.

Between 2021 and 2024, revenue expanded at an average annual growth rate of approximately 4–5%. Pricing optimization, product extensions, and premium positioning within the mixer segment contributed to this expansion.

From 2025 to 2026, revenue growth accelerated slightly to approximately 3.7% year-over-year, reaching $1.40 billion. This growth reflects stable category demand and disciplined pricing rather than aggressive volume expansion.

2026 Brand Net Worth

Canada Dry’s estimated brand net worth of $4.9 billion as of February 2026 reflects brand equity rather than physical assets. Brand valuation models typically consider revenue contribution, operating margin strength, market leadership, brand loyalty, and long-term growth stability.

Canada Dry maintains a dominant market share in the U.S. ginger ale category. Strong brand recognition, consistent product formulation, and long-standing retail partnerships support its valuation.

The brand’s valuation has increased from approximately $2.4 billion in 2016 to nearly $5 billion in 2026. This represents more than 100% growth over ten years. The increase reflects steady revenue expansion, improved category positioning, and higher pricing power within the carbonated soft drink segment.

Revenue Drivers and Profitability Structure

Canada Dry benefits from relatively stable input costs compared to more volatile beverage categories. Its core ingredients include carbonated water, sweeteners, and flavor concentrates. Packaging and distribution remain the largest cost components.

Gross margins are estimated to align with premium carbonated soft drink averages, generally ranging between 50% and 55% at the brand contribution level. Premium mixer pricing and strong retail turnover support margin consistency.

Retail sales channels account for the majority of revenue, with grocery chains, mass merchandisers, and club stores representing the largest distribution outlets. On-premise hospitality sales provide additional margin support in the mixer segment.

Future Revenue Forecast (2027–2030)

Looking forward, Canada Dry’s revenue is projected to grow at a moderate annual rate of 3% to 4% over the next four years.

Projected revenue estimates are as follows:

- 2027: $1.45 billion

- 2028: $1.50 billion

- 2029: $1.55 billion

- 2030: $1.60 billion.

Growth is expected to be driven by incremental pricing adjustments, flavor line extensions, and continued demand in the premium mixer category. However, growth is likely to remain steady rather than aggressive due to category maturity in North America.

Brand net worth could approach $5.5 billion to $6.0 billion by 2030 if current revenue and margin trends continue. This assumes stable consumer demand and no major category disruption.

Brands Owned by Canada Dry

As of 2026, Canada Dry operates multiple product lines, mixer beverages, flavored extensions, and trademark-controlled brand entities.

| Brand / Entity | Category | Core Purpose | Key Products / Variants | Market Role | Strategic Importance |

|---|---|---|---|---|---|

| Canada Dry Ginger Ale | Carbonated Soft Drink | Flagship beverage and primary revenue driver | Original, Diet, Zero Sugar | Dominant in North American ginger ale market | Core brand identity and largest revenue contributor |

| Canada Dry Bold Ginger Ale | Premium Ginger Ale Variant | Stronger ginger flavor positioning | Bold Ginger Ale | Targets consumers seeking intense ginger taste | Expands reach into premium and flavor-intensity segment |

| Canada Dry Tonic Water | Mixer Beverage | Cocktail and mixed drink use | Regular Tonic, Diet Tonic | Strong presence in hospitality and retail mixer category | Supports premium mixer positioning and diversified revenue |

| Canada Dry Club Soda | Sparkling Mixer | Neutral carbonated beverage for mixing | Classic Club Soda | Widely used in beverage mixing and standalone consumption | Maintains presence in non-flavored mixer segment |

| Canada Dry Sparkling Seltzer Water | Low-Calorie Sparkling Beverage | Sugar-free and flavored sparkling water | Lemon Lime, Orange, Triple Berry, others | Targets health-conscious and low-calorie beverage consumers | Supports diversification beyond traditional soda |

| Canada Dry Flavored Ginger Ale Series | Flavored Carbonated Drinks | Seasonal and flavor-driven product extensions | Cranberry, Blackberry, Lemon, Green Tea Ginger Ale | Expands consumption occasions and flavor variety | Enhances consumer engagement and product innovation |

| Canada Dry Diet and Zero Sugar Line | Low-Calorie Beverage Segment | Reduced sugar and calorie beverage options | Diet Ginger Ale, Zero Sugar Ginger Ale, Diet Tonic | Serves health-conscious consumer segment | Critical for long-term demand sustainability |

| Canada Dry Mixer Portfolio | Mixer Beverage Segment | Cocktail-focused beverage positioning | Ginger Ale Mixers, Tonic Water, Club Soda | Used in both retail and hospitality channels | Strengthens premium mixer category leadership |

| Canada Dry Trademark and Brand Entity | Brand Management | Brand identity, formulation, and trademark control | Brand name, logo, proprietary formulations | Ensures product consistency across markets | Protects intellectual property and brand equity |

Canada Dry Ginger Ale

Canada Dry Ginger Ale is the flagship and most valuable product line of the brand. It represents the largest share of Canada Dry’s revenue and brand recognition. The product is positioned as a smooth, crisp, and less sweet ginger ale compared to competitors.

This product line includes Regular Ginger Ale, Diet Ginger Ale, and Zero Sugar Ginger Ale. The formulation and branding remain consistent with the original 1904 recipe identity. It dominates the North American ginger ale category and is widely used both as a standalone beverage and as a mixer.

