Asplundh Tree Expert, LLC is one of the largest privately held companies in the United States, yet many people still wonder who owns Asplundh and what the company actually does. Founded nearly a century ago, the company plays a major role in utility vegetation management and infrastructure services. Understanding its ownership and structure gives insight into how this family-run giant operates today.

Asplundh Company Profile

Asplundh Tree Expert, LLC is a leading utility services company specializing in vegetation management, utility infrastructure support, and traffic control. As of 2025, it operates in the United States, Canada, Australia, and New Zealand. The company is best known for maintaining safe clearances between trees and power lines, but it has significantly expanded its service offerings over the past few decades.

Asplundh remains one of the largest privately held companies in the U.S. In 2025, it employs over 36,000 people and serves electric utilities, municipalities, railroads, and telecommunications providers across North America and abroad.

Founding and Early History

The company was founded in 1928 in Pennsylvania by Carl Hjalmar Asplundh and his three sons—Carl Jr., Griffith, and Lester Asplundh. Their goal was to offer specialized tree pruning services to utility companies, ensuring power line safety and reliability. The company quickly became known for its technical precision and safety standards, which were pioneering at the time.

From its inception, the business was family-run, and that tradition continues nearly 100 years later. The founders emphasized professionalism in a field that was, at the time, loosely regulated and often informal.

Key Milestones and Growth

1950s–1970s: Asplundh expanded its reach across the U.S., establishing regional offices and winning long-term contracts with major utility providers.

1980s: Introduced advanced tree-trimming techniques and invested in safety training programs. By the end of the decade, Asplundh had grown to thousands of employees and was working with nearly every major utility in North America.

1990s: The company began diversifying. It expanded into traffic control, utility line construction, and railroad vegetation services.

1995: Launched Asplundh Australia, marking its first major international expansion.

2000s–2010s: Acquired several subsidiaries such as UtiliCon Solutions and Traffic Control Services, enhancing its non-vegetation business lines.

2017: Faced a major compliance issue involving undocumented workers. The company paid a $95 million settlement, the largest immigration-related fine at the time. It restructured its internal systems and compliance processes afterward.

2020–2025: Acquired firms like ACRT Services, Wright Tree Service of the West, and CN Utility Consulting, expanding its role in utility consulting, environmental services, and infrastructure development. In 2025, the company is stronger than ever, with a solid reputation and a growing portfolio of service areas.

As of 2025, Asplundh remains headquartered in Willow Grove, Pennsylvania, and is widely respected for its operational scale, low employee turnover, and long-term client relationships.

