Bed Bath & Beyond has been one of the most recognized names in American retail for decades. Many people still search for who owns Bed Bath & Beyond after its bankruptcy, closure of stores, and eventual revival. The company has gone through several ownership changes, restructuring, and brand transformations that have shaped where it stands today.

Bed Bath & Beyond Company Profile

Bed Bath & Beyond began in 1971 in suburban New Jersey. It grew into a big-box home goods retailer in the US and Canada. It once ranked on the Fortune 500. The chain offered everything from linens to kitchenware.

All stores closed after Chapter 11 filings in 2023. Ownership then passed to Overstock.com, which has since been rebranded. Today, the company runs as a digital-first brand with re-emerging physical locations in slimmed-down formats.

Bed Bath & Beyond Founders

Bed Bath & Beyond was founded in 1971 by Warren Eisenberg and Leonard Feinstein, two seasoned retailers who had previously worked together at Arlan’s, a discount store chain. Both men believed there was room in the American retail market for a specialty store that focused on quality home goods at competitive prices. They invested their savings and opened the first store in Springfield, New Jersey, under the name Bed ’n Bath.

Eisenberg and Feinstein personally managed the earliest operations. They built the business model around large-format stores that could carry a wider selection than traditional department stores. This strategy quickly distinguished Bed ’n Bath from competitors. By the mid-1980s, the founders had expanded to multiple locations across the Northeast.

In 1987, as the product selection grew beyond linens and bathroom essentials, they renamed the company Bed Bath & Beyond. The new name reflected their ambition to cover every corner of the home, from kitchenware to furniture and decorative accessories. Both founders remained deeply involved in leadership roles for decades, guiding the company through its public listing in 1992 and overseeing its rise to a household name in American retail.

Even after stepping down from day-to-day management, Eisenberg and Feinstein continued to influence the company as board members and advisors. Their vision of combining variety, scale, and affordability set the foundation for Bed Bath & Beyond’s peak years, when it operated hundreds of stores across the US and Canada.

Major Milestones

- 1971 – First store opens as Bed ’n Bath in New Jersey.

- 1985 – The first superstore debuts; rapid growth begins.

- 1987 – Rebrands to Bed Bath & Beyond.

- Early 1990s – Product lines expand to include appliances and home furnishings.

- 1992 – Company goes public.

- 1999–2000 – Reaches over $1 billion in sales; grows to over 300 stores in 43 states.

- Acquisitions: Harmon (health & beauty), Buy Buy Baby in 2007, Cost Plus World Market in 2012, One Kings Lane and Decorist mid-2010s.

- Early 2020s – Faces mounting competition, supply chain issues, and online pressure.

- 2023 – Files for Chapter 11; closes all 360 stores.

- 2023 – Overstock.com acquires its brand and IP assets.

- November 2023 – Overstock.com rebrands to Beyond, Inc.

- February 2025 – Beyond, Inc. acquires Buy Buy Baby rights.

- October 2024 – Announces $25 million investment partnership with Kirkland’s to restart physical stores in smaller formats.

- August 2025 – First new store opens in Nashville as Bed, Bath & Beyond Home.

- August 18, 2025 – Beyond, Inc. officially renames to Bed Bath & Beyond, Inc. and reclaims ticker symbol BBBY effective August 29, 2025.

Who Owns Bed Bath & Beyond?

As of 2025, Bed Bath & Beyond is owned and operated by Beyond, Inc., the company formerly known as Overstock.com. After acquiring the Bed Bath & Beyond brand and intellectual property during bankruptcy proceedings in 2023, Overstock shifted its entire corporate identity to Bed Bath & Beyond.

In August 2025, Beyond, Inc. officially changed its name to Bed Bath & Beyond, Inc. and reclaimed the iconic ticker symbol BBBY on the Nasdaq.

One of the most significant ownership-related developments in 2025 was the reacquisition of Buy Buy Baby, a brand Bed Bath & Beyond had originally launched in the early 2000s.

The rights were purchased in February 2025, reuniting the two brands under one umbrella. Additionally, in partnership with Kirkland’s, Bed Bath & Beyond began reintroducing physical stores in slimmed-down formats. However, the company announced it would not reopen stores in California, citing high costs and regulatory burdens.

Acquisition Insights

When Bed Bath & Beyond filed for Chapter 11 bankruptcy in April 2023, all physical stores were slated for closure. Overstock saw value in the brand’s recognition and digital potential.

It acquired the Bed Bath & Beyond trademarks, domain names, and customer database for $21.5 million in cash. Importantly, the deal excluded most of the physical assets and real estate, focusing instead on digital transformation.