Canada Dry Bold Ginger Ale

Canada Dry Bold Ginger Ale is a stronger-flavored variant launched to target consumers seeking a more intense ginger taste. It contains higher ginger extract concentration and delivers a sharper flavor profile compared to the original product.

This variant was introduced to capture market share from premium and craft-style ginger beverages. It appeals to consumers looking for a more pronounced ginger experience and has strengthened Canada Dry’s position in the flavor-intensity segment.

Canada Dry Tonic Water

Canada Dry Tonic Water is one of the brand’s longest-running mixer products. It is widely used in cocktail preparation and is positioned within the premium mixer beverage category.

The tonic water line includes Regular Tonic Water and Diet Tonic Water. The product contributes significantly to Canada Dry’s presence in the hospitality and at-home cocktail market. It also supports the brand’s reputation beyond ginger ale.

Canada Dry Club Soda

Canada Dry Club Soda operates as a key sparkling mixer product. It is used in both beverage mixing and standalone consumption. The product is positioned as a clean, neutral sparkling water with balanced carbonation.

Club Soda supports Canada Dry’s presence in the non-flavored mixer segment and is widely distributed across retail and foodservice channels.

Canada Dry Sparkling Seltzer Water

Canada Dry Sparkling Seltzer Water represents the brand’s entry into the low-calorie sparkling water segment. It targets consumers shifting away from traditional sugary sodas.

This product line includes multiple flavors such as Lemon Lime, Orange, and Triple Berry. It contributes to Canada Dry’s diversification beyond classic carbonated soft drinks.

Canada Dry Flavored Ginger Ale Series

The Flavored Ginger Ale Series includes line extensions designed to capture seasonal and flavor-driven demand. These include:

- Blackberry Ginger Ale

- Cranberry Ginger Ale

- Lemon Ginger Ale

- Green Tea Ginger Ale.

These variants help Canada Dry maintain consumer interest and expand beyond traditional ginger ale consumption occasions.

Canada Dry Diet and Zero Sugar Beverage Line

Canada Dry operates a dedicated low-calorie and zero-sugar product segment. This includes Diet Ginger Ale, Zero Sugar Ginger Ale, Diet Tonic Water, and low-calorie flavored variants.

This segment addresses health-conscious consumers and supports long-term brand relevance as sugar-reduction trends continue influencing beverage demand.

Canada Dry Mixer Portfolio

The Canada Dry Mixer Portfolio includes tonic water, club soda, and ginger ale products specifically marketed for cocktail and mixed drink use. This segment focuses on carbonation consistency, clean flavor balance, and premium positioning.

It plays a key role in retail and hospitality channels, especially in at-home mixology trends and premium beverage consumption.

Canada Dry Trademark and Brand Licensing Entity

Canada Dry operates as a trademark-controlled brand entity within its operating structure. The brand name, logo, and formulations are protected and licensed across production and distribution networks.

Although manufacturing and distribution are handled through corporate bottling systems, Canada Dry maintains its own brand identity, product formulations, and trademark portfolio. This ensures consistent product positioning across all markets.

Final Words

Canada Dry remains one of the most recognized ginger ale brands in the world. For those asking who owns Canada Dry, the brand operates under Keurig Dr Pepper and benefits from strong corporate backing, stable demand, and deep market presence. Its long history, consistent flavor, and trusted reputation keep it relevant across generations. While the beverage industry continues to evolve, Canada Dry maintains a steady position through brand strength, product consistency, and enduring consumer loyalty.

FAQs

Where is Canada Dry manufactured?

Canada Dry is manufactured through a network of licensed bottling and production facilities primarily in the United States and Canada. Production is handled by bottling partners and company-operated plants under the supervision of Keurig Dr Pepper. The brand does not rely on a single factory. Instead, it uses a distributed manufacturing system to ensure consistent supply across North America.

What company owns Canada Dry?

Canada Dry is owned by Keurig Dr Pepper. It operates as one of the company’s core beverage brands and is not an independent corporation.

Who owns Canada Dry brand?

The Canada Dry brand, including its trademarks, formulations, and product identity, is owned and controlled by Keurig Dr Pepper.

Who makes Canada Dry products?

Canada Dry products are produced by Keurig Dr Pepper through its manufacturing and authorized bottling network. These facilities handle formulation, carbonation, packaging, and distribution of all Canada Dry beverages.

Is Canada Dry owned by Pepsi or Coca-Cola?

No. Canada Dry is not owned by PepsiCo or The Coca-Cola Company. It is owned by Keurig Dr Pepper, a separate beverage company.

Which ginger ale is owned by Coca-Cola?

The Coca-Cola Company owns and distributes Seagram’s Ginger Ale in several markets. Coca-Cola also controls Schweppes in many international regions, where it competes with Canada Dry.

Is Canada Dry Coca-Cola?

No. Canada Dry is not part of The Coca-Cola Company. It is a brand under Keurig Dr Pepper.

Is Canada Dry a soda?

Yes. Canada Dry is a carbonated soft drink. Its most famous product, Canada Dry Ginger Ale, is a soda made with carbonated water, flavoring, and sweeteners.

Why is it called Canada Dry?

The name reflects both the brand’s origin and its taste profile. “Canada” represents where the drink was created. “Dry” refers to its less sweet, crisp flavor compared to traditional ginger ales when it was first introduced in 1904.