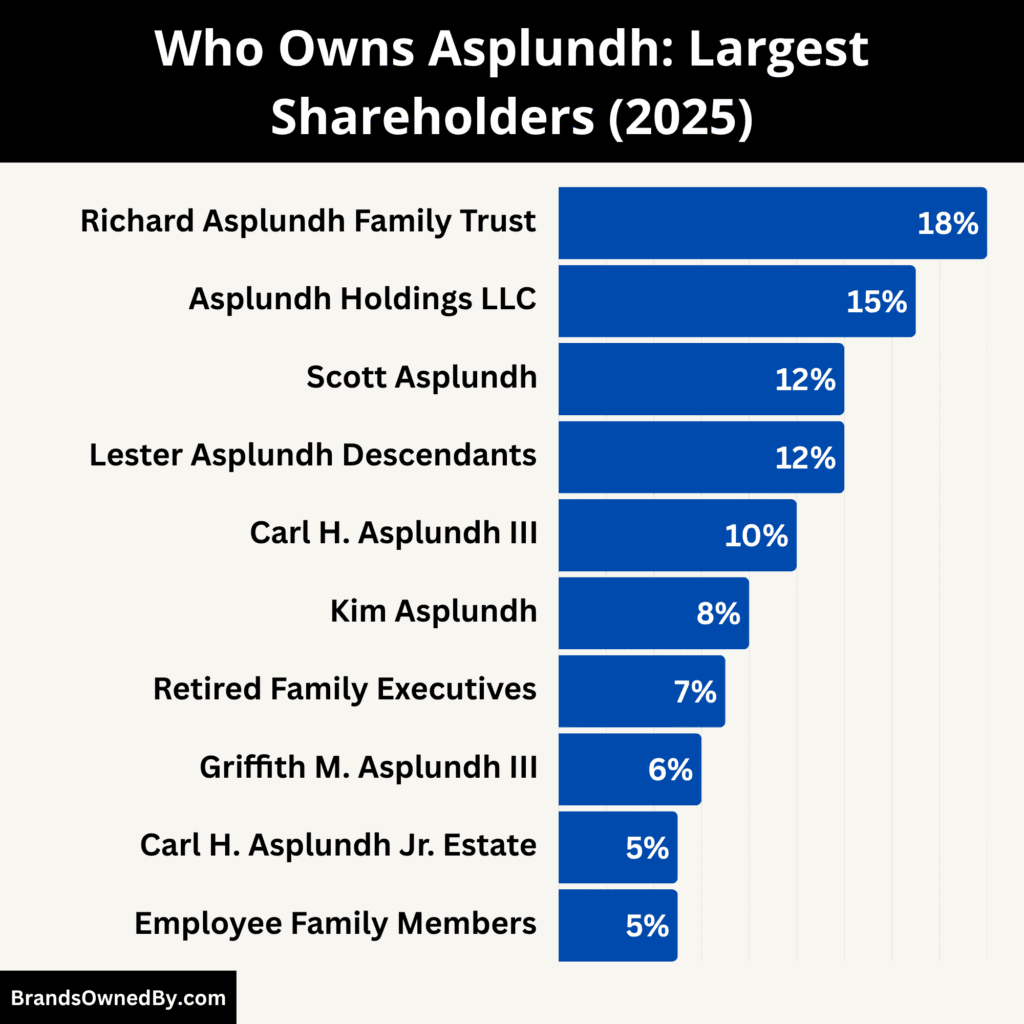

Who Owns Asplundh: Top Shareholders

Asplundh Tree Expert, LLC is a privately held, family-owned company. As of 2025, ownership is spread across multiple members of the Asplundh family. The company does not have any public or institutional shareholders, and its shares are not traded on any exchange. Instead, ownership has been passed down through multiple generations of the founding family. The structure is maintained through family trusts and holding companies to preserve legacy and control.

Here’s a summary of Asplundh ownership:

- Largest Shareholder Block: Carl and Richard Asplundh branches (via family trusts and direct ownership)

- Voting Control: Fully retained by the Asplundh family through multiple trusts and LLCs

- Institutional Investors: None

- Public Ownership: None

- Board Representation: Entirely family and trusted long-time company executives

- Stock Transfers: Limited to family members only, with restrictions enforced through internal policy.

Below are the major shareholders and entities that play a key role in owning and controlling Asplundh as of August 2025:

Scott Asplundh (12%)

Scott Asplundh is the current CEO and one of the key shareholders. As a third-generation family member, Scott holds a significant stake in the company. Though the exact percentage is private, his leadership role gives him substantial influence over strategy and operations. He is a member of the board of directors and is involved in most executive-level decisions.

Scott’s ownership is tied to a family trust that consolidates his branch’s shares. This ensures continuity and influence in board-level matters. His leadership has focused on safety compliance, expansion, and strengthening internal governance since the post-2017 restructuring.

Kim Asplundh (8%)

Kim Asplundh is a senior family member with deep involvement in operations. She holds a moderate share of the company through a generational trust fund and continues to advise leadership on family governance and long-term planning. Although not involved in daily operations, her vote on the board carries weight in decisions related to expansion, hiring of key executives, and corporate ethics.

Her role ensures that the founding principles continue across generations. She represents a more traditional wing of the family, favoring gradual growth and preservation of the company culture.

Carl H. Asplundh III (10%)

Carl H. Asplundh III is another active shareholder and relative of co-founder Carl H. Asplundh Jr. He holds a sizeable equity interest and is known for his influence in strategic planning and field operations. He served in an executive capacity in the past and now acts more as a board advisor.

His shares are held through a family entity that combines voting power for stronger board influence. He remains a crucial figure in contract negotiations and regional expansion strategy.