The acquisition was part of Overstock’s strategy to reinvent itself by adopting a stronger retail identity. Overstock already had experience in online home goods and furniture sales, but lacked the broad consumer awareness that Bed Bath & Beyond commanded.

By merging its e-commerce infrastructure with the Bed Bath & Beyond brand name, the company aimed to combine recognition with efficiency.

Ownership Structure

Bed Bath & Beyond, Inc. is a publicly traded company listed on the Nasdaq. Its ownership is split among institutional investors, retail investors, and company insiders. Large asset managers such as Vanguard Group and BlackRock hold significant stakes.

These institutions have voting rights that give them influence in major corporate decisions, including board appointments and strategic direction. Retail investors also make up a sizable portion of the shareholder base, many of whom were drawn to the brand during its “meme stock” phase.

Control and Leadership

Although shareholders own the company, operational control rests with the executive team and board of directors. The CEO and senior management direct strategy, branding, and financial planning, while shareholders exert influence through board votes and annual meetings.

The company’s leadership has emphasized shifting from a failing big-box model to a leaner online-first approach, with selective partnerships bringing physical stores back in smaller, more efficient formats.

Bed Bath & Beyond Bankruptcy

Bed Bath & Beyond, once a dominant force in home goods retail, began facing challenges in the late 2010s. The rapid shift toward online shopping and the growing dominance of Amazon, Walmart, and Target created fierce competition. The company struggled to modernize its stores and e-commerce platforms at the same pace.

Heavy reliance on coupon-based promotions further reduced profitability, while supply chain disruptions in the early 2020s worsened its financial position.

Filing for Chapter 11

By 2023, Bed Bath & Beyond’s situation had become unsustainable. The company filed for Chapter 11 bankruptcy protection in April 2023. This move marked the collapse of a retail giant that had operated for over 50 years.

The bankruptcy proceedings led to widespread store closures across the United States, as the company sought to preserve cash and reorganize its remaining assets.

Acquisition by Overstock.com

During the bankruptcy process, Overstock.com acquired Bed Bath & Beyond’s intellectual property, brand name, and digital assets for $21.5 million. This acquisition did not include most of the physical stores, which were shut down. Overstock saw an opportunity to revive the well-known brand by shifting it into a digital-first model.

Following the acquisition, Overstock rebranded itself as Beyond, Inc. and relaunched the Bed Bath & Beyond name in 2024.

This bold move allowed the company to leverage decades of brand recognition while leaving behind the operational inefficiencies of the past.

By 2025, Bed Bath & Beyond was repositioned as an e-commerce leader with selective new retail locations and stronger private-label offerings.

The bankruptcy of Bed Bath & Beyond highlights the importance of adapting to consumer behavior shifts. A failure to modernize quickly, combined with poor inventory management and overreliance on promotions, caused the retailer to lose its competitive edge.

Its rebirth under Beyond, Inc. shows how brand equity can survive even when the original business fails.

Who is the CEO of Bed Bath & Beyond?

In March 2025, Beyond, Inc.—the parent of Bed Bath & Beyond—appointed Marcus Lemonis as its Principal Executive Officer, combining the roles of Executive Chairman with executive leadership responsibilities. This move was aimed at driving a strategic turnaround and a return to profitability.

At the same time, Adrianne Lee, who had served as Chief Financial Officer since 2020, was elevated to President & CFO. In her expanded capacity, she now oversees finance, legal, investor relations, human resources, and IT security.

| Period | CEO / Principal Executive Officer | Supporting Executive |

|---|---|---|

| Until November 2023 | Jonathan Johnson | — |

| Nov 2023 – mid-2024 | Dave Nielsen (Interim CEO) | Adrianne Lee (as CFO) |

| Early 2024 – mid 2024 | Chandra Holt (CEO, Bed Bath & Beyond) | Adrianne Lee (expanded CFO role) |

| March 2025 – present | Marcus Lemonis (Principal Executive Officer) | Adrianne Lee (President & CFO) |

Former CEO: Chandra Holt

Prior to the March 2025 leadership shake-up, Chandra Holt had been serving as CEO of the Bed Bath & Beyond segment under Beyond, Inc. She brings extensive experience in retail and e-commerce, having previously held senior roles at Walmart, Sam’s Club, and Conn’s HomePlus. However, she ceased this role in mid-2024 amid an internal reorganization.