Griffith M. Asplundh III (6%)

Griffith Morgan Asplundh III is a fourth-generation shareholder. His stake comes through direct family inheritance and holding trusts. While not involved in day-to-day management, he serves on committees related to risk management and capital allocation.

His influence is largely financial, as he plays a behind-the-scenes role in decisions involving acquisitions and external partnerships. His focus is to ensure the company stays debt-light and conservatively financed.

Richard Asplundh Family Trust (18%)

The Richard Asplundh Family Trust holds a combined share on behalf of Richard Asplundh’s descendants. This trust controls a significant block of voting shares. It’s structured to consolidate generational wealth and ownership, ensuring a united voice within the board.

The trust has designated representatives who attend shareholder meetings and review governance policies. Their focus is long-term stability, investment planning, and intergenerational wealth preservation.

Lester Asplundh Descendants (12%)

Lester Asplundh, one of the co-founders, has several descendants who remain shareholders in 2025. Though none of them hold executive positions, their collective ownership forms an important voting bloc in the family council and board elections.

Their shares are held through individual family vehicles and a legacy trust. They often align their vote with the Richard and Carl branches to maintain continuity and shared family vision.

Family Holding Entity – Asplundh Holdings LLC (15%)

Asplundh Holdings LLC is the private corporate structure that holds pooled shares for many family members, especially those who are passive owners. This entity simplifies internal governance, streamlines dividends, and helps maintain ownership boundaries.

It also functions as a protective shield, ensuring that shares remain within the family. The entity appoints representatives to the board and votes collectively on strategic and financial issues.

Employee Family Members (5%)

Several family members are employees at various levels of the organization and own minor to moderate shares in the company. These include operations managers, legal advisors, and regional directors. Their equity is often in the form of non-voting shares or restricted shares issued through internal family stock programs.

Their role ensures that operational decisions reflect a strong connection to the company’s founding values. These individuals often provide valuable field feedback to top executives.

Retired Family Executives (7%)

Past leaders who stepped down but retained their ownership include members of the second and third generations. Their combined equity is considerable, although they no longer participate in active decision-making. They serve as advisors and hold honorary board titles.

They influence succession planning and provide mentorship to current leadership. Their shares are managed through trusts or family foundations focused on legacy and philanthropy.

Carl H. Asplundh Jr. Estate (5%)

The estate of Carl H. Asplundh Jr., who passed away in 2020, continues to hold a significant interest in the company. The shares are being gradually transferred to his heirs under the terms of a multi-phase estate plan. These heirs are now represented by family advisors and estate managers, ensuring consistent involvement in governance.

The estate still plays a stabilizing role in major company votes and succession decisions.

Consolidated Family Council

While not a shareholder in itself, the Family Council represents the interests of all branches of the Asplundh family. It ensures equal participation in strategic decisions and shareholder meetings. It helps resolve disputes, advises on executive succession, and maintains alignment on long-term goals.

In 2025, the Council continues to be a binding force, especially as the fourth generation takes on more responsibility.

Who is the CEO of Asplundh?

As of August 2025, Matt Asplundh serves as the Chief Executive Officer of Asplundh Tree Expert, LLC. He is a fourth‑generation member of the Asplundh family. He was elected CEO in 2021 following a strategic succession plan by the board.

Prior to that, long‑time family leader Scott M. Asplundh transitioned to vice‑chairman.

Matt holds a bachelor’s degree in management from the University of Central Florida. He spent nearly three decades rising through Asplundh, starting from field crew assignments up to executive leadership roles, including responsibility for 23 field regions and seven subsidiaries, before becoming CEO.

Role and Leadership Structure

As CEO, Matt oversees all facets of operations. He sets strategic direction for the company’s vegetation management and infrastructure divisions across multiple continents. He also plays an active role in sustainability initiatives, corporate governance, and inclusion efforts in the workplace.

The decision‑making structure features a board of directors chaired by Steven G. Asplundh, who serves separately as chairman, while Matt focuses on day‑to‑day and long‑term execution. The board comprises family members and trusted long‑time executives, facilitating continuity through generational shifts.

Past CEOs in Recent Generations

Scott M. Asplundh

Scott served as CEO from 2010 to 2021 and was elected chairman in 2017 due to the declining health of then‑chairman Christopher B. Asplundh Sr. He had joined the company in 1980 and climbed through field and leadership roles before assuming the top position.

Under Scott’s leadership, Asplundh expanded internationally and improved safety and compliance systems.

Predecessor: Christopher B. Asplundh Sr.

Christopher B. Asplundh Sr. preceded Scott as chairman of the board. Due to illness, he stepped back in 2017, paving the way for Scott to take on dual roles. Christopher played a major part in maintaining family governance and oversight prior to his passing.

Leadership Style and Key Initiatives

Matt embodies the family’s long-term stewardship philosophy while driving modernization and sustainability.

In 2022, he joined CEO Action for Diversity & Inclusion to further DEI across the company, highlighting Asplundh’s effort to evolve not only operationally, but culturally as well.

He also emphasizes technology adoption—investing in AI, telematics, and digital mapping—to improve utility operations and fleet efficiency across regions serviced by Asplundh Tree Expert, LLC.

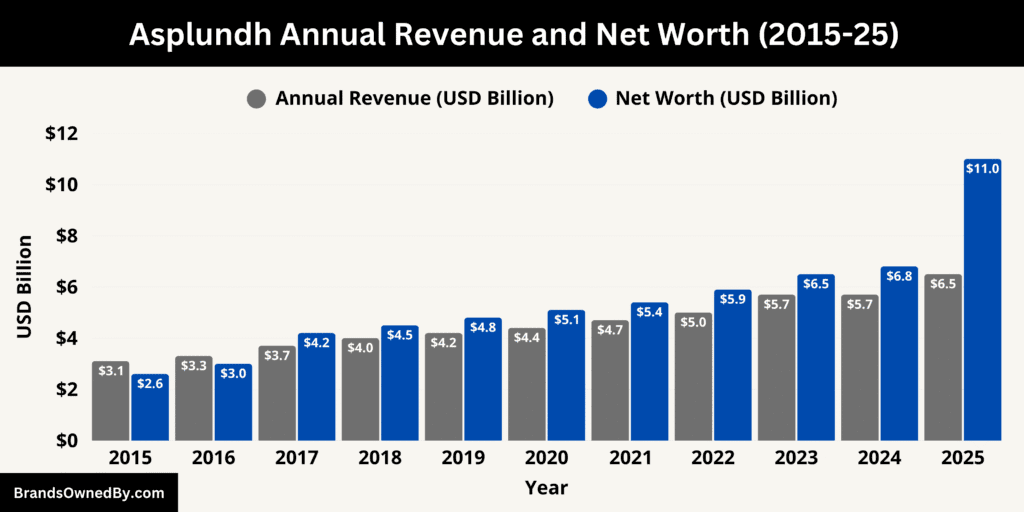

Asplundh Annual Revenue and Net Worth

In 2025, Asplundh Tree Expert, LLC achieved approximately $6.5 billion in revenue. This reflected steady growth over the prior decade and robust demand for vegetation management, utility services, and traffic infrastructure support. Revenue was derived from major long‑term contracts with electric utilities, telecommunication companies, railroads, and municipalities across the United States, Canada, Australia, and New Zealand.

Strong performance in consulting services and acquisitions such as ACRT Services and Wright Tree Service of the West bolstered overall revenue. Growth in remote monitoring and utility infrastructure services also contributed meaningfully to total top‑line results.

Asplundh Net Worth (2025)

As of August 2025, Asplundh’s estimated net worth or enterprise value stands at around $11 billion. This reflects the company’s private equity held within the Asplundh family, its tangible and intangible assets, and retained earnings. The valuation considers the value of owned equipment fleets, proprietary technology platforms for vegetation management, ongoing and recurring contracts, and the value embedded in its estate of family‑held shares. Conservative debt levels and strong liquidity further support this private valuation figure.