Interim Leadership: Dave Nielsen & Jonathan Johnson

Initially, following the 2023 acquisition of the Bed Bath & Beyond brand, Jonathan Johnson—longtime CEO of Overstock.com—stepped down. Dave Nielsen took over as Interim CEO and President, overseeing the company during the transitional phase into Beyond, Inc.

Bed Bath & Beyond Annual Revenue and Net Worth

Beyond, Inc.—now operating fully as Bed Bath & Beyond, Inc.—has shown steady improvement in revenue as it transitions from restructuring toward growth. In the second quarter of 2025, the company recorded net revenue of $282 million, marking a 22 percent increase over the first quarter.

This sequential growth demonstrates early traction from cost optimizations, streamlined operations, and focused branding efforts.

Earlier in the year, the company emphasized that it was “less than 60 days from transitioning out of restructuring and into a revenue growth phase”.

While exact full-year figures for 2025 are not publicly available yet, these quarterly results signal that the company is on the path to meaningful revenue expansion.

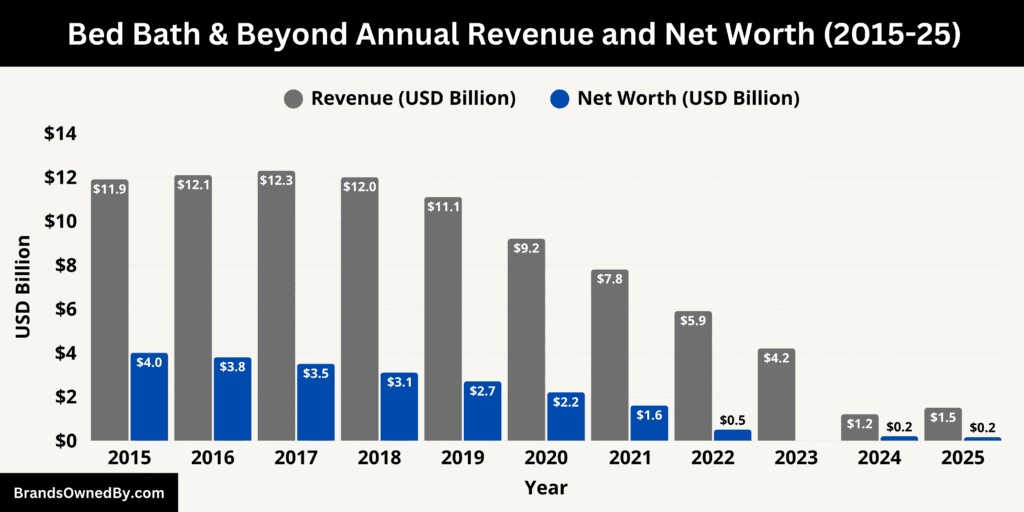

Here’s an overview of the Bed Bath & Beyond annual revenue and net worth for the last 10 years:

| Year | Revenue (Approx.) | Net Worth / Shareholders’ Equity (Approx.) | Notes |

|---|---|---|---|

| 2015 | $11.9 billion | $4.0 billion | Peak years, company still a dominant home goods retailer. |

| 2016 | $12.1 billion | $3.8 billion | Revenue peak period, but competition from Amazon and Walmart begins to erode margins. |

| 2017 | $12.3 billion | $3.5 billion | Sales plateau; profits begin to shrink; coupons lose effectiveness. |

| 2018 | $12.0 billion | $3.1 billion | Online competition accelerates, margins tighten further. |

| 2019 | $11.1 billion | $2.7 billion | Store traffic declines, restructuring attempts underway. |

| 2020 | $9.2 billion | $2.2 billion | Pandemic impacts; Buy Buy Baby still provides some stability. |

| 2021 | $7.8 billion | $1.6 billion | Aggressive turnaround efforts under new leadership, limited success. |

| 2022 | $5.9 billion | $500 million | Severe losses; liquidity crisis worsens. |

| 2023 | $4.2 billion* | Negative equity | Files for Chapter 11 bankruptcy; assets acquired by Overstock for $21.5M. (*Partial year prior to bankruptcy filing.) |

| 2024 | $1.2 billion | ~$200 million | First full year under Beyond, Inc. (formerly Overstock), online-only business model. |

| 2025 | $1.3–1.5 billion (projected) | ~$156 million cash + inventory, net worth improving | Revenue rebound under rebranded Bed Bath & Beyond, Inc. (formerly Beyond, Inc.); profitability gap narrows, brand reunites with Buy Buy Baby. |

Profitability and Operating Efficiency

Despite still being in a net loss position, Bed Bath & Beyond has made marked gains in narrowing its losses and improving margins.