Here is the historical revenue and estimated net worth of Asplundh Tree Expert, LLC over the last 10 years (2015–2025):

| Year | Estimated Annual Revenue (USD) | Estimated Net Worth / Valuation (USD) |

|---|---|---|

| 2015 | $3.1 B | $2.6 B |

| 2016 | $3.3 B | $3.0 B |

| 2017 | $3.7 B | $4.2 B |

| 2018 | $4.0 B | $4.5 B |

| 2019 | $4.2 B | $4.8 B |

| 2020 | $4.4 B | $5.1 B |

| 2021 | $4.7 B (reported) | $5.4 B |

| 2022 | $5.0 B | $5.9 B |

| 2023 | $5.7 B (estimated) | $6.5 B |

| 2024 | $5.7 B (reported) | ~$6.8 B |

| 2025 | $6.5 B (projected) | $11 B+ (estimated) |

Revenue Growth and Financial Strength

Asplundh’s revenue trend over the past several years shows consistent annual increases. Each year saw modest gains driven by geographic expansion, contract renewals, and service diversification.

The company’s internal cost discipline, focus on safety and compliance post‑2017 reforms, and investments in technology and training have helped sustain margins while enabling calculated growth. The net worth growth from roughly $5.4 billion in net worth in 2021 to $6.8 billion in 2025 reflects both operational performance and rising market estimates for private utility service providers.

Financial Outlook and Future Prospects

Looking ahead, Asplundh is positioned to grow further. Continued infrastructure modernization across North America, expanding utility vegetation regulations, and rising demand for consulting and technology‑based services are expected to boost revenue beyond the 2025 baseline.

The company’s conservative financial structure, deeply entrenched client relationships, and family‑driven governance continue to support long‑term net worth appreciation. The combination of core vegetation services, utility construction, and traffic infrastructure makes Asplundh financially resilient even in varying economic cycles.

Asplundh Competitors

Asplundh is the largest utility vegetation management company in North America, serving major utility companies, municipalities, and transportation departments. The company’s market share is significant due to its scale, resources, and long-standing relationships with clients.

Here’s a list of the major competitors of Asplundh Tree Expert:

Davey Tree Expert Company

Davey Tree is a major competitor in the tree care and vegetation management industry. As an employee-owned company, Davey Tree offers services similar to Asplundh, including utility vegetation management, residential tree care, and environmental consulting. The company generates annual revenues exceeding $1.5 billion.

Lewis Tree Service

Lewis Tree Service is another key competitor in the utility vegetation management sector. With a strong presence in the U.S., the company provides tree trimming, storm restoration, and line clearance services. Lewis Tree is employee-owned and has annual revenues surpassing $500 million.

Wright Tree Service

Wright Tree Service specializes in vegetation management for utility companies and government agencies. It competes with Asplundh in terms of reliability and service quality, generating annual revenues of approximately $400 million.

Bartlett Tree Experts

While Bartlett Tree Experts primarily focuses on residential and commercial tree care, it competes with Asplundh in certain sectors. Bartlett is a privately owned company with an emphasis on scientific tree care and environmental preservation.

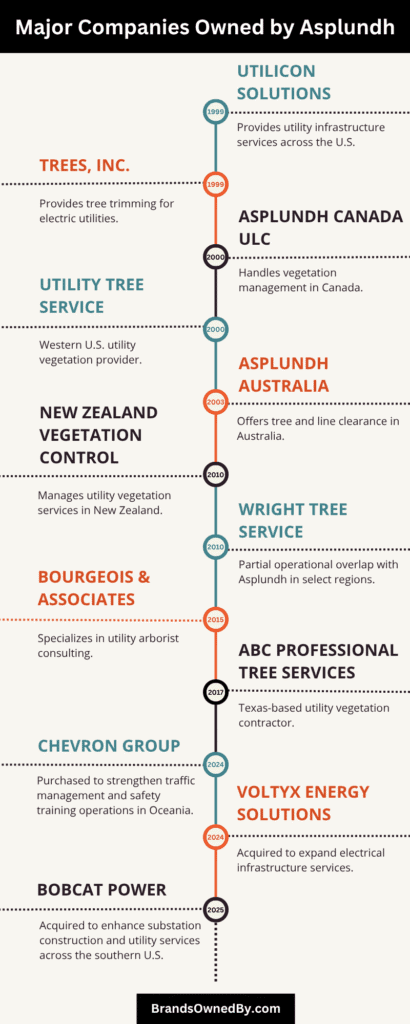

Companies Owned by Asplundh

Asplundh owns and controls several companies and subsidiaries related to utility services, transportation, and safety. These subsidiaries operate independently but share strategic alignment with the parent company.

Here’s a list of the major companies owned by Asplundh as of 2025:

| Company/Brand | Year | Type | Location | Core Services | Strategic Value to Asplundh |

|---|---|---|---|---|---|

| Asplundh Tree Expert, LLC | 1928 | Parent Company | Willow Grove, Pennsylvania | Vegetation management and utility services | Foundation of all operations and global brand identity |

| Utility Lines Construction Services (ULCS) | Acquired 1998 | Subsidiary | U.S. | Electrical construction and maintenance | Expands capabilities in electrical distribution infrastructure |

| UtiliCon Solutions, Ltd. | Formed 2000 | Subsidiary | U.S. | Infrastructure services, electrical testing, traffic control | Manages all infrastructure services subsidiaries under one holding structure |

| American Lighting and Signalization (ALSI) | Acquired 2000s | Subsidiary | Southeastern U.S. | Street lighting, traffic signals, intelligent transportation systems | Supports municipal and state infrastructure contracts |

| Aerial Solutions, Inc. | Acquired 2010 | Subsidiary | North Carolina | Aerial tree trimming and vegetation control | Provides aerial vegetation services using helicopters |

| Trees, Inc. | Acquired 1990s | Subsidiary | Texas | Utility line clearance and vegetation management | Regional brand for vegetation services in the Southwest |

| Wright Tree Service of the West | Acquired early 2000s | Subsidiary | Western U.S. | Line clearance, right-of-way management | Strengthens vegetation services in western states |

| New River Electrical Corporation | Acquired 2013 | Subsidiary | Virginia and Eastern U.S. | High-voltage electrical construction | Expanded construction services in transmission and distribution |

| The Traffic Group (TTG) Canada | Acquired 2021 | Subsidiary | Canada | Traffic management and control services | Entered Canadian market for traffic solutions |

| Asplundh Electrical Testing (AET) | Merged 2023–2024 | Internal Merger | U.S. (Multiple) | Electrical testing, commissioning (NETA-accredited) | Consolidated testing services under one brand |

| Chevron Group (incl. Chevtrain) | Acquired 2024 | Acquisition | New Zealand | Traffic control, safety training | Expanded Oceania operations, integrated local training and control expertise |

| Voltyx Energy Solutions | Acquired 2024 | Acquisition | U.S. (Headquartered in Nashville) | Substation testing, transformer services, field commissioning | National expansion in electrical infrastructure services |

| Bobcat Power, LLC | Acquired 2025 | Acquisition | Texas, Oklahoma, Louisiana | Substation site work, below/above grade construction | Strengthened utility substation construction capacity in key southern markets |

UtiliCon Solutions, Ltd.

UtiliCon Solutions began as an internal division in the late 1990s and has evolved into a distinct subsidiary by 2025. It provides utility infrastructure support including cable installation, meter testing, and line inspection services. Operating across the United States and Canada, UtiliCon enhances Asplundh’s ability to offer end-to-end service packages beyond vegetation management. The brand is recognized for its technical precision and rapid deployment capabilities.

ACRT Services

ACRT Services joined the Asplundh family in 2020. The acquisition expanded Asplundh’s footprint in consulting, environmental services, and vegetation planning. ACRT’s expertise in utility risk assessment and forest health data complements the parent company’s field operations. By 2025, ACRT is fully integrated, contributing significantly to consulting revenue streams and leading training programs on arboriculture standards.

Asplundh Canada ULC

Established decades ago, Asplundh Canada remains wholly owned by Asplundh Tree Expert, LLC. By 2025, it operates in all provinces, offering vegetation management and utility clearing services. The Canadian division has grown into a regional powerhouse, with its own operations team, fleet, and local leadership. It routinely wins multimillion‑dollar contracts from major Canadian utilities.