In Q2 2025, the adjusted EBITDA loss was trimmed to $8 million, representing a remarkable 78 percent improvement from the prior year.

The gross profit for that quarter came in at $67 million, equivalent to 23.7 percent of net revenue, a 360-basis-point year-over-year improvement.

These metrics reflect the company’s disciplined approach to cost management, including significant reductions in technology and general & administrative expenses (down $9 million compared to 2024).

This level of operational discipline is steadily constructing a foundation for profitability.

Net Worth

As of August 2025, the estimated net worth of Bed Bath & Beyond is around $156 million.

Regarding liquidity and balance sheet strength, the company ended Q2 2025 with about $156 million in combined cash, cash equivalents, restricted cash, and inventory.

While we lack a fully consolidated net worth figure for mid-2025, this level of working capital reflects a leaner and more stable financial posture compared to pre-bankruptcy times.

Earlier in the Q1 2025 update, the company revealed a 46 percent improvement in net loss and a 72 percent improvement in adjusted EBITDA year-over-year, further underlining the pace of financial recovery.

Brands Owned by Bed Bath & Beyond

Bed Bath & Beyond, restructured and revived in 2025, operates a mix of brands and entities that reflect its shift toward a modern, digital-first retailer. While some legacy names were lost during bankruptcy, several core brands remain active, and new ventures are shaping their future.

Below is a list of major brands and companies owned by Bed Bath & Beyond as of August 2025:

| Brand/Entity | Status in 2025 | Focus & Operations | Strategic Importance |

|---|---|---|---|

| Bed Bath & Beyond (Core Brand) | Active | Flagship brand, restructured into a digital-first retailer with select new smaller-format stores. Focus on home essentials, furniture, bedding, and kitchenware. | Central to the company’s identity and revival, blending e-commerce with modern in-store experience. |

| Buy Buy Baby | Active (Reacquired 2025) | Baby products, gear, and nursery furniture. Operates online and reopening standalone stores. | Key growth engine; captures the family and baby market, one of the strongest assets in company history. |

| Bed Bath & Beyond Home Stores | Active (2025 launch with Kirkland’s partnership) | Smaller physical retail stores featuring curated home furnishings and lifestyle décor. | Represents a return to physical retail in a leaner, modernized form. |

| Harmon Face Values | Dormant (Brand Rights Retained) | Former health and beauty chain. No standalone stores. Exploring relaunch through private-label products online and in stores. | Opportunity to revive as a low-cost, value-driven personal care line under Bed Bath & Beyond umbrella. |

| One Kings Lane | Discontinued standalone brand, integrated into marketplace | Luxury home furnishings and design. Elements folded into Bed Bath & Beyond’s premium online offerings. | Adds aspirational and higher-end appeal to the Bed Bath & Beyond platform. |

| Bed Bath & Beyond Marketplace | Active | Third-party online seller marketplace integrated into main platform. Competes with Amazon, Walmart, and Wayfair. | Expands product assortment at lower cost, key driver of digital-first strategy. |

| Private Labels (Various) | Active | In-house product lines in bedding, kitchenware, furniture, and décor. Higher-margin categories. | Critical for differentiation, pricing power, and brand revival strategy. |

Bed Bath & Beyond (Core Brand)

The flagship brand continues to operate as the centerpiece of the business. Originally built on large-format home goods stores, the brand was restructured into a digital-first retailer after bankruptcy.

By 2025, Bed Bath & Beyond has returned to physical retail in select markets, opening smaller, modernized store formats. The focus is on home essentials, furniture, bedding, and kitchenware, blending e-commerce with a streamlined in-store experience. The rebranded company has made it clear that it intends to grow as an omnichannel brand rather than a traditional big-box retailer.

Buy Buy Baby

In February 2025, Bed Bath & Beyond reacquired the rights to Buy Buy Baby, a popular chain specializing in baby products, gear, and furniture. This brand had previously been one of the company’s strongest-performing assets before being separated during the 2023 bankruptcy.

Its return marks a significant strategic move, allowing Bed Bath & Beyond to capture the lucrative baby and family market once again. Buy Buy Baby is expected to operate both online and through select standalone stores.

Bed Bath & Beyond Home Stores

In partnership with Kirkland’s, Bed Bath & Beyond began opening new physical stores in 2025 under the name “Bed Bath & Beyond Home.” These locations are smaller than the company’s legacy superstores and designed to emphasize curated collections, modern home furnishings, and lifestyle décor. The model reflects consumer preferences for more efficient retail footprints with integrated digital shopping options.

Harmon Face Values

Harmon, once a health and beauty chain owned by Bed Bath & Beyond, was shut down during the bankruptcy process. However, Bed Bath & Beyond retained the branding rights. While no physical Harmon stores remain open, the company is exploring opportunities to bring Harmon products back as private-label offerings within its e-commerce site and physical stores.

This would allow the company to reintroduce value-priced health, beauty, and personal care products under a trusted brand name.

One Kings Lane

One Kings Lane, a luxury home furnishings and design brand acquired in 2016, no longer operates as a standalone company under Bed Bath & Beyond. However, in 2025, elements of its product catalog and aesthetic have been incorporated into the Bed Bath & Beyond online marketplace.

The brand identity serves as an inspiration for the premium segment of Bed Bath & Beyond’s online offerings, providing higher-end furniture and décor options.

Bed Bath & Beyond Marketplace

As part of its reinvention, the company operates a third-party seller marketplace under the Bed Bath & Beyond platform. This allows independent sellers to list products alongside core inventory, expanding the brand’s assortment without the heavy costs of traditional retail inventory.

The marketplace is a central piece of the growth plan, aiming to compete directly with Amazon, Wayfair, and Walmart in the home goods space.

Bed Bath & Beyond Private Labels

The company also operates several private-label product lines across bedding, kitchenware, and home furnishings. These in-house brands, developed during its earlier expansion years, continue to play a role in differentiating its product mix. Private labels offer higher margins and greater control over design and pricing.

In 2025, Bed Bath & Beyond is emphasizing these collections more strongly as part of its brand revival strategy.

Final Words

The question of who owns Bed Bath & Beyond has a complex answer. Originally an independent retail giant, it went through years of decline and eventually bankruptcy. Today, it is owned by the company formerly known as Overstock, rebranded entirely under the Bed Bath & Beyond name.

The business now operates as an online retailer with major institutional shareholders and a reshaped leadership team. Its survival depends on competing effectively in the digital marketplace against dominant players like Amazon and Walmart.

FAQs

Who is Bed Bath & Beyond owned by?

As of 2025, Bed Bath & Beyond is owned by Beyond, Inc., the parent company that was formerly known as Overstock.com. The company acquired the brand out of bankruptcy in 2023, restructured it, and later rebranded itself under the Bed Bath & Beyond name to leverage its stronger consumer recognition.

Who bought Bed Bath & Beyond?

Bed Bath & Beyond was purchased in 2023 by Overstock.com for $21.5 million during its bankruptcy proceedings. Overstock acquired the intellectual property, brand name, and digital assets, and later relaunched the business as a digital-first retailer.

Who is Bed Bath & Beyond new owner?

The new owner of Bed Bath & Beyond is Beyond, Inc. (formerly Overstock.com). The company completed its transformation in 2024 by officially renaming itself to Bed Bath & Beyond, Inc., signaling a fresh chapter for the brand.

Who founded Bed Bath & Beyond?

Bed Bath & Beyond was founded in 1971 by Warren Eisenberg and Leonard Feinstein. The two former retail executives opened the first store in New Jersey, initially called “Bed ’n Bath.” The company grew into one of America’s largest home goods retailers over the following decades.

Who is the owner of Bed Bath and Beyond?

The current owner of Bed Bath & Beyond is Beyond, Inc. (previously Overstock.com). It operates the brand along with Buy Buy Baby and other associated assets.

Why did Bed Bath & Beyond go broke?

Bed Bath & Beyond went broke due to a combination of factors: declining in-store traffic, intense competition from Amazon, Walmart, and Target, and a failure to adapt quickly to e-commerce trends. Its reliance on heavy couponing eroded margins, while supply chain issues and unsuccessful private-label strategies accelerated losses. By 2023, mounting debt and cash flow problems led to its Chapter 11 bankruptcy.

Who owns Bed Bath & Beyond now?

Bed Bath & Beyond is owned by Overstock.com, which acquired its brand name and assets in 2023 and later rebranded itself as Bed Bath & Beyond.

Is Bed Bath & Beyond still in business?

Yes, but it no longer operates physical stores. It now functions as an online retailer under the Bed Bath & Beyond brand.

Did Bed Bath & Beyond go bankrupt?

Yes, the company filed for bankruptcy in 2023 due to mounting debt and declining sales. Its brand was later revived by Overstock.

What happened to Buy Buy Baby and other subsidiaries?

Buy Buy Baby, Cost Plus World Market, and other subsidiaries were sold off during the bankruptcy process. They are no longer part of Bed Bath & Beyond.