Asplundh Australia

Launched in 1995, Asplundh Australia covers utility vegetation management and environmental services across Australia and New Zealand. By 2025, it is fully aligned under corporate strategy but retains regional branding and leadership. It delivers services in remote terrain and urban centers, often under government contracts or major infrastructure projects.

Traffic Control Services

Traffic Control Services (TCS) was acquired in 2012. This entity provides traffic flagging, work‑zone protection, and safety personnel for roadway, utility, and infrastructure works. By 2025 it is strategically embedded in Asplundh’s broader project operations, coordinating traffic safety across projects nationwide. TCS operates under its own brand but is run by Asplundh leadership with integrated financial reporting.

CN Utility Consulting

After acquisition in 2019, CN Utility Consulting became Asplundh’s consulting arm for utility vegetation assessments, asset analytics, and data management. By 2025, CN Utility Consulting is fully established, offering technical reports, ecological planning, and GIS‑based risk forecasting. It serves internal field operations as well as external clients seeking expertise in utility forestry management.

Wright Tree Service of the West

Wright Tree Service of the West joined Asplundh in 2021. This company significantly expanded Asplundh’s reach into western U.S. markets. Wright Tree operates under its brand identity but shares Asplundh’s operational practices. By 2025, it supports major utility contracts across states west of the Rockies, handling both vegetation management and infrastructure support.

American Lighting and Signalization

Acquired in 2014, American Lighting and Signalization delivers street lighting maintenance and traffic signal services. As of 2025, it remains an Asplundh brand specializing in nighttime infrastructure support, LED retrofits, and signal restoration. Its alignment with utility contracts adds value to Asplundh’s network of services and regional influence.

Utility Lines Construction Services (ULCS)

ULCS was integrated into Asplundh in 2007 to expand construction support for electric utilities. As of 2025, ULCS operates as a brand focused on utility infrastructure installation, grounding, and emergency restoration. Its teams work closely with Asplundh field crews during storm response or major outage recovery efforts.

ABC Professional Tree Services

Following its 2015 acquisition, ABC Professional Tree Services became part of Asplundh’s southern U.S. operations. By 2025, it serves clients across the southeast offering specialized tree care, large‑scale vegetation removal, and maintenance packages. ABC’s regional expertise strengthens Asplundh’s geography‑specific capabilities.

Asplundh Railroad Division

Asplundh established its Railroad Division internally in 1998, and by 2025, it leads vegetation clearance and infrastructure support for freight and passenger rail corridors. It manages internal resources dedicated to rail-specific standards, track protection, and regulatory compliance. This division embodies Asplundh’s expansion beyond roads and utilities into rail infrastructure.

Asplundh Electrical Testing (AET) — Merger (Dec 2023 / Early 2024)

In December 2023, two internal branches—American Electrical Testing and Burlington Electrical Testing—were merged under the Asplundh banner to form a unified brand: Asplundh Electrical Testing (AET). The newly formed entity retained NETA accreditation and began operating as a consolidated testing and commissioning services provider.

Led by President Jason Briggs and Vice President Paul Norton, AET employed around 200 commissioning engineers and technicians across multiple U.S. locations by early 2024. This move strengthened Asplundh’s infrastructure segment and allowed streamlined delivery of electrical testing services across transmission, distribution, and generation networks.

Chevron Group (New Zealand) — Acquisition (June 2024)

In June 2024, Asplundh acquired the Chevron Group, which includes traffic management operations (Chevron Traffic Services) and training services (Chevtrain) based in Greater Auckland, New Zealand.

This acquisition added over 250 staff across six northern New Zealand locations and integrated local traffic control, planning, and safety training into Asplundh’s regional portfolio. Asplundh’s New Zealand and Australian divisions now operate Chevron under its familiar regional branding.

Voltyx Energy Solutions — Acquisition (May 2024)

On May 28, 2024, Asplundh finalized the acquisition of Voltyx Energy Solutions, a Nashville‑based provider of substation and transformer testing, engineering, commissioning and maintenance services. Voltyx had earlier consolidated Electric Power Systems, North American Substation Services, and other specialist firms.

The addition of Voltyx expanded Asplundh Infrastructure Group’s capabilities—adding over 1,200 employees at 35 U.S. locations and enabling national coverage in substation equipment services. This move elevated Asplundh into the electrical testing and infrastructure maintenance market.

Bobcat Power, LLC — Acquisition (March 2025)

In March 2025, Asplundh’s construction subsidiary Utility Lines Construction Services, LLC (ULCS) acquired Bobcat Power, LLC, a Texas‑based substation infrastructure services firm founded in 2007.

Bobcat Power specializes in site work, below‑grade and above‑grade substation construction across central and southwest Texas, Oklahoma, and Louisiana. The addition brought over 300 employees to Asplundh’s portfolio and reinforced its ability to deliver turnkey substation services across its service footprint.

Conclusion

Understanding who owns Asplundh reveals the strength of a privately held, family-run operation that has maintained its core values for nearly a century. The company’s expansive reach and consistent growth show the stability of its ownership and leadership. From utility services to traffic safety, Asplundh has diversified its operations while staying true to its roots. Its ownership structure ensures long-term focus, and its financial performance proves the effectiveness of that model.

FAQs

Who owns Asplundh Tree?

Asplundh Tree Expert, LLC is owned entirely by members of the Asplundh family. It is a private, family-held company, with no shares traded publicly. Multiple family members collectively own 100% of the business through private holdings, trusts, and estate structures.

Is Asplundh a private company?

Yes, Asplundh is a private, family-owned company. It has never been publicly listed on any stock exchange. All shares are held by descendants of the original founders, making it one of the largest privately held utility contractors in the United States.

What companies does Asplundh own?

Asplundh owns several subsidiaries and affiliated companies including UtiliCon Solutions, Utility Lines Construction Services (ULCS), New River Electrical, American Lighting and Signalization (ALSI), Aerial Solutions, Trees Inc., Wright Tree Service of the West, The Traffic Group (Canada), Chevron Group (New Zealand), Voltyx Energy Solutions, and Bobcat Power LLC. These subsidiaries support Asplundh’s operations in utility vegetation management, traffic control, and infrastructure services across North America and parts of Oceania.

Who are the investors in Asplundh?

Asplundh does not have outside investors. All investment and equity ownership is held internally by the Asplundh family. There are no venture capital, private equity, or institutional investors involved in the business.

What is Chris Asplundh’s net worth?

Chris Asplundh, one of the prominent family members involved in Asplundh’s leadership, is estimated to have a net worth exceeding $700 million as of 2025. His wealth is primarily derived from his ownership stake in the company and long-term executive leadership.

Who is the owner of Asplundh?

Asplundh is owned by the extended Asplundh family, consisting of descendants of the three original founders: Griffith, Lester, and Carl Hjalmar Asplundh. Ownership is distributed among multiple family members through direct shares and family trusts.

What is Matt Asplundh’s net worth?

Matt Asplundh, another influential member of the Asplundh family and former executive, is estimated to have a net worth around $600 million in 2025. His wealth is tied to his long-term role in leadership and family ownership of the company.

What does Asplundh do?

Asplundh provides vegetation management, utility line clearance, infrastructure support, traffic control, and electrical testing services. It works primarily with electric utilities, municipalities, and infrastructure firms. The company is known for trimming trees around power lines, building and maintaining substations, and managing traffic flow around construction zones.

Who is the managing director of Asplundh?

As of 2025, the company does not use the specific title of “Managing Director.” However, Matt Asplundh and Chris Asplundh Jr. hold executive leadership roles and influence operational direction, supported by a senior executive team that includes division presidents and service line directors.

Who is the vice president of Asplundh?

As of 2025, Jim Asplundh and David Asplundh Jr. are among those serving in vice presidential or equivalent leadership capacities within Asplundh Tree Expert, LLC and its subsidiaries. These roles vary across regional and service divisions under the company’s broad umbrella.

Is Asplundh a publicly traded company?

No, Asplundh is a privately held company owned by the Asplundh